Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Blog January Post

Caricato da

api-486743837Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Blog January Post

Caricato da

api-486743837Copyright:

Formati disponibili

January 2020

REAL ESTATE NEWS

Brought to you by Lisa Moxley

Credit Scores Demystified

If you've made a resolution this year to get your credit on track, getting started

can feel a bit daunting. After all, it can sometimes seem as if credit agencies

want to keep you in the dark about how scores are calculated. Not to worry -

with some diligence on your part and a little insight into the world of

credit score-keeping, you can get back on track in 2020.

Credit scores follow an algorithm first developed by the data analytics

company FICO years ago. For a while, credit scores weren't the primary force

behind a credit decision but over time the impact of a credit score became

more and more important. Most every loan program available today has a

minimum credit score.

There are five characteristics of your credit history that make up your three-

digit score: your payment history, account balances, the length of your credit

history, the types of credit used and how often you've applied for new credit.

Credit scores will improve much more quickly by paying attention to the

two categories that have the greatest impact on a score: payment

history and account balances.

Payment history accounts for 35 percent of the total score. When

someone makes a payment more than 30 days past the due date, scores will

fall. An occasional "late pay" won't do much damage to your score but

continued payments made more than 30 days past due definitely will.

Preventing late payments is a key to recovering your score.

Account balances compare outstanding loan balances with credit lines

and make up 30 percent of your score. If a credit card has a $10,000 credit

line and there is a $3,300 balance, scores will actually improve, as the ideal

balance-to-limit is about one-third of the credit line. As the balance grows and

approaches or exceeds the limit, scores will begin to fall.

The remaining three have relatively little impact. How long someone has used

credit accounts for 15 percent of the score, but there's really nothing anyone

can do to improve this area other than to wait. Types of credit and credit

inquiries both make up 10 percent of the score. By concentrating on

payment history and account balances, scores will improve significantly

over the next few months.

Inspections vs. Appraisals vs. AVMs

Inspections, appraisals, and automated valuation

models, while related, all have different functions but

can be easily confused. Let's take a closer look.

Inspections: A property inspection is ordered by the

buyer and is meant to be an unbiased look at the

condition of the property. While not necessarily

required by a lender, an inspection protects the

buyer from purchasing a home that requires

expensive repairs or otherwise doesn't live up to its

list price. A property inspector will examine the

condition of the property inside and out, running

through a checklist of areas including, but not limited

to, the roof, electrical panels, wiring, plumbing,

appliances, doors and windows. If any issues pop

up, the inspector makes note and provides the buyer with a report.

Many reported issues will need some attention but won't affect financing. If

major repairs are needed however, the lender might want to have those

issues addressed before they provide any funding.

Appraisals: Once the inspection has been completed and reviewed, the

lender can order an appraisal. The appraisal will consider comparable homes

in the area as well as other factors such as lot size, nearby schools and crime

rates. The goal of the appraisal is to determine the true value of the property

for the sake of the lender.

The key difference between an inspection and an appraisal is that an

inspection aims to assess the physical condition of a home itself, while an

appraisal solely determines the market value of the real estate.

AVMs: An automated valuation model is a digital evaluation of the value of a

home. An AVM will quickly research the database of similar homes in the area

and compare them with the value of the subject property. AVMs are often

used to assess the value of a property portfolio, and have the advantage of

saving time and money since no one physically visits the property. However,

AVMs can't take into account the true condition of a property and often aren't

enough to secure a conventional loan for a home buyer.

QUESTIONS? VISIT lisamoxleyrealestate.com

LISA MOXLEY

Broker

CENTURY 21 New Heritage

847.669.9555

630.209.4354

lisamoxley4242@gmail.com

lisamoxleyknowsrealestate.weebly.com

© 2019 Century 21 Real Estate LLC. CENTURY 21® and the CENTURY 21 Logo are registered

service marks owned by Century 21 Real Estate LLC. Equal Housing Opportunity. Each office is

independently owned and operated.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Get More Done in 2021Documento1 paginaGet More Done in 2021api-486743837Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Edible Cookie DoughDocumento2 pagineEdible Cookie Doughapi-486743837Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Mini Slider RecipeDocumento2 pagineMini Slider Recipeapi-486743837Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Blog 1Documento2 pagineBlog 1api-486743837Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Financial Accounting and Reporting IDocumento5 pagineFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Work of The Export Credits Guarantee Department: House of Commons Trade and Industry CommitteeDocumento37 pagineThe Work of The Export Credits Guarantee Department: House of Commons Trade and Industry CommitteeJefferson KabundaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Occidental Sells North Sea Fields For $1.35 Billion - LA Times, May 09, 1991Documento3 pagineOccidental Sells North Sea Fields For $1.35 Billion - LA Times, May 09, 1991The Toxic TrinityNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Stop Stiffing The Taxpayer On Lansdowne ParkDocumento2 pagineStop Stiffing The Taxpayer On Lansdowne Parkapi-26098936Nessuna valutazione finora

- UN-Habitat, Slum Upgrading Facility. 2009Documento70 pagineUN-Habitat, Slum Upgrading Facility. 2009Marcos BurgosNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Expected Questions of InterviewDocumento4 pagineExpected Questions of InterviewAmit RanjanNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Accounting Information SystemDocumento58 pagineAccounting Information SystemMohammed Akhtab Ul HudaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Barangay Budget PreparationDocumento72 pagineBarangay Budget PreparationRjay's EscapadeNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

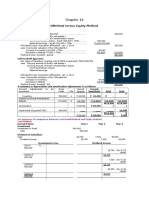

- Solution Chapter 16Documento90 pagineSolution Chapter 16Frances Chariz YbioNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Political Economy Annotated BibliographyDocumento3 paginePolitical Economy Annotated BibliographyAndrew S. Terrell100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- A Kerl of ShillerDocumento11 pagineA Kerl of Shillerramy6233Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Your Secret Wealth BookDocumento156 pagineYour Secret Wealth BookminkhangNessuna valutazione finora

- Accounting For Merchandising OperationsDocumento41 pagineAccounting For Merchandising OperationsAlfitri 90Nessuna valutazione finora

- BW TablesDocumento39 pagineBW TablesNandeesh Kodimallaiah100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

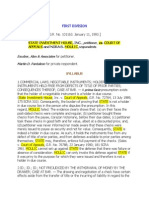

- State Investment Vs CA and MoulicDocumento10 pagineState Investment Vs CA and MoulicArlyn R. RetardoNessuna valutazione finora

- Canons of Monetary Law Canonum de Ius PecuniaeDocumento121 pagineCanons of Monetary Law Canonum de Ius Pecuniaemragsilverman0% (3)

- Project Finance in Developing CountriesDocumento8 pagineProject Finance in Developing Countries'Daniel So-fly OramaliNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Payroll Management Software India - Best Online Payroll Software ?Documento5 paginePayroll Management Software India - Best Online Payroll Software ?Naveen Kumar NaiduNessuna valutazione finora

- ??eventi Swig 2019 @india?? PDFDocumento2 pagine??eventi Swig 2019 @india?? PDFjinefretNessuna valutazione finora

- Amendment To Negotiable Instruments ActDocumento5 pagineAmendment To Negotiable Instruments ActRamanujarInstitutionalLearningNessuna valutazione finora

- 4.2.18.2 Nigeria's Road To SDGsDocumento44 pagine4.2.18.2 Nigeria's Road To SDGsotuekong ekpoNessuna valutazione finora

- Salary Slip SampleDocumento21 pagineSalary Slip Samplesantosh pathakNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- DRM CompDocumento4 pagineDRM CompHarsh JaiswalNessuna valutazione finora

- Documents To Check Before Buying A HouseDocumento13 pagineDocuments To Check Before Buying A Housenshetty22869Nessuna valutazione finora

- Chapter One Overview of Financial Management: 1.1. Finance As An Area of StrudyDocumento33 pagineChapter One Overview of Financial Management: 1.1. Finance As An Area of Strudysamuel kebedeNessuna valutazione finora

- ATP Case Digest 2Documento7 pagineATP Case Digest 2Tay Wasnot TusNessuna valutazione finora

- General Accounting Plan Local Government Units: Table 1Documento1 paginaGeneral Accounting Plan Local Government Units: Table 1Pee-Jay Inigo UlitaNessuna valutazione finora

- Chap. 5 Variable CostingDocumento8 pagineChap. 5 Variable CostingAnand DubeyNessuna valutazione finora

- SB Orders at A Glance - Sapost PDFDocumento61 pagineSB Orders at A Glance - Sapost PDFAman Singh100% (2)

- %age YesDocumento3 pagine%age Yesanshul4clNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)