Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FAR Estimating Inventory Student

Caricato da

Mary AquinoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FAR Estimating Inventory Student

Caricato da

Mary AquinoCopyright:

Formati disponibili

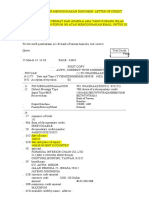

ESTIMATING INVENTORY 2019

LECTURE NOTES deducted from the retail value of inventory available

for sale. The resulting amount represents ending

Gross profit method inventory priced at retail. When this amount is

multiplied by the cost to retail ratio, an

The gross profit method is an inventory estimation approximation of the cost of ending inventory

technique based on a relationship between gross results. Use of this method eliminates the need for a

profit and sales that is assumed to be fairly stable. physical count of inventory each time an income

Its use is not appropriate for financial reporting statement is prepared. However, physical counts are

purposes; however, it can serve a useful purpose made at least yearly to determine the accuracy of

when an approximation of ending inventory is the records and to avoid overstatements due to

needed. Such approximations are sometimes theft, loss, and breakage.

required by auditors or when inventory and inventory

records are destroyed by fire or some other To obtain the appropriate inventory figures under the

catastrophe. The gross profit method should never retail inventory method, proper treatment must be

be used as a substitute for a yearly physical given to markups, markup cancellations, markdowns,

inventory unless the inventory has been destroyed. and markdown cancellations.

The gross profit method is based on the assumptions

that (a) the beginning inventory plus purchases

equal total goods to be accounted for; (b) goods not

sold must be on hand; and (c) if sales, reduced to When the cost to retail ratio is computed after net

cost, are deducted from the sum of the opening markups (markups less markup cancellations) have

inventory plus purchases, the result is the ending been added, the retail inventory method

inventory. approximates lower of cost or market. This is known

as the conventional retail inventory method. If both

In developing a reliable gross profit percentage, net markups and net markdowns are included before

reference is made to past years and adjustments are the cost to retail ratio is computed, the retail

made for current circumstances. inventory method approximates cost.

The retail inventory method becomes more

Techniques for the Measurement of Cost under PAS 2 complicated when such items as freight-in, purchase

returns and allowances, and purchase discounts are

Techniques for the measurement of the cost of

involved. In essence, the treatment of the items

inventories, such as the standard cost method or the

affecting the cost column of the retail inventory

retail method, may be used for convenience if the

approach follows the computation of cost of goods

results approximate cost.

available for sale. Freight costs are treated as a part

of the purchase cost; purchase returns and

Standard cost method

allowances are ordinarily considered both a reduction

Standard costs take into account normal levels of of the price at both cost and retail; and purchase

materials and supplies, labor, efficiency and capacity discounts usually are considered as a reduction of

utilization. They are regularly reviewed and, if the cost of purchases.

necessary, revised in the light of current conditions.

Other items that require careful consideration include

Retail method transfers-in, normal shortages, abnormal shortages,

and employee discounts. Transfers-in from another

The retail inventory method is an inventory departments should be reported in the same way as

estimation technique based upon an observable purchases from an outside enterprise. Normal

pattern between cost and sales price that exists in shortages should reduce the retail column because

most retail concerns. This method requires that a these goods are no longer available for sale.

record be kept of (a) the total cost and retail of Abnormal shortages should be deducted from both

goods purchased, (b) the total cost and retail value the cost and retail columns and reported as a special

of the goods available for sale, and (c) the sales for inventory amount or as a loss. Employee discounts

the period. should be deducted from the retail column in the

same way as sales.

Basically, the retail method requires the computation

of the cost-to-retail ratio of inventory available for The retail inventory method is widely used (a) to

sale. This ratio is computed by dividing the cost of permit the computation of net income without a

the goods available for sale by the retail value physical count of inventory, (b) as a control measure

(selling price) of goods available for sale. Once the in determining inventory shortages, (c) in regulating

ratio is determined, total sales for the period are

FEU – IABF Page 1

ESTIMATING INVENTORY 2019

quantities of inventory on hand, and (d) for would be three percentage points higher than the

insurance information. one earned in 2018.

Salvaged undamaged merchandise was marked

The retail method is often used in the retail industry

to sell at P120,000 while damaged merchandise

for measuring inventories of large numbers of rapidly

was marked to sell at P80,000 had an estimated

changing items with similar margins for which it is

realizable value of P18,000.

impracticable to use other costing methods.

The percentage used takes into consideration How much is the inventory loss due to fire?

inventory that has been marked down to below

its original selling price.

An average percentage for each retail 3. Luna Manufacturing began operations 5 years

department is often used. ago. On August 13, 2019, a fire broke out in the

warehouse destroying all inventory and many

accounting records relating to the inventory. The

PROBLEMS information available is presented below. All

sales and purchases are on account.

1. On May 6, 2019 a flash flood caused damage to January August

the merchandise stored in the warehouse of 1, 2019 13, 2019

Cabanatuan Co. You were asked to submit an Inventory P143,850

estimate of the merchandise destroyed in the Accounts Receivable 130,590 P128,890

warehouse. The following data were established: Accounts Payable 88,140 122,850

a. Net sales for 2018 were P800,000, matched Collections on accounts

against cost of P560,000. rec., Jan. 1- Aug. 13 753,800

b. Merchandise inventory, Jan. 1, 2019 was Payments to suppliers,

P200,000, 90% of which was in the Jan. 1- Aug. 13 487,500

warehouse and 10% in downtown Goods out on consignment

showrooms. at Aug. 13, at cost 52,900

c. For Jan. 1, 2019 to date of flood, you

ascertained invoice value of purchases (all

stored in the warehouse), P100,000; freight

inward, P4,000; purchases returned, P6,000.

d. Cost of merchandise transferred from the Summary on previous years’ sales:

warehouse to show-rooms was P8,000, and

net sales from January 1 to May 6, 2019 (all 2016 2017 2018

warehouse stock) were P320,000. Sales P626,000 P705,000 P680,000

Gross Profit 187,800 183,300 231,200

Assuming gross profit rate in 2019 to be the GPR 30% 26% 34%

same as in the previous year, the estimated

merchandise destroyed by the flood was Determine the inventory loss suffered as a result

of the fire.

2. The Bayambang Corporation was organized on

January 1, 2018. On December 31, 2019, the 4. The work-in-process inventory of Burp Company

corporation lost most of its inventory in a were completely destroyed by fire on June 1,

warehouse fire just before the year-end count of 2019. You were able to establish physical

inventory was to take place. Data from the inventory figures as follows:

records disclosed the following: January 1, 2019 June 1, 2019

2018 2019 Raw materials P 60,000 P120,000

Beginning inventory, Work-in-process 200,000 -

January 1 P 0 P1,020,000 Finished goods 280,000 240,000

Purchases 4,300,000 3,460,000 Sales from January 1 to May 31, were P546,750.

Purchases returns and Purchases of raw materials were P200,000 and

allowances 230,600 323,000 freight on purchases, P30,000. Direct labor

Sales 3,940,000 4,180,000 during the period was P160,000. It was agreed

Sales returns and with insurance adjusters that an average gross

allowances 80,000 100,000 profit rate of 35% based on cost be used and

On January 1, 2019, the Corporation’s pricing that direct labor cost was 160% of factory

policy was changed so that the gross profit rate overhead.

FEU – IABF Page 2

ESTIMATING INVENTORY 2019

The work in process inventory destroyed by fire

is

Use the following information for the next two

questions.

Pugo uses the retail inventory method. The following

information is available for the current year:

Cost Retail

Beginning inventory P 1,300,000 P 2,600,000

Purchases 18,000,000 29,200,000

Freight in 400,000

Purchase returns 600,000 1,000,000

Purchase allowances 300,000

Departmental transfer 400,000 600,000

in

Net markups 600,000

Net markdowns 2,000,000

Sales 24,700,000

Sales returns 350,000

Sales discounts 200,000

Employee discounts 600,000

Loss from breakage 50,000

5. The estimated cost of inventory at the end of the

current year using the conventional (lower of

cost or market) retail inventory method is

6. The estimated cost of inventory at the end of the

current year using the average retail inventory

method is

7. The estimated cost of inventory at the end of the

current year using the FIFO retail inventory

method is

8. The records of Binmaley’s Department

Store report the following data for the

month of January:

Beginning inventory at cost 440,000

Beginning inventory at sales price 800,000

Purchases at cost 4,500,000

Initial markup on purchases 2,900,000

Purchase returns at cost 240,000

Purchase returns at sales price 350,000

Freight on purchases 100,000

Additional mark up 250,000

Mark up cancellations 100,000

Mark down 600,000

Mark down cancellations 100,000

Net sales 6,500,000

Sales allowance 100,000

Sales returns 500,000

Employee discounts 200,000

Theft and other losses 100,000

Using the average retail inventory method,

Binmaley’s ending inventory is

FEU – IABF Page 3

Potrebbero piacerti anche

- Cost Management For Just-in-Time EnvironmentsDocumento57 pagineCost Management For Just-in-Time EnvironmentsSunny NayakNessuna valutazione finora

- GN Merc 401-412Documento18 pagineGN Merc 401-412Jett ChuaquicoNessuna valutazione finora

- Chapter 2 Premium and Warranty LiabilityDocumento20 pagineChapter 2 Premium and Warranty LiabilityCarlo VillanNessuna valutazione finora

- Estimating Risk and Return On Assets: S A R Q P I. QuestionsDocumento13 pagineEstimating Risk and Return On Assets: S A R Q P I. QuestionsRonieOlarteNessuna valutazione finora

- Final Tfa CompiledDocumento109 pagineFinal Tfa CompiledAsi Cas JavNessuna valutazione finora

- Cost Accounting 1 - Chapter 3 PDFDocumento3 pagineCost Accounting 1 - Chapter 3 PDFsheenah estoresNessuna valutazione finora

- Quiz SIA - SolvedDocumento5 pagineQuiz SIA - SolvedShinta AyuNessuna valutazione finora

- Hyper InflationDocumento4 pagineHyper InflationMjhayeNessuna valutazione finora

- Property, Plant and EquipmentDocumento6 pagineProperty, Plant and EquipmenthemantbaidNessuna valutazione finora

- CORRECTION OF ERRORS TheoriesDocumento7 pagineCORRECTION OF ERRORS TheoriesDonitaNessuna valutazione finora

- Theory of Accounts - Exam1Documento7 pagineTheory of Accounts - Exam1PhoebeLOuCelizNessuna valutazione finora

- DfggyuujjDocumento2 pagineDfggyuujjJornel MandiaNessuna valutazione finora

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Documento14 pagineACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNessuna valutazione finora

- UP Cfas Reviewer (Theories)Documento9 pagineUP Cfas Reviewer (Theories)MJ MagnoNessuna valutazione finora

- University of Santo Tomas Alfredo M. Velayo College of AccountancyDocumento4 pagineUniversity of Santo Tomas Alfredo M. Velayo College of AccountancyChni Gals0% (1)

- Borrowing CostsDocumento1 paginaBorrowing CostsJulliena BakersNessuna valutazione finora

- Home My Courses ECON-101-LEC-1913T Week 13: Quiz Quiz 006: Answer Saved Marked Out of 2.00Documento2 pagineHome My Courses ECON-101-LEC-1913T Week 13: Quiz Quiz 006: Answer Saved Marked Out of 2.00Frank WaleNessuna valutazione finora

- Investment in Securities (Notes)Documento5 pagineInvestment in Securities (Notes)Karla BordonesNessuna valutazione finora

- CM1 PAS1 Presentation of Financial StatementsDocumento16 pagineCM1 PAS1 Presentation of Financial StatementsMark GerwinNessuna valutazione finora

- Chapter 18 IAS 2 InventoriesDocumento6 pagineChapter 18 IAS 2 InventoriesKelvin Chu JYNessuna valutazione finora

- Financial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPADocumento17 pagineFinancial Asset at Fair Value: Intermediate Accounting 1 Ray Patrick S. Guangco, CPAClaire Magbunag AntidoNessuna valutazione finora

- Quiz 1 Ia2Documento4 pagineQuiz 1 Ia2Angelica NilloNessuna valutazione finora

- Chapter 3Documento5 pagineChapter 3Julie Neay AfableNessuna valutazione finora

- Capital StructureDocumento9 pagineCapital StructureRavi TejaNessuna valutazione finora

- Toa Interim ReportingDocumento17 pagineToa Interim ReportingEmmanuel SarmientoNessuna valutazione finora

- 13 x11 Financial Management ADocumento7 pagine13 x11 Financial Management AamirNessuna valutazione finora

- Ethics, Fraud and Internal ControlDocumento4 pagineEthics, Fraud and Internal ControlCjay Dolotina0% (1)

- Adjusting Entries KaroleDocumento89 pagineAdjusting Entries Karole이시연Nessuna valutazione finora

- Variable & Absorption Costing LectureDocumento11 pagineVariable & Absorption Costing LectureElisha Dhowry PascualNessuna valutazione finora

- PAS 01 Presentation of FSDocumento12 paginePAS 01 Presentation of FSRia GayleNessuna valutazione finora

- Module 1 Overview of Management ScienceDocumento10 pagineModule 1 Overview of Management ScienceRaphael GalitNessuna valutazione finora

- Ias 7 Statement of Cash Flows: PurposeDocumento14 pagineIas 7 Statement of Cash Flows: Purposemusic niNessuna valutazione finora

- Impairment of AssetsDocumento19 pagineImpairment of AssetsTareq SojolNessuna valutazione finora

- CHAPTER 16 Financing Current AssetsDocumento24 pagineCHAPTER 16 Financing Current AssetsAhsanNessuna valutazione finora

- 41 DepletionDocumento5 pagine41 DepletionjsemlpzNessuna valutazione finora

- GHJKLL B KLDocumento1 paginaGHJKLL B KLJornel MandiaNessuna valutazione finora

- Cash and Accrual BasisDocumento2 pagineCash and Accrual Basisviji9999Nessuna valutazione finora

- Bridging Session 1 10Documento12 pagineBridging Session 1 10West AfricaNessuna valutazione finora

- Fundamentals of AccountingDocumento11 pagineFundamentals of AccountingJacob DiazNessuna valutazione finora

- 02 Audit of Mining Entities PDFDocumento12 pagine02 Audit of Mining Entities PDFelaine piliNessuna valutazione finora

- Hand OutDocumento8 pagineHand OutziahnepostreliNessuna valutazione finora

- Far/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Documento2 pagineFar/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Andrei Nicole RiveraNessuna valutazione finora

- Income Taxation Finals Quiz 2Documento7 pagineIncome Taxation Finals Quiz 2Jericho DupayaNessuna valutazione finora

- MODADV3 Handouts 1 of 2Documento23 pagineMODADV3 Handouts 1 of 2Dennis ChuaNessuna valutazione finora

- GFXHGJGKGKLDocumento2 pagineGFXHGJGKGKLJornel MandiaNessuna valutazione finora

- Kinney 8e - CH 09Documento17 pagineKinney 8e - CH 09Ashik Uz ZamanNessuna valutazione finora

- Ias 37 Provisions Contingent Liabilities and Contingent Assets SummaryDocumento5 pagineIas 37 Provisions Contingent Liabilities and Contingent Assets SummaryChristian Dela Pena67% (3)

- Tfa CompiledDocumento109 pagineTfa CompiledAsi Cas JavNessuna valutazione finora

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDocumento3 pagine2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyNessuna valutazione finora

- Principles of TaxationDocumento11 paginePrinciples of TaxationJay GamboaNessuna valutazione finora

- Chaper 2 Taxes, Tax, Laws and Tax AdministrationDocumento35 pagineChaper 2 Taxes, Tax, Laws and Tax AdministrationPearlyn VillarinNessuna valutazione finora

- Elements of Strategic AuditDocumento2 pagineElements of Strategic AuditMae ann LomugdaNessuna valutazione finora

- Adjusting EntriesDocumento43 pagineAdjusting EntriesCH Umair MerryNessuna valutazione finora

- Module1 - Foreign Currency Transaction and TranslationDocumento3 pagineModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocumento2 pagineCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNessuna valutazione finora

- Module 1 - Auditing Assurance CA 1Documento6 pagineModule 1 - Auditing Assurance CA 1Merliza JusayanNessuna valutazione finora

- CH 11 ImDocumento28 pagineCH 11 ImidentifierNessuna valutazione finora

- Ra 9298Documento10 pagineRa 9298Abraham Mayo MakakuaNessuna valutazione finora

- Module 2 Conceptual Frameworks and Accounting Standards PDFDocumento7 pagineModule 2 Conceptual Frameworks and Accounting Standards PDFJonabelle DalesNessuna valutazione finora

- FAR - Estimating Inventory - StudentDocumento3 pagineFAR - Estimating Inventory - StudentPamelaNessuna valutazione finora

- Theory of The Firm NotesDocumento11 pagineTheory of The Firm NotesGeorge EscribanoNessuna valutazione finora

- Advertisement and Sales Management Paper - 2Documento2 pagineAdvertisement and Sales Management Paper - 2maheta shivang100% (1)

- Practice Cases BCGDocumento8 paginePractice Cases BCGYouna YangNessuna valutazione finora

- Vietnam: B) Structural Cost ManagementDocumento2 pagineVietnam: B) Structural Cost ManagementBáchHợpNessuna valutazione finora

- Riska Kartika Marufa Ginting - Perusahaan DagangDocumento6 pagineRiska Kartika Marufa Ginting - Perusahaan DagangRiska GintingNessuna valutazione finora

- SLK SoftwareDocumento11 pagineSLK SoftwareSaimadhav MamidalaNessuna valutazione finora

- Sales and Operations Planning: Chapter NineteenDocumento28 pagineSales and Operations Planning: Chapter NineteenMay MiaNessuna valutazione finora

- SM AssignmentDocumento4 pagineSM AssignmentNikita Mallick100% (1)

- Facility Location and LayoutDocumento104 pagineFacility Location and LayoutSindhuja Kumar100% (2)

- Assignment No.2 - Tinagsa, Luisito JR., ADocumento3 pagineAssignment No.2 - Tinagsa, Luisito JR., ALuisito100% (5)

- Entrepreneurship: Quarter 2 - Module 7: Forecasting Revenues and Costs DepartmentDocumento39 pagineEntrepreneurship: Quarter 2 - Module 7: Forecasting Revenues and Costs DepartmentBergonsolutions Aingel100% (9)

- Task Performance in The Entrepreneurial MindDocumento1 paginaTask Performance in The Entrepreneurial MindBianca Nicole LiwanagNessuna valutazione finora

- Ax 2012 KB Article ListDocumento158 pagineAx 2012 KB Article ListniravmodyNessuna valutazione finora

- WWW I Scoop Eu Digital Transformation Transportation Logistics Supply Chain ManagementDocumento8 pagineWWW I Scoop Eu Digital Transformation Transportation Logistics Supply Chain ManagementvinayNessuna valutazione finora

- Port DirectoryDocumento30 paginePort DirectoryMax WillNessuna valutazione finora

- Manage Global Atp in Sap ApoDocumento30 pagineManage Global Atp in Sap ApoHarsha de Hero100% (2)

- Competitiveness, Strategy, and Productivity: Mcgraw-Hill/IrwinDocumento42 pagineCompetitiveness, Strategy, and Productivity: Mcgraw-Hill/IrwinKawsar Ahmed BadhonNessuna valutazione finora

- 4 Degrees of Commitment Level in eDocumento1 pagina4 Degrees of Commitment Level in eThu TrangNessuna valutazione finora

- Interim YI 0321 - Sample Revenue - StatusDocumento3 pagineInterim YI 0321 - Sample Revenue - Statusachmad agungNessuna valutazione finora

- Incoterms SummaryDocumento1 paginaIncoterms SummaryArvind JadliNessuna valutazione finora

- Deus International Global Logistics Inc - Company ProfileDocumento35 pagineDeus International Global Logistics Inc - Company ProfileFerlie TagleNessuna valutazione finora

- Clearing and Forwarding Terminology: Course ManualDocumento79 pagineClearing and Forwarding Terminology: Course ManualMALIMA100% (1)

- Accounting Information SystemDocumento21 pagineAccounting Information SystemTaira Marie Macalinao100% (1)

- Chapter 8Documento61 pagineChapter 8Mhmad Mokdad100% (4)

- Oracle EBS End To End Process - List - v1.2Documento41 pagineOracle EBS End To End Process - List - v1.2qkhan2000Nessuna valutazione finora

- Hill e Scudder (2002)Documento13 pagineHill e Scudder (2002)Igor MonteiroNessuna valutazione finora

- 이산사건 시뮬레이션 시스템을 활용한 생산성 개선 사례 연구 - ARENADocumento94 pagine이산사건 시뮬레이션 시스템을 활용한 생산성 개선 사례 연구 - ARENAsk parkNessuna valutazione finora

- Supply Chain Management - Test 1 MemoDocumento5 pagineSupply Chain Management - Test 1 MemoNaomiNessuna valutazione finora

- Contoh Dokumen Ekspor Dengan LCDocumento6 pagineContoh Dokumen Ekspor Dengan LCIvan RystyawanNessuna valutazione finora

- ERP PepsicoDocumento24 pagineERP PepsicoPreeti Dhillon100% (20)