Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bill

Caricato da

Sowmya DTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bill

Caricato da

Sowmya DCopyright:

Formati disponibili

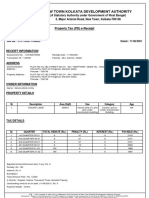

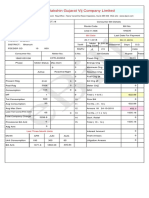

TIRUPATI MUNICIPAL CORPORATION

CHITTOOR DISTRICT

PROPERTY TAX DEMAND BILL for 2016-17

(Issued Under Section-266(1) of AP Municipal Corporations Act, 1994(formerly GHMC Act, 1955))

Demand Bill No : 101200009593 Date : 24/04/2016

Remittance into the Account of Commissioner

Assessment No : 1012008617 Name : B Chandra Sekar Reddy

House No : 6-11-191 Revenue Ward : Revenue Ward No 6

Block : Block No 11 Locality : Chennareddy Colony

PROPERTY TAX DEMAND BILL FOR THE YEAR 2016-17

Property Tax Education Tax Library Cess UC Penalty Total

Current 1st Half 244.00 53.00 21.00 32.00 350.00

Current 2nd Half 244.00 53.00 21.00 32.00 350.00

Arrears 0.00 0.00 0.00 0.00 0.00

Interest on Arrears Upto 01/04/2016 0.00

Total 700.00

Total Adjustments 0.00

Net Total 700.00

NET AMOUNT PAYABLE WITH PENALTY

If paid before Arrear with Interest Current Year Tax with Interest Total

1st Half 2nd Half

30/04/2016 0.00 350.00 350.00 700.00

31/05/2016 0.00 350.00 350.00 700.00

30/06/2016 0.00 350.00 350.00 700.00

31/07/2016 0.00 357.00 350.00 707.00

31/08/2016 0.00 364.00 350.00 714.00

30/09/2016 0.00 371.00 350.00 721.00

31/10/2016 0.00 378.00 350.00 728.00

30/11/2016 0.00 385.00 350.00 735.00

31/12/2016 0.00 392.00 350.00 742.00

31/01/2017 0.00 399.00 357.00 756.00

28/02/2017 0.00 406.00 364.00 770.00

31/03/2017 0.00 413.00 371.00 784.00

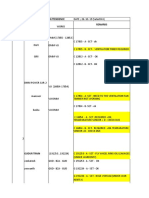

Guidelines for the Tax Payer

1. The Single Demand Bill for both 1st half and 2nd half years is issued 6. A Simple interest @2% per month will be charged in case of failure to

for the convenience of the public. pay property tax by due dates as above.

2. Tax payers are at liberty to pay tax either half year wise or both at a 7. If the tax payers fail to pay the property tax with in 15 days from the

time. date of receipt of this Demand Bill the same amount can be collected by

3. 5% rebate will be given if tax is paid for both half years at a time before issuing a distraint warrant.

30th April of current financial year.

4.Property tax can be paid through: Cash or cheque at e Seva, Mee Seva 8. Please bring this bill while paying at Office counter or eSeva or Mee

centres or Municipal office or online through Creditcard/Debitcard/Net Seva centers.

Banking.

5. Due dates for payment of property tax with out interest for current

financial year: First half year 30th June, Second Half year : 31st

Commissioner.

December.

Powered by www.egovernments.org Visit your city portal at tirupati.cdma.ap.gov.in

ACKNOWLEDGEMENT FOR DEMAND BILL FROM TIRUPATI MUNICIPAL CORPORATION

CHITTOOR DISTRICT

Assessment No : 1012008617 House No : 6-11-191 Demand Bill No : 101200009593

Name : B Chandra Sekar Reddy Signature of the Receiver

Name :

Mobile No :

Potrebbero piacerti anche

- ACCOUNT NO: 40114640559: Mode of Payment Dishonoured ChequeDocumento2 pagineACCOUNT NO: 40114640559: Mode of Payment Dishonoured Chequeshubhanshu5758Nessuna valutazione finora

- Current Month Bill Details New (May - 2019) : Home Billing InformationDocumento1 paginaCurrent Month Bill Details New (May - 2019) : Home Billing Informationpyramid lavanNessuna valutazione finora

- Muktsar Punjab LBDocumento1 paginaMuktsar Punjab LBSatkar GarmentNessuna valutazione finora

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocumento1 paginaAhmedabad Municipal Corporation Mahanagar Sewa SadanManish ChawdaNessuna valutazione finora

- Urja Mitra Application - Jharkhand Bijli Vitran Nigam LTD - DumkaDocumento2 pagineUrja Mitra Application - Jharkhand Bijli Vitran Nigam LTD - DumkaSaket KumarNessuna valutazione finora

- HESCO ONLINE BILLL NovDocumento2 pagineHESCO ONLINE BILLL NovHanif GhiranoNessuna valutazione finora

- LT E-BillDocumento2 pagineLT E-BillAjay ShindeNessuna valutazione finora

- Property TaxDocumento1 paginaProperty TaxBig BossNessuna valutazione finora

- Orig 230007885568Documento1 paginaOrig 230007885568Shivam KhoslaNessuna valutazione finora

- PSPCL Bill 3002893131 Due On 2020-JUL-27Documento2 paginePSPCL Bill 3002893131 Due On 2020-JUL-27Gurvinder SinghNessuna valutazione finora

- CIN NO. U40108JH2013SGC001702: Print This Page Continue To Payment Gateway Pay by Neft/RtgsDocumento1 paginaCIN NO. U40108JH2013SGC001702: Print This Page Continue To Payment Gateway Pay by Neft/RtgsMalay YadavNessuna valutazione finora

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocumento1 paginaDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallAnonymous WuoOVZKNessuna valutazione finora

- New Town Kolkata Development Authority: Property Tax (PD) E-ReceiptDocumento2 pagineNew Town Kolkata Development Authority: Property Tax (PD) E-ReceiptSSK DEVELOPERSNessuna valutazione finora

- Current BillDocumento1 paginaCurrent BillamitNessuna valutazione finora

- Have You Checked Your Name in The Voters List!?: Meter Readings For Meter ID 0232405832Documento1 paginaHave You Checked Your Name in The Voters List!?: Meter Readings For Meter ID 0232405832YashaswiniTateneniNessuna valutazione finora

- LT E-Bill Shop 7 17sept 2019Documento2 pagineLT E-Bill Shop 7 17sept 2019John Smith0% (1)

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocumento1 paginaPrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsGaurav KohliNessuna valutazione finora

- Moshi Home Electricity Bill PDFDocumento2 pagineMoshi Home Electricity Bill PDFUtkarsh ChoudharyNessuna valutazione finora

- Power BillDocumento1 paginaPower BillMahesh NukalaNessuna valutazione finora

- Meter Reading Details: Assam Power Distribution Company LimitedDocumento1 paginaMeter Reading Details: Assam Power Distribution Company LimitedParthapratim GogoiNessuna valutazione finora

- Electricity BillDocumento1 paginaElectricity BillPaul LivesNessuna valutazione finora

- Meter Reading Details: Assam Power Distribution Company LimitedDocumento1 paginaMeter Reading Details: Assam Power Distribution Company LimitedSaidur RahmanNessuna valutazione finora

- LT Bill 57000406406 201907Documento2 pagineLT Bill 57000406406 201907Faku RikiNessuna valutazione finora

- Urja Mitra Application - Jharkhand Bijli Vitran Nigam LTD PDFDocumento2 pagineUrja Mitra Application - Jharkhand Bijli Vitran Nigam LTD PDFRajNessuna valutazione finora

- Bill of Supply For Electricity: Area Details Connection Details Supply and Meter DetailsDocumento2 pagineBill of Supply For Electricity: Area Details Connection Details Supply and Meter DetailsSujat Khan100% (1)

- PSPCL Bill 3015013843 Due On 2020-JUN-08Documento2 paginePSPCL Bill 3015013843 Due On 2020-JUN-08RitishNessuna valutazione finora

- View BillDocumento1 paginaView BillParvezNessuna valutazione finora

- Wa0001 PDFDocumento1 paginaWa0001 PDFKevinNessuna valutazione finora

- Urja Mitra Application - Jharkhand Bijli Vitran Nigam LTD - PDFDocumento2 pagineUrja Mitra Application - Jharkhand Bijli Vitran Nigam LTD - PDFgmatweakNessuna valutazione finora

- Madhyanchal Vidyut Vitran Nigam Limited: NON-TOD Bill PreviewDocumento2 pagineMadhyanchal Vidyut Vitran Nigam Limited: NON-TOD Bill Previewabhishek singhNessuna valutazione finora

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocumento1 paginaPrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsSURESH GARGNessuna valutazione finora

- LT Bill 19000113351 201909 PDFDocumento2 pagineLT Bill 19000113351 201909 PDFDipayan100% (1)

- Electricity Bill: Account No: 7791830000Documento1 paginaElectricity Bill: Account No: 7791830000Jai Mata diNessuna valutazione finora

- Urja Mitra Application - Jharkhand Bijli Vitran Nigam Ltd.Documento2 pagineUrja Mitra Application - Jharkhand Bijli Vitran Nigam Ltd.Md Safdar SadatNessuna valutazione finora

- Bar Graph Unit MonthDocumento2 pagineBar Graph Unit MonthHimansh ChaprodNessuna valutazione finora

- LT E-Bill-compressedDocumento2 pagineLT E-Bill-compressedDSESDFNessuna valutazione finora

- KMC Tax Reciept - 2019Documento1 paginaKMC Tax Reciept - 2019Biswabandhu PalNessuna valutazione finora

- Electric Bill Third SpaceDocumento1 paginaElectric Bill Third SpacekinshukNessuna valutazione finora

- Electricity BillDocumento1 paginaElectricity BillJitendra PandeyNessuna valutazione finora

- D-8 - Property Tax-Payment Receipt - 2021-22Documento1 paginaD-8 - Property Tax-Payment Receipt - 2021-22Raviraj BankarNessuna valutazione finora

- LT E-BillDocumento2 pagineLT E-BillTushar SukhiyaNessuna valutazione finora

- Your DetailsDocumento2 pagineYour DetailsPragnesh PrajapatiNessuna valutazione finora

- 535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067Documento2 pagine535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067chetankvoraNessuna valutazione finora

- View-Bill DhaliywasDocumento1 paginaView-Bill DhaliywasGourav RaoNessuna valutazione finora

- Dakshin Gujarat Vij Company Limited: Bill DateDocumento1 paginaDakshin Gujarat Vij Company Limited: Bill DatePawan ChaturvediNessuna valutazione finora

- Idoc - Pub Electricity-Bill PDFDocumento1 paginaIdoc - Pub Electricity-Bill PDFUsman JaffarNessuna valutazione finora

- Dec17 BillDocumento1 paginaDec17 Billpiyushjindal98Nessuna valutazione finora

- Property Tax NE W Delhi Municipal CorporationDocumento1 paginaProperty Tax NE W Delhi Municipal CorporationSatkar Garment100% (1)

- Best Mumbai LBDocumento2 pagineBest Mumbai LBSatkar Garment50% (2)

- UPPCL October 2019 PDFDocumento1 paginaUPPCL October 2019 PDFGopal KaushikNessuna valutazione finora

- View BillDocumento1 paginaView BillaaaaaaaaNessuna valutazione finora

- Your Electricity Bill For: Samir Kumar ChakrabortyDocumento2 pagineYour Electricity Bill For: Samir Kumar ChakrabortyscNessuna valutazione finora

- TSSPDCL Sec-1561 PDFDocumento2 pagineTSSPDCL Sec-1561 PDFRamu MylaramNessuna valutazione finora

- EDMC Property Tax Delhi 2018-19Documento1 paginaEDMC Property Tax Delhi 2018-19Indra MishraNessuna valutazione finora

- PF No: BG/BNG/0035224/000/1414312 EPS-95 No: BG/BNG/0035224/000/1414312Documento1 paginaPF No: BG/BNG/0035224/000/1414312 EPS-95 No: BG/BNG/0035224/000/1414312Dhiraj Kumar ShuklaNessuna valutazione finora

- StatmentDocumento2 pagineStatmentRatan SinghNessuna valutazione finora

- Sofdigital Systems: Salary SheetDocumento1 paginaSofdigital Systems: Salary SheetBilal SaeedNessuna valutazione finora

- Fondo de Ahorro PrevisionalDocumento3 pagineFondo de Ahorro PrevisionalAdrian Chacae ManuelNessuna valutazione finora

- June 2018 0400029701747 - 721005565186Documento2 pagineJune 2018 0400029701747 - 721005565186Saad MirzaNessuna valutazione finora

- Servicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesDocumento1 paginaServicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesMiguel Flores CornejoNessuna valutazione finora

- Ap Express Invoice 08.11.19Documento32 pagineAp Express Invoice 08.11.19Sowmya DNessuna valutazione finora

- Ambattur Ac 3Documento23 pagineAmbattur Ac 3Sowmya DNessuna valutazione finora

- DATE OF ISSUE: - Address: Medchal Dist - 500040Documento1 paginaDATE OF ISSUE: - Address: Medchal Dist - 500040Sowmya DNessuna valutazione finora

- Man Approval ListDocumento3 pagineMan Approval ListSowmya DNessuna valutazione finora

- S.No Thirupathi Works Remarks 5 Hamsafer PowercarDocumento4 pagineS.No Thirupathi Works Remarks 5 Hamsafer PowercarSowmya DNessuna valutazione finora

- Dps Sales & Services Attendence Date 26. 10. 19 (Saturday) Name RemarksDocumento12 pagineDps Sales & Services Attendence Date 26. 10. 19 (Saturday) Name RemarksSowmya DNessuna valutazione finora

- 1 9:45 OJR Office: Dps Sales & Services Attendence Date:26.10.19 (Satuarday) S.No Name Works RemarksDocumento21 pagine1 9:45 OJR Office: Dps Sales & Services Attendence Date:26.10.19 (Satuarday) S.No Name Works RemarksSowmya DNessuna valutazione finora

- EHDF Module 4 & 5Documento5 pagineEHDF Module 4 & 5Faizal KhanNessuna valutazione finora

- Ioana Ramona JurcaDocumento1 paginaIoana Ramona JurcaDaia SorinNessuna valutazione finora

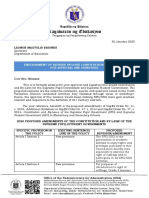

- L Final Endorsement Letter To SLMB Constitution Without National FedDocumento8 pagineL Final Endorsement Letter To SLMB Constitution Without National FedJerson AgsiNessuna valutazione finora

- Asuncion Bros. & Co., Inc. vs. Court Oflndustrial RelationsDocumento8 pagineAsuncion Bros. & Co., Inc. vs. Court Oflndustrial RelationsArya StarkNessuna valutazione finora

- Retro 80s Kidcore Arcade Company Profile Infographics by SlidesgoDocumento35 pagineRetro 80s Kidcore Arcade Company Profile Infographics by SlidesgoANAIS GUADALUPE SOLIZ MUNGUIANessuna valutazione finora

- Garcia Vs CA 167 SCRA 815Documento7 pagineGarcia Vs CA 167 SCRA 815JamesAnthonyNessuna valutazione finora

- "Raphy" PinaDocumento34 pagine"Raphy" PinaMetro Puerto RicoNessuna valutazione finora

- CTA CasesDocumento177 pagineCTA CasesJade Palace TribezNessuna valutazione finora

- Case 20Documento6 pagineCase 20Chelle Rico Fernandez BONessuna valutazione finora

- Rosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrDocumento5 pagineRosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrEliza Den DevilleresNessuna valutazione finora

- Marijuana Prohibition FactsDocumento5 pagineMarijuana Prohibition FactsMPPNessuna valutazione finora

- Panay Autobus v. Public Service Commission (1933)Documento2 paginePanay Autobus v. Public Service Commission (1933)xxxaaxxxNessuna valutazione finora

- AWS QuestionnaireDocumento11 pagineAWS QuestionnaireDavid JosephNessuna valutazione finora

- Form - 28Documento2 pagineForm - 28Manoj GuruNessuna valutazione finora

- Boskalis Position Statement 01072022Documento232 pagineBoskalis Position Statement 01072022citybizlist11Nessuna valutazione finora

- People Vs ParanaDocumento2 paginePeople Vs ParanaAnonymous fL9dwyfekNessuna valutazione finora

- Vocabulary Monologue Your JobDocumento2 pagineVocabulary Monologue Your JobjoseluiscurriNessuna valutazione finora

- Positive Recall ProcedureDocumento6 paginePositive Recall ProcedureSiva RamNessuna valutazione finora

- Sample Compromise AgreementDocumento3 pagineSample Compromise AgreementBa NognogNessuna valutazione finora

- Rent Agreement Format MakaanIQDocumento2 pagineRent Agreement Format MakaanIQShikha AroraNessuna valutazione finora

- List of European Countries Via WIKIPEDIA: Ran K State Total Area (KM) Total Area (SQ Mi) NotesDocumento3 pagineList of European Countries Via WIKIPEDIA: Ran K State Total Area (KM) Total Area (SQ Mi) NotesAngelie FloraNessuna valutazione finora

- Trailhead Virtual Bootcamp For Platform Developer Slide DeckDocumento111 pagineTrailhead Virtual Bootcamp For Platform Developer Slide DeckBrenda Paiva100% (1)

- MMD Political Overview CroatiaDocumento3 pagineMMD Political Overview CroatiaMmd SEE100% (2)

- Craig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Documento12 pagineCraig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Immigrant & Refugee Appellate Center, LLCNessuna valutazione finora

- JEEVAN LABH 5k-10k 21-15Documento1 paginaJEEVAN LABH 5k-10k 21-15suku_mcaNessuna valutazione finora

- Stevens V University of Birmingham (2016) 4 All ER 258Documento25 pagineStevens V University of Birmingham (2016) 4 All ER 258JYhkNessuna valutazione finora

- HarmanDocumento10 pagineHarmanharman04Nessuna valutazione finora

- M1-06 - Resultant ForcesDocumento9 pagineM1-06 - Resultant ForcesHawraa HawraaNessuna valutazione finora

- Licensing Notes For Oracle'S Peopletools 8.52Documento19 pagineLicensing Notes For Oracle'S Peopletools 8.52Juan Pablo GasparriniNessuna valutazione finora

- The Sorcerer's Tale: Faith and Fraud in Tudor EnglandDocumento224 pagineThe Sorcerer's Tale: Faith and Fraud in Tudor Englandnevernevernever100% (1)