Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

3.2 VAT Exempt Transactions

Caricato da

Juls MacCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

3.2 VAT Exempt Transactions

Caricato da

Juls MacCopyright:

Formati disponibili

TAXATION

FAR EASTERN UNIVERSITY – MANILA

VAT EXEMPT TRANSACTIONS (302)

VAT-Exempt Transaction Under Section 109

Exempt sale of

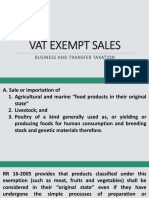

a. Sale or importation of: goods

- agricultural and marine food products in their original state. Exempt

- livestock and poultry of a kind generally used as, or yielding or producing foods for human consumption; and importation

- breeding stock and genetic materials;

Examples of Agricultural and Marine Food Products in their Original State

Agricultural Marine Livestock Poultry

Polished/husked rice Fish Cows Fowls

Corn grits Crustaceans such as: Bulls Ducks

Raw cane sugar and Molasses Lobsters, shrimps Calves Geese

Ordinary salt Prawns, oysters Pigs Turkey

Copra Mussels, clams Sheep

Trout, eels Goats

Rabbits

.

b. Sale or importation of: Exempt sale of

- fertilizers, seeds, seedlings and fingerlings; goods

- fish, prawn, livestock and poultry feeds, including ingredients, whether locally produced or imported, used in the manufacture of Exempt

finished feeds. importation

- (except specialty feeds for race horses, fighting cocks, acquarium fish, zoo animals and other animals generally considered as

pets);

c. Importation of personal and household effects Exempt

- belonging to residents of the Philippines returning from abroad and importation

- non-residing citizens coming to resettle in the Philippines;

- Provided, that such goods are exempt from custom duties under the Tariff and Customs Code of the Philippines;

d. Importation of professional instruments and implements, tools of trade, occupation or employment, wearing apparel, domestic Exempt

animals, and personal and household effects belonging to persons coming to settle in the Philippines or Filipinos or their families importation

and descendants who are now residents or citizens of other countries, such parties hereinafter referred to as overseas Filipinos, in

quantities and of the class suitable to the profession, rank or position of the persons importing said items, for their own use and not

for barter or sale, accompanying such persons, or arriving within a reasonable time: Provided, That the Bureau of Customs may,

upon the production of satisfactory evidence that such persons are actually coming to settle in the Philippines and that the goods

are brought from their former place of abode, exempt such goods from payment of duties and taxes: Provided, further, That

vehicles, vessels, aircrafts, machineries and other similar goods for use in manufacture, shall not fall within this classification and

shall therefore be subject to duties, taxes and other charges;

e. Services subject to percentage tax; Exempt sale of

services

f. Services by agricultural contract growers and milling for others of palay into rice, corn into grits and sugar cane into raw sugar; Exempt sale of

services

RR No. 4-2015 (Definition of Raw Sugar and Raw Cane Sugar for VAT purposes)

Raw Sugar — refers to sugar whose content of sucrose by weight in dry state, corresponds to a polarimeter reading of less

than 99.5 o. Raw Sugar produced each production year shall be classified. for internal revenue purposes, as follows:

''A" is raw sugar which is intended for export to the United States Market.

"B" is raw sugar which is intended for the Domestic Market.

''C" is raw sugar which is reserved for, but have not yet matured for release to the Domestic Market.

"D" is raw sugar which is intended for export to the World Market.

''E" is reclassified "D" sugar for sale to Food Processors/Exporters operating Customs Bonded Warehouse

(CBW) or to an enterprise located within the special processing export zone.

'Raw Cane Sugar —refers to sugar produced by simple process of conversion of sugar cane without need of any mechanical or

similar device such as muscovado. For this purpose, raw cane sugar refers only to muscovado sugar. Thus only muscovado is

exempt from VAT under Section 109 (1) (A) of the Tax Code.

Centrifugal process of producing sugar is not in itself a simple process. Therefore, any type of sugar produced therefrom are not

exempt from VAT such as raw sugar and refined sugar.

Only raw sugar cane is exempt from vat.

Raw sugar as sugar whose content of sucrose by weight in dry state, corresponds to a polarimeter reading of less than 99.5o.

Refined sugar as sugar whose content of sucrose by weight in dry state, corresponds to a polarimeter reading of 99.5o and above.

Sugar Refinery Mill refers to entity, natural or juridical, engaged in the business of milling sugar cane into raw or in the refining

of raw sugar.

Cane sugar produced from the following shall be presumed, for internal revenue purposes, as refined sugar:

1. Product of a refining process

2. Product of a sugar refinery

3. Product of a production line of a sugar mill accredited by the BIR to be producing and /or capable of producing sugar with

polarimeter reading of 99.5o and above.

3.2 VAT exempt transactions Page 1 of 7

Nonetheless, sugar produced from sugar production lines accredited by the Bureau to be capable of producing sugar with

polarimeter reading of 99.5° or above shall be prima facie presumed to be refined sugar.

SECTION 3. Advance VAT. — Refined sugar and raw sugar, shall be subject to advance payment of VAT by the owner/seller

before the sugar is withdrawn from any sugar refinery/mill.

Base Price The amount of advance VAT payment shall be determined by applying the vat rate of 12% on the

applicable base price of P1,400 per 50 kg. bag for refined sugar and P1,000 per 50 kg. bag for all

other types of sugar.

Exempt from Advance 1. Withdrawal of raw cane sugar

payment of VAT (RR 6- 2. Withdrawal of sugar by duly accredited and registered agricultural cooperative of good

2015) standing.

3. Withdrawal of sugar by duly accredited and registered agricultural cooperative which is sold to

another agricultural cooperative

Withdrawal or transfer The proprietor of a sugar refinery/mill shall not allow the issuance of quedan/warehouse receipts

of ownership of sugar or other evidence of ownership or allow any withdrawal of sugar from its premises without proof

of payment of advance VAT.

Credit for advance In addition to input tax credits under Sec. 110 of the tax code, the advance payment of VAT made

payment by sellers of sugar under RR 6-2015 shall be allowed as credit against the output tax based on the

actual gross selling price of sugar.

g. Medical, dental, hospital and veterinary services, except those rendered by professionals; Exempt sale of

services

Laboratory services are exempted. Hospital bills constitute medical services.

If the hospital or clinic operates a pharmacy or drugstore, the sale of drugs and medicines are :

1. Sales made by the drugstore to the in-patients which are included in the hospital bills are part of medical bills exempt from

VAT.

2. Sales of the drug store to the out-patients are subject to VAT, because they are not part of medical services of the hospital.

(RR 14-2013) Doctor’s fee paid by a patient admitted/confined in a hospital should not be subject to VAT

h. Educational services rendered by: Exempt sale of

- private educational institutions, duly accredited by DepEd, CHED and Technical Education and Skills Development Authority services

(TESDA), and

- those rendered by government educational institutions;

Educational services does not include seminars, in service training, review classes and other similar services rendered by persons

who are not accredited by the DepED, the CHED, and TESDA

i. Services rendered by individuals pursuant to an employer-employee relationship; Exempt sale of

services

j. Services rendered by regional or area headquarters established in the Philippines by multinational corporations: Exempt sale of

- which act as supervisory, communications and coordinating centers for their affiliates, subsidiaries or branches in the Asia-Pacific services

Region and

- do not earn or derive income from the Philippines

k. Transactions which are exempt Exempt sale of

- under international agreement to which the Philippines is a signatory or goods

- under special laws except those granted under PD No. 529, Petroleum Exploration Concessionaries under Petroleum Act of 1949; Exempt sale of

services

l. Sales by agricultural cooperatives duly registered and in good standing with the Cooperative Development Authority to their Exempt sale of

members as well as goods

- sale of their produce, whether in its original state or processed form, to non-members; Exempt

-their importation of direct farm inputs, machineries and equipment, including spare parts thereof, to be used directly and importation

exclusively in the production and/or processing of their produce;

Sale by agricultural cooperatives to non-members can only be exempted from VAT if the producer of the agricultural product sold

is the cooperative itself. If the cooperative is not the producer (e.g., trader), then only those sales to its members shall be exempted

from VAT; It is to be reiterated, however, that sale or importation of agricultural food products in their original state is exempt

from VAT irrespective of the seller and buyer thereof, pursuant to Subsection (a) hereof;

Sales by Agricultural Cooperatives To member To non-members

Sale of cooperative’s own produce Exempt Exempt

Other than the cooperative’s own produce (i.e. from traders) Exempt VAT*

*Sale to non-members - Exempt if referring to agricultural food products in its original state.

3.2 VAT exempt transactions Page 2 of 7

m. Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered and in good standing with the Exempt sale of

Cooperative Development Authority; services

Gross receipts by Credit or Multi-purpose cooperatives From members From Non-members

From lending activities Exempt Exempt

From non-lending activities VAT VAT

Exempt sale of

n. Sales by non-agricultural, non-electric and non-credit cooperatives duly registered and in good standing with the Cooperative services

Development Authority;

- Provided, That the share capital contribution of each member does not exceed P15,000 and regardless of the aggregate capital and

net surplus ratably distributed among the members;

Gross receipts by From members From non-members

Electric cooperatives VAT VAT

Non-agricultural, non-electric, non-lending/credit cooperatives

Contribution per member < P15,000 Exempt Exempt

Contribution per member > P15,000 VAT VAT

Under the IRR, all duly-registered cooperatives enjoy exemption from transactions with insurance companies and

banks.

Also, cooperatives dealing exclusively with members are exempt from payment of any taxes and fees, including but

not limited to, income tax, percentage tax, donor's tax, excise tax, documentary tax, and the annual registration fee of

P500.

Electric cooperatives are also exempt from payment of Value Added Tax (VAT) on systems loss and VAT on the

distribution of electricity to their members.

Cooperatives doing business with members and non-members with accumulated reserves and undivided net savings of

not more than P10 million are exempted from the same taxes as those that deal with members only.

Likewise, business transactions with members of duly registered cooperatives which have accumulated reserves and

undivided net savings of more than P10 million are exempted from all national internal revenue taxes for which it is

liable.

On the other hand, duly registered cooperatives with accumulated reserves and undivided net savings of more than

P10 million dealing with non-members shall pay their income taxes and VAT at their full rate, subject to some

exemptions.

VAT, will not be collected against sales by agricultural cooperatives, including sales to non-members, importation of

direct farm inputs, machineries and equipment, including spare parts, to be used directly and exclusively in the

production and/or processing of their produce; gross receipts from lending companies by credit or multi-purpose

cooperatives; and sales by non-agricultural, non-electric and non-credit cooperatives.

o. Export sales by persons who are not VAT registered; Exempt sale of

Non-VAT registered VAT registered goods

Export sales Vat Exempt Vatable (zero rated

sales)

Export Sales by a VAT Registered Entity

Output tax Zero

Input tax 1. Refunded

2. Claimed as deduction or tax credit against output

3. Claimed as tax credit against any internal revenue taxes

Export Sales by a Non-VAT Registered Entity

Output tax VAT exempt

Input tax Not allowed (charged to cost or expense)

:

p. The following sales of real properties are exempt from VAT, namely: Exempt sale of

real properties

1. Sale of real property not primarily held for sale to customer or held for lease in the ordinary course of trade or business.

However, even if the real property is not primarily for sale to customers or held for lease in the ordinary course of trade or

3.2 VAT exempt transactions Page 3 of 7

business but the same is used in the trade or business of the seller, the sale thereof shall be subject to VAT being a transaction

incidental to the taxpayer’s main business;

2. Sale of real property utilized for low-cost housing (price ceiling per unit of: Level 1 - P450,000 to P1,700,000; Level 2 -

P1,700,000 to P3,000,000;

(1) 3. Sale of real property utilized for socialized housing (price ceiling for house and lot – P450,000;

for lot only – P180,000);

4. Sale of residential lot valued at P1,500,000 and below and house and lot and other residential dwellings valued at P2,500,000

and below.

Provided, That beginnning January 1, 2021, the VAT exemption shall only apply to sale of real

properties not primarily held for sale to customers or held for lease in the ordinary course of trade

or business, sale of real property utilized for socialized housing as defined by Republic Act No.

7279, sale of house and lot, and other residential dwellings with selling price of not more than

Two million pesos (P2,000,000): Provided, further, That every three (3) years thereafter, the

amount herein stated shall be adjusted to its present value using the Consumer Price

q. Lease of: Exempt lease

- residential units of properties

- with a monthly rental not exceeding P15,000

- regardless of the amount of the aggregate rentals received by the lessor during the year.

Residential unit shall refer to

1. Apartment and houses and lots used for residential purposes

2. Buildings or parts or units thereof used solely as dwellings places (i.e., dormitories, rooms, bed spaces) except motels, motel

rooms, hotel and hotel rooms.

Unit shall refer to

1. Apartment unit in case of apartments

2. House in case of residential houses

3. Per person in case of dormitories, boarding houses and bed spaces

4. Per room in case of rooms for rent

Lease of Residential Units

Monthly Rental Annual Receipts Tax

Monthly rental <P15,000 > P3,000,000 VAT exempt

Monthly rental <P15,000 < P3,000,000 VAT exempt

Monthly rental > P15,000 > P3,000,000 VAT

Monthly rental > P15,000 < P3,000,000 VAT exempt**

** Non-VAT registered (Subject to 3% percentage tax)

Lease of commercial units, regardless of the amount of monthly rental is subject to VAT unless the lessor is non-VAT registered

and annual gross receipts <P3,000,000.

r. Sale or importation, printing or publication of books and any newspaper, magazine, review or bulletin which appears at regular Exempt sale of

intervals with fixed prices for subscription and sale and which is not devoted principally to the publication of paid goods

advertisement; Exempt sale of

services

Exempt

importation

s. Transport of passengers by international carriers Exempt

importation

(RR 15-2015) The transport of passengers by international carriers doing business in the Philippines shall be

exempt from value-added tax (VAT), as amended by RA No. 10378.

The transport of cargo by international carriers doing business in the Philippines shall be exempt from VAT pursuant to

Sections 109(1)(E) of the NIRC, as amended by RA No. 10378.

International carriers exempt under Sections 109(1)(S) and 109(1)(E) of the NIRC, as amended, shall not be allowed to register

for VAT purposes.

t. Sale, importation or lease of passenger or cargo vessels and aircraft, including engine, equipment and spare parts thereof for Exempt sale of

domestic or international transport operations. goods

(RR 15-2015) Sale, importation or lease of passenger or cargo vessels and aircraft, including engine, equipment and spare parts Exempt

thereof for domestic or international transport operations; Provided, however, that the exemption from VAT on the importation

importation and local purchase of passenger and/or cargo vessels shall be subject to the/requirements on restriction on vessel

importation and mandatory vessel retirement program of Maritime Industry Authority (MARINA).

u. Importation of fuel, goods and supplies by persons engaged in international shipping or air transport operations; provided, that Exempt

3.2 VAT exempt transactions Page 4 of 7

the fuel, goods, and supplies shall be used for international shipping or air transport operations. importation

(RR 15-2015) Importation of fuel, goods and supplies by persons engaged in international shipping and air transport operations;

Provided, that the said fuel, goods and supplies shall be used exclusively or shall pertain to the transport of goods and/or

passengers from a port in the Philippines directly to a foreign port, or vice-versa, without docking or stopping at any other port in

the Philippines unless the docking or stopping at any other Philippine port is for the purpose of unloading passengers and/or

cargoes that originated from abroad, or to load passengers and/or cargoes bound for abroad; Provided further, that if any portion

of such fuel, goods or supplies is used for purposes other than that mentioned in this paragraph, such fuel, goods and supplies

shall be subject to 12% VAT;

v. Services of banks, non-bank financial intermediaries performing quasi-banking functions, and other non-bank financial Exempt sale of

intermediaries, such as money changers and pawnshops, subject to percentage tax under Secs. 121 and 122, respectively, of the Tax services

Code; and

(W) Sale or lease of goods and services to senior citizens and persons with disability, as provided under Republic Act Nos. 9994 Exempt sale of

(Expanded Senior Citizens Actof2010) and10754 (An Act Expanding the Benefits and Privileges of Persons With Disability), goods

respectively; Exempt sale of

services

(X) Transfer of property pursuant to Section 40(C)(2) of the NIRC, as amended;(persons retiring from business) Exempt lease

of properties

(Y) Association dues, membership fees, and other assessments and charges collected by homeowners associations and Exempt sale of

condominium corporations; services

(Z) Sale of gold to the Bangko Sentral ng Pilipinas (BSP); Exempt sale of

goods

(AA) Sale of drugs and medicines prescribed for diabetes, high cholesterol, and hypertension beginning January 1, 2019; and Exempt sale of

goods

(BB) Sale or lease of goods or properties or the performance of services other than the transactions mentioned in the preceding Exempt sale of

paragraphs, the gross annual sales and/or receipts do not exceed the amount of Three million pesos (P3,000,000). goods

Exempt sale of

services

Exempt lease

of properties

Sale or lease of

- goods or properties or

- the performance of services

- other than the transactions mentioned in the preceding paragraphs,

- the annual gross annual sales and/or receipts do not exceed the amount of P3,000,000.

For the purpose of the threshold of P3,000,000, the husband and wife shall be considered separate taxpayers. However, the

aggregation rule for each taxpayer shall apply. For instance, if a professional, aside from the practice of his profession, also

derives revenue from other lines of business which are otherwise subject to VAT, the same shall be combined for purposes of

determining whether the threshold has been exceeded. Thus, the VAT-exempt sales shall not be included in determining the

threshold.

PWD/ Senior Citizen Discount = (Total Billing Amount - VAT) x 20%

Amount Due:

Total bill inclusive of VAT Xxx

Less: VAT (xxx)

Total bill exclusive of VAT Xxx

Less: 20% discount (xxx) **

Total amount Due Xxx

** Total Billing Amount

No. Of Customers Less VAT x 20%

2. Mandatory Registration under the VAT System

Persons required Any person who, in the course of trade or business, sells, barters or exchanges goods or properties or engages in the sale or

to mandatorily exchange of services shall be liable to register if:

register a. His gross sales or receipts for the past twelve (12) months, other than those that are exempt under Sec. 109 (1) (A) to (AA)

of the Tax Code, have exceeded three million pesos (P3,000,000) or

b. There are reasonable grounds to believe that his gross sales or receipts for the next twelve (12) months, other than those that

are exempt under Sec. 109 (1) (A) to (AA) of the Tax Code, will exceed three million pesos (P3,000,000).

3. Optional Registration of VAT-Exempt Persons

a. Persons a. Any person who is VAT exempt under Section 109 (BB) not required to register for VAT may elect to be VAT-registered by

allowed VAT registering with the RDO that has jurisdication over the head office of that person, and pay the annual registration fee of P500

registration for every separate and distinct establishment;

b. Any person who is VAT-registered but enters into transactions which are exempt from VAT (mixed transactions) may opt

3.2 VAT exempt transactions Page 5 of 7

that the VAT apply to his transactions which would have been exempt under Section 109 (1) of the Tax Code;

c. Franchise grantees of radio and/or television broadcasting whose annual gross receipts of the preceding year do not exceed

P10,000,000 derived from the business covered by the law granting the franchise may opt for VAT registration. This option,

once exercised, shall be irrevocable.

b. Irrevocability Once the election is made, it shall be irrevocable for a period of three (3) years counted from the quarter when the election

of the optional was made except for franchise grantees of radio and TV broadcasting whose annual gross receipts for the preceding year do not

VAT registration exceed ten million pesos (P10,000,000) where the option becomes perpetually irrevocable.

EXERCISES

Exercise A

Instruction: Place E if the transaction is VAT exempt.

1 Sale of meat, fish, vegetables and fruits that have undergone the simple process of preparation or preservation such as E

freezing, drying, salting, broiling, roasting, smoking, stripping including advanced technological means of packing (shrink

wrapping in plastics, vacuum packing, tetra-pack and other similar packaging methods).

2 Importation of resettlers of personal and household effects. E

3 Growing of poultry, livestock and marine food products into marketable products. E

4 Laboratory services and medicines provided by the hospital to the patient. E

5 Sale of drugs and medicine by a pharmacy operating in a hospital.

6 Seminars, in service trainings, review classes conducted by the University of the Philippines.

7 Sale of medicine to a senior citizen, person with disability and to students

8 Sale of four adjacent lot with a contract price of P1,000,000 per lot.

9 Sale of parking lot amounting to P900,000.

10 Sale of e-books, e-journals, CDs and software.

11 Transport of goods and cargo by an international carrier. E

12 Honorarium given to a director of a company who is at the same time is also a manager of the production department. E

13 Services rendered by a regional area headquarters. E

14 Importation by non-agricultural, non–electric, and non-credit cooperatives. E

Exercise B (Adapted)

Instruction: Determine the VAT-subject and VAT-exempt amounts:

Selling price: A B C

Condominium unit P1,500,000 P3,500,000 P5,000,000

Parking lot 1, 500,000 800,000 900,000

VAT-subject P 1,500,000 P4,300,000 P5,900,000

Vat-exempt P 3,000,000

Exercise C

Instruction: Determine which is VAT-subject and VAT-exempt from sale of adjacent lots A to F.

Lot A Lot B Lot C Lot D Lot E Lot F

Value of the lot P500,000 P700,000 P800,000 P800,000 P1,900,000 P2,000,000

Sold to Buyer A Buyer A Buyer A Buyer 1 Buyer 2 Buyer 3

VAT-subject P500,000 P700,000 P800,000 - - P2,000,000

VAT-exempt P800,000 P1,900,000 -

Exercise D

Instruction: Determine the VAT-subject and VAT-exempt amounts from the rentals of residential units and commercial units.

Residential Commercial

Unit Unit

Case A-Monthly rental per unit (10 residential units and 10 commercial units) P 10,000 P 10,000

Annual gross rentals P1,200,000 P1,200,000

VAT-subject

VAT-exempt P1,700,000 P1,700,000

Case B -Monthlyrental per unit (10 residential units and 10 commercial units) P 15,000 P 15,000

Annual gross rentals P1,536,000 P1,536,000

VAT-subject - P2,536,000

VAT-exempt P2,500,000 -

Case C -Monthlyrental per unit (10 residential units and 10 commercial units) P 35,000 P 15,000

Annual gross rentals P1,800,000 P1,800,000

VAT-subject -

VAT-exempt P1,900,000 P1,900,000

Case D -Monthlyrental per unit (10 residential units and 10 commercial units) P 15,000 P 15,000

Annual gross rentals P4,800,000 P6,800,000

VAT-subject P4,300,000 P4,300,000

VAT-exempt - -

3.2 VAT exempt transactions Page 6 of 7

Exercise E (Adapted)

Instruction: Determine the VAT-subject and VAT-exempt amounts:

Husband Wife

Case A – Gross sales, trading business P3,919,500 P3,000,000

VAT-subject - P2,000,000

VAT-exempt P1,919,500 -

Case B –Gross receipts, practice of profession P1,000,000 P -

Gross receipts, massage parlor 1,200,000

Gross sales, trading business 1,000,000

Gross receipts, gym business 1,500,000 -

Gross sales, RTW and bags business 1,500,000

Gross rentals, monthly rental for leased units, P10,000 1,200,000

Gross sales, pineapple, coconut and vegetables (farm produce) 300,000

Gross sales, Milk fish from own fishpond, marinated and vacuum packed. 1,000,000

Gross receipts, poultry contract grower services 1,300,000

Total P6,919,500 P7,000,000

VAT-subject P4,419,500 P5,700,000

VAT-exempt P1,500,000 P1,300,000

Case C- Gross receipts practice of profession P1,000,000 1,000,000

Salaries 2,000,000 500,000

Tuition fees from family owned vocational school registered under TESDA 5,000,000 5,000,000

Sale of own published books 1,000,000

Total 9,000,000 6,500,000

VAT-subject

VAT-exempt 9,000,000 6,500,000

Exercise F Determine whether or not the VAT can be passed-on and the treatment of the passed-on VAT.

Can pass on VAT? Treatment

1. Sale by a VAT registered seller to a VAT-registered trader Input tax Yes

2. Sale by a VAT registered seller to a VAT-exempt trader Cost and expense Yes

3. Sale by a VAT-registered seller to IRRI - No

4. Sale by a VAT-exempt seller to a VAT-subject trader - No

3.2 VAT exempt transactions Page 7 of 7

Potrebbero piacerti anche

- 04 Vat Exempt TransactionsDocumento4 pagine04 Vat Exempt TransactionsJaneLayugCabacunganNessuna valutazione finora

- Consumption Tax On ImportationDocumento27 pagineConsumption Tax On ImportationOwncoebdief100% (1)

- Notes On Excise TaxesDocumento19 pagineNotes On Excise TaxesLalaine ReyesNessuna valutazione finora

- Chapter 8 Output Vat Zero-Rated SalesDocumento8 pagineChapter 8 Output Vat Zero-Rated SalesJamaica DavidNessuna valutazione finora

- Quiz On VAT154623Documento5 pagineQuiz On VAT154623Sandy100% (1)

- Activity in Documentary Stamp TaxDocumento2 pagineActivity in Documentary Stamp TaxLucy Heartfilia100% (1)

- Test I - Multiple Choice Questions. Write The Letter of Your Answer Beside Each Item Number. Use Capital Letter OnlyDocumento8 pagineTest I - Multiple Choice Questions. Write The Letter of Your Answer Beside Each Item Number. Use Capital Letter OnlyJessa Mae LavadoNessuna valutazione finora

- xP04 Value Added Tax Booklet PDFDocumento70 paginexP04 Value Added Tax Booklet PDFmae KuanNessuna valutazione finora

- Quiz Bee Excise TaxDocumento43 pagineQuiz Bee Excise TaxReginald ValenciaNessuna valutazione finora

- Corresponding Supporting ScheduleDocumento3 pagineCorresponding Supporting Schedulealmira garciaNessuna valutazione finora

- Magic Notes - TaxDocumento5 pagineMagic Notes - TaxJeanette PareNessuna valutazione finora

- Quiz For Business TaxDocumento5 pagineQuiz For Business TaxAngela WaganNessuna valutazione finora

- Sde WRDocumento10 pagineSde WRNitinNessuna valutazione finora

- Chapter 10 Vat Still DueDocumento7 pagineChapter 10 Vat Still DueHazel Jane EsclamadaNessuna valutazione finora

- Answer: 2,000,000 Solution:: Sample ProblemDocumento17 pagineAnswer: 2,000,000 Solution:: Sample ProblemJohayra AbbasNessuna valutazione finora

- Business Tax MidtermDocumento7 pagineBusiness Tax MidtermRenalyn Paras50% (2)

- Arturo Died Leaving The Following PropertiesDocumento1 paginaArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNessuna valutazione finora

- Value Added Tax DiscussionDocumento6 pagineValue Added Tax DiscussionAcademeNessuna valutazione finora

- Strategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Documento15 pagineStrategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Earl Daniel RemorozaNessuna valutazione finora

- Value Added Tax PracticeDocumento7 pagineValue Added Tax PracticeSelene DimlaNessuna valutazione finora

- Excise TaxDocumento50 pagineExcise TaxQuinnee VallejosNessuna valutazione finora

- Tax2 Quiz2 FinalsDocumento11 pagineTax2 Quiz2 Finalsishinoya keishiNessuna valutazione finora

- Tax Remedies QuizDocumento5 pagineTax Remedies QuizAnonymous 03JIPKRkNessuna valutazione finora

- Gross Estate ReviewerDocumento8 pagineGross Estate ReviewerCharles RiveraNessuna valutazione finora

- Group Quiz On Documentary Stamp TaxDocumento2 pagineGroup Quiz On Documentary Stamp TaxRowena RogadoNessuna valutazione finora

- DRAFTLevel 3Documento129 pagineDRAFTLevel 3Mark Paul RamosNessuna valutazione finora

- Taxation - PB - 19thDocumento9 pagineTaxation - PB - 19thKenneth Bryan Tegerero TegioNessuna valutazione finora

- Lease of Properties: ExemptDocumento12 pagineLease of Properties: Exemptmariyha PalangganaNessuna valutazione finora

- Vat-Exempt-Sales - (1) 3Documento74 pagineVat-Exempt-Sales - (1) 3Andrea Florence Guy Vidal75% (4)

- Ast TX 1001 Capital Assets (Batch 22)Documento3 pagineAst TX 1001 Capital Assets (Batch 22)CeciliaNessuna valutazione finora

- Set ADocumento11 pagineSet ALizi100% (1)

- Chapter 6 Banggawan RevierwerDocumento9 pagineChapter 6 Banggawan RevierwerKyleZapantaNessuna valutazione finora

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Documento4 pagineTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNessuna valutazione finora

- Chapter 9 - Input VatDocumento1 paginaChapter 9 - Input VatPremium AccountsNessuna valutazione finora

- Let's Analyze: Pacalna, Anifah BDocumento2 pagineLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNessuna valutazione finora

- Part 1 of Chapter 5Documento3 paginePart 1 of Chapter 5RB Janelle YTNessuna valutazione finora

- Tariff and Customs Code of The Philippines - Test BankDocumento3 pagineTariff and Customs Code of The Philippines - Test BankTyrelle CastilloNessuna valutazione finora

- Estate Tax Sample Problems 2Documento7 pagineEstate Tax Sample Problems 2Arj Sulit Centino Daqui0% (1)

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocumento3 pagineAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNessuna valutazione finora

- Other Percentage TaxesDocumento5 pagineOther Percentage TaxesAlexandra Nicole IsaacNessuna valutazione finora

- PrefinalDocumento7 paginePrefinalLeisleiRagoNessuna valutazione finora

- Business and Transfer Taxes P1 Exam Key Answers PDFDocumento16 pagineBusiness and Transfer Taxes P1 Exam Key Answers PDFJamaica DavidNessuna valutazione finora

- Exercise DrillDocumento6 pagineExercise DrillAbigail Ann PasiliaoNessuna valutazione finora

- Preferential Taxation For Senior CitizensDocumento53 paginePreferential Taxation For Senior CitizensNddejNessuna valutazione finora

- How Much Is The Distributable Income of The GPP?Documento2 pagineHow Much Is The Distributable Income of The GPP?Katrina Dela CruzNessuna valutazione finora

- Introduction To Transfer TaxationDocumento5 pagineIntroduction To Transfer Taxationjohn100% (1)

- STC Vat Test Bank 1Documento29 pagineSTC Vat Test Bank 1alden123Nessuna valutazione finora

- Excise TaxDocumento15 pagineExcise TaxDaniella MananghayaNessuna valutazione finora

- Business TaxationDocumento41 pagineBusiness TaxationKim AranasNessuna valutazione finora

- Sec. 109 VAT Exempt TransactionsDocumento2 pagineSec. 109 VAT Exempt TransactionsDis Cat100% (1)

- VatDocumento7 pagineVatCharla SuanNessuna valutazione finora

- Quiz 405Documento3 pagineQuiz 405Shaika HaceenaNessuna valutazione finora

- Assignment - VAT and Exemptions From VAT - AnswersDocumento3 pagineAssignment - VAT and Exemptions From VAT - AnswersMark Paul RamosNessuna valutazione finora

- ERG-TAX 3.1-VAT Exempt TransactionsDocumento7 pagineERG-TAX 3.1-VAT Exempt Transactionsyna kyleneNessuna valutazione finora

- Tax 3.1-Vat Exempt Transactions: Learning Advancement Review Center TAX 3.1Documento27 pagineTax 3.1-Vat Exempt Transactions: Learning Advancement Review Center TAX 3.1Mark Gelo WinchesterNessuna valutazione finora

- Chapter 8 - VAT - Part 1 - LatestDocumento38 pagineChapter 8 - VAT - Part 1 - Latestargene.malubayNessuna valutazione finora

- Value Added TaxDocumento9 pagineValue Added TaxSatana ArcherNessuna valutazione finora

- Vat NotesDocumento11 pagineVat NotesStephen CabalteraNessuna valutazione finora

- Normal Course of Trade or Business Are Subject To Vat "Unless Exempt 'Documento14 pagineNormal Course of Trade or Business Are Subject To Vat "Unless Exempt 'Aureen TabamoNessuna valutazione finora

- VAT Exempt TransactionsDocumento10 pagineVAT Exempt TransactionsAce Hulsey TevesNessuna valutazione finora

- Types of Oral CommDocumento12 pagineTypes of Oral CommJuls MacNessuna valutazione finora

- Gitman - IM - ch11 (CFM)Documento19 pagineGitman - IM - ch11 (CFM)jeankoplerNessuna valutazione finora

- Intercultural CommunicationDocumento7 pagineIntercultural CommunicationJuls MacNessuna valutazione finora

- Phil LItDocumento8 paginePhil LItJuls MacNessuna valutazione finora

- Periodical Test - English 5 - Q1Documento7 paginePeriodical Test - English 5 - Q1Raymond O. BergadoNessuna valutazione finora

- Test 5Documento4 pagineTest 5Lam ThúyNessuna valutazione finora

- TallyDocumento70 pagineTallyShree GuruNessuna valutazione finora

- Matalam V Sandiganbayan - JasperDocumento3 pagineMatalam V Sandiganbayan - JasperJames LouNessuna valutazione finora

- Tucker Travis-Reel Site 2013-1Documento2 pagineTucker Travis-Reel Site 2013-1api-243050578Nessuna valutazione finora

- SWOT Analysis and Competion of Mangola Soft DrinkDocumento2 pagineSWOT Analysis and Competion of Mangola Soft DrinkMd. Saiful HoqueNessuna valutazione finora

- House Tax Assessment Details PDFDocumento1 paginaHouse Tax Assessment Details PDFSatyaNessuna valutazione finora

- Đề Cương CK - QuestionsDocumento2 pagineĐề Cương CK - QuestionsDiệu Phương LêNessuna valutazione finora

- OD428150379753135100Documento1 paginaOD428150379753135100Sourav SantraNessuna valutazione finora

- The Irish Chocolate CompanyDocumento7 pagineThe Irish Chocolate CompanyMaeveOSullivanNessuna valutazione finora

- Assets Misappropriation in The Malaysian Public AnDocumento5 pagineAssets Misappropriation in The Malaysian Public AnRamadona SimbolonNessuna valutazione finora

- Alpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MuDocumento3 pagineAlpha Beta Gamma Delta Epsilon Zeta Eta Theta Iota Kappa Lambda MulanNessuna valutazione finora

- Standalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Documento2 pagineStandalone Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Frias Vs Atty. LozadaDocumento47 pagineFrias Vs Atty. Lozadamedalin1575Nessuna valutazione finora

- Gerson Lehrman GroupDocumento1 paginaGerson Lehrman GroupEla ElaNessuna valutazione finora

- G.R. No. 187730Documento10 pagineG.R. No. 187730Joses Nino AguilarNessuna valutazione finora

- Profile Story On Survivor Contestant Trish DunnDocumento6 pagineProfile Story On Survivor Contestant Trish DunnMeganGraceLandauNessuna valutazione finora

- Homicide Act 1957 Section 1 - Abolition of "Constructive Malice"Documento5 pagineHomicide Act 1957 Section 1 - Abolition of "Constructive Malice"Fowzia KaraniNessuna valutazione finora

- Keys For Change - Myles Munroe PDFDocumento46 pagineKeys For Change - Myles Munroe PDFAndressi Label100% (2)

- Grand Boulevard Hotel Vs Genuine Labor OrganizationDocumento2 pagineGrand Boulevard Hotel Vs Genuine Labor OrganizationCuddlyNessuna valutazione finora

- Aaron VanneyDocumento48 pagineAaron VanneyIvan KelamNessuna valutazione finora

- China Bank v. City of ManilaDocumento10 pagineChina Bank v. City of ManilaCharles BusilNessuna valutazione finora

- Working Capital FinancingDocumento80 pagineWorking Capital FinancingArjun John100% (1)

- Basic Fortigate Firewall Configuration: Content at A GlanceDocumento17 pagineBasic Fortigate Firewall Configuration: Content at A GlanceDenisa PriftiNessuna valutazione finora

- IMTG-PGPM Student Manual - Google DocsDocumento12 pagineIMTG-PGPM Student Manual - Google DocsNADExOoGGYNessuna valutazione finora

- Civics: Our Local GovernmentDocumento24 pagineCivics: Our Local GovernmentMahesh GavasaneNessuna valutazione finora

- Construction Design Guidelines For Working Within and or Near Occupied BuildingsDocumento7 pagineConstruction Design Guidelines For Working Within and or Near Occupied BuildingsAthirahNessuna valutazione finora

- SOL 051 Requirements For Pilot Transfer Arrangements - Rev.1 PDFDocumento23 pagineSOL 051 Requirements For Pilot Transfer Arrangements - Rev.1 PDFVembu RajNessuna valutazione finora

- MhfdsbsvslnsafvjqjaoaodldananDocumento160 pagineMhfdsbsvslnsafvjqjaoaodldananLucijanNessuna valutazione finora

- BloggingDocumento8 pagineBloggingbethNessuna valutazione finora