Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1 - Notes Payable and Bonds Payable - Part 1

Caricato da

John Wendell EscosesDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1 - Notes Payable and Bonds Payable - Part 1

Caricato da

John Wendell EscosesCopyright:

Formati disponibili

AUDIT IN CIS ENVIRONMENT (REVIEW IN FAR TOPICS)

Accounting for Notes and Bonds Payable

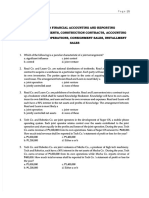

A. At December 31, 2016, GOLDIE Corp. had the following liability account balances:

11% Bonds payable, at face value P2,500,000

Premium on bonds payable 177,400

Notes payable to Emmy – due December 31, 2019 1,000,000

Transactions during 2017 and other information affecting these accounts were as follows:

a. The bonds were issued to yield 10%. Interest is payable every December 31.

b. The note payable to Emmy was issued on December 31, 2016 in exchange for a land

with a market value of P750,000. The nominal rate for a note of this type is 10%.

c. On October 2, 2017, GOLDIE borrowed P2,000,000 at 10% evidenced by a note payable

to BPI. The note is payable in 5 equal annual installments of P527,600. The first

installment payment is due on October 2, 2018.

REQUIRED:

1) How much is the interest expense on bonds payable in 2017?

2) How much is the bond premium amortization in 2017?

3) What is the carrying value of Bonds payable on December 31, 2017?

4) How much is the current portion of notes payable – BPI on December 31, 2017?

5) How much is the total interest expense in 2017?

6) How much is the accrued interest payable at the end of 2017?

B. On September 1, 2016, Fine Company issued a note payable to National Bank in the amount of

P1,800,000, bearing interest at 12% and payable in three equal annual principal payments of

P600,000. On this date, the bank’s prime rate was 11%. The first interest and principal payment

was made on September 1, 2017. On December 31, 2017, what amount should be reported as

accrued interest payable?

C. On December 31, 2016, Ruth Company issued a P1,000,000 face value note payable to Jake

Company in exchange for services rendered to Ruth. The note, made at usual trade terms, is due

in nine months and bears interest, payable at maturity, at the annual rate of 3%. The market interest

rate is 8%. The compound interest factor of 1 due in nine months at 8% is .944. At what amount

should the note payable be reported on December 31, 2016?

D. Chiu Company had the following loans at 12% interest payable at maturity. Chiu repaid each loan

on scheduled maturity date.

Date Amount Maturity date Term

11/1/2016 500,000 10/31/2017 1 year

2/1/2017 1,500,000 7/31/2017 6 months

5/1/2017 800,000 1/31/2018 9 months

The entity recorded interest expense when the loans are repaid. As a result, interest expense of

P150,000 was recorded in 2013. If no correction is made, by what amount would 2017

interest expense be understated?

E. On January 1, 2016, Bo Company issued 4,000 of 8% P2,000 face value bonds at 97 plus accrued

interest. The bonds are dated October 1, 2015 and mature on October 1, 2025. Interest is payable

semiannually on April 1 and October 1. Accrued interest for the period October 1, 2015 to January

1, 2016 amounted to P160,000. On January 1, 2016, what is the carrying amount of bonds

payable?

F. On January 1, 2016, East Company issued 9% bonds in the face amount of P5,000,000 which

mature on January 1, 2026. The bonds were issued for P4,695,000 to yield 10%. Interest is payable

annually on December 31. The entity used the interest method of amortizing bond discount. On

December 31, 2018, what is the carrying amount of the bonds payable?

Potrebbero piacerti anche

- Securities and CollateralDocumento101 pagineSecurities and CollateralNurfashihahNessuna valutazione finora

- The Cost of Capital: All Rights ReservedDocumento56 pagineThe Cost of Capital: All Rights ReservedANISA RABANIANessuna valutazione finora

- Credit Process and Credit Appraisal of A CommercialDocumento26 pagineCredit Process and Credit Appraisal of A CommercialLiza Ahmed100% (2)

- Taxation 2Documento112 pagineTaxation 2cmv mendoza100% (7)

- Basic Things To Be Checked While Buying Property:: Here Is The List of Documents RequiredDocumento8 pagineBasic Things To Be Checked While Buying Property:: Here Is The List of Documents RequiredGovind100% (1)

- Risk and Return: Sample ProblemsDocumento14 pagineRisk and Return: Sample ProblemsRynette FloresNessuna valutazione finora

- Law of Contract NotesDocumento112 pagineLaw of Contract NotesChris Sanders80% (5)

- Cooperative Code of The PhilippinesDocumento29 pagineCooperative Code of The PhilippinesKaren Angela DizonNessuna valutazione finora

- Legal Memo Collection of Sum of MoneyDocumento9 pagineLegal Memo Collection of Sum of MoneySamn Pistola Cadley0% (1)

- #3 Deferred Taxes PDFDocumento3 pagine#3 Deferred Taxes PDFjanus lopezNessuna valutazione finora

- AZRC-ERF Fillable Application Forms (May 2017)Documento5 pagineAZRC-ERF Fillable Application Forms (May 2017)Karen CraigNessuna valutazione finora

- FAR - Final Preboard CPAR 92Documento14 pagineFAR - Final Preboard CPAR 92joyhhazelNessuna valutazione finora

- Credit Trans PowerPoint inDocumento20 pagineCredit Trans PowerPoint inPearl Angeli Quisido CanadaNessuna valutazione finora

- 2016 4083 4th Evaluation ExamDocumento8 pagine2016 4083 4th Evaluation ExamPatrick ArazoNessuna valutazione finora

- ContractsDocumento11 pagineContractschowchow1230% (1)

- Auditing Problem 2Documento1 paginaAuditing Problem 2jhobs100% (1)

- Piecemeal RealizationDocumento6 paginePiecemeal RealizationSethwilsonNessuna valutazione finora

- Prelim Quiz 2Documento11 paginePrelim Quiz 2Sevastian jedd EdicNessuna valutazione finora

- Ia3 BSDocumento5 pagineIa3 BSMary Joy CabilNessuna valutazione finora

- Lesson 4 Expenditure Cycle PDFDocumento19 pagineLesson 4 Expenditure Cycle PDFJoshua JunsayNessuna valutazione finora

- Module 1 Problems and Exercises 1 QuestionsDocumento2 pagineModule 1 Problems and Exercises 1 QuestionsRafael Capunpon VallejosNessuna valutazione finora

- P 1Documento4 pagineP 1Kenneth Bryan Tegerero TegioNessuna valutazione finora

- Management Services101Documento24 pagineManagement Services101Jan ryanNessuna valutazione finora

- Multiple Choice Questions Plus Solutions Flexible Budget and Standard CostingDocumento5 pagineMultiple Choice Questions Plus Solutions Flexible Budget and Standard Costingnhu nhuNessuna valutazione finora

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocumento5 pagine(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNessuna valutazione finora

- 4A8 FormationDocumento5 pagine4A8 FormationCarl Dhaniel Garcia SalenNessuna valutazione finora

- Great DepressionDocumento5 pagineGreat DepressionDarrelNessuna valutazione finora

- PRACTICAL ACCOUNTING 1 Part 2Documento9 paginePRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNessuna valutazione finora

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocumento60 pagineAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNessuna valutazione finora

- Business Combination Drill PDFDocumento2 pagineBusiness Combination Drill PDFMelvin MendozaNessuna valutazione finora

- Prelim Exam Aud Prob ReviewDocumento2 paginePrelim Exam Aud Prob ReviewgbenjielizonNessuna valutazione finora

- Chapter 4: Process Costing and Hybrid Product-Costing SystemsDocumento33 pagineChapter 4: Process Costing and Hybrid Product-Costing Systemsrandom17341Nessuna valutazione finora

- Sec Code of Corporate Governance AnswerDocumento3 pagineSec Code of Corporate Governance AnswerHechel DatinguinooNessuna valutazione finora

- MAS04-06 - Standard Costing - MF - EncryptedDocumento9 pagineMAS04-06 - Standard Costing - MF - EncryptedRachel FuentesNessuna valutazione finora

- QUIZ-Audit Evidence and Audit ProgramsDocumento12 pagineQUIZ-Audit Evidence and Audit ProgramsKathleenNessuna valutazione finora

- Accounting - Proof of Cash Test BankDocumento1 paginaAccounting - Proof of Cash Test BankAyesha RGNessuna valutazione finora

- AFAR Question PDFDocumento16 pagineAFAR Question PDFNhel AlvaroNessuna valutazione finora

- Module 5 - Assessment ActivitiesDocumento4 pagineModule 5 - Assessment Activitiesaj dumpNessuna valutazione finora

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Documento8 pagineHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNessuna valutazione finora

- 10 Responsibility Accounting Live DiscussionDocumento4 pagine10 Responsibility Accounting Live DiscussionLee SuarezNessuna valutazione finora

- Audit of Current LiabilitiesDocumento4 pagineAudit of Current LiabilitiesMark Anthony TibuleNessuna valutazione finora

- True/False: Variable Costing: A Tool For ManagementDocumento174 pagineTrue/False: Variable Costing: A Tool For ManagementKianneNessuna valutazione finora

- Finman Midterms Part 1Documento7 pagineFinman Midterms Part 1JerichoNessuna valutazione finora

- Practice Questions Psa 210 Amp 300Documento10 paginePractice Questions Psa 210 Amp 300Trixie Pearl TompongNessuna valutazione finora

- Ms 03 - CVP AnalysisDocumento10 pagineMs 03 - CVP AnalysisDin Rose GonzalesNessuna valutazione finora

- EXERCISES On EARNINGS PER SHAREDocumento4 pagineEXERCISES On EARNINGS PER SHAREChristine AltamarinoNessuna valutazione finora

- Quizzer 1 - OverallDocumento25 pagineQuizzer 1 - OverallJan Elaine CalderonNessuna valutazione finora

- Intacc2 - Assignment 4Documento3 pagineIntacc2 - Assignment 4Gray JavierNessuna valutazione finora

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Documento7 pagineRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNessuna valutazione finora

- Accounting For Business Combination - Practice ExamDocumento6 pagineAccounting For Business Combination - Practice ExamZYRENE HERNANDEZNessuna valutazione finora

- AT-07 (FS Audit Process - Audit Planning)Documento4 pagineAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNessuna valutazione finora

- Relevant Costing Simulated Exam Ans KeyDocumento5 pagineRelevant Costing Simulated Exam Ans KeySarah BalisacanNessuna valutazione finora

- IT Audit 4ed SM Ch10Documento45 pagineIT Audit 4ed SM Ch10randomlungs121223Nessuna valutazione finora

- Cash and Cash EquivalentsDocumento3 pagineCash and Cash EquivalentsEuniceChungNessuna valutazione finora

- Reviewer 1st PB P1 1920Documento7 pagineReviewer 1st PB P1 1920Therese AcostaNessuna valutazione finora

- Hakdog PDFDocumento18 pagineHakdog PDFJay Mark AbellarNessuna valutazione finora

- Conceptual FrameworkDocumento9 pagineConceptual FrameworkJosua PagcaliwaganNessuna valutazione finora

- Earnings Per ShareDocumento3 pagineEarnings Per ShareYeshua DeluxiusNessuna valutazione finora

- Interim Financial ReportingDocumento3 pagineInterim Financial ReportingHalina ValdezNessuna valutazione finora

- Activity 1.1 PDFDocumento2 pagineActivity 1.1 PDFDe Nev OelNessuna valutazione finora

- The Conversion Cycle: Acco20153 - Accounting Information System By: James HallDocumento8 pagineThe Conversion Cycle: Acco20153 - Accounting Information System By: James HallKim EllaNessuna valutazione finora

- Aud ProbDocumento9 pagineAud ProbKulet AkoNessuna valutazione finora

- Cashflow A. Indirect Method: KM Manufacturing CompanyDocumento2 pagineCashflow A. Indirect Method: KM Manufacturing CompanyArnold AdanoNessuna valutazione finora

- Cost Accounting & Control Final ExaminationDocumento6 pagineCost Accounting & Control Final ExaminationAlexandra Nicole IsaacNessuna valutazione finora

- Try This - Cost ConceptsDocumento6 pagineTry This - Cost ConceptsStefan John SomeraNessuna valutazione finora

- Financial Accounting Part 2Documento5 pagineFinancial Accounting Part 2Christopher Price0% (1)

- Acctg 100C 07Documento1 paginaAcctg 100C 07lov3m3Nessuna valutazione finora

- Problems On Financial AssetsDocumento1 paginaProblems On Financial AssetsNhajNessuna valutazione finora

- CE and HW On Debt SecuritiesDocumento3 pagineCE and HW On Debt SecuritiesAmy SpencerNessuna valutazione finora

- Intermediate Accounting 1 Sample Problem For Debt Investments - CompressDocumento55 pagineIntermediate Accounting 1 Sample Problem For Debt Investments - CompresslerabadolNessuna valutazione finora

- Warranty 1Documento3 pagineWarranty 1Cherry joyNessuna valutazione finora

- 1 Corporate Financial Planing Ch1 2Documento96 pagine1 Corporate Financial Planing Ch1 2Kazi MohasinNessuna valutazione finora

- NV1 Fact Sheet (May 2014)Documento3 pagineNV1 Fact Sheet (May 2014)ccrispin_733435883Nessuna valutazione finora

- Basic of Sarfaesi ActDocumento4 pagineBasic of Sarfaesi ActsrinivaspdfNessuna valutazione finora

- Profile of CompleteBankData in The Pittsburgh Business TimesDocumento1 paginaProfile of CompleteBankData in The Pittsburgh Business TimesNate TobikNessuna valutazione finora

- Housing Loan Requirement PAGIBIGDocumento2 pagineHousing Loan Requirement PAGIBIGMaria Lena HuecasNessuna valutazione finora

- Towne and City Development Vs CADocumento12 pagineTowne and City Development Vs CAFai MeileNessuna valutazione finora

- FREE Sample Loan GuarantyDocumento3 pagineFREE Sample Loan GuarantyStan BurmanNessuna valutazione finora

- Solangon Vs Salazar PDFDocumento8 pagineSolangon Vs Salazar PDFkmanligoyNessuna valutazione finora

- Mers RulesDocumento43 pagineMers RulessnrdadNessuna valutazione finora

- Acctg 402aDocumento2 pagineAcctg 402aPauline Keith Paz ManuelNessuna valutazione finora

- Motion To Vacate Order Lifting Stay in CaliforniaDocumento5 pagineMotion To Vacate Order Lifting Stay in CaliforniaBlaqRubiNessuna valutazione finora

- Flores V Spouses LindoDocumento5 pagineFlores V Spouses LindoCistron ExonNessuna valutazione finora

- Finance 313Documento8 pagineFinance 313Charina Jane CatallaNessuna valutazione finora

- Sreedhar's CCE - Online Exam Rbi Grade-B 2Documento52 pagineSreedhar's CCE - Online Exam Rbi Grade-B 2Atcharao ThamballaNessuna valutazione finora

- Creating A Legal Mortgage in UgandaDocumento10 pagineCreating A Legal Mortgage in UgandaLUGANDA GeofreyNessuna valutazione finora

- Decree Number 19-2002: The Congress of The Republic of GuatemalaDocumento65 pagineDecree Number 19-2002: The Congress of The Republic of GuatemalaEstudiantes por DerechoNessuna valutazione finora

- What Are The Various Sources of Raising Business Finance in IndiaDocumento2 pagineWhat Are The Various Sources of Raising Business Finance in IndiapankajbrilliantNessuna valutazione finora

- India Banking 2010Documento12 pagineIndia Banking 2010mafidyNessuna valutazione finora

- BDA CRISIL Elevated Corridor Pre Feasibility ReportDocumento28 pagineBDA CRISIL Elevated Corridor Pre Feasibility ReportVarunHemachandranNessuna valutazione finora