Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Robinson Short-Term Project 1

Caricato da

HHS Business Industry CertificationCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Robinson Short-Term Project 1

Caricato da

HHS Business Industry CertificationCopyright:

Formati disponibili

Name _____________________________________________________

My Budget: I’ve Graduated…Now What???

Life After High School

My Future Plans…

Using the space below write about your plans after you graduate High School. Where will you

live? Will you get a job? How many hours will you work? Or Will you go to college? How will

you get around? What will you do for fun? What are your financial goals? Etc.?

Directions…

You will create a monthly budget for all the expenses that you will have the first three months after you graduate.

Your budget must include all the income and expenses that you will have each month. Please carefully read and

follow each step listed below. As we all know, there are always unexpected things that may arise. As you calculate

your monthly budget make sure to account for the unforeseen circumstance listed in red.

Step 1 - Calculate your checking and savings accounts starting balances:

• The starting balance for your checking and savings accounts on your June Monthly Budget will be $0

• After the first month, your checking and savings account beginning balances will be the same as the

previous months ending balance.

Step 2 - Calculate your monthly income:

Assume you start off working part-time (20 hours per week) making $10.50 per hour.

• Weekly Gross Income: $10.50 x 20 = $__________

• Weekly Net Income (income after taxes): $ (Gross income) x 0.85 = $_____________

• Additional Income (any other income that you make babysitting, side jobs, etc.):

$ _________

✓ Total Monthly Income: $ ______________

($ Weekly Net Income * 4) + $ Additional Income

Step 3 - Calculate your monthly living expenses:

• Monthly Rent: Where are you going to live?

o Live at home: $0

or

o Live on your own: $ 750

(If you will have roommates, divide by the number of people)

• Monthly Utility Bill (water, gas, electricity, and electricity):

o Live at home: $0

or

o Live on your own: $ 175

(If you will have roommates, divide by the number of people)

Step 4 – Calculate your monthly food expenses:

• Groceries $300 per month

• Eating out (restaurants, Starbucks, 7-11) $_____________

Step 5 – Calculate your monthly transportation expenses:

• How will you get around?

o Public Transportation: $45 (Bus/Train Pass)

or

o Own a Car:

▪ Car Payment $ __________

▪ Gas $ __________

▪ Car Maintenance / Repair $ 75

▪ Car Insurance $ 185

Step 6 – Calculate your monthly personal expenses:

• Clothing $ __________

• Health Insurance $ 50

• Personal Care/Hygiene (Shampoo, toothpaste Haircuts, etc.) $ _______

• Laundry $ __________

Step 7 – Calculate any miscellaneous monthly expenses:

• Cell phone, data plan, internet, etc. $ ______

• Travel $ _______

• Gifts $ ________

• Additional miscellaneous expense 1 $ __________

• Additional miscellaneous expense 2 $ __________

Step 8 – Calculate monthly entertainment expenses:

• Movies, bowling, etc. $ ___________

• Cable / Netflix / Hulu $ __________

• Going out $ _________

• Additional entertainment expense 1 $ __________

• Additional entertainment expense 2 $ __________

Step 9 – Calculate your total monthly expenses by adding all of your monthly expenses.

Step 10 - Calculate your total monthly savings expenses by adding all of the monthly savings expenses:

• Emergency Fund: Over the next 12 months you must save $1,200 to have in your savings account in case

of an emergency.

o $1,200 / 12 months = $ _______

• Future Goals: Next year you would like to purchase a car, go on a vacation, attend a concert, or save

money to achieve some other goal.

o What is your Goal?

o How much money will you need to save?

o Over the next year (12 months), how much money should put in your savings account every

month in order to achieve this goal?

$ Amount of goal / 12 months = $ ________

• Additional Savings = $ __________

✓ Total monthly savings expenses = $ ________

($Emergency Fund + $Future Goals + $ Additional Savings)

Step 11 – Calculate your cash on hand by subtracting your total monthly income from your total monthly expenses.

Step 12 – Calculate the checking account deposit by subtracting your cash on hand from your total monthly savings

expenses.

Step 13 – Calculate the ending balance bank accounts:

• Calculate your checking account ending balance by adding your checking account deposit to your

checking account starting balance.

• Calculate your savings account ending balance by adding your total monthly savings account deposit

to your savings account starting balance.

My June Monthly Budget

Starting Balance: Checking Account $ ___________________ Savings Account$ _______________

MONTHLY INCOME… AMOUNT

Paycheck (Net Income)

Additional Income

TOTAL MONTHLY INCOME

MONTHLY EXPENSES… AMOUNT

LIVING

Rent

Utility Bill

FOOD

Groceries

Eating Out

TRANSPORTATION

Public Transportation

Car Payment

Gas

Car Maintenance/ Repair

Car Insurance

PERSONAL

Clothing

Health Insurance

Personal Care/Hygiene

Laundry

MISCELLANEOUS

Cell phone, data plan, internet, etc.

Travel

Gifts

Additional miscellaneous expense 1

Additional miscellaneous expense 2

ENTERTAINMENT

Movies, bowling, etc.

Cable / Netflix/ Hulu

Going Out

Additional entertainment expense 1

Additional entertainment expense 2

TOTAL MONTHLY EXPENSES

MONTHLY SAVINGS EXPENSES… AMOUNT

Emergency Fund

Future Goals

Additional Savings

TOTAL MONTHLY SAVINGS EXPENSES

Unforeseen Circumstance - You had time to pick up extra hours at work. After taxes you made an additional $202

CASH ON HAND

CHECKING ACCOUNT DEPOSIT

SAVINGS ACCOUNT DEPOSIT = TOTAL MONTHLY SAVINGS EXPENSES

Ending Balance: Checking Account $ ___________________ Savings Account$ _______________

My July Monthly Budget

Starting Balance: Checking Account $ ___________________ Savings Account$ _______________

MONTHLY INCOME… AMOUNT

Paycheck (Net Income)

Additional Income

TOTAL MONTHLY INCOME

MONTHLY EXPENSES… AMOUNT

LIVING

Rent

Utility Bill

FOOD

Groceries

Eating Out

TRANSPORTATION

Public Transportation

Car Payment

Gas

Car Maintenance/ Repair

Car Insurance

PERSONAL

Clothing

Health Insurance

Personal Care/Hygiene

Laundry

MISCELLANEOUS

Cell phone, data plan, internet, etc.

Travel

Gifts

Additional miscellaneous expense 1

Additional miscellaneous expense 2

ENTERTAINMENT

Movies, bowling, etc.

Cable / Netflix/ Hulu

Going Out

Additional entertainment expense 1

Additional entertainment expense 2

TOTAL MONTHLY EXPENSES

MONTHLY SAVINGS EXPENSES… AMOUNT

Emergency Fund

Future Goals

Additional Savings

TOTAL MONTHLY SAVINGS EXPENSES

Unforeseen Circumstance - Your car got a flat tire. You need to pay an extra $60

CASH ON HAND

CHECKING ACCOUNT DEPOSIT

SAVINGS ACCOUNT DEPOSIT = TOTAL MONTHLY SAVINGS EXPENSES

Ending Balance: Checking Account $ ___________________ Savings Account$ _______________

My August Monthly Budget

Starting Balance: Checking Account $ ___________________ Savings Account$ _______________

MONTHLY INCOME… AMOUNT

Paycheck (Net Income)

Additional Income

TOTAL MONTHLY INCOME

MONTHLY EXPENSES… AMOUNT

LIVING

Rent

Utility Bill

FOOD

Groceries

Eating Out

TRANSPORTATION

Public Transportation

Car Payment

Gas

Car Maintenance/ Repair

Car Insurance

PERSONAL

Clothing

Health Insurance

Personal Care/Hygiene

Laundry

MISCELLANEOUS

Cell phone, data plan, internet, etc.

Travel

Gifts

Additional miscellaneous expense 1

Additional miscellaneous expense 2

ENTERTAINMENT

Movies, bowling, etc.

Cable / Netflix/ Hulu

Going Out

Additional entertainment expense 1

Additional entertainment expense 2

TOTAL MONTHLY EXPENSES

MONTHLY SAVINGS EXPENSES… AMOUNT

Emergency Fund

Future Goals

Additional Savings

TOTAL MONTHLY SAVINGS EXPENSES

Unforeseen Circumstance - You got sick and had to go to the doctor. The bill and medication cost you $125

CASH ON HAND

CHECKING ACCOUNT DEPOSIT

SAVINGS ACCOUNT DEPOSIT = TOTAL MONTHLY SAVINGS EXPENSES

Ending Balance: Checking Account $ ___________________ Savings Account$ _______________

Reflection

What was the hardest part of the project? What was the most interesting part of the project? Has your

opinion changed about the importance of a budget? Do you think that you would be able to live by a

budget? Any additional comments about the assignments…

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Kia MotorsDocumento24 pagineKia MotorsJose Ramon MendezNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Volvo 240Documento24 pagineVolvo 240stenhammer100% (3)

- The European Aftermarket in 2030Documento29 pagineThe European Aftermarket in 2030maciej.ciolekgmail.comNessuna valutazione finora

- Project Proposal FOR Car Assembly & Parts Manufacturing PlantDocumento40 pagineProject Proposal FOR Car Assembly & Parts Manufacturing PlantTesfaye DegefaNessuna valutazione finora

- Marketting Plan - Car LeasingDocumento7 pagineMarketting Plan - Car LeasingRavindra DananeNessuna valutazione finora

- Renault Can Clip V195 Software Download Installation Activation and PanchDocumento1 paginaRenault Can Clip V195 Software Download Installation Activation and Panchgrvjg2mjc6Nessuna valutazione finora

- Marketing Research FINAL PROJECT REPORTDocumento37 pagineMarketing Research FINAL PROJECT REPORTvaibhav100% (1)

- Honda CarsDocumento6 pagineHonda CarsDori Vee Magusib0% (1)

- Intro To Digital Technology SyllabusDocumento4 pagineIntro To Digital Technology SyllabusHHS Business Industry CertificationNessuna valutazione finora

- Web Design Syllabus PDFDocumento5 pagineWeb Design Syllabus PDFAisha RobinsonNessuna valutazione finora

- Information Technology PathwayPacing GuideDocumento2 pagineInformation Technology PathwayPacing GuideHHS Business Industry CertificationNessuna valutazione finora

- Business Pathway Pacing GuideDocumento2 pagineBusiness Pathway Pacing GuideHHS Business Industry CertificationNessuna valutazione finora

- DD Long-Term ProjectDocumento2 pagineDD Long-Term ProjectAisha RobinsonNessuna valutazione finora

- Intro To Business & Technology Syllabus PDFDocumento5 pagineIntro To Business & Technology Syllabus PDFAisha RobinsonNessuna valutazione finora

- Hiram High School: 2019-2020 Course SyllabusDocumento4 pagineHiram High School: 2019-2020 Course SyllabusHHS Business Industry CertificationNessuna valutazione finora

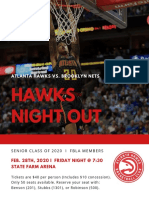

- FBLA Hawks Night OutDocumento1 paginaFBLA Hawks Night OutAisha RobinsonNessuna valutazione finora

- Employability Development Activity 1Documento7 pagineEmployability Development Activity 1Aisha RobinsonNessuna valutazione finora

- Employability Development Activity 2Documento7 pagineEmployability Development Activity 2Aisha RobinsonNessuna valutazione finora

- Business Pathway Long-Term ProjectDocumento2 pagineBusiness Pathway Long-Term ProjectHHS Business Industry CertificationNessuna valutazione finora

- Fbla Agenda (8-30)Documento1 paginaFbla Agenda (8-30)Aisha RobinsonNessuna valutazione finora

- Fbla Agenda (11-8)Documento1 paginaFbla Agenda (11-8)Aisha RobinsonNessuna valutazione finora

- Career Skills Activity 1Documento13 pagineCareer Skills Activity 1Aisha RobinsonNessuna valutazione finora

- Intro To DigitalTechnology FBLA Student Activity 1Documento2 pagineIntro To DigitalTechnology FBLA Student Activity 1HHS Business Industry CertificationNessuna valutazione finora

- Digital Design FBLA Student Activity 1Documento2 pagineDigital Design FBLA Student Activity 1HHS Business Industry CertificationNessuna valutazione finora

- Employability Development Activity 3Documento6 pagineEmployability Development Activity 3Aisha RobinsonNessuna valutazione finora

- Career Skills Activity 2Documento1 paginaCareer Skills Activity 2Aisha RobinsonNessuna valutazione finora

- Career Skills Activity 3Documento1 paginaCareer Skills Activity 3Aisha RobinsonNessuna valutazione finora

- Intro To DigitalTechnology FBLA Student Activity 2Documento2 pagineIntro To DigitalTechnology FBLA Student Activity 2HHS Business Industry CertificationNessuna valutazione finora

- Introduction To Business FBLA Student Activity 2 PDFDocumento2 pagineIntroduction To Business FBLA Student Activity 2 PDFHHS Business Industry CertificationNessuna valutazione finora

- Digital Design FBLA Student Activity 2Documento2 pagineDigital Design FBLA Student Activity 2HHS Business Industry CertificationNessuna valutazione finora

- Robinson Short-Term Project 2Documento37 pagineRobinson Short-Term Project 2Aisha RobinsonNessuna valutazione finora

- The Dramatic Rise and Fall of Vehicle VirginsDocumento4 pagineThe Dramatic Rise and Fall of Vehicle Virginstanay patekarNessuna valutazione finora

- The Maple Lake The Maple Lake: Wright County CollisionDocumento4 pagineThe Maple Lake The Maple Lake: Wright County CollisionMaple Lake MessengerNessuna valutazione finora

- 9A03606 Automobile EngineeringDocumento4 pagine9A03606 Automobile EngineeringsivabharathamurthyNessuna valutazione finora

- Review Unit 1 - Family LifeDocumento6 pagineReview Unit 1 - Family LifeNguyễn Anh ThơNessuna valutazione finora

- Mechanical EngineeringDocumento15 pagineMechanical EngineeringKuo MabucchiNessuna valutazione finora

- RNS Motors Final ProjectDocumento84 pagineRNS Motors Final ProjectSangamesh Bagali100% (1)

- BMW E12Documento118 pagineBMW E12mnbvqwertNessuna valutazione finora

- A Study On Marketing Strategies of Tata Motors, VaranasiDocumento11 pagineA Study On Marketing Strategies of Tata Motors, VaranasiRahul VermaNessuna valutazione finora

- Submitted By:: Shahzaib Amir Zuhaib Naeem Abdullah Butt Laiha Nawaz Sadaf ShafiqueDocumento15 pagineSubmitted By:: Shahzaib Amir Zuhaib Naeem Abdullah Butt Laiha Nawaz Sadaf ShafiqueAbdullah AmjadNessuna valutazione finora

- Predicting The Future ParagraphDocumento2 paginePredicting The Future Paragraphpedro perezNessuna valutazione finora

- Auto MechnaicDocumento49 pagineAuto Mechnaicpmm05479Nessuna valutazione finora

- Reeba PPT OperationsDocumento15 pagineReeba PPT Operationssridevi gopalakrishnanNessuna valutazione finora

- A Business Model For Hydrogen Fuel and Hydrogen CaDocumento7 pagineA Business Model For Hydrogen Fuel and Hydrogen CaSWAGAT SHOVANNessuna valutazione finora

- NANO-"A Dream Car For The PoorDocumento16 pagineNANO-"A Dream Car For The PoorRaunak JainNessuna valutazione finora

- General Motors IndiaDocumento21 pagineGeneral Motors IndiaARSHU . SNessuna valutazione finora

- Unseen PassageDocumento2 pagineUnseen PassageAKSHATNessuna valutazione finora

- Tata MotorsDocumento49 pagineTata MotorsUnknown 123Nessuna valutazione finora

- Commercial Bank of Ethiopian Estimation Manual For Mechanical EquipmentDocumento47 pagineCommercial Bank of Ethiopian Estimation Manual For Mechanical EquipmentTekeba BirhaneNessuna valutazione finora

- 16 5Documento2 pagine16 5ReyhanNessuna valutazione finora

- AejazDocumento12 pagineAejazSamra AmeenNessuna valutazione finora

- Tata MotorsDocumento64 pagineTata MotorsAlfan KotadiaNessuna valutazione finora