Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fin541 651 630-1 PDF

Caricato da

KiMi MooeNaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fin541 651 630-1 PDF

Caricato da

KiMi MooeNaCopyright:

Formati disponibili

CONFIDENTIAL BM/JAN 2013/FIN541/651/630

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE MALAYSIAN DERIVATIVES/MALAYSIAN

FUTURES AND OPTIONS

COURSE CODE FIN541/651/630

EXAMINATION JANUARY 2013

TIME 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of:

i) the Question Paper

ii) an Answer Booket - provided by the Faculty

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 4 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 BM/JAN 2013/FIN541/651/630

QUESTION 1

a) Explain the process of novation and its importance in futures trading.

(5 marks)

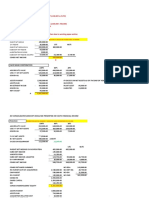

b) An active speculator forms a strong opinion that the current economic policy relating to

the plantation sector will bring down the total production of CPO. If this policy pursues,

the price for this commodity is expected to be adversely affected due to undersupply.

The scenario will impose direct impact on the FCPO market. So, a speculator decides to

trade four December FCPO contracts at RM3,190. The changes in settlement prices of

FCPO turn out to be the following for the next five days.

Trading Day Changes in Settlement Prices:

(+ / -) Compared to Previous Day's Price

1 + RM10

2 -RM30

3 +RM10

4 -RM15

5 -RM15

i) Determine whether the speculator should enter the market as long or short position.

(2 marks)

ii) Calculate the contract value of the December FCPO contracts.

(2 marks)

iii) Prepare the marked-to-market position for the five-day trading assuming the initial

margin is 10% of the contract value and all traders must maintain 90% of it.

(10 marks)

iv) Compute the realized profit or loss if the speculator closes out his position on the fifth

day.

(1 mark)

QUESTION 2

a) It is now 17 January 2013 and the FBM KLCI is at 1146. The average dividend yield

of the FBM KLCI is 2.3% and the risk-free interest rate is 5% per annum. A trader

has RM10 million which he can fund at the risk-free rate. Meanwhile, June FKLI is

trading at 1192.5. The trader believes that there is an arbitrage opportunity.

i) Calculate the fair value of the June FKLI.

(Use the actual number of calendar days in determining the numbers of days

to maturity)

(5 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 BM/JAN 2013/FIN541/651/630

ii) Determine the number of contracts he can trade and outline the strategy he

can partake. At maturity, assume both the cash and futures market prices

converge at 1165.

(5 marks)

iii) Show the profit or loss of the arbitrage.

(6 marks)

b) Briefly explain the importance of speculators in the futures market and the reason

why speculation is considered risky.

(4 marks)

QUESTION 3

a) Identify the potential users of MGS futures and the primary use of this instrument.

(4 marks)

b) Explain how clearing house is able to guarantee performance in the futures and

option market.

(4 marks)

c) It is now February 2013 and ABC Bank intends to purchase RM200 million 5-year

MGS when these instruments are issued in one month's time. The current interest

rate is 8 percent. The bank is concerned about a fall in interest rate and decides to

hedge its position today to lock in the purchase price of the bond. Currently, March

FMG5 is trading at 114.0 In March, the interest rate falls to 7 percent and March

FMG5 trades at 116.0.

i) Describe the bank's strategy and indicate whether it makes a profit or loss.

(8 marks)

ii) Calculate and comment on the effective price.

(4 marks)

QUESTION 4

a) A trader is expecting a large move in a stock price in the next 3 months but does not

know in which direction the move will be. Currently the stock is valued at RM69 by

the market. The trader participates in a straddle with a strike price of RM70 and an

expiration date in 3 months. The call costs RM4 and the put costs RM3.

i) Construct a payoff table for the straddle if the stock prices are as follows:

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 Day 8

RM50 RM55 RM60 RM70 RM75 RM80 RM85 RM90

(8 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 BM/JAN 2013/FIN541/651/630

ii) Sketch an expiry profit diagram for this position showing the break-even

points and maximum profit or loss.

(2 marks)

b) Briefly explain the difference in risk taken by the buyer and the seller of an option.

(4 marks)

c) A trader buys a put option on a share for RM3. The stock price is RM42 and the

strike price is RM40.

i) Describe the circumstances of a profitable trade for the trader.

(2 marks)

ii) State the circumstances when the option is to be exercised.

(2 marks)

iii) Draw a diagram showing the variation of the trader's profit with the stock

price at the maturity of the option.

(2 marks)

QUESTION 5

Your uncle is working at the arbitrage desk of a large insurance firm. His job is to identify

and exploit arbitrage opportunities. He notices the following quotations in December 2012:

90-day KLIBOR 7.2%

180-day KLIBOR 8.5%

December 2012 FKB3 93.20

March 2013 FKB3 92.50

Assume that the firm can invest RM10 million.

a) Prove to him that arbitrage is possible.

(4 marks)

b) Outline the appropriate arbitrage strategy to be undertaken today.

(4 marks)

c) Determine the arbitrage profit or loss that the firm would make if the 90-day KLIBOR

and March 2013 FKB3 converge at 9.0% at the maturity.

(12 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- A Trader S Astrological Almanac 2014 - Galactic Investor (Pdfdrive)Documento23 pagineA Trader S Astrological Almanac 2014 - Galactic Investor (Pdfdrive)ky Le100% (1)

- Adeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFDocumento1 paginaAdeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFGrace AdeyinkaNessuna valutazione finora

- 06 MaterialityDocumento2 pagine06 MaterialityMan Cheng100% (1)

- CHAPTER 7 - Basic Characteristic of VolumeDocumento32 pagineCHAPTER 7 - Basic Characteristic of VolumeKiMi MooeNaNessuna valutazione finora

- TBCH 13Documento43 pagineTBCH 13Tornike JashiNessuna valutazione finora

- 10.digest. NG Cho Cio VS NG DiogDocumento2 pagine10.digest. NG Cho Cio VS NG DiogXing Keet LuNessuna valutazione finora

- Cash and Cash EquivalentsDocumento33 pagineCash and Cash EquivalentsMerry Julianne DaymielNessuna valutazione finora

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Documento5 pagineRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- Kentucky Fried ChickenDocumento30 pagineKentucky Fried ChickenDelicaDello86% (14)

- Bir 2Q 2020Documento4 pagineBir 2Q 2020Leo Archival ImperialNessuna valutazione finora

- DasdasdDocumento1 paginaDasdasdKiMi MooeNaNessuna valutazione finora

- Total Quality Management LatestDocumento14 pagineTotal Quality Management LatestKiMi MooeNaNessuna valutazione finora

- Question AirDocumento2 pagineQuestion AirKiMi MooeNaNessuna valutazione finora

- ImplicationDocumento1 paginaImplicationKiMi MooeNaNessuna valutazione finora

- Enviromental Cost and BenefitDocumento11 pagineEnviromental Cost and BenefitKiMi MooeNaNessuna valutazione finora

- HTTP - WWW - Aphref.aph - Gov.au House Committee Ewr Owk Report Chapter2Documento22 pagineHTTP - WWW - Aphref.aph - Gov.au House Committee Ewr Owk Report Chapter2edgartorno1Nessuna valutazione finora

- Case StudiesDocumento8 pagineCase StudiesKiMi MooeNaNessuna valutazione finora

- Orange and WhiteDocumento1 paginaOrange and WhiteKiMi MooeNaNessuna valutazione finora

- Anzo Holdings BerhadDocumento3 pagineAnzo Holdings BerhadKiMi MooeNaNessuna valutazione finora

- 4ps Marketing Mix The KurungsDocumento6 pagine4ps Marketing Mix The KurungsKiMi MooeNaNessuna valutazione finora

- MAF 651 Measuring Economic and Social Impact of Environmental CostDocumento15 pagineMAF 651 Measuring Economic and Social Impact of Environmental CostKiMi MooeNaNessuna valutazione finora

- Program Objectives and Setting TargetsDocumento30 pagineProgram Objectives and Setting TargetsKiMi MooeNaNessuna valutazione finora

- Correlation and Diversification: Nur Balqish Izzati Nur Izzaty Mohammad Syamir Hilmi Muhammad HakimiDocumento5 pagineCorrelation and Diversification: Nur Balqish Izzati Nur Izzaty Mohammad Syamir Hilmi Muhammad HakimiKiMi MooeNaNessuna valutazione finora

- DDocumento3 pagineDKiMi MooeNaNessuna valutazione finora

- Jadual Highlander SportsDocumento4 pagineJadual Highlander SportsKiMi MooeNaNessuna valutazione finora

- Credit Risk DataDocumento25 pagineCredit Risk DataKiMi MooeNaNessuna valutazione finora

- New Microsoft Office PowerPoint PresentationDocumento16 pagineNew Microsoft Office PowerPoint PresentationKiMi MooeNaNessuna valutazione finora

- KikiDocumento5 pagineKikiKiMi MooeNaNessuna valutazione finora

- Guide On Furnishing of ReturnsDocumento28 pagineGuide On Furnishing of ReturnsKiMi MooeNaNessuna valutazione finora

- InsDocumento5 pagineInsKiMi MooeNaNessuna valutazione finora

- Name of The GameDocumento1 paginaName of The GameKiMi MooeNaNessuna valutazione finora

- COMPETITORSDocumento2 pagineCOMPETITORSKiMi MooeNaNessuna valutazione finora

- Fundamentals of Corporate FinanceDocumento56 pagineFundamentals of Corporate FinanceKiMi MooeNaNessuna valutazione finora

- Elc 590Documento17 pagineElc 590KiMi MooeNaNessuna valutazione finora

- Critical AnalysisDocumento2 pagineCritical AnalysisKiMi MooeNaNessuna valutazione finora

- The Author Explain The Issue and To Investigate About Should Animal Be Used For Scientific or CommercialDocumento1 paginaThe Author Explain The Issue and To Investigate About Should Animal Be Used For Scientific or CommercialKiMi MooeNaNessuna valutazione finora

- Final Outline Speech 1Documento7 pagineFinal Outline Speech 1KiMi MooeNaNessuna valutazione finora

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDocumento114 pagineUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010Nessuna valutazione finora

- Substabtive Test of CashDocumento14 pagineSubstabtive Test of CashWyler AkiNessuna valutazione finora

- CA51024 - Quiz 2 (Solutions)Documento6 pagineCA51024 - Quiz 2 (Solutions)The Brain Dump PHNessuna valutazione finora

- Marc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFDocumento48 pagineMarc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFMaria Alejandra Malaver DazaNessuna valutazione finora

- 1) Securities Scam (1992) : in April 1992, A Shortfall in The Government Securities Held byDocumento3 pagine1) Securities Scam (1992) : in April 1992, A Shortfall in The Government Securities Held byManmohan SinghNessuna valutazione finora

- StockRants CostBasisCalcDocumento2 pagineStockRants CostBasisCalcArvinNessuna valutazione finora

- Opportunity Cost in Finance and AccountingDocumento8 pagineOpportunity Cost in Finance and AccountingMary Grace GonzalesNessuna valutazione finora

- NHB Vishal GoyalDocumento24 pagineNHB Vishal GoyalSky walkingNessuna valutazione finora

- CH 21 TBDocumento18 pagineCH 21 TBJessica Garcia100% (1)

- A Guide To UK Oil and Gas TaxationDocumento172 pagineA Guide To UK Oil and Gas Taxationkalite123Nessuna valutazione finora

- Buying The Dip: Did Your Portfolio Holding Go On Sale?Documento16 pagineBuying The Dip: Did Your Portfolio Holding Go On Sale?Rafael CampeloNessuna valutazione finora

- Project Profile: M/S Ragini Kirana Store (Prop Upendra Yadav)Documento18 pagineProject Profile: M/S Ragini Kirana Store (Prop Upendra Yadav)Satendra DhakarNessuna valutazione finora

- Banks - Sector Update - 22 Dec 21Documento86 pagineBanks - Sector Update - 22 Dec 21Kaushal ShahNessuna valutazione finora

- Model Asset and Liability Affidavit D. VDocumento12 pagineModel Asset and Liability Affidavit D. VsavagecommentorNessuna valutazione finora

- Accounting Words IDocumento1 paginaAccounting Words IArnold SilvaNessuna valutazione finora

- Banking Theory, Law and PracticeDocumento51 pagineBanking Theory, Law and PracticePrem Kumar.DNessuna valutazione finora

- National Income Accounting - 2020 - PrintDocumento31 pagineNational Income Accounting - 2020 - PrintAndrea RodriguezNessuna valutazione finora

- ADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsDocumento6 pagineADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsFahad33% (3)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento9 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNessuna valutazione finora

- Assignment 01-Fin421Documento11 pagineAssignment 01-Fin421i CrYNessuna valutazione finora

- Important Points of Our Notes/Books:: TH THDocumento42 pagineImportant Points of Our Notes/Books:: TH THpuru sharmaNessuna valutazione finora

- 4 - Problem SolvingDocumento8 pagine4 - Problem SolvingKlenida DashoNessuna valutazione finora