Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

p8-1 Tugas GSLC

Caricato da

elaine aureliaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

p8-1 Tugas GSLC

Caricato da

elaine aureliaCopyright:

Formati disponibili

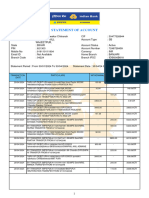

Elaine Aurelia

2101652486

Problem 8-1

Sarko Company had 300,000 shares of $10 par value commen stock outstanding at all times and retained earning bala

Retained Earnings

January 1, 2013 $260,000

January 1, 2014 $540,000

January 1, 2015 $630,000

January 1, 2016 $820,000

Pelzer Company acquired Sarko Company stock through open-market purchases as follows :

Date % Acquired Shares Cost

1/1/2013 10% 30000 $365,000

1/1/2014 25% 75000 $960,000

1/1/2015 45% 135000 $1,890,000

80%

Sarko Company declared no dividens during this period. The fair values of Sarko Company's asset and liabilities wer

to their book values throughout this period (2013 through 2015). Pelzer Company uses the cost method.

Required :

A. Prepare a schedule to compare investment cost with the book value of equity acquired.

Computation Allocation Schedule

Parent NCI TOTAL

80% 20% 100%

Purchase Price:

1/1/13 purchases (30,000 x $14) 420,000

1/1/14 purchases (75,000 x $14) 1,050,000

1/1/15 purchases (135,000 x $14) 1,890,000

Purchase Price and implied value 3,360,000 840,000 4,200,000

Less : Book value of equity acquired

Common Stock 2,400,000 600,000 3,000,000

Retained Earnings 504,000 126,000 630,000

Difference 456,000 114,000 570,000

Goodwill (456,000) (114,000) (570,000)

Balance 0 0 0

B. Prepare elimination entries for the preparation of a consolidated statements workpaper on December 31, 2015

Common stock 3,000,000

Retained Earning 630,000

Difference 570,000

Investment in Sarko company 3,360,000

NCI 840,000

Goodwill 570,000

Difference 570,000

Investment in Sarko Company 59,500

Retained Earning 1/1 - P Company 59,500

Change in Retained Earnings, 1/1/13 $ 37,000 (630,000-5400,00)*10%

Change in Retained Earnings, 1/1/14 $ 22,500 (630,000-540,000)*25%

$ 59,500

nd retained earning balances as indicated here :

Cost/Share

$12.17

$12.80

$14.00

sset and liabilities were approximately equal

t method.

December 31, 2015

Potrebbero piacerti anche

- 8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionDocumento29 pagine8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionParamithaNessuna valutazione finora

- Pengaruh Persepsi Dan Motivasi Terhadap Minat Mahasiswa Jurusan Akuntasi Fakultas Ekonomi Dan Bisnis Universitas Brawijaya BerkDocumento15 paginePengaruh Persepsi Dan Motivasi Terhadap Minat Mahasiswa Jurusan Akuntasi Fakultas Ekonomi Dan Bisnis Universitas Brawijaya BerkRecca Damayanti0% (1)

- Teori Sinyal Dalam Manajemen Keuangan: September 2009Documento31 pagineTeori Sinyal Dalam Manajemen Keuangan: September 2009Gabriella SumendaNessuna valutazione finora

- Smartfren Praktikum Manajemen StrategikDocumento110 pagineSmartfren Praktikum Manajemen StrategikFahmi MirzaNessuna valutazione finora

- Case 6.2Documento5 pagineCase 6.2Azhar KanedyNessuna valutazione finora

- Bab 12 - 13 Akuntansi Derivatif Dan Lindung Nilai SP Jan 2016Documento52 pagineBab 12 - 13 Akuntansi Derivatif Dan Lindung Nilai SP Jan 2016RifqiNessuna valutazione finora

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocumento22 pagineAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNessuna valutazione finora

- SolutionDocumento14 pagineSolutionRishiaendra Cool100% (1)

- The Following Data For Coca Cola Ticker Symbol Ko AreDocumento1 paginaThe Following Data For Coca Cola Ticker Symbol Ko AreTaimur TechnologistNessuna valutazione finora

- Summary of CH 8 Auditing Planning and MaterialityDocumento17 pagineSummary of CH 8 Auditing Planning and MaterialityMutia WardaniNessuna valutazione finora

- Opini Pendapat Tidak Wajar (Adverse Opinion)Documento3 pagineOpini Pendapat Tidak Wajar (Adverse Opinion)Isnin Nadjama FitriNessuna valutazione finora

- Jawaban Tugas Inventory 2Documento8 pagineJawaban Tugas Inventory 2wijayaNessuna valutazione finora

- Jawaban Kieso Intermediate Accounting p19-4Documento3 pagineJawaban Kieso Intermediate Accounting p19-4nadiaulyNessuna valutazione finora

- Manipulating Profits Ford S WorthyDocumento4 pagineManipulating Profits Ford S WorthyvaniaNessuna valutazione finora

- Analisis Laporan Keuangan PT Bukit AsamDocumento10 pagineAnalisis Laporan Keuangan PT Bukit AsamALFIZAN AMINUDDINNessuna valutazione finora

- Body EmailDocumento2 pagineBody Emailferry firmannaNessuna valutazione finora

- Tugas Audit BoyDocumento34 pagineTugas Audit BoyreynaldieNessuna valutazione finora

- Ujian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1Documento2 pagineUjian Akhir Semester Genap Tahun Akademik 2020-2021: .Ekonomi Dan Bisnis Akuntansi S1mzulfikar3031Nessuna valutazione finora

- Bookoff Case AnalysisDocumento7 pagineBookoff Case AnalysisLeo SanjayaNessuna valutazione finora

- Problems P 15-1 Apply Threshold Tests: Net Income Tax RateDocumento2 pagineProblems P 15-1 Apply Threshold Tests: Net Income Tax Rateardi yansyahNessuna valutazione finora

- 2017 Annual Report - PT Graha Layar Prima TBK PDFDocumento220 pagine2017 Annual Report - PT Graha Layar Prima TBK PDFKevin D'ShōnenNessuna valutazione finora

- Soal Myob PT DinamikaDocumento5 pagineSoal Myob PT DinamikaRaden Andini AnggreaniNessuna valutazione finora

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Documento6 pagineGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioNessuna valutazione finora

- Jeter AA 4e SolutionsManual Ch16Documento22 pagineJeter AA 4e SolutionsManual Ch16Dian Ayu Permatasari100% (1)

- Assignment 3Documento5 pagineAssignment 3Sherisse' Danielle Woodley100% (2)

- RMK Bab 10Documento17 pagineRMK Bab 10Vidia AinnieNessuna valutazione finora

- FASB Accounting Standards Codification Topic 605Documento2 pagineFASB Accounting Standards Codification Topic 605justwonder2Nessuna valutazione finora

- Modul 1 CertDADocumento8 pagineModul 1 CertDAIndra SiswantoNessuna valutazione finora

- Treaty ShoppingDocumento16 pagineTreaty ShoppingSarah EfranyNessuna valutazione finora

- Teori Akuntansi Case 6.1Documento9 pagineTeori Akuntansi Case 6.1Tessa Nurul QolbiNessuna valutazione finora

- Accounting Theory & Contemporary IssuesDocumento8 pagineAccounting Theory & Contemporary IssuesAqsa ButtNessuna valutazione finora

- Christensen 12e Chap01 2019Documento70 pagineChristensen 12e Chap01 2019Christy You100% (2)

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocumento45 pagineChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNessuna valutazione finora

- Akuntansi Keuangan Lanjutan 2Documento6 pagineAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNessuna valutazione finora

- Pt. Istana Balqis Furnitures Trial Balance 30-Nov-10 33. MELYANTI SARUMPAET-190500057 Acc. No Description Debit KreditDocumento35 paginePt. Istana Balqis Furnitures Trial Balance 30-Nov-10 33. MELYANTI SARUMPAET-190500057 Acc. No Description Debit KreditMely SarumpaetNessuna valutazione finora

- Fatimatuz Zahro - Ex 2 - ch06Documento2 pagineFatimatuz Zahro - Ex 2 - ch06Fatimatuz ZahroNessuna valutazione finora

- Anthony & Govindarajan - CH 11Documento3 pagineAnthony & Govindarajan - CH 11Astha Agarwal100% (1)

- Makalah Professional Due CareDocumento26 pagineMakalah Professional Due Caresiska100% (1)

- Rangkuman TaDocumento19 pagineRangkuman Tamutia rasyaNessuna valutazione finora

- Bab 14. Jawaban Contoh SoalDocumento2 pagineBab 14. Jawaban Contoh SoalVanaNessuna valutazione finora

- CH 06Documento50 pagineCH 06Dr-Bahaaeddin Alareeni100% (1)

- Nama: Yandra Febriyanti No BP: 1810531018 P2-23 1) Equity Method Entroes On Peanut Company's BooksDocumento7 pagineNama: Yandra Febriyanti No BP: 1810531018 P2-23 1) Equity Method Entroes On Peanut Company's BooksYandra FebriyantiNessuna valutazione finora

- TR-1 (Hanifah Nabilah Ginting)Documento3 pagineTR-1 (Hanifah Nabilah Ginting)Hanifah Nabilah100% (1)

- 11 PPT The Audit Process Ed 6 GrayDocumento23 pagine11 PPT The Audit Process Ed 6 Grayina oktavianiNessuna valutazione finora

- Bab 1 Managerial Accounting: An OverviewDocumento18 pagineBab 1 Managerial Accounting: An Overviewedhi asmiranthoNessuna valutazione finora

- Cisco Case Study AnalysisDocumento2 pagineCisco Case Study AnalysisVega AgnityaNessuna valutazione finora

- CLEO - Annual Report - 2018 Dicetak Mulai Halaman 115-128Documento196 pagineCLEO - Annual Report - 2018 Dicetak Mulai Halaman 115-128Dian AnjaniNessuna valutazione finora

- Muh - Syukur - A031191077 - Akl Ii - Tugas Problem P9-1 Dan P9-5Documento4 pagineMuh - Syukur - A031191077 - Akl Ii - Tugas Problem P9-1 Dan P9-5Drawing For LifeNessuna valutazione finora

- MINI CASE - CH 14Documento2 pagineMINI CASE - CH 14Dedi JayadiNessuna valutazione finora

- The Richter Company A Technology Company Has Been Growing RapidlyDocumento1 paginaThe Richter Company A Technology Company Has Been Growing RapidlyHassan JanNessuna valutazione finora

- Calculus Company Makes Calculators For StudentsDocumento2 pagineCalculus Company Makes Calculators For StudentsElliot RichardNessuna valutazione finora

- Exercise - Dilutive Securities - AdillaikhsaniDocumento4 pagineExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- HT Media Facing Competitive & Technological Convergence Challenges in 21st CenturyDocumento10 pagineHT Media Facing Competitive & Technological Convergence Challenges in 21st CenturyPrabal Pratim DasNessuna valutazione finora

- Income Tax DTL - DTADocumento10 pagineIncome Tax DTL - DTASagita RajagukgukNessuna valutazione finora

- Akuntansi Keuangan Lanjutan - Baker (10 E)Documento1.086 pagineAkuntansi Keuangan Lanjutan - Baker (10 E)Nabila Nur IzzaNessuna valutazione finora

- Chapter 11Documento23 pagineChapter 11sarahjohnsonNessuna valutazione finora

- On January 1 2014 Palmer Company Acquired A 90 InterestDocumento1 paginaOn January 1 2014 Palmer Company Acquired A 90 InterestCharlotteNessuna valutazione finora

- Advanced AccountingDocumento4 pagineAdvanced Accountinggisela gilbertaNessuna valutazione finora

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocumento14 paginePurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNessuna valutazione finora

- Haryono Umar, Dantes Partahi Dan Rahima Br. Purba (2020) (Jurnal Internasional)Documento10 pagineHaryono Umar, Dantes Partahi Dan Rahima Br. Purba (2020) (Jurnal Internasional)elaine aureliaNessuna valutazione finora

- Rowland Pengemabangan HipotesisDocumento15 pagineRowland Pengemabangan Hipotesiselaine aureliaNessuna valutazione finora

- C. From The Cash Basis of Accounting To The Accrual Basis of AccountingDocumento11 pagineC. From The Cash Basis of Accounting To The Accrual Basis of Accountingelaine aureliaNessuna valutazione finora

- CH20 PDFDocumento81 pagineCH20 PDFelaine aureliaNessuna valutazione finora

- KUIS FA 2 Anak AkunDocumento4 pagineKUIS FA 2 Anak Akunelaine aureliaNessuna valutazione finora

- ch17 180206123815 PDFDocumento75 paginech17 180206123815 PDFYeni Amelia100% (1)

- 66 127 1 SM PDFDocumento23 pagine66 127 1 SM PDFelaine aureliaNessuna valutazione finora

- LUYỆN TẬP BT CÓ CÔNG THỨC - TTCKDocumento11 pagineLUYỆN TẬP BT CÓ CÔNG THỨC - TTCKLâm Thị Như ÝNessuna valutazione finora

- IpoDocumento4 pagineIpohasratbaloch22Nessuna valutazione finora

- Presentation On: Project FinanceDocumento80 paginePresentation On: Project FinanceSachinNessuna valutazione finora

- Costing Homework SolutionsDocumento97 pagineCosting Homework SolutionsKunal BhansaliNessuna valutazione finora

- PARTNERSHIP FORMATION-Boticario D.Documento2 paginePARTNERSHIP FORMATION-Boticario D.Dominic E. BoticarioNessuna valutazione finora

- Financial Eng. Notes 8Documento3 pagineFinancial Eng. Notes 8sammidianeeshNessuna valutazione finora

- Test Bank For Essentials of Corporate Finance 7th Edition by RossDocumento36 pagineTest Bank For Essentials of Corporate Finance 7th Edition by Rossstripperinveigle.7m8qg9100% (47)

- Financial Accounting 2 Conrado ValixDocumento549 pagineFinancial Accounting 2 Conrado ValixJM Dela Cruz100% (1)

- Business Valuation Modeling:: Corporate Finance Institute®Documento44 pagineBusiness Valuation Modeling:: Corporate Finance Institute®Elie YabroudiNessuna valutazione finora

- Lexcel Pack 2010Documento30 pagineLexcel Pack 2010vivalakhan7178Nessuna valutazione finora

- 2023.03.01 - Entain - Annual ReportDocumento240 pagine2023.03.01 - Entain - Annual ReportLexi EisenbergNessuna valutazione finora

- Chapter 1 - Solution Manual PDFDocumento32 pagineChapter 1 - Solution Manual PDFNatalie ChoiNessuna valutazione finora

- Financial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareDocumento11 pagineFinancial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareairaNessuna valutazione finora

- 161 15 PAS 28 Investment in AssociateDocumento2 pagine161 15 PAS 28 Investment in AssociateRegina Gregoria SalasNessuna valutazione finora

- Daftar Akun KompakDocumento2 pagineDaftar Akun Kompak-Nessuna valutazione finora

- Stock Valuation: A Second LookDocumento116 pagineStock Valuation: A Second LookHuy PanhaNessuna valutazione finora

- MAF603 COC - StudentsDocumento12 pagineMAF603 COC - StudentsZoe McKenzieNessuna valutazione finora

- Statement 724xxxx8459 30042024 095112Documento11 pagineStatement 724xxxx8459 30042024 095112facebookdiwakar0Nessuna valutazione finora

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Documento5 pagineGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei Tsukishima100% (2)

- Financial Accounting: Long-Term Investments and The Time Value of MoneyDocumento68 pagineFinancial Accounting: Long-Term Investments and The Time Value of Moneygizem akçaNessuna valutazione finora

- Chapter Five: Audit Planning and Types of Audit TestsDocumento42 pagineChapter Five: Audit Planning and Types of Audit TestsJade BelenNessuna valutazione finora

- Chapter 10 - Profitability AnalysisDocumento41 pagineChapter 10 - Profitability AnalysisSyafiq IzzuddinNessuna valutazione finora

- MPERS Article - A Comparative Analysis of PERS MPERS and MFRS FrameworksDocumento59 pagineMPERS Article - A Comparative Analysis of PERS MPERS and MFRS FrameworksHaron BadrulNessuna valutazione finora

- I. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDocumento6 pagineI. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDensNessuna valutazione finora

- CMA - Volume 1Documento181 pagineCMA - Volume 1Abdul QaviNessuna valutazione finora

- The Determination and Allocation of Excess ScheduleDocumento2 pagineThe Determination and Allocation of Excess ScheduleWawex DavisNessuna valutazione finora

- Chapter 11 Study NotesDocumento4 pagineChapter 11 Study NotesRajaa BerryNessuna valutazione finora

- FIN 072 - SAS - Day 17 - IN - Second Period ExamDocumento12 pagineFIN 072 - SAS - Day 17 - IN - Second Period ExamEverly Mae ElondoNessuna valutazione finora

- DSSM - Business Maths & Finance Day 1Documento49 pagineDSSM - Business Maths & Finance Day 1Nadeera WijebandaraNessuna valutazione finora

- ACCA FA Progress Test PDFDocumento21 pagineACCA FA Progress Test PDFNicat IsmayıloffNessuna valutazione finora