Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Matrik Fraud Mindmap WildanR 120620190008

Caricato da

Wildan RahmansyahCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Matrik Fraud Mindmap WildanR 120620190008

Caricato da

Wildan RahmansyahCopyright:

Formati disponibili

Universitas Padjadjaran Bandung

TUGAS METODOLOGI PENELTIAN

Dosen : Ersa Tri Wahyuni, S.E., M.Acc., CPMA, Ph.D

UNPAD

Universitas

NAMA : WILDAN RAHMANSYAH TOPIK : FRAUD Padjadjaran

NPM : 120620190008

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

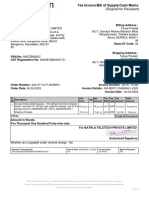

1 Kummer, T.- Managerial The effectiveness of Data were obtained from an The findings provide valuable insights into Fraud risk assesments, Fraud risk Australia Webster’s Dictionary (2001, p. 380) defines fraud as “[…] the Survey

F., Singh, K., Auditing fraud detection NFP fraud survey conducted in understanding fraud detection mechanisms. register, code of conduct, fraud and New multifarious means which human ingenuity can devise, which

& Best, P. Journal, 30(4/5), instruments in not- Australia and New Zealand. A Although most fraud detection measures may awareness training, whistleblowers Zealand are resorted to by one individual, to get an advantage over

(2015). 435–455. for-profit set of contingency tables is not lead to more fraud detection, three highly policy, fraud control plan, fraud control another by false representations”

organizations produced to explore the effective instruments emerge, namely, fraud policy, internal controls review, no The three key elements of fraud triangle theory are pressure

(an un-shareable need), rationalization (of personal ethics)

and opportunity (lack of adequate controls and knowledge to

commit a fraud. All three must be present for a

fraud to be perpetrated (Cressey, 1950).

The Association of Certified Fraud Examiners (ACFE) further

defines occupational fraud as, “[…] the use of one’s

occupation for personal enrichment through the deliberate

misuse or misapplication of the employing organization’s

resources or assets” (ACFE, 2012, p. 6)

2 Krambia‐Kap Journal of A fraud detection The paper first provides a that irregularity-prone companies are Fraud Risk assesments. Cyprus and Australian Accounting Research Foundation, Auditing ROP Fraud Risk

ardis, M. Financial model: A must for critique of existing fraud characterised by a lack of an effective internal Australia Standards Board (AuSB) (1995) ‘Auditing Standard AUS 210: Assessment

(2002) Regulation and auditors aetiology models and then control, system and the absence of a code of Irregularities, including fraud, other illegal acts and errors’, Model, EFD

Compliance, describes the ROP Fraud Risk- conduct. This finding is not surprising when it Australian Accounting Research Foundation, Caulfield, Model,

10(3), 266–278. Assessment Model constructed is remembered that 76 per cent of the Victoria-Irregularities such as fraud that result in a materially Albrecht,

by the author in a study of companies where management fraud had misstated financial report are of particular interest to auditors Cressey,

convicted serious fraud occurred had ineffective internal controls and since they have legal responsibilities for detecting and Loebbecke.

offenders in Australia 64 per cent lacked a code of conduct. reporting such irregularities. Material irregularities include

Similarly, of the companies where employee management fraud, employee fraud, error, intentional acts,

fraud occurred 65 per cent had ineffective other illegal acts and, finally, intentional but not fraudulent or

internal controls and 56 percent lacked a code other illegal misstatements

of conduct. As already

indicated, these two company characteristics

are significantly correlated.

3 Tatiana Advances in Early detection of Content analysis is used in Implications of the findings suggest that Total words, Lexical diversity, Colons, UK Content analysis has also been used to examine concealment qualitative

Churyk, N., Accounting fraud: Evidence analyzing the Management’s qualitative methods of deception detection Semicolons, For Example, Positive of negative information using either the president’s letter or methods of

Lee, C.-C., & Behavioral from restatements. Discussion and Analysis (MDA) may provide an earlier, and thus more useful, Emotion, Optimism and energy, chairperson’s statement. Abrahamson and Park (1994) deception

Clinton, B. D. Research, section of the annual report to method of the detection of fraud. The results Anxiety, Causation, Present Tense examined 1,118 president’s letters to determine if corporate detection

(2009) 25–40. identify potential indicators of of this study should provide stakeholders with officers hide negative outcomes in communications with

deception to increase the a set of indicators to aid in identifying stockholders intentionally (i.e., as evidenced by short selling).

likelihood of fraud detection in a misstated information. This approach is also They found that some environments led to intentional

timelier manner than current one that can be generalized to other written concealment and that disclosure of negative outcomes was

quantitative models documents used to predict fraudulent more likely when financial performance was poor. When

communication. Abrahamson and Amir (1996) used content analysis to

examine the president’s letter and to estimate a measure of

negativity, they found that investors used the information to

assess the quality of earnings. Smith and Taffler (2000) found

that the information content in the chairperson’s statement

was associated with firm failure.

Tugas Metodologi Penelitian 1 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

4 Siregar, S. V., Journal of Fraud awareness This paper presents a It was found that majority of respondents Fraud Awareness Indonesia Keller and Owens (2015), there are two categories of frauds: Descriptive

& Tenoyo, B. Financial Crime, survey of private descriptive survey. In total, 67 agree that fraud is a major concern for internal and external. Internal frauds are committed by and Inferential

(2015) Vol. 22 Iss 3 pp. sector in Indonesia respondents returned the businesses in Indonesia and that corporations persons inside the entities, such as employees, officers and Statistics.

329 - 346 questionnaires, which can be have enough level of fraud awareness. Poor directors. External frauds are committed by persons outside Survey,

considered suitable for a internal control and lack of ethical values are the entities, such as vendors. financial statement frauds questionnaire

descriptive survey. Some ranked as the most likely reasons why entities involve fraudulent journal entries or managerial override of

descriptive (included are being threatened by fraud, and a sound controls that have utilized journal entries within accounting

percentages, means) and ethical policy and code of conduct is information systems (Debreceny and Gray, 2010). Rezaee

inferential statistics (mean perceived as the most important fraud risk (2005) define financial statement fraud as a deliberate

differences test) are used to management process. Corporations have attempt by corporations to deceive or mislead users of

summarize and analyze the implemented several tools to detect or published financial statements, especially investors and

questionnaire results prevent fraud, such as internal audit and creditors, by preparing and disseminating materially

internal control. They also have a system in misstated financial statements. Examples are inappropriate

place for anonymous reporting of suspicions revenue recognition, inappropriate capitalization of expenses

of fraud, corruption or misconduct.inferential and a wide variety of inappropriate accruals.

statistics (mean differences test) are used to

summarize and analyze the questionnaire

results

5 Kathryn Journal of Financial fraud in A qualitative methodological All funds reported a need for more Financial Fraud Australia The Australian government defines fraud as “dishonestly Qualitative

Flynn , (2016) Financial Crime, the private health approach was used, and technological resources and higher staffing obtaining a benefit, or causing a loss, by deception or other research

Vol. 23 Iss 1 pp. insurance sector in interviews were conducted with levels to manage fraud. Inadequate means” (Commonwealth Fraud Control Guidelines, 2011: 4).

143 - 158 Australia fraud managers from Australia’s resourcing has the predictable outcome of a For fraud to occur, there has to be a proven intention to

largest private health insurance low detection and recovery rate. The fund defraud. For it to be judged as a criminal offence, the behavior

funds and experts in fields managers had differing approaches to in question must demonstrate intention to defraud,

connected to health fraud recovery action and this ranged from police recklessness or negligence (Commonwealth Fraud Control

detection action, the use of debt recovery agencies, to Guidelines, 2011: 16)

derecognition from the health fund. As for

present and future harm to the industry, the

funds found on-line claiming platforms a

major threat to the integrity of their

insurance system. In addition, they all viewed

the Privacy Act as an impediment to

managing fraud against their organizations

and they desired that there be greater

information sharing between themselves and

Medicare

Tugas Metodologi Penelitian 2 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

6 Oluwatoyin Accounting An empirical The study used cross-sectional The results of the present study confirm the Fraud-Related Problem Representation, Nigeria Fraud is an intentional act designed principally to deceive or cross-sectional

Muse Research investigation of design and 400 survey positive relationship between KR on TPFRA, Task Performance Fraud Risk mislead another party (Arens and Loebbecke, 1996), and, design and 400

Johnson Journal, Vol. 28 fraud risk questionnaires. The positive relationship of KR on FRPR and Assessment, Knowledge Requirement regardless of the form fraud is noticed, it is problematic to survey

Popoola Iss 1 pp. 78 - 97 assessment and respondents are real positive relationship of FRPR and TPFRA. (forensic accountant and auditor) auditors to detect, as the perpetrators take steps deliberately questionnaires

Ayoib B Che- knowledge professional people (auditors Specifically, the results revealed that FRPR to conceal the resulting wrongdoings (Knapp and Knapp,

Ahmad Rose requirement on and forensic accountants in the positively mediates the relationship between 2001). In addition, fraud harms the character and the

Shamsiah fraud related Nigerian public sector) as true TPFRA and KR (forensic accountant and trustworthiness of the audit profession (Wuerges, 2011).

Samsudin , problem representatives to enhance the auditor) in the areas of fraud prevention, Accounting researchers, practitioners and standard setters

(2015) representation in generalization of the outcomes. detection and response. alike uttered the concern for auditors’ apparent failure in

Nigeria A total of 36 indicator items was detecting fraud during an audit (Jamal, 2008; Wells, 2005;

measured on five-point Likert AICPA, 2002).

scale from 1 (strongly disagree)

to 5 (strongly agree). Partial

Least Square – Structural

Equation Modelling 2.0 3M and

IBM SPSS Statistics 20.0 were

used as the primary statistical

analysis tool for the study.

7 Chioma International The management of The authors conducted three The authors found that many retailers are Deterrence, prevention, detection, UK Wilhelm (2004) proposed the fraud management lifecycle Qualitative

Vivian Journal of Retail first party fraud in case studies and a total of 24 treating this problem as just a cost of doing mitigation, analysis, policy, theory consisting of eight components that drive success or Study

Amasiatu, & Distribution etailing: a semi-structured interviews with business online and have no detailed plans for investigation and prosecution failure in fraud management: deterrence, prevention,

Mahmood Management, qualitative study retail managers, and evaluated dealing with this problem or any reporting to detection, mitigation, analysis, policy, investigation and

Hussain Vol. 47 Issue: 4, their existing prevention-related law enforcement agencies. However, they prosecution

Shah, (2019) pp.433-452 documentation. Fraud have begun working with delivery companies

management lifecycle theory for delivery accuracy. Use of convenience

was used to organise and stores as collection points is also showing

discuss the findings. early improvements

8 Bonita Journal of Small Trust, but verify: Recent statistics from This paper summarizes pertinent facts that Perceived unshareable pressure, USA Fraud prevention circles have a 10/10/80 rule: 10 percent of Qualiative

Kramer Business and fraud in small international fraud surveys are repeatedly show small businesses are most Perceived opportunity, Rationalization employees will steal regardless; 10 percent will never steal; Research

(2015) Enterprise businesses, presented, and the theory of vulnerable to fraud and suffer a and the remaining 80 percent may, depending on the

Development, why people commit fraud is disproportionate median loss when compared circumstances (Rothberg, 2011). three elements must exist

Vol. 22 Iss 1 pp. described. The most common to larger businesses. External audits by simultaneously for an otherwise honest person to commit

4 - 20 internal fraud schemes as Certified Public Accountants cannot be relied fraud, referred to as the “fraud triangle” (Cressey, 1971)

identified in the international upon to detect fraud. Owners, managers, and

fraud surveys are explained, as advisors are strongly encouraged to have

well as some of the related red knowledge of how fraud can affect their

flags and preventative organizations in order to prevent or detect

measures. Examples of actual fraud and avoid the devastating effect it can

internal frauds perpetrated in have on the small business’s viability.

small businesses are discussed.

9 Rohaida Journal of The case studies of The multiple case studies The findings suggest that the fraud cases Fraud Prevention Mechanism Malaysia Frauds can be grouped into three main categories: corruption, Case Studies

Basiruddin, Financial Crime fraud prevention approach has been employed in experienced by the enterprises were related asset misappropriation and financial statement fraud. In

Malar mechanisms in the this study. The data was to broken trust and non-cash larceny. The terms of frequency, the most common type of fraud scheme

Gunasegaran Malaysian medium collected through interviews implementation of fraud prevention reported, in both large and small organizations, was that of

, Siti Zaleha enterprises with the directors, owners, mechanisms in the enterprises seem to be asset misappropriation (ACFE, 2014, 2016; KPMG, 2013;

Abdul Rasid, managers and supervisors of very limited due to resources and budget Omar et al., 2012). T

Adriana three medium size enterprises. constraints.

Mohd Rizal,

A (2018)

Tugas Metodologi Penelitian 3 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

10 Curtis M. Advances in Second Chance This exercise presents an actual Student surveys confirm that students learn Fraud Exercise: The exercise was clear USA The Association of Certified Fraud Examiners (ACFE), in their Introductory or

Nicholls, Accounting Homeless Shelter: A embezzlement committed by a about detecting and preventing fraud. and understandable, The exercise ACFE 2014 Report to the Nation on Occupational Fraud and survey

Stacy A. Education, Fraud Exercise for long-tenured employee of a Students also indicate that they find the not- provided an interesting setting in which Abuse, found that 10.8% of the frauds they studied occurred accounting

Mastrolia 1–24. Introductory and local not-for-profit organization. forprofit setting interesting and would use the to study the topic of financial fraud, at not-for-profit organizations and an additional 15.1% (hereafter

(2015) Survey Courses in Each component of the exercise principles in the exercise if they become This exercise and the related questions occurred at government agencies (ACFE, 2014). referred to as

Accounting. contains a series of questions to affiliated with a not-for-profit organization. were too introductory

facilitate classroom discussion. difficult, I learned something new about accounting)

detecting fraud, I learned something courses

new about preventing fraud, I learned typically

something new about individuals provide only

involved in financial fraud and their minimal

motivation, If I become associated with discussion of

an NFP, I would the accounting

likely use the principles demonstrated internal

in this exercise. controls

required for

fraud

prevention or

detection

11 P. K. Gupta Journal of Corporate frauds in – An exploratory research was It was found that the regulatory system is Perceived unshareable pressure, India Fraud is the use of false representations to gain unjust A survey of

Sanjeev Financial Crime, India – perceptions conducted through a combined weak, and there is dire need to redefine the Perceived opportunity, Rationalization advantage and criminal deception. The Internal Resources literature,

Gupta (2015) Vol. 22 Iss 1 pp. and emerging issues mode of literature review; case role of auditors. Coordination among Service, Department of the USA of the Treasury, defines a questionnaire

79 - 103 studies; structured different regulatory authorities is poor, and corporate fraud as a violation of the Internal Revenue Code

questionnaires from 346 sample after every scam, there is a blame game. and related statutes committed by large, publicly traded

companies; and 43 interviews Reporting of fraud and publication of fraud corporations and/or by their senior executives (IRIS, 2010).

with the corporate prevention policy are missing. Banks and Corporate frauds, conceptually, is broad and encompasses a

professionals, management, financial institutions are ineffective on due variety of criminal and civil violations. In addition, corporate

investors, government offices diligence, and there is a lack of frauds have gradually become very complex in nature

and authorities having wide professionalism on the board and other (Sutherland, 1949). A typical fraud triangle quoted in th

experience. executive levels in companies

12 N’Guilla Sow, Journal of Fraud prevention in This study used self-administer The output of multiple regressions showed the culture of honesty, fraud effective Malaysia According to Girgenti and Hedley (2011), an effective fraud This study has

A., Financial Crime, Malaysian small and questioners and distributed 126 that culture of honesty and high integrity, prevention mechanisms in Malaysian risk management approach has three controlled objectives: to utilised the

Basiruddin, 00–00. medium enterprises questionnaire to general antifraud processes and controls, and SMEs, internal controls, the prevent, to detect, and to respond quantitative

R., (SMEs) managers, financial managers, appropriate oversight functions has a positive development of appropriate oversight method to

Mohammad, and supervisors at Malaysian’s and significant effective on fraud prevention functions achieve the

J., & Abdul SMEs. Multiple regression was mechanisms. objectives of

Rasid, S. Z. used to test the theoretical this research.

(2018) model Data was

collected

through

questionnaire

surveys.

Tugas Metodologi Penelitian 4 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

13 Hans-Ulrich Journal of The escalating The anti-fraud requirements Over the years IA has been continuously Identification of fraud as a strategic Canada - Viewpoint

Westhausen, Financial Crime, relevance of internal stipulated in the “International increasing its auditing quality and audit topic, Qualification and quality

(2017) Vol. 24 Issue: auditing as anti- Standards for the Professional effectiveness with new analytical methods, improvement and

2,pp. fraud control Practice of Internal Auditing” specialized software tools and professional Utilization of audit technology.

are confronted with empirical certifications. But all these efforts have hardly

data about the current situation been reflected in statistical or research data,

of the IA as anti-fraud control. especially not in the listing of the top sources

The empirical data were of fraud detection. The “ACFEFraud Report

extracted from global sources 2016” revealed that IA is now – for the first

such as “Fraud Reports” (ACFE) time ever – second among the initial

and “CBOK”‐studies (IIA). detections of occupational frauds (financial

statement fraud, corruption, asset

misappropriation) worldwide. This positive

trend of global anti-fraud auditing was

probably no “one‐hit wonder”, but a result of

a lengthy process of professionalization of IA.

14 Lloyd Advances in Does Fraud Training A total of 369 experienced The results indicate that auditors with fraud fraud training, identify fraud risk Fraudulent financial reporting often arises from the perceived Experimental

Bierstaker, J., Accounting Help Auditors auditors completed a complex training identified significantly more red flags factors, 15 risk factors identified by the need by management to get through a difficult period of time Design

Hunton, J. E., Behavioral Identify Fraud Risk audit simulation task that and obtained greater knowledge about fraud Big 4 firm’s training (e.g., cash shortage), or to meet or beat analysts’

& Thibodeau, Research, Factors? involved 15 seeded fraud risk risk than auditors who did not receive the function as the model (normative) expectations. Management often views these conditions as

J. C. (2012) 85–100. red flags. A total of 143 auditors training. Considering that the fraud training answer temporary and believes that the falsification of the financial

participated in a 30-minute consumed only 30 minutes out of a 64-hour statements will help the company get through the difficulties

training session focused training session, the findings suggest that and expectations (Louwers, Ramsay, Sinason, Strawser, &

specifically on fraud risk, while even modest exposure to fraud training is Thibodeau, 2011).

the remaining 226 auditors quite effective.

learned about general internal

control risk during this time

block.

15 Kwabena Journal of Back to basics: The article draws on secondary Fraud is a challenge in the UK public sector Fraud and Austerity UK the ambiguous nature of the role of internal auditors and Qualitative

Frimpong Financial Crime, fighting fraud and sources of data and available but the cut-back on anti-fraud and financial widespread criticism levelled against internal auditors by the

(2015) Vol. 22 Iss 2 pp. austerity literature on fraud and financial crime investigative resources, given the scale public in relation to the minimal role played in organisational

219 - 227 crime. of public sector fraud, the growing emphasis fraud detection at a time when fraud is increasingly becoming

on accountability and the time of austerity a challenge to organisations (See, Alleyne and Howard, 2005;

with public money more exposed to fraud is Hassink et al., 2010; Smith, 2012)

arguably a back-door/u-turn policy on zero-

tolerance approach in tackling public sector

fraud and financial crime. There is the

potential of this encouraging more fraud and

financial crime against the public sector in the

long term if measures are not taken to devise

strategies for enhancing anti-fraud and

financial crime investigative resource

capacity.

Tugas Metodologi Penelitian 5 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

16 Spyridon Journal of An investigation of Data used for this study were Results showed that forgeries, bribery and the impact of global financial crises of Greek Association of Certified Fraud Examiners (2011), defines fraud The study

Repousis, Money the fraud risk and obtained from primary source money laundering are the most important 2008 in Greek commercial banks, major as “Any illegal acts characterized by deceit, concealment or adopted a

Petros Lois, Laundering fraud scheme through questionnaires. This types of fraud risk and the best fraud scheme types of fraud risk and fraud risk violation of trust. These acts are not dependent on the descriptive

Varvara Veli Control methods in Greek method of data collection was methods are using dormant accounts and scheme methods, determine basic application of threat of violence or of physical force”. Cresse’s survey design

(2019) commercial banks followed and was considered checks. Based on the empirical findings, the principles of bank internal controls to final hypothesis published in Other People’s Money: A Study which is a

appropriate because the study recommends there is a need banks to detect and prevent fraud in the Social Psychology of Embezzlement (1973), was: method of

information sought is not implement a code of conduct and a code of “Trusted Persons become trust violators when they conceive collecting

publicly available and middle ethics for staff, staff training, signature of themselves as having a financial problem which is non- information by

management and internal verification, control over dormant accounts, shareable, are aware this problem can be secretly resolved by interviewing or

auditors are in a good position asking employees about their opinions and violation of the position of financial trust, and are able to passing a

to know the answers to the the way they feel about their bank, apply to their own conduct in that situation verbalizations questionnaire

questions asked. Questionnaires conducting surprise audits and using a hot which enable them to adjust their conceptions of themselves to a sample of

were sent to a sample of 230 line for whistlebowing as trusted persons with their conceptions of themselves as individuals

persons, all bank branch trusted persons with their conceptions of themselves as users

employees (internal auditors entrusted funds or property.”

were excluded), in the city of

Athens (city capital of Greece),

in five banks, National Bank of

Greece, Piraeus Bank, Alpha

Bank, Eurobank and Postal

Bank, during February 2017 –

March 2017. Finally, of the 230

questionnaires distributed, 225

completed and returned but

only 203 of them were usable

questionnaires. The Cronbach’s

alpha was used to test the

reliability of variables.

17 Peltier‐Rivest Journal of An analysis of the This study is based on a 2006 The analysis shows that occupational fraud Fraud loss, Asset misappropriations, Canada Occupational fraud may be defined as “the use of one’s Qualitative

, D. (2009) Financial Crime, victims of occupational fraud web survey losses are quite large, accounting for a Corruption, Fraudulent statements occupation for personal enrichment through the deliberate

16(1), 60–66. occupational fraud: conducted in Canada by the median loss of C$187,500 and a mean loss of misuse or misapplication of the employing organization’s

a Canadian Association of Certified Fraud C$1,142,494. These losses represent, resources or assets” (ACFE and Peltier‐Rivest, 2007).

perspective Examiners (ACFE). respectively, 0.3 percent (median) and 9

percent (mean) of the victim organization’s

annual sales. Private companies, not-for-

profit organizations and small businesses are

particularly vulnerable to relatively larger

fraud losses. It is also shown that the smaller

the organization the more likely fraud losses

will be relatively larger.

Tugas Metodologi Penelitian 6 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

18 Nor Azrina Journal of An integrative This paper is grounded on three By integrating these three theories, this paper TRA, TPB and the “Fraud Diamond Malaysia Wolfe and Hermanson (2004) explained that there were five Qualitative

Mohd Yusof Financial Crime, model in predicting theories, namely, the theory of proposes that individual cognitive factors, Theory components of capability: first, position/function. A person

Ming Ling Lai Vol. 21 Iss 4 pp. corporate tax fraud reasoned action, theory of fraud diamond factors and organizational having a position/function within the organization may try to

, (2014) 424 - 432 planned behaviour and the factors such as normative and control factors find an opportunity for fraud. The second component is the

“Fraud Diamond Theory” influence managers to commit corporate tax brain. Fraudsters are smart enough to handle and exploit the

fraud. weaknesses of internal control and authorized access for

personal advantage. The third component is confidence/ego.

Fraudsters have a strong confidence and ego that they will not

be detected. The next component is related to coercion skills.

Fraudsters can coerce others to commit or conceal fraud.

Effective lying is the fifth component whereby successful

fraudsters lie effectively and consistently. Finally, the

successful fraudsters deal very well with stress. This is

because fraud usually occurs for over a long period and it can

be extremely stressful (Brennan and McGrath, 2007).

19 Mahito The Journal of The relationship Using a theoretical model First, the amount of policyholder’s effort is a Moral Hazard and Insurance Fraud Japan The difference between moral hazard and insurance fraud is theoretical

Okura, Risk Finance, between moral containing five-stages, the weakly monotone decreasing function of the explained in some insurance textbooks. According to Dorfman model

(2013) Vol. 14 Issue: 2, hazard and author sheds light on how the insurance firm’s investment in preventing (2008), insurance fraud in our research indicates “moral

pp.120-128 insurance fraud possibility of insurance fraud insurance fraud. Second, unlike in previous hazard” and moral hazard in our research indicates “morale

affects the amount of moral hazard models, the policyholder hazard”, respectively. This classification may be based on the

policyholder’s effort. chooses a strictly positive amount of effort background if the person who commits moral hazard is

even in the full insurance case because the “abnormal”. Another kind of explanation about the difference

possibility of insurance fraud gives an is given from information-deficiencies

incentive to realize policyholder’s effort.

Third, the amount of insurance firm’s

investment in preventing insurance fraud

depends on whether it wants to give an

additional incentive to policyholder’s effort in

exchange for realizing the possibility of

insurance fraud

20 Mark Button Journal of Fraud in overseas The research is based on 21 This paper shows there are significant Measurements of Fraud UK Overseas aid in developing and transition countries is semi-

Chris Lewis Financial Crime, aid and the semi-structured interviews with challenges to using fraud loss measurement generally at high risk of fraud and corruption (Transparency structured

David Vol. 22 Iss 2 pp. challenge of key persons working in the to gauge fraud in overseas aid. However, it International, 2006; and Fletcher and Herrmann, 2012). Fraud interviews

Shepherd 184 - 198 measurement delivery of aid in both the public argues that, along with other types of Loss Measurements (FLM) is a process to measure fraud in a with key

Graham and voluntary sectors. It uses measures, it could be used in areas of similar group of transactions based upon a sample, which are persons

Brooks theUKDepartment for expenditure in overseas governments and investigated to a higher standard than normal, to determine

(2015) International Development as a charities to measure aid. Given the high risk whether such transactions are correct, erroneous or

case study to applying more of such aid to fraud, it argues helping to fraudulent (Brooks et al., 2012).

accurate measures of fraud. develop capacity to reduce aid, of which

measuring the size of the problem is an

important part; this could be considered as

aid in its own right

21 Alon, A., & Management The impact of The research framework links The results of the study provide insight on Fraud risk assessment guidance, USA In 2002, the fraud guidance was expanded by the Statement a literature

Dwyer, P. Research groups and decision the influences of the fraud how the brainstorming impacts fraud risk Information load and decision aids, of Auditing Standards (SAS) No. 99 (AICPA, 2002) to reinforce review and

(2010) Review, 33(3), aid reliance on fraud assessment setting and decision assessment, decision aid use and decision aid Brainstorming, Decision aid reliance, to auditors the need to maintain professional skepticism and hypothesis

240–256 risk assessment. aid reliance. The hypotheses are reliance. The results show that groups using a Likelihood of fraud rating, overcome the tendency of over-reliance on client development,

tested in an experiment with decision aid with fraud risk factors representation. followed by

two manipulated factors: demonstrate superior decision quality and the description

setting (group or individual) and effectiveness even with lower decision aid of the

decision aid (provided or not reliance. experiment

provided). and

methodology

Tugas Metodologi Penelitian 7 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

22 Grace Mui Accounting A tale of two The application of the Crime The Crime Triangle complements the Fraud Perceived unshareable pressure, UK Fraud has been examined using the universally accepted lens Qualitative

Jennifer Research triangles: comparing Triangle is illustrated using Triangle’s perpetrator‐centric focus by Perceived opportunity, Rationalization, of the Fraud Triangle (Albrecht, 2014; Dorminey et al., 2012). Research

Mailley , Journal, Vol. 28 the Fraud Triangle scenarios of asset examining the environment where fraud crime triangle The Fraud Triangle takes a perpetrator-centric focus to

(2015) Iss 1 pp. 45 - 58 with criminology’s misappropriations by type of occurs and the relevant parties that play their explain why the fraud was perpetrated (Cressey, 1953)

Crime Triangle perpetrator: external role in preventing fraud or not playing their

perpetrator, employee, role, and thus, allowing the occurrence of

management and the board and fraud. Applying both triangles to a fraud event

its governing bodies provides a comprehensive view of the fraud

event.

23 Chun-Keung Corporate Labor market Board membership of Compared to non-executive directors, Labor Market, Accounting Fraud USA Manipulation of financial statements and earnings (or Qualitative

Hoi Ashok Governance: consequences of incumbent directors in US firms executive directors are more than twice as earnings management) arises because of flexibility in research

Robin, (2010) The accounting fraud accused of accounting fraud are likely to lose own firm board seat and at least accounting systems. There are many ways to manage

international tracked for three years after the five times as likely to lose at least one outside earnings. For example, Marquardt and Wiedman (2004)

journal of revelation. Two labor market directorship. Moreover, all executives, top or

business in consequences/penalties are otherwise, appear to face similar tough

society, Vol. 10 considered. Probability of losing penalties

Iss 3 pp. 321 - internal, own firm board seat is

333 the likelihood that incumbent

directors leave the accused

firm’s board upon accounting

fraud revelation. The likelihood

of losing at least one external

board seat (outside

directorship) is also examined.

Both univariate tests and

multivariate LOGIT regressions

are used to conduct the analysis

24 Jiali Tang, Managerial Financial fraud The authors review the The existing audit practice aimed at Fraud detection and big data analysis USA In the fraud triangle put forward by Cressey (1973), three Review

Khondkar E. Auditing Journal detection and big literature related to fraud, identifying the fraud risk factors needs factors determine the likelihood of fraud occurrence, Literature

Karim (2018) data analytics – brainstorming sessions and Big enhancement, due to the inefficient use of including pressure, opportunity and rationalization. The core

implications on Data, and propose a model that unstructured data. The brainstorming session of these factors lies in people’s belief and behavior. Due to the

auditors’ use of auditors can follow during the provides a useful setting for such concern as it unpredictability and uncertainty in fraudsters’ incentives and

fraud brainstorming brainstorming sessions by draws on collective wisdom and encourages techniques, fraud detection requires the skillset that

session applying Big Data analytics at idea generation. The integration of Big Data encompasses both diligence and judgment.

different steps. analytics into brainstorming can broaden the

information size, strengthen the results from

analytical procedures and facilitate auditors’

communication. In the model proposed, an

audit team can use Big Data tools at every

step of the brainstorming process, including

initial data collection, data integration, fraud

indicator identification, group meetings,

conclusions and documentation

Tugas Metodologi Penelitian 8 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

25 Richard Lane Accounting The changing face of This paper analyses a sample of This paper finds evidence of changes in the issuance of AAERs by the SEC in the Australia The findings of the COSO Report should also be considered in Case Studies

Brendan T. Research regulators' AAERs from 2002 to 2005. It Securities and Exchange Commission (SEC) period after 2001,e US accounting light of a number of studies that have examined the incentives

O'Connell, Journal, Vol. 22 investigations into also provides case studies of an enforcement activities since the COSO Report. scandals. for financial statement fraud and/or earnings management

(2009) Iss 2 pp. 118 - financial statement additional five high-profile case Specifically, it is found that enforcement (Dechow et al., 1996; Graham et al., 2005).

143 fraud studies from that period. activities have increased substantially post-

Enron and the companies subject to AAERs

are, on average, much larger, more profitable

and the frauds are more substantial than

those exhibited in the COSO Report. These

findings suggest that the SEC has become

more aggressive at pursuing larger companies

for financial statement fraud in the post-

Enron environment.

26 Jinyu Zhu, Accounting in Fraudulent Financial This study adopts a descriptive Based on the sample of 83 cases over the 5- Management Fraud Chinese Corporate fraud has recently received considerable attention Case Study

Simon S. Gao. Asia. Published Reporting: research approach using the year period from 2002 to 2006, this study from the business community, accounting profession,

(2011) 61-82. Corporate Behavior data based on 182 punishment finds that all the frauds in the sample involved academicians, and regulators (Kedia & Philippon, 2009;

of Chinese Listed bulletins issued by the China the manipulation, alteration, and falsification Rezaee, 2005). Fraud may be defined as intentional deception,

Companies Securities Regulatory of reported financial information. Fraud cheating, or stealing. It can be committed against users such

Commission from 2002 to 2006. schemes often contained more than one as investors, creditors, customers, or government entities

The study considers three technique to misstate financial statements, (Weirich & Reinstein, 2000).

categories of frauds (i.e., false typically through overstating revenues and

income statements, false assets, and understating liabilities and

balance sheets, and insufficient expenses. Most of the sample companies

or false disclosure) and uses committed several frauds simultaneously.

these categories to describe and This study also reveals that most of the frauds

analyze the fraud cases. committed by Chinese listed companies lasted

more than 2 years, with the longest being 9

years, and common intervals between the

initial fraud year and the announcement year

of punishment were more than 3 years, with

the longest being 11 years

27 Jingjing Yang, Advances in Accounting Fraud, We discuss the institutional Our results suggest that Chinese government (1) the impact of government Chinese Gerakos and Syverson (2015) point out that firms seeking Ordinary Least

Hao-Chang Pacific Basin Audit Fees, and background of the audit market support to local auditors does not significantly intervention on the pricing ability of audit services choose among several auditors, and each Square (OLS)

Sung (2017) Business Government in China in Section 2. We enhance these auditors’ competitiveness in both international and local big potential auditor provides varying aspects of service that are

Economics and Intervention in develop our main hypothesis in terms of audit fee and audit quality. auditors; (2) the impact of government potentially valued differentially by each client firm

Finance. China Section 3, and present the intervention on the incidence of

Published sample selection process and financial statement fraud for local big

online: 18 Sep research design in Section 4. auditors.

2017; 101-120. The empirical results and

additional analyses are reported

in Section 5. Section 6 concludes

above remarks.

Tugas Metodologi Penelitian 9 of 10 Wildan Rahmansyah - 120620190008

Universitas Padjadjaran Bandung

No. Author Nama Jurnal Judul Penelitian Metodologi Finding/Result Variable Country Theories Model

28 Philip Law, Managerial Corporate Factor analysis using principal The results indicate that audit committee (1) audit committee effectiveness; Chinese Prior research has focused on fraud detection and prevention quantitative

(2011) Auditing governance and no component extraction was first effectiveness, internal audit effectiveness, the (2) internal audit effectiveness; methods (Bierstaker et al., 2006; Cormier and Antunes, 2006; and qualitative

Journal, Vol. 26 fraud occurrence in employed. Logistic regression tone at the top managerial level, and ethical (3) tone at the top management level; Moyes and Anandarajan, 2002; Albrecht and Romney, 1986; research

Iss 6 pp. 501 - organizations was then performed to analyze guidelines and policies are positively (4) impact of receiving an unqualified Pincus, 1989). The organizational impact of fraud clearly methods

518 the survey responses of 253 associated with a lack of fraud within audit report; cannot be neglected. About 40 percent of companies that

chief financial officers (CFOs) in organizations. Neither auditors’ prior success (5) ethical policies and guidelines; have experienced fraud suffer significant losses in terms of

Hong Kong. A total of 20 semi- in fraud detection nor the type of auditor (6) external auditors’ prior success in their reputation and in damaged business

structured interviews were also employed is an influential factor in the detecting fraud; and relations and decreased staff motivation (Rezaee, 2008)

carried out with CFOs to absence of fraud. These results are interesting (7) the type of external auditors

supplement the research and counter those of earlier studies employed by the organization

results. conducted in the USA. Also contradicting prior

research, the receipt of unqualified audit

reports was not found to be significant in this

study

29 Hassink, H., Managerial Fraud detection, To gather data on the role of The results reveal that auditors fail to comply The performance of auditors regarding USA Such lawsuits have introduced the effect of litigation risk into survey among

Meuwissen, Auditing redress and auditors in fraud cases, a survey with some important elements of fraud the detection of corporate fraud and auditors’ fraud detection, as a result of which auditors may all audit

R., & Bollen, Journal, 25(9), reporting by was conducted among all audit standards. There are substantial differences Compliance with relevant auditing adjust their audit planning to understate firm performance partners of the

L. (2010) 861–881. auditors. partners of the top 30 Dutch among audit firms regarding compliance with standards (Baron et al., 2001) top 30 Dutch

audit firms. In total, 1,218 audit the relevant auditing standards. Furthermore, audit firms

partners were selected and auditors appear to encounter corporate fraud

received a postal questionnaire. only incidentally. About half of the auditors

In total, 326 questionnaires believe they have a “significant” impact on

were returned (27 per cent), of redressing fraud.

which 296 (24 per cent) were

usable.

30 Wei, Y., Pacific Detecting fraud in Every balance sheet account is Other receivables, inventories, prepaid Chinese listed companies’ balance Australia for different types of fraud, firms are motivated by different Quantitative

Chen, J., & Accounting Chinese listed proposed to be a potential expenses, employee benefits payables and sheets , Fraudulent financial incentives; some relate to the firm’s rights issuance (Chen and reserch based

Wirth, C. Review, 29(3), company balance vehicle to manipulate financial long-term payables are important indicators statements. (examination that covers Yuan, 2004) on cases

(2017) 356–379. sheets. statements. of fraudulent financial statements. These all the accounts in the balance sheet)

results confirm that asset account

manipulation is frequently carried out and

cast doubt on earlier conclusions by

researchers that inflation of liabilities is the

most common source of financial statement

manipulation.

Tugas Metodologi Penelitian 10 of 10 Wildan Rahmansyah - 120620190008

Potrebbero piacerti anche

- Published PDFDocumento12 paginePublished PDFChess NutsNessuna valutazione finora

- Published With Cover Page v2Documento12 paginePublished With Cover Page v2BAMS WIDODONessuna valutazione finora

- Haryono Umar, Dantes Partahi Dan Rahima Br. Purba (2020) (Jurnal Internasional)Documento10 pagineHaryono Umar, Dantes Partahi Dan Rahima Br. Purba (2020) (Jurnal Internasional)elaine aureliaNessuna valutazione finora

- The New Fraud Triangle Theory - Integrating Ethical Values of EmployeesDocumento6 pagineThe New Fraud Triangle Theory - Integrating Ethical Values of EmployeesmohammpooyaNessuna valutazione finora

- Raising The Red Flags: The Concept and Indicators of Occupational FraudDocumento4 pagineRaising The Red Flags: The Concept and Indicators of Occupational FraudManuelito C. MacailaoNessuna valutazione finora

- The Construction of The Risky Individual and Vigilant Organization A Genealogy of The Fraud Triangle PDFDocumento25 pagineThe Construction of The Risky Individual and Vigilant Organization A Genealogy of The Fraud Triangle PDFMohsin Ul Amin KhanNessuna valutazione finora

- Quality of Internal Control Procedures Antecedents and Moderating Effect On Organisational Justice and Employee FraudDocumento22 pagineQuality of Internal Control Procedures Antecedents and Moderating Effect On Organisational Justice and Employee FraudNaufal IhsanNessuna valutazione finora

- A Comparison of Conventional and Online FraudDocumento12 pagineA Comparison of Conventional and Online FraudIoana StanescuNessuna valutazione finora

- Jurnal 7Documento19 pagineJurnal 7yaniNessuna valutazione finora

- What Determinants of Academic Fraud Behavior? From Fraud Triangle To Fraud Pentagon PerspectiveDocumento14 pagineWhat Determinants of Academic Fraud Behavior? From Fraud Triangle To Fraud Pentagon Perspectivemerie satyaNessuna valutazione finora

- Pengaruh Penciptaan Lingkungan Budaya Jujur Terhadap Kecenderungan Kecurangan (Studi Empiris Pada Perusahaan BUMN Di Kota Padang)Documento20 paginePengaruh Penciptaan Lingkungan Budaya Jujur Terhadap Kecenderungan Kecurangan (Studi Empiris Pada Perusahaan BUMN Di Kota Padang)Yulia Tri hastutiNessuna valutazione finora

- The Research Methodology: Chapter ThreeDocumento11 pagineThe Research Methodology: Chapter Threemamdouh mohamedNessuna valutazione finora

- Content Fraud BrainstormingDocumento6 pagineContent Fraud BrainstormingHaris BurneyNessuna valutazione finora

- Farud Triangle & DiamondDocumento8 pagineFarud Triangle & Diamondmuhammad hidayatNessuna valutazione finora

- 1077-Article Text-4264-1-10-20220728Documento13 pagine1077-Article Text-4264-1-10-20220728eneng surtiniNessuna valutazione finora

- Article 05 Fraud Triangle Theory and Fraud Diamond Theory PDFDocumento8 pagineArticle 05 Fraud Triangle Theory and Fraud Diamond Theory PDFrumiNessuna valutazione finora

- Pemcegahan FraudDocumento14 paginePemcegahan FraudAchirul Aprisal AnnasNessuna valutazione finora

- The Roles of Whistleblowing System and Fraud Awareness As Financial Statement Fraud DeterrentDocumento20 pagineThe Roles of Whistleblowing System and Fraud Awareness As Financial Statement Fraud DeterrentEstetika MutiaranisaNessuna valutazione finora

- Exactech Newsletter May 2019Documento2 pagineExactech Newsletter May 2019Mario FazekasNessuna valutazione finora

- 10 - SabauDocumento13 pagine10 - SabauSyifa RNessuna valutazione finora

- Triangulo de FraudeDocumento7 pagineTriangulo de FraudeCamilo A. Vargas TrianaNessuna valutazione finora

- 2020 Report To The Nations PDFDocumento88 pagine2020 Report To The Nations PDFADRIANMONTOYAANessuna valutazione finora

- Penelitian Terdahulu PrintDocumento6 paginePenelitian Terdahulu PrintDeaLukitasariNessuna valutazione finora

- Audit Internal Chapter 9Documento21 pagineAudit Internal Chapter 9Winda FauziahNessuna valutazione finora

- Chapter One General FrameworkDocumento9 pagineChapter One General Frameworkmamdouh mohamedNessuna valutazione finora

- Why Do Employees Commit Fraud Theory, Measurement, and ValidationDocumento13 pagineWhy Do Employees Commit Fraud Theory, Measurement, and ValidationJorge Jimenez SerranoNessuna valutazione finora

- 1 SMDocumento11 pagine1 SMVispyanthika 03Nessuna valutazione finora

- Corporate Detection MethodDocumento12 pagineCorporate Detection MethodAbhishek RajNessuna valutazione finora

- Jurnal Skripsi Fraud-4Documento7 pagineJurnal Skripsi Fraud-4BAMS WIDODONessuna valutazione finora

- Variabel - Variabel Penentu Terjadinya Kecurangan (Froud)Documento22 pagineVariabel - Variabel Penentu Terjadinya Kecurangan (Froud)Lyle WaltNessuna valutazione finora

- Intelligent Agents in Computer Supported Training For Emergency ManagementDocumento21 pagineIntelligent Agents in Computer Supported Training For Emergency ManagementranaulyaNessuna valutazione finora

- Exactech Newsletter APRIL 2019Documento2 pagineExactech Newsletter APRIL 2019Mario FazekasNessuna valutazione finora

- Fraud StoriesDocumento38 pagineFraud StoriesGauravNessuna valutazione finora

- Not Too Good To Be True': A Proposal To Further Benefit From Emergence in Management ResearchDocumento10 pagineNot Too Good To Be True': A Proposal To Further Benefit From Emergence in Management ResearchFabiana AlmeidaNessuna valutazione finora

- Fraud - Risk - Assessment PWC PDFDocumento2 pagineFraud - Risk - Assessment PWC PDFHarinakshi PoojaryNessuna valutazione finora

- Future Generation Computer Systems: Jorge Maestre Vidal Marco Antonio Sotelo Monge Sergio Mauricio Martínez MonterrubioDocumento15 pagineFuture Generation Computer Systems: Jorge Maestre Vidal Marco Antonio Sotelo Monge Sergio Mauricio Martínez MonterrubioLuis RojasNessuna valutazione finora

- Whistleblower Reward Programmes: QueryDocumento13 pagineWhistleblower Reward Programmes: QueryManikantan ThappaliNessuna valutazione finora

- Amira Hassan, Computational Intelligence Models For Insurance Fraud Detection - A Review of A Decade of ResearchDocumento7 pagineAmira Hassan, Computational Intelligence Models For Insurance Fraud Detection - A Review of A Decade of ResearchNuno GarciaNessuna valutazione finora

- The Relationship of Individual Morality and Auditor Perceptions of Fraud Tendency: Testing of The Fraud Pentagon Theory ApproachDocumento15 pagineThe Relationship of Individual Morality and Auditor Perceptions of Fraud Tendency: Testing of The Fraud Pentagon Theory ApproachIJAR JOURNALNessuna valutazione finora

- Safety Maturity LevelDocumento25 pagineSafety Maturity LevelN Sarah88% (8)

- 5539 9417 1 PBDocumento28 pagine5539 9417 1 PBJaka Rahman DarmawanNessuna valutazione finora

- Graft Prevention Program PrimerDocumento2 pagineGraft Prevention Program PrimerCHARLOTTE THALININessuna valutazione finora

- Recruitment & Selection Process in Textile Sector With Reference To Coimbatore DistrictDocumento5 pagineRecruitment & Selection Process in Textile Sector With Reference To Coimbatore DistrictMaryamNessuna valutazione finora

- Corruption Risk Assessment and Management Approaches in The Public Sector 2015 PDFDocumento11 pagineCorruption Risk Assessment and Management Approaches in The Public Sector 2015 PDFHambisaM.LataNessuna valutazione finora

- Fairness TestingDocumento13 pagineFairness TestingSainyam GalhotraNessuna valutazione finora

- 23-Article Text-65-1-10-20191106Documento14 pagine23-Article Text-65-1-10-20191106septyaniekawulandari77Nessuna valutazione finora

- Combatting Financial Fraud A Coevolutionary AnomalyDetection ApproachDocumento8 pagineCombatting Financial Fraud A Coevolutionary AnomalyDetection ApproachPrashant ChafleNessuna valutazione finora

- Punishing People or Learning From FailureDocumento18 paginePunishing People or Learning From FailureSinan ÖzNessuna valutazione finora

- tOBEST rEPORTDocumento18 paginetOBEST rEPORTmosesNessuna valutazione finora

- Human ErrorDocumento3 pagineHuman ErrorAsri KarimaNessuna valutazione finora

- Fraud Triangle Theory and Fraud Diamond Theory UndDocumento9 pagineFraud Triangle Theory and Fraud Diamond Theory UndJamshaid AwanNessuna valutazione finora

- The Use of Personality Traits To Predict Propensity To Commit FraudDocumento28 pagineThe Use of Personality Traits To Predict Propensity To Commit FraudakreditasimedicalpegadaianNessuna valutazione finora

- Fraud Triangle Theory and Fraud Diamond Theory UndDocumento9 pagineFraud Triangle Theory and Fraud Diamond Theory Undjorgearchila2010Nessuna valutazione finora

- Faking Fairness Via Stealthily Biased SamplingDocumento24 pagineFaking Fairness Via Stealthily Biased Samplingygh1254Nessuna valutazione finora

- The New Fraud Diamond Model How Can It Help Forensic Accountants in Fraud Investigation in NigeriaDocumento10 pagineThe New Fraud Diamond Model How Can It Help Forensic Accountants in Fraud Investigation in NigeriaWahyudi WahdaniNessuna valutazione finora

- 2013 Fraud Dinamics in Organizations-DavisDocumento15 pagine2013 Fraud Dinamics in Organizations-DavisAlmi HafizNessuna valutazione finora

- Machine Learning Algorithm For Financial Fruad DetectionDocumento25 pagineMachine Learning Algorithm For Financial Fruad DetectionJOHN ETSUNessuna valutazione finora

- A New Approach To Modelling The Effects of Cognitive Processing and Threat Detection On Phishing SusceptibilityDocumento22 pagineA New Approach To Modelling The Effects of Cognitive Processing and Threat Detection On Phishing Susceptibilityhuyen vuNessuna valutazione finora

- SSRN Id2596825Documento26 pagineSSRN Id2596825germanlmdvNessuna valutazione finora

- Payroll Fraud Detection and Prevention Audit Expert SystemDa EverandPayroll Fraud Detection and Prevention Audit Expert SystemNessuna valutazione finora

- Jurnal Take Out 2017 Audited by WR 15Documento2 pagineJurnal Take Out 2017 Audited by WR 15Wildan RahmansyahNessuna valutazione finora

- Internal ControlDocumento39 pagineInternal ControlWildan RahmansyahNessuna valutazione finora

- AIS Cycle PDFDocumento25 pagineAIS Cycle PDFWildan RahmansyahNessuna valutazione finora

- 10 1108@13590790910924966Documento7 pagine10 1108@13590790910924966Wildan RahmansyahNessuna valutazione finora

- Hoi 2010Documento15 pagineHoi 2010Wildan RahmansyahNessuna valutazione finora

- Popoola 2015Documento22 paginePopoola 2015Wildan RahmansyahNessuna valutazione finora

- Fraud Prevention: Relevance To Religiosity and Spirituality in The WorkplaceDocumento9 pagineFraud Prevention: Relevance To Religiosity and Spirituality in The WorkplaceJannah ZahraNessuna valutazione finora

- Fraud Mind Map - Wildan R PDFDocumento1 paginaFraud Mind Map - Wildan R PDFWildan RahmansyahNessuna valutazione finora

- Alon 2010Documento17 pagineAlon 2010Wildan RahmansyahNessuna valutazione finora

- Applying Modern Accounting Technique in Complex ManufacturingDocumento17 pagineApplying Modern Accounting Technique in Complex ManufacturingWildan RahmansyahNessuna valutazione finora

- AOS 2015 Suddaby Et Al Twitterin ChangeDocumento17 pagineAOS 2015 Suddaby Et Al Twitterin ChangeWildan RahmansyahNessuna valutazione finora

- Nomor Undian StandDocumento4 pagineNomor Undian StandWildan RahmansyahNessuna valutazione finora

- Lean AccountingDocumento26 pagineLean AccountingWildan RahmansyahNessuna valutazione finora

- Iamb 2014 Fullpaper DefDocumento11 pagineIamb 2014 Fullpaper DefWildan RahmansyahNessuna valutazione finora

- Peni 2010 Gender Issues and Earnings Management PDFDocumento17 paginePeni 2010 Gender Issues and Earnings Management PDFWildan RahmansyahNessuna valutazione finora

- Ameer Othman 2012 JBE Sustainability Practices and Corporate FinanceDocumento20 pagineAmeer Othman 2012 JBE Sustainability Practices and Corporate FinanceWildan RahmansyahNessuna valutazione finora

- AbsDocumento19 pagineAbsWildan RahmansyahNessuna valutazione finora

- Ker61035 Appd Case01Documento3 pagineKer61035 Appd Case01GeeSungNessuna valutazione finora

- TMF - A Quick Look at Ethan Allen - Ethan Allen Interiors IncDocumento4 pagineTMF - A Quick Look at Ethan Allen - Ethan Allen Interiors InccasefortrilsNessuna valutazione finora

- Funds FlowDocumento5 pagineFunds FlowSubha KalyanNessuna valutazione finora

- Data Warehousing & DATA MINING (SE-409) : Lecture-2Documento36 pagineData Warehousing & DATA MINING (SE-409) : Lecture-2Huma Qayyum MohyudDinNessuna valutazione finora

- InvoiceDocumento1 paginaInvoicetanya.prasadNessuna valutazione finora

- She Bsa 4-2Documento7 pagineShe Bsa 4-2Justine GuilingNessuna valutazione finora

- MNM3702 Full Notes - Stuvia PDFDocumento57 pagineMNM3702 Full Notes - Stuvia PDFMichaelNessuna valutazione finora

- F3 - Consolidation, RatiosDocumento11 pagineF3 - Consolidation, RatiosArslan AlviNessuna valutazione finora

- ConWay Stewart Pen Catalogue 2012Documento76 pagineConWay Stewart Pen Catalogue 2012MarcM77100% (1)

- Accounting Standard 5-8Documento36 pagineAccounting Standard 5-8Aseem1Nessuna valutazione finora

- International Commodity Traders (ICT LLC) & World Gold CouncilDocumento1 paginaInternational Commodity Traders (ICT LLC) & World Gold CouncilPratik MishraNessuna valutazione finora

- Internal Sales Representative As of SAP ERP EhP5 (New)Documento32 pagineInternal Sales Representative As of SAP ERP EhP5 (New)Khalid SayeedNessuna valutazione finora

- Research Project ReportDocumento21 pagineResearch Project ReportinternationalbankNessuna valutazione finora

- Employee Motivation and Retention ProgrammeDocumento2 pagineEmployee Motivation and Retention ProgrammeHarish Kumar100% (1)

- Business Plan Pizza ShopDocumento11 pagineBusiness Plan Pizza ShopPaulaBrinzeaNessuna valutazione finora

- Microsoft Project Training ManualDocumento15 pagineMicrosoft Project Training ManualAfif Kamal Fiska100% (1)

- Laguna y Markklund PDFDocumento668 pagineLaguna y Markklund PDFjuan carlos sanchezNessuna valutazione finora

- De Guzman V de DiosDocumento4 pagineDe Guzman V de DiosJulius Carmona GregoNessuna valutazione finora

- Mms-Ente-Case StudyDocumento2 pagineMms-Ente-Case Studyvivek ghatbandheNessuna valutazione finora

- Form Restoran Sederhana Masakan PadangDocumento30 pagineForm Restoran Sederhana Masakan PadangLuthfi's Mzakki'sNessuna valutazione finora

- SAG - Front Office Services NC IIDocumento6 pagineSAG - Front Office Services NC IImiles1280Nessuna valutazione finora

- Factory Audit ReportDocumento33 pagineFactory Audit ReportMudit Kothari100% (1)

- Costa CoffeeDocumento18 pagineCosta CoffeeNuwan Liyanagamage75% (4)

- Pricing Concepts & Setting The Right PriceDocumento33 paginePricing Concepts & Setting The Right PriceNeelu BhanushaliNessuna valutazione finora

- Evaluasi Kinerja Angkutan Umum Di Kota Magelang (Studi Kasus Jalur 1 Dan Jalur 8)Documento10 pagineEvaluasi Kinerja Angkutan Umum Di Kota Magelang (Studi Kasus Jalur 1 Dan Jalur 8)Bahar FaizinNessuna valutazione finora

- Point 03 07 2023Documento89 paginePoint 03 07 2023Raouia El OuaiNessuna valutazione finora

- Marketing IndividualDocumento2 pagineMarketing Individualsinyi0Nessuna valutazione finora

- Front Office ManagementDocumento3 pagineFront Office ManagementLu XiyunNessuna valutazione finora

- Indo Gold Mines PVT LTDDocumento30 pagineIndo Gold Mines PVT LTDSiddharth Sourav PadheeNessuna valutazione finora

- Exclusive Legislative ListDocumento4 pagineExclusive Legislative ListLetsReclaim OurFutureNessuna valutazione finora