Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

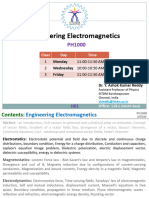

Divegence

Caricato da

Mohammad E AbbassianDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Divegence

Caricato da

Mohammad E AbbassianCopyright:

Formati disponibili

ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ :ﺧﻮﺍﻧﺪﻥ ﻭﺍﮔﺮﺍﻳﻲ ﺑﻪ ﻛﻤﻚ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

https://telegram.me/TRIGGER_Ha

http://www.aparat.com/trigger_ha

ﻣﺘﺮﺟﻢ :ﻣﺤﻤﺪ ﺣﺴﻦ ﺭﺣﻤﺎﻧﻴﺎﻥ ﺣﻘﻴﻘﻲ )ﻋﻀﻮ ﻣﺤﺘﺮﻡ ﮔﺮﻭﻩ ﻣﺘﺮﺟﻤﻴﻦ ﺗﺮﻳﮕﺮﻫﺎ(

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ،ﺧﻮﺍﻧﺪﻥ ﻭﺍﮔﺮﺍﻳﻲ ﺩﺭ ﭼﺎﺭﺕ ﻗﻴﻤﺖ

ﺑﻌﻨﻮﺍﻥ ﻳﻚ ﺗﻜﻨﻴﻜﺎﻝ ﺗﺮﻳﺪﺭ ﻛﻪ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ ﻭ ﺍﻧﺪﻳﻜﺎﺗﻮﺭﻫﺎﻱ ﺗﻜﻨﻴﻜﺎﻝ ﺭﺍ ﺑﻠﺪ ﻫﺴﺘﻴﺪ ،ﺑﺎﻳﺪﺑﺎ ﻣﻔﻬﻮﻡ

ﻭﺍﮔﺮﺍﻳﻲ ﺑﻪ ﻋﻨﻮﺍﻥ ﻭﺳﻴﻠﻪ ﺍﻱ ﺑﺮﺍﻱ ﺗﺎﻳﻴﺪ ﺳﻴﮕﻨﺎﻝ ﻭﺭﻭﺩ ﻭ ﻳﺎ ﺑﻌﻨﻮﺍﻥ ﺍﺑﺰﺍﺭﻱ ﺑﺮﺍﻱ ﺳﻨﺠﺶ ﻣﻮﻣﻨﺘﻮﻡ

ﺑﺎﺯﺍﺭ ﺁﺷﻨﺎ ﺑﺎﺷﻴﺪ.

ﺩﺭﻙ ﺍﻳﺪﻩ ﻭﺍﮔﺮﺍﻳﻲ ﺍﺯ ﻧﮕﺎﻫﻲ ﻓﺮﺍﺗﺮ

ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﻫﻨﺮﻱ ﺍﺳﺖ ﻛﻪ ﻣﻦ ﺑﺮﺍﻱ ﻳﺎﻓﺘﻦ ﻭﺍﮔﺮﺍﻳﻲ ﺣﺮﻛﺎﺕ ﻗﻴﻤﺖ ﺩﺭ ﭼﺎﺭﺕ ﺑﺪﻭﻥ ﺍﺳﺘﻔﺎﺩﻩ ﺍﺯ

ﺍﻧﺪﻳﻜﺎﺗﻮﺭﻫﺎﻱ ﺗﺎﺧﻴﺮﻱ ﺗﻜﻨﻴﻜﺎﻝ ﺍﻧﺘﺨﺎﺏ ﻛﺮﺩﻩ ﺍﻡ.ﭘﺲ ﺑﻴﺎﻳﻴﺪ ﺑﺎﻫﻢ ﺍﻳﻦ ﻣﻄﻠﺐ ﺭﺍ ﻓﺮﺍ ﺑﮕﻴﺮﻳﻢ.

ﺩﺭ ﺍﺑﺘﺪﺍ ﺑﺎ ﻫﻢ ﺑﻪ ﻣﻔﻬﻮﻡ ﻛﻠﻲ ﻭﺍﮔﺮﺍﻳﻲ ﻧﮕﺎﻫﻲ ﻣﻴﺎﻧﺪﺍﺯﻳﻢ:

ﻭﺍﮔﺮﺍﻳﻲ ﭘﺪﻳﺪﻩ ﺍﻱ ﺗﻜﺮﺍﺭ ﺷﻮﻧﺪﻩ ﺩﺭ ﺑﺎﺯﺍﺭ ﺍﺳﺖ ﻛﻪ ﺩﺭﺁﻥ ﻳﻚ ﺭﻭﻧﺪ ﻗﻴﻤﺖ ﺑﺮﺍﻱ ﺍﺩﺍﻣﻪ ﺩﺭ ﻣﻮﺝ ﺑﻌﺪﻱ

ﺧﻮﺩ ﺑﻪ ﻣﺸﻜﻞ ﻣﻲ ﺧﻮﺭﺩ ﻭ ﻣﻲ ﺗﻮﺍﻧﺪ ﻧﺸﺎﻧﻪ ﺍﻱ ﺍﺯ ،ﺍﺯ ﺩﺳﺖ ﺭﻓﺘﻦ ﺍﻧﺮژﻱ ﺑﺎﺯﺍﺭ ﺑﺎﺷﺪ .ﻛﻪ ﺩﺭ ﺍﻳﻨﺠﺎ

ﺩﻗﻴﻘﺎ ﻣﻨﻈﻮﺭ ﺳﺖ ﺷﺪﻥ ﺩﻭ ﻟﻮﺭ ﻟﻮ) (lower lowsﺩﺭ ﺍﻧﺪﻳﻜﺎﺗﻮﺭﻫﺎﻱ MACDﻳﺎ RSIﺑﺎ ﺩﻭ ﻫﺎﻳﺮ

ﻫﺎﻱ ) (higher highsﺩﺭ ﻣﻴﻠﻪ ﻫﺎﻱ ﭼﺎﺭﺕ ﻗﻴﻤﺖ ﻣﻲ ﺑﺎﺷﺪ).ﻭ ﺑﺮﻋﻜﺲ(.

ﺍﺯ ﺳﻮﻱ ﺩﻳﮕﺮ ﺩﺭ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﺷﻤﺎ ﻣﻲ ﺗﻮﺍﻧﻴﺪ ﺳﺮﻧﺦ ﻫﺎﻱ ﺍﺯ ﺩﺳﺖ ﺭﻓﺘﻦ ﺍﻧﺮژﻱ ﺑﺎﺯﺍﺭ ﺭﺍ ﻣﺴﺘﻘﻴﻤﺎ

ﺍﺯ ﺧﻮﺩ ﭼﺎﺭﺕ ﻗﻴﻤﺖ ﺑﺪﺳﺖ ﺁﻭﺭﻳﺪ.ﺑﻨﺎﺑﺮﺍﻳﻦ ﺑﺎ ﺍﺳﺘﻔﺎﺩﻩ ﺍﺯ ﭼﺎﺭﺕ ﺧﺎﻟﻲ ﻭ ﺧﻴﻠﻲ ﺯﻭﺩ ﺗﺮ ﺍﺯ ﺍﻧﺪﻳﻜﺎﺗﻮﺭﻫﺎ

ﻣﻴﺨﻮﺍﻫﻴﻢ ﺑﻔﻬﻤﻴﻢ ﻛﻪ ﻣﻮﻣﻨﺘﻮﻡ ﻛﻲ ﺧﺴﺘﻪ ﻣﻴﺸﻮﺩ؟

ﻣﻴﻠﻪ ﻫﺎﻱ ﻗﻴﻤﺖ ﺑﻄﻮﺭ ﻣﻨﺘﺨﺐ ،ﻳﻚ ﺩﺍﺳﺘﺎﻥ ﻋﻤﻴﻖ ﺭﺍ ﺭﻭﺍﻳﺖ ﻣﻲ ﻛﻨﻨﺪ.

ﻳﻚ ﻧﺤﻠﻴﻠﮕﺮ ﺗﻜﻨﻴﻜﺎﻝ ﺑﺪﻭﻥ ﺗﻮﺟﻪ ﻛﺮﺩﻥ ﺑﻪ ﻣﻴﻠﻪ ﻫﺎﻱ ﻗﻴﻤﺘﻲ ﻭ ﺍﻟﮕﻮﻫﺎﻱ ﺁﻥ ﭼﻴﺴﺖ؟ﺷﺎﻳﺪ ﺑﻴﺸﺘﺮ

ﻳﻚ ﻋﺎﺭﻑ ﺍﻳﻨﺪﻩ ﻧﮕﺮ ﺍﺳﺖ ﻛﻪ ﺑﺠﺎﻱ ﺍﺳﺘﻔﺎﺩﻩ ﺍﺯ ﺻﻔﺤﻪ ﻛﺎﻣﭙﻴﻮﺗﺮ ﺑﻴﺸﺘﺮ ﺑﺎﻳﻚ ﮔﻮﻱ ﺷﻴﺸﻪ ﺍﻱ )ﻛﻪ

ﺍﻳﻨﺪﻩ ﺭﻭ ﺩﺭ ﺍﻭﻥ ﻣﻴﺒﻴﻨﻪ( ﻣﻌﺎﻣﻠﻪ ﻣﻴﻜﻨﻪ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﻧﻜﺘﻪ ﻱ ﻣﻬﻢ ﺍﻳﻨﺠﺎﺳﺖ ،ﺩﺭ ﻳﻚ ﻣﺮﺣﻠﻪ ﻫﻤﻪ ﻣﺎ ﺗﻮﺟﻪ ﻭ ﻭﺳﻮﺍﺱ ﺷﺪﻳﺪﻱ ﺑﻪ ﺍﻟﮕﻮﻫﺎﻱ ﻣﻴﻠﻪ ﺍﻱ ﻭ ﺑﺪﻧﻪ

ﻭﻓﻴﺘﻴﻠﻪ )ﺳﺎﻳﻪ( ﻫﺎﻱ ﻧﺴﺒﻲ ﺁﻥ ﻭ ﺳﻄﻮﺡ ﺑﺎﺯ ﻭ ﺑﺴﺘﻪ ﺷﺪﻥ ﺁﻥ ﺩﺍﺭﻳﻢ .ﺷﺎﻳﺪ ﺍﻳﻦ ﺍﺻﻮﻝ ﺩﺭ ﺣﺎﻝ ﺣﺎﺿﺮ

ﺷﻜﻞ ﺩﻫﻨﺪﻩ ﻱ ﻧﻘﺎﻁ ﭘﻴﻮﺕ ﺩﺭ ﺭﻭﺵ ﻣﻌﺎﻣﻼﺗﻲ ﻣﻮﻓﻘﻴﺖ ﺁﻣﻴﺰ ﺷﻤﺎ ﻣﻲ ﺑﺎﺷﺪ.

ﺍﻳﻦ ﺩﻳﺪﮔﺎﻩ ﻫﺮ ﭼﻨﺪ ﻛﻪ ﺩﺭ ﻧﻮﻉ ﺧﻮﺩ ﻋﺎﻟﻲ ﻣﺤﺴﻮﺏ ﻣﻴﺸﻮﺩ ،ﺍﻏﻠﺐ ﺍﻭﻗﺎﺕ ﺑﺎﻋﺚ ﻛﻮﺭ ﺷﺪﻥ ﻣﻌﺎﻣﻠﻪ

ﮔﺮﺍﻥ ﺍﺯ ﺩﺍﺷﺘﻦ ﻧﮕﺎﻩ ﺟﺎﻣﻌﻲ ﻛﻪ ﻣﻴﻠﻪ ﻫﺎ ﺭﺍ ﺩﺭ ﻛﻨﺎﺭ ﻳﻜﺪﻳﮕﺮ ﻗﺮﺍ ﻣﻴﺪﻫﺪ ﺷﺪﻩ ﺍﺳﺖ .ﺍﻣﺎ ﻭﺍﮔﺮﺍﻳﻲ

ﺿﻤﻨﻲ ﻳﻚ ﻓﺼﻞ ﺟﺎﻟﺐ ﺩﻳﮕﺮﻱ ﺍﺳﺖ.

ﺗﻌﺮﻳﻒ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ

ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﺑﻄﻮﺭ ﻋﻤﻴﻘﻲ ﺩﺭ ﻣﻔﻬﻮﻡ ﺭﻭﻧﺪ ﺭﻳﺸﻪ ﺩﻭﺍﻧﺪﻩ ﺍﺳﺖ .ﺑﻪ ﺍﻳﻦ ﺻﻮﺭﺕ ﻛﻪ ،ﻗﻴﻤﺖ ﺯﻣﺎﻧﻲ ﻛﻪ

ﺩﺭ ﺭﻭﻧﺪ ﺻﻌﻮﺩﻱ ﻣﻲ ﺑﺎﺷﺪ ﻛﻪ ﻣﻴﺘﻮﺍﻧﺪ ﺑﻪ ﻫﺎﻱ ﭘﻲ ﺩﺭ ﭘﻲ ﻗﺒﻠﻲ ﺧﻮﺩ ﺑﺮﺳﺪ ﻭ ﺯﻣﺎﻧﻲ ﻛﻪ ﺩﺭ ﺭﻭﻧﺪ ﻧﺰﻭﻟﻲ

ﺍﺳﺖ ﻣﻴﺘﻮﺍﻧﺪ ﺑﻪ ﻟﻮﻭ ﻣﺘﻮﺍﻟﻲ ﺧﻮﺩ ﺑﺮﺳﺪ.

ﺑﺎ ﺍﻳﻦ ﺣﺎﻝ ﺑﺎ ﺩﺍﺷﺘﻦ ﻧﮕﺎﻫﻲ ﺩﻗﻴﻘﺘﺮ ﺑﻪ ﺭﻓﺘﺎﺭ ﻗﻴﻤﺖ،ﮔﺎﻫﻲ ﺍﻭﻗﺎﺕ ﺑﻪ ﺭﺍﺣﺘﻲ ﻣﻴﺘﻮﺍﻥ ﮔﻔﺖ ﻛﻪ ﭼﻪ

ﺯﻣﺎﻥ ﺩﺭ ﺣﺎﻟﻲ ﻛﻪ ﻗﻴﻤﺘﻲ ﻫﻨﻮﺯ ﺩﺭ ﺭﻭﻧﺪ ﺧﻮﺩ ﺍﺳﺖ ﻣﻴﺘﻮﺍﻧﺪ ﺑﺨﺎﺭ ﻭ ﺗﻮﺍﻥ ﺧﻮﺩ ﺭﺍ ﺍﺯ ﺩﺳﺖ ﺑﺪﻫﺪ .ﺩﺭ

ﺍﻳﻦ ﻣﻮﺍﻗﻊ ،ﻛﻨﺪﻝ ﻫﺎ ﺩﺭ ﺩﺍﻣﻨﻪ ﻱ ﻗﻴﻤﺘﻲ ﺿﻌﻴﻔﺘﺮ ﺍﺯ ﻛﻨﺪﻝ ﻗﺒﻠﻲ)ﻳﻌﻨﻲ ﺩﺭ ﺭﻭﻧﺪ ﺻﻌﻮﺩﻱ ﺩﺭ ﺳﺰﺣﻲ

ﭘﺎﻳﻴﻦ ﺗﺮ ﻭ ﺩﺭ ﺭﻭﻧﺪﻱ ﻧﺰﻭﻟﻲ ﺩﺭ ﺳﻄﺤﻲ ﺑﺎﻻﺗﺮ(ﻗﺮﺍﺭ ﻣﻴﮕﻴﺮﻧﺪ ﻭﻟﻲ ﺩﺭ ﻳﻚ ﻛﺸﻤﻜﺸﻲ ﻗﻮﻱ ﺑﺎ ﻫﻢ ﺩﺭ

ﺑﺴﺘﻪ ﺷﺪﻥ ﻫﺴﺘﻨﺪ .ﺍﺯ ﻣﺸﺨﺼﻪ ﻫﺎﻱ ﺁﻥ ﻛﻪ ﺑﻪ ﻛﺮﺍﺕ ﺑﺎ ﺁﻥ ﻫﻤﺮﺍﻫﻲ ﻣﻴﻜﻨﺪ ﺳﺎﻳﻪ ﻫﺎﻱ ﻣﻌﻤﻮﻟﻲ

ﻛﻨﺪﻝ ﻫﺎﻱ ﺁﻥ ﺩﺭ ﺟﻬﺖ ﺭﻭﻧﺪ ﻣﻲ ﺑﺎﺷﺪ ،ﭼﺮﺍ ﻛﻪ ﺟﺮﻳﺎﻥ ﺳﻔﺎﺭﺷﺎﺕ ﺍﺯ ﻃﺮﻑ ﺩﻳﮕﺮ ﺷﺮﻭﻉ ﺑﻪ ﻭﺍﺭﺩ

ﺷﺪﻥ ﺩﺭ ﻣﺎﺟﺮﺍ ﻣﻴﻜﻨﺪ.

ﺑﻴﺎﻳﻴﺪ ﻧﮕﺎﻫﻲ ﺑﻪ ﻳﻚ ﻣﺜﺎﻝ ﺯﻧﺪﻩ ﺩﺍﺷﺘﻪ ﺑﺎﺷﻴﻢ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﺩﺭ ﺍﻳﻨﺠﺎ ﻣﺎ ﻳﻚ ﺭﻭﻧﺪ ﺻﻌﻮﺩﻱ ﺧﻮﺏ ﻭ ﻗﻮﻱ ﺩﺍﺭﻳﻢ ﻛﻪ ﺍﻭﻟﻴﻦ ﻧﺸﺎﻧﻪ ﻱ ﺿﻌﻴﻒ ﺷﺪﻥ ﺁﻥ ﺟﺎﻳﻲ ﺍﺳﺖ

ﻛﻪ ﻗﻴﻤﺖ ﺑﻪ ﭘﺎﻳﻴﻦ ﺑﺮﻣﻴﮕﺮﺩ ﻭ ﺩﺭ ﺳﻄﺢ ﺿﻌﻴﻔﻲ ﺯﻳﺮ ﻓﺘﻴﻠﻪ)ﺳﺎﻳﻪ( ﺑﺴﺘﻪ ﻣﻴﺸﻮﺩ.ﺩﺭ ﻭﺍﻗﻊ ﺷﺒﻴﻪ ﺑﻪ ﭘﻴﻦ

ﺑﺎﺭ ﻣﻲ ﺑﺎﺷﺪ ﺍﻣﺎ ﻧﻪ ﺑﻪ ﺻﻮﺭﺕ ﻳﻚ ﭘﻴﻦ ﺑﺎﺭ ﻛﺎﻣﻞ ﻛﻪ ﻛﻠﻮﺯ ﺁﻥ ﺩﺭ ﺳﻄﺢ ﻣﻴﺎﻧﻲ ﻣﻴﻠﻪ ﻭ ﻳﺎ ﻛﻨﺪﻝ ﻗﺒﻠﻲ

ﺑﺎﺷﺪ .ﻛﻠﻮﺯ ﺿﻌﻴﻒ ﻭ ﺳﺎﻳﻪ ﻱ ﺑﻠﻨﺪ ﻣﺨﺼﻮﺻﺎ ﺩﺭ ﻗﺴﻤﺖ ﺑﺎﻻ ﻫﻤﺎﻧﻄﻮﺭ ﻛﻪ ﻧﺸﺎﻥ ﺩﺍﺩﻩ ﺷﺪﻩ ﺍﺳﺖ ﻧﻜﺎﺕ

ﺍﺳﺎﺳﻲ ﺑﺮﺍﻱ ﻣﺎ ﻣﻲ ﺑﺎﺷﻨﺪ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﻛﻨﺪﻝ ﺑﻌﺪﻱ ﻗﺴﻤﺖ ﺑﻴﺸﺘﺮﻱ ﺍﺯ ﺩﺍﺳﺘﺎﻥ ﺭﺍ ﻓﺎﺵ ﻣﻴﻜﻨﺪ.ﺑﻪ ﺻﻮﺭﺕ ﻭﺍﺿﺤﻲ ﺑﻨﻈﺮ ﻣﻴﺮﺳﺪ ﻛﻪ ﻣﺎ ﺑﺎ ﻳﻚ

ﻧﻮﻉ ﻣﻘﺎﻭﻣﺖ ﺑﺮﺧﻮﺭﺩ ﻛﺮﺩﻩ ﺍﻳﻢ.ﺍﻳﻦ ﺯﻣﺎﻥ ﺍﻣﺘﺤﺎﻥ ﻛﺮﺩﻥ ﺑﺮﺍﻱ ﺷﺮﺍﻳﻂ ﺑﺎﺯﺍﺭ ﮔﺎﻭﻱ Bullishﺍﺳﺖ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﻭﻟﻲ ﺍﻳﻨﺠﺎ ﻣﺎ ﻳﻚ ﻣﺸﻜﻞ ﺍﺳﺎﺳﻲ ﺩﺍﺭﻳﻢ .ﻧﮕﺎﻩ ﻛﻨﻴﺪ ﻛﻪ ﭼﻄﻮﺭ ﻛﻨﺪﻝ ﻫﺎ ﺩﺭ ﺳﻄﺢ ﻫﺎﻱ)ﺑﺎﻻﻱ( ﻛﻨﺪﻝ

ﻗﺒﻠﻲ ﺑﺮﺍﻱ ﺑﺴﺘﻪ ﺷﺪﻥ ﺩﺭ ﻛﺸﻤﻜﺶ ﻭ ﺗﻼﺵ ﻣﻴﺒﺎﺷﻨﺪ.ﻣﻤﻜﻦ ﺍﺳﺖ ﺷﻤﺎ ﺑﮕﻮﻳﻴﺪ ﻛﻪ ﻛﻨﺪﻝ ﺁﺧﺮ ﺑﺎﻻﺗﺮ

ﺍﺯ ﻛﻨﺪﻝ ﺩﻭﺗﺎ ﻣﺎﻧﺪﻩ ﺑﻪ ﺁﺧﺮ ﺑﺴﺘﻪ ﺷﺪﻩ ﺍﺳﺖ ،ﺍﻣﺎ ﭼﻴﺰﻱ ﻛﻪ ﻣﻦ ﻣﻴﺨﻮﺍﻫﻢ ﺑﻪ ﺷﻤﺎ ﻳﺎﺩ ﺑﺪﻫﻢ ﺩﺭ ﺩﺍﺷﺘﻦ

ﻧﮕﺎﻩ ﺩﻗﻴﻖ ﻭ ﺟﺎﻣﻊ ﺍﺳﺖ.

ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﻣﺴﺘﻠﺰﻡ ﺍﻳﻦ ﻧﻴﺴﺖ ﻛﻪ ﻫﺮ ﻛﻨﺪﻝ ﺩﺭ ﺳﻄﺤﻲ ﺿﻌﻴﻔﺘﺮ ﺍﺯ ﻛﻨﺪﻝ ﻗﺒﻠﻲ ﺑﺴﺘﻪ ﺷﻮﺩ ﻫﺮ

ﭼﻨﺪ ﭼﻨﺎﻧﭽﻪ ﺍﻳﻦ ﺍﺗﻔﺎﻕ ﺑﻴﻔﺘﺪ ﺷﺮﺍﻳﻂ ﻭﺍﺿﺤﺘﺮ ﻭ ﮔﻮﻳﺎ ﺗﺮ ﻣﻲ ﺑﺎﺷﺪ .ﺍﻣﺎ ﺿﺮﻭﺭﻱ ﻧﻴﺴﺖ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﺑﻠﻜﻪ ﺑﻴﺸﺘﺮ ﺗﻮﺟﻪ ﺷﻤﺎ ﺭﺍ ﺑﻪ ﺍﻳﻦ ﻣﺴﻴﻠﻪ ﺟﻠﺐ ﻣﻴﻜﻨﺪ ﻛﻪ ﺑﺴﺘﻪ ﺷﺪﻥ ﻫﺎﻱ ﺿﻌﻴﻒ ﻛﻨﺪﻝ ﻫﺎ ﻧﺸﺎﻥ

ﺩﻫﻨﺪﻩ ﻱ ﺍﻳﻦ ﺍﺳﺖ ﻛﻪ ﺭﻭﻧﺪ ﺳﺎﻟﻢ ﻭ ﭘﺎ ﺑﺮﺟﺎﻱ ﻗﺒﻠﻲ ﺿﻌﻴﻒ ﻭ ﺗﻨﺒﻞ ﺷﺪﻩ ﺍﺳﺖ.

ﻣﺎ ﻣﺠﺪﺩﺍ ﻳﻚ ﻛﻨﺪﻝ ﺑﻮﻟﻴﺶ ﻭ ﺻﻌﻮﺩﻱ ﺩﺍﺭﻳﻢ .ﺑﻪ ﺑﺴﺘﻪ ﺷﺪﻥ ﺿﻌﻴﻒ ﻭ ﺳﺎﻳﻪ ﻱ ﺁﻥ ﺩﺭ ﺟﻬﺖ ﺭﻭﻧﺪ

ﺗﻮﺟﻪ ﻛﻨﻴﺪ.ﻗﻴﻤﺖ ﺑﻪ ﺻﻮﺭﺕ ﻭﺍﺿﺤﻲ ﺑﻪ ﻫﻴﭻ ﺟﺎﻱ ﻣﺸﺨﺼﻲ ﻫﺪﺍﻳﺖ ﻧﻤﻴﺸﻮﺩ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﻳﻚ ﻛﻨﺪﻝ ﺻﻌﻮﺩﻱ ﺩﻳﮕﺮ ﻛﻪ ﺑﻨﻈﺮ ﻣﻴﺮﺳﺪﺩﺭ ﺩﺍﻣﻨﻪ ﻱ ﻛﻨﺪﻝ ﻗﺒﻠﻲ ﮔﺮﻓﺘﺎﺭ ﺷﺪﻩ ﺍﺳﺖ.ﺩﻗﻴﻘﺎ ﺩﺭ ﻳﻚ

ﻧﻘﻄﻪ ﻓﺮﺍﺗﺮ ﺍﺯ ﻫﺎﻱ ﻛﻨﺪﻝ ﺍﺻﻠﻲ ﻗﺒﻠﻲ ﺑﺴﺘﻪ ﺷﺪﻩ ﺍﺳﺖ .ﻭ ﻫﻤﭽﻨﻴﻦ ﻓﺮﺍﺗﺮ ﺍﺯ ﻫﺎﻱ ﺩﻭ ﻛﻨﺪﻝ ﻗﺒﻠﻲ.

ﻭﻟﻲ ﻣﺎ ﻳﻚ ﺳﺎﺧﺘﺎﺭ ﺷﻜﻨﻨﺪﻩ ﻱ ﻭﺍﺿﺢ ﺑﺮﺍﻱ ﺍﻳﺠﺎﺩ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﺩﺍﺭﻳﻢ.ﺧﻮﺏ ﺗﺎﻣﻞ ﻛﻨﻴﺪ ﻭ ﺑﺒﻴﻨﻴﺪ

ﭼﻪ ﺗﻌﺪﺍﺩ ﺯﻳﺎﺩﻱ ﺍﺯ ﻣﻌﺎﻣﻠﻪ ﮔﺮﺍﻥ ﺑﻪ ﻛﻨﺪﻝ ﻗﻮﻱ ﺑﻪ ﻋﻨﻮﺍﻥ ﺳﻴﮕﻨﺎﻟﻲ ﺑﺮﺍﻱ ﺍﺩﺍﻣﻪ ﻱ ﺭﻭﻧﺪ ﺻﻌﻮﺩﻱ ﻧﮕﺎﻩ

ﻣﻴﻜﻨﻨﺪ.ﺍﻳﻦ ﻣﻌﺎﻣﻠﻪ ﮔﺮﺍﻥ ﺍﺣﺘﻤﺎﻻ ﻛﺴﺎﻧﻲ ﻫﺴﺘﻨﺪ ﻛﻪ ﻫﻴﭻ ﺍﻃﻼﻋﺎﺗﻲ ﺩﺭ ﺧﺼﻮﺹ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ ﻭ

ﺭﻓﺘﺎﺭ ﻗﻴﻤﺖ ﺟﻤﻊ ﺁﻭﺭﻱ ﻧﻜﺮﺩﻩ ﺍﻧﺪ ﻭ ﺑﻪ ﺍﺳﺘﺮﺍﺗﮋﻱ ﺍﺳﺘﻔﺎﺩﻩ ﺍﺯ ﺍﻟﮕﻮﻫﺎﻱ ﻛﻨﺪﻟﻲ ﺑﺪﻭﻥ ﺩﺍﺷﺘﻦ ﻫﻴﭽﮕﻮﻧﻪ

ﺩﺭﻙ ﻭ ﺷﻨﺎﺧﺘﻲ ﭼﺴﺒﻴﺪﻩ ﺍﻧﺪ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﺗﺮﻛﻴﺐ ﺍﻳﻦ ﺷﻴﻮﻩ ﻱ ﻛﻨﺪﻝ ﺑﻪ ﻛﻨﺪﻝ ﺑﺎ ﻣﻔﺎﻫﻴﻢ ﮔﺴﺘﺮﺩﻩ ﺗﺮ ﺳﻄﻮﺡ ﺣﻤﺎﻳﺖ ﻭ ﻣﻘﺎﻭﻣﺖ ﺭﻭﻧﺪ ﺑﻠﻨﺪ

ﻣﺪﺕ ﻭ ﺳﺎﻳﺮ ﺟﻨﺒﻪ ﻫﺎ)ﺧﻂ ﺭﻭﻧﺪ ،ﻣﻴﻴﻨﮓ ﺍﻭﺭﺝ ﻫﺎ،ﺍﻋﺪﺍﺩ ﮔﺮﺩﻭ (...ﺑﺎﻋﺚ ﻣﻴﺸﻮﺩ ﻛﻪ ﻳﻚ ﺳﻴﺴﺘﻢ ﻣﻮﻓﻖ

ﺑﺮﺍﻱ ﻣﻌﺎﻣﻠﻪ ﺭﺍ ﺩﺍﺷﺘﻪ ﺑﺎﺷﻴﺪ.

ﺭﺍﺳﺘﻲ ...ﺑﺮﺍﻱ ﻛﺴﺎﻧﻲ ﻛﻪ ﺑﻪ ﻭﺍﮔﺮﺍﻳﻲ ﻣﻌﻤﻮﻝ ﻭ ﻣﺮﺳﻮﻡ ﻋﻼﻗﻪ ﺩﺍﺭﻧﺪ ﺑﺎﻳﺪ ﺑﮕﻮﻳﻢ ﻛﻪ ﺩﺭ ﺍﻳﻦ ﻣﻮﺿﻮﻋﻲ

ﻛﻪ ﻣﺎ ﺻﺤﺒﺖ ﻛﺮﺩﻳﻢ ﺩﺭ ﻭﺍﻗﻊ ﻫﻴﭽﮕﻮﻧﻪ ﻭﺍﮔﺮﺍﻳﻲ ﻣﺮﺳﻮﻡ ﻭ ﻣﺘﻌﺎﺭﻓﻲ ﻭﺟﻮﺩ ﻧﺪﺍﺭﺩ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﺍﮔﺮ ﺑﻪ ﺍﻧﺪﺍﺯﻩ ﻱ ﻛﺎﻓﻲ ﺩﻗﻴﻖ ﻧﮕﺎﻩ ﻛﻨﻴﺪ ﻣﻴﺘﻮﺍﻧﻴﺪ ﺷﺮﺍﻳﻂ ﻭﺍﺿﺢ ﻭ ﺁﺷﻜﺎﺭﻱ ﺭﺍ ﺩﺭ ﭼﺎﺭﺕ ﻫﺎﻱ ﻣﺸﺎﺑﻪ

ﭘﻴﺪﺍ ﻛﻨﻴﺪ ﻛﻪ ﺑﻮﺳﻴﻠﻪ ﻱ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﻣﻴﺘﻮﺍﻧﺪ ﺑﻪ ﻣﺎ ﺩﺭ ﻛﺴﺐ ﺳﻮﺩ ﺩﺭ ﺳﻮﻳﻨﮓ ﻫﺎ ﻛﻤﻚ ﻛﻨﺪ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

ﭼﻘﺪﺭ ﺗﻤﻴﺰ ﻭ ﻣﺸﺨﺺ ﻧﺸﺎﻥ ﺩﺍﺩﻩ ﺷﺪﻩ ﺍﺳﺖ .ﻣﮕﻪ ﻧﻪ؟

ﺩﺭ ﻛﻞ ﺍﻋﺘﺮﺍﻑ ﻣﻴﻜﻨﻢ ﻛﻪ ﺍﻳﻦ ﭼﺎﺭﺕ ﻫﺎ ﺑﻪ ﺩﻗﺖ ﮔﺰﻳﻨﺶ ﺷﺪﻩ ﺍﻧﺪ ﺍﻣﺎ ﺑﺮﺍﻱ ﻧﺸﺎﻥ ﺩﺍﺩﻥ ﻣﺴﺎﻟﻪ ﻧﻴﺎﺯ ﺑﻪ

ﺍﻳﻦ ﻛﺎﺭ ﺩﺍﺷﺘﻴﻢ ﻭ ﺍﻣﻴﺪﻭﺍﺭﻡ ﻛﻪ ﺗﻮﺍﻧﺴﺘﻪ ﺑﺎﺷﻢ ﺍﻳﻨﻜﺎﺭ ﺭﺍ ﺍﻧﺠﺎﻡ ﺩﻫﻢ.

ﺑﺎﻳﺪ ﺑﮕﻮﻳﻢ ﻛﻪ ﻣﻦ ﺑﻪ ﺷﻤﺎ ﻧﺸﺎﻥ ﺩﺍﺩﻡ ﻛﻪ ﺑﺮﺍﻱ ﺩﺍﺷﺘﻦ ﻳﻚ ﻧﮕﺎﻩ ﮔﺴﺘﺮﺩﻩ ﺑﺎﻳﺪ ﺷﺮﻭﻉ ﺑﻪ ﻧﮕﺎﻩ ﻛﺮﺩﻥ ﺑﻪ

ﭼﺎﺭﺕ ﻗﻴﻤﺘﻲ ﻛﻨﻴﺪ ﻭ ﺑﺎ ﮔﺬﺍﺷﺘﻦ ﻭﻗﺖ ﻛﺎﻓﻲ ﺩﺭ ﻧﮕﺎﻩ ﺑﻪ ﭼﺎﺭﺕ ﻗﻴﻤﺘﻲ ﻣﻦ ﺑﻪ ﺷﻤﺎ ﺍﻃﻤﻴﻨﺎﻥ ﻣﻴﺪﻫﻢ

ﻛﻪ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ ﺑﻪ ﺻﻮﺭﺕ ﺣﺲ ﻃﺒﻴﻌﻲ ﺩﻭﻡ ﺷﻤﺎ ﻣﻴﺸﻮﺩ ﻭ ﻫﻤﺎﻧﻄﻮﺭ ﻛﻪ ﮔﻔﺘﻢ ﻭﺍﮔﺮﺍﻳﻲ ﺿﻤﻨﻲ

ﻳﻜﻲ ﺍﺯ ﻓﺼﻞ ﻫﺎﻱ ﺟﺎﻟﺐ ﺩﺭ ﻣﻴﺎﻥ ﺑﺴﻴﺎﺭﻱ ﺍﺯ ﻓﺼﻞ ﻫﺎﻱ ﺟﺎﻟﺐ ﺩﻳﮕﺮ ﺍﺳﺖ.

ﺗﺮﻳﮕﺮ ﭘﺮﺍﻳﺲ ﺍﻛﺸﻦ

Potrebbero piacerti anche

- Find a Job: Little Known Secrets That They Don't Want You to KnowDa EverandFind a Job: Little Known Secrets That They Don't Want You to KnowNessuna valutazione finora

- 9 10Documento28 pagine9 10rodaki100% (1)

- Hair Loss Treatment: 21 Facts Everyone Should Know About Hair LossDa EverandHair Loss Treatment: 21 Facts Everyone Should Know About Hair LossNessuna valutazione finora

- Animal Farm Farsi PDFDocumento102 pagineAnimal Farm Farsi PDFAlireza TaheriNessuna valutazione finora

- Swimsuits for Women: Super Useful Tips That You'll LoveDa EverandSwimsuits for Women: Super Useful Tips That You'll LoveNessuna valutazione finora

- Animal FarmDocumento102 pagineAnimal FarmMasoud JRNessuna valutazione finora

- Magic of Declutter - How to Declutter, Organize, & Simply Your Life!Da EverandMagic of Declutter - How to Declutter, Organize, & Simply Your Life!Nessuna valutazione finora

- قلعه حیوانات جورج اورولDocumento229 pagineقلعه حیوانات جورج اورولleniamoradiNessuna valutazione finora

- Keeping Healthy: The Ultimate Book On How to Be HealthyDa EverandKeeping Healthy: The Ultimate Book On How to Be HealthyNessuna valutazione finora

- Ghale HeyvanatDocumento87 pagineGhale HeyvanatBehnamNessuna valutazione finora

- Taekwondo: Unconventional Tips That They Don't Want You to KnowDa EverandTaekwondo: Unconventional Tips That They Don't Want You to KnowNessuna valutazione finora

- Kasravi M Ce Mix Him K MelDocumento158 pagineKasravi M Ce Mix Him K MelM. FarhixtNessuna valutazione finora

- Words of Inspiration: The Unconventional Guide to Living Life to the FullestDa EverandWords of Inspiration: The Unconventional Guide to Living Life to the FullestNessuna valutazione finora

- Ghale Heyvanat PDFDocumento102 pagineGhale Heyvanat PDFBabak mahmoudiNessuna valutazione finora

- Kasravi - Dur Az Z Degist-1Documento91 pagineKasravi - Dur Az Z Degist-1M. FarhixtNessuna valutazione finora

- Kasravi-Dar Pir Mune Adabi TDocumento102 pagineKasravi-Dar Pir Mune Adabi TM. FarhixtNessuna valutazione finora

- Aug TaylorDocumento3 pagineAug TaylorMohsen111Nessuna valutazione finora

- Animal FarmDocumento103 pagineAnimal FarmSaman Mahdi AbadiNessuna valutazione finora

- صادق هدایت - ترانه های خيامDocumento109 pagineصادق هدایت - ترانه های خيامbaharehkianieNessuna valutazione finora

- 5 Short StoriesDocumento42 pagine5 Short StoriesDanial KeshaniNessuna valutazione finora

- Don Juan KarajDocumento7 pagineDon Juan Karajapi-3741779Nessuna valutazione finora

- دن ژوان کرجDocumento7 pagineدن ژوان کرج786mashaNessuna valutazione finora

- SadeghDocumento7 pagineSadeghelioteNessuna valutazione finora

- )Documento220 pagine)BonyadRezaiNessuna valutazione finora

- Kasravi Porsewo P SoxDocumento48 pagineKasravi Porsewo P SoxM. FarhixtNessuna valutazione finora

- Abonacci HelpDocumento75 pagineAbonacci HelpmahmoudNessuna valutazione finora

- داستان هاي مثنوي به نثرDocumento64 pagineداستان هاي مثنوي به نثرapi-26183506Nessuna valutazione finora

- تجلي PDFDocumento6 pagineتجلي PDFSpatzNessuna valutazione finora

- Cinema 1: The Movement-ImageDocumento10 pagineCinema 1: The Movement-ImageSiavash AminiNessuna valutazione finora

- Cultureal Pages 292Documento9 pagineCultureal Pages 292QalamroNessuna valutazione finora

- AdliyeDocumento12 pagineAdliyeomi221Nessuna valutazione finora

- Refutation of Ahmad Kasravi's 'Bahaigari' by Bahman NikandishDocumento171 pagineRefutation of Ahmad Kasravi's 'Bahaigari' by Bahman NikandishAdibMNessuna valutazione finora

- Hezar & Yek HavasDocumento3 pagineHezar & Yek Havasm7806207Nessuna valutazione finora

- .PP - PVDocumento135 pagine.PP - PVParsaNessuna valutazione finora

- Nameh Hashemi Be EmamDocumento1 paginaNameh Hashemi Be EmamBahman UnessiNessuna valutazione finora

- SooratakhaDocumento6 pagineSooratakhasohrabNessuna valutazione finora

- ميهن پرست PDFDocumento12 pagineميهن پرست PDFSpatzNessuna valutazione finora

- 'Abdu'l-Baha, Mufavidat - MufavizatDocumento192 pagine'Abdu'l-Baha, Mufavidat - Mufavizatmomen5255Nessuna valutazione finora

- Hedayat - Tarane Haaye KhayyamDocumento109 pagineHedayat - Tarane Haaye KhayyamRyan SmithNessuna valutazione finora

- Kasravi-Kaf Nameh K FN Me PDFDocumento27 pagineKasravi-Kaf Nameh K FN Me PDFnamavayaNessuna valutazione finora

- Darya-Yi DanishDocumento83 pagineDarya-Yi Danishmomen5255Nessuna valutazione finora

- Az'rbaycanl) Biliyurdlular Toplumu Ara D) Rma M'rk'ziDocumento8 pagineAz'rbaycanl) Biliyurdlular Toplumu Ara D) Rma M'rk'ziemre_taysizNessuna valutazione finora

- Kérama T Movallali Psychoa NalysisDocumento38 pagineKérama T Movallali Psychoa NalysisAli QasimPouriNessuna valutazione finora

- Choobak - Sange Saboor PDFDocumento263 pagineChoobak - Sange Saboor PDFseaview1199Nessuna valutazione finora

- Choobak - Sange Saboor PDFDocumento263 pagineChoobak - Sange Saboor PDFseaview1199Nessuna valutazione finora

- Sang-E SaboorDocumento263 pagineSang-E Saboorمحمد نصرتیNessuna valutazione finora

- Yazda - Understanding Expansion Tanks - TaylorDocumento11 pagineYazda - Understanding Expansion Tanks - TaylorhosseinNessuna valutazione finora

- Kasravi - Payam Be DaneshmandanDocumento24 pagineKasravi - Payam Be Daneshmandan4BeautifulMindsNessuna valutazione finora

- 18474Documento4 pagine18474M BabaNessuna valutazione finora

- Kasravi - Dur Az Z Degist-2Documento88 pagineKasravi - Dur Az Z Degist-2M. FarhixtNessuna valutazione finora

- Mohandesi NarmafzarDocumento68 pagineMohandesi Narmafzarhector_mhrNessuna valutazione finora

- Vil Dorant-Tarikh e TamadonDocumento42 pagineVil Dorant-Tarikh e TamadondiroozemroozNessuna valutazione finora

- ( ) Le Romantism C Est La Revolution ( )Documento2 pagine( ) Le Romantism C Est La Revolution ( )ehsan nooriNessuna valutazione finora

- @HealingWithReiki PDFDocumento7 pagine@HealingWithReiki PDFzahra taheriNessuna valutazione finora

- چیست troubleshooting مراحل عیب یابی شبکه پروسه عیب یابیDocumento8 pagineچیست troubleshooting مراحل عیب یابی شبکه پروسه عیب یابیali chNessuna valutazione finora

- Cultureal Pages 291Documento11 pagineCultureal Pages 291QalamroNessuna valutazione finora

- Salman FarsiDocumento56 pagineSalman FarsiBaha2r BabaeiNessuna valutazione finora

- Neveshta20 4 23 PDFDocumento20 pagineNeveshta20 4 23 PDFkeivan hshmtiNessuna valutazione finora

- زنده ایم یا زندگی میکنیم PDFDocumento221 pagineزنده ایم یا زندگی میکنیم PDFFaridoon DaneshNessuna valutazione finora

- Zende Be Goor PDFDocumento11 pagineZende Be Goor PDFمحمد نصرتیNessuna valutazione finora

- E1+Jitter+Wander+Data: TestingDocumento8 pagineE1+Jitter+Wander+Data: TestingMohammad E AbbassianNessuna valutazione finora

- Data Communication Networks Physical LayerDocumento22 pagineData Communication Networks Physical LayerMohammad E AbbassianNessuna valutazione finora

- SDH - All Chapter PDFDocumento166 pagineSDH - All Chapter PDFMohammad E AbbassianNessuna valutazione finora

- CryptoNTez Ultimate Crypto Trading ScriptDocumento5 pagineCryptoNTez Ultimate Crypto Trading ScriptMohammad E AbbassianNessuna valutazione finora

- Difference Between GSM and UMTS - Difference BetweenDocumento8 pagineDifference Between GSM and UMTS - Difference BetweenMohammad E AbbassianNessuna valutazione finora

- AvrbaseDocumento1 paginaAvrbaseMohammad E AbbassianNessuna valutazione finora

- A Miniature Jumping Robot With Flea-Inspired Catapult System: Active Latch and TriggerDocumento3 pagineA Miniature Jumping Robot With Flea-Inspired Catapult System: Active Latch and TriggerMohammad E AbbassianNessuna valutazione finora

- Optical Networks: Switching and Routing: Adv. Comp. Comm. Networks, Spring 2008Documento17 pagineOptical Networks: Switching and Routing: Adv. Comp. Comm. Networks, Spring 2008Mohammad E AbbassianNessuna valutazione finora

- RENATER WDM Infrastructure: Deployment and UsagesDocumento11 pagineRENATER WDM Infrastructure: Deployment and UsagesMohammad E AbbassianNessuna valutazione finora

- Induction MotorDocumento59 pagineInduction MotorAkama Kulasekara100% (3)

- Tutorial 1Documento5 pagineTutorial 1Muhammad HanifNessuna valutazione finora

- KopsDocumento2 pagineKopstomhankssNessuna valutazione finora

- 3.5 Surface IntegralsDocumento5 pagine3.5 Surface IntegralsSyafiyatulMunawarahNessuna valutazione finora

- Helmholtz DecompositionDocumento5 pagineHelmholtz DecompositionMike AlexNessuna valutazione finora

- Partial Differential EquationsDocumento2 paginePartial Differential EquationsDaniel Jose Dela CruzNessuna valutazione finora

- Vect VadfunDocumento38 pagineVect VadfunAymen SeidNessuna valutazione finora

- Slide 01 - 3D Coordinate SystemDocumento49 pagineSlide 01 - 3D Coordinate SystemOmor FarukNessuna valutazione finora

- Lesson PlanDocumento2 pagineLesson PlanRizwan 106Nessuna valutazione finora

- Lecture 4 Nonlinear First-Order PDEs PDFDocumento5 pagineLecture 4 Nonlinear First-Order PDEs PDFSrinivas JangiliNessuna valutazione finora

- Chapter 8 The Streamfunction and VorticityDocumento4 pagineChapter 8 The Streamfunction and VorticityShailendra PratapNessuna valutazione finora

- Engg. Maths-II - II MT - II Sem Set 1Documento1 paginaEngg. Maths-II - II MT - II Sem Set 1EE ArnavNessuna valutazione finora

- MATH2023 Multivariable Calculus Chapter 6 Vector Calculus L2/L3 (Fall 2019)Documento40 pagineMATH2023 Multivariable Calculus Chapter 6 Vector Calculus L2/L3 (Fall 2019)物理系小薯Nessuna valutazione finora

- Maths (Fourier Series) Qp'sDocumento8 pagineMaths (Fourier Series) Qp'sRajesh RajasekharNessuna valutazione finora

- Partial Differential Equation MCQ For M.Sc. From T. AmaranatjDocumento10 paginePartial Differential Equation MCQ For M.Sc. From T. AmaranatjSanket K Mohare100% (5)

- Calculus 3 Solution ManualDocumento150 pagineCalculus 3 Solution ManualAdrian Antonio Torres100% (2)

- Gradient Diver CurlDocumento60 pagineGradient Diver CurlAnik100% (3)

- Lesson 10-6 Surface Integrals PDFDocumento7 pagineLesson 10-6 Surface Integrals PDFAnonymous 5v9deValNessuna valutazione finora

- Three-Vector and Scalar Field Identities and Uniqueness Theorems in Euclidean and Minkowski SpacesDocumento10 pagineThree-Vector and Scalar Field Identities and Uniqueness Theorems in Euclidean and Minkowski SpacesDale Woodside, Ph.D.Nessuna valutazione finora

- Note On Vector AnalysisDocumento37 pagineNote On Vector AnalysisNabil MunshiNessuna valutazione finora

- Rotational Divergent PDFDocumento12 pagineRotational Divergent PDFraiz123Nessuna valutazione finora

- Presentation1 1Documento10 paginePresentation1 1Tanmoy GhoshNessuna valutazione finora

- MC OWEN, ROBERT - Partial Differential Equations. Methods and ApplicationsDocumento427 pagineMC OWEN, ROBERT - Partial Differential Equations. Methods and ApplicationsAndres Naranjo75% (4)

- Subject: Engineering Mathematics-I: Roll No.: Subject Code: BS-111Documento18 pagineSubject: Engineering Mathematics-I: Roll No.: Subject Code: BS-111dawddaNessuna valutazione finora

- M II - Electrostatics Class Material@Part IDocumento70 pagineM II - Electrostatics Class Material@Part ISurendar VijayNessuna valutazione finora

- CHE 406, Spring 2020 (Lecture 2) Transport Phenomena: Review of Vectors, Tensor and Coordinate Systems (Appendix A)Documento18 pagineCHE 406, Spring 2020 (Lecture 2) Transport Phenomena: Review of Vectors, Tensor and Coordinate Systems (Appendix A)Ahmad IjazNessuna valutazione finora

- Vectors Ds Mathur AsDocumento6 pagineVectors Ds Mathur AsAstha SinghNessuna valutazione finora

- Time Varyng Field LectureDocumento11 pagineTime Varyng Field LectureSarwar Hosen SimonNessuna valutazione finora

- CH 13 SC 1 PdeDocumento3 pagineCH 13 SC 1 PdeAmreshAmanNessuna valutazione finora

- Vector CalculusDocumento9 pagineVector CalculusKowsik_JS50% (2)