Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting For Labor Exercise

Caricato da

Gian Joshua Dayrit0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni1 paginaTitolo originale

Accounting-for-Labor-Exercise

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni1 paginaAccounting For Labor Exercise

Caricato da

Gian Joshua DayritCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

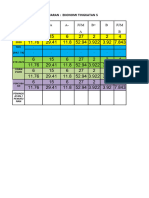

Problem 1: The Laborer Corporation uses an hourly wage system.

The contract provides for a 5-day week, with time and

one half for all work over eight hours in regular working day, double time for Saturday and Sunday. Deductions from

workers earnings are: SSS, Withholding taxes, Philhealth and HDMF at 8%, 15%, 5% and 2% of gross pay respectively.

The time records for the week show the following information:

Name Card No. Mon Tue Wed Thu Fri Sat Rate/Hr

LLL 101 8 8 10 10 8 4 P80

AAA 102 8 8 10 9 8 P60

BBB 103 8 10 8 8 10 P55

OOO 104 8 9 8 10 10 4 P55

RRR 105 10 8 10 10 9 4 P60

An analysis of the job time ticket for the week indicated the following:

Card No. Job No. Mon Tue Wed Thu Fri Sat

101 -----------------------Supervision-----------------------------

102 1 8 4 6 3 -

2 - 3 4 2 2

3 - - - 4 6

103 1 6 6 3 4 2

3 2 - 5 4 4

104 2 5 5 3 2 -

3 2 4 3 7 8 4

105 1 8 6 6 4 -

2 - 2 3 4 8 4

From the forgoing information compute the following:

a. Regular Pay (Total Hours Worked X Regular Rate)

b. Overtime Premium (Overtime Hours Worked X OT Premium)

c. Total Deductions

d. Net Pay

e. Direct labor cost charged to each Job

f. Distribution of Payroll

Potrebbero piacerti anche

- IBM System 360 RPG Debugging Template and Keypunch CardDa EverandIBM System 360 RPG Debugging Template and Keypunch CardNessuna valutazione finora

- LaborProbs PDFDocumento1 paginaLaborProbs PDFJuMakMat MacNessuna valutazione finora

- Labor and Overhead ExerciseDocumento3 pagineLabor and Overhead ExerciseNikki GarciaNessuna valutazione finora

- Student Evaluation Form PDFDocumento2 pagineStudent Evaluation Form PDFVIJ2512Nessuna valutazione finora

- RandomDocumento9 pagineRandomharry potterNessuna valutazione finora

- MathSubtProblemCardsThous-Thous RGDocumento10 pagineMathSubtProblemCardsThous-Thous RGrebecacaNessuna valutazione finora

- Math Subt Problem Cards Thous-Thous NGDocumento10 pagineMath Subt Problem Cards Thous-Thous NGrebecacaNessuna valutazione finora

- 1st M2 2310-1 PRACTICE EXAMDocumento4 pagine1st M2 2310-1 PRACTICE EXAMraymondNessuna valutazione finora

- Single Reduced PlansDocumento1 paginaSingle Reduced Planszikacu6129Nessuna valutazione finora

- 6resourceu 110912204906 31Documento69 pagine6resourceu 110912204906 31Sunil KushwahaNessuna valutazione finora

- For TabbingDocumento2 pagineFor TabbingCarmina T. JuanicoNessuna valutazione finora

- Catable Oadfasdfadf: Merry M. Deloso NDPDocumento2 pagineCatable Oadfasdfadf: Merry M. Deloso NDPJD Paler RinNessuna valutazione finora

- 3850 Mathematics Stage 1 Marking Guide Set 1Documento1 pagina3850 Mathematics Stage 1 Marking Guide Set 1Perry SinNessuna valutazione finora

- Ay 14 15 Cse D Co CalculationDocumento19 pagineAy 14 15 Cse D Co CalculationRambabuDaraNessuna valutazione finora

- PsyCog Sheet 02 (Udah Dijawab)Documento54 paginePsyCog Sheet 02 (Udah Dijawab)Farraz AkbarNessuna valutazione finora

- Daun Nyamplung - PH3 (24.15.216.MS)Documento9 pagineDaun Nyamplung - PH3 (24.15.216.MS)Galih HarisenoNessuna valutazione finora

- Activity 8Documento4 pagineActivity 8Jaysa RamosNessuna valutazione finora

- Procurement Capacity Assessment of Each PEDocumento5 pagineProcurement Capacity Assessment of Each PEAnik SahaNessuna valutazione finora

- Montvalley Short-Haul Lines - Case StudyDocumento6 pagineMontvalley Short-Haul Lines - Case StudyCừu đang học bàiNessuna valutazione finora

- 2nd Practice 2310 MT2Documento4 pagine2nd Practice 2310 MT2raymondNessuna valutazione finora

- 4 Payroll Computation ProblemDocumento1 pagina4 Payroll Computation ProblemLee PascuaNessuna valutazione finora

- Actividad Duración Tiempo Optimista Tiempo Pesimista I J Simbolo Tij T°i T°j T I T JDocumento2 pagineActividad Duración Tiempo Optimista Tiempo Pesimista I J Simbolo Tij T°i T°j T I T JJuan RLNessuna valutazione finora

- Probabylities Exp 4Documento8 pagineProbabylities Exp 4rxn insurgentNessuna valutazione finora

- 1T01218 2 PDFDocumento855 pagine1T01218 2 PDFrvcNessuna valutazione finora

- 4 - DS - TAM - Counting SortDocumento12 pagine4 - DS - TAM - Counting Sortchowdhury aponNessuna valutazione finora

- Book 1Documento2 pagineBook 1leminhthamNessuna valutazione finora

- Macrocycle TableDocumento1 paginaMacrocycle TableRosettaNessuna valutazione finora

- Memory Upgrade For Fanuc 10Documento3 pagineMemory Upgrade For Fanuc 10mtcalirezaNessuna valutazione finora

- 2 Digit Subtraction With RegroupingDocumento41 pagine2 Digit Subtraction With RegroupingBea Datay100% (1)

- Preventive Maintenance Schedule SampleDocumento4 paginePreventive Maintenance Schedule SampleAji DwitangoroNessuna valutazione finora

- FM MMGT Exercise No1Documento7 pagineFM MMGT Exercise No1Elmi YareNessuna valutazione finora

- C-Chart: Machine No No Defectos UCL LCL CDocumento2 pagineC-Chart: Machine No No Defectos UCL LCL CKaroll GutierrezNessuna valutazione finora

- New Microsoft Word DocumentDocumento4 pagineNew Microsoft Word DocumentAryan MalikNessuna valutazione finora

- Date: Day:: SMS Projected GC Actual GC Difference Total Projected Hrs Actual Hrs Projected GCPCH COMBINEDDocumento55 pagineDate: Day:: SMS Projected GC Actual GC Difference Total Projected Hrs Actual Hrs Projected GCPCH COMBINEDQuennie ReyesNessuna valutazione finora

- Nonparametric TestsDocumento35 pagineNonparametric TestsMurari NayuduNessuna valutazione finora

- AssignDocumento1 paginaAssignAswin RamNessuna valutazione finora

- 1T00718Documento4 pagine1T00718Prof. Sudesh R. AgrawalNessuna valutazione finora

- 2C00345 PDFDocumento721 pagine2C00345 PDFSunny PalNessuna valutazione finora

- AssignmentstatDocumento5 pagineAssignmentstatAl ShahriarNessuna valutazione finora

- 2C00346C10 PDFDocumento21 pagine2C00346C10 PDFAbhishekNessuna valutazione finora

- TablaDocumento1 paginaTablaapi-254934021Nessuna valutazione finora

- BA Lab 4 22MBA0168Documento5 pagineBA Lab 4 22MBA0168Jayagokul SaravananNessuna valutazione finora

- Tablas de Coordination XTmaxDocumento41 pagineTablas de Coordination XTmaxMiguel Guillermo Zelaya DamianNessuna valutazione finora

- 2C00455Documento1.747 pagine2C00455Shraddha RamavtarNessuna valutazione finora

- 1T00918Documento2 pagine1T00918Clovis MachadoNessuna valutazione finora

- Results: Tutor - Developing A Workforce ScheduleDocumento15 pagineResults: Tutor - Developing A Workforce ScheduleKaren GoinesNessuna valutazione finora

- ASME ANSI B16.9 Wrought Steel Butt Weld FittingsDocumento17 pagineASME ANSI B16.9 Wrought Steel Butt Weld FittingsStoyanov Damiana2001Nessuna valutazione finora

- ANSI B16.9 Standard Is Factory-Made Wrought Steel Butt-Welding FittingsDocumento17 pagineANSI B16.9 Standard Is Factory-Made Wrought Steel Butt-Welding FittingsPedro AngeloNessuna valutazione finora

- Tugas Problem 3,6,7,8 Scheduling Operation Kelompok 2Documento6 pagineTugas Problem 3,6,7,8 Scheduling Operation Kelompok 2Denny SibueaNessuna valutazione finora

- Chalermchai - Kuliah Tamu 2012Documento64 pagineChalermchai - Kuliah Tamu 2012intanrosalinaNessuna valutazione finora

- Quran/Religion Practice Chart: The Surahs) Then Try To Memorize ItDocumento1 paginaQuran/Religion Practice Chart: The Surahs) Then Try To Memorize ItshahoorhussainNessuna valutazione finora

- Headcount Men RendahDocumento3 pagineHeadcount Men RendahAZLINA BINTI IBRAHIM MoeNessuna valutazione finora

- Networking PDFDocumento2 pagineNetworking PDFhemchand movvaNessuna valutazione finora

- Exercício 1Documento8 pagineExercício 1DANIELLE DE LIMA BARBOSANessuna valutazione finora

- CGLE 2015 Cutoff PDFDocumento9 pagineCGLE 2015 Cutoff PDFArora JitinNessuna valutazione finora

- Hv0013 SR p540 CT RequirementsaDocumento26 pagineHv0013 SR p540 CT RequirementsaRavi MehroliyaNessuna valutazione finora

- Syuaiba - 170130058 - A3 - Tugas 6 Tabel Perencanaan Pengambilan Sampel MIL-STD-105EDocumento14 pagineSyuaiba - 170130058 - A3 - Tugas 6 Tabel Perencanaan Pengambilan Sampel MIL-STD-105EFahmi RamadhanNessuna valutazione finora

- Test Kraepelin: Lajur KeDocumento17 pagineTest Kraepelin: Lajur KedityacummyNessuna valutazione finora

- BK - ofDocumento4 pagineBK - ofdovieargaNessuna valutazione finora

- Subtraction 0s (V)Documento20 pagineSubtraction 0s (V)Shahrazad8Nessuna valutazione finora

- Dead StarsDocumento10 pagineDead StarsJustine AlcantaraNessuna valutazione finora

- Multiple Choices Quiz 1Documento31 pagineMultiple Choices Quiz 1Justine AlcantaraNessuna valutazione finora

- INTRODUCTION Xero Learn Practice GuideDocumento1 paginaINTRODUCTION Xero Learn Practice GuideJustine AlcantaraNessuna valutazione finora

- Chapter 3 Practice ActivityDocumento2 pagineChapter 3 Practice ActivityJustine AlcantaraNessuna valutazione finora

- 1 Other Percentage TaxesDocumento5 pagine1 Other Percentage TaxesFlorine Fate SalungaNessuna valutazione finora

- STS Name Formats PDFDocumento2 pagineSTS Name Formats PDFJustine AlcantaraNessuna valutazione finora