Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Invoice Title

Caricato da

Amit Kumar Agarwal0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

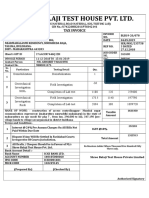

78 visualizzazioni3 pagineCICO Technologies Limited has issued a tax invoice to Shree Balaji Bhandar for the sale of 2250 kg of CICO No. 3 for a total price of Rs. 63720. The invoice details the supplier and buyer information, description and quantity of goods, applicable taxes, and total amount. It also specifies the terms and conditions of the sale including transfer of property and risk of the goods.

Descrizione originale:

LLLLEETER

Titolo originale

158

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCICO Technologies Limited has issued a tax invoice to Shree Balaji Bhandar for the sale of 2250 kg of CICO No. 3 for a total price of Rs. 63720. The invoice details the supplier and buyer information, description and quantity of goods, applicable taxes, and total amount. It also specifies the terms and conditions of the sale including transfer of property and risk of the goods.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

78 visualizzazioni3 pagineTax Invoice Title

Caricato da

Amit Kumar AgarwalCICO Technologies Limited has issued a tax invoice to Shree Balaji Bhandar for the sale of 2250 kg of CICO No. 3 for a total price of Rs. 63720. The invoice details the supplier and buyer information, description and quantity of goods, applicable taxes, and total amount. It also specifies the terms and conditions of the sale including transfer of property and risk of the goods.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

Tax Invoice

(See Section 31 of CGST Act and Rule 46 of CGST Rules 2017)

Supplier Original for Recipient

CICO Technologies Limited M.S.M.E. No.: Invoice No.: KOLFY1819/0158

Jalan Complex, Road no. 1 HR05B0001937 Invoice Date: November 16, 2018

Mouza- Bipronnopara UK06B0001076 Buyer Order No.: BY MAIL

Begri 711411 TN24B0009959 Buyer Order Date: 13-11-18

West Bengal India WB08B0000049 Being Goods Through: Suitable Transport

Place of Supply: 19 - West Bengal PAN No. AABCC2930K Freight Charges: TO PAY

GSTIN No.: 19AABCC2930K1ZO GR No.: GR Date: Vehicle No.:

C.I.N. No.: U99999DL2000PLC103782 WB 25G 5522

E-way Bill No.: E-way Bill Date:

Buyer/Receipent: Consignee:

Shree Balaji Bhandar Shree Balaji Bhandar Date & time of Removal of Goods

ITAMATI C/O Deepak Kumar Agarwal 16-11-18 at 10:18:56

Plot No.270/278, Rasulgarh

Reverse Charge : NO

Nayagarh 752094 Orissa Bhubaneswar 751010 Orissa India Order No.

State Code: 21 - Orissa State Code: 21 - Orissa

GSTIN No.: 21ADTPA3679D1ZP GSTIN No.: 21ADTPA3679D1ZP DISSO1819/04434

Phone No.: 9437002484 / 06742580903

Contact: Mr.Dilip Kumar Agarwalla Amount in INR

Sr. Description & Specification of No. of HSN / SAC Total Qty. of Rate Per Basic Amount Disc. % Discount Total Assessable

No. Goods Package Code Goods (Net) Unit Amount Value

1 CICO No.3 (225Kg) 10 Barrel 38244010 2250 Kg 24.00 54000.00 0.00 0.00 54000.00

Taxable Value of Goods 54000.00

Reverse Charge @ GST

Total Taxable Value of Goods 54000.00

IGST @ 18 % Total 9720.00

Total Qty. 2250.00 Grand Total 63720.00

Amount in Words:

**** SIXTY THREE THOUSAND SEVEN HUNDRED TWENTY RUPEES AND ZERO PAISA ONLY

Terms and Conditions MTC No.:

Certified that the particulars given are true & correct the amount indicated represests the price actually MTC Date:

Charged & that there is no flow additional consideration directly or indirectly from the buyer. the duty charged by us has been shown For CICO Technologies Limited

in all the doucments.

This property in goods will pass from the vendor to purchaser & the goods will be at risk of purchaser as from the time they are

placed on rail, ship or other transport for dispatched at the place mentioned abv.

All Claims for goods after they have left the company premises.

Note : Goods once sold will not be taken back or exchanged. Please pay by A/C payee Cheque/Draft. Intrest @25% per annum will Authorized Signatory

be charged on the bill not paid within 30 days from the delivery.

H.O. : CICO Technologies Limited, C-44/2. Okhla Industrial Area, Phase II, New Delhi - 110020

C.I.N. No.: U99999DL2000PLC103782 Phone: 011 - 40509400, Telefax: 011-40509413, Email: cicotech@cicogroup.com, Website: www.cicogroup.com

Tax Invoice

(See Section 31 of CGST Act and Rule 46 of CGST Rules 2017)

Supplier Duplicate for Transporter

CICO Technologies Limited M.S.M.E. No.: Invoice No.: KOLFY1819/0158

Jalan Complex, Road no. 1 HR05B0001937 Invoice Date: November 16, 2018

Mouza- Bipronnopara UK06B0001076 Buyer Order No.: BY MAIL

Begri 711411 TN24B0009959 Buyer Order Date: 13-11-18

West Bengal India WB08B0000049 Being Goods Through: Suitable Transport

Place of Supply: 19 - West Bengal PAN No. AABCC2930K Freight Charges: TO PAY

GSTIN No.: 19AABCC2930K1ZO GR No.: GR Date: Vehicle No.:

C.I.N. No.: U99999DL2000PLC103782 WB 25G 5522

E-way Bill No.: E-way Bill Date:

Buyer/Receipent: Consignee:

Shree Balaji Bhandar Shree Balaji Bhandar Date & time of Removal of Goods

ITAMATI C/O Deepak Kumar Agarwal 16-11-18 at 10:18:56

Plot No.270/278, Rasulgarh

Reverse Charge : NO

Nayagarh 752094 Orissa Bhubaneswar 751010 Orissa India Order No.

State Code: 21 - Orissa State Code: 21 - Orissa

GSTIN No.: 21ADTPA3679D1ZP GSTIN No.: 21ADTPA3679D1ZP DISSO1819/04434

Phone No.: 9437002484 / 06742580903

Contact: Mr.Dilip Kumar Agarwalla Amount in INR

Sr. Description & Specification of No. of HSN / SAC Total Qty. of Rate Per Basic Amount Disc. % Discount Total Assessable

No. Goods Package Code Goods (Net) Unit Amount Value

1 CICO No.3 (225Kg) 10 Barrel 38244010 2250 Kg 24.00 54000.00 0.00 0.00 54000.00

Taxable Value of Goods 54000.00

Reverse Charge @ GST

Total Taxable Value of Goods 54000.00

IGST @ 18 % Total 9720.00

Total Qty. 2250.00 Grand Total 63720.00

Amount in Words:

**** SIXTY THREE THOUSAND SEVEN HUNDRED TWENTY RUPEES AND ZERO PAISA ONLY

Terms and Conditions MTC No.:

Certified that the particulars given are true & correct the amount indicated represests the price actually MTC Date:

Charged & that there is no flow additional consideration directly or indirectly from the buyer. the duty charged by us has been shown For CICO Technologies Limited

in all the doucments.

This property in goods will pass from the vendor to purchaser & the goods will be at risk of purchaser as from the time they are

placed on rail, ship or other transport for dispatched at the place mentioned abv.

All Claims for goods after they have left the company premises.

Note : Goods once sold will not be taken back or exchanged. Please pay by A/C payee Cheque/Draft. Intrest @25% per annum will Authorized Signatory

be charged on the bill not paid within 30 days from the delivery.

H.O. : CICO Technologies Limited, C-44/2. Okhla Industrial Area, Phase II, New Delhi - 110020

C.I.N. No.: U99999DL2000PLC103782 Phone: 011 - 40509400, Telefax: 011-40509413, Email: cicotech@cicogroup.com, Website: www.cicogroup.com

Tax Invoice

(See Section 31 of CGST Act and Rule 46 of CGST Rules 2017)

Supplier Triplicate for Supplier

CICO Technologies Limited M.S.M.E. No.: Invoice No.: KOLFY1819/0158

Jalan Complex, Road no. 1 HR05B0001937 Invoice Date: November 16, 2018

Mouza- Bipronnopara UK06B0001076 Buyer Order No.: BY MAIL

Begri 711411 TN24B0009959 Buyer Order Date: 13-11-18

West Bengal India WB08B0000049 Being Goods Through: Suitable Transport

Place of Supply: 19 - West Bengal PAN No. AABCC2930K Freight Charges: TO PAY

GSTIN No.: 19AABCC2930K1ZO GR No.: GR Date: Vehicle No.:

C.I.N. No.: U99999DL2000PLC103782 WB 25G 5522

E-way Bill No.: E-way Bill Date:

Buyer/Receipent: Consignee:

Shree Balaji Bhandar Shree Balaji Bhandar Date & time of Removal of Goods

ITAMATI C/O Deepak Kumar Agarwal 16-11-18 at 10:18:56

Plot No.270/278, Rasulgarh

Reverse Charge : NO

Nayagarh 752094 Orissa Bhubaneswar 751010 Orissa India Order No.

State Code: 21 - Orissa State Code: 21 - Orissa

GSTIN No.: 21ADTPA3679D1ZP GSTIN No.: 21ADTPA3679D1ZP DISSO1819/04434

Phone No.: 9437002484 / 06742580903

Contact: Mr.Dilip Kumar Agarwalla Amount in INR

Sr. Description & Specification of No. of HSN / SAC Total Qty. of Rate Per Basic Amount Disc. % Discount Total Assessable

No. Goods Package Code Goods (Net) Unit Amount Value

1 CICO No.3 (225Kg) 10 Barrel 38244010 2250 Kg 24.00 54000.00 0.00 0.00 54000.00

Taxable Value of Goods 54000.00

Reverse Charge @ GST

Total Taxable Value of Goods 54000.00

IGST @ 18 % Total 9720.00

Total Qty. 2250.00 Grand Total 63720.00

Amount in Words:

**** SIXTY THREE THOUSAND SEVEN HUNDRED TWENTY RUPEES AND ZERO PAISA ONLY

Terms and Conditions MTC No.:

Certified that the particulars given are true & correct the amount indicated represests the price actually MTC Date:

Charged & that there is no flow additional consideration directly or indirectly from the buyer. the duty charged by us has been shown For CICO Technologies Limited

in all the doucments.

This property in goods will pass from the vendor to purchaser & the goods will be at risk of purchaser as from the time they are

placed on rail, ship or other transport for dispatched at the place mentioned abv.

All Claims for goods after they have left the company premises.

Note : Goods once sold will not be taken back or exchanged. Please pay by A/C payee Cheque/Draft. Intrest @25% per annum will Authorized Signatory

be charged on the bill not paid within 30 days from the delivery.

H.O. : CICO Technologies Limited, C-44/2. Okhla Industrial Area, Phase II, New Delhi - 110020

C.I.N. No.: U99999DL2000PLC103782 Phone: 011 - 40509400, Telefax: 011-40509413, Email: cicotech@cicogroup.com, Website: www.cicogroup.com

Potrebbero piacerti anche

- Invoice: Charge DetailsDocumento2 pagineInvoice: Charge Detailssilvia HelenaNessuna valutazione finora

- Nike Bag InvoiceDocumento1 paginaNike Bag InvoiceAshish MishraNessuna valutazione finora

- Invoice DI102305154 RDF52626464Documento1 paginaInvoice DI102305154 RDF52626464Harbans LalNessuna valutazione finora

- Tax Invoice: GSTIN - 37AACCA0117F1ZB PAN No. - AACCA0117F CIN No. - U01122TG1995PLC019729Documento1 paginaTax Invoice: GSTIN - 37AACCA0117F1ZB PAN No. - AACCA0117F CIN No. - U01122TG1995PLC019729prasadmvkNessuna valutazione finora

- Union Bank of India (Tarnaka) : Signature Not VerifiedDocumento6 pagineUnion Bank of India (Tarnaka) : Signature Not VerifiedAnil AsangiNessuna valutazione finora

- Nike 09Documento2 pagineNike 09Jason WeberNessuna valutazione finora

- Invoice PDFDocumento1 paginaInvoice PDFSapna VermaNessuna valutazione finora

- InvoiceFMDocumento1 paginaInvoiceFMharshNessuna valutazione finora

- Billing Address: Tax InvoiceDocumento1 paginaBilling Address: Tax InvoiceSatish ValaNessuna valutazione finora

- Commercial Invoice: NotifyDocumento2 pagineCommercial Invoice: NotifyAngie WilchezNessuna valutazione finora

- Washing Machine InvoiceDocumento1 paginaWashing Machine InvoiceAmeet ParekhNessuna valutazione finora

- RIL Tax InvoiceDocumento2 pagineRIL Tax InvoiceD K YadavNessuna valutazione finora

- Lenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopDocumento2 pagineLenovo Ideapad S340 Core I3 10th Gen - (8 GB/256 GB SSD/Windows 10 Home) S340-14IIL Thin and Light LaptopAshish KumarNessuna valutazione finora

- Invoice: 226A Commerce St. Altec AIR, LLCDocumento1 paginaInvoice: 226A Commerce St. Altec AIR, LLCFrio EspecializadoNessuna valutazione finora

- Invoice No.1197Documento2 pagineInvoice No.1197LL Lawwise Consultech India Pvt LtdNessuna valutazione finora

- Tax invoice detailsDocumento1 paginaTax invoice detailsas constructionNessuna valutazione finora

- Billing Address: Tax InvoiceDocumento1 paginaBilling Address: Tax InvoiceShivani SinghNessuna valutazione finora

- Invoice 1560936730Documento1 paginaInvoice 1560936730sagi komaNessuna valutazione finora

- Laptop InvoiceDocumento1 paginaLaptop InvoiceSahil MahtoNessuna valutazione finora

- Invoice PDFDocumento1 paginaInvoice PDFAniket Ghosh0% (1)

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocumento1 paginaBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSudesh SharmaNessuna valutazione finora

- Pareq MdsessionidDocumento2 paginePareq Mdsessionidთამთა გურგენიძეNessuna valutazione finora

- Tax Invoice: Billing Address: Shipping AddressDocumento7 pagineTax Invoice: Billing Address: Shipping AddressAnkit JainNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceDaniel Saúl OtinianoNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceSateesh ReddyNessuna valutazione finora

- Register Domains for Police WebsiteDocumento1 paginaRegister Domains for Police WebsiteBance AdamaNessuna valutazione finora

- Tax Invoice: G-One Enterprises 31-Mar-22Documento2 pagineTax Invoice: G-One Enterprises 31-Mar-22LAKSHAY JAINNessuna valutazione finora

- Hygree 1Documento3 pagineHygree 1viksha12Nessuna valutazione finora

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019Documento2 pagineTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019pravv vvvNessuna valutazione finora

- Tax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratDocumento1 paginaTax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratGaurav ChaudharyNessuna valutazione finora

- Invoice 1560936730Documento1 paginaInvoice 1560936730sagi komaNessuna valutazione finora

- ProductDocumento1 paginaProductAbhijitChandraNessuna valutazione finora

- JR Electrokits: Jrelectrokits - inDocumento1 paginaJR Electrokits: Jrelectrokits - inDhaval KonarkNessuna valutazione finora

- Mobile HandsetDocumento2 pagineMobile HandsetnykbswNessuna valutazione finora

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocumento2 pagineBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceUNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sona mishraNessuna valutazione finora

- Tax Invoice DetailsDocumento1 paginaTax Invoice DetailsSANJAY PRAKASHNessuna valutazione finora

- Tax Invoice: MAHESHWARA INDANE (0000190023)Documento2 pagineTax Invoice: MAHESHWARA INDANE (0000190023)Sathish DavulaNessuna valutazione finora

- Tax Invoice for Video Editing ChargesDocumento1 paginaTax Invoice for Video Editing Chargeskuldeep singhNessuna valutazione finora

- International Package Services InvoiceDocumento2 pagineInternational Package Services InvoiceMAGICGUMBALLNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SHYAM GEORGENessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceraamanNessuna valutazione finora

- Complete TV Protection (3 Years) : Grand Total 629.00Documento1 paginaComplete TV Protection (3 Years) : Grand Total 629.00VasanthKumarNessuna valutazione finora

- Tax Invoice: Abb Australia Pty. LimitedDocumento1 paginaTax Invoice: Abb Australia Pty. LimitedHumayraNessuna valutazione finora

- Invoice 272243 PropellerDocumento1 paginaInvoice 272243 PropellermahdiNessuna valutazione finora

- Invoices 89905 PDFDocumento2 pagineInvoices 89905 PDFMagdalenaOgielloNessuna valutazione finora

- Catalyst - C22-2300505Documento1 paginaCatalyst - C22-2300505Tea CozyNessuna valutazione finora

- Installation ChargesVDocumento1 paginaInstallation ChargesVbaby yodaNessuna valutazione finora

- Tax Invoice Footwear SaleDocumento1 paginaTax Invoice Footwear SaleRashid KhanNessuna valutazione finora

- Accounting VoucherDocumento1 paginaAccounting VoucherUttam PurohitNessuna valutazione finora

- Amazon Order 2 - SidDocumento1 paginaAmazon Order 2 - SidArzoo ChaudhariNessuna valutazione finora

- Deviceinvoice 252262 1Documento3 pagineDeviceinvoice 252262 1Anoop JangraNessuna valutazione finora

- Recepit of PaymentDocumento1 paginaRecepit of PaymentShashank Shekhar JaiswalNessuna valutazione finora

- SA300535Documento1 paginaSA300535JEFF WONNessuna valutazione finora

- .BD & . Domain InvoiceDocumento3 pagine.BD & . Domain InvoiceBWEB SOLUTIONSNessuna valutazione finora

- Realme 7 (Mist White, 64 GB) : Grand Total 12145.00Documento2 pagineRealme 7 (Mist White, 64 GB) : Grand Total 12145.00Sachin JaiswalNessuna valutazione finora

- Print DataDocumento12 paginePrint DataMarijana IvanovicNessuna valutazione finora

- Samsung Refrigerator Tax InvoiceDocumento1 paginaSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- MINAR PLASTIC 0104_240329_151232Documento3 pagineMINAR PLASTIC 0104_240329_151232minarplastic200Nessuna valutazione finora

- Route - TGT Vs AchvDocumento9 pagineRoute - TGT Vs AchvAmit Kumar AgarwalNessuna valutazione finora

- 752C56DE-61FE-432F-BD7C-4A8A4B8FB174Documento1 pagina752C56DE-61FE-432F-BD7C-4A8A4B8FB174Amit Kumar AgarwalNessuna valutazione finora

- A Project Report OnDocumento43 pagineA Project Report OnSusheel Pachauri0% (1)

- 3 PNB-2017 ProspectusDocumento17 pagine3 PNB-2017 ProspectusAmit Kumar AgarwalNessuna valutazione finora

- Letter Amit Kr.Documento1 paginaLetter Amit Kr.Amit Kumar AgarwalNessuna valutazione finora

- LeeterDocumento8 pagineLeeterAmit Kumar AgarwalNessuna valutazione finora

- Section - 5 - Conditions of Particular ApplicationDocumento53 pagineSection - 5 - Conditions of Particular ApplicationHaile AndargNessuna valutazione finora

- Project On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078Documento147 pagineProject On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078awaisjinnahNessuna valutazione finora

- Affidavit of GiftDocumento2 pagineAffidavit of GiftAnonymous puqCYDnQNessuna valutazione finora

- Finance Class 04 - New With TestDocumento23 pagineFinance Class 04 - New With TestMM Fakhrul IslamNessuna valutazione finora

- Maritime Labour Convention 2006 PDFDocumento93 pagineMaritime Labour Convention 2006 PDFMeleti Meleti MeletiouNessuna valutazione finora

- SAE1Documento555 pagineSAE1Aditya100% (1)

- Book of RecordsDocumento395 pagineBook of RecordsareyoubeefinNessuna valutazione finora

- Fiscal Policy Vs Monetary PolicyDocumento6 pagineFiscal Policy Vs Monetary PolicyShahrukh HussainNessuna valutazione finora

- Salim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director StatementDocumento124 pagineSalim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director Statementilham pakpahanNessuna valutazione finora

- 5 Days To Improve Your Pronunciation Day 1: BBC Learning EnglishDocumento3 pagine5 Days To Improve Your Pronunciation Day 1: BBC Learning EnglishKelly AliagaNessuna valutazione finora

- A Project Report Submitted To: Market Survey of Consumer Perception About Cement IndustryDocumento36 pagineA Project Report Submitted To: Market Survey of Consumer Perception About Cement Industryriteshgautam77Nessuna valutazione finora

- Lambo v. NLRCDocumento17 pagineLambo v. NLRCPatrisha AlmasaNessuna valutazione finora

- Event Concept Paper Edited1Documento20 pagineEvent Concept Paper Edited1Tyler HerroNessuna valutazione finora

- CDM Regulations EbookDocumento14 pagineCDM Regulations EbookZeeshan BajwaNessuna valutazione finora

- Casino PowerpointDocumento23 pagineCasino Powerpointmanami11Nessuna valutazione finora

- FM11 CH 10 Capital BudgetingDocumento56 pagineFM11 CH 10 Capital Budgetingm.idrisNessuna valutazione finora

- Aavin Summer Internship ReportDocumento45 pagineAavin Summer Internship Reportmo25% (4)

- Malaysia's Petrochemical Zones For Location PDFDocumento41 pagineMalaysia's Petrochemical Zones For Location PDFWan Faiz50% (2)

- MC DonaldDocumento3 pagineMC DonaldRahulanandsharmaNessuna valutazione finora

- Economic Espionage: A Framework For A Workable Solution: Mark E.A. DanielsonDocumento46 pagineEconomic Espionage: A Framework For A Workable Solution: Mark E.A. DanielsonmiligramNessuna valutazione finora

- Ybn Fee 2019 2020Documento5 pagineYbn Fee 2019 2020SDPMIT SHUBH DIAGNOSTICSNessuna valutazione finora

- COHR321 Module Guide S2 2019Documento14 pagineCOHR321 Module Guide S2 2019Tsakane SibuyiNessuna valutazione finora

- BCBS 239 Compliance: A Comprehensive ApproachDocumento7 pagineBCBS 239 Compliance: A Comprehensive ApproachCognizantNessuna valutazione finora

- Barilla-SpA CaseStudy Short Reaction PaperDocumento3 pagineBarilla-SpA CaseStudy Short Reaction Papersvk320Nessuna valutazione finora

- Lgu Naguilian HousingDocumento13 pagineLgu Naguilian HousingLhyenmar HipolNessuna valutazione finora

- QTC Cert Module 2 CPQDocumento41 pagineQTC Cert Module 2 CPQjalaj01Nessuna valutazione finora

- Integrated Marketing Communications in 40 CharactersDocumento6 pagineIntegrated Marketing Communications in 40 CharactersHenry PK ZEeNessuna valutazione finora

- Marketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseDocumento2 pagineMarketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseKeJuanDuBoseNessuna valutazione finora

- Enterprise System Engineering: Course Code: SWE - 304Documento8 pagineEnterprise System Engineering: Course Code: SWE - 304syed hasnainNessuna valutazione finora

- Product Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.Documento22 pagineProduct Diversification and Financial Performance The Moderating Role of Secondary Stakeholders.R16094101李宜樺Nessuna valutazione finora