Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Taxation Past Paper 2019

Caricato da

Adeel AhmedDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Taxation Past Paper 2019

Caricato da

Adeel AhmedCopyright:

Formati disponibili

Business Taxation Past Paper B.

Com Part 2 Punjab University 2019

Question No.1

Define and explain the following terms with reference to Income Tax Ordinance 2001:

a) Appellate Tribunal

b) Industrial Undertaking

c) Resident Company

d) Tax

Question No.2

Explain the legal provisions governing the exemption of the following under the second schedule of

the Income Tax Ordinance 2001:

a) Agricultural Income

b) Amount of Gratuity

c) Profit on debt

d) Medical Charges or Hospital Charges

Question No.3

What are the different types of perquisites enjoyed by the salaried individual, Discuss?

Question No.4

What are the allowable deductions under section 15A in respect of “Income from property”

Question No.5

Discuss the powers and functions of the Federal Board of Revenue?

Question No.6

Define and explain the following terms with reference to Sales Tax Act 1990

a) Associates

b) Return

c) Manufacturer or Producer

d) Input Tax

Question No.7

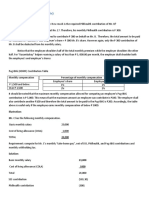

Calculate Sales Tax Liability of Mr. Zeeshan Ahmad being a registered manufacturer from the

following dates for the month of August 2018:

Taxable supplies to registered person Rs. 25,00,0000

Taxable supplies to needy person 150,000

Taxable supplies @ 20% discount (normal business practice) 100,000

Taxable supplies to associated person (open market price = Rs. 170,0000) 130,000

Advance Payment received in respect of taxable supplies 350,000

Goods pledge with a bank were disposed off by the Bank for satisfaction of debt 200,000

(normal selling price = Rs. 250,000)

Free Samples 180,000

Export Sales 160,000

Purchases from registered person (tax invoice available of Rs. 360,000) 500,000

Purchase raw material used in taxable & exempted supplies 180,000

Acquisition of fixed asset from registered person 500,000

Imported goods 120,000

Purchase of gift items for customers 50,000

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Punjab University

Business Taxation Past Paper B.Com Part 2 Punjab University 2019

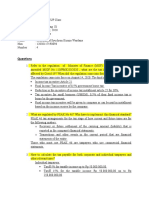

Question No.8

From the following data, calculate income tax payable by Mr. Sultan Baig for the tax year ending 30th

June 2018:

1. Basic salary Rs. 50,000 per month in the scale (Rs. 40,000-4,000-54,000)

2. Bonus Rs. 100,000

3. Entertainment allowance Rs. 50,000

4. House rent allowance at 60% of the minimum time scale.

5. Conveyance allowance Rs. 80,000

6. Tax paid by the employer Rs. 35,000

7. Loan received from father through crossed cheque Rs. 250,000

8. Re-imbursement of internet bill (used for office) Rs. 38,000

9. Encashment against unavailed leave Rs. 27,000.

10. Interest free loan obtained from employer RS. 12,00,000.

11. Medical allowance Rs. 66,000

12. Tution Fe of (3) school children Rs. 42,000

13. Share from AOP Rs. 10,000

14. Donation to Government Hospital Rs. 80,000

15. Hotel bills paid by the company relating to official duties Rs. 55,000

16. Received Income tax refund related to tax year 2016 Rs.20,000

17. TV and Refrigerator provided by the employer only for use of employee costing Rs. 200,000

18. On which the company charged depreciation @ 20% in its books of accounts.

Sr. Taxable Income Rate of Tax

1 Where the taxable income exceeds Rs. 7,50,000 but does Rs.14,500+10% of amount

not exceed Rs. 14,00,000 exceeding Rs. 7,50,000

2 Where the taxable income exceeds Rs.14,00,000 but does Rs.79,500+12.5% of amount

not exceed Rs. 15,00,000 exceeding Rs. 14,00,000

3 Where the taxable income exceeds Rs. 7,50,000 but does Rs.92,000+15% of amount

not exceed Rs. 14,00,000 exceeding Rs. 15,00,000

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Punjab University

Potrebbero piacerti anche

- Business Taxation Past Paper 2019 PDFDocumento2 pagineBusiness Taxation Past Paper 2019 PDFNouman BaigNessuna valutazione finora

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocumento3 pagineBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNessuna valutazione finora

- Question Paper 2010: Punjab UniversityDocumento2 pagineQuestion Paper 2010: Punjab UniversitySajid YaqoobNessuna valutazione finora

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocumento5 pagineModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNessuna valutazione finora

- COMLAW TAX Atty GuideDocumento6 pagineCOMLAW TAX Atty GuideMarco Alejandro IbayNessuna valutazione finora

- QuickBooks For BeginnersDocumento9 pagineQuickBooks For BeginnersZain U DdinNessuna valutazione finora

- TaxationDocumento18 pagineTaxationMags Morten Malatamban100% (2)

- BCom Part 2 Business Taxation Past Paper 2015Documento3 pagineBCom Part 2 Business Taxation Past Paper 2015dilbaz karimNessuna valutazione finora

- XI ACCOUNTING SET 2Documento6 pagineXI ACCOUNTING SET 2aashirwad2076Nessuna valutazione finora

- Practice QuestionsDocumento4 paginePractice QuestionsMff DeadsparkNessuna valutazione finora

- Question CAP III AND CA MEMBERHSIP New OneDocumento17 pagineQuestion CAP III AND CA MEMBERHSIP New OneSuraj ThapaNessuna valutazione finora

- How To Tax An Individual 1Documento25 pagineHow To Tax An Individual 1Lianna Xenia EspirituNessuna valutazione finora

- Synthesis - Problem Solving QuizDocumento3 pagineSynthesis - Problem Solving QuizEren CuestaNessuna valutazione finora

- AIOU Business Taxation Assignment GuideDocumento4 pagineAIOU Business Taxation Assignment GuideUsman Shaukat Khan100% (1)

- Tax RateDocumento10 pagineTax Rateusha chimariyaNessuna valutazione finora

- Test 9Documento4 pagineTest 9lalshahbaz57Nessuna valutazione finora

- Philhealth and Pag-IBIG contribution tables explainedDocumento5 paginePhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongNessuna valutazione finora

- Allowable Deductions Part 1Documento3 pagineAllowable Deductions Part 1John Rich GamasNessuna valutazione finora

- PGBP QuestionsDocumento6 paginePGBP QuestionsHdkakaksjsb100% (2)

- Corresponding Supporting ScheduleDocumento3 pagineCorresponding Supporting Schedulealmira garciaNessuna valutazione finora

- TAX DEDUCTIONS GUIDEDocumento4 pagineTAX DEDUCTIONS GUIDEAnonymous LC5kFdtcNessuna valutazione finora

- Section:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Documento5 pagineSection:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Shaheer MalikNessuna valutazione finora

- Philippine corporate income tax problems and solutionsDocumento2 paginePhilippine corporate income tax problems and solutionsRandy Manzano100% (1)

- Taxation PDFDocumento27 pagineTaxation PDFnanabaNessuna valutazione finora

- Tax-1-Solutions Bsa Quiz - Theories W AnsDocumento6 pagineTax-1-Solutions Bsa Quiz - Theories W AnsCyrss BaldemosNessuna valutazione finora

- Philippine Taxation Questions GuideDocumento36 paginePhilippine Taxation Questions GuideShaira BugayongNessuna valutazione finora

- Tax 1 Bsais Quiz4 Theories W AnsDocumento6 pagineTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNessuna valutazione finora

- Business & Profession Q - A 02.9.2020Documento42 pagineBusiness & Profession Q - A 02.9.2020shyamiliNessuna valutazione finora

- DE TaxationDocumento22 pagineDE TaxationHappy MagdangalNessuna valutazione finora

- San Beda University: Department of Accountancy and TaxationDocumento11 pagineSan Beda University: Department of Accountancy and TaxationOG FAMNessuna valutazione finora

- Test 6 (QP)Documento4 pagineTest 6 (QP)iamneonkingNessuna valutazione finora

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocumento8 pagineCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNessuna valutazione finora

- Tax 1st Drills Answer KeyDocumento18 pagineTax 1st Drills Answer KeyJerma Dela Cruz100% (1)

- Naga College Foundation, Inc. College of Business and Accountancy Taxation Exam ReviewDocumento12 pagineNaga College Foundation, Inc. College of Business and Accountancy Taxation Exam ReviewJykx SiaoNessuna valutazione finora

- Homework Number 4Documento8 pagineHomework Number 4ARISNessuna valutazione finora

- Tax Computations SampleDocumento5 pagineTax Computations Samplelcsme tubodaccountsNessuna valutazione finora

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDocumento21 pagineAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanNessuna valutazione finora

- Quiz Week 2 No AnswerDocumento10 pagineQuiz Week 2 No AnswerKatherine EderosasNessuna valutazione finora

- NATIONAL UNIVERSITY MIDTERM EXAMDocumento6 pagineNATIONAL UNIVERSITY MIDTERM EXAMCrizzalyn Cruz100% (1)

- Taxation GuideDocumento6 pagineTaxation GuideMff DeadsparkNessuna valutazione finora

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocumento5 pagineACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- Principles of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsDocumento15 paginePrinciples of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsosamaNessuna valutazione finora

- Model Question BBS 3rd Taxation in NepalDocumento6 pagineModel Question BBS 3rd Taxation in NepalAsmita BhujelNessuna valutazione finora

- Corporate Income TaxDocumento8 pagineCorporate Income TaxClaire BarbaNessuna valutazione finora

- Income Tax Law and PracticeDocumento5 pagineIncome Tax Law and PracticeHarsh chetiwal50% (2)

- FinalroundDocumento35 pagineFinalroundJenny Keece RaquelNessuna valutazione finora

- Iup 4 (Midterm)Documento9 pagineIup 4 (Midterm)Wilkinson MardikaNessuna valutazione finora

- 4 GSTDocumento4 pagine4 GSTafsiya.mjNessuna valutazione finora

- MASTERY TAXATION October-2019 PDFDocumento12 pagineMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- Taxation 2004 SolvedDocumento18 pagineTaxation 2004 Solvedapi-3832224100% (2)

- Problem 1: CAT LEVEL 3 - SET 4 QuestionsDocumento4 pagineProblem 1: CAT LEVEL 3 - SET 4 QuestionsEliza BethNessuna valutazione finora

- L-NU AA-23-02-01-18 Finals Exam ReviewDocumento10 pagineL-NU AA-23-02-01-18 Finals Exam ReviewAmie Jane MirandaNessuna valutazione finora

- Midterm Examination BSAISDocumento11 pagineMidterm Examination BSAISAlexis Kaye DayagNessuna valutazione finora

- INCOME FROM BUSINESSDocumento23 pagineINCOME FROM BUSINESSkhushi shahNessuna valutazione finora

- TX 201Documento4 pagineTX 201Pau SantosNessuna valutazione finora

- LIM2019PROBLEMEXERCISESININCOMETAXATIONandTRAINLAW BDocumento11 pagineLIM2019PROBLEMEXERCISESININCOMETAXATIONandTRAINLAW BMark MagnoNessuna valutazione finora

- Review MaterialsDocumento3 pagineReview MaterialsAngie S. Rosales100% (1)

- Assignment 1 Taxes On IndividualsDocumento7 pagineAssignment 1 Taxes On IndividualsMarynissa CatibogNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNessuna valutazione finora

- Chapter5 3pageDocumento8 pagineChapter5 3pageAdeel AhmedNessuna valutazione finora

- ch21 AnsDocumento8 paginech21 AnsmazamniaziNessuna valutazione finora

- Ministry of Finance - Government of Pakistan - 3Documento20 pagineMinistry of Finance - Government of Pakistan - 3muhammad nazirNessuna valutazione finora

- Q6. Draw and Label The Diagram of Internal Structure of Kidney. (/10)Documento1 paginaQ6. Draw and Label The Diagram of Internal Structure of Kidney. (/10)Adeel AhmedNessuna valutazione finora

- BIRA91 EvolutionDocumento16 pagineBIRA91 EvolutionRishi JainNessuna valutazione finora

- Quant Checklist 463 by Aashish Arora For Bank Exams 2024Documento102 pagineQuant Checklist 463 by Aashish Arora For Bank Exams 2024sharpleakeyNessuna valutazione finora

- MGMT E-2000 Fall 2014 SyllabusDocumento13 pagineMGMT E-2000 Fall 2014 Syllabusm1k0eNessuna valutazione finora

- Private Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularDocumento2 paginePrivate Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularApostol RogerNessuna valutazione finora

- Global Dis Trip Arks ProspectusDocumento250 pagineGlobal Dis Trip Arks ProspectusSandeepan ChaudhuriNessuna valutazione finora

- How To Apply For A Rental Property - Rent - Ray White AscotDocumento2 pagineHow To Apply For A Rental Property - Rent - Ray White AscotRRWERERRNessuna valutazione finora

- Palepu - Chapter 5Documento33 paginePalepu - Chapter 5Dương Quốc TuấnNessuna valutazione finora

- KV Recruitment 2013Documento345 pagineKV Recruitment 2013asmee17860Nessuna valutazione finora

- Bharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDocumento4 pagineBharti Airtel Services LTD.: Your Account Summary This Month'S ChargesVinesh SinghNessuna valutazione finora

- Rahma ConsutingDocumento6 pagineRahma ConsutingEko Firdausta TariganNessuna valutazione finora

- Toaz - Info Preparation of Financial Statements and Its Importance PRDocumento7 pagineToaz - Info Preparation of Financial Statements and Its Importance PRCriscel SantiagoNessuna valutazione finora

- E Stamp ArticleDocumento2 pagineE Stamp ArticleShubh BanshalNessuna valutazione finora

- Mrunal Economy Handouts PCB8 2023-24Documento901 pagineMrunal Economy Handouts PCB8 2023-24Adharsh Surendhiran100% (3)

- CDP Revised Toolkit Jun 09Documento100 pagineCDP Revised Toolkit Jun 09kittu1216Nessuna valutazione finora

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDocumento5 pagineTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNessuna valutazione finora

- BMWDocumento52 pagineBMWDuje Čipčić100% (3)

- CONTRACT OF LEASE (Virgo)Documento7 pagineCONTRACT OF LEASE (Virgo)Grebert Karl Jennelyn SisonNessuna valutazione finora

- ST 2 PDFDocumento2 pagineST 2 PDFEbenezer SamedwinNessuna valutazione finora

- Inventory Trading SampleDocumento28 pagineInventory Trading SampleRonald Victor Galarza Hermitaño0% (1)

- Hair Salon Business Plan ExampleDocumento20 pagineHair Salon Business Plan ExampleJamesnjiruNessuna valutazione finora

- Fundraising - Public Sector, Foundations and TrustsDocumento5 pagineFundraising - Public Sector, Foundations and TrustsLena HafizNessuna valutazione finora

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDocumento5 pagineNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNessuna valutazione finora

- Acct TutorDocumento22 pagineAcct TutorKthln Mntlla100% (1)

- Laporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018Documento49 pagineLaporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018rahmaNessuna valutazione finora

- Vajiram & Ravi Civil Services Exam Details for Sept 2022-23Documento3 pagineVajiram & Ravi Civil Services Exam Details for Sept 2022-23Appu MansaNessuna valutazione finora

- Croissance Economique Taux Change Donnees Panel RegimesDocumento326 pagineCroissance Economique Taux Change Donnees Panel RegimesSalah OuyabaNessuna valutazione finora

- Taurian Curriculum Framework Grade 11 BSTDocumento6 pagineTaurian Curriculum Framework Grade 11 BSTDeepak SharmaNessuna valutazione finora

- Upkar Dhawan Fy 2016-17Documento3 pagineUpkar Dhawan Fy 2016-17amit22505Nessuna valutazione finora

- Nava Bharat-2013-2014Documento180 pagineNava Bharat-2013-2014SUKHSAGAR1969Nessuna valutazione finora