Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NIBC 2019 2020 Competition Overview2

Caricato da

HarshDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

NIBC 2019 2020 Competition Overview2

Caricato da

HarshCopyright:

Formati disponibili

Competition Overview | NIBC 2019-2020

VANCOUVER TORONTO NEW YORK

Participate in the World’s Largest Investment Banking Competition

WATCH COMPETITION VIDEO

National Investment Banking Competition 2009-2020 1

Organizing Team Welcome

Competition Team Board Representation

James Eric Maori Tennille Eric Viktoriya Philip Tim

Huang Hall Hayashi Robertson Norman Tsurikova Chua Vipond

Corporate Competition Operations Conference Training Events Oversight Training

For more information, James Huang Director, Corporate James.Huang@nibc.ca

please contact: Tennille Robertson Director, Conference Tennille.Robertson@nibc.ca

Maori Hayashi Director, Operations Maori.Hayashi@nibc.ca

nibc.ca

National Investment Banking Competition 2009-2020 2

Invitation to NIBC 2019-2020

We would like to invite Undergraduate and Graduate/MBA candidates to the 2019-2020 Global Competition

NIBC aims to offer students from all backgrounds an opportunity to advance their investment banking careers

1 Access to online video tutorials, industry templates, presentation and interview training resources

2 Professionals from top tier investment banks and private equity firms to adjudicate the competition

3 Speeches and panels by company founders, finance executives and sellside & buyside professionals

4 Unique experience to build global network with 250+ career-driven international peers

Visit NIBC.ca to register starting July 15, 2019

FIRST ROUND: Oct/Nov 2019 - Jan 2020 (ONLINE) with teams of FINAL ROUND: March 10-13, 2020 (VANCOUVER) with finalists

2-4 producing Corporate Valuation & Strategic Review giving Transaction Advice to Panel of Managing Directors

Successful competitors must submit “client-ready” pitchbook Live deal environment featuring authentic current transaction

Competitors receive 100-page case package and model template Finalists receive fully-built financial model to analyze transactions

and have 6-8 weeks to prepare online submission and present in boardrooms and Gala Dinner for $10k+ prize

3

National Investment Banking Competition 2009-2020 3

Event Profile

NIBC was founded to give Undergraduate and Graduate students from all geographies a merit-based

opportunity to measure their skills and be recognized by recruiters

NIBC (2009-2020)

CASES DCF, Comparable, Precedent, LBO | Strategic Client Review | Corporate Finance Transaction

TRAINING Access to Industry Templates | Video Tutorials through Online Competitor Portal

COMPETITION Equal Access for Students | 10,000+ Competitors | 200+ Universities | $100,000+ Prize Pool to Date

CONFERENCE High-Profile Keynotes | Deal Presentations | Sellside & Buyside Panels

AUDIENCE 400 Students at Final Round | 150 Industry Professionals & Alumni

Event Statistics & Participants

Event Overview Competitor Attendance Professional Involvement Corporate Partners

Venue 5-Star Universities 100 Board Members 15 Investment Banks 17

Boardroom Judging 30 Private Equity Firms 4

Keynotes 3 Competitors 1,600

Workshops & Panels 25 Asset Management 8

Deal Presentations 3 Competition Finalists 300

Wine & Cheese 70 Accounting/Law Firms 5

Panels 2 Conference Delegates 100 Gala Dinner 120 Corporate Clients 9

Total 150 Total Firms 43

National Investment Banking Competition 2009-2020 4

Competition Timeline

The First Round will take place in the Fall of 2019 with the Final Round held in the Spring of 2020

Competition Timeline:

Registration Opening

First Round Release (Oct/Nov 2019)

First Round Submission (Jan 2020)

VANCOUVER

Final Round (Mar 10-13, 2020)

Summer 2019 Fall 2019 Spring 2020

Preparation & Training First Round Final Round

Summer 4 Weeks 2 days

Skills Development Valuation & Strategic Overview Transaction Advice

Online Resources Analyst / Associate Perspective Director Perspective

▪ Online case resources ▪ DCF, Trading Comparables, Precedent ▪ Pre-built models, data sets, transaction

▪ Research guides, video tutorials Transactions, LBOs templates memo for strategic analysis

industry templates, interview training ▪ Pitchbook and valuation model ▪ 8-hour slot to develop boardroom pitch

▪ One-day skills workshop and ▪ 40-60 teams selected for final round ▪ Present to Managing Director panel at

networking in Western Canada Gala Dinner

National Investment Banking Competition 2009-2020 5

Competitors

Competitors from the most reputed finance schools in the world come together to compete at NIBC

Select Past Competition Winners Select Past Competing Schools

Haroon Chaudhry 2011 BMO Capital Markets University of Pennsylvania University of British Columbia

Jeremy Beadow 2011 BMO Capital Markets | Scotiabank GBM Columbia University Simon Fraser University

Jeff McLay 2012 TorQuest Partners | Onex Stanford University University of Victoria

Ian Sinclair 2012 TD Securities New York University University of Calgary

Aman Malik 2012 CPPIB | Credit Suisse Massachusetts Institute of Technology University of Saskatchewan

Gregory Jones 2012 BMO Capital Markets | CPPIB Cornell University

Shaaj Vijay 2012 RBC Capital Markets Yale University

Stephen Ou 2012 RBC Capital Markets | Scotiabank GBM London Business School

Dartmouth College

Kevin Zhou 2013 Long Arc Capital | Goldman Sachs Cambridge University

Georgetown University

Kevin Gryp 2013 Steadfast Financial | Silver Lake Partners University of Oxford

UC Berkeley

Feroz Qayyum 2013 Pershing Square | Evercore Newcastle University

UCLA

Lewis Peattle 2013 Bain & Company HEC Paris

Carnegie Mellon

Ivan Di 2014 Onex | RBC Capital Markets EDHEC Business School

John Hopkins University

Mak Doric 2014 Goldman Sachs IE Business School

California Polytechnic State University

Emily Ren 2014 HarbourVest Partners | RBC Capital Markets University of Melbourne

University of San Diego

Nicholas Bigelow 2014 Birch Hill | CIBC World Markets State University of New York

Patrick Fong 2015 TPG Global | Evercore Florida International University

Ryan Liu 2015 Google | Evercore National University of Singapore

University of Wisconsin-Madison Chulalongkorn University

Ryan Yaraghi 2015 Searchlight Capital | Evercore Ohio State University

Stephen Caputo 2015 Barclays Peking University

Nolan Lypka 2016 Moelis | BMO Capital Markets University of Hong Kong

University of Western Ontario Chinese University of Hong Kong

Olivier Babin 2016 Goldman Sachs | National Bank Financial McGill University

Stephen Toth 2016 Barclays City University of Hong Kong

Queen’s University

Immanuel Palugod 2016 PJT Partners | Blackstone University of Toronto

Luis Spradley 2016 Apollo | Moelis HEC Montreal Indian School of Business

Michael Brown 2017 RBC Capital Markets University of Waterloo Indian Institute of Management

Christy Ma 2017 RBC Capital Markets | CIBC Capital Markets McMaster University Putra Business School

Eric Van Hees 2018 Evercore | RBC Capital Markets Wilfred Laurier University IPADE Business School

Tejas Saggi 2018 PJT Partners | CPPIB Concordia University Universidad de Los Andes

Emilie Granger 2018 Houlihan Lokey | RBC Capital Markets Ryerson University University of Ljubljana

Kyle Costanzo 2018 Liontree Advisors | J.P. Morgan

National Investment Banking Competition 2009-2020 6

Corporate Participation

Professionals and recruiters from top tier firms help adjudicate the competition every year

Past Participating Firms

National Investment Banking Competition 2009-2020 7

Speakers

Many business leaders and finance executives have attended NIBC to speak to competitors

Past Keynote Speakers

Frank Giustra Noah Wintroub Ian Telfer

Founder & CEO Vice Chairman, IB Chairman

Darren Throop David Rawlings Don Lindsay

President & CEO CEO, Canada President & CEO

Robert Herjavec W. Brett Wilson Randy Smallwood

Panelist & Entrepreneur Co-Founder & Chairman President & CEO

Michele Romanow Derek Neldner Clive Johnson

Panelist & Entrepreneur Global Head, IB President & CEO

Peter Brown Patrick Meneley Jill Leversage

Founder & Chairman Global Head, IB Regional Head, IB

Tracey McVicar Kathy Butler Ryan Voegeli

Global Head Head, Western Canada IB Head, Telecom & Diversified

Fraser Hall Egizio Bianchini Curt Sigfstead

Co-Founder & Chairman Vice Chairman, IB Co-Head, Technology IB

David Trujillo Paul Donnelly Carrie Cook

Head, New Media CEO, Canada Managing Director

National Investment Banking Competition 2009-2020 8

Board Support

NIBC draws on the support of senior investment banking and private equity executives

Board Members & Industry Experience Case & Oversight Committee

Tracey McVicar Kathy Butler Chris Tsoromocos Philip Chua Noam Gilead

CAI CIBC Trafalgar Partners Macquarie J.P. Morgan

Private Equity World Markets Stern Partners UBS Vice President

Managing Partner Managing Director CIBC

Managing Director

Chair

Board Member Board Member Board Member Case & Oversight Board Member

Harry Pokrandt Rizvan Dhalla Jordan Anderson David Lam Haroon Chaudhry

Hive Blockchain Morgan Stanley bcIMC Macquarie Capital BMO Capital

Espresso Capital Managing Director Portfolio Manager Associate Markets

Macquarie Vice President

TD Securities

Board Member Board Member Board Member Board Member Board Member

Tim Vipond Michael Scott Dipak Kamdar Gint Austrins Charles Wong

Corporate RBC Capital Google Global Securities Canaccord

Finance Institute Markets Manager Equity Analyst Genuity

CEO Director UBS HSBC

McKinsey & Co

CIBC

Board Member Board Member Board Member Board Member Board Member

Amardeep Chandi Brenden Lee Martin Haakonsen Nicole Ponto Olya Kubliy

Singh Capital Oaktree TD Securities Jefferies RBC Capital

KKR Evercore Analyst Markets

Fund Manager Analyst

Board Member Board Member Board Member Board Member Board Member

National Investment Banking Competition 2009-2020 9

Authentic Cases

The cases studies are based on current market information and authentic transaction scenarios

Selected Past Case Topics

Apparel Mining Gaming Film Telecom Video Games OTT Streaming Luxury Fashion

Valuation Acquisition Financing Restructuring Acquisition Acquisition Merger Acquisition Merger

Case Materials (2015 Sample Final Round Case)

Information package with key information and relevant data on EA and Take-Two

Fully-built Excel model with pre-set variable inputs and pre-formatted summary outputs

Director memo from "transaction director" suggesting sequence of analysis and topics of slides

Model Inputs Model Outputs

Grand Theft Auto (Take-Two)

Premium over Share Price Sensitivities on Forecast Levered/Unlevered IRR and NPV

Earn-out on Sales / EBITDA Proportion of Shares versus Cash EPS Accretion / Dilution

Size and Timing of Synergies Interest Rate on Corporate Debt Net Debt to EBITDA Ratio

Research Concepts Assigned to Competitors

Strategic & Financial Rationales for M&A Stock Versus Cash Consideration

Valuation and Stock Price Impact Deferred Payment Structures

Accretion / Dilution, IRR and NPV Metrics Board and Shareholder Approvals

Synergies and Operational Efficiencies Management Incentives and Retention FIFA (Electronic Arts)

Levered Financing Structures and Debt Metrics Bid Security and Price Protection Mechanisms

National Investment Banking Competition 2009-2020 10

Video Tutorials Library

NIBC has created a training portal to help competitors develop all of the required skills

Content Trailer Resume Writing Pitchbooks Case Templates

Training Series | Preview Valuation Example | Watch

The NIBC Live video portal provides video

Training Series tutorials & templates to competitors in the

Video tutorials by professionals on concepts

National Investment Banking Competition.

applied in investment banking

Graduate & undergraduate students may

Corporate Finance RESEARCH sign up teams of 2-4 students. Upon

TRANSACTIONS

registering for the First Round, competitors

PITCHBOOKS

MODELLING TIPS

can access NIBCLive.com.

BEST PRACTICES

A selection of clips can be viewed under the

Interview Training links provided.

Interview Interview 50 model answers to most frequent

investment banking interview questions

INTERVIEW ANSWERS

ONE-PAGE SUMMARY

PRACTICE INTERVIEWS Download

Fireside Chat Industry Insights

Presentations by NIBC board members,

keynote speakers & past winners

NIBC INTERVIEWS

KEYNOTES & DEAL PRESENTATIONS

Winning Team INDUSTRY PANELS

National Investment Banking Competition 2009-2020 11

Select Venues

NIBC has hosted the competition in some of the most beautiful hotel & conference venues

PAN PACIFIC – SHANGRI-LA – HYATT – DRAI’S

NIBC 2009 - 2020 |

National Investment Banking Competition 2009-2020 12

Organizing Team

Operations Competition Team Conference Team Case Team Marketing Team

James Maori Brandon Eric Eric Nina Tennille Viktoriya Izabella Mehtaab Ayush Brett Shaurab Angela Alan

Huang Hayashi Jao Hall Norman Erdevicki Robertson Tsurikova Shalygina Chandi Paliwal Hennessey Hamal Co Yang

Team Member Responsibilities Compl. Experience & Extracurricular Achievements

James Huang Director, Corporates 2020 Macquarie Capital | Blair Franklin Capital Partners | ACIIC UBC Chapter

Maori Hayashi Director, Operations 2020 Citigroup (Tokyo) | M&A Cloud | Longbow Consulting

Brandon Jao Associate, Operations 2021 Mackenzie Investments | 3rd Place in JDC West Athletics

Eric Hall Director, Competition 2020 HSBC GBM (Hong Kong) | Pan American Jiu-Jitsu Competitor / 1st Place BC Provincials

Eric Norman Manager, Training 2020 BMO Capital Markets | Canalyst | Character Capital

Nina Erdevicki Manager, Conference 2021 Gravitas Securities | 1st in BC & 7th in Canada in Women’s Tennis

Tennille Robertson Director, Conference 2020 Canaccord Genuity | Founder of Events Media Group

Viktoriya Tsurikova Director, Events 2020 Internal Controller at Longbow Consulting | 1st in Regional Horse Ridding & Russian National Contest

Izabella Shalygina Manager, Conference 2019 Assistant Manager at Pandora | Recipient of Russian National Government Award

Mehtaab Chandi Director, Case 2021 MvC Capital | 1st Place in UBCFA Portfolio Management Competition

Ayush Paliwal Associate, Case 2021 BCI | WestPeak Research | Analyst at Sell Side Handbook

Brett Hennessey Associate, Conference 2022 Mackenzie Investments | Multidiscipline Provincial Medallist in Track and Field

Shaurab Hamal Director, Marketing 2021 Grosvenor Group | Strategic Exits | 2x BC Soccer Champion

Angela Co Manager, Conference 2021 Philippine National Bank | Fund Development Manager at UBC Enactus

Alan Yang Associate, Conference 2022 Deloitte | Four-time Volleyball Provincial Medalist

National Investment Banking Competition 2009-2020 13

Global Organizing Team Network

Year Work Experience Year Work Experience

Philip Chua 2010 Macquarie Capital | UBS Investment Bank Leanne Li 2015 Scotiabank | HSBC

Amardeep Chandi 2010 Caspian Capital | KKR | Morgan Stanley Juliet Zhu 2015 HSBC | Silicon Valley Bank

Dipak Kamdar 2010 Google | McKinsey & Co. | RBS Sandra Woo 2015 TD Securities | AGF Investments

Jenny Hu 2010 McKinsey | Partnerships BC Clarabel Luk 2015 PwC | Wesgroup Properties

Noam Gilead 2010 JP Morgan | RBC Global Asset Management Soroush Karimzadeh 2015 Novarc Technologies | Andritz

Gint Austrins 2011 Global Securities | UBS Investment Bank Jennifer Jordache 2015 Connor, Clark & Lunn | CPPIB | BAML

Jacky So 2011 Barclays | BAML Karsten Lee 2015 BMO Capital Markets | GMP FirstEnergy

Sean B. McNulty 2011 JP Morgan | CIBC Capital Markets Hovy Qiu 2015 GF Capital | Canalyst

Jose A. Gonzalez 2011 Citigroup | Leith Wheeler Nicole Ponto 2015 Jefferies | CIBC Wood Gundy

Katherine Barends 2011 PwC | CIBC Wood Gundy Olya Kubliy 2016 RBC Capital Markets | National Bank

Martin Eston 2011 Morgan Stanley | RBC Capital Markets Joseph Liu 2016 Fulcrum Capital | Tricor Pacific Capital

Carl F. Stange 2012 SEB Investment Bank | Morgan Stanley Lucien Lu 2016 Ardenton Capital | IVEST Consumer Partners

Jessica Zhang 2012 Houlihan Lokey | BAML

Jonathan Young 2016 BMO Capital Markets | RBC GAM

Amelia Lak 2012 Goldman Sachs | RBC Capital Markets

Jamie Farrell 2016 Macquarie Capital | BCI

Sara Keng 2012 TD Securities | CIBC Capital Markets

Jessica Ljustina 2016 RBC Capital Markets

Andra Bosneaga 2012 Birch Hill | CIBC Capital Markets

Martin Haakonsen 2012 Arctic Securities | TD Securities Josh Dogor 2016 CPPIB | OTPP

Vina Yiu 2012 BAML | Morgan Stanley Cameron Strukoff 2017 Scotiabank GBM | Morgan Stanley

Terence Kwan 2012 Golden Gate Capital | Bridgewater William Liaw 2017 Goldman Sachs | Barclays

David Lam 2013 Macquarie Capital | GE Capital Mathilde Ho 2017 Scotiabank GBM | Canalyst

Brenden Lee 2013 Oaktree Capital | Evercore Matheus Sampaio 2017 Scotiabank GBM

Jasmin Kirk 2013 Lane Crawford | Rabobank Alexander Qu 2017 RBC Capital Markets | Macquarie Capital

John Sanden 2013 Connor, Clark & Lunn | RBC Capital Markets Ali Geum 2017 CIBC Capital Markets | Canalyst

Charles Wong 2013 Ondra Partners | Canaccord Genuity Sofiia Salimova 2017 Canaccord Genuity | Catalyst Capital

Carmen Chan 2013 Citi | Global Securities Beca Yin 2017 Scotiabank | HSBC GBM

Piper Hoekstra 2013 Connor, Clark & Lunn | CIBC Capital Markets Valerie Tsui 2018 BMO Financial Group | Canaccord Genuity

Derek Dodd 2013 Anchorage Capital Group | KKR Prithvi Khanna 2018 CIBC Capital Markets | OTPP

Jennifer Liu 2013 Ares | Goldman Sachs James Huang 2018 Macquarie Capital | Blair Franklin Capital

Garrett Clyne 2014 DW Healthcare Partners | TD Securities Eric Hall 2018 HSBC GBM | Deloitte

Louisa Yeung 2014 Deloitte M&A Advisory | TD Securities Tennille Robertson 2018 Canaccord Genuity

McKenzie Milhousen 2014 Morgan Stanley | Goldman Sachs Nina Erdevicki 2018 Gravitas Securities

Taylor Carkner 2014 National Bank | BMO Capital Markets Shaurab Hamal 2018 Grosvenor Group | Strategic Exits

Chris Wong 2015 Lululemon | BMO Capital Markets Mehtaab Chandi 2018 MvC Capital

Nicole Dee 2015 Cadian Capital | Goldman Sachs Maori Hayashi 2018 Citigroup | M&A Cloud

National Investment Banking Competition 2009-2020 14

Competition & Case Examples

VANCOUVER TORONTO NEW YORK

National Investment Banking Competition 2009-2020 15

First Round Components

Case Materials & Preparation Resources Expectations & Evaluation

After signing up a team, competitors can access online Submissions are graded against industry standard models

resources to develop investment banking skills and prepare for ✓ & pitchbooks prepared by professionals for each case

the competition

FIRST ROUND | Case Deliverables

Industry Primers Valuation & Strategic Review Presentation

Key Characteristics, Competitive Analysis Company & Industry Overview

Business & Operating Model

Model Templates Industry & Competitive Analysis

DCF, Comps, Precedents, LBO, Transaction Model*

Liquidity & Capital Requirements

Technical Instructions Valuation Analysis

Based on Fully-Completed Case Solutions by Professionals

Share Price Analysis

Pitchbook Instructions Trading Comparables

Detailed Outline, Sample Pitchbooks, Past Finalist Videos Precedent Transactions

Discounted Cashflows

Research Guides Leveraged Buyout

Recommended Sources for Information & Data Corporate Finance

Career Resources Capital Raising

Practical Insights on Application Process & Interviews M&A, Divestitures

Valuation Model

Outputs & Assumptions Summary

Discounted Cashflows

Trading Comparables

Precedent Transactions

Video

*Final Tutorials

Round Case Templates Interviews Leveraged Buyout

National Investment Banking Competition 2009-2020 16

Final Round Itinerary

Day 1 - Wednesday (Mar 13th, 2019) Day 1: Case Resolution (Hotel Rooms)

Each finalist team is given 6-8 hours to prepare a pitchbook working

Case Resolution in a dedicated hotel room. Teams will be provided with a scenario-

enabled financial model, datasets and charts.

*Boardroom Presentations

Day 1: Boardroom Presentations (Sponsor Offices)

*Competitor Reception

8 teams will present in each boardroom with seasoned bankers

Day 2 – Thursday (Mar 14th, 2019) adjudicating the presentations. The top teams will be advanced to the

semi-final round held the following day at the hotel.

Refreshments

Day 1: Competitor Reception (Reception Venue)

Opening Keynote Competitors will have an opportunity to network with judges after the

Investment Banking Deal Presentation boardroom presentation with food & drinks being served in the hotel

ballroom throughout the evening.

Investment Banking Q&A Panel

Day 2: Panels & Deal Presentations (Hotel Ballroom)

Lunch Break

Executives will be sharing insights on marquee deals in addition to

Sector Market Update industry professionals taking questions from conference guests on

buyside & sellside career panels.

Buyside Deal Presentation

Day 2: Wine & Cheese and Gala Dinner (Hotel Ballroom)

Buy-Side Q&A Panel

Over 100 professionals will be at the Wine & Cheese and Gala

*Wine & Cheese Networking Dinner, which features a gala dinner keynote and senior managing

director panel adjudicating the finalist teams.

*Gala Dinner Keynote & Final Round

Day 2: Evening Event (Night Venue)

*Evening Event

Conference guests will be invited to attend an evening event held in

Day 3 – Friday (Mar 15th, 2019) a high-end establishment the heart of downtown Vancouver.

*Group Interviews Day 3: Interviews and Reception (Reception Venue)

Select conference guests will be invited to attend interviews with

*Reception professionals and recruiters. Please note the number of invites will

be limited based on performance in the case simulation.

* Designates professional involvement

National Investment Banking Competition 2009-2020 17

Electronic Arts / Take Two Example

High Valuation & Lagging M&A Cost Control High Share Strengthen

Low Profits

Market Leadership AAA Titles & Strategy & Strong Price & Core Console

& Strong

in Video Games Customer into Mobile Financial Valuation Segment

Competition

(Console) Reviews & Online Performance Multiple through TTWO

2008: Financial 2012-2013: EA faces some critical 2014: Good performance Titles: TTWO would

crisis resulted in poor consumer reviews for slow in traditional core provide EA with most

performance for product releases and excessive franchises with FIFA 14 successful open world role

global publishers charges for add-on content and Battlefield play franchise GTA and

other valuable franchises

Growth: TTWO is a

growth company and GTA

franchise has untapped

potential which matches

EA's current stock profile

Market Share: Combined

with TTWO, EA would

reclaim its #1 position in

console segment and

overall games markets

Asia: EA may take

advantage of TTWO’s

relationships in Asia to

expand outside of core

North American market

2009-2011: Acquisitions of 2012: Star Wars: The Old 2014: Cost reductions

Accretion: 2018 accretion

PopCap Games and Republic falls short of being and shift to digital

of 3.7% to 13.2% possible

Playfish allowed EA to a major game-changer delivery led to EBITDA

based on synergies from

increase revenue mix to despite an estimated $500m margin +42% YoY in

shared overhead

45% digital budget 2014

National Investment Banking Competition 2009-2020 18

Appendix – Case Examples

National Investment Banking Competition 2009-2020 19

Appendix – Case Examples

National Investment Banking Competition 2009-2020 20

Past Events & Photo Highlights

VANCOUVER TORONTO NEW YORK

National Investment Banking Competition 2009-2020 21

Event Photo Highlights

Spring 2019 Opening Industry Address

Global Head of Investment Banking, RBC

Derek Neldner Derek Neldner is Head of Global Investment Banking at RBC Capital Markets. Mr. Neldner

has oversight for the firm’s investment banking practices in Canada, the U.S., Europe and

the Asia Pacific region, and has senior client coverage responsibility for a number of RBC

Capital Markets’ most important corporate clients. Mr. Neldner is a member of the firm’s

Operating Committee, the Loan Commitments Committee and the M&A Opinion Review

Committee. He is also a board member of The Hospital for Sick Children (SickKids)

Foundation and is a member of the Major Individual Giving campaign cabinet for the United

Way of Toronto & York Region. Mr. Neldner holds a Bachelor of Commerce degree in

Finance from the University of Alberta and holds the Chartered Financial Analyst

designation.

Day 1 – Wednesday (March 13th, 2019)

6am – 5pm M&A Resolution and Boardroom Presentations

6pm – 9pm Opening Reception

N I B C 1 0 - Ye a r A n n i v e rs a r y

Day 2 – Thursday (March 14th, 2019)

8am – 9am Refreshments

9am – 10am RBC Presents: Opening Industry Address

10am – 11am CIBC Presents: Aritzia IPO & Selldown

11am – 12am JP Morgan Presents: IB Panel

12pm – 2pm Lunch Break

2pm – 3pm Blackstone Presents: PE Panel

VANCOUVER TORONTO NEW YORK

3pm – 4pm BMO Presents: Client Perspectives

4:30pm – 5:50pm Intralinks Presents: Wine & Cheese

5:50pm – 9pm Gala Dinner and M&A Presentations

10pm – 12am Blakes Presents: Evening Event

Day 3 – Friday (March 15th, 2019)

1pm – 3pm Industry Networking & Interviews

National Investment Banking Competition 2009-2020

Aritzia IPO & Selldown Client Perspectives

Lead Underwriter & Regional Head, CIBC President & CEO, Wheaton Precious Metals

Kathy Butler Kathy inButler is a Managing Director and Regional Head of CIBC Capital Markets. She R. Smallwood Randy Smallwood is the President & CEO of Wheaton Precious Metals which is traded on

Joined the firm 20 years ago and has been involved numerous mergers & acquisitions and the NYSE with a market capitalization of close to $11bn as of March 2019. Wheaton was

debt and equity financings for clients in technology, telecom and consumer retail. Ms. the world’s most valuable public company per employee with 24 full-time employees. Mr.

Butler is on the board of CIBC World Markets Inc., CIBC Children’s Foundation and St. Smallwood holds a geological engineering degree from the University of British Columbia,

George’s Foundation and a Partner of Social Venture Partners Vancouver. She represented and a mine engineering diploma from the British Columbia Institute of Technology. He was

the tech industry on the BC Jobs and Investment Board and is currently on the Board of involved in the founding of Wheaton Precious Metals and joined Wheaton full time in 2007

Governors of the Business Council of British Columbia. She holds an MBA (Honours) from and was appointed President in 2010 and Chief Executive Officer in 2011. Prior to that Mr.

the Rotman School of Management at the University of Toronto and a Bachelor of Smallwood was an instrumental part of the team that built Wheaton River / Goldcorp into

Commerce in Finance (Honours) from the Sauder School of Business at the University of one of the largest, and importantly, most profitable gold companies in the world.

British Columbia.

Randy John Mark Haroon

Smallwood DeCooman Tiberio Chaudhry

President & CEO Senior Vice President Vice President Vice President

Wheaton SSR TD BMO

Precious Metals Mining Securities Capital Markets

Investment Banking Panel Private Equity Panel

JP Morgan, New York Blackstone, New York

Noam Samuel Jessica Jeffrey Samantha Erica Sam Ralph Joanne Ashton Syed

Gilead Johnson Zhang Feng Wu Seidel Young Yang Gutwinski Herriott Ahmad

Vice President Analyst Associate Analyst Analyst Vice President Senior Associate Associate Associate Director Associate

New York Calgary London San Francisco New York New York New York New York New York Vancouver Victoria

National Investment Banking Competition 2009-2020 23

Event Photo Highlights

Gala Dinner (Pan Pacific)

National Investment Banking Competition 2009-2020 24

Event Photo Highlights

Conference Panelists (Pan Pacific)

National Investment Banking Competition 2009-2020 25

Event Photo Highlights

Final Round (Hyatt Toronto)

National Investment Banking Competition 2009-2020 26

Event Photo Highlights

Wine

Conference

& Cheese

(Hyatt

(Shangri-La)

Toronto)

National Investment Banking Competition 2009-2020 27

Event Photo Highlights

Opening

Conference

Reception

(Hyatt

(Former Drai’s)

Toronto)

National Investment Banking Competition 2009-2020 28

Event Photo Highlights

Organizing Team & Keynotes

Michele Romanow & NIBC Team Robert Herjavec & NIBC Team

Darren Throop & NIBC Team Frank Giustra | Brett Wilson & NIBC Team

David Rawlings & NIBC Team Peter Brown & NIBC Team

National Investment Banking Competition 2009-2020 29

Canadian Origin

Selected Participating Canadian Schools

Western

Canada

Western Eastern

Eastern

Canada Canada

Canada

Eastern

Eastern

Canada

Canada

Target Competition Participation Geographic Distribution Academic Distribution

Other

1% Undergraduate 61%

Universities 100

EU Western

14% CAD Year 3

11%

Year 2

Competitors 1,600 Eastern

CAD

Asia

22% Year 1 Year 4

18%

Competing Teams 400 US MBA MBA 39%

Western 34%

Canada

National Investment Banking Competition 2009-2020 30

International Footprint

Selected Participating American Schools

Selected Participating International Schools

National Investment Banking Competition 2009-2020 31

Potrebbero piacerti anche

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDa EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNessuna valutazione finora

- CLO Investing: With an Emphasis on CLO Equity & BB NotesDa EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNessuna valutazione finora

- Exam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesDa EverandExam Prep for:: Business Analysis and Valuation Using Financial Statements, Text and CasesNessuna valutazione finora

- WST University Training MALBODocumento5 pagineWST University Training MALBOJason ToopNessuna valutazione finora

- OilGas Intro PDFDocumento18 pagineOilGas Intro PDFKoray YilmazNessuna valutazione finora

- INSEAD - Master in FinanceDocumento25 pagineINSEAD - Master in FinanceJM KoffiNessuna valutazione finora

- Equity Research Interview Questions PDFDocumento5 pagineEquity Research Interview Questions PDFAkanksha Ajit DarvatkarNessuna valutazione finora

- Vault Guide PEDocumento155 pagineVault Guide PENéné Oumou BARRYNessuna valutazione finora

- Critical Financial Review: Understanding Corporate Financial InformationDa EverandCritical Financial Review: Understanding Corporate Financial InformationNessuna valutazione finora

- Bloomberg Investing ManualDocumento21 pagineBloomberg Investing Manualpicothiam100% (2)

- TTS - LBO PrimerDocumento5 pagineTTS - LBO PrimerKrystleNessuna valutazione finora

- Merger Arbitrage: A Fundamental Approach to Event-Driven InvestingDa EverandMerger Arbitrage: A Fundamental Approach to Event-Driven InvestingValutazione: 5 su 5 stelle5/5 (1)

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsDa EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNessuna valutazione finora

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondDa EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNessuna valutazione finora

- 50 AAPL Buyside PitchbookDocumento22 pagine50 AAPL Buyside PitchbookZefi KtsiNessuna valutazione finora

- VFC Meeting 8.31 Discussion Materials PDFDocumento31 pagineVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNessuna valutazione finora

- Wall Street Prep Premium Exam Flashcards QuizletDocumento1 paginaWall Street Prep Premium Exam Flashcards QuizletRaghadNessuna valutazione finora

- M&a Interview QuestionsDocumento1 paginaM&a Interview QuestionsJack JacintoNessuna valutazione finora

- How To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldDocumento12 pagineHow To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldLindsey SantosNessuna valutazione finora

- Axial - 7 MA Documents DemystifiedDocumento23 pagineAxial - 7 MA Documents DemystifiedcubanninjaNessuna valutazione finora

- Goldman Sachs IB Summer Analyst ProgramDocumento6 pagineGoldman Sachs IB Summer Analyst ProgramSandra DeeNessuna valutazione finora

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesDa EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesValutazione: 5 su 5 stelle5/5 (1)

- Merger Model Sample BIWS JobSearchDigestDocumento7 pagineMerger Model Sample BIWS JobSearchDigestCCerberus24Nessuna valutazione finora

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKDa EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNessuna valutazione finora

- Capital Structure A Complete Guide - 2020 EditionDa EverandCapital Structure A Complete Guide - 2020 EditionNessuna valutazione finora

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresDa EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNessuna valutazione finora

- Summary of Joshua Rosenbaum & Joshua Pearl's Investment BankingDa EverandSummary of Joshua Rosenbaum & Joshua Pearl's Investment BankingNessuna valutazione finora

- LEK - Valuation TechniquesDocumento42 pagineLEK - Valuation TechniquesCommodityNessuna valutazione finora

- Blackstone - A Primer For Today's Secondary PE Market - Fall 2017v7Documento18 pagineBlackstone - A Primer For Today's Secondary PE Market - Fall 2017v7zeScribdm15Nessuna valutazione finora

- Consolidated Interview Questions (IB) PDFDocumento7 pagineConsolidated Interview Questions (IB) PDFEric LukasNessuna valutazione finora

- Investment Banking Preparation Week 1Documento12 pagineInvestment Banking Preparation Week 1daniel18ctNessuna valutazione finora

- Finance Placement Preparation GuideDocumento14 pagineFinance Placement Preparation GuideYash NyatiNessuna valutazione finora

- Financial Fine Print: Uncovering a Company's True ValueDa EverandFinancial Fine Print: Uncovering a Company's True ValueValutazione: 3 su 5 stelle3/5 (3)

- Technical Interview Questions - IB and S&TDocumento5 pagineTechnical Interview Questions - IB and S&TJack JacintoNessuna valutazione finora

- Quantitative Analytics in Debt Valuation & ManagementDa EverandQuantitative Analytics in Debt Valuation & ManagementNessuna valutazione finora

- Middle Market M & A: Handbook for Investment Banking and Business ConsultingDa EverandMiddle Market M & A: Handbook for Investment Banking and Business ConsultingValutazione: 4 su 5 stelle4/5 (1)

- Elevator Pitch DraftDocumento2 pagineElevator Pitch DraftJack JacintoNessuna valutazione finora

- How To Prepare For An Asset Management Interview - Online Version2 PDFDocumento11 pagineHow To Prepare For An Asset Management Interview - Online Version2 PDFGuido FranchettiNessuna valutazione finora

- Piper Jaffray - US LBO MarketDocumento40 paginePiper Jaffray - US LBO MarketYoon kookNessuna valutazione finora

- Investment Banking Interview Question 1565173573 PDFDocumento19 pagineInvestment Banking Interview Question 1565173573 PDFONKAR BHAGATNessuna valutazione finora

- TBO M&a QuestionsDocumento2 pagineTBO M&a Questionsowen sherryNessuna valutazione finora

- WetFeet I-Banking Overview PDFDocumento3 pagineWetFeet I-Banking Overview PDFNaman AgarwalNessuna valutazione finora

- Ibig 04 08Documento45 pagineIbig 04 08Russell KimNessuna valutazione finora

- LBO Valuation Model PDFDocumento101 pagineLBO Valuation Model PDFAbhishek Singh100% (3)

- Lecture 5 - A Note On Valuation in Private EquityDocumento85 pagineLecture 5 - A Note On Valuation in Private EquitySinan DenizNessuna valutazione finora

- How to Invest in Structured Products: A Guide for Investors and Asset ManagersDa EverandHow to Invest in Structured Products: A Guide for Investors and Asset ManagersNessuna valutazione finora

- Elliott Management's BMC PresentationDocumento36 pagineElliott Management's BMC PresentationDealBookNessuna valutazione finora

- Asian Financial Statement Analysis: Detecting Financial IrregularitiesDa EverandAsian Financial Statement Analysis: Detecting Financial IrregularitiesNessuna valutazione finora

- Fortress Investment GroupDocumento8 pagineFortress Investment GroupAishwarya Ratna PandeyNessuna valutazione finora

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisDa EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNessuna valutazione finora

- J-Curve Exposure: Managing a Portfolio of Venture Capital and Private Equity FundsDa EverandJ-Curve Exposure: Managing a Portfolio of Venture Capital and Private Equity FundsValutazione: 4 su 5 stelle4/5 (1)

- 7 Secrets of Structured Synergy: Optimizing M&As, Alliances and Strategic PartnershipsDa Everand7 Secrets of Structured Synergy: Optimizing M&As, Alliances and Strategic PartnershipsNessuna valutazione finora

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsDa EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNessuna valutazione finora

- Active Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsDa EverandActive Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsNessuna valutazione finora

- Behavioral Questions: Preparation For Finance InterviewsDocumento63 pagineBehavioral Questions: Preparation For Finance InterviewsNicole GiacaloneNessuna valutazione finora

- Networking WSODocumento14 pagineNetworking WSOladyjacket420% (1)

- FinClub - 57th Batch Interview Question BankDocumento16 pagineFinClub - 57th Batch Interview Question BankAKSHAY PANWARNessuna valutazione finora

- Geojit Financial Services LTD.,: Pay Slip - July 2019Documento1 paginaGeojit Financial Services LTD.,: Pay Slip - July 2019sanjit deyNessuna valutazione finora

- Bill 20100202184032 2795583Documento1 paginaBill 20100202184032 2795583cynthiaemmaNessuna valutazione finora

- VP Marketing Communications Brand Management in Hartford CT Resume Christine FitzgeraldDocumento2 pagineVP Marketing Communications Brand Management in Hartford CT Resume Christine FitzgeraldChristineFitzgeraldNessuna valutazione finora

- Banks - Sector Update - 16 Nov 23Documento8 pagineBanks - Sector Update - 16 Nov 23krishna_buntyNessuna valutazione finora

- IncotermsDocumento31 pagineIncotermsYogie Ariyadi SupriyatmanNessuna valutazione finora

- TABathroom Price ListDocumento12 pagineTABathroom Price ListMuhammad Atique MabNessuna valutazione finora

- IRS Audit Guide For FarmersDocumento83 pagineIRS Audit Guide For FarmersSpringer Jones, Enrolled AgentNessuna valutazione finora

- PDFDocumento9 paginePDFRajeshNessuna valutazione finora

- Gallagher InroductionDocumento16 pagineGallagher InroductionAnkit BalapureNessuna valutazione finora

- Reseach Report On Impact of Reward System On Motivational Level of Employee in HDFC Bank Branch in VaranasiDocumento76 pagineReseach Report On Impact of Reward System On Motivational Level of Employee in HDFC Bank Branch in VaranasiAbhishek Singh Raghuvanshi100% (1)

- RO11BRMA0999100059748310MT940Documento60 pagineRO11BRMA0999100059748310MT940Cristina CobzaruNessuna valutazione finora

- Research Proposal On Corporate GovernanceDocumento12 pagineResearch Proposal On Corporate GovernanceOlabanjo Shefiu Olamiji60% (5)

- Financial - Education - Workbook-VIII (R) - 220924 - 083544Documento15 pagineFinancial - Education - Workbook-VIII (R) - 220924 - 083544No oneNessuna valutazione finora

- Company Profile - Quebral Diaz & Co.Documento6 pagineCompany Profile - Quebral Diaz & Co.Achie DennaNessuna valutazione finora

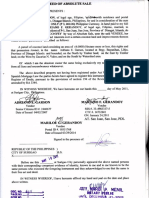

- Deed of Absolute SaleDocumento1 paginaDeed of Absolute SaleMariano GerandoyNessuna valutazione finora

- List+No 347+update+Available+BGs, MTNS, CDs+&+BONDsDocumento15 pagineList+No 347+update+Available+BGs, MTNS, CDs+&+BONDsJuan Pablo ArangoNessuna valutazione finora

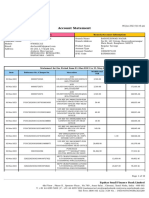

- Account Statement 15-02-2023T18 26 39Documento2 pagineAccount Statement 15-02-2023T18 26 39Younas KhanNessuna valutazione finora

- 4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)Documento6 pagine4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)winstons2311Nessuna valutazione finora

- This ForDocumento2 pagineThis ForChapter 11 DocketsNessuna valutazione finora

- Retail LoansDocumento3 pagineRetail LoansMonisha Bhatia0% (1)

- Letter To Car LoanDocumento3 pagineLetter To Car Loanfreetradezone100% (4)

- Bank of America Case SolutionDocumento7 pagineBank of America Case SolutionSAMBIT HALDER PGP 2018-20 BatchNessuna valutazione finora

- NiyoX-Statementl-01Mar23 To 31may23 Ep1ct3m8Documento10 pagineNiyoX-Statementl-01Mar23 To 31may23 Ep1ct3m8Devharsh ToshniwalNessuna valutazione finora

- FDIC Core Deposits White PaperDocumento18 pagineFDIC Core Deposits White PaperDouglas FunkNessuna valutazione finora

- TNM Yangon Telenor House, No. 40, Sattmu (1) Road Myanmar: NotesDocumento1 paginaTNM Yangon Telenor House, No. 40, Sattmu (1) Road Myanmar: NotesRon LeeNessuna valutazione finora

- Cu Profile 24299Documento11 pagineCu Profile 24299Odel KabristanteNessuna valutazione finora

- Halifax StatementDocumento4 pagineHalifax StatementSW ProjectNessuna valutazione finora

- Tijara CaseDocumento5 pagineTijara CaseHammad Ahmad0% (1)

- TRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDocumento302 pagineTRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchNessuna valutazione finora

- Substantive Tests123Documento3 pagineSubstantive Tests123Ryan TamondongNessuna valutazione finora