Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Journal Entry

Caricato da

pixie dust0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni3 pagineTitolo originale

JOURNAL ENTRY

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

21 visualizzazioni3 pagineJournal Entry

Caricato da

pixie dustCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

JOURNAL ENTRY

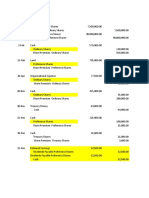

Jan 2. The entity was authorized to issue share capital as follows:

Preference Share capital, no par value with stated valuue of P500 per share, 100,000 shares 50

000 000

Ordinary Share Capital, par value of P10 per share, 25,000,000 shares 250

000 000

Authorized Share Capital 300

000 000

Subscription Receivable- ordinary shares 90 000 000

Subscribed share capital -ordinary shares 75 000 000

Share premium- ordinary shares 15 000 000

#

Cash 67 500 000

Subscription Receivable-ordinary shares 67 500 000

#

Organization Expense 613 580

Cash 613 580

#

Subscription receivable-preference shares 26 775 000

Subscribed share capital-preference shares 25 000 000

Share premium- preference shares 1 775 000

#

Cash 10 465 000

Subscription receivable-preference shares 10 465 000

#

Jan. 5 Subscription receivable - ordinary shares 80 000 000

Share premium- ordinary shares 20 000 000

Subscribed share capital- ordinary shares 100 000 000

#

Cash 80 000 000

Discount on share capital- ordinary shares. 20 000 000

Ordinary share capital 100 000 000

#

Jan. 10 Land 45 000 000

Equipment 7 000 000

Share premium- ordinary shares 500 000

Ordinary share capital 50 000 000

Share premium- ordinary shares 2 500 000

#

Share issuance costs 150 000

Cash 150 000

#

Jan 12 Cash 19 500 000

Subscription receivable- ordinary shares

#

Subscribed share capital - ordinary shares

Ordinary share capital - ordinary shares

#

Share issuance costs 1500 000

Cash 1500 000

#

Jan. 25 Cash 5512 500

Subscription receivable -preference shares 5512 500

#

Subscribed share capital 13 025 000

Preference share capital 12 500 000

Share premium- preference shares 525 000

#

Share issuance costs 125 000

Cash 125 000

#

Jan 31 NO ENTRY

#

Feb 25 Share issuance cost 150,000

Cash 150 000

#

Feb. 7 NO ENTRY

Feb. 10 Cash 9500 000

Subscription receivable- preference shares 9500 000

#

Subscribed share capital-preference share 9500 000

Preference share capital 9500 000

#

Feb 12 Cash 2525 000

Redeemable Preference Shares 2525 000

#

Cash 1750 000

Redeemable Preference shares 1750 000

#

Preference share capital 765 000

Ordinary share capital 15000

Share premium- ordinary shares 750 000

#

Cash 5250 000

Preference share capital 5000 000

Share warrants outstanding 50 000

Share premium- preference shares 200 000

#

Feb 15 Treasury shares 1800 000

Cash 1800 000

#

Cash 1800 000

Treasury Shares 800 000

Share premium-treasury shares 1000 000

#

Ordinary share capital 500 000

Share premium-treasury shares 1000 000

Retained earnings- 23 500 000

Treasury shares 25 000 000

#

March 15 Cash

Subscription receivable- ordinary shares

#

Subscribed share capital

Ordinary share capital

#

March 25 Cash 150 000

Share warrants outstanding 50 000

Ordinary share capital 100 000

Share premium- ordinary shares 50 000

#

Aug. 12 Redeemable preference shares 2525 000

Loss on redemption 25 000

Cash 2550 000

#

Nov. 12 Redeemable preference shares 1750 000

Cash 1725 000

Gain on redemption 25 000

#

Preference share capital

Ordinary share capital 150 000

#

Nov. 25 Ordinary share capital 275 000 000

Ordinary share capital 250 000 000

Share premium- recapitalization 25 000 000

#

Potrebbero piacerti anche

- Final Output 2Documento5 pagineFinal Output 2Kurt Leonard AlbaoNessuna valutazione finora

- JDocumento9 pagineJsyramaebillones26Nessuna valutazione finora

- Memorandum and Journal Entry Methods for Share Capital TransactionsDocumento3 pagineMemorandum and Journal Entry Methods for Share Capital TransactionsFeiya Liu100% (1)

- HW On Basic Share Capital TransactionsDocumento7 pagineHW On Basic Share Capital TransactionsJoana TrinidadNessuna valutazione finora

- Consolidation PartBDocumento29 pagineConsolidation PartBHuzaifa AhmedNessuna valutazione finora

- Assignment 3.1 Additional Equity TransactionsDocumento4 pagineAssignment 3.1 Additional Equity TransactionsJOHN RUSSEL ANTIVONessuna valutazione finora

- Horizontal Groups (2021)Documento5 pagineHorizontal Groups (2021)Tawanda Tatenda HerbertNessuna valutazione finora

- VARGAS Corporation Quiz 2 Part 2Documento3 pagineVARGAS Corporation Quiz 2 Part 2Angelika SinguranNessuna valutazione finora

- Accounting For Corporation: Memo Entry MethodDocumento4 pagineAccounting For Corporation: Memo Entry MethodAlfred SistosoNessuna valutazione finora

- Corporation Part 1Documento9 pagineCorporation Part 11701791Nessuna valutazione finora

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocumento3 paginePam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNessuna valutazione finora

- Quiz 1 - Statement of Financial PositionDocumento9 pagineQuiz 1 - Statement of Financial PositionJonathan SolerNessuna valutazione finora

- Mantuhac, Anthony Bsa-3 Seatwork 01: Audit of Stockholders' Equity Problem No. 1Documento6 pagineMantuhac, Anthony Bsa-3 Seatwork 01: Audit of Stockholders' Equity Problem No. 1Anthony Tunying MantuhacNessuna valutazione finora

- Corporate Share Transactions Journal EntriesDocumento9 pagineCorporate Share Transactions Journal EntriesJasmine ActaNessuna valutazione finora

- Activity CorporationDocumento5 pagineActivity CorporationbucsitNessuna valutazione finora

- Chapter 9 ExercisesDocumento14 pagineChapter 9 Exercisesshiroe raabuNessuna valutazione finora

- Journal entries for PT AndrifaDocumento5 pagineJournal entries for PT AndrifaALICE NADINE KURNIA SURYANessuna valutazione finora

- Asistensi 1 Kunci JawabanDocumento7 pagineAsistensi 1 Kunci JawabanNur Fitriah Ayuning BudiNessuna valutazione finora

- Chapter 9 ExerciseDocumento4 pagineChapter 9 ExerciseKaila Clarisse CortezNessuna valutazione finora

- Parcor Chap 6 DoneDocumento10 pagineParcor Chap 6 DoneJohn Carlo CastilloNessuna valutazione finora

- Assignment Bsma 1a May 27Documento14 pagineAssignment Bsma 1a May 27Maeca Angela Serrano100% (1)

- WEEK 6-7 ULO A, B, C Answer KeyDocumento4 pagineWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Chapter 6 ParcorDocumento10 pagineChapter 6 Parcornikki syNessuna valutazione finora

- Let's Check For 26-1Documento1 paginaLet's Check For 26-1Jerah TorrejosNessuna valutazione finora

- JOURNAL ENTRIES AND ACCOUNT BALANCES FOR PREFERENCE AND ORDINARY SHARESDocumento4 pagineJOURNAL ENTRIES AND ACCOUNT BALANCES FOR PREFERENCE AND ORDINARY SHARESJoshua CabinasNessuna valutazione finora

- Date Particular DR CR: La Bambina Inc. Journal EntriesDocumento5 pagineDate Particular DR CR: La Bambina Inc. Journal EntriesLoida OcaslaNessuna valutazione finora

- Dave Chapter 9Documento11 pagineDave Chapter 9Mark Dave SambranoNessuna valutazione finora

- Subsequent Share Transactions GuideDocumento3 pagineSubsequent Share Transactions GuidePrincess NozalNessuna valutazione finora

- Accounting Equation ch5Documento19 pagineAccounting Equation ch5Ebony Ann delos SantosNessuna valutazione finora

- Business transactions of a men's salonDocumento13 pagineBusiness transactions of a men's salonEbony Ann delos SantosNessuna valutazione finora

- Shareholders EquityDocumento11 pagineShareholders EquityJasmine ActaNessuna valutazione finora

- Asg in FinlcorDocumento34 pagineAsg in FinlcorQuokka KyuNessuna valutazione finora

- 01/1 01/26 CashDocumento2 pagine01/1 01/26 CashVirther MajorNessuna valutazione finora

- Chap 15, 16, 17 AssignmentDocumento12 pagineChap 15, 16, 17 AssignmentSamantha Charlize VizcondeNessuna valutazione finora

- Dividend Journal Entries and CalculationsDocumento4 pagineDividend Journal Entries and CalculationsLorence Patrick LapidezNessuna valutazione finora

- Accounting for Share Capital TransactionsDocumento16 pagineAccounting for Share Capital TransactionsLee Suarez100% (1)

- Amity Inc. share transactions 2021Documento3 pagineAmity Inc. share transactions 2021Rae MichaelNessuna valutazione finora

- CA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 1Documento5 pagineCA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 1eyaczNessuna valutazione finora

- AFR - Question BankDocumento31 pagineAFR - Question BankDownloder UwambajimanaNessuna valutazione finora

- Diandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Documento3 pagineDiandra Murti Liza Aulia 2022210006 Tugas P-12 Pengantar Akuntansi 2Diandra MurtiNessuna valutazione finora

- Past Paper Question 1 With AnswerDocumento6 paginePast Paper Question 1 With AnswerChitradevi RamooNessuna valutazione finora

- Study Guide Principle CH 10-11Documento28 pagineStudy Guide Principle CH 10-11PPBP 90 Astrella ElvarettaNessuna valutazione finora

- BuenaventuraEJ Corporation ActivityDocumento5 pagineBuenaventuraEJ Corporation ActivityAnonnNessuna valutazione finora

- Business Combination Case StudyDocumento3 pagineBusiness Combination Case StudyHuỳnh Minh Gia HàoNessuna valutazione finora

- Quiz No 2Documento5 pagineQuiz No 2Aubrey AsioNessuna valutazione finora

- Fair PricingDocumento10 pagineFair PricingMallet S. GacadNessuna valutazione finora

- Prepare Trading, P&L and Balance SheetDocumento4 paginePrepare Trading, P&L and Balance SheetShreya ShrivastavaNessuna valutazione finora

- Stockholders' Equity Calculations for Multiple ProblemsDocumento5 pagineStockholders' Equity Calculations for Multiple ProblemsMariah MacasNessuna valutazione finora

- Audit of Shareholders EquityDocumento5 pagineAudit of Shareholders EquityShane KimNessuna valutazione finora

- Essay QuestionDocumento11 pagineEssay QuestionAramina Cabigting BocNessuna valutazione finora

- Accounting Share CapitalDocumento12 pagineAccounting Share CapitalMMCNessuna valutazione finora

- Answered The Following Information Was Provided BartlebyDocumento5 pagineAnswered The Following Information Was Provided BartlebyMarkNessuna valutazione finora

- Advantages:: ACN 4127: CORPO Accounting For Preferred and Ordinary Shares Ordinary SharesDocumento8 pagineAdvantages:: ACN 4127: CORPO Accounting For Preferred and Ordinary Shares Ordinary SharesMj BauaNessuna valutazione finora

- Prob 14Documento3 pagineProb 14Abegail DuhanNessuna valutazione finora

- (Quiz Uas Take Home) Akl-1 PDFDocumento7 pagine(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNessuna valutazione finora

- BB QuestionsDocumento2 pagineBB QuestionsHari NaamNessuna valutazione finora

- A. P100 Par Value Date Account Title DR CRDocumento5 pagineA. P100 Par Value Date Account Title DR CRCalyx ImperialNessuna valutazione finora

- Page 197-198Documento10 paginePage 197-198MALICDEM, CharizNessuna valutazione finora

- PARCORDocumento15 paginePARCORkristian eldric BondocNessuna valutazione finora

- Governance RulesDocumento2 pagineGovernance Rulespixie dustNessuna valutazione finora

- Assignment 101Documento1 paginaAssignment 101pixie dustNessuna valutazione finora

- CIR vs. GeothermalDocumento2 pagineCIR vs. Geothermalpixie dustNessuna valutazione finora

- Operational Gvoernance NotesDocumento1 paginaOperational Gvoernance Notespixie dustNessuna valutazione finora

- YOWDocumento5 pagineYOWpixie dustNessuna valutazione finora

- Business and TRading OpinionDocumento1 paginaBusiness and TRading Opinionpixie dustNessuna valutazione finora

- PhilosophyDocumento1 paginaPhilosophypixie dustNessuna valutazione finora

- Chapter 1-The Information System: An Accountant's PerspectiveDocumento2 pagineChapter 1-The Information System: An Accountant's Perspectivepixie dustNessuna valutazione finora

- E CommerceDocumento1 paginaE Commercepixie dustNessuna valutazione finora

- Business and TRading OpinionDocumento1 paginaBusiness and TRading Opinionpixie dustNessuna valutazione finora

- Advantage vs. DisadvantagesDocumento4 pagineAdvantage vs. Disadvantagespixie dustNessuna valutazione finora

- YassDocumento2 pagineYasspixie dustNessuna valutazione finora

- Essay Writing: Tuesday, 10 November 2020 7:53 PMDocumento2 pagineEssay Writing: Tuesday, 10 November 2020 7:53 PMpixie dustNessuna valutazione finora

- Glibalization ConceptsDocumento1 paginaGlibalization Conceptspixie dustNessuna valutazione finora

- Trade and BusinessDocumento1 paginaTrade and Businesspixie dustNessuna valutazione finora

- AteecelDocumento1 paginaAteecelpixie dustNessuna valutazione finora

- SotryyDocumento1 paginaSotryypixie dustNessuna valutazione finora

- Traditional Filipino Ways-SubDocumento2 pagineTraditional Filipino Ways-Subpixie dustNessuna valutazione finora

- LectureDocumento2 pagineLecturepixie dustNessuna valutazione finora

- INVESTMENT DEMAND AND EXPECTATIONSDocumento2 pagineINVESTMENT DEMAND AND EXPECTATIONSpixie dustNessuna valutazione finora

- Barcelona: A Love UntoldDocumento1 paginaBarcelona: A Love Untoldpixie dustNessuna valutazione finora

- Filipino WaysDocumento3 pagineFilipino Wayspixie dustNessuna valutazione finora

- Globalisation MHDocumento26 pagineGlobalisation MHpixie dustNessuna valutazione finora

- Human ExperienceDocumento2 pagineHuman Experiencepixie dustNessuna valutazione finora

- Market PriceDocumento2 pagineMarket Pricepixie dustNessuna valutazione finora

- Return, Risk and The Security Market LineDocumento25 pagineReturn, Risk and The Security Market Linewww_peru9788Nessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Human ExperienceDocumento2 pagineHuman Experiencepixie dustNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chapter 2 Islamic Civilization4Documento104 pagineChapter 2 Islamic Civilization4Anas ShamsudinNessuna valutazione finora

- Biffa Annual Report and Accounts 2022 InteractiveDocumento232 pagineBiffa Annual Report and Accounts 2022 InteractivepeachyceriNessuna valutazione finora

- Winny Chepwogen CVDocumento16 pagineWinny Chepwogen CVjeff liwaliNessuna valutazione finora

- Fil 01 Modyul 7Documento30 pagineFil 01 Modyul 7Jamie ann duquezNessuna valutazione finora

- Festive FeastDocumento25 pagineFestive FeastLina LandazábalNessuna valutazione finora

- FX MKT Insights Jun2010 Rosenberg PDFDocumento27 pagineFX MKT Insights Jun2010 Rosenberg PDFsuksesNessuna valutazione finora

- Addis Ababa University-1Documento18 pagineAddis Ababa University-1ASMINO MULUGETA100% (1)

- Disaster Drilling Land RigsDocumento21 pagineDisaster Drilling Land Rigsmohanned salahNessuna valutazione finora

- Maxwell McCombs BioDocumento3 pagineMaxwell McCombs BioCameron KauderNessuna valutazione finora

- Pindyck Solutions Chapter 5Documento13 paginePindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- INFOSYS120 2014 D2 Daniela Avellaneda HernandezDocumento11 pagineINFOSYS120 2014 D2 Daniela Avellaneda HernandezdaniaveNessuna valutazione finora

- Godbolt RulingDocumento84 pagineGodbolt RulingAnthony WarrenNessuna valutazione finora

- ALDI Growth Announcment FINAL 2.8Documento2 pagineALDI Growth Announcment FINAL 2.8Shengulovski IvanNessuna valutazione finora

- The Genesis of The Five Aggregate TeachingDocumento26 pagineThe Genesis of The Five Aggregate Teachingcrizna1Nessuna valutazione finora

- Marine Insurance Final ITL & PSMDocumento31 pagineMarine Insurance Final ITL & PSMaeeeNessuna valutazione finora

- Questionnaire For Online Banking SurveyDocumento3 pagineQuestionnaire For Online Banking Surveycallyash91178% (32)

- Demand To Vacate - Januario MendozaDocumento1 paginaDemand To Vacate - Januario Mendozaclaudenson18Nessuna valutazione finora

- Perception of People Towards MetroDocumento3 paginePerception of People Towards MetrolakshaymeenaNessuna valutazione finora

- Bernardo Motion For ReconsiderationDocumento8 pagineBernardo Motion For ReconsiderationFelice Juleanne Lador-EscalanteNessuna valutazione finora

- Censorship Is Always Self Defeating and Therefore FutileDocumento2 pagineCensorship Is Always Self Defeating and Therefore Futileqwert2526Nessuna valutazione finora

- 2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyDocumento2 pagine2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyAurangzaib JahangirNessuna valutazione finora

- Civil Litigation MCQ FeedbackDocumento17 pagineCivil Litigation MCQ Feedbackbennyv1990Nessuna valutazione finora

- European Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009Documento1 paginaEuropean Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009api-26115791Nessuna valutazione finora

- Eep306 Assessment 1 FeedbackDocumento2 pagineEep306 Assessment 1 Feedbackapi-354631612Nessuna valutazione finora

- The Catholic Encyclopedia, Volume 2 PDFDocumento890 pagineThe Catholic Encyclopedia, Volume 2 PDFChristus vincit SV67% (3)

- 3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Documento436 pagine3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Anonymous 2o0az0zOJNessuna valutazione finora

- Surface Chemistry Literature List: Literature On The SubjectDocumento5 pagineSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaNessuna valutazione finora

- ITMS (Intelligent Transit Management System) : 1. Name of Project: 2. BackgroundDocumento6 pagineITMS (Intelligent Transit Management System) : 1. Name of Project: 2. Backgroundashish dhakalNessuna valutazione finora

- Pride & Prejudice film sceneDocumento72 paginePride & Prejudice film sceneha eunNessuna valutazione finora

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDocumento4 pagineHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertNessuna valutazione finora

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- LLC or Corporation?: Choose the Right Form for Your BusinessDa EverandLLC or Corporation?: Choose the Right Form for Your BusinessValutazione: 3.5 su 5 stelle3.5/5 (4)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsDa EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNessuna valutazione finora

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionDa EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionValutazione: 5 su 5 stelle5/5 (3)

- Financial Management: The Basic Knowledge of Financial Management for StudentDa EverandFinancial Management: The Basic Knowledge of Financial Management for StudentNessuna valutazione finora

- Will Work for Pie: Building Your Startup Using Equity Instead of CashDa EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNessuna valutazione finora

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EDa EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EValutazione: 4.5 su 5 stelle4.5/5 (6)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)