Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case 2 PDF

Caricato da

Hari Krishnan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

80 visualizzazioni3 pagineTitolo originale

Case-2.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

80 visualizzazioni3 pagineCase 2 PDF

Caricato da

Hari KrishnanCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

John Krog is president, chairman of the board, production supervisor and majority

shareholder of Krog’s Metalfab, Inc. He formed the company in 1991 to

manufacture custom- built aluminum storm windows for sale to contractors in the

greater Chicago area. Since that time the company has experienced tremendous

growth and currently operates two plants: one in Chicago, the main production

facility and a smaller plant in Moline, Illinols. The company now produces a wide

variety of metal windows, framing materials, ladders, and other products related to

the construction industry. Recently the company developed a new line of bronze-

finished storm windows, and initial buyer reaction has been quite favorable. The

company’s future seemed bright. But on January 3. 2013, a light fixture overheated

causing a fire that virtually destroyed the entire Chicago plant. Three days later,

Krog had moved 50 percent of his Chicago workforce to the Moline plant.

Workers were housed in hotels, paid overtime wages and provided with bus

transportation home on weekends. Still, the company could not meet delivery

schedules because of reduced operating capacity, and total business began to

decline. At the end of 2013, Krog felt that the worst was over. A new plant had

been leased in Chicago and the company was almost back to normal.

Finally, Krog could turn his attention to a matter of considerable importance:

settlement with the insurance company. The company’s policy stipulated that the

building and equipment loss be calculated at replacement cost. This settlement had

been fairly straightforward and the proceeds had aided the rapid rebuilding of the

company. A valued feature of the insurance policy was ‘lost profit” coverage. This

coverage was to ‘compensate the company for profits lost due to reduced operating

capacity related to fire or flood damage. The period of ‘lost profit” was limited to

12 months. Interpreting the exact nature of this coverage proved to be difficult. The

insurance company agreed to reimburse Krog for the overtime premium,

transportation, and housing costs related to operating out of the Moline

plant. These expenses obviously minimized the damages related to the 12 months

of lost or reduced profits. But was the company entitled to any additional

compensation?

Krog got out the latest edition of Construction Today. According to this respected

trade journal, sales of products similar to products produced by Krog’s Metalfab

had increased by 7 percent during 2013. Krog felt that were it not for the fire, his

company could also have increased sales by this percentage.

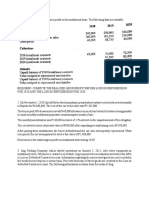

Income statement information is available for 2012 (the year prior to the fire) and

2013 (the year during which the company sustained “lost profit”).The expenses in

2013 include excess operating costs of $250,000. Krog has documentation

supporting these items, which include overtime costs, hotel costs, meals and such

related to operating out of Moline.The insurance company is quite Willing to pay

for these costs since they reduced potential lost profit.

The chief accountant at Krog, Peter Newell, has estimated Iost profit to be only

$34,184.Thus, he does feel that it’s worthwhile spending a lot of company

resources trying to collect more than the $250,000.

Peter at his calculation as follows:

Sales in 2012 $5,091,094

Predicted sales in 2013. assuming a 7% increase $5,447,471

Actual sales in 2013 . $3,857,499

(A) Lost sales $1,589,972

(B) Profit in 2012 as a percentage of 2012 sales

($109,495 / 5,091,094) .0215

Lost profit (A X B) $34,184

Required:

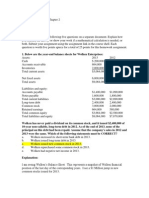

a) Mr, Krog is not convinced by Peter’s analysis and has turned to you, an outside

consultant to provide a preliminary estimate of lost profits Using the limited

information contained in the financial statements for 2012 and 2013, estimate lost

profits. (Hint: You can proceed as follows.)

STEP 1: Determine the level of fixed and variable costs in 2012 as a function of

sales. You can use account

analysis, the high-low method or regression if you are familiar with that technique.

STEP 2: Predict what sales would have been in 2013 if there was no fire. Using

this level of sales and the fixed and variable cost information from Step 1, estimate

what profit would have been in 2013.

STEP 3: The difference between actual profit in 2013 and the amount estimated in

Step 2 is lost profit.

b) Based on your preliminary analysis do you recommend that Mr. Krog

aggressively pursue a substantial claim for lost profit?

c) What is the fundamental flaw in Peter Newell’s analysis?

Potrebbero piacerti anche

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementDa EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNessuna valutazione finora

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesDa EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNessuna valutazione finora

- KROG's MetalFab IncDocumento8 pagineKROG's MetalFab Incaviralsharma1711Nessuna valutazione finora

- P7uk - 2012 - Dec (Groohl Co.)Documento10 pagineP7uk - 2012 - Dec (Groohl Co.)Information InsidserNessuna valutazione finora

- Gujarat Guardian Limited: Rs. 200 Million Short-Term Debt Programme Including Commercial Paper Retained at A1+Documento4 pagineGujarat Guardian Limited: Rs. 200 Million Short-Term Debt Programme Including Commercial Paper Retained at A1+rachitjain72Nessuna valutazione finora

- Advanced Audit and Assurance (International) : Monday 11 June 2012Documento10 pagineAdvanced Audit and Assurance (International) : Monday 11 June 2012hiruspoonNessuna valutazione finora

- ACC 356 Practice Exam (1) - UpdateDocumento12 pagineACC 356 Practice Exam (1) - Updateanon_430129688Nessuna valutazione finora

- Real Options and Financial Structuring - Case Study 2 Corning: Convertible Preferred StockDocumento6 pagineReal Options and Financial Structuring - Case Study 2 Corning: Convertible Preferred StockRoy SarkisNessuna valutazione finora

- ACCT 557 Final ExamDocumento18 pagineACCT 557 Final Examlynnturner123Nessuna valutazione finora

- Financial Reporting Financial Statement Analysis and Valuation 7Th Edition Whalen Test Bank Full Chapter PDFDocumento67 pagineFinancial Reporting Financial Statement Analysis and Valuation 7Th Edition Whalen Test Bank Full Chapter PDFanthelioncingulumgvxq100% (11)

- Group 4 - Krogs Metal Fab FinalDocumento11 pagineGroup 4 - Krogs Metal Fab FinalAnkit SahuNessuna valutazione finora

- GriefDocumento116 pagineGriefchicku76Nessuna valutazione finora

- Bindura Nickel Corporation Limited PDFDocumento1 paginaBindura Nickel Corporation Limited PDFBusiness Daily ZimbabweNessuna valutazione finora

- Assignment Gilbert LumbertDocumento6 pagineAssignment Gilbert LumbertHenri De sloovereNessuna valutazione finora

- CF GLC C4Documento7 pagineCF GLC C4George KangasNessuna valutazione finora

- Newsletter: Latest UpdatesDocumento7 pagineNewsletter: Latest Updatesapi-199476594Nessuna valutazione finora

- GOCH Report - WordDocumento18 pagineGOCH Report - WordMattNessuna valutazione finora

- Keck Seng AR 2013Documento91 pagineKeck Seng AR 2013red cornerNessuna valutazione finora

- Jacobs Engineering Group Inc. Initiating Coverage ReportDocumento13 pagineJacobs Engineering Group Inc. Initiating Coverage Reportbarone4375Nessuna valutazione finora

- Hindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsDocumento4 pagineHindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsSandeep KumarNessuna valutazione finora

- N Retail Full Mock T4-1Documento6 pagineN Retail Full Mock T4-1Josiah MwashitaNessuna valutazione finora

- Digby Corp 2021 Annual ReportDocumento13 pagineDigby Corp 2021 Annual ReportwerfsdfsseNessuna valutazione finora

- Solution Engineering EconomicsDocumento130 pagineSolution Engineering EconomicsSparrowGospleGilbertNessuna valutazione finora

- Microsoft Corporation: Net Cash From OperationsDocumento4 pagineMicrosoft Corporation: Net Cash From OperationsrmsNessuna valutazione finora

- Barclays Glencore Xstrata Sep 2013Documento16 pagineBarclays Glencore Xstrata Sep 2013Ganesh ShenoyNessuna valutazione finora

- ComprehensiveexamDocumento14 pagineComprehensiveexamLeah BakerNessuna valutazione finora

- Danish - FinancialDocumento5 pagineDanish - FinancialAtul GirhotraNessuna valutazione finora

- ACCO320Midterm Winter2013V02Sol - 281 - 29 PDFDocumento16 pagineACCO320Midterm Winter2013V02Sol - 281 - 29 PDFzzNessuna valutazione finora

- C Ipm01079 Mm-IDocumento2 pagineC Ipm01079 Mm-IAlok KumarNessuna valutazione finora

- Multiple Choice: - ComputationalDocumento5 pagineMultiple Choice: - ComputationalCarlo ParasNessuna valutazione finora

- Problämes ch06Documento6 pagineProblämes ch06jessicalaurent1999Nessuna valutazione finora

- Financial Management and ControlDocumento18 pagineFinancial Management and ControlcrystalNessuna valutazione finora

- Kellogg Embarks On MultiDocumento3 pagineKellogg Embarks On MultiJose Luis Becerril BurgosNessuna valutazione finora

- TRW FinancialsDocumento1 paginaTRW FinancialsLynnie BrewsterNessuna valutazione finora

- Vladi FAF Financial ReportDocumento4 pagineVladi FAF Financial ReportVladi DimitrovNessuna valutazione finora

- p2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Documento12 paginep2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1AGNES CASTILLONessuna valutazione finora

- Godrej Financial AnalysisDocumento16 pagineGodrej Financial AnalysisVaibhav Jain100% (1)

- Qa - Installment SalesDocumento3 pagineQa - Installment SalesSittie Ainna Acmed UnteNessuna valutazione finora

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Documento12 pagineP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Mid-Game ReportDocumento10 pagineMid-Game ReportRamizNessuna valutazione finora

- FIN 534 Homework Chap.2Documento3 pagineFIN 534 Homework Chap.2Jenna KiragisNessuna valutazione finora

- Installment Sales - PretestDocumento2 pagineInstallment Sales - PretestCattleyaNessuna valutazione finora

- Comprehensive Exam EDocumento10 pagineComprehensive Exam Ejdiaz_646247100% (1)

- HRM732 Final Exam Review Practice Questions SUMMER 2022Documento12 pagineHRM732 Final Exam Review Practice Questions SUMMER 2022Rajwinder KaurNessuna valutazione finora

- Solutiondone 475Documento1 paginaSolutiondone 475trilocksp SinghNessuna valutazione finora

- Revenue RecognitionDocumento6 pagineRevenue RecognitionnaserNessuna valutazione finora

- Current Ratio Current Asset/Current LiabilitiesDocumento5 pagineCurrent Ratio Current Asset/Current LiabilitiesAkash SinhaNessuna valutazione finora

- Strategic Management 2nd Edition Rothaermel Test Bank 1Documento128 pagineStrategic Management 2nd Edition Rothaermel Test Bank 1dorothyNessuna valutazione finora

- GT SolarDocumento2 pagineGT Solarsommer_ronald5741Nessuna valutazione finora

- ExercisesDocumento13 pagineExercisesalyNessuna valutazione finora

- Midterm Winter 2013 With Final Winter 2013 For Posting FallDocumento10 pagineMidterm Winter 2013 With Final Winter 2013 For Posting FallMiruna CiteaNessuna valutazione finora

- Go Green Inc Business PlanDocumento43 pagineGo Green Inc Business PlanGustavo1722Nessuna valutazione finora

- FIN 534 AssignmentDocumento9 pagineFIN 534 Assignmentmorgan mugoNessuna valutazione finora

- Case Enager IndustriesDocumento4 pagineCase Enager IndustriesNikko Sucahyo50% (2)

- 3Q2013earningsCall11 7Documento32 pagine3Q2013earningsCall11 7sabah8800Nessuna valutazione finora

- 2013Q4 Google Earnings SlidesDocumento14 pagine2013Q4 Google Earnings Slides10TAMBKANessuna valutazione finora

- Instructions To Students: Annual Examinations For Schools 2019Documento8 pagineInstructions To Students: Annual Examinations For Schools 2019parapara11Nessuna valutazione finora

- 41) Risk and Response Question KangarooDocumento2 pagine41) Risk and Response Question KangarookasimranjhaNessuna valutazione finora

- Shareholder Letter Q3 2022 11.8.22 FINALDocumento36 pagineShareholder Letter Q3 2022 11.8.22 FINALAlexNessuna valutazione finora

- Mastering Google My Business: 2024-2025: A Comprehensive Guide to Boost Your Local Presence and Skyrocket Your BusinessDa EverandMastering Google My Business: 2024-2025: A Comprehensive Guide to Boost Your Local Presence and Skyrocket Your BusinessNessuna valutazione finora

- Thyrocare TechDocumento9 pagineThyrocare TechHari KrishnanNessuna valutazione finora

- Codes For Rbi ChallengeDocumento2 pagineCodes For Rbi ChallengeHari KrishnanNessuna valutazione finora

- Eurotex Industries and Exports Limited: Summary of Rated InstrumentsDocumento7 pagineEurotex Industries and Exports Limited: Summary of Rated InstrumentsHari KrishnanNessuna valutazione finora

- Book 2Documento4 pagineBook 2Hari KrishnanNessuna valutazione finora

- HydropowerDocumento24 pagineHydropowerHari KrishnanNessuna valutazione finora

- Revised AIS Rule Vol I Rule 23Documento7 pagineRevised AIS Rule Vol I Rule 23Shyam MishraNessuna valutazione finora

- Free ConsentDocumento11 pagineFree Consentparijat_96427211Nessuna valutazione finora

- Bimal Jalan CommitteeDocumento17 pagineBimal Jalan CommitteeManish MahajanNessuna valutazione finora

- LTD CasesDocumento4 pagineLTD CasestearsomeNessuna valutazione finora

- Claude BalbastreDocumento4 pagineClaude BalbastreDiana GhiusNessuna valutazione finora

- Audit Program - CashDocumento1 paginaAudit Program - CashJoseph Pamaong100% (6)

- Pak301 Long QsDocumento6 paginePak301 Long QsAijaz khanNessuna valutazione finora

- Soal Pas Sastra Inggris Xi Smester 2 2024Documento10 pagineSoal Pas Sastra Inggris Xi Smester 2 2024AsahiNessuna valutazione finora

- VC SpyGlass CDC Quick Start GuideDocumento28 pagineVC SpyGlass CDC Quick Start Guideworkat60474Nessuna valutazione finora

- Executive Department by Atty. Anselmo S. Rodiel IVDocumento39 pagineExecutive Department by Atty. Anselmo S. Rodiel IVAnselmo Rodiel IVNessuna valutazione finora

- AllBeats 133Documento101 pagineAllBeats 133Ragnarr FergusonNessuna valutazione finora

- Bidding Documents (Two Stage Two Envelopes-TSTE) TorgharDocumento63 pagineBidding Documents (Two Stage Two Envelopes-TSTE) TorgharEngr Amir Jamal QureshiNessuna valutazione finora

- Pains of Imprisonment: University of Oslo, NorwayDocumento5 paginePains of Imprisonment: University of Oslo, NorwayFady SamyNessuna valutazione finora

- CL-173 Product Sheet - 3T3-L1Documento7 pagineCL-173 Product Sheet - 3T3-L1Andreas HaryonoNessuna valutazione finora

- 8e Daft Chapter 06Documento24 pagine8e Daft Chapter 06krutikdoshiNessuna valutazione finora

- AOIKenyaPower 4-12Documento2 pagineAOIKenyaPower 4-12KhurshidNessuna valutazione finora

- Letter About Inadmissibility MP Majid Johari 2016-03-05Documento6 pagineLetter About Inadmissibility MP Majid Johari 2016-03-05api-312195002Nessuna valutazione finora

- Global Systems Support: Cobas C 501Documento2 pagineGlobal Systems Support: Cobas C 501Nguyễn PhúNessuna valutazione finora

- Ansi B 1.5Documento37 pagineAnsi B 1.5Ramana NatesanNessuna valutazione finora

- Social Situation in The French SuburbsDocumento13 pagineSocial Situation in The French Suburbsazaleea_roseNessuna valutazione finora

- Free ConsentDocumento2 pagineFree Consentkashif hamidNessuna valutazione finora

- European PrivateDocumento593 pagineEuropean PrivateSamuel bineNessuna valutazione finora

- Assignment Political Science Subject Code: Ba 101 Semester: FirstDocumento7 pagineAssignment Political Science Subject Code: Ba 101 Semester: FirstNaman MishraNessuna valutazione finora

- CarlDocumento20 pagineCarlAnton NaingNessuna valutazione finora

- AO233473236THRISURDocumento3 pagineAO233473236THRISURample.facilitiesNessuna valutazione finora

- UntitledDocumento1.339 pagineUntitledIanNessuna valutazione finora

- People vs. BillaberDocumento12 paginePeople vs. BillaberAb CastilNessuna valutazione finora

- 139-Asia Brewery, Inc. v. Tunay Na Pagkakaisa NG Mga Manggagawa Sa Asia G.R. Nos. 171594-96 September 18, 2013Documento10 pagine139-Asia Brewery, Inc. v. Tunay Na Pagkakaisa NG Mga Manggagawa Sa Asia G.R. Nos. 171594-96 September 18, 2013Jopan SJNessuna valutazione finora

- Offer LetterDocumento10 pagineOffer LetterAtul SharmaNessuna valutazione finora