Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Handout 4Q Philippine Individual Income Tax Return Sample Problems

Caricato da

Maria Jennifer Intong SalazarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Handout 4Q Philippine Individual Income Tax Return Sample Problems

Caricato da

Maria Jennifer Intong SalazarCopyright:

Formati disponibili

San Beda College Alabang

Alabang Hills Village

Alabang, Muntinlupa City

Integrated Basic Education (High School) That In All Things, God May Be Glorified

Social Studies IV Handout – Individual Income Tax Return Sample Problems

Name: Date:

Section: Teacher:

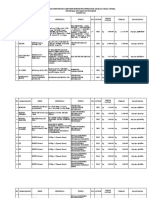

Problem 1

Mrs. Jolie Sy is employed as a sales manager. Her husband is unemployed for three years now. They have four children;

the eldest is 25 years old, the second is 20 years old, the third is 18 years old and the youngest is 15 years old. Compute

for the annual income tax return for the taxable year 2011 given the following additional information:

Monthly salary 18,000

Monthly allowance 3,000

Annual Commission 120,000

Withholding Tax 60,000

Solution:

Amount Explanation/Calculation

(monthly salary x 12 months) + (monthly allowance x 12

I. Gross Compensation Income 372,000

months) + annual commission

II. Less: Personal Exemption 50,000 Compensation for Married Individuals

Additional Exemptions 75,000 3 dependents x 25,000 per dependent

III. Total Exemptions 125,000 Total of Section II

IV. Taxable Income 247,000 Section I – Section III

Over 140,000 but not over 250,000

V. Tax Due 49,250

22,500 + 25% of excess over 140,000

VI. Less: Tax Withheld 60,000 Given in the problem

Section V – Section VI

VII. Tax Payable/Tax Refundable (10,750)

TAX REFUND

Tax Due Calculation:

Taxable Income 247,000 Over 140,000 but not over 250,000

22,500 + 25% of excess over 140,000

Tax Due = 22,500 + (247,000 – 140,000) x 0.25

= 22,500 + 26,750

= 49,250

Problem 2

Mr. Herrera is unmarried with two legal dependents. The following information is used to determine his income tax.

Compute for his annual income tax return for the year 2011:

Monthly salary 20,000

Monthly overtime pay 1,500

Monthly gas and food allowance 3,500

Withholding Tax 35,000

Solution:

Amount Explanation/Calculation

(monthly salary x 12 months) + (monthly allowance x 12

I. Gross Compensation Income 300,000

months) + (monthly overtime pay x 12 months)

II. Less: Personal Exemption 50,000 Compensation for Head of the Family

Additional Exemptions 50,000 2 dependents x 25,000 per dependent

III. Total Exemptions 100,000 Total of Section II

IV. Taxable Income 200,000 Section I – Section III

Over 140,000 but not over 250,000

V. Tax Due 37,500

22,500 + 25% of excess over 140,000

VI. Less: Tax Withheld 35,000 Given in the problem

Section V – Section VI

VII. Tax Payable/Tax Refundable 2,500

TAX PAYABLE

Tax Due Calculation:

Taxable Income 200,000 Over 140,000 but not over 250,000

22,500 + 25% of excess over 140,000

Tax Due = 22,500 + (200,000 – 140,000) x 0.25

= 22,500 + 15,000

= 37,500

Problem 3

Mr. Dan Medina is a bank employee. He is married with four children, all in elementary and high school. His salary is

P30,000 per month and the following:

Medicine allowance every 3 months 5,000

Monthly transportation and food allowance 2,500

Tax withheld per month 3,250

13th month pay equal to his monthly salary, given once a year

Solution:

Amount Explanation/Calculation

(monthly salary x 12 months) + (monthly allowances x 12

I. Gross Compensation Income 440,000 months) + (medicine allowance x 4 months) + 13th month

pay

II. Less: Personal Exemption 50,000 Compensation for Married Individuals

Additional Exemptions 100,000 4 dependents x 25,000 per dependent

III. Total Exemptions 150,000 Total of Section II

IV. Taxable Income 290,000 Section I – Section III

Over 250,000 but not over 500,000

V. Tax Due 62,000

50,000 + 30% of excess over 250,000

VI. Less: Tax Withheld 39,000 3,250 x 12 months

Section V – Section VI

VII. Tax Payable/Tax Refundable 23,000

TAX PAYABLE

Tax Due Calculation:

Taxable Income 290,000 Over 250,000 but not over 500,000

50,000 + 30% of excess over 250,000

Tax Due = 50,000 + (290,000 – 250,000) x 0.30

= 50,000 + 12,000

= 62,000

Potrebbero piacerti anche

- Gene Locke Tax Return, 2006Documento25 pagineGene Locke Tax Return, 2006Lee Ann O'NealNessuna valutazione finora

- 2020 Instructions For Schedule C: Profit or Loss From BusinessDocumento19 pagine2020 Instructions For Schedule C: Profit or Loss From BusinessI'm JuicyNessuna valutazione finora

- Income TaxDocumento21 pagineIncome TaxJericho ValenciaNessuna valutazione finora

- Please Complete The 2015 Federal Income Tax Return For Magdalena Schmitz PDFDocumento5 paginePlease Complete The 2015 Federal Income Tax Return For Magdalena Schmitz PDFDoreen0% (1)

- 2018 Form I Individual Income Tax Return 2017Documento20 pagine2018 Form I Individual Income Tax Return 2017KSeegurNessuna valutazione finora

- 2016 1040 Individual Tax Return Engagement LetterDocumento11 pagine2016 1040 Individual Tax Return Engagement LettersarahvillalonNessuna valutazione finora

- Final Testbank For Tax 4001Documento74 pagineFinal Testbank For Tax 4001ceimeen50% (2)

- 2022 Individual Tax Organizer FillableDocumento6 pagine2022 Individual Tax Organizer FillableTham DangNessuna valutazione finora

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocumento7 pagineAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNessuna valutazione finora

- F1040es 2020Documento12 pagineF1040es 2020Job SchwartzNessuna valutazione finora

- Tax Return - 2018-2019Documento30 pagineTax Return - 2018-2019kutner8181Nessuna valutazione finora

- Investment Declaration Form - FY 2022-23Documento7 pagineInvestment Declaration Form - FY 2022-23varaprasadNessuna valutazione finora

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Documento6 pagine(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBNessuna valutazione finora

- Total Rewards For Civil Servants - WB - MukherjeeDocumento6 pagineTotal Rewards For Civil Servants - WB - MukherjeeAngel Tejeda MorenoNessuna valutazione finora

- 1065 Case StudyDocumento5 pagine1065 Case StudyHimani SachdevNessuna valutazione finora

- Train LawDocumento44 pagineTrain LawJuan MiguelNessuna valutazione finora

- Income Tax PDFDocumento16 pagineIncome Tax PDFMay Tan100% (1)

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Documento8 pagineJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaNessuna valutazione finora

- April 16, 2024 at 5 - 30 PM - Canutillo ISD Board WorkshopDocumento36 pagineApril 16, 2024 at 5 - 30 PM - Canutillo ISD Board WorkshopSammy CShowNessuna valutazione finora

- TAX HO1002 Individual Taxation StudentDocumento12 pagineTAX HO1002 Individual Taxation StudentYuri CaguioaNessuna valutazione finora

- ch2 Version1-2Documento59 paginech2 Version1-2yea okayNessuna valutazione finora

- Finals - II. Deductions & ExemptionsDocumento13 pagineFinals - II. Deductions & ExemptionsJovince Daño DoceNessuna valutazione finora

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Documento10 paginePublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorNessuna valutazione finora

- Think Computer Foundation 2009 Tax ReturnDocumento10 pagineThink Computer Foundation 2009 Tax ReturnTaxManNessuna valutazione finora

- Tax Cases - Atty CatagueDocumento264 pagineTax Cases - Atty CatagueJo-Al GealonNessuna valutazione finora

- FinMa ExamDocumento7 pagineFinMa ExamRose Anne CastilloNessuna valutazione finora

- NYSE - BX. Dear Unit Holder - PDFDocumento9 pagineNYSE - BX. Dear Unit Holder - PDFEugene FrancoNessuna valutazione finora

- Joint Astronomy Centre - Birthday Stars - FinalDocumento2 pagineJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNessuna valutazione finora

- Tax Organizer ShortDocumento28 pagineTax Organizer ShortExactCPANessuna valutazione finora

- Economics ReportDocumento32 pagineEconomics ReportGazelle Joy UlalanNessuna valutazione finora

- Capital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp TaxDocumento2 pagineCapital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp Taxloonie tunesNessuna valutazione finora

- Oregon Public Employees Retirement (PERS) 2001Documento74 pagineOregon Public Employees Retirement (PERS) 2001BiloxiMarxNessuna valutazione finora

- Tuition and Fees Deduction: Before You BeginDocumento4 pagineTuition and Fees Deduction: Before You BeginSarah Kuldip100% (1)

- Copy Individual Income TaxDocumento10 pagineCopy Individual Income TaxMari Louis Noriell MejiaNessuna valutazione finora

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 pagineAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNessuna valutazione finora

- Appendix C - GlossaryDocumento27 pagineAppendix C - GlossarySoriano GabbyNessuna valutazione finora

- Loan Guidelines Us BankDocumento12 pagineLoan Guidelines Us BankcraigscNessuna valutazione finora

- Ia2 16 Accounting For Income TaxDocumento57 pagineIa2 16 Accounting For Income TaxLawrence NarvaezNessuna valutazione finora

- Houston Zoo 990 - 2011Documento46 pagineHouston Zoo 990 - 2011Lee Ann O'Neal100% (1)

- Florida Homestead AplicationDocumento4 pagineFlorida Homestead AplicationJohn DollNessuna valutazione finora

- CorporationsDocumento46 pagineCorporationsDandred AdrianoNessuna valutazione finora

- ACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Documento14 pagineACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Migz labianoNessuna valutazione finora

- US Internal Revenue Service: I1065bsk - 2005Documento10 pagineUS Internal Revenue Service: I1065bsk - 2005IRSNessuna valutazione finora

- Oregon Public Employees Retirement (PERS) 2007Documento108 pagineOregon Public Employees Retirement (PERS) 2007BiloxiMarxNessuna valutazione finora

- BAC103A-02a Income Tax For IndividualsDocumento8 pagineBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Chapter 12 TR Assignment Kelsey EwellDocumento22 pagineChapter 12 TR Assignment Kelsey Ewellapi-272863459Nessuna valutazione finora

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocumento72 pagineInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Nessuna valutazione finora

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocumento2 pagineEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNessuna valutazione finora

- Return of Net WealthDocumento4 pagineReturn of Net WealthbharatNessuna valutazione finora

- Cruz16e Chap09 IMDocumento10 pagineCruz16e Chap09 IMJosef Galileo SibalaNessuna valutazione finora

- Chase Mortgage Finance Trust 2007-S6 ProspectusDocumento214 pagineChase Mortgage Finance Trust 2007-S6 ProspectusBrenda ReedNessuna valutazione finora

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Documento69 pagineCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519Nessuna valutazione finora

- Individual TaxpayerDocumento17 pagineIndividual TaxpayermysterymieNessuna valutazione finora

- Payroll Register-1-15th - 2019Documento9 paginePayroll Register-1-15th - 2019PW WANessuna valutazione finora

- Tax Free Weekend InfoDocumento6 pagineTax Free Weekend InfoMichael AllenNessuna valutazione finora

- 2010 Income Tax ReturnDocumento2 pagine2010 Income Tax ReturnCkey ArNessuna valutazione finora

- Metro Board of Directors Agenda, Feb. 2020Documento15 pagineMetro Board of Directors Agenda, Feb. 2020Metro Los AngelesNessuna valutazione finora

- Please To Do Not Use The Back ButtonDocumento2 paginePlease To Do Not Use The Back ButtonDavid MillerNessuna valutazione finora

- 0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Documento1 pagina0 - 1098 Mortgage Interest 2022 - 01122023 - 162111Osvaldo CalderonUACJNessuna valutazione finora

- Handout 4Q - Philippine Individual Income Tax Return Sample ProblemsDocumento3 pagineHandout 4Q - Philippine Individual Income Tax Return Sample Problemskathy14392% (24)

- Exam First Grading 2nd Semester - ReadingDocumento3 pagineExam First Grading 2nd Semester - ReadingArleneRamosNessuna valutazione finora

- Strategic Audit of VodafoneDocumento35 pagineStrategic Audit of VodafoneArun Guleria89% (9)

- Marieb ch3dDocumento20 pagineMarieb ch3dapi-229554503Nessuna valutazione finora

- Maharashtra State Board 9th STD History and Political Science Textbook EngDocumento106 pagineMaharashtra State Board 9th STD History and Political Science Textbook EngSomesh Kamad100% (2)

- Heirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseDocumento2 pagineHeirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseAlvin Dela CruzNessuna valutazione finora

- T688 Series Instructions ManualDocumento14 pagineT688 Series Instructions ManualKittiwat WongsuwanNessuna valutazione finora

- Inspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsDocumento13 pagineInspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsAmanda RojasNessuna valutazione finora

- Durability of Prestressed Concrete StructuresDocumento12 pagineDurability of Prestressed Concrete StructuresMadura JobsNessuna valutazione finora

- Corporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalDocumento76 pagineCorporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalNidhi LathNessuna valutazione finora

- Brochure GM Oat Technology 2017 enDocumento8 pagineBrochure GM Oat Technology 2017 enArlette ReyesNessuna valutazione finora

- Uts Cmo Module 5Documento31 pagineUts Cmo Module 5Ceelinah EsparazNessuna valutazione finora

- JCIPDocumento5 pagineJCIPdinesh.nayak.bbsrNessuna valutazione finora

- HPCL CSR Social Audit ReportDocumento56 pagineHPCL CSR Social Audit Reportllr_ka_happaNessuna valutazione finora

- Shaker ScreenDocumento2 pagineShaker ScreenRiaz EbrahimNessuna valutazione finora

- Instruction Manual 115cx ENGLISHDocumento72 pagineInstruction Manual 115cx ENGLISHRomanPiscraftMosqueteerNessuna valutazione finora

- Rab Sikda Optima 2016Documento20 pagineRab Sikda Optima 2016Julius Chatry UniwalyNessuna valutazione finora

- ProjectDocumento33 pagineProjectPiyush PatelNessuna valutazione finora

- Heart Rate Variability Threshold As An Alternative.25Documento6 pagineHeart Rate Variability Threshold As An Alternative.25Wasly SilvaNessuna valutazione finora

- Atlascopco XAHS 175 DD ASL Parts ListDocumento141 pagineAtlascopco XAHS 175 DD ASL Parts ListMoataz SamiNessuna valutazione finora

- Pontevedra 1 Ok Action PlanDocumento5 paginePontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- Waswere Going To Waswere Supposed ToDocumento2 pagineWaswere Going To Waswere Supposed ToMilena MilacicNessuna valutazione finora

- User ManualDocumento96 pagineUser ManualSherifNessuna valutazione finora

- CUET 2022 General Test 6th October Shift 1Documento23 pagineCUET 2022 General Test 6th October Shift 1Dhruv BhardwajNessuna valutazione finora

- Biscotti: Notes: The Sugar I Use in France, Is CalledDocumento2 pagineBiscotti: Notes: The Sugar I Use in France, Is CalledMonica CreangaNessuna valutazione finora

- DN12278 - 5008 - Indicative Cable Way Route - Rev BDocumento9 pagineDN12278 - 5008 - Indicative Cable Way Route - Rev BArtjoms LusenkoNessuna valutazione finora

- Risha Hannah I. NazarethDocumento4 pagineRisha Hannah I. NazarethAlpaccino IslesNessuna valutazione finora

- Compact 1.8" Height Standardized Installation 9 Months To Flight Powerful and LightweightDocumento2 pagineCompact 1.8" Height Standardized Installation 9 Months To Flight Powerful and LightweightStanley Ochieng' OumaNessuna valutazione finora

- Hydraulics and PneumaticsDocumento6 pagineHydraulics and PneumaticsRyo TevezNessuna valutazione finora

- Carpentry Grade 8 Week 1 2Documento20 pagineCarpentry Grade 8 Week 1 2SANTIAGO ALVISNessuna valutazione finora

- 16 Personalities ResultsDocumento9 pagine16 Personalities Resultsapi-605848036Nessuna valutazione finora