Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IA Reviewer

Caricato da

Karen Clarisse AlimotDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IA Reviewer

Caricato da

Karen Clarisse AlimotCopyright:

Formati disponibili

Problem 20-16: (Unamortized Discount)

On January 2, 2014, Anger Company issued its 9% bonds in the face amount of P 4,000,000 which

mature on January 1, 2024. The bonds were issued for P 3,756,000 to yield 10%. Anger uses the

interest method of amortizing bond discount. Interest is payable annually on December 31.

At December 31, 2015, how much should be Anger's unamortized bond discount?

al P192,364

b) P228,400

c) P211,240

d) P244,000

Answer: C

Face Value P4,000,000

Less: Carrying Value, December 31, 2015 3,788,760

Unamortized bond discount P 211,240

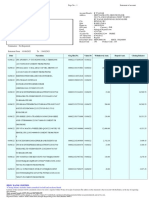

Date Interest Paid Interest Expense Discount Amortization Carrying Value

01.01.14 0 0 0 P3,756,000

12.31.14 P360,000 P375,600 P15,600 3,771,600

12.31.15 360,000 377,160 17,160 3,788,760

Interest Expense = Carrying value of the liability x Yield rate

Problem 20 - 15: (Carrying Value of Debt Instruments)

On January 2, 2014, East Co. issued 9% bonds in the amount of P1,000,000 which mature on

January 2, 2024. The bonds were issued for P939,000 to yield 10%. Interest is payable annually

on December 31. East uses the interest method of amortizing bond discount. In its December

31, 2014 statement of financial position, what amount should East report as bonds payable?

a) P939,000

b) P947,000

c) P942,900

d) P1,000,000

Answer: C

Carrying Value, January 2, 2014 P939,000

Add: Discount Amortization

Interest paid (P1,000,000 x 9%) P90,000

Less: Interest expense (P939,000 x 10%) 93,900 3,900

Carrying Value, December 31, 2014 P942,900

Problem 20 – 17: (Detachable Warrants)

During 2014, Royal Corporation booed at 95, one thousand of its 8% P5,000 bonds due in ten years.

One detachable stock purchase warrants entitling the holder to buy 20 shares of Royal’s

ordinary shares was attached to each bond. Shortly after issuance, the bonds are selling at 10%

ex-warrant, and each warrant was quoted at P60. The present value factors are the following:

PV of 10% for an ordinary annuity of P1 after 10 periods 6.145

PV of 10% after 10 interest periods .385

What amount of any of the proceeds from the bond issuance should be recorded as part e

Royal's shareholders' equity?

a) none

b) 9250000

c) P225,000

d) P367,000

Answer: D

Proceeds from issue (P5,000,000 x 95%) P4,750,000

Less Fair value of the bands (Schedule 1) 4,383,000

Fair value of equity component P 367,000

Schedule 1

Present value of total interest (P5,000,000 x 8% x 6.145) P2,458,000

Present value of principal (P5,000,000 x .385) 1,925,000

Fair value of debt instrument P4,383,000

Problem 20 - 22: (Issue of Convertible Debt Instruments)

On January 1, 2014, Grader Company issued its 10%, 4 year convertible debt instrument with a

face amount of P 4,000,000 for P4,400,000. Interest is payable every December 31 of each year.

The debt instrument is convertible into 35,000 ordinary shares with a par value of P100. When

the debt instruments were issued, the prevailing market rate of interest for similar debt without

conversion option is 8%.

PV of 8% for an ordinary annuity of P1 after 4 periods 3.312

PV of 8% after 4 interest periods .735

Question 2: What is the balance of the unamortized premium on debt instrument as of

December 31, 2014?

a) P 73,860

b) P205,984

c) P142,463

d) P264,800

Answer: B

Carrying value of debt as of January 1, 2014 P4,264,800

Less: Premium amortization

Interest Paid P400,000

Interest Expense (P4,424,800 x 8%) 341,184 58,816

Carrying value of debt as of December 31, 2014 P4,205,984

Less: Face value of debt 4,000,000

Unamortized premium as of December 31, 2014 P 205,984

Problem 20 - 23: (Issue of Convertible Debt Instruments)

On January 1, 2014, Tudor Company issued its 10%, 5-year convertible debt instrument with a

face amount of P10,000,000 for P10,000,000. Interest is payable every December 31 of each

year. The debt instrument is convertible 90,000 ordinary shares with a par value of P100.

When the debt instruments were issued, they were selling 97% without conversion option

Tudor Company incurred P80,000 transaction costs on the issue of the debt instruments.

Question 1: How much of the net proceeds represent the equity component?

a) P 297,600

b) P 9,920,000

c) P 9,622,400

d) P 10,000,000

Question 2: How much of the net proceeds represent the debt component?

a) P 297,600

b) P 9,622,400

c) P 9,920,000

d) P 10,000,000

Answers: Q1: A Q2: B

Ratio Proceeds Transaction Net Proceeds

Debt 97% P 9,700,000 P77,600 P9,622,400

Equity 3% 300,000 2,400 297,600

Total 100% P10,000,000 P80,000 P9,920,000

Problem 20- 26: (Conversion of Debt to Equity)

On January 1, 2014, Emilia Corporation issued its 5-year, 12% P5,000,000 face value convertible

debt instrument for P 4,800,000. The debt instrument is convertible into 80,000 ordinary shares

with a par value of P50 per share and can be converted anytime from January 2015 to maturity.

At the time of issue, the market rate of interest for a similar instrument is 14%. Interest is

payable every six months on January 1 and July 1.

On July 1, 2015, the entire debt instrument was converted into equity instrument by the issuance

of 80,000 ordinary shares of the enterprise. Transaction costs of P50,000 were incurred in

relation to the issue of new shares.

PV of 7% for an ordinary annuity of P1 after 10 periods 7.024

PV of 7% after 10 interest periods .508

What amount should be credited to the share premium account as a result of the conversion?

a) None

b) P831,349

c) P152,800

d) P881,549

Answer: B

Carrying value of debt as of December 31, 2015 P 4,728,549

Equity component 152,800

Total P4,881,349

Less: Par value of ordinary shares (80,000 shares x PS0) 4,000,000

Excess P 881,349

Less: Transaction costs 50,000

Credit to Share Premium P 831,349

Date Interest Paid Interest Expense Discount Amortization Carrying Value

01.01.14 0 0 0 P4,647,200

07.01.14 P300,000 P325,304 P25,304 4,672,504

12.31.14 300,000 327,075 27,075 4,699,579

07.01.15 300,000 328,970 28,970 4,728,549

Total proceeds from issue of debt P4,800,000

Less: Liability component (PV expected cash flows)

Interest (P5,000,000 x 6% x 7.024) P2,107,200

Face (P5,000,000 x .508) 2,540,000 4,647,200

Equity component P 152,800

Problem 20-27: (Partial Conversion of Debt to Equity)

On January 1, 2014, Wisdom Company issued its 10%, 6-year convertible debt instrument with a face

amount of P 3,000,000 for P 3,500,000. Interest is payable every December 31 of each year.

The debt instrument is convertible into 30,000 ordinary shares with a par value of P100. The debt

instrument is convertible into equity from the time of issue until maturity. Without the

conversion feature, the debt instrument would have sold at 106.

On December 31, 2015, Wisdom Company converted 1,000,000 debt instruments by issuing

10,000 ordinary shares. As of December 31, 2015, the unamortized premium on the debt

instrument is P135,000.

What amount should be credited to the share premium account as a result of the conversion

a) None

b) P151,667

c) P135,000

d) P180,000

Answer: B

Total issue price P 3,500,000

Less: Liability component (1,000,000 x 106%) 3,180,000

Equity Component P 320,000

Face of the debt instruments P 3,000,000

Potrebbero piacerti anche

- LiabilitiesDocumento5 pagineLiabilitiesmalaya negadNessuna valutazione finora

- Reviewer FinalsDocumento23 pagineReviewer FinalsMark AloysiusNessuna valutazione finora

- Intermediate AccountingDocumento36 pagineIntermediate AccountingJerome SarmientoNessuna valutazione finora

- This Study Resource Was: Accounting For BondsDocumento4 pagineThis Study Resource Was: Accounting For BondsSeunghyun ParkNessuna valutazione finora

- Chapter 7 Current Liabilities: 7.1 Trade and Other PayableDocumento11 pagineChapter 7 Current Liabilities: 7.1 Trade and Other PayableMaryrose SumulongNessuna valutazione finora

- FAR Practical Exercises Liabilities PDFDocumento8 pagineFAR Practical Exercises Liabilities PDFRemy Caperocho80% (5)

- Bonds PayableeeeeDocumento48 pagineBonds Payableeeeespur ious100% (2)

- P1 HSHSJSKDJHSHDocumento8 pagineP1 HSHSJSKDJHSHabcdefg0% (1)

- FX FINACC 2 A KeyDocumento9 pagineFX FINACC 2 A KeyEzekiel MalazzabNessuna valutazione finora

- Non Current Liabilities San Carlos CollegeDocumento12 pagineNon Current Liabilities San Carlos CollegeRowbby Gwyn50% (2)

- ACG3141-Chap 14Documento35 pagineACG3141-Chap 14Minh NguyễnNessuna valutazione finora

- ApDocumento8 pagineApMonina Cabalag100% (1)

- Finance Lease - Lessee: Aklan Catholic CollegeDocumento9 pagineFinance Lease - Lessee: Aklan Catholic CollegeLouiseNessuna valutazione finora

- Compund Financial Instrument - ProblemsDocumento3 pagineCompund Financial Instrument - ProblemsLouiseNessuna valutazione finora

- Retirement BenefitsDocumento4 pagineRetirement BenefitsJona FranciscoNessuna valutazione finora

- Answer: C - 465,000Documento9 pagineAnswer: C - 465,000kyle G50% (2)

- CSC 201-Leones, Mary Grace O. - IntermediateDocumento28 pagineCSC 201-Leones, Mary Grace O. - IntermediateMary Grace Ocampo LeonesNessuna valutazione finora

- ACC 211 SIM Week 6 7Documento40 pagineACC 211 SIM Week 6 7Threcia Rota50% (2)

- Financial Accounting and Reporting Ii Final Quiz 2/3Documento7 pagineFinancial Accounting and Reporting Ii Final Quiz 2/3Patrick Ferdinand Alvarez50% (2)

- 2Documento14 pagine2MARIANessuna valutazione finora

- DySAS General Review Acctg6 - AnsDocumento11 pagineDySAS General Review Acctg6 - Ansyasira0% (1)

- ACC 577 Quiz Week 4Documento11 pagineACC 577 Quiz Week 4MaryNessuna valutazione finora

- PAS37 ProbsDocumento4 paginePAS37 ProbsAngelicaNessuna valutazione finora

- Practical Accounting 1Documento22 paginePractical Accounting 1Mica Gonzales63% (8)

- Info 1Documento28 pagineInfo 1Veejay Soriano Cuevas0% (1)

- 02a Bonds Payable Compound Financial InstrumentDocumento64 pagine02a Bonds Payable Compound Financial Instrumentfordan Zodorovic74% (19)

- Chapt 25 Bonds PayableDocumento124 pagineChapt 25 Bonds Payablelc71% (7)

- Chapter 7 B-EconDocumento14 pagineChapter 7 B-EconCathy Tapinit43% (7)

- FAR Vol 2 Chapter 19 21Documento13 pagineFAR Vol 2 Chapter 19 21Allen Fey De Jesus50% (4)

- Assignment 7 On Chapt 3 Problem 3 17 On Page 93Documento2 pagineAssignment 7 On Chapt 3 Problem 3 17 On Page 93Joylyn CombongNessuna valutazione finora

- Non-Financial Liabilities HomeworDocumento6 pagineNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- ROGEN AssignmentDocumento9 pagineROGEN AssignmentRogen Paul GeromoNessuna valutazione finora

- Chapter 31SMEs Property Plant and EquipmentDocumento2 pagineChapter 31SMEs Property Plant and EquipmentDez ZaNessuna valutazione finora

- Quiiz 1Documento4 pagineQuiiz 1max pNessuna valutazione finora

- Ia 3 PrelimDocumento12 pagineIa 3 PrelimshaylieeeNessuna valutazione finora

- Far 129 Notes PayableDocumento3 pagineFar 129 Notes PayableJemwell Pagalanan100% (1)

- Notes PayableDocumento8 pagineNotes Payablechamie143Nessuna valutazione finora

- FINALS QUIZ Fin3Documento11 pagineFINALS QUIZ Fin3Erika Larinay100% (1)

- DYSAS QuestionairesDocumento5 pagineDYSAS QuestionairesAngelica Manaois100% (1)

- C2 - Premium LiabilityDocumento14 pagineC2 - Premium LiabilityMarjorie Tuinkle G. Rivera50% (2)

- Quiz 1-Current LiabDocumento11 pagineQuiz 1-Current LiabBadAssNessuna valutazione finora

- Module 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYDocumento20 pagineModule 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYKathleen Sales75% (4)

- AuditingDocumento5 pagineAuditingJona Mae Milla0% (1)

- AP Review LiabDocumento10 pagineAP Review LiabTuya DayomNessuna valutazione finora

- Quiz FinalDocumento6 pagineQuiz FinalChriztel Joy Manansala100% (1)

- Installment Sales OldDocumento3 pagineInstallment Sales OldThea Grace Bianan0% (1)

- Random Problem 2 (Pinky)Documento23 pagineRandom Problem 2 (Pinky)spur iousNessuna valutazione finora

- Third Week - Dsadfor PrintingDocumento14 pagineThird Week - Dsadfor Printingyukiro rineva0% (2)

- Problems Problem 9-1 (ACP)Documento11 pagineProblems Problem 9-1 (ACP)Emey Calbay33% (3)

- Contingent Liab Bonds PayableDocumento11 pagineContingent Liab Bonds PayableKristine Lirose Bordeos100% (1)

- Group Activity 2 Answer KeyDocumento4 pagineGroup Activity 2 Answer Keykrisha milloNessuna valutazione finora

- Batch 17 1st Preboard (P1)Documento13 pagineBatch 17 1st Preboard (P1)Jericho Pedragosa100% (1)

- Assessment Task 3Documento5 pagineAssessment Task 3Christian N MagsinoNessuna valutazione finora

- Nfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Documento18 pagineNfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Merliza Jusayan100% (1)

- Batch 17 1st Preboard (P1)Documento13 pagineBatch 17 1st Preboard (P1)mjc24100% (7)

- ACC314 A31 ProblemsDocumento12 pagineACC314 A31 ProblemsaceNessuna valutazione finora

- Examination About Investment 15Documento3 pagineExamination About Investment 15BLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Documento14 pagineNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNessuna valutazione finora

- Inter AccDocumento6 pagineInter AccshaylieeeNessuna valutazione finora

- Intermediate Accounting Questions PDFDocumento4 pagineIntermediate Accounting Questions PDFJeanieNessuna valutazione finora

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocumento60 pagineAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNessuna valutazione finora

- QFGDocumento120 pagineQFGAlexander NadolinskiNessuna valutazione finora

- AccDocumento4 pagineAccrenoNessuna valutazione finora

- Non Negotialbe IntrumentDocumento15 pagineNon Negotialbe IntrumentSenthil MassenNessuna valutazione finora

- 32366cfmip22274 BDocumento21 pagine32366cfmip22274 BRadhakrishnaraja RameshNessuna valutazione finora

- Power Trading Winning Guerrilla Micro and Core Tactics Wiley Trading by Oliver L VelezDocumento10 paginePower Trading Winning Guerrilla Micro and Core Tactics Wiley Trading by Oliver L Velezabhikvisha0% (2)

- BusinessFinance12 Q1 Mod1 Introduction-to-Financial-Management V5Documento21 pagineBusinessFinance12 Q1 Mod1 Introduction-to-Financial-Management V5Anna May Serador CamachoNessuna valutazione finora

- Cbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Documento3 pagineCbtllll2O2O: Goreng: Customer'S Po No: Date 23-April-?02S Supermi Mie 4.50Procopio DoysabasNessuna valutazione finora

- S&P Structed Finance Australia & NZDocumento162 pagineS&P Structed Finance Australia & NZCameronNessuna valutazione finora

- Introduction To Investment & SecurityDocumento38 pagineIntroduction To Investment & Securitygitesh100% (1)

- Fintech Company:Paytm: 1.financial Statements and Records of CompanyDocumento7 pagineFintech Company:Paytm: 1.financial Statements and Records of CompanyAnkita NighutNessuna valutazione finora

- AdanirightsDocumento291 pagineAdanirightsVivek AgarwalNessuna valutazione finora

- Principles of Marketing TestDocumento10 paginePrinciples of Marketing TestCL PalisNessuna valutazione finora

- High-Frequency Trading - Mauricio LabadieDocumento55 pagineHigh-Frequency Trading - Mauricio LabadieAnonymous Y4YFzPT0100% (1)

- Chapter 6 Investing FundamentalsDocumento19 pagineChapter 6 Investing Fundamentalsashmita18Nessuna valutazione finora

- Best Ideas 10.3Documento65 pagineBest Ideas 10.3Mallory WeilNessuna valutazione finora

- Homework 2Documento1 paginaHomework 2noreen1009Nessuna valutazione finora

- FAQs of Batch 2021Documento92 pagineFAQs of Batch 2021PRABAL BHATNessuna valutazione finora

- My02Stories CompressedDocumento26 pagineMy02Stories CompressednhvinhNessuna valutazione finora

- Bitmex Profit and Fees CalculatorDocumento95 pagineBitmex Profit and Fees CalculatorArun KumarNessuna valutazione finora

- ChartGenie User GuideDocumento18 pagineChartGenie User GuideSitanur BuanaNessuna valutazione finora

- Practice Questions CH08-AnswersDocumento3 paginePractice Questions CH08-AnswersyuviNessuna valutazione finora

- Overview SAPMDocumento11 pagineOverview SAPManirbanccim8493Nessuna valutazione finora

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento65 pagineDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMohan KumarNessuna valutazione finora

- Professional Stage - Financial Management Ot Examiner'S CommentsDocumento8 pagineProfessional Stage - Financial Management Ot Examiner'S Commentscima2k15Nessuna valutazione finora

- BMAN23000 Online Exam 2019-20Documento5 pagineBMAN23000 Online Exam 2019-20Munkbileg MunkhtsengelNessuna valutazione finora

- Time Value of Money: TVM, Risk and ReturnDocumento11 pagineTime Value of Money: TVM, Risk and ReturnKath LeynesNessuna valutazione finora

- Blue Chip JulyDocumento1 paginaBlue Chip JulyPiyushNessuna valutazione finora

- Fxtradermagazine 6 EgDocumento67 pagineFxtradermagazine 6 EgDoncov EngenyNessuna valutazione finora

- Impact of Dividend Announcement On The Stock Prices of Indian Companies An Empirical Evidences PDFDocumento11 pagineImpact of Dividend Announcement On The Stock Prices of Indian Companies An Empirical Evidences PDFpsrajaaNessuna valutazione finora