Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CIR Vs Manning

Caricato da

Vel JuneDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CIR Vs Manning

Caricato da

Vel JuneCopyright:

Formati disponibili

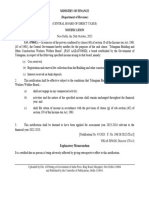

Title: CIR vs. John L. Manning, GR No.

L-28398 August 06, 1975

Ponente:

Doctrine to Remember

A stock dividend, being one payable in capital stock, cannot be declared out of outstanding capital

stock, but only from retained earnings. A stock dividend always involves a transfer of surplus to capital

stock.

Stock dividend constitutes income if it gives the shareholder an interest different from that which his

former stockholdings represented. On the other hand, it does constitute income if the new shares confer

no different rights or interests than did the old shares.

Facts

In 1952 MANTRASCO had an authorized capital stock of P2,500,000.00 divided into 25,000 common

shares; 24,700 of which was owned by Julius S. Reese, and the rest, at 100 shares each, by the

three respondents.

Reese entered into a trust agreement whereby it is stated that upon Reese’s death, the company

would purchase back all of its shares. On October 19, 1954 Reese died.

MANTRASCO repurchased the 24,700 shares. Thereafter, a resolution was passed authorizing that

the 24,700 shares be declared as stock dividends to be distributed to the stockholders.

The BIR ordered an examination of MANTRASCO’s books and discovered that the 24,700 shares

declared as dividends were not disclosed by respondents as part of their taxable income for the year

1958.

The BIR concluded that the distribution of the “asset or property of the corporation as may be gleaned

from the payment of cash for the redemption of said stock and distributing the same as stock

dividend. Hence, the CIR issued notices of assessment for deficiency income taxes to respondents.

Respondents appealed before the CTA. CTA rendered judgment absolving the respondents from any

liability for receiving the questioned stock dividends on the ground that their respective 1/3 shares

remained the same before and after the declaration of stock dividends.

Issues Articles/Law Involved

Whether the respondents are liable for deficiency Section 73 NIRC – A stock dividend representing

income taxes on the stock dividends? the transfer of surplus (retained earnings) to capital

account (share capital) shall not be subject to

income tax. HOWEVER, if a corporation cancels or

redeems stock issued as a dividend such

redemption or cancellation amounts to a taxable

dividend.

Rulings

Yes.

Dividends mean any distribution made by a corporation to its shareholders out of its earnings or profits.

Stock dividends which represent transfer of surplus to capital account are not subject to income tax. But if

a corporation redeems or cancels stock issued so as to make a distribution, this is essentially equivalent

to the distribution of a taxable dividend, hence, taxable income.

The distinctions between a stock dividend which does not and one which does constitute taxable income

to the shareholders is that a stock dividend constitutes income if its gives the shareholder an interest

different from that which his former stockholdings represented. On the other hand, it does constitute

income if the new shares confer no different rights or interests than did the old shares.

Therefore, whenever the companies involved parted with a portion of their earnings to buy the

corporate holdings of Reese, they were making a distribution of such earnings to respondents.

These amounts are thus subject to income tax as a flow of cash benefits to respondents. Hence,

respondents are liable for deficiency income taxes.

Potrebbero piacerti anche

- Outlines Taxation of Corporations and ShareholdersDocumento131 pagineOutlines Taxation of Corporations and ShareholdersAlexNessuna valutazione finora

- 172 CIR v. ManningDocumento5 pagine172 CIR v. ManningPio MathayNessuna valutazione finora

- Prelim Lecture 1 Assignment: Multiple ChoiceDocumento4 paginePrelim Lecture 1 Assignment: Multiple Choicelinkin soyNessuna valutazione finora

- Income Taxation Part 2Documento42 pagineIncome Taxation Part 2Anonymous r1cRm7FNessuna valutazione finora

- Shareholders' Equity: Learning CompetenciesDocumento41 pagineShareholders' Equity: Learning CompetenciesRaezel Carla Santos Fontanilla100% (3)

- Mindanao II Vs CIRDocumento2 pagineMindanao II Vs CIRVel JuneNessuna valutazione finora

- Ing Bank N.V vs. CIRDocumento2 pagineIng Bank N.V vs. CIRVel JuneNessuna valutazione finora

- Doctrine To RememberDocumento2 pagineDoctrine To RememberVel JuneNessuna valutazione finora

- Ordinary V CapitalDocumento26 pagineOrdinary V CapitalerwinNessuna valutazione finora

- CIR V Soriano DigestDocumento4 pagineCIR V Soriano DigestKristian AguilarNessuna valutazione finora

- Eisner v. MacomberDocumento4 pagineEisner v. MacomberDiwata de LeonNessuna valutazione finora

- St. Luke's Medical Center, Inc Vs CIRDocumento1 paginaSt. Luke's Medical Center, Inc Vs CIRVel June50% (2)

- InvoiceDocumento1 paginaInvoiceyogesh gupta100% (1)

- Income Tax RevDocumento19 pagineIncome Tax Revjuna luz latigayNessuna valutazione finora

- CIR v. CADocumento3 pagineCIR v. CAAnonymous vQakSgNessuna valutazione finora

- Philamlife Vs SOFDocumento2 paginePhilamlife Vs SOFVel June100% (3)

- Power Sector v. CIR GR No. 198146 Dated August 08, 2017Documento4 paginePower Sector v. CIR GR No. 198146 Dated August 08, 2017Vel JuneNessuna valutazione finora

- NIELSEN & CO. Vs LEPANTO CONSOLIDATEDDocumento2 pagineNIELSEN & CO. Vs LEPANTO CONSOLIDATEDJoannaNessuna valutazione finora

- Tax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDDocumento1 paginaTax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDSrikanth BhaskaraNessuna valutazione finora

- CIR vs. BATANGAS TRANSPORTATION COMPANY and LAGUNA-TAYABAS BUS COMPANYDocumento2 pagineCIR vs. BATANGAS TRANSPORTATION COMPANY and LAGUNA-TAYABAS BUS COMPANYVel JuneNessuna valutazione finora

- Fisher Vs TrinidadDocumento3 pagineFisher Vs TrinidadMark AlfredNessuna valutazione finora

- Types of Dividends and Other Distributions Nielson & Co. Inc. vs. Lepanto Consolidated Mining Co. (GR. No. L-21601 December 28, 1968)Documento17 pagineTypes of Dividends and Other Distributions Nielson & Co. Inc. vs. Lepanto Consolidated Mining Co. (GR. No. L-21601 December 28, 1968)Gabe BedanaNessuna valutazione finora

- Eisner Vs Macomber 3Documento2 pagineEisner Vs Macomber 3JVLNessuna valutazione finora

- Commissioner Vs ManningDocumento2 pagineCommissioner Vs ManningLudy Jane FelicianoNessuna valutazione finora

- Jose P. Obillos, JR., Et - Al vs. CIRDocumento1 paginaJose P. Obillos, JR., Et - Al vs. CIRVel JuneNessuna valutazione finora

- Afisco Insurance Corporation Et - AlDocumento2 pagineAfisco Insurance Corporation Et - AlVel JuneNessuna valutazione finora

- Nature of Treasury SharesDocumento4 pagineNature of Treasury SharesMae SampangNessuna valutazione finora

- Income Taxation Case Digests Donalvo 2016 v02 COMPLETEDocumento24 pagineIncome Taxation Case Digests Donalvo 2016 v02 COMPLETESanchez RomanNessuna valutazione finora

- CIR Vs Soriano TAX DigestDocumento3 pagineCIR Vs Soriano TAX DigestGeorge PandaNessuna valutazione finora

- Fort Bonifacio Development Vs CIRDocumento2 pagineFort Bonifacio Development Vs CIRVel JuneNessuna valutazione finora

- Marubeni Corporation vs. CIRDocumento2 pagineMarubeni Corporation vs. CIRVel JuneNessuna valutazione finora

- CIR Vs Mannign2Documento3 pagineCIR Vs Mannign2elmersgluethebombNessuna valutazione finora

- Nielson & Co V Lepanto Consolidated Mining CoDocumento16 pagineNielson & Co V Lepanto Consolidated Mining Covmanalo16Nessuna valutazione finora

- Cir V ManningDocumento12 pagineCir V Manningnia_artemis3414Nessuna valutazione finora

- Cases For February 15Documento29 pagineCases For February 15PJANessuna valutazione finora

- Tax - Gross IncomeDocumento5 pagineTax - Gross IncomeCamille Benjamin RemorozaNessuna valutazione finora

- Lee Jr. V CADocumento3 pagineLee Jr. V CAVianca MiguelNessuna valutazione finora

- CIR v. CADocumento2 pagineCIR v. CAJohn Mark RevillaNessuna valutazione finora

- Episodes 22 & 23 - Corpo LawDocumento7 pagineEpisodes 22 & 23 - Corpo LawBarem Salio-anNessuna valutazione finora

- G.R. No. L-28398 - Commissioner of Internal Revenue v. ManningDocumento14 pagineG.R. No. L-28398 - Commissioner of Internal Revenue v. ManningKaren Gina DupraNessuna valutazione finora

- Marubeni Corporation v. Commissioner of Internal Revenue, G.R. No. 76573, 14 September 1989Documento27 pagineMarubeni Corporation v. Commissioner of Internal Revenue, G.R. No. 76573, 14 September 1989Shiela MarieNessuna valutazione finora

- Dividend PolicyDocumento16 pagineDividend PolicyDương Thuỳ TrangNessuna valutazione finora

- Company Law Dividends InfoDocumento13 pagineCompany Law Dividends InfoLeigh018Nessuna valutazione finora

- DemergerDocumento5 pagineDemergerSunil SoniNessuna valutazione finora

- 7 - Consolidated Financial Statements P3 PDFDocumento7 pagine7 - Consolidated Financial Statements P3 PDFDarlene Faye Cabral RosalesNessuna valutazione finora

- CIR vs. CA and ANSCORDocumento4 pagineCIR vs. CA and ANSCORI took her to my penthouse and i freaked itNessuna valutazione finora

- Treasury SharesDocumento9 pagineTreasury SharesKathleenNessuna valutazione finora

- Accumulated Profits. - Any Distribution Made To The Shareholders or Members ofDocumento10 pagineAccumulated Profits. - Any Distribution Made To The Shareholders or Members ofGreggy BoyNessuna valutazione finora

- Accumulated Profits. - Any Distribution Made To The Shareholders or Members ofDocumento10 pagineAccumulated Profits. - Any Distribution Made To The Shareholders or Members ofGreggy BoyNessuna valutazione finora

- Taxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Documento2 pagineTaxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Ergel Mae Encarnacion RosalNessuna valutazione finora

- 3 Internal ReconstructionDocumento11 pagine3 Internal ReconstructionkautiNessuna valutazione finora

- CIR VS CA-OstiqueDocumento5 pagineCIR VS CA-OstiquePSYCHE SHYNE OSTIQUENessuna valutazione finora

- Commissioner of Internal Revenue V. John L. Manning, W.D. Mcdonald, E.E. Simmons and The Court of Tax AppealsDocumento3 pagineCommissioner of Internal Revenue V. John L. Manning, W.D. Mcdonald, E.E. Simmons and The Court of Tax AppealsJorge AngNessuna valutazione finora

- Lecture 14 Raising FinanceDocumento23 pagineLecture 14 Raising FinanceNick WilliamNessuna valutazione finora

- CTPDocumento31 pagineCTPMohit ChhabriaNessuna valutazione finora

- Frank Nyamari OnchweriDocumento3 pagineFrank Nyamari OnchweriBrian Okuku OwinohNessuna valutazione finora

- University of The Philippines College of Law: HDD 4DDocumento3 pagineUniversity of The Philippines College of Law: HDD 4DYunhosshi DisomangcopNessuna valutazione finora

- 094 Hay vs. HayDocumento3 pagine094 Hay vs. HayAlfonso VargasNessuna valutazione finora

- New Microsoft Office Word DocumentDocumento30 pagineNew Microsoft Office Word Documentawais_hussain7998Nessuna valutazione finora

- 36 Retained EarningsDocumento7 pagine36 Retained EarningsShenna Mae LibradaNessuna valutazione finora

- Parcorp ReportDocumento7 pagineParcorp ReportDough and SlicesNessuna valutazione finora

- 16-17 Recit ReviewerDocumento40 pagine16-17 Recit ReviewerjovelanvescanoNessuna valutazione finora

- CIR v. ManningDocumento18 pagineCIR v. Manningmceline19Nessuna valutazione finora

- ACCT 5327 - Formation of A CorporationDocumento23 pagineACCT 5327 - Formation of A CorporationAndrew NeuberNessuna valutazione finora

- Tax II OutlineDocumento68 pagineTax II OutlineEdmond MenchavezNessuna valutazione finora

- Capital Maintenance and Dividend Law (ACCA, LW-F4)Documento18 pagineCapital Maintenance and Dividend Law (ACCA, LW-F4)simranNessuna valutazione finora

- Sec 8Documento5 pagineSec 8laurice julienneNessuna valutazione finora

- 28908cpt Fa SM cp9 Part3 PDFDocumento31 pagine28908cpt Fa SM cp9 Part3 PDFBaking passionsNessuna valutazione finora

- Going Concern, Distributed Ordinary Dividends To Them ThereafterDocumento25 pagineGoing Concern, Distributed Ordinary Dividends To Them ThereafterjNessuna valutazione finora

- Assignment On Company Law & Secretary Pactices Group 7Documento75 pagineAssignment On Company Law & Secretary Pactices Group 7MdramjanaliNessuna valutazione finora

- Corporations Part 3Documento20 pagineCorporations Part 3Miss LunaNessuna valutazione finora

- Joint Accounts On Forex DepositsDocumento2 pagineJoint Accounts On Forex DepositsdailydoseoflawNessuna valutazione finora

- Section 9Documento2 pagineSection 9Hv EstokNessuna valutazione finora

- Mariano P. Pascual, Et - Al vs. CIRDocumento1 paginaMariano P. Pascual, Et - Al vs. CIRVel JuneNessuna valutazione finora

- Impact V IncidenceDocumento1 paginaImpact V IncidenceVel JuneNessuna valutazione finora

- Tax Ii RemediesDocumento92 pagineTax Ii RemediesVel JuneNessuna valutazione finora

- BATCH 1 Torts and Damages CASESDocumento117 pagineBATCH 1 Torts and Damages CASESVel JuneNessuna valutazione finora

- Test Sheet-Accounts v1Documento6 pagineTest Sheet-Accounts v1Minaketan DasNessuna valutazione finora

- Research FinalDocumento57 pagineResearch Finalmahletchane12Nessuna valutazione finora

- Luminous Solar Dealer Price List MH & GOA 18.04.2023Documento12 pagineLuminous Solar Dealer Price List MH & GOA 18.04.2023Nilesh PatilNessuna valutazione finora

- Canons of TaxationDocumento16 pagineCanons of Taxationdhwani shahNessuna valutazione finora

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Documento23 pagineMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Jesse Rielle CarasNessuna valutazione finora

- CS Executive Tax Laws Amendments by Vipul ShahDocumento41 pagineCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNessuna valutazione finora

- GSTR 3B Calculation Summary - JushTNDocumento6 pagineGSTR 3B Calculation Summary - JushTNShail MehtaNessuna valutazione finora

- Oregon Income Tax Instructions and SchedulesDocumento36 pagineOregon Income Tax Instructions and SchedulesStatesman JournalNessuna valutazione finora

- Payroll 2023 1Documento19 paginePayroll 2023 1Carl Dela CruzNessuna valutazione finora

- Employee Payslip NewDocumento1 paginaEmployee Payslip NewRitika SharmaNessuna valutazione finora

- LLP RatificationDocumento2 pagineLLP RatificationShiv Prakash GuptaNessuna valutazione finora

- Jawaban 8 - Accounting For Income TaxDocumento2 pagineJawaban 8 - Accounting For Income TaxBie SapuluhNessuna valutazione finora

- Acknowledgement Fy 2020-21Documento1 paginaAcknowledgement Fy 2020-21Prajwal ShettyNessuna valutazione finora

- Projects Topics - Law of Taxation - 1Documento6 pagineProjects Topics - Law of Taxation - 1AnshuSinghNessuna valutazione finora

- ACT Yearly BillDocumento2 pagineACT Yearly BillNarenNessuna valutazione finora

- GSTDocumento40 pagineGSTsangkhawmaNessuna valutazione finora

- Print - H NIZAMUDDIN (NZM) - MIRAJ JN (MRJ) - 2452618700Documento1 paginaPrint - H NIZAMUDDIN (NZM) - MIRAJ JN (MRJ) - 2452618700Rahul BudhawaleNessuna valutazione finora

- GST ChallanDocumento1 paginaGST ChallanWilfred DsouzaNessuna valutazione finora

- m02 Government Budget and The EconomyDocumento17 paginem02 Government Budget and The EconomyAman patidarNessuna valutazione finora

- 2 - Financial Independence UK - FIRE FlowchartDocumento1 pagina2 - Financial Independence UK - FIRE FlowchartRay JouwenaNessuna valutazione finora

- ViewPDF (15) .Aspx PDFDocumento1 paginaViewPDF (15) .Aspx PDFPiter RoyNessuna valutazione finora

- Notification 93 2023Documento1 paginaNotification 93 2023tax.contactNessuna valutazione finora

- PT Prudential Life Assurance Payslip September 2021: ConfidentialDocumento1 paginaPT Prudential Life Assurance Payslip September 2021: ConfidentialVenysunny KusnadiNessuna valutazione finora

- Gujarat Technological UniversityDocumento3 pagineGujarat Technological Universityamit raningaNessuna valutazione finora

- IJRR008Documento9 pagineIJRR008Viena Chyntia FirdausNessuna valutazione finora

- MR Eb Direct InvoiceDocumento2 pagineMR Eb Direct InvoiceHIMANSHU BHARDWAJNessuna valutazione finora