Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FINANZAS2

Caricato da

Leslie DiazTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FINANZAS2

Caricato da

Leslie DiazCopyright:

Formati disponibili

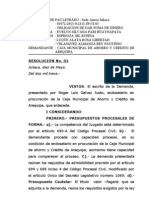

RATIOS FINANCIEROS DE CIA CHRISTIAN S.A.

A. LIQUIDEZ

-Prueba Ácida o Liquidez Severa

Act. Cte. – Inventarios – Gast.Pag. Antic.

Pasivo Corriente

199A 13,700 – 2,800 - 700 = 1.7

6,000

199B 12,800 – 3,200 - 600 = 1.216216216216216

7,400

199C 12,300 – 2,800 - 600 = 1.072289156626506

8,300

-Liquidez Absoluta

Disponible en Efectivo y Equivalentes

Pasivo Corriente

199A 2,200 = 0.3666666666666667

6,000

199B 500 = 0.0675675675675676

7,400

199C 400 = 0.0481927710843373

8,300

-Razón de liquidez general

Activo corriente 199A 13,700 = 2.283333333333333

Pasivo Corriente 6,000

199B 12,800 = 1.72972972972973

7,400

199C 12,300 = 1.481927710843373

8,300

B. RENTABILIDAD

- Margen de Ganancia Neta

Ganancia Neta 199A 500 = 0.0206611570247934

Ventas Netas 24,200

199B 100 = 0.0040816326530612

24,500

199C -1,360 = -0.0546184738955823

24,900

-Rentabilidad Patrimonial

Ganancia Neta 199A 500 = 0.05

Patrimonio 10,000

199B 100 = 0.0090909090909091

11,000

199C -1,360 = -0.1320388349514563

10,300

-Rentabilidad del Activo o Índice de Dupont

Ganancia Neta 199A 500 = 0.0263157894736842

Activo Total 19,000

199B 100 = 0.0051546391752577

19,400

199C -1,360 = -0.0727272727272727

18,700

-Rentabilidad del Capital

Ganancia Neta 199A 500 = 0.0561797752808989

Capital Social 8,900

199B 100 = 0.0108695652173913

9,200

199C -1,360 = -0.1511111111111111

9,000

C. GESTIÓN

-Rotación de Inventarios

Costo de Ventas D.

199A -16,900 = -6.035714285714286

Inventarios E. 2,800

199B

F. -17,200 = -5.375

3,200

G.

199C -18,000 = -6.428571428571429

2,800

H.

-Rotación del Activo Total

Ventas 199A 24,200 = 1.273684210526316

Activo Total 19,000

199B 24,500 = 1.262886597938144

19,400

199C 24,900 = 1.331550802139037

18,700

-Rotación del Patrimonio

Ventas 199A 24,200 = 2.42

Patrimonio 10,000

199B 24,500 = 2.227272727272727

11,000

199C 24,900 = 2.41747572815534

10,300

D. ENDEUDAMIENTO (SOLVENCIA)

-Apalancamiento Financiero o Solvencia

Pasivo Total 199A 9,000 = 0.4736842105263158

Activo total 19,000

199B 8,400 = 0.4329896907216495

19,400

199C 8,400 = 0.4491978609625668

18,700

- Endeudamiento Patrimonial

Pasivo Total 199A 9,000 = 0.9

Patrimonio 10,000

199B 8,400 = 0.7636363636363636

11,000

199C 8,400 = 0.8155339805825243

10,300

- Cobertura

Utilidad antes de impuestos e intereses

Gastos Financieros

199A 800 = -0.8888888888888889

-900

199B 300 = -0.2727272727272727

-1,100

199C -1,360 = 1.36

-1,000

Potrebbero piacerti anche

- Estructura de CostosDocumento10 pagineEstructura de Costosmaria joseNessuna valutazione finora

- Títulos ValoresDocumento25 pagineTítulos Valoresyaniz sanchezNessuna valutazione finora

- Derecho Bancario 3Documento7 pagineDerecho Bancario 3Shirley VeraNessuna valutazione finora

- Lienzo Modelo CanvasDocumento3 pagineLienzo Modelo CanvasJhonYanaNessuna valutazione finora

- Comprobante Retención de Iva COCA COLADocumento1 paginaComprobante Retención de Iva COCA COLAArnaldo UrrutiaNessuna valutazione finora

- Métodos Que Consideran El Valor Del Dinero en El TiempoDocumento2 pagineMétodos Que Consideran El Valor Del Dinero en El TiempoCarlos EstradaNessuna valutazione finora

- Mercados Binarios.Documento4 pagineMercados Binarios.Belen CastellanosNessuna valutazione finora

- Tamarindo Diapos AngelineDocumento77 pagineTamarindo Diapos AngelineJavier GuevaraNessuna valutazione finora

- Auto Admi So Rios Dey SiDocumento4 pagineAuto Admi So Rios Dey SiJose Antonio Martinez OlivaresNessuna valutazione finora

- Curso Modelos Financieros ExcelDocumento2 pagineCurso Modelos Financieros ExcelJuan CantillanoNessuna valutazione finora

- Caso 2 Borja FrancisDocumento6 pagineCaso 2 Borja Francisluisrubenarturo100% (1)

- VALORES MOBILIARIOS MonografiaDocumento22 pagineVALORES MOBILIARIOS MonografiaGrittsell Fabiola Trujillo DavilaNessuna valutazione finora

- PARCIAL 2 - Revisión Del Intento 1Documento9 paginePARCIAL 2 - Revisión Del Intento 1Manolo PuelloNessuna valutazione finora

- Orden de Transferencia AceptadaDocumento6 pagineOrden de Transferencia AceptadaWalter Rincon VargasNessuna valutazione finora

- Fase 3 - RoldelContador - Grupo 106019 - 60Documento11 pagineFase 3 - RoldelContador - Grupo 106019 - 60carol cuellarNessuna valutazione finora

- Taller de Matematicas Financieras UPTCDocumento14 pagineTaller de Matematicas Financieras UPTCJohan Reyes KersNessuna valutazione finora

- Fusiones y AdquisicionesDocumento44 pagineFusiones y AdquisicionesEvelyn SuárezNessuna valutazione finora

- Modelo - Contrato Mutuo (Prestamo)Documento2 pagineModelo - Contrato Mutuo (Prestamo)Alvaro CaleroNessuna valutazione finora

- La Revaluación de Los Activos FijosDocumento227 pagineLa Revaluación de Los Activos FijosMafab MNessuna valutazione finora

- Admin de Los Recursos FinancierosDocumento12 pagineAdmin de Los Recursos FinancierosRina MMrNessuna valutazione finora

- CAPM Van HorneDocumento2 pagineCAPM Van Hornemanu_chao_Nessuna valutazione finora

- Pre Parcial Contabilidad de CostosDocumento7 paginePre Parcial Contabilidad de CostosCristian Fernando Sastoque PeraltaNessuna valutazione finora

- Dependencia Económica Interna y ExternaDocumento2 pagineDependencia Económica Interna y Externajefferson grandaNessuna valutazione finora

- Segunda EntregaDocumento11 pagineSegunda EntregaLeidy RiveraNessuna valutazione finora

- WACC y CAPM - Práctica Calificada p2Documento2 pagineWACC y CAPM - Práctica Calificada p2editaNessuna valutazione finora

- Resumen Estatuto TributarioDocumento11 pagineResumen Estatuto TributarioCAROLINANessuna valutazione finora

- U2a1 Materia PrimaDocumento3 pagineU2a1 Materia PrimaAdyNessuna valutazione finora

- Interpone Recurso de QuejaDocumento9 pagineInterpone Recurso de Quejadanfer2312Nessuna valutazione finora

- Analisis CASO CRLDocumento7 pagineAnalisis CASO CRLAlejandro AguilarNessuna valutazione finora

- Problemas Resueltos Ejercicios Resueltes Sobre OpcionesDocumento15 pagineProblemas Resueltos Ejercicios Resueltes Sobre OpcionesKatty Johanna89% (9)