Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CA5102 - Managerial Economics-3 PDF

Caricato da

Black ScoopTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CA5102 - Managerial Economics-3 PDF

Caricato da

Black ScoopCopyright:

Formati disponibili

Managerial Economics

CHAPTER 1: FUNDAMENTALS OF MANAGERIAL ECONOMICS

A. The Manager - A person who directs resources to achieve a stated goal.

• Roles of a manager:

1. directs the efforts of others, including those who delegate tasks within an organization such as a firm, a

family or a club

2. purchase inputs to be used in the production of goods and services such as the output of a firm

3. directs the product price or quality decisions

4. states the goal of the company/segments of company

• He is responsible for his own actions

• He has to influence the attitude of others so that similar goal can be achieved

• He must use constant communication with his/her employees

B. Economics - The science of making decisions in the presence of scarce resources

• Scarcity: Limited availability of resources

• Resources: Anything used to produce a good or service or achieve a goal

• Decisions are important because SCARCITY implies TRADE-OFFS (what you’ve given up)

• Time is a scarce resource.

C. Managerial Economics - The study of how to direct scarce resources in the way that most efficiently achieves a

managerial goal: maximization of profits (the value of the firm).

D. Basic Principles that Comprise Effective Management (to be practiced by managers)

1. Identifying goals and constraints

• To have WELL-DEFINED GOALS (different goals have different decisions; different units within a firm have

different goals – e.g. marketing department – sales maximization)

• Overall goal: To maximize profits – can be achieved by giving each unit within the firm an incentive to

achieve potentially different goals; however, constraints make it difficult for managers to achieve goals

• Constraints: Are artifacts of scarcity; limitations/restrictions (e.g. available technology, prices/costs of

inputs used in production)

2. Recognize the nature and importance of profits

• Accounting profit: The total amount of money taken in from sales (shown in the income statement)

FORMULA à Accounting profit = Total revenue or sales – Explicit Costs

§ Explicit costs: main costs

§ Implicit costs: the cost of giving up the best alternative use of the resource (the value that was given

up)

§ Explicit costs + implicit costs = opportunity costs

• Economic profit: The difference between the total revenue and the total opportunity cost of production

FORMULA à Economic profit = Total revenue or sales – Opportunity Costs

• Role of profits:

Ø Misconception: Maximizing profits is necessarily bad for society due to self-interested view; however,

considering Adam Smith’s classic line from The Wealth of the Nations: “It is not out of the benevolence

of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own

interest.”

1 ASC Academics Committee|A.Y. 2019 - 2020

Ø Explanation of Smith’s line: By pursuing its self-interest, the goal of maximizing profits, a firm

ultimately meets the needs of society. The profits of business signal where society’s scarce resources

are best allocated. Profits are signal to resource holders, where resources are most highly valued by

society. (The total welfare of society is improved)

• Five forces framework by Michael Porter

I. Entry

• heightens competition and reduces margins of existing firms

• ability to sustain profits depends on how barriers to entry affect the case with which other firms

can enter the industry (government policies)

• entrants are less likely to capture market share quickly enough to justify the costs of entry in

environments with these factors

II. Power of Input Suppliers

• industry profits are lower when suppliers have the power to negotiate favorable terms for their

inputs

• supplier power is low when inputs are relatively standardized and relationship-specific

investments are minimal, input markets are not highly concentrated, or alternative inputs are

available with similar marginal productivities per money spent

• government constraints the prices of inputs through price ceilings and other controls, which limits

to some extent the ability of suppliers to expropriate profits from firms in the industry

III. Power of Buyers

• industry profits tend to be lower when customers have the power to negotiate favorable terms

for the products/services

• buyer concentration and customer power are higher in industries that serve relatively few high-

volume customers. Buyer power is lower in industries where the cost to customers of switching

to other products is high

• government regulations (eg: price floors/ceilings) can also impact the ability of buyers to obtain

more favorable terms

IV. Industry Rivalry

• sustainability of industry profits depends on the nature and intensity of rivalry among firms

competing

2 ASC Academics Committee|A.Y. 2019 - 2020

• rivalry is less intense in concentrated industries (those with relatively few firms)

• rivalry is more intense in industry settings where there is little product differentiation and firms

compete in price and where consumer switching costs are low

• imperfect information and timing of decisions also affect rivalry

V. Substitutes and Complements

• level and sustainability of industry profits depend on the price and value of interrelated

products/services

• the presence of close substitutes erodes industry profitability

• government policies can directly impact the availability of substitutes and thus industry profits

• complementarities/synergies also affect industry profitability (this can be done by quantifying

them and identifying strategies to create and exploit complementarities and network effects)

3. Understand incentives

• Incentives affect how resources are used and how hard workers work.

• The key is to design a mechanism such that if the manager does what is in his own interest, he will indirectly

do what is best for the owner

• Bonuses: Are also incentive plans, and are in direct proportion to the firm’s profitability

• Some individuals earn commissions based on the revenue they generate for the firm’s owner

4. Understand markets

• There are two sides to every transaction in a market: For every buyer of a good, there is a corresponding

seller.

• The outcome of the market process depends on the relative power of buyers and sellers in the marketplace

• The power of consumers and producers in the market is limited by three sources of rivalry:

§ Consumer-producer rivalry – Consumers attempt to negotiate or locate low prices, while producers

attempt to negotiate high prices

§ Consumer-consumer rivalry – When limited quantities of goods are available, consumers will compete

with one another for the right to purchase the available goods

§ Producer-producer rivalry – firms that offer the best quality product at the lowest price earn the right

to serve the customers

o Government and the market – Agents frequently attempt to induce the government to

intervene on their behalf when they find themselves disadvantaged in the market process

5. Recognize the time value of money

• Often a gap exists between the time when costs are borne and benefits received.

• Managers can use present value analysis to properly account for the timing of receipts and expenditures.

• The opportunity cost of receiving P100 in the future is the foregone interest that could be earned were

P100 received today

§ Present Value – Amount that would have to be invested today at the prevailing interest rate to

generate the given future value.

𝑭𝑽

FORMULA: 𝑷𝑽 =

(𝟏(𝒊)𝒏

- 𝒊 is the rate of interest or the opportunity cost of funds and 𝒏 refers to no. of years

- The higher the interest rate, the higher the opportunity cost of waiting to receive a future amount

and thus the lower the present value of the future amount.

Take note: The present and future value coincide

v The PV of a future payment reflects the difference between the future value (FV) and the

opportunity cost of waiting (OCW)

3 ASC Academics Committee|A.Y. 2019 - 2020

FORMULA: PV=FV-OCW

v Present value of the sum of future payments

𝑭𝑽𝟏 𝑭𝑽 𝑭𝑽 𝑭𝑽

FORMULA: 𝑷𝑽 =

(𝟏(𝒊)𝟏

+ (𝟏(𝒊)𝟐 𝟐 + (𝟏(𝒊)𝟑 𝟑 + ⋯ + (𝟏(𝒊)𝒏 𝒏

v Present value of a stream – When the interest rate is i, the present value of a stream of future

payments of 𝐹𝑉2 , 𝐹𝑉3 , …𝐹𝑉4 is

𝑭𝑽𝒕

FORMULA: 𝑷𝑽 = ∑𝒏

𝒕7𝟏 (𝟏(𝒊)𝒕

v Net Present Value – The present value of the income stream generated by a project minus the

current cost (C_0) of the project

FORMULA:

Note:

• If the NPV is positive, the project is profitable because the PV of the earnings from the project

exceeds the current cost of the project

• A project with a negative NPV should be rejected

Example (Net Present Value):

Consider a project that returns the following income stream:

- Year 1, $10,000; Year 2, $50,000; and Year 3, $100,000.

- At an annual interest rate of 3 percent, what is the present value of this income stream?

Solution:

v Present Value of Indefinitely Lived Assets – Some decisions generate cash flows that continue

indefinitely. Assets generate a cash flow of today, one year from today, and so on for an

indefinite period of time.

FORMULA:

o Perpetuity – Instances where some assets generate a perpetual stream of identical cash flows

at the end of each period.

Þ If current cash flow is 0, all future cash flows are identical

Þ In this case, the asset generates a perpetual stream of identical cash flows at the end of

each period

𝑪𝑭

FORMULA: 𝑷𝑽𝑷𝒆𝒓𝒑𝒆𝒕𝒖𝒊𝒕𝒚 = 𝒊

Note:

• The value of a firm today is the present value of the current and future profits

• Notice that the value of a firm takes into account the long-term impact of managerial decisions

on profits

4 ASC Academics Committee|A.Y. 2019 - 2020

o PV used in determining the value of a firm

𝝅𝟏 𝝅 𝟐 𝝅 𝟑

FORMULA: 𝑷𝑽𝑭𝒊𝒓𝒎 = 𝝅𝟎 + + (𝟏(𝒊) 𝟐 + (𝟏(𝒊)𝟑 + ⋯

(𝟏(𝒊)

- The value of the firm today is the PV of its current and future profits

- Maximizing the lifetime (long term) value of the firm is equivalent to maximizing the firm’s current profits

of π_0

¨ π_0 – current profits have not yet been paid out as dividends. These profits are expected to grow at a

constant rate of g% each year.

FORMULA:

- When dividends are immediately paid out of current profits, the present value of the firm is (at ex-

dividend date):

FORMULA:

- If the interest rate and growth rate are constant, the strategy of the maximizing current profits also

maximizes the value of the firm.

- Maximizing short-term profits may maximize long-term profits if the growth rate in profits is less than the

interest rate and both are constant.

6. Use marginal analysis

• one of the most important managerial tools; states that optimal managerial decisions involve comparing

the marginal/incremental benefits of a decision with the marginal/incremental costs

EXAMPLE: Optimal amount of studying is determined by comparing the improvement of your grade that will

result from an additional hour of studying and the additional costs of studying an additional hour.

~ If the benefits of studying an additional hour exceed the costs of studying an additional hour,

it is profitable to continue to study

~ Once an additional hour of studying adds more to costs than to benefits, stop studying

• Discrete decisions

~ Marginal benefit - The additional benefits that arise by using an additional unit of the managerial

control variable. (OR It is the change in total benefits arising from a change in the managerial control

variable Q)

~ Marginal cost - The additional cost incurred by using an additional unit of the managerial control

variable (OR It is the change in total costs arising from a change in the managerial control variable Q)

~ Marginal net benefits - The change in net benefits that arise from one-unit change in Q

Note: To maximize net benefits, the manager should increase the managerial control variable up to the point

where marginal benefits equal marginal costs.

5 ASC Academics Committee|A.Y. 2019 - 2020

Figure 1.3: Marginal Analysis Figure 1.4: Marginal Value Curves

• Continuous decisions - Marginal value curves are the slopes of total value curves. When the control variable

is infinitely divisible, the slope of a total value curve at a given point is the marginal value at that point.

~ The slope of total benefit curve at a given Q is the marginal benefit of that level of Q

~ The slope of total cost curve at a given Q is the marginal cost of that level of Q

~ The slope of net benefit curve at a given Q is the marginal net benefit of that level of Q

~ The slopes of the total benefits curve and the total cost curve are equal when the net benefits are

maximized

~ When net benefits are maximized, MB = MC

Þ Since the slope of a function is the derivative of that function, the derivative of a given function is the marginal

value of that function

§ MB= dB(Q)d(Q)

§ MC= dC(Q)d(Q)

§ MNB= dN(Q)d(Q)

• Incremental decisions - Marginal analysis is the appropriate tool to use for decisions that require a simple

thumbs up or down

~ Incremental revenues - Additional revenues that stem

~ Incremental costs - Additional costs that stem from a yes or no decision

Direct and indirect fixed costs are the same regardless

of any changes (this means that these are irrelevant to

the decision-making process)

Figure 1.4: Incremental Decisions

6 ASC Academics Committee|A.Y. 2019 - 2020

CHAPTER 2 – MARKET FORCES: DEMAND AND SUPPLY

A. Demand - the quantity of a good that consumers are willing and able to buy at various prices during a given period of

time.

• Law of Demand: “As price increases (decreases), quantity demanded decreases (increases).” Ceteris Paribus (all

things remain constant except the price)

- There is a negative/inverse relationship between the Price and Demand

• Market Demand Curve: A curve indicating the total quantity of a good all consumers are willing and able to buy

at a possible price, ceteris paribus

• Demand Shifters (B I T E R) - Variables other than

the price of a good that affects the demand.

v Buyers – no. of buyers (e.g. increase in no. of

buyers or population, shift to the right:

increase in demand)

v Income – affects the ability of consumers to

purchase goods

• Normal good - A good which increases

demand (shift to the right) when

consumer income rise and vice versa.

• Inferior good - A good for which an

increase in income leads to a decrease

in the demand for that good and vice

versa.

v Tastes – includes consumer tastes (e.g.

increase in advertising, shift to the right: increase in demand)

v Expectations – consumer expectations (e.g. Christmas sale, shift to the right: increase in demand. Another:

Panic buying- purchasing large quantities of a particular product/commodity due to sudden fear of price

increase in the future.)

v Related goods – changes in price of related goods

• Substitutes - (increase) in price of good X; (increase) in demand for good Y

• Complements - (increase) in price of good X; (decrease) in demand for good Y

• Demand Function

- the final step in the analysis of the demand side

- describes how much of a good will be purchased at alternative prices of that good and related goods,

alternative income levels, and alternative values of other variables affecting demand

Example: The demand function for good X is a mathematical representation describing how many units of X

will be purchased at alternative prices of X, price of a related good Y, alternative levels of income, and alternative

values of other variables that affect demand.

FORMULA: Qxd = f (Px, Py, M, H)

Where:

Qxd - quantity demanded of good X

Px - Price of good X

Py - Price of related good

M- Income

H- value of any other variable that affects demand

7 ASC Academics Committee|A.Y. 2019 - 2020

ü Linear demand function

- One simple, but useful representation of a demand function is the linear demand function.

- A representation of demand function in which the demand for a given good is a linear function of

prices, income levels, and other variables influencing demand.

Example:

FORMULA: 𝑄xd = 𝛼0 + 𝛼x𝑃x + 𝛼y𝑃y + 𝛼H𝑀 + 𝛼H𝐻

Where:

𝑄xd is the number of units of good X demanded;

𝑃x is the price of good X;

𝑃y is the price of a related good Y;

𝑀 is income;

𝐻 is the value of any other variable affecting demand

The signs and magnitude of the 𝛼 coefficients determine the impact of each variable on the number of units of X

demanded.

FORMULA: 𝑄xd = 𝛼0 + 𝛼x 𝑃x + 𝛼y 𝑃y + 𝛼H 𝑀

Example:

– 𝛼x < 0 by the law of demand;

– 𝛼y > 0 if good Y is a substitute for good X;

– 𝛼M < 0 if good X is an inferior good

Explanation:

By the law of demand,

Ø An INCREASE in Px leads to a DECREASE in the quantity demanded of good X.

• This means 𝛼x < 0

Ø Sign ay will be positive or negative depending on whether the goods X and Y are SUBSTITUTE or

COMPLEMENTS.

• If ay is a POSITIVE number, an increase in the price of good Y will lead to an increase in the consumption

of good X. Therefore, good X is a SUBSTITUTE good for good Y.

• If ay is a NEGATIVE number, an increase in the price of good Y will lead to a decrease in the consumption

of good X. Therefore, good X is a COMPLEMENT of good Y.

Ø Sign 𝛼M can be positive or negative depending on whether X is a NORMAL or an INFERIOR good.

• If 𝛼M is a POSITIVE number, an increase in income (M) will lead to an increase in the consumption of

good X. Therefore, good X is a NORMAL good.

• If 𝛼M is a NEGATIVE number, an increase in income will lead to a decrease in the consumption of good

X. Therefore, good X is an INFERIOR good.

Demonstration Problem:

An Economic Consultant for X Corp. recently provided the firm’s marketing manager with this estimate of

the demand function for the firm’s product.

FORMULA: Qxd = 12,000 – 3Px + 4Py – 1M + 2Ax

Where:

Qxd – Amount consumed of good X

Px - Price of good X

Py- Price of good Y

M- Income

8 ASC Academics Committee|A.Y. 2019 - 2020

Ax – Amount of advertising spent on good X

Suppose good X sells for $100 per unit, good Y sells for $20 per unit, the company utilizes 3,000 units of advertising,

and consumer income is $10,000. How much of good X do consumers purchase? Are good X and Y substitutes or

complements? Is good X a normal or an inferior good?

Answer:

Substitute the given values of prices, income, and advertising into the linear demand equation:

Qxd = 12,000 – 3(100) + 4(20) – 1(10,000) + 2(3,000)

= 7,780 units

Explanation:

• The total consumption of X is 7,780 units.

• Since the coefficient of Py in the demand function is 4 > 0, an increase of $1 in the price of good Y will

increase the consumption of good X by 4 units. Thus, good X and Y are substitutes.

• Since the coefficient of M in the demand function is -1 < 0, an increase of $1 in income will decrease the

consumption of good X by 1 unit. Thus, good X is an inferior good.

ü Inverse demand function

- This function is used to construct a market demand curve.

- reveals how much consumers are willing and able to pay for each additional unit of good X

Demonstration Problem (using the same problem in linear demand function):

Let:

Py = $15

M = $10,000

A = 2,000

Qxd = 12,000 – 3Px + 4(15) – 1(10,000) + 2(2,000)

= 6,060 - 3Px

𝟏

Px= 2,020 – 𝟑 Qxd

Consumer Surplus

- Marketing strategies like value pricing and price discrimination

- Consumer Surplus is the area above the price paid for a good but below the demand curve.

• Total consumer value - is the sum of the maximum amount a consumer is willing to pay at different

quantities

• Total expenditure - is the per-unit market price times the number of units consumed

Marketing Strategies

• Value pricing – a price-setting strategy where prices are set primarily on a consumers' perceived value

of the product or service

9 ASC Academics Committee|A.Y. 2019 - 2020

• Pricing discrimination – is a pricing strategy that charges customers different prices for the same

product or service. In pure price discrimination, the seller charges each customer the maximum price

he or she will pay.

Example of Consumer Surplus:

A typical consumer’s demand for the Happy Beverage Company’s product looks like in the figure beside. If the firm

charges a price of $2 per liter, how much revenue will the firm earn and how much consumer surplus will the typical

consumer enjoy? What is the most a consumer would be willing to pay for a bottle containing exactly 3 liters of the

firm’s beverage?

At a price of $2 per liter, a typical consumer will purchase 3 liters of the beverage. The firm’s total expenditure is $6

and the consumer surplus is $4.50. The total consumer value (or benefit) of 3 liters to a typical consumer is $10.50.

This is also the maximum amount of a consumer would be willing to pay for a bottle containing exactly 3 liters of

the firm’s beverage. Therefore, if the firm sold the product in 3-liter bottles rather than small units, it could sell

each bottle for $10.50 to earn higher revenue.

B. Supply - refers to the quantity of goods that a seller is willing to offer for sale.

• Law of Supply: “As price increases (decreases), quantity supplied increases (decreases).” Ceteris Paribus (all

things remain constant except the price)

- There is a positive or direct relationship between the Price and Demand

• Market Supply Curve: A curve indicating the total quantity of a good that all producers in a competitive market

would produce at each price, holding input prices, technology, and other variables affecting supply constant.

• Supply Shifters (S T O N E R) – are variables that affect the position of the supply curve; the change in supply is

the shift due to supply shifters.

v Subsidies and taxes

• Subsidy- a benefit given to an individual,

business, or institution, usually by the

government. It is usually in the form of a cash

payment or a tax reduction. (supply curve

will shift to the right)

• excise tax- is a tax on each unit of output

sold, where the tax revenue is collected from

the supplier (shift to the left)

• ad valorem tax- a percentage tax; a sales tax

of a good (shift to the left)

10 ASC Academics Committee|A.Y. 2019 - 2020

v Technology - Improved technology for production will shift the supply curve to the right (increase in supply),

while the use of an obsolete technology will shift the supply curve to the left (decrease in supply)

v Other goods - prices of related goods: substitutes and complements

v Number of sellers - An entry in the industry, supply curve shift to the right (more output availability); while,

an exit from the industry, supply curve shift to the left (fewer units of output to be sold)

v Expectations - producer expectations: If firms suddenly expect prices to be higher in the future and the

product is not perishable, producers can hold back output today and sell it later at a higher price.

v Resource costs - higher production costs will cause the supply curve to shift to the left (decrease in supply)

and vice versa

• Supply Function

Þ describes how much of the good will be produced at alternative prices of the good, alternative prices of

inputs, and alternative values of other variables that affect supply.

FORMULA: Qxs=f (Px, Pr, W, H)

Where:

Px = price of the good

Pr = price of the technologically- related good

W = price of an input

H = value of some other variable that affects supply

ü Linear supply function - a representation of the supply function in which the supply of a given good is a

linear function of prices and other variables affecting supply

FORMULA: Qxs=β0 + βxPx + βrPr + βwW + βHH

• Producer Surplus - the amount of money producers receive in excess of the amount of necessary to induce them

to produce the good

• Supply Elasticity - the percentage change in the quantity supplied divided by the percentage change in the price

of good

CHAPTER 3: QUANTITATIVE DEMAND ANALYSIS

A. Elasticity - measures the responsiveness of one variable to a change in another variable. The primary tool used to

measure the magnitude of such change is the Elasticity Analysis.

• Types of Elasticity

Own Price Elasticity of Demand

Þ The own price elasticity of demand is a very important elasticity concept that measures the

responsiveness of quantity demanded to a change in price.

Þ Denoted as EQxPx.

§ Point elasticity - elasticity for comparing two set of points in the demand curve.

FGHIJK LMFGHIJK N

FORMULA: EQxPx = FGHIJK N

OPQRG LMOPQRG N

OPQRG N

§ Arc elasticity - average elasticity of the whole demand function or curve.

(STMSU)(OTVOU)

(Y2ZY3)([2([3)

FORMULA: E Arc

= U

(OTMOU)(STVSU) 𝑜𝑟 ([2Z[3)(Y2(Y3)

U

11 ASC Academics Committee|A.Y. 2019 - 2020

• Classification of Elasticity

a. Elastic – when the absolute value of the elasticity is greater than 1 (means greater change in Qd than in

Price)

b. Inelastic – when the absolute value of the elasticity is less than 1 (means lesser change in Qd than in Price)

c. Unitary - when the absolute value of the elasticity is equal to 1 (means equal change in Qd and Price)

d. Perfectly elastic – when the elasticity is infinite in absolute value (means no change in Price, but continuous

change in Qd)

e. Perfectly inelastic – when the absolute value of elasticity is 0 (means any change in Price does not affect

Qd of good X)

ü Elasticity and Total Revenue

~ Conceptually as the price own price elasticity of demand increases the price of good x increases.

~ For the relationship of elasticity and total revenue:

- As the absolute value of elasticity increases as long as it is less than 1 the total revenue increases.

- When the elasticity of demand is greater than 1 an increase in price would lead to a reduction of

total revenue.

Total revenue test

- Shows the relationship of the changes in price, elasticity, and total revenue.

- If the demand is elastic, an increase in price will decrease the total revenue.

- If the demand is inelastic, an increase in price will increase the total revenue of the firm.

ü Factors Affecting the Own Price Elasticity

Available substitutes

- The more substitutes available for the good, the more elastic the demand for it. A price increase

leads consumers to substitute toward another product, thus reducing considerably the quantity

demanded of the good.

- If there are few close substitutes for a good, demand tends to be relatively inelastic. This is

because consumers cannot readily switch to a close substitute when the price increases.

- Broadly defined commodities tend to be more inelastic and specific commodity is said to be more

elastic.

Time

- Demand tends to be more inelastic in the short term than in the long term. The more time

consumers have to react to a price change, the more elastic the demand for the good. Time allows

the consumer to seek out available substitutes.

Example: If a consumer has 30 minutes to catch a flight, he or she is much less sensitive to the

price charged for a taxi ride to the airport than would be the case if the flight were several hours

later.

- Given enough time, the consumer can seek alternative modes of transportation such as a bus, a

friend’s car, or even on foot. But in the short term, the consumer does not have time to seek out

the available substitutes, and the demand for taxi rides is more inelastic.

Expenditure share

- If a consumer spends a large portion of his/her income to purchase a specific product, then the

demand for that product would be elastic. On the contrary, the demand would be inelastic for

products which are purchased after spending a small portion of consumers’ income.

Example: Goods such as salt, newspaper, toothpaste, matchboxes, pens, and books, entitle a small

portion of consumer’s income. The demand for these goods is usually inelastic as increase in the

12 ASC Academics Committee|A.Y. 2019 - 2020

price of these goods does not have major impact on consumer’s budget. Therefore, consumers

continue to purchase the same quantity of these goods even in case of increase in their prices.

• Cross-Price Elasticity - Measures of the responsiveness of the demand for good X to changes in the price

of a related good Y.

FORMULA:

v Substitutes Goods – if cross elasticity of demand is positive, meaning that the sales of X move in the

same direction as a change in the price of Y, then X and Y are substitute goods.

v Complementary Goods – when cross elasticity of demand is negative, meaning that the sales of X

“go together”; an increase in the price of one decreases the demand for the other.

v Independent Goods – a zero o near-zero cross elasticity suggests that the two products being

considered are unrelated.

Example:

1. If the price of Product X increased by 10%, the quantity demanded of Y increases by 15 %. Then the

coefficient for the cross elasticity of the X and Y is:

Cross price elasticity = percentage change in Qx / percentage change in Py

= (15%) / (10%) = 1.5 > 0, indicating X and Y are substitutes

2. If the price of Product X increased by 10%, the quantity demanded of Y decreases by 15 %. Then the

coefficient for the cross elasticity of the X and Y is:

Cross price elasticity = percentage change in Qx / percentage change in Py

= (- 15%) / (10%) = - 1.5 < 0, indicating X and Y are complements

• Income Elasticity - is a measure of the responsiveness of consumer demand to changes in income.

FORMULA:

v Normal goods – The income-elasticity coefficient Ei is positive, meaning more of them are

demanded as income rise.

v Inferior goods – The income-elasticity coefficient Ei is negative, meaning consumers decrease their

purchases of inferior goods as income rise.

v Insights – When recessions (business downturns) occur and incomes fall, income elasticity of

demand helps predict which products will decline in demand more rapidly than others.

• Other Elasticity

- Impact of changes in other variables, such as advertising, may be analyzed in elasticity terms.

- Note: The concept of getting other elasticities could be compared to getting the income

%∆Y^K

elasticity. FORMULA: EQxAx =

%∆_^

Example:

For instance, we know the EQxAx = 0.25 and the %∆𝐴a = 60 and the question asks for the

%∆𝑄ab .

13 ASC Academics Committee|A.Y. 2019 - 2020

We can simply input all the given to our equation like this:

%∆Y^K %∆Y^K

EQxAx = >>> 0.25 =

%∆_^ cd

%∆𝑄ab = 15

• Elasticities for Non-Linear Demand Functions

— One non-linear demand function is the log-linear demand function

b

— We don’t have to solve anything for here. Basically, what we see is what we 𝐼𝑛𝑄g = 𝛽d +

𝛽a 𝑙𝑛 𝑃a + 𝛽j 𝑙𝑛 𝑃j + 𝛽k 𝑙𝑛 𝑀

— Own Price Elasticity - 𝜷𝒙

— Income Elasticity - 𝜷𝑴

• Positive – Normal Good

• Negative – Inferior Good

— Cross-Price Elasticity - 𝜷𝒚

• Positive – Substitute

• Negative – Complement

B. Regression Analysis - a set of statistical processes for estimating the relationships among variables.

• Confidence interval

— range of values we are fairly sure our true value lies in.

• The t-Statistic

— It is the ratio of the departure of the estimated value of a parameter from its hypothesized value to its

standard error.

— When the absolute value of the t-statistic is large, the standard error of the parameter estimate is small

relative to the absolute value of the parameter estimate.

§ Absolute Value ≥ 2

o The corresponding parameter estimate is statistically different from zero.

§ The lower the P-Value for an estimates coefficient, the more confident you are in the estimate.

14 ASC Academics Committee|A.Y. 2019 - 2020

QUESTIONS

1. Accounting profits are:

A. total revenue minus total cost.

B. total cost minus total revenue.

C. marginal revenue minus total cost.

D. total revenue minus marginal cost.

2. A firm will maximize the present value of future profits by maximizing current profits when the:

A. growth rate in profits is constant.

B. growth rate in profits is larger than the interest rate.

C. interest rate is larger than the growth rate in profits and both are constant.

D. growth rate and interest rate are constant and equal.

3. The additional cost incurred by using an additional unit of the managerial control variable is defined as the:

A. total cost.

B. net cost.

C. net benefit.

D. marginal cost.

4. A floor price is:

A. the minimum legal price that can be charged in a market.

B. the maximum legal price that can be charged in a market.

C. below the initial market equilibrium price.

D. equal to the initial market equilibrium price.

5. Which of the following is probably NOT a normal good?

A. Designer jeans

B. Diamond rings

C. Intercity passenger bus travel

D. New automobiles

6. Good X is an inferior good if a decrease in income leads to:

A. an increase in the supply of good X.

B. a decrease in the supply of good X.

C. an increase in the demand for good X.

D. a decrease in the demand for good X.

7. The buyer side of the market is known as the:

A. income side.

B. demand side.

C. supply side.

D. seller side.

8. The law of demand states that, holding all else constant:

A. as price falls, demand will fall also.

B. as price rises, demand will also rise.

C. price has no effect on quantity demanded.

D. as price falls, quantity demanded rises.

15 ASC Academics Committee|A.Y. 2019 - 2020

9. Changes in the price of good A lead to a change in:

A. demand for good A.

B. demand for good B.

C. the quantity demanded for good A.

D. the quantity demanded for good B.

10. As we move down along a linear demand curve, the price elasticity of demand becomes more:

A. elastic.

B. inelastic.

C. log-linear.

D. variable.

11. Demand is perfectly elastic when the absolute value of the own price elasticity of demand is:

A. zero.

B. one.

C. infinite.

D. unknown.

12. Which of the following factors would NOT affect the own price elasticity of a good?

A. Time

B. Price of an input

C. Available substitutes

D. Expenditure share

13. If the cross-price elasticity between goods A and B is negative, we know the goods are:

A. inferior goods.

B. complements.

C. inelastic.

D. substitutes.

14. Suppose the demand function is Q xd = 100 − 8Px + 6Py – M. If Px = $4, Py = $2, and M = $10, what is the cross-price

elasticity of good x with respect to the price of good y?

A. 0.17

B. 0.38

C. 0.21

D. 0.04

15. Negotiation between the buyer and seller of a new ski boat is an example of:

A. consumer− producer rivalry.

B. consumer− consumer rivalry.

C. producer− producer rivalry.

D. None of the statements associated with this question are correct.

16. Other things held constant, the greater the price of a good:

A. the lower the demand.

B. the higher the demand.

C. the greater the consumer surplus.

D. the lower the consumer surplus.

17. Suppose the supply of good X is given by Qsx = 10 + 2Px. How many units of good X are produced if the price of

good X is 20?

16 ASC Academics Committee|A.Y. 2019 - 2020

A. 10

B. 20

C. 30

D. None of the statements associated with this question are correct.

18. Demand shifters do NOT include:

A. the price of the good.

B. the consumer's income.

C. the level of advertising.

D. the price of the other goods.

19. Which of the following is LEAST likely to be a normal good?

A. Steak

B. Airline travel

C. Bologna

D. A house

20. Which of the following statements is INCORRECT?

A. As the population rises, the market demand curve shifts to the right.

B. As a greater fraction of the population becomes elderly, the demand for medical services will tend to increase.

C. Changes in the composition of the population affect the demand for a product.

D. None of the statements associated with this question are incorrect.

21. Compute the present value of a perpetual bond that pays a monthly cash flow of $1,000 at an annual interest rate

of 12 percent.

A. $8,333.33

B. $9,333.33

C. $100,000

D. $101,000

22. Compute the present value of a preferred stock that pays, in perpetuity, an annual cash flow of $200 at an annual

interest rate of 5 percent.

A. $190.48

B. $210

C. $4,000

D. $4,200

23. The lower the interest rate:

A. the greater the present value of a future amount.

B. the smaller the present value of a future amount.

C. the greater the level of inflation.

D. None of the statements associated with this question are correct.

24. Suppose there is a simultaneous increase in demand and decrease in supply. What effect will this have on the

equilibrium price?

A. It will rise.

B. It will fall.

C. It may rise or fall.

D. It will remain the same.

17 ASC Academics Committee|A.Y. 2019 - 2020

25. Given a linear demand function of the form QXd = 100 − 0.5PX, find the inverse linear demand function.

A. PX = 200 − 2QX

B. PX = 100 − 0.5QX

C. PX = 100 − 2QX

D. PX = 100QX − 0.5PX

26. If supply increases, then the:

A. supply curve shifts to the left.

B. equilibrium price goes down.

C. equilibrium quantity goes down.

D. demand curve shifts to the right.

27. Technological advances will cause the supply curve to:

A. shift to the left.

B. shift to the right.

C. become flatter.

D. become steeper.

28. Which of the following provides a measure of the overall fit of a regression?

A. t-statistic

B. F-statistic

C. R-square

D. The F-statistic and R-square

29. The statistical analysis of economic phenomena is defined as:

A. econometrics.

B. variance.

C. confidence intervals.

D. standard deviation.

30. An income elasticity less than zero tells us that the good is:

A. a normal good.

B. a Giffen good.

C. an inferior good.

D. an inelastic good.

31. Since most consumers spend very little on salt, a small increase in the price of salt will:

A. reduce quantity demanded by a large amount.

B. not reduce quantity demanded by very much.

C. not change quantity demanded.

D. increase quantity demanded by a small amount.

32. For a given set of data and a regression equation, the greater the R-square:

A. the greater the t-value.

B. the lower the t-value.

C. the greater the adjusted R-square.

D. the lower the adjusted R-square.

33. Generally when calculating profits as total revenue minus total costs, accounting profits are larger than economic

profits because economists take into account:

18 ASC Academics Committee|A.Y. 2019 - 2020

A. only explicit costs.

B. only implicit costs.

C. both explicit and implicit costs.

D. Both types of profits are always equal because they account for the same costs.

34. In order to maximize net benefits, the managerial control variable should be used up to the point where:

A. total costs equal total benefits.

B. average costs equal marginal benefits.

C. average benefits equal marginal costs.

D. net marginal benefits equal zero.

35. Managerial economics:

A. has little to say about day-to-day decisions.

B. is valuable to the coordinator of a shelter for the homeless.

C. is not relevant for managers of not-for-profit groups.

D. is the study of how to get rich in the stock market.

36. When dealing with present value, a higher interest rate:

A. does not affect the present value of the future amount.

B. increases the present value of a future amount.

C. decreases the present value of a future amount.

D. None of the statements associated with this question are correct.

37. The short-run response of quantity demanded to a change in price is usually:

A. the same as the long-run response.

B. less than the long-run response.

C. greater than the long-run response.

D. None of the preceding statements is correct.

38. The cross-price elasticity of demand for textbooks and copies of old exams is −3.5. If the price of copies of old exams

increases by 10 percent, the quantity demanded of textbooks will:

A. fall by 3.5 percent.

B. rise by 3.5 percent.

C. fall by 35 percent.

D. rise by 35 percent.

39. You are the manager of a popular hat company. You know that the advertising elasticity of demand for your product

is 0.25. How much will you have to increase advertising in order to increase demand by 5 percent?

A. 0.05 percent

B. 20 percent

C. 25 percent

D. 1.25 percent

40. If steak is a normal good, what do you suppose would happen to price and quantity during an economic recession?

A. Price would increase and quantity decrease.

B. Price and quantity would both increase.

C. Price and quantity would both decrease.

D. Price would decrease and quantity increase.

19 ASC Academics Committee|A.Y. 2019 - 2020

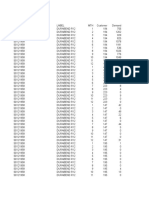

ANSWER KEY

1. A 21. C

2. C 22. C

3. D 23. A

4. A 24. A

5. C 25. A

6. C 26. B

7. B 27. B

8. D 28. D

9. C 29. A

10 .B 30. C

11. C 31. B

12. B 32. C

13. B 33. C

14. A 34. D

15. A 35. B

16. D 36. C

17. D 37. B

18. A 38. C

19. C 39. B

20. D 40. C

Prepared by:

Macrin Recinto

Maeren Apple Agbing

References:

Managerial Economics Business Strategy: for University of Santo Tomas (2018)

USTASC Reviewer for Microeconomics (2017-2018)

USTASC Managerial Economics Reviewer (2018-2019)

20 ASC Academics Committee|A.Y. 2019 - 2020

Potrebbero piacerti anche

- Test Bank Chapter1Documento4 pagineTest Bank Chapter1shawktNessuna valutazione finora

- Module 3 - Capital BudgetingDocumento1 paginaModule 3 - Capital BudgetingPrincess Frean VillegasNessuna valutazione finora

- Chap 5Documento52 pagineChap 5jacks ocNessuna valutazione finora

- Chapter 9 Multiple Choice QuestionsDocumento32 pagineChapter 9 Multiple Choice Questionsmistermakaveli0% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Ratio Analysis: Profitability RatiosDocumento10 pagineRatio Analysis: Profitability RatiosREHANRAJNessuna valutazione finora

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocumento33 pagineChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Solutions Chapter 7Documento39 pagineSolutions Chapter 7Brenda Wijaya100% (2)

- 2011-02-03 230149 ClarkupholsteryDocumento5 pagine2011-02-03 230149 ClarkupholsteryJesus Cardenas100% (1)

- Ch010.Lam2e TBDocumento25 pagineCh010.Lam2e TBTnananaNessuna valutazione finora

- Differential AnalysisDocumento26 pagineDifferential AnalysisEdma Glory MacadaagNessuna valutazione finora

- Exercise 1 - Decision Theory PDFDocumento5 pagineExercise 1 - Decision Theory PDFKaran Kakkar0% (1)

- Financial ManagementDocumento13 pagineFinancial ManagementEliNessuna valutazione finora

- Financial Management Assignment 1 PDFDocumento2 pagineFinancial Management Assignment 1 PDFSELAM ANessuna valutazione finora

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocumento7 pagineChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNessuna valutazione finora

- MA Tutorial 2Documento6 pagineMA Tutorial 2Jia WenNessuna valutazione finora

- Chapter 6 - Fundamentals of Product and Service CostingDocumento26 pagineChapter 6 - Fundamentals of Product and Service Costingalleyezonmii100% (1)

- Test: Managerial Accounting Chapter 10 - QuizletDocumento4 pagineTest: Managerial Accounting Chapter 10 - Quizletariel4869Nessuna valutazione finora

- Lecture 5 - Interest - Rates - and - Bond - ValuatDocumento30 pagineLecture 5 - Interest - Rates - and - Bond - ValuatShams Istehaad100% (1)

- Basket Wonders' Balance Sheet (Asset Side)Documento32 pagineBasket Wonders' Balance Sheet (Asset Side)OSAMA0% (1)

- Assignment On: Managerial Economics Mid Term and AssignmentDocumento14 pagineAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNessuna valutazione finora

- DM Mid TermDocumento102 pagineDM Mid TermSourya MitraNessuna valutazione finora

- Chapter 18 Simplex-Based Sensitivity Analysis and DualityDocumento20 pagineChapter 18 Simplex-Based Sensitivity Analysis and DualityTito TitoNessuna valutazione finora

- Time Value of Money General Instructions:: Activity 4 MfcapistranoDocumento2 pagineTime Value of Money General Instructions:: Activity 4 MfcapistranoAstrid BuenacosaNessuna valutazione finora

- Basic BEP Problems and Solutions PDFDocumento3 pagineBasic BEP Problems and Solutions PDFseepumma100% (1)

- Testbank - Chapter 18Documento3 pagineTestbank - Chapter 18naztig_017100% (1)

- AIS CH 10 Flashcards - QuizletDocumento5 pagineAIS CH 10 Flashcards - QuizletArmen CordovaNessuna valutazione finora

- ECON: Practice Quizes 1-5Documento37 pagineECON: Practice Quizes 1-5Audrey JacksonNessuna valutazione finora

- 677261-Foundations of Financial Management Ch04Documento28 pagine677261-Foundations of Financial Management Ch04pcman92Nessuna valutazione finora

- ch19 PDFDocumento23 paginech19 PDFDonita BinayNessuna valutazione finora

- TB Chapter08Documento79 pagineTB Chapter08CGNessuna valutazione finora

- Exercise 3-8 MADocumento1 paginaExercise 3-8 MAsesegar_nailofarNessuna valutazione finora

- Questio Bank Managerial EconomicsDocumento12 pagineQuestio Bank Managerial EconomicsSarthak Bhargava67% (3)

- Chapter 3 - Planning & Strategic Management PDFDocumento43 pagineChapter 3 - Planning & Strategic Management PDFOh Jia HaoNessuna valutazione finora

- Chapter 15Documento2 pagineChapter 15Faizan ChNessuna valutazione finora

- Mock BoardDocumento9 pagineMock BoardChristian Rey Sandoval DelgadoNessuna valutazione finora

- DocxDocumento40 pagineDocxJamaica DavidNessuna valutazione finora

- Management Science Chapter 13Documento43 pagineManagement Science Chapter 13Myuran SivarajahNessuna valutazione finora

- Managerial economics Complete Self-Assessment GuideDa EverandManagerial economics Complete Self-Assessment GuideNessuna valutazione finora

- Quiz 14 - Financial ManagementDocumento9 pagineQuiz 14 - Financial ManagementAurelio Delos Santos Macatulad Jr.Nessuna valutazione finora

- Chapter Three CVP AnalysisDocumento65 pagineChapter Three CVP AnalysisBettyNessuna valutazione finora

- Questions On Capital Structure: Leverage and Capital Structure Answer: A Diff: EDocumento3 pagineQuestions On Capital Structure: Leverage and Capital Structure Answer: A Diff: ETeddyPeterNessuna valutazione finora

- Unit 3: Introduction To Linear ProgrammingDocumento12 pagineUnit 3: Introduction To Linear ProgrammingbojaNessuna valutazione finora

- Chapter 1 Managerial Accounting, The Business Organization, and Professional EthicsDocumento36 pagineChapter 1 Managerial Accounting, The Business Organization, and Professional EthicssamahNessuna valutazione finora

- Exercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Documento2 pagineExercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Chryshelle LontokNessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- McqsDocumento4 pagineMcqsaashir ch0% (1)

- Unit 2-Cost Classification TutorialDocumento4 pagineUnit 2-Cost Classification TutorialBarby AngelNessuna valutazione finora

- Chap 7 and 8 QuizDocumento3 pagineChap 7 and 8 QuizWelshfyn ConstantinoNessuna valutazione finora

- 2012 EE enDocumento76 pagine2012 EE enDiane MoutranNessuna valutazione finora

- CH 12Documento31 pagineCH 12Mochammad RidwanNessuna valutazione finora

- Cost ConceptsDocumento24 pagineCost ConceptsAshish MathewNessuna valutazione finora

- 18e Key Question Answers CH 7Documento2 pagine18e Key Question Answers CH 7AbdullahMughalNessuna valutazione finora

- Chapter 11 Quiz Connect CampDocumento25 pagineChapter 11 Quiz Connect CampaksNessuna valutazione finora

- QUIZZER Cost of CapitalDocumento8 pagineQUIZZER Cost of CapitalJOHN PAOLO EVORANessuna valutazione finora

- Chapter 11 - Network Models - Operations ResearchDocumento12 pagineChapter 11 - Network Models - Operations ResearchAnkit Saxena100% (5)

- 2 Pay Off TableDocumento2 pagine2 Pay Off TableIanNessuna valutazione finora

- ACCT 331 ABC Class Problem 2Documento7 pagineACCT 331 ABC Class Problem 2邱子驊Nessuna valutazione finora

- Chapter 15 Test Bank Cost AccountingDocumento20 pagineChapter 15 Test Bank Cost AccountingKayla Shelton0% (1)

- ME - Chapter 01 Summary PointsDocumento2 pagineME - Chapter 01 Summary PointsArka BandyopadhyayNessuna valutazione finora

- Intellectual Revolutions and Society PDFDocumento17 pagineIntellectual Revolutions and Society PDFBlack ScoopNessuna valutazione finora

- Cost BehaviorDocumento15 pagineCost BehaviorUSO CLOTHINGNessuna valutazione finora

- Framework of Accounting (TOA) - ValixDocumento42 pagineFramework of Accounting (TOA) - ValixFatima Pasamonte88% (43)

- Conceptual Framework PAS 1 With Answer KeyDocumento11 pagineConceptual Framework PAS 1 With Answer KeyRichel Armayan67% (21)

- EXPENSEDocumento6 pagineEXPENSEBlack ScoopNessuna valutazione finora

- Handout For Financial AccountingDocumento9 pagineHandout For Financial AccountingBlack ScoopNessuna valutazione finora

- CA5102 - Managerial Economics-3 PDFDocumento20 pagineCA5102 - Managerial Economics-3 PDFBlack ScoopNessuna valutazione finora

- The Success of CRMDocumento4 pagineThe Success of CRMFoo Shu FongNessuna valutazione finora

- Dimitri Iordan Planning For GrowthDocumento34 pagineDimitri Iordan Planning For GrowthSoumyadeep BoseNessuna valutazione finora

- Accelerating Innovation Training Overview EbookDocumento22 pagineAccelerating Innovation Training Overview EbookdrustagiNessuna valutazione finora

- Pick N PayDocumento8 paginePick N PayAndy WilbyNessuna valutazione finora

- Steel Works Inventory TablesDocumento8 pagineSteel Works Inventory Tableskanikajain1Nessuna valutazione finora

- Marketing Management Module 2Documento7 pagineMarketing Management Module 2Sharon Cadampog MananguiteNessuna valutazione finora

- How To Cold CallDocumento21 pagineHow To Cold Callghica05Nessuna valutazione finora

- AMA Corrieri: Graphic DesignerDocumento1 paginaAMA Corrieri: Graphic DesignerSarah FisherNessuna valutazione finora

- Grade 12 Exam 4q Applied Economics Last 1Documento3 pagineGrade 12 Exam 4q Applied Economics Last 1Paul Paguia100% (1)

- Marketing Plan of PelDocumento37 pagineMarketing Plan of PelAtterat NawabNessuna valutazione finora

- Term Paper On AmazonDocumento17 pagineTerm Paper On AmazonSagarNessuna valutazione finora

- Geccis Question Innovation and Ethics Related To MarketingDocumento2 pagineGeccis Question Innovation and Ethics Related To MarketingSadaanNessuna valutazione finora

- BiscuitsDocumento6 pagineBiscuitschaudharinitinNessuna valutazione finora

- Marketing Strategy Group-8Documento21 pagineMarketing Strategy Group-8ZarahJoyceSegoviaNessuna valutazione finora

- Bestea Group 8 2a Bsoa FinalDocumento35 pagineBestea Group 8 2a Bsoa Finalmae KuanNessuna valutazione finora

- Cccu LSC Babs MM Assessment Apr22Documento9 pagineCccu LSC Babs MM Assessment Apr22Simona AlexandruNessuna valutazione finora

- Chapter 11 Sales SkillsDocumento26 pagineChapter 11 Sales SkillsAshish SinghNessuna valutazione finora

- Entrepreneurship Chapter 4 - Updated - HaithamDocumento18 pagineEntrepreneurship Chapter 4 - Updated - HaithamHaitham YousefNessuna valutazione finora

- The Strategic AuditDocumento2 pagineThe Strategic AuditZareen Irfan BhojaniNessuna valutazione finora

- BrandsDocumento44 pagineBrandsKarifa capito TRAORENessuna valutazione finora

- Cincinnati Zoo Case StudyDocumento8 pagineCincinnati Zoo Case StudyColleen67% (3)

- Introduction To Business Process: Magal and Word - Integrated Business Processes With ERP Systems - © 2011Documento11 pagineIntroduction To Business Process: Magal and Word - Integrated Business Processes With ERP Systems - © 2011Damola AdeoshunNessuna valutazione finora

- Curriculum Vitae Sample ObjectivesDocumento8 pagineCurriculum Vitae Sample Objectivesafiwhwlwx100% (2)

- Emami Mission StatementDocumento4 pagineEmami Mission Statementsonucool009Nessuna valutazione finora

- Q9ADocumento2 pagineQ9Apriyadarshini212007Nessuna valutazione finora

- Kent Grayson - Friendship Versus Business in Marketing Relationships 71 (October 2007, Journal of Marketing) PDFDocumento20 pagineKent Grayson - Friendship Versus Business in Marketing Relationships 71 (October 2007, Journal of Marketing) PDFAlvaro Perez RomanNessuna valutazione finora

- The Effect of Negative Online Customer Reviews On Brand Equity and Purchase Intention of Consumer Electronics in South AfricaDocumento32 pagineThe Effect of Negative Online Customer Reviews On Brand Equity and Purchase Intention of Consumer Electronics in South AfricaPriyaAnantamaAhadinNessuna valutazione finora

- Market Analysis of E-Commerce Trends in The Retail SectorDocumento3 pagineMarket Analysis of E-Commerce Trends in The Retail SectorwebinatoNessuna valutazione finora

- UUU... SHOOOP!!! MPDocumento3 pagineUUU... SHOOOP!!! MPyo_lam6108Nessuna valutazione finora

- OYO: Creating Effective Spaces: Group 1 Dilip Dwivedi Lovely Pateriya Malvika Chandel Sauhard SinghDocumento12 pagineOYO: Creating Effective Spaces: Group 1 Dilip Dwivedi Lovely Pateriya Malvika Chandel Sauhard SinghDilip DwivediNessuna valutazione finora