Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Issue of Debentures

Caricato da

Sheikh Afeef AyubTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Issue of Debentures

Caricato da

Sheikh Afeef AyubCopyright:

Formati disponibili

COC (CA- CPT) Issue of debenture SANTOSH KUMAR(CA/CMA)

ISSUE OF DEBENTURES

1. Introduction

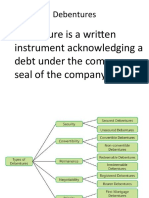

A debenture is a bond issued by a company under its seal, acknowledging a debt and

containing provisions as regards repayment of the principal and interest.

Under section 71 (1) of the Companies Act 2013, a company may issue debentures with an

option to convert such debentures into shares, either wholly or partly at the time of

redemption. Provided that the issue of debentures with an option to convert such debentures

into shares, wholly or partly, shall be approved by a special resolution passed at a duly

convened general meeting. Section 71 (2) further provides that no company can issue any

debentures which carry any voting rights.

Section 71 (4) provides that where debentures are issued by a company under this section, the

company shall create a debenture redemption reserve account out of the profits of the

company available for payment of dividend and the amount credited to such account shall not

be utilized by the company for any purpose other than the redemption of debentures.

Issue of debentures for consideration other than cash

Question1 X Ltd purchased a machine costing Rs 99,000 payable by issue of 10% debentures of Rs 100

each at

Case 1. Par

Case 2. Premium of 10%

Case 3. Discount of 10%

Question2 Blue Prints Limited Purchases building worth Rs. 1,50,000, plant and machinery worth Rs.

1,40,000 and furniture for Rs. 10,000 from Wadhwa and Company and took over liabilities of Rs. 20,000 for

a purchase consideration Rs. 3,15,000. Blue Prints Limited paid the purchase consideration by issuing 12%

debentures of Rs. 100 each at a premium of 5%. Pass the necessary journal entries.

Question3 Assume in the previous question purchase consideration was Rs 2,70,000 and payment was

made by issue of 12% debentures of Rs 100 each at a discount of 10%.

Question4 (Issue of debentures to vendors with part payment in cash)

G.W.K Ltd. purchased assets worth Rs. 4,50,000 and took over liabilities of Rs. 35,000 of K.L.M. and Co. for a

purchase consideration of Rs. 4,00,000. The purchase price was paid by issue of Rs. 100, 12% debentures at a

premium of 10% The debentures of GWK Ltd. are quoted in the market at Rs. 140 at the relevant time. You are

required to give journal entries to record the above transactions in the books of the purchasing company.

Debentures issued as a collateral security:-a collateral security may be defined as additional

security in addition to some principal security. When a limited company obtains a loan from bank or any other

financial institutions, it may pledge some assets as a security against the said loan. But the lending institution

may insist on some more assets as collateral security so that the amount of loan can be realized in full with the

help of collateral security. In such case company may issue its debentures as collateral security. The collateral

security will not be used or realized as long as company fulfills its obligation regarding payment of interest

when due and repayment of loan on the maturity date. If the amount realized from sale of principal security

falls short of the loan money, then loan of lending institution converted into debentures of the company and

lending institution claims all the right of being a debenture holders. Debentures issued as collateral security

will be realized by the lender only in case the loan is not repaid on the due date.

TREATMENT OF ISSUE OF DEBENTURES AS COLLATERAL SECURITY

Question5 A Ltd borrowed loan of Rs 10,00,000 from HDFC Bank. Company pledged machinery worth Rs

40 lacs. In addition to machine company issued 40,000,12% debentures of Rs 100 each to the bank as

collateral security. Show its treatment in the book of A Ltd.

1 CONCEPTONLINECLASSES.COM Mob. No. 9999631597, 9811455109

COC (CA- CPT) Issue of debenture SANTOSH KUMAR(CA/CMA)

Issue of debentures for cash

Question6 (Terms of issue and redemption)

Give journal entries for the following:

(a) Issue of Rs. 1,00,000 – 9% Debentures at par and redeemable at par.

(b) Issue of Rs, 1,00,000 – 9% debentures at premium of 5% but redeemable at par

(c) Issue of Rs. 1,00,000 – 9% Debentures at a discount of 10%, repayable at par.

(d) Issue of Rs. 1,00,000 – 9% Debentures at par but repayable at a premium of 5%.

(e) Issue of Rs. 1,00,000 – 9% Debentures at discount of 5% but redeemable at premium of 5%.

Question7 Pass journal entries in year 1 in the case of the issue of debentures by ABC Co. Ltd.: Issued

Rs. 1,00,000,11% debentures at 95 per cent redeemable at the end of 10 years (i) at 102 per cent, and (ii)

at 98 per cent.

[C.A. (Inter) May 2000]

DEBENTURE INTEREST

st

Question8 On 1 Jan 2010, X Ltd issued 12% debentures of Rs 2,00,000 at a premium of 15%. Interest is

th st

payable half yearly on 30 June and 31 December each year. Make journal entries assuming that

st st

accounts are closed on 31 December each year. Assume that interest due on 31 December has not yet

been paid.

st

Question9 On 1 Jan 2010, X Ltd issued 12% debentures of Rs 2,00,000 at a discount of 10%. Interest is

st th

payable half yearly on 31 march and 30 September each year. Make journal entries assuming that

st

accounts are closed on 31 December each year.

Question10 Babli Auto Limited had Rs. 10,00,000 -12% Debentures on which the interest is payable on 30

September and 31 March. Show the necessary journal entries relating to debenture interest for the year

ending on 31 March 2004 assuming that all payments to debenture holders and Government were made

in time. Tax deducted at source is 10%.

DISCOUNT/ LOSS ON ISSUE OF DEBENTURES

Question11 A company issued 9% Debentures of the face value of Rs. 2,00,000 at a discount of 6%. The

debentures were repayable by annual drawings of Rs. 40,000. How would you deal with the discount on

issue of debentures? Show the discount account in company's ledger for the duration of debentures.

Question12 A company issued 9% Debentures of the face value of Rs. 2,00,000 at a discount of 6%. The

debentures were repayable as follow

Year end amount repaid

2 40,000

4 1,20,000

5 40,000

How would you deal with the discount on issue of debentures? Show the discount account in company's

ledger for the duration of debentures.

Question13 Rashi Ltd. issued 12%Debentures at 94% for Rs. 1,00,000 on 1 July 2003 repayable by five

equal annual installments of Rs. 20,000 each. The company closes its accounts on 31 March every year.

Indicate the amount of discount to the written off every accounting year assuming that the company

decides to write off the debenture discount during the life of the debentures.

Question14 Indira Ltd. issued 10,000 debentures of Rs. 100 each at a discount of 6%. The expenses on

issue amounted to Rs. 35,000: The debentures have to be redeemed at the rate of Rs. 1,00,000 each year

commencing with the end of the fifth year. How much discount and expenses should be written off each

year.

2 CONCEPTONLINECLASSES.COM Mob. No. 9999631597, 9811455109

Potrebbero piacerti anche

- CH 9 Company Accounts - Issue of Debentures QueDocumento1 paginaCH 9 Company Accounts - Issue of Debentures QueYashvi ShahNessuna valutazione finora

- Issue of Debentures - Class WorkDocumento4 pagineIssue of Debentures - Class Worklalitha sureshNessuna valutazione finora

- Debentures Questions 1Documento3 pagineDebentures Questions 1Ishant GargNessuna valutazione finora

- Issue of Debentures Revision QuestionsDocumento4 pagineIssue of Debentures Revision Questionslalitha sureshNessuna valutazione finora

- Debentures 2024 SPCCDocumento53 pagineDebentures 2024 SPCCdollpees01Nessuna valutazione finora

- 5 Debenture Material3619080524732228932Documento14 pagine5 Debenture Material3619080524732228932Prabin stha100% (1)

- Redemption of Debentures NewDocumento12 pagineRedemption of Debentures NewDebjit RahaNessuna valutazione finora

- Leac 202Documento34 pagineLeac 202Shreyas BansalNessuna valutazione finora

- Chapter 3 - Company Account - Redemption of DebentureDocumento58 pagineChapter 3 - Company Account - Redemption of DebentureShreya GuheNessuna valutazione finora

- Ind AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLDocumento9 pagineInd AS 109 FI - Material 3 (Revisied) Derecogniatoin of FA - FLjvbsdNessuna valutazione finora

- Concept of Installment SystemDocumento5 pagineConcept of Installment Systemshambhuling ShettyNessuna valutazione finora

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Documento11 pagineThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNessuna valutazione finora

- Isc Accounts 5 MB: (Three HoursDocumento7 pagineIsc Accounts 5 MB: (Three HoursShivam SinghNessuna valutazione finora

- Debentures One Shot PDF - 96151713 5d28 4d1b Bb80 8af5aef292d2Documento19 pagineDebentures One Shot PDF - 96151713 5d28 4d1b Bb80 8af5aef292d2XYZ XYZNessuna valutazione finora

- Group II AccountsDocumento14 pagineGroup II AccountsPardeep GuptaNessuna valutazione finora

- Accountancy Test 2Documento3 pagineAccountancy Test 2legendsabari2004Nessuna valutazione finora

- Financial Instruments: Scope and DefinitionsDocumento168 pagineFinancial Instruments: Scope and Definitionskiran gNessuna valutazione finora

- Debentures: Que. No.1 Distinguish Between: Shares & Debentures CS (Executive) - June 2009 (5 Marks)Documento4 pagineDebentures: Que. No.1 Distinguish Between: Shares & Debentures CS (Executive) - June 2009 (5 Marks)Hitanshu KumarNessuna valutazione finora

- CH 10Documento3 pagineCH 10pablozhang1226Nessuna valutazione finora

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Documento1 paginaLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosNessuna valutazione finora

- Redemption of DebenturesDocumento2 pagineRedemption of DebenturesSofi YounisNessuna valutazione finora

- 12 Redemption of DebenturesDocumento13 pagine12 Redemption of DebenturesRohith KumarNessuna valutazione finora

- Question Bank (Repaired)Documento7 pagineQuestion Bank (Repaired)jayeshNessuna valutazione finora

- Intermediate Group I Test Papers FOR 2014 DECDocumento88 pagineIntermediate Group I Test Papers FOR 2014 DECwaterloveNessuna valutazione finora

- TH TH STDocumento3 pagineTH TH STsharathk916Nessuna valutazione finora

- Chap 2Documento2 pagineChap 2Siva SankariNessuna valutazione finora

- Issue of DebenturesDocumento15 pagineIssue of DebenturesKrish BhargavaNessuna valutazione finora

- Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesDocumento3 pagineChapter - 5 Chapter - 5 Chapter - 5 Chapter - 5 Chapter - 5: Redemption of DebenturesAryan JainNessuna valutazione finora

- 1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDocumento45 pagine1 20MAY201420ACCOUNTS20 (420files20merged) Mtps PDFDipen AdhikariNessuna valutazione finora

- L.T. LiabilitiesDocumento18 pagineL.T. LiabilitiesNaeemullah baigNessuna valutazione finora

- Corporate Accounting - IIDocumento5 pagineCorporate Accounting - IIjeganrajrajNessuna valutazione finora

- Worksheet IODDocumento2 pagineWorksheet IODJanaNessuna valutazione finora

- BBA Hon's 1 & 2 Year (New Syllabus) : Principle of Finance / Fundamental of FinanceDocumento2 pagineBBA Hon's 1 & 2 Year (New Syllabus) : Principle of Finance / Fundamental of FinanceBarakaNessuna valutazione finora

- Corporate Accounting II (T)Documento6 pagineCorporate Accounting II (T)BISLY MARIAM BINSONNessuna valutazione finora

- Questions For PracticeDocumento4 pagineQuestions For PracticeBeing NarratedNessuna valutazione finora

- Debt Practice ProblemsDocumento11 pagineDebt Practice ProblemsmikeNessuna valutazione finora

- 13 Bbfa1103 T9Documento25 pagine13 Bbfa1103 T9djaljdNessuna valutazione finora

- Issue of Debentures 21.12.2021Documento5 pagineIssue of Debentures 21.12.2021SPARSH VACHHERNessuna valutazione finora

- Issue of Debentures Collage SPCC Term 2Documento4 pagineIssue of Debentures Collage SPCC Term 2Taaran ReddyNessuna valutazione finora

- Time-Bound Home Exam-2020: Purbanchal UniversityDocumento2 pagineTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNessuna valutazione finora

- Redemption of DebenturesDocumento2 pagineRedemption of DebenturesLakshmi PanayappanNessuna valutazione finora

- CH 14Documento42 pagineCH 14maxhaakeNessuna valutazione finora

- Imp-Issue of DebenturesDocumento2 pagineImp-Issue of DebenturesArun AroraNessuna valutazione finora

- ACC 106 Final ExaminationDocumento5 pagineACC 106 Final ExaminationJezz Culang0% (1)

- Paper - 2: Strategic Financial Management Questions Index FuturesDocumento26 paginePaper - 2: Strategic Financial Management Questions Index FutureskaranNessuna valutazione finora

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocumento3 pagineSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNessuna valutazione finora

- COMM 229 Notes Chapter 4Documento4 pagineCOMM 229 Notes Chapter 4Cody ClinkardNessuna valutazione finora

- Famba6e Quiz Mod07 032014Documento4 pagineFamba6e Quiz Mod07 032014aparna jethaniNessuna valutazione finora

- DebentureDocumento10 pagineDebentureLakshya GandhiNessuna valutazione finora

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDocumento38 pagineCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNessuna valutazione finora

- Chapter 14 QuizDocumento7 pagineChapter 14 QuizSherri BonquinNessuna valutazione finora

- MODADV3 Handouts 2 of 2Documento21 pagineMODADV3 Handouts 2 of 2Dennis ChuaNessuna valutazione finora

- Vikas Mahila Campus Accountancy - XIIDocumento1 paginaVikas Mahila Campus Accountancy - XIIAnkit GuptaNessuna valutazione finora

- Class Xii CH 7 MCQ AccountancyDocumento16 pagineClass Xii CH 7 MCQ AccountancyhanaNessuna valutazione finora

- Illustrative Examples - Bonds Payable - Bsa 1a&bDocumento3 pagineIllustrative Examples - Bonds Payable - Bsa 1a&bMitshelle Mae PeraltaNessuna valutazione finora

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Documento6 pagineSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNessuna valutazione finora

- FA2 03 Bonds Payable PDFDocumento3 pagineFA2 03 Bonds Payable PDFdasdsadsadasdasdNessuna valutazione finora

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysDa EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNessuna valutazione finora

- WHAT'S F.R.E.E. CREDIT? the personal game changerDa EverandWHAT'S F.R.E.E. CREDIT? the personal game changerValutazione: 2 su 5 stelle2/5 (1)

- Accounting Revision Notes (0452)Documento38 pagineAccounting Revision Notes (0452)MissAditi KNessuna valutazione finora

- Chapter 1 Introduction To Engineering EconomyDocumento55 pagineChapter 1 Introduction To Engineering EconomyNadia IsmailNessuna valutazione finora

- Bank Strategic Positioning and Some Determinants of Bank SelectionDocumento11 pagineBank Strategic Positioning and Some Determinants of Bank SelectionDian AnantaNessuna valutazione finora

- Corps Outline StoneDocumento63 pagineCorps Outline StoneBen VisserNessuna valutazione finora

- Project Report - UMW Dongshin MotechDocumento22 pagineProject Report - UMW Dongshin MotechGAURAV NIGAM0% (1)

- The Grameen Bank Model Corporate Success PDFDocumento11 pagineThe Grameen Bank Model Corporate Success PDFSamreet Singh100% (1)

- General Reform SummaryDocumento10 pagineGeneral Reform SummaryRaghu RamNessuna valutazione finora

- Understanding Real Property Interests and DeedsDocumento9 pagineUnderstanding Real Property Interests and DeedsLisa Stinocher OHanlon100% (1)

- Technical English WordDocumento147 pagineTechnical English WordJORGE LUIS JIMENEZ CASTILLONessuna valutazione finora

- 47 Corpo Banate V PCRBDocumento2 pagine47 Corpo Banate V PCRBJoesil Dianne SempronNessuna valutazione finora

- Master Minds: No.1 For CA/CWA & MEC/CECDocumento8 pagineMaster Minds: No.1 For CA/CWA & MEC/CECr_s_kediaNessuna valutazione finora

- Bank Alfalah Clearance DepartmentDocumento7 pagineBank Alfalah Clearance Departmenthassan_shazaib100% (1)

- KCCDocumento3 pagineKCCRahul ChoudharyNessuna valutazione finora

- How To Zero Bills With The Bill ItselfDocumento2 pagineHow To Zero Bills With The Bill ItselfJoshua Sygnal Gutierrez90% (20)

- Air Philippines Employees' Cooperative Loans Granted For The Month ofDocumento8 pagineAir Philippines Employees' Cooperative Loans Granted For The Month ofChristian LlanteroNessuna valutazione finora

- Hire Purchase AccountingDocumento123 pagineHire Purchase AccountingLallan Sharma50% (2)

- Isaguirre v. de Lara, G.R. No. 138053, May 31, 2000Documento1 paginaIsaguirre v. de Lara, G.R. No. 138053, May 31, 2000Al Jay Mejos100% (1)

- LibreOffice Calc Guide 20Documento20 pagineLibreOffice Calc Guide 20Violeta XevinNessuna valutazione finora

- Act No. 3135 (Regulating The Sale of Property Under Special Powers Inserted in or Annexed To Real Estate Mortgages)Documento1 paginaAct No. 3135 (Regulating The Sale of Property Under Special Powers Inserted in or Annexed To Real Estate Mortgages)Reuben MercadoNessuna valutazione finora

- Bangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestDocumento3 pagineBangko Sentral NG Pilipinas vs. Banco Filipino Savings and Mortgage Bank DigestEmir Mendoza100% (3)

- SI, CI WS SolutionDocumento6 pagineSI, CI WS SolutionKhushal Bhanderi33% (3)

- Akta SyarikatDocumento50 pagineAkta SyarikatKamsul DiksiNessuna valutazione finora

- Name - Revati Tapaskar Roll No - 2k181175 Specialization - Finance Porter's Five Force Model of Air IndiaDocumento2 pagineName - Revati Tapaskar Roll No - 2k181175 Specialization - Finance Porter's Five Force Model of Air Indiarevati tapaskarNessuna valutazione finora

- Lecture Notes On Income From Business - TY 2019Documento23 pagineLecture Notes On Income From Business - TY 2019jafferyasimNessuna valutazione finora

- Challenges Faced by The Aviation IndustryDocumento5 pagineChallenges Faced by The Aviation Industryshiv000291Nessuna valutazione finora

- 1990-2013 Examinations: Beneficiary: Effects: Irrevocable Beneficiary (2005)Documento27 pagine1990-2013 Examinations: Beneficiary: Effects: Irrevocable Beneficiary (2005)JubsNessuna valutazione finora

- Guidelines For: Travel Grant Scheme For College Teachers/Collegelibrarians/Vice Chancellors/CommissionmembersDocumento14 pagineGuidelines For: Travel Grant Scheme For College Teachers/Collegelibrarians/Vice Chancellors/CommissionmemberschaitalideNessuna valutazione finora

- CBS NewDocumento92 pagineCBS NewBen MathewsNessuna valutazione finora

- Dec 2007 - AnsDocumento10 pagineDec 2007 - AnsHubbak KhanNessuna valutazione finora

- Funds Transfer Pricing in BanksDocumento8 pagineFunds Transfer Pricing in BankshemanthkumarcsNessuna valutazione finora