Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

India AMC

Caricato da

sandipktTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

India AMC

Caricato da

sandipktCopyright:

Formati disponibili

Logo

Reliance Nippon, HDFC AMC rally up to 29% in 2 months; what lies ahead?

Analysts at Centrum Broking said the Indian mutual fund industry has several structural factors in place which will lead to its multi-year growth.

Swati Verma | New Delhi November 04, 2019 Last Updated at 11:50 IST

Asset management companies (AMCs), Reliance Nippon Life Asset Management and HDFC Asset Management

Company (HDFC AMC), were trading in the positive territory in the morning deals on Monday. While Reliance Nippon

surged as much as 2.54 per cent to Rs 364.80 apiece on the BSE, HDFC AMC hit a high of Rs 2,990, up nearly a per

cent.

In the past two months, shares of these two companies have outperformed the market. The stock of Reliance Nippon has

surged around 29 per cent while that of HDFC AMC has climbed over 15 per cent. In comparison, the broader Nifty50

index has gained around 10 per cent, ACE Equity data shows.

WHAT LIES AHEAD?

Initiating coverage on both Reliance Nippon and HDFC AMC, analysts at Centrum Broking said the Indian mutual fund

industry has several structural factors in place which will lead to its multi-year growth. First of all, RBI data shows

households are moving higher shares of their savings to financial assets. Household investments in financial assets have

grown at 14.1 per cent CAGR (compound annual growth rate) from FY15-FY19. This shows that MFs are becoming a

key investment vehicle as funds are moving from cash and deposits into investment products.

Secondly, retail investors' share in industry AUM has been rising and steady retail flows should, to an extent, shield the

industry from cyclical fluctuations in the markets, wrote Cyrus Dadabhoy, analyst - Banks and Diversified Financials, at

Centrum Broking in a co-authored note with Gaurav Jani and Rahul Nandwani.

Flows to Systematic Investment Plans (SIPs), which have doubled over the last five years, are poised to be a strong

growth driver for equity mutual funds, the report added.

That apart, regulatory change to lower Total Expense Ratio (TER) on industry AUM will lower costs for mutual fund

investors and hence, should aid in greater retail participation.

Photo: Shutterstock The report further notes that the Indian MF industry AUM as a share of GDP (11 per cent) remains significantly lower

than the world average (62 per cent). Furthermore, unique mutual fund investor count in the industry is still only nearly

20 million. This low penetration provides scope for strong future growth.

SHOULD YOU BUY THE STOCKS?

As regards HDFC AMC, the brokerage believes the company is likely to see earnings compounding given high brand equity of the HDFC group, strong pan-India distribution network, operational efficiency, focus on the

higher-yield equity segment, and consistent fund performance over the past. The brokerage has 'buy' rating on the stock.

"We value HDFC AMC at 48.1x FY21E P/E resulting in a target price of Rs 3447 (15.1 per cent upside)," the analysts wrote.

For the quarter ended September 30, HDFC AMC reported a strong set of numbers with robust traction in AUM and profitability. AUM growth continued to outpace industry growth with 25 per cent YoY growth to Rs

3,66,200 crore led by higher traction in non-equity-oriented asset. Accordingly, the share of non-equity in AUM was at 55 per cent while equity was at 45 per cent.

With benefits of lower corporate tax rate kicking in, ICICI Securities has revised its PAT estimates up by 10 per cent, 9 per cent for FY20E, FY21E, respectively.

"Given HDFC AMC’s strong positioning and superior earnings profile, the business deserves a premium valuation. However, a recent price spike appears to factor in all positives. Factoring in tax cut benefits, we revise

our Target higher to Rs 3,040." It has 'HOLD' rating on the stock.

For Reliance Nippon, analysts at HDFC Securities say they are concerned about the loss of investor confidence which debt schemes face given significant write-downs/offs on exposures to stressed corporates. Besides,

"the macro environment remains challenging and thus despite our positive bias towards Nippon Life as sole promoter, increased credibility to raise HNI/institutional capital, and valuation discount (26.7% on FY21E P/E)

to HDFCAMC, we retain NEUTRAL with a revised Sep-20E TP of Rs 260 (24x Sep-21E NOLPAT + cash)," it said.

Centrum Broking values Reliance Nippon (RNAM) at 40.8 FY21E P/E resulting in a target price of Rs 421 (16.3 per cent upside).

Risks for both companies, according to them, include reduction in financial savings rate, potential negative news on the brands, and underperformance of schemes.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- BRIHAT PARASHARA HORA SHASTRA Vol 1 - En'gI Isht Rans I A Tion, C Ommenlary, Annotation and Editing by R. SANTHANAMDocumento482 pagineBRIHAT PARASHARA HORA SHASTRA Vol 1 - En'gI Isht Rans I A Tion, C Ommenlary, Annotation and Editing by R. SANTHANAMANTHONY WRITER63% (8)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Gyaneshwari English TranslationDocumento447 pagineGyaneshwari English Translationsandipkt86% (14)

- Innovation in InsuranceDocumento63 pagineInnovation in InsuranceShaheen ShaikhNessuna valutazione finora

- Burger King DRHPDocumento320 pagineBurger King DRHPZaidNessuna valutazione finora

- Past Life YogaDocumento17 paginePast Life YogaViditJain100% (9)

- Asset Allocator Fund KotakDocumento79 pagineAsset Allocator Fund KotaksandipktNessuna valutazione finora

- Election Poll PlacesDocumento92 pagineElection Poll PlacessandipktNessuna valutazione finora

- Ares Investor Presentation: March 2018Documento37 pagineAres Investor Presentation: March 2018sandipktNessuna valutazione finora

- Fund Formation Attracting Global InvestorsDocumento82 pagineFund Formation Attracting Global InvestorssandipktNessuna valutazione finora

- Nvesting in Pandemic Markets: Montgomery Investment ManagementDocumento9 pagineNvesting in Pandemic Markets: Montgomery Investment ManagementsandipktNessuna valutazione finora

- Expat TaxationDocumento91 pagineExpat TaxationsandipktNessuna valutazione finora

- Lumber: Worth Its Weight in Gold: Offense and DefenseDocumento6 pagineLumber: Worth Its Weight in Gold: Offense and DefensesandipktNessuna valutazione finora

- Crisil Yearbook On The Indian Debt Market 2018Documento17 pagineCrisil Yearbook On The Indian Debt Market 2018sandipktNessuna valutazione finora

- Dave Rosenberg 2018 Economic OutlookDocumento9 pagineDave Rosenberg 2018 Economic OutlooksandipktNessuna valutazione finora

- Yoga Sutras of Patanjali - EnGLISHDocumento32 pagineYoga Sutras of Patanjali - EnGLISHsandipktNessuna valutazione finora

- Factors Affecting Investors Preference For Mutual Funds in IndiaDocumento52 pagineFactors Affecting Investors Preference For Mutual Funds in Indiaanuragmehta1985100% (15)

- AGS InfotechDocumento349 pagineAGS InfotechBikashNessuna valutazione finora

- Bach Et Al 2015 SwedenDocumento57 pagineBach Et Al 2015 SwedenhoangpvrNessuna valutazione finora

- Nischith ProjectDocumento17 pagineNischith ProjectMadhu RaoNessuna valutazione finora

- Mutual FundDocumento43 pagineMutual Fundsssagar92100% (1)

- SUNMAFDocumento9 pagineSUNMAFSridhar NarayananNessuna valutazione finora

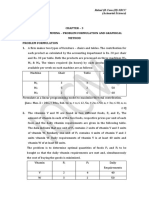

- Chapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForDocumento11 pagineChapter - 3 Linear Programming - Problem Formulation and Graphical Method Problem Formulation 1. A Firm Makes Two Types of Furniture - Chairs and Tables. The Contribution ForYamica ChopraNessuna valutazione finora

- Thesis Performance of Mutual Funds in IndiaDocumento110 pagineThesis Performance of Mutual Funds in IndiaAnuj Kumar Singh50% (2)

- Mutual Fund Management: A Comparative Study of Public and Private Sector Financial InstitutionsDocumento16 pagineMutual Fund Management: A Comparative Study of Public and Private Sector Financial InstitutionsSilversterNessuna valutazione finora

- Ch19 Performance Evaluation and Active Portfolio ManagementDocumento29 pagineCh19 Performance Evaluation and Active Portfolio ManagementA_StudentsNessuna valutazione finora

- Mutual Fund Performance in Bangladesh - An Empirical StudyDocumento19 pagineMutual Fund Performance in Bangladesh - An Empirical Studysouthern.edu100% (1)

- The New Rules of Financial Planning IndiaDocumento111 pagineThe New Rules of Financial Planning Indiaharpal_abhNessuna valutazione finora

- Security Analysis and Portfolio Management Project by TanveerDocumento77 pagineSecurity Analysis and Portfolio Management Project by TanveeradeenNessuna valutazione finora

- Sources of Long-Term FinanceDocumento13 pagineSources of Long-Term FinanceVikas BhaduNessuna valutazione finora

- Bond MarketDocumento29 pagineBond MarketShintia Ayu PermataNessuna valutazione finora

- Berkeley Casebook 2006 For Case Interview Practice - MasterTheCaseDocumento42 pagineBerkeley Casebook 2006 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (1)

- Insurance Vs Mutual FundDocumento105 pagineInsurance Vs Mutual FundLalit Kumar100% (1)

- Buffett's Alpha - Frazzini, Kabiller and PedersenDocumento45 pagineBuffett's Alpha - Frazzini, Kabiller and PedersenkwongNessuna valutazione finora

- Olm July 2020Documento68 pagineOlm July 2020Payal MehtaNessuna valutazione finora

- IFC BrochureDocumento2 pagineIFC BrochurePradeep PerwaniNessuna valutazione finora

- Study of Mutual Funds in IndiaDocumento41 pagineStudy of Mutual Funds in IndiaUnnati GuptaNessuna valutazione finora

- Kotak Mahindra Bank 121121123739 Phpapp02Documento112 pagineKotak Mahindra Bank 121121123739 Phpapp02RahulSinghNessuna valutazione finora

- Review Literature - 01 (12 Files Merged)Documento12 pagineReview Literature - 01 (12 Files Merged)Obaid AhmedNessuna valutazione finora

- Black Book CompleteDocumento77 pagineBlack Book CompletedhrupkhadseNessuna valutazione finora

- Project FinalDocumento56 pagineProject FinalAnand RaphaelNessuna valutazione finora

- FINN 353 - Investments-Samir AhmedDocumento6 pagineFINN 353 - Investments-Samir AhmedHaris AliNessuna valutazione finora

- HRM - All in One SOLVEDPastPapersDocumento105 pagineHRM - All in One SOLVEDPastPapersVardah RizwanNessuna valutazione finora