Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

What Are The Main Functions of Export Credit and Guarantee Corporation

Caricato da

Pooja SkTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

What Are The Main Functions of Export Credit and Guarantee Corporation

Caricato da

Pooja SkCopyright:

Formati disponibili

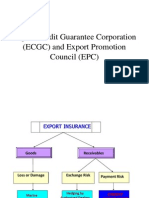

What are the Main Functions of Export Credit and Guarantee Corporation

(ECGC) of India?

The Export Credit and Guarantee Corporation were set up as a Government undertaking

in 1964 on the recommendation of a study group on export finance. It works on ‘no profit

no loss’ basis.

The main functions of the corporation are to provide insurance to export risks and to

finance exports. E.C.G.C. helps exporters by furnishing guarantees to the financial banks

in order to enable them to provide sufficient credit facilities.

It further insures the exporter’s credit risks against both commercial and political

conditions and guarantees payment to the exporters. The corporation provides various

types of insurance covers to suit the varying needs of customers.

Functions of ECGC

Provides a range of credit risk insurance covers to exportersagainst loss in export

of goods and services

Offers Export Credit Insurance covers to banks and financialinstitutions to enable

exporters to obtain better facilities fromthem

Provides Overseas Investment Insurance to Indian

companies investing in joint ventures abroad in the form of equity or loan

Objectives of ECGC

To encourage and facilitate globalization of India’s trade

To assist Indian exporters in managing their credit risks by providing timely

information on worthiness of the buyers,bankers and the countries.

To protect the Indian exporters against unforeseen losses which may arise due to

failure of the buyer, bank or problems face by the country of the buyer by

providing cost effecting credit insurance covers.

To facilitate availability of adequate bank finance to the Indian exporters by

providing surety insurance covers for bankers at competitive rates

To develop world class expertise in credit insurance among employees and ensure

continuous innovation and achieve the highest customer satisfaction by delivering

top qualityservices

To educate the customers by continuous publicity and effective marketing

Potrebbero piacerti anche

- Export Credit Guarantee Corporation LTDDocumento6 pagineExport Credit Guarantee Corporation LTDASHUTOSH GUPTANessuna valutazione finora

- EcgcDocumento5 pagineEcgcRonik PasswalaNessuna valutazione finora

- Ecgc (Export Credit Guarantee Corporation)Documento64 pagineEcgc (Export Credit Guarantee Corporation)pratikshapatil5975% (8)

- Functions of Ecgc and Exim BankDocumento12 pagineFunctions of Ecgc and Exim BankbhumishahNessuna valutazione finora

- What Is ECGCDocumento3 pagineWhat Is ECGCSujal ShahNessuna valutazione finora

- Export Credit Guarantee Corporation of IndiaDocumento1 paginaExport Credit Guarantee Corporation of IndiaPranavNessuna valutazione finora

- Role of ECGC and EXIM BankDocumento4 pagineRole of ECGC and EXIM BankChirag ShahNessuna valutazione finora

- Exim BankDocumento18 pagineExim Bankdhara_kidNessuna valutazione finora

- Role of EcgcDocumento2 pagineRole of Ecgcambrosialnectar100% (2)

- The ECGC Limited NotesDocumento4 pagineThe ECGC Limited NotesRobert ClarkNessuna valutazione finora

- EcgcDocumento3 pagineEcgcRajesh LataNessuna valutazione finora

- Ecgc ProjectDocumento4 pagineEcgc ProjectrabharaNessuna valutazione finora

- Export Finance by EXIM Bank IndiaDocumento9 pagineExport Finance by EXIM Bank IndiaAmanNessuna valutazione finora

- Financing To Overseas ImportersDocumento9 pagineFinancing To Overseas ImportersimadNessuna valutazione finora

- A Critical Analysis of 'Export Credit Institutions in IndiaDocumento13 pagineA Critical Analysis of 'Export Credit Institutions in IndiaMinh Tú HoàngNessuna valutazione finora

- Ecgc BrochureDocumento12 pagineEcgc BrochureSankara NarayananNessuna valutazione finora

- ECGCDocumento9 pagineECGCbuntymth05Nessuna valutazione finora

- Introduction of EcgcDocumento41 pagineIntroduction of Ecgcurmi_patel22100% (3)

- EPC and ECGCDocumento2 pagineEPC and ECGCShubhajit Nandi100% (1)

- Exim BankDocumento8 pagineExim BankMani GuptaNessuna valutazione finora

- ECGCDocumento4 pagineECGCyashu29Nessuna valutazione finora

- ECGCDocumento9 pagineECGCzakirno19248Nessuna valutazione finora

- Export Credit and Guarantee CorporationDocumento8 pagineExport Credit and Guarantee CorporationIndrajitNessuna valutazione finora

- Export-Import Bank of India (Exim Bank)Documento7 pagineExport-Import Bank of India (Exim Bank)Yash ThakkarNessuna valutazione finora

- Smu Ib0018Documento8 pagineSmu Ib0018Ankit SinghNessuna valutazione finora

- Export Credit Guarantee Corporation: Submitted To Aparna Jain Mam Class: SYBMSDocumento30 pagineExport Credit Guarantee Corporation: Submitted To Aparna Jain Mam Class: SYBMSSnehal ThoratNessuna valutazione finora

- Exim BankDocumento14 pagineExim BankReema AroraNessuna valutazione finora

- School of Commerce D.A.V.V. A Presentation On Export Credit Guarantee Corporation of IndiaDocumento14 pagineSchool of Commerce D.A.V.V. A Presentation On Export Credit Guarantee Corporation of IndiaSonam NaharNessuna valutazione finora

- EXim BankDocumento14 pagineEXim Banksaps156Nessuna valutazione finora

- EXim BankDocumento12 pagineEXim Banksaps156Nessuna valutazione finora

- A Study On Financial Facilities Provided To Exporters by Exim Bank With Specific Reference To IndiaDocumento13 pagineA Study On Financial Facilities Provided To Exporters by Exim Bank With Specific Reference To IndiaPranav ViraNessuna valutazione finora

- ECGCDocumento2 pagineECGCanupNessuna valutazione finora

- Mission Background of The Exim Bank Significance of The Topic Objective of The StudyDocumento50 pagineMission Background of The Exim Bank Significance of The Topic Objective of The StudyMitesh DamaNessuna valutazione finora

- Export Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal KeotDocumento45 pagineExport Finance and Payment Presented by Sri Jintu Borthakur Sri Dipranjal Keotjunet123123Nessuna valutazione finora

- Sanghvi Institute of Management & ScienceDocumento19 pagineSanghvi Institute of Management & ScienceFatema MhowwalaNessuna valutazione finora

- EEFC AccountDocumento4 pagineEEFC AccountAarti GajulNessuna valutazione finora

- Role of ECGC in ExportsDocumento2 pagineRole of ECGC in Exportsapoorva498Nessuna valutazione finora

- Exim Bank of India: A Brief Overview of The Functioning of EXIM Bank and Its Role in Facilitating Trade Finance in IndiaDocumento5 pagineExim Bank of India: A Brief Overview of The Functioning of EXIM Bank and Its Role in Facilitating Trade Finance in IndiaAshok GeorgeNessuna valutazione finora

- History: Government of India Mumbai Maharashtra Insurance Ministry of Commerce Government of IndiaDocumento2 pagineHistory: Government of India Mumbai Maharashtra Insurance Ministry of Commerce Government of IndiaMorerpNessuna valutazione finora

- SCM LogisticsDocumento38 pagineSCM LogisticsShah AyushNessuna valutazione finora

- BC NEIA Booklet English 01-08-2019Documento14 pagineBC NEIA Booklet English 01-08-2019abhiroopboseNessuna valutazione finora

- ECGCDocumento24 pagineECGCDrRuchi GargNessuna valutazione finora

- Introduction (: Industrial Credit and Investment Corporation of India)Documento19 pagineIntroduction (: Industrial Credit and Investment Corporation of India)Academic BunnyNessuna valutazione finora

- Company'S ProfileDocumento5 pagineCompany'S ProfileAmar RajputNessuna valutazione finora

- Exim Bank FinalDocumento9 pagineExim Bank FinalSudha NadarNessuna valutazione finora

- EXIM Bank Buyer Credit Scheme SALIENT FEATURESDocumento3 pagineEXIM Bank Buyer Credit Scheme SALIENT FEATURESkumarranjeet2003Nessuna valutazione finora

- Exim BankDocumento2 pagineExim BankShailesh SinghNessuna valutazione finora

- Export Credit Guarantee Corporation of IndiaDocumento3 pagineExport Credit Guarantee Corporation of IndiaNikhil PatidarNessuna valutazione finora

- A Presentation On: Comparitive Study of Ecgc and Its Competitors & Swot AnalysisDocumento23 pagineA Presentation On: Comparitive Study of Ecgc and Its Competitors & Swot AnalysisHitesh ParmarNessuna valutazione finora

- Role of RbiDocumento4 pagineRole of Rbitejas1989Nessuna valutazione finora

- Study of Bancassuarance in IndiaDocumento45 pagineStudy of Bancassuarance in IndiaParinShahNessuna valutazione finora

- A. Commercial RisksDocumento9 pagineA. Commercial Riskssumitg2781Nessuna valutazione finora

- Export-Import Bank of India-Agri Business GroupDocumento4 pagineExport-Import Bank of India-Agri Business GroupRahul SavaliaNessuna valutazione finora

- Meaning of Export FinanceDocumento2 pagineMeaning of Export Financeforamdoshi86% (7)

- International Business - Exim, Ecgc: by Prakash.VDocumento13 pagineInternational Business - Exim, Ecgc: by Prakash.VHitesh ParmarNessuna valutazione finora

- A Study On Role of Exim Bank in Export Trade: Parvata Raj PrabhuDocumento20 pagineA Study On Role of Exim Bank in Export Trade: Parvata Raj PrabhuTejas MakwanaNessuna valutazione finora

- A Guide to Trade Credit InsuranceDa EverandA Guide to Trade Credit InsuranceNessuna valutazione finora

- Credit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionDa EverandCredit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionNessuna valutazione finora

- What Are The Main Functions of Export Credit and Guarantee CorporationDocumento2 pagineWhat Are The Main Functions of Export Credit and Guarantee CorporationPooja SkNessuna valutazione finora

- Health InsuranceDocumento3 pagineHealth InsurancePooja SkNessuna valutazione finora

- Insurance PPPPPTDocumento12 pagineInsurance PPPPPTPooja SkNessuna valutazione finora

- What Are The Main Functions of Export Credit and Guarantee CorporationDocumento2 pagineWhat Are The Main Functions of Export Credit and Guarantee CorporationPooja SkNessuna valutazione finora

- What Are The Main Functions of Export Credit and Guarantee CorporationDocumento2 pagineWhat Are The Main Functions of Export Credit and Guarantee CorporationPooja SkNessuna valutazione finora

- SAFTA333Documento7 pagineSAFTA333Pooja SkNessuna valutazione finora

- Principles of Sound LendingDocumento6 paginePrinciples of Sound LendingAnkit ChoudharyNessuna valutazione finora

- Lic PlansDocumento19 pagineLic PlansPooja SkNessuna valutazione finora

- ProjectDocumento18 pagineProjectPooja SkNessuna valutazione finora

- Marketing Plan TemplateDocumento10 pagineMarketing Plan TemplateThanh Thao NguyenNessuna valutazione finora

- 3rdsem2012 PDFDocumento16 pagine3rdsem2012 PDFPooja SkNessuna valutazione finora

- ProjectDocumento18 pagineProjectPooja SkNessuna valutazione finora

- ProjectDocumento18 pagineProjectPooja SkNessuna valutazione finora