Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Manhattan Important Information

Caricato da

Singaravelu SanthanamCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Manhattan Important Information

Caricato da

Singaravelu SanthanamCopyright:

Formati disponibili

If calling from a BSNL/MTNL phone, please dial 1800-345-3969 or 080-30301969. Email us at : helpme@manhattan.co.

in

If calling from a non BSNL/MTNL/mobile phone, please dial local city code followed by 30301969. or visit our website www.manhattan.co.in

n Method of payment: with your cheque/draft.

n Payment of Credit card bills can be through cheque, draft or cash payments at the n In case you make your payment without a payment coupon, then clearly write all the card

SCB ATMs or Branches or through ECS (Electronic Clearing Service) numbers and the specific amount against each card on the reverse of the cheque.

instruction. Please make your cheques and drafts payable to Manhattan Card No. n If multiple cheques are being issued for each account, then the card member should

xxxx xxxx xxxx xxxx (your 16 digit Manhattan card number). Please ensure that your clearly mention Not to allocate on the reverse. In the absence of any specific instruction

cheques / drafts are complete in all respects and any material alteration is duly signed on the reverse of the instrument, the bank will apply the funds first towards clearance of

off. We encourage you to drop your payments in the Cheque Collection Box at least 3 the Minimum amount due in respect of all the cards and any excess payment will be

days in advance of your Payment Due Date. However, the cheque can be dated as per allocated sequential towards the account with highest balance. In case the payment made

the actual Payment Due Date. This is to facilitate timely credit of the funds into your card is lesser than the Minimum Amount due, the payments will be prioritised to the overdue

account. In case the bank does not receive payment by the Payment Due Date, the accounts first as per the internal policy. For Cash payments, funds transfer and payment

Bank reserves the right to levy a Late Payment Charge. For overdue accounts, the through Net banking, individual payment should be made against each of the accounts.

Payment will be credited only post clearance of the cheque. Cash can only be deposited n Payment Due Date (PDD) will be 18 days from the statement date (17 days in case the 18th

at the Banks branches during normal banking hours. Please do not deposit cash in the day is a Sunday).

Cheque Collection Box. Payments can be made through the Electronic Clearing System n Billing Dispute Resolution : The dispute in billing has to be brought to the Bank's notice within

in New Delhi, Kolkatta, Mumbai, Ahmedabad, Pune, Coimbatore, Chennai, Hyderabad 21 days from the date of receipt of the statement. A Dispute Declaration Form (DDF) or a signed

and Bangalore. Responsibility is on the customer to ensure that the ECS is honoured. letter is mandatory. Please contact the Helpline for further details.

n If you have more than one Manhattan or SCB Card Account n Grievance Escalation : For any unresolved grievances please write in to CDK Sai Narain, Head

n You could write any one of your card numbers on the cheque. Just specify the amount Service, Manhattan Credit Cards, Post Box No.8888, Chennai 600 001. Ph : +91 99002 60046,

you are paying against each of your card accounts in the payment coupon and attach it email Head.Customerexperience@manhattan.co.in.

n Annualized Percentage Rates (APR) : The monthly interest rate is annualized to arrive at the APR. For deducting the utilised limit from the Total Credit Limit. In case the cardmember has availed of any loan

example: A monthly interest rate of 1.49% is equal to an APR of 17.88% when annualized. Similarly, a within the credit limit on the card, the outstanding loan amount will also be deducted from the Total Credit

monthly interest rate of 3.1% when annualized is equal to an APR of 37.20%. Limit to arrive at the Available Credit limit. The Bank reserves the right to reduce your credit limit at its

Credit Cards are a credit mechanism for short term credit needs/every day spend categories. sole discretion based on certain conditions.

Should you have any long term funding requirement we do have a range of products for the same. Do n Cash Advance Limit: The Cash Advance Limit is not a fixed percentage of the credit limit, but is evaluated

call the helpline for further details. and reset monthly. For further details and charges on the same, please contact the card service helpline

n Interest Free Period:Interest free period varies from 17 - 47 days assuming that you make 100% full numbers.

payment of your card bill every month. This is only for retail transactions. However, for cash advances, n Minimum Payment Due: The minimum payment due every month is 5% of the billed value, unless

interest is charged from the date of the transaction and there is no interest free period. The Bank reserves credit limit & cash advance limit you default on your payment. In which case, we may ask you to pay up

the right to change this interest free period by giving prior notice. the entire outstanding. In case, you have gone overlimit on your card account, the minimum payment

If payment is not made in full, even if the Minimum Amount Due (MAD) is paid by the due will be the overlimit amount in addition to the 5% of the billed value.

due date, interest will still be charged on the Total Amount Due (TAD). If you spend Rs 5,000 and pay back exactly the Minimum Payment Due (subject to a minimum

n Billing Statement Periodicity & Mode of Sending : Your credit card statement will be sent to you on a payment of Rs 100) every month, it will take you up to 6 years to pay back the complete amount.

monthly basis through regular post and/or through Email (if you have registered for E-statements). You We, therefore, suggest that whenever your cash flows allow you, do pay back substantially more

can also check your statement on the Manhattan website if you have registered for Net Banking. The than your minimum payment due.

statement for any given month will be generated/mailed to you only if there are spends or balances greater Notwithstanding anything contained herein, the facility is at the bank's sole discretion and subject to

than Rs.100/- (including credit balances) on the card in the given month. cancellation at any time by the bank

n Credit Limit: Credit limit will be set at the discretion of the bank. Available credit limit is calculated by

n Levy of Interest for various Payment Options (Please note that monthly payments will be applied first towards meeting the old borrowing.)

Option How Interest will be levied Example

If FULL payment of Total Outstanding

is made every month before Payment No Interest will be charged *

Due Date

Interest will be charged for all transactions Previous Statement Date: 1 Aug,

incurred in the current statement from the Statement Balance: Rs.10,000/-

transaction date till the Statement Date. Payment Due Date: 18 Aug

If PARTIAL payment of Total The closing balance in the previous statement Transaction incurred on 15 Aug: Rs.3,000/-

Outstanding is made every month will attract interest, from one day post the Payment: Rs 8,000/- received on 18 Aug

before Payment Due Date Statement Date till one day prior to the date Current Statement Date: 1 Sep,

of payment, in the current statement. The In this case, interest will be charged for Rs.10,000/- from 2 Aug till 17 Aug and the unpaid balance of

balance after payment will attract interest

from the date of payment till the Statement Rs.2,000/- will attract interest from 18 Aug till 1 Sep.

Date. Interest will also be charged for Rs.3,000/- from 15 Aug to 1 Sep.

If you usually make PARTIAL The closing balance as per your previous Previous statement date: 1 Aug,

payment, but in the CURRENT statement will accrue interest until the date Closing Balance Rs.10,000/,

month you have made the FULL of payment.

Payment of the Total Outstanding Current Statement Date: 1 Sep

before the Payment Due Date Due Date: 18 Aug, Payment: Rs.10,000/- on 15 Aug.

Rs 10,000/- will attract interest from 2 Aug to 14 Aug (for 13 days in Aug which has 31 days).^

*Does not include Cash transactions ^ Interest debited in this case will be = 10,000 x 3.10% x 13/31 = Rs.130.0

n Fees & Charges: (Service Tax is at 12.36 % on Service Charges. Service Tax Registration No.ST/Mumbai/CDCOS/Dn I/13/2006 under "Credit Card, Debit Card, Charge Card or Other payment card services".Regd. Office

Standard Chartered Bank, 23 - 25, M.G. Road, Fort, Mumbai -400001.No Service tax credit shall be claimed by the customer under CENVAT credit Rules 2004 in respect of charges waived or reversed.)

Charges effective 1st June 2006

n The Manhattan Primary and Supplementary Cards are free for life : there are no Joining n Return Cheque : Rs. 300/- per instance.

and Annual fees. n Card Replacement and Lost Card Fee : Rs. 200/- per instance.

n Late Fee : An additional late fee of Rs. 100/- will be charged over and above the LPC if n Duplicate Statement : Rs. 125/- per statement (Prior to last 3 months)

the Minimum Amount Due is not received for two or more consecutive months. n Pin Replacement Fee : Rs. 100/- per replacement.

n OverLimit Charges : Rs. 500/- per instance. n Charge Slip Retrieval : Rs.100/- per instance.

n Interest Rate: The retail interest rate applicable on your account is mentioned overleaf. n Overseas Transaction Fee : All non-INR transactions are converted into INR as per

The APR will be assigned and reviewed every six months based on your card usage and re- rate advised by VISA. The Bank charges 2.50% on the transaction as a mark-up and

payment behaviour at the sole discretion of the Bank and will vary between 1.49% p.m. an additional 1% mark-up is charged towards reimbursement to VISA.

(APR of 17.88%) and 3.40% p.m. (APR of 40.80%).The new APR will be communicated n Airline/Railway Ticket Cancellation : We will levy a handling charge of Rs. 100/-for

through your statement at the time of each revision and will be applicable for a period of these requests.

3 months from the date of revision. n Surcharges: Rs. 25/- or 2.5% (whichever is higher) on Railway transactions. Rs.10/-

n Non Usage Fees : Rs. 250/- if you have not used the card for a retail or cash transaction or 2.5% (whichever is higher) on Petrol transactions.

in the last 6 months.

n LifeStyle Experiences Fee : Free for first year. Rs. 99/- per year from second year onwards. Charges effective 18th June 2007:

Branch Transaction Fee : Rs 99/- will be charged every time a payment is made in cash n Late payment charges: Rs. 350 for statement outstanding less than Rs. 10,000

n

at the SCB branches using teller facilities. Rs. 500 for statement outstanding between Rs. 10,000 and Rs. 20,000 Rs. 600 for

statement outstanding greater than Rs. 20,000.

n Cash Withdrawal Limit : Your cash withdrawal limit is not a fixed number or percentage, n Cash advance fee: ATM Withdrawals: 3% of cash withdrawal amount subject to a

but is evaluated and reset monthly based on your card usage and repayment behaviour. You minimum of Rs. 300 For withdrawals using the teller facility at our Branches, an additional

Stmt Rev_MH_Oct_07

may check your availability by calling us any time. fee of Rs. 500 will be levied.

Announcing our "24 hours Service Assurance", a first of its kind Customer Service initiative. Just SMS "Service" to 9845222222 and

we will provide assistance to you within 24 hours. The bank assures to pay INR. 100 on failure of establishing contact within 24 hours*.

*Terms and Conditions apply. Please visit our website at www.manhattan.co.in for more details.

Note: We have adopted the recently introduced Banking Code of Commitment that sets the minimum standards of service. This will further strengthen our endeavor to provide you world class service and products. To get a copy of the code, call us at Phonebanking or

download it from http://www.manhattan.co.in/legal_mumbo_jumbo(BCSBI).htm

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Impact of GST On Hotel Industry (A Case Study of Hotel Arya Niwas Jaipur)Documento15 pagineImpact of GST On Hotel Industry (A Case Study of Hotel Arya Niwas Jaipur)Anushi JainNessuna valutazione finora

- Bus Rapid Transit System Case Study On Indore BRTS Route & Gaunghou, China BRTS RouteDocumento18 pagineBus Rapid Transit System Case Study On Indore BRTS Route & Gaunghou, China BRTS Routesimran deo100% (3)

- Chapter 1Documento18 pagineChapter 1cerayNessuna valutazione finora

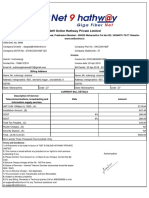

- Net9 Online Hathway Private Limited: Terms and ConditionsDocumento1 paginaNet9 Online Hathway Private Limited: Terms and ConditionsArjun DhingraNessuna valutazione finora

- CHALLANADocumento3 pagineCHALLANANaganaboina SaiNessuna valutazione finora

- Incoterms 2010 GB PDFDocumento1 paginaIncoterms 2010 GB PDFmoinhzNessuna valutazione finora

- JNTU (K) LSCM 4th Sem 2017 Question PaperDocumento1 paginaJNTU (K) LSCM 4th Sem 2017 Question Paperujjal dasNessuna valutazione finora

- S8359999 enDocumento223 pagineS8359999 enMighellNessuna valutazione finora

- GST ChallanDocumento2 pagineGST ChallanrajorajisunnyNessuna valutazione finora

- Accounts Payables 3 DocumentsDocumento4 pagineAccounts Payables 3 DocumentsHerald GangcuangcoNessuna valutazione finora

- Final Accounts of Banking CompaniesDocumento28 pagineFinal Accounts of Banking CompaniesAmit_Agarwal_7219Nessuna valutazione finora

- Mashreq Credit Card Statement Oct - Nov 2021Documento4 pagineMashreq Credit Card Statement Oct - Nov 2021bAYASUNessuna valutazione finora

- Lembar Kerja Spreadsheet 3Documento7 pagineLembar Kerja Spreadsheet 3NanaNessuna valutazione finora

- Ingenico iWL250 QRG PDFDocumento10 pagineIngenico iWL250 QRG PDFZen Eulalio TalubanNessuna valutazione finora

- AccountStatement 3943009192 Jan12 040619Documento30 pagineAccountStatement 3943009192 Jan12 040619govindu sumanNessuna valutazione finora

- Knet03 Jan 19Documento2 pagineKnet03 Jan 19anand singhNessuna valutazione finora

- Citizen&Imm-eapps Enligne - Moneris SolutionsDocumento1 paginaCitizen&Imm-eapps Enligne - Moneris SolutionsCin SagaNessuna valutazione finora

- 2013 12 Dec PaybillDocumento121 pagine2013 12 Dec Paybillapi-276412679Nessuna valutazione finora

- Chetan Jain - Exp. - Sheet - Sep 2020Documento7 pagineChetan Jain - Exp. - Sheet - Sep 2020rishichauhan25Nessuna valutazione finora

- Siva Prakash A/L Gunaseelan No 23 Jalan Seri Mersing 37 Kawasan 2 Taman Seri Andalas, 41200, KLANG, SELDocumento2 pagineSiva Prakash A/L Gunaseelan No 23 Jalan Seri Mersing 37 Kawasan 2 Taman Seri Andalas, 41200, KLANG, SELJaya PrathapNessuna valutazione finora

- RID 3141 District Dues Form 2019 - 20Documento2 pagineRID 3141 District Dues Form 2019 - 20priyanka desaiNessuna valutazione finora

- Double Entry Book KeepingDocumento20 pagineDouble Entry Book KeepingLynda Davis100% (4)

- Statements of AccountDocumento1 paginaStatements of AccountMaricar RoldanNessuna valutazione finora

- MLTC CATRAM Market Study Container Terminals West and Central AfricaDocumento133 pagineMLTC CATRAM Market Study Container Terminals West and Central AfricazymiscNessuna valutazione finora

- CNC 1Documento127 pagineCNC 1Suraj PrakashNessuna valutazione finora

- Toyota DistributionDocumento23 pagineToyota DistributionSudhansu Sekhar PandaNessuna valutazione finora

- HIMANSHUGUPTASONARESHCHANDRA 16013141754 UnlockedDocumento24 pagineHIMANSHUGUPTASONARESHCHANDRA 16013141754 Unlockedbkomal719Nessuna valutazione finora

- Audit ChecklistDocumento32 pagineAudit ChecklistParth Joshi100% (1)

- Salma Bano: Indian Income Tax ReturnDocumento3 pagineSalma Bano: Indian Income Tax Return9956272017Nessuna valutazione finora

- 2023 02 23 12 53 06jan 23 - 410501Documento5 pagine2023 02 23 12 53 06jan 23 - 410501bibhuti bhusan routNessuna valutazione finora