Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Eagle Eye Equities

Caricato da

RogerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Eagle Eye Equities

Caricato da

RogerCopyright:

Formati disponibili

Eagle Eye Equities

January 07, 2020

Index

Punter’s Call

Looking Trendy

Nifty Trader

Smart Charts

Momentum Swing

CTFT (Carry Today For Tomorrow)

Bank Nifty

Bank Nifty Trader

Day Trader’s Hit List

Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Eagle Eye Equities

Punter’s Call

Nosedive

January 06, 2020 Nifty daily: 11993.05

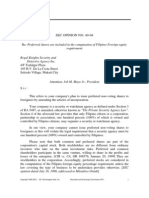

On account of global cues, the Nifty opened gap down

and traded with bearish bias throughout the day.

The index refused to respect the key daily moving

averages (DMAs) that were acting as good supports

on the occasions of minor dips. Consequently, the

Nifty breached the key psychological level of 12000

on a closing basis. On the way down, the Nifty filled

up the gap of 12005-12023, which it had left on the

daily chart in December. The next gap area is at 11923-

11934. In terms of the price patterns, the benchmark

index seems to be forming a broadening formation

60-minute

and is currently tumbling towards the lower end of

the pattern. The daily lower Bollinger Band is also

lying around the lower pattern line. Thus 11870-11850

is the next key support area to watch out for.

Other technical observations

On the daily chart, the Nifty is below the 20-day

moving average (DMA) and the 40-DEMA, of 12135

and 12032, respectively. The momentum indicator is

bearish on the daily chart.

On the hourly chart, the Nifty is below the 20-hour

moving average (HMA) and the 40-HEMA, i.e. 12171

and 12167, respectively. The hourly momentum

Market breadth

indicator is bearish. Market breadth was negative BSE NSE

with 379 advances and 1449 declines on the National Todays Close 40676.63 11993.05

Stock Exchange. Advances 608 379

Decline 1939 1449

Unchanged 182 337

Volume (Rs.) 2,839.54 cr 31,073.49 cr

January 07, 2020 2

Sharekhan Eagle Eye Equities

Looking Trendy

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

Nifty 12350 á 11832 11832 / 12350 Nifty 12560 á 11694 11694 / 12560

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Nifty Trader

Support Resistance

11923 12118

11832 12191

11694 12294

20 DSMA 40 DEMA

12135 12032

Smart Charts

Stop Loss Potential%

Buy Price/ Call Closing

Date Scrip Name Action (On closing P/L at Exit/ Target 1 Target 2

Sell Price Price/ CMP

Basis ) Current

06-Jan-20 Ujjivan Jan Fut Sell 357.00 341.85 334.95 2.02% 315.00 302.00

03-Jan-20 Glenmark Jan Fut Buy 336.00 353.45 340.15 -3.76% 384.00 424.00

01-Jan-20 Godrej CP Jan Fut Sell Exit 686.45 685.60 0.12% 647.00 625.00

01-Jan-20 Escorts Jan Fut Sell 642.00 624.75 608.00 2.68% 575.00 560.00

NOTE: Kindly note that all stop losses in Smart Charts are on closing basis unless specified.

TPB: Trailing profit booked

Momentum Swing

Call Potential %

Action Stop Loss/ Buy Price/

Scrip Name Action Closing P/L at Exit/ Target 1 Target 2

Date Reversal Sell Price

Price/CMP Current

06-Jan-20 Cadila HC Jan Fut Sell 260.60 256.35 255.70 0.25% 248.00 244.00

06-Jan-20 Voltas Bank Jan Fut Sell 666.00 654.50 650.45 0.62% 642.00 628.00

06-Jan-20 Indusind Bank Jan Fut Sell Booked Profit 1508.00 1478.85 1.93% 1475.00 1450.00

03-Jan-20 Divis Lab Jan Fut Sell Exit 1844.05 1833.00 0.60% 1800.00 1782.00

03-Jan-20 Bajaj Finance Jan Fut Sell Booked Profit 4207.50 4133.70 1.75% 4120.00 4050.00

NOTE: Kindly note that all stop losses in Momentum swing are on an intra-day basis.

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

January 07, 2020 3

Sharekhan Eagle Eye Equities

CTFT (Carry Today For Tomorrow)

Potential%

Stop Loss/ Buy Price/ Sell Call Closing

Date Scrip Name Action P/L at Exit/ Target 1 Target 2

Reversal Price Price/CMP

Current

06-Jan-20 Ujjivan Jan Fut Sell 339.00 334.15 334.95 -0.24% 328.00 323.00

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

Bank Nifty

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

Bank Nifty 32900 á 30800 30800 / 32900 Bank Nifty 33540 á 29600 29600 / 33540

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Bank Nifty Trader Bank Nifty Daily

Support Resistance

30996 31526

30789 31989

30500 32057

20 DSMA 40 DEMA

31989 31526

Key Indices

Particulars Target Trend Reversal Support / Resistance

Nifty Auto 8500 á 7568 7568 / 8500

Nifty Fin. Service 15027 á 13900 13900 / 15027

Nifty FMCG 29100 â 30800 29100 / 30800

Nifty IT 16218 á 15500 15500 / 16218

Nifty Metal 3045 á 2700 2700 / 3045

Nifty Pharma 8650 á 7775 7775 / 8650

Nifty Mid Cap 100 18400 á 16800 16800 / 18400

Nifty Small Cap 100 6200 á 5770 5770 / 6200

January 07, 2020 4

Sharekhan Eagle Eye Equities

Day Trader’s Hit List

For January 07, 2020

Support Levels Close Resistance Levels

Scrip Name Action

S2 S1 (Rs.) R1 R2

NIFTY Jan Futures 11906.0 11966.0 12038.5 12080.0 12173.0 Sell on rise near R1

Bank Nifty Jan Futures 31065.0 31220.0 31350.0 31510.0 31800.0 Sell on rise near R1

Axis Bank 703.0 715.3 722.50 728.0 736.0 Sell on rise near R1

Bajaj Finance 3880.0 3983.8 4000.10 4050.0 4093.0 Sell on rise near R1

HDFC 2336.0 2371.0 2388.00 2400.0 2424.0 Sell Below S1

HDFC Bank 1220.0 1236.0 1241.00 1247.0 1255.0 Sell on rise near R1

Hindustan Unilever 1893.0 1907.0 1917.00 1929.0 1959.0 Sell Below S1

INFOSYS 724.0 732.0 738.50 744.0 753.8 Sell Below S1

ICICI Bank 518.0 523.8 525.7 529.0 538.0 Sell Below S1

ITC 229.0 233.8 235.30 239.5 242.8 Sell Below S1

Kotak Bank 1607.0 1638.6 1653.8 1664.7 1682.0 Buy Above R1/ Sell Below S1

LNT 1291.2 1304.0 1315.5 1328.0 1338.0 Sell Below S1

Maruti 6864.0 6981.0 7032.0 7100.0 7211.0 Sell on rise near R1

Reliance Industries 1460.0 1477.0 1500.0 1512.0 1528.0 Buy Above R1/ Sell Below S1

SBI 308.0 313.3 318.3 322.0 329.0 Sell on rise near R1

SunPharma 431 435.1 439.0 443 449 Buy Above R1/ Sell Below S1

Tata Steel 461.0 470.6 473.0 476.8 485.0 Sell Below S1

TCS 2164.0 2187.9 2201.4 2210.0 2232.0 Buy Above R1/ Sell Below S1

Titan 1138.7 1150.1 1157.0 1171.4 1182.3 Sell Below S1

Zeel 244.4 256.6 261.6 266.2 275.0 Sell Below S1

*Note: Closing price of Nifty futures is last traded price of Nifty futures on NSE

SL=Stoploss

January 07, 2020 5

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- SEC Opinion No. 40-04 Establishment Security AgencyDocumento2 pagineSEC Opinion No. 40-04 Establishment Security Agencyskylark74Nessuna valutazione finora

- TBF Superintendent of Insurance Annual Report 2020Documento36 pagineTBF Superintendent of Insurance Annual Report 2020CTV CalgaryNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Attendee List For Aarmr 28th Annual RegulatoryDocumento26 pagineAttendee List For Aarmr 28th Annual Regulatoryranjith123Nessuna valutazione finora

- How To Start Your Own Hedge Fund - Joe Ponzio's F Wall StreetDocumento5 pagineHow To Start Your Own Hedge Fund - Joe Ponzio's F Wall StreetPhilonious PhunkNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Important MCQs of Financial DerivativesDocumento22 pagineImportant MCQs of Financial Derivativespk100% (4)

- Bank of BarodaDocumento2 pagineBank of BarodaSudhir SatyanarayanNessuna valutazione finora

- Common Stock CertificateDocumento1 paginaCommon Stock CertificateLegal Forms100% (4)

- Corporation CodeDocumento54 pagineCorporation CodeLordson RamosNessuna valutazione finora

- Girding of Tug BoatDocumento4 pagineGirding of Tug BoatKiran KrishnamoorthyNessuna valutazione finora

- Corporate Crime Project FinalDocumento32 pagineCorporate Crime Project Finalankita100% (1)

- Introduction To Corporate FinanceDocumento16 pagineIntroduction To Corporate FinanceMuhammad SyanizamNessuna valutazione finora

- Catfines Paper 5510 0207 00 Web PDFDocumento62 pagineCatfines Paper 5510 0207 00 Web PDFStefas Dimitrios100% (1)

- Eagle Eye Equities: April 03, 2020Documento6 pagineEagle Eye Equities: April 03, 2020RogerNessuna valutazione finora

- Sheen Cake Portfolio 2022Documento6 pagineSheen Cake Portfolio 2022RogerNessuna valutazione finora

- Eagleeye - e (March 02)Documento6 pagineEagleeye - e (March 02)RogerNessuna valutazione finora

- Eagleeye - e February 20, 2020Documento6 pagineEagleeye - e February 20, 2020RogerNessuna valutazione finora

- Eagleeye - e March 30Documento6 pagineEagleeye - e March 30RogerNessuna valutazione finora

- Legislative Brief - Taxation Laws (Amendment) Bill, 2019Documento4 pagineLegislative Brief - Taxation Laws (Amendment) Bill, 2019RogerNessuna valutazione finora

- Archives 24Documento138 pagineArchives 24RogerNessuna valutazione finora

- The Meteorological Aspects: of Ice Accretion On ShipsDocumento48 pagineThe Meteorological Aspects: of Ice Accretion On ShipsRogerNessuna valutazione finora

- Introduction To Options - The BasicsDocumento27 pagineIntroduction To Options - The BasicsAlexNessuna valutazione finora

- BIMCO PresentationDocumento26 pagineBIMCO PresentationRogerNessuna valutazione finora

- Eagleeye - e February 20, 2020Documento6 pagineEagleeye - e February 20, 2020RogerNessuna valutazione finora

- Maritime Security South East Asia LP BriefingDocumento6 pagineMaritime Security South East Asia LP BriefingRogerNessuna valutazione finora

- Use of Armed Guards To Defend Against PiracyDocumento35 pagineUse of Armed Guards To Defend Against PiracybritanniamsNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Ships Operating in Ice Covered WatersDocumento4 pagineShips Operating in Ice Covered WatersRogerNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Eagle Eye Equities Oct 14 - 2019Documento7 pagineEagle Eye Equities Oct 14 - 2019RogerNessuna valutazione finora

- Eagle Eye EquitiesDocumento6 pagineEagle Eye EquitiesRogerNessuna valutazione finora

- Eagleeye - e March 28 2019Documento7 pagineEagleeye - e March 28 2019RogerNessuna valutazione finora

- Eagleeye SKhanDocumento7 pagineEagleeye SKhanRogerNessuna valutazione finora

- Eagleeye - 30th April 2019Documento7 pagineEagleeye - 30th April 2019RogerNessuna valutazione finora

- Eagle Eye Equities: April 03, 2020Documento6 pagineEagle Eye Equities: April 03, 2020RogerNessuna valutazione finora

- Eagle Eye Equities: April 03, 2020Documento6 pagineEagle Eye Equities: April 03, 2020RogerNessuna valutazione finora

- BA-20160504-8 Duties of Directors Case LawDocumento13 pagineBA-20160504-8 Duties of Directors Case LawAsra Tufail DahrajNessuna valutazione finora

- Basic Earning Per Share QDocumento3 pagineBasic Earning Per Share Qjano_art210% (2)

- Beal Companies LNV MGC Key PeopleDocumento8 pagineBeal Companies LNV MGC Key PeopleDenise Subramaniam100% (1)

- Derivatives and Risk ManagementDocumento23 pagineDerivatives and Risk ManagementSubhrodeep DasNessuna valutazione finora

- MODULE 5-Part 2Documento9 pagineMODULE 5-Part 2Mary Joy CabilNessuna valutazione finora

- Types of BanksDocumento10 pagineTypes of Bankssaeed BarzaghlyNessuna valutazione finora

- ApplicationsDocumento415 pagineApplicationsRohitKumarNessuna valutazione finora

- Sebi Takeover CodeDocumento9 pagineSebi Takeover CodePrerna DhandNessuna valutazione finora

- Mergers and Other Forms of Corporate RestructuringDocumento44 pagineMergers and Other Forms of Corporate RestructuringfazatiaNessuna valutazione finora

- NTCL Annual Report 18-19 PDFDocumento138 pagineNTCL Annual Report 18-19 PDFHello USANessuna valutazione finora

- Debt Redeemed-20.06.2016Documento830 pagineDebt Redeemed-20.06.2016Reedos LucknowNessuna valutazione finora

- Business Essentials: Entrepreneurship, New Ventures, and Business OwnershipDocumento45 pagineBusiness Essentials: Entrepreneurship, New Ventures, and Business OwnershipAhmad MqdadNessuna valutazione finora

- New Company Law AssignmentDocumento11 pagineNew Company Law AssignmentAshish parihar0% (1)

- Republic-vs-Sunlife-Insurance-of-CanadaDocumento3 pagineRepublic-vs-Sunlife-Insurance-of-CanadaRobby DelgadoNessuna valutazione finora

- Dhanuka Agritech LTDDocumento57 pagineDhanuka Agritech LTDSubscriptionNessuna valutazione finora

- Intercorporate Acquisitions and Investments in Other EntitiesDocumento48 pagineIntercorporate Acquisitions and Investments in Other EntitiesDuga Rennabelle100% (1)

- Multiplan Empreendimentos ImobiliÁrios S.A. CNPJ/MF: 07.816.890/0001-53 NireDocumento10 pagineMultiplan Empreendimentos ImobiliÁrios S.A. CNPJ/MF: 07.816.890/0001-53 NireMultiplan RINessuna valutazione finora

- Facebook, Inc.: A Look at Corporate Governance: Company DescriptionDocumento22 pagineFacebook, Inc.: A Look at Corporate Governance: Company Descriptionabhinav johnNessuna valutazione finora

- Chief Financial Officer CfoDocumento3 pagineChief Financial Officer Cfoapi-78900505Nessuna valutazione finora

- Company Law QuestionsDocumento9 pagineCompany Law QuestionsBadrinath ChavanNessuna valutazione finora