Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Binny

Caricato da

saarthak srivastavaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Binny

Caricato da

saarthak srivastavaCopyright:

Formati disponibili

Name:Poornima Gupta

About the Company – BINNY MILLS

Introduction:

Binny mills ltd was incorporated on 20th December 2007 as a public ltd

company .It obtained certificate for commencement of business on the February

2008.The Registered office of the company is at no.4 ,Karpagambal Nagar

,Mylapur Chennai 600004.

Business Activities:

The company is in the process of acquiring the agencies and services business of

Binny ltd by Demerger process . After the demerger is completed ,the company

will engage in the business of agencies and services which will include business

,activities and operations pertaining to trading of textiles and engineering products

,agencies cold storage plants at cochin and warehousing.

INTERPRETATION

BETA= Beta tell us about the change of risk in % due to the

0.690926617 change in the market. In this we can say that when the

market goes down then the risk of the stock will also go

down.

DOWNSIDE BETA= As the downside beta is less than 0 it means that the

-11.88909722 stock will increase as the market will go down. this show

an inverse relationship.

LEVERED BETA= Levered beta includes the market risk as is similar to beta

0.690926617 .

SECTOR BETA= As ths is negative the sector will fluctuate negatively

1.007944972 means for 1%change in market sector will change by

0.0061times.

SYSTEMATIC =0.00130 This thethe risk which is overall risk of the market and

includes the risks which are uncontrollable.

UNSYSTEMATIC This means that after removing the market risk the stock

BETA=0.9986 will fluctuate 0.998 times but this is all the controllable

risk.

SHARP RATIO =0.0443

TREYNOR RATIO=-0.049

EXPECTED RATE OF

RETURN=

0.62 %

WACC= Since the WACC is about 1 % than return so it creates

0.8358236 about value for its investors.

ROE= As the ROE is very high here hence the company’s

1.24% capital has been taken from right sources.

ROA= Return on assets is showing that company’s asset are

3.45% giving fair returns and have been utilized properly.

INTEREST RATIO= As the interest coverage ratio is very good and the

14.35135135 sources from where they have taken money are being

utilized at the right places giving good returns

Current 2.8084 As the current ratio is 2.8 times which indicates that the

Ratio Company has been maintaining sufficient cash to meet its

short term obligations.

Quick Ratio 0.759 As the quick ratio is little less than 1 it indicates that the

company does not relies too much on inventory or other

assets to pay its short-termliabilities.

Debt to 4.75225 As debt equity ratio is less means that a company has

equity ratio been aggressive in financing its growth with debt.

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

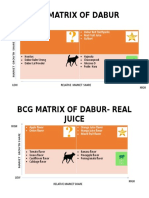

- Brand Equity of DaburDocumento2 pagineBrand Equity of Dabursaarthak srivastavaNessuna valutazione finora

- OM 1 Saarthak Srivastava JL 18PG 125Documento5 pagineOM 1 Saarthak Srivastava JL 18PG 125saarthak srivastavaNessuna valutazione finora

- V MartDocumento2 pagineV Martsaarthak srivastavaNessuna valutazione finora

- Brave and Beautiful - Dabur Vatika SaluteDocumento3 pagineBrave and Beautiful - Dabur Vatika Salutesaarthak srivastavaNessuna valutazione finora

- AkashDocumento8 pagineAkashsaarthak srivastavaNessuna valutazione finora

- Sales and Marketing Activities Used by Real Estate Questionnaire For Channel PartnersDocumento3 pagineSales and Marketing Activities Used by Real Estate Questionnaire For Channel Partnerssaarthak srivastavaNessuna valutazione finora

- Human Resource 1Documento9 pagineHuman Resource 1saarthak srivastavaNessuna valutazione finora

- CCBM 2 AssignmentDocumento2 pagineCCBM 2 Assignmentsaarthak srivastavaNessuna valutazione finora

- 3.3 Approach of Performing TasksDocumento1 pagina3.3 Approach of Performing Taskssaarthak srivastavaNessuna valutazione finora

- Sales and Marketing Activities Used by Real Estate Questionnaire For Channel PartnersDocumento3 pagineSales and Marketing Activities Used by Real Estate Questionnaire For Channel Partnerssaarthak srivastavaNessuna valutazione finora

- BCG - Real JuiceDocumento2 pagineBCG - Real Juicesaarthak srivastavaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Term Structure of Interest Rates: InvestmentsDocumento29 pagineThe Term Structure of Interest Rates: InvestmentssesiliaNessuna valutazione finora

- Templeton Global Bond Fund: Key Investor InformationDocumento2 pagineTempleton Global Bond Fund: Key Investor Informationspsc059891Nessuna valutazione finora

- A Chapter 3Documento30 pagineA Chapter 3shomy02Nessuna valutazione finora

- Mark McRae - Trading For Beginners PDFDocumento103 pagineMark McRae - Trading For Beginners PDFToma IulianNessuna valutazione finora

- Fabozzi Fofmi4 Ch11 ImDocumento12 pagineFabozzi Fofmi4 Ch11 ImYasir ArafatNessuna valutazione finora

- Chapter 2 Review of Financial Statement Preparation Analysis InterpretationDocumento46 pagineChapter 2 Review of Financial Statement Preparation Analysis InterpretationMark DavidNessuna valutazione finora

- 5th Semester Finance True False FullDocumento12 pagine5th Semester Finance True False FullTorreus Adhikari75% (4)

- Vertex: InvestingDocumento12 pagineVertex: InvestingGolconda Mitra100% (2)

- Econ115 Tut06-AKDocumento3 pagineEcon115 Tut06-AKsarthakNessuna valutazione finora

- Structure of Case Study Invest Policy Hewlett Foundation.Documento4 pagineStructure of Case Study Invest Policy Hewlett Foundation.SulaimanAl-SulaimaniNessuna valutazione finora

- CMNPDocumento2 pagineCMNPIsni AmeliaNessuna valutazione finora

- CiplaDocumento5 pagineCiplaSantosh AgarwalNessuna valutazione finora

- History of EurobondsDocumento2 pagineHistory of Eurobondsterigand50% (2)

- Duyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesDocumento14 pagineDuyao - Yvonne - Antonette - M2ModuleAssignment-Data FilesYvonne DuyaoNessuna valutazione finora

- Financial InstrumentDocumento2 pagineFinancial InstrumentMarto FeNessuna valutazione finora

- IAPM MCQs MergedDocumento70 pagineIAPM MCQs Mergedsinan1600officialNessuna valutazione finora

- Unit Three Money - Forms and FunctionsDocumento6 pagineUnit Three Money - Forms and FunctionsMihai TudorNessuna valutazione finora

- Capital Gains Tax Handouts May2020Documento29 pagineCapital Gains Tax Handouts May2020Elsie GenovaNessuna valutazione finora

- Portfolio Theory, CAPM, WACC and Optimal Capital Structure - 20072018 PDFDocumento50 paginePortfolio Theory, CAPM, WACC and Optimal Capital Structure - 20072018 PDFdevashnee100% (2)

- Investment in Associates: PAS 28, PAS 29, and PAS 32Documento5 pagineInvestment in Associates: PAS 28, PAS 29, and PAS 32Mica DelaCruzNessuna valutazione finora

- Fin552 Group PDFDocumento50 pagineFin552 Group PDFImran Azizi100% (2)

- SourceDocumento27 pagineSourceAnonymous kwi5IqtWJNessuna valutazione finora

- Mva EvaDocumento11 pagineMva EvaRian ChiseiNessuna valutazione finora

- Dervative Market, London School of EconomicDocumento29 pagineDervative Market, London School of EconomicUyên NguyễnNessuna valutazione finora

- Performance Evaluation of Sharekhan Ltd. With Other Mutual Fund CompaniesDocumento108 paginePerformance Evaluation of Sharekhan Ltd. With Other Mutual Fund CompaniesVaishakh ChandranNessuna valutazione finora

- FM1 Assignment - AirAsiaDocumento22 pagineFM1 Assignment - AirAsiatkjingNessuna valutazione finora

- Cita Mineral Investindo TBK.: Company Report: January 2019 As of 31 January 2019Documento3 pagineCita Mineral Investindo TBK.: Company Report: January 2019 As of 31 January 2019ElusNessuna valutazione finora

- 7 Powers PDFDocumento87 pagine7 Powers PDFKIRIT MODINessuna valutazione finora

- Chapter 2Documento10 pagineChapter 2Lasborn DubeNessuna valutazione finora

- Titman PPT CH18Documento79 pagineTitman PPT CH18IKA RAHMAWATINessuna valutazione finora