Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bab 7 Dan 8 Akm

Caricato da

alesha nindya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

4 visualizzazioni2 pagineAKUNTANSI KEUANGAN MENENGAH

1 - BAB 7 DAN 8

Titolo originale

BAB 7 DAN 8 AKM

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAKUNTANSI KEUANGAN MENENGAH

1 - BAB 7 DAN 8

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

4 visualizzazioni2 pagineBab 7 Dan 8 Akm

Caricato da

alesha nindyaAKUNTANSI KEUANGAN MENENGAH

1 - BAB 7 DAN 8

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

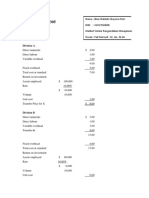

P7-2

1. Net sales................................................................................................ $1,200,000

Percentage ........................................................................................... X 1 1/2%

Bad debt expense .............................................................................. $ 18,000

2. Accounts receivable ......................................................................... $1,750,000

Amounts estimated to be uncollectible...................................... (180,000)

Net realizable value ........................................................................... $1,570,000

3. Allowance for doubtful accounts 1/1/10..................................... $ 17,000

Establishment of accounts written off in prior years............. 8,000

Customer accounts written off in 2010....................................... (30,000)

Bad debt expense for 2010 ($2,400,000 X 3%).......................... 72,000

Allowance for doubtful accounts 12/31/10 ................................ $ 67,000

4. Bad debt expense for 2010 ............................................................. $ 84,000

Customer accounts written off as uncollectible during

2010...................................................................................... (24,000)

Allowance for doubtful accounts balance 12/31/10................ $ 60,000

Accounts receivable, net of allowance for doubtful

Accounts.................................................................. $ 950,000

Allowance for doubtful accounts balance 12/31/10................ 60,000

Accounts receivable, before deducting allowance for doubtful accounts....$1,010,000

5. Accounts receivable ......................................................................... $ 310,000

Percentage ........................................................................................... X 3%

Bad debt expense, before adjustment........................................ 9,300

Allowance for doubtful accounts (debit balance)................... 14,000

Bad debt expense, as adjusted ..................................... ................ $ 23,300

P8-1

1. $175,000 – ($175,000 X 0.20) = $140,000;

$140,000 – ($140,000 X 0.10) = $126,000, cost of goods purchased

2. $1,100,000 + $69,000 = $1,169,000. The $69,000 of goods in transit on

which title had passed on December 24 (f.o.b. shipping point) should

be added to 12/31/10 inventory. The $29,000 of goods shipped (f.o.b.

shipping point) on January 3, 2011, should remain part of the 12/31/10

inventory.

3. Because no date was associated with the units issued or sold, the

periodic (rather than perpetual) inventory method must be assumed.

FIFO inventory cost:

1,000 units at $24 $ 24,000

1,000 units at 23 23,000

Total $ 47,000

Average cost:

1,500 at $21 $ 31,500

2,000 at 22 44,000

3,500 at 23 80,500

1,000 at 24 24,000

Totals 8,000 $180,000

$180,000 ÷ 8,000 = $22.50

Ending inventory (2,000 X $22.50) is $45,000.

4. The inventoriable costs for 2011 are:

Merchandise purchased ........................................ $909,400

Add: Freight-in......................................................... 22,000

931,400

Deduct: Purchase returns.................................... $16,500

Purchase discounts .............................. 6,800 23,300

Inventoriable cost .................................................... $908,100

Potrebbero piacerti anche

- Intermediate Accounting Vol.2 Chapter 22Documento59 pagineIntermediate Accounting Vol.2 Chapter 22Ahmad Obaidat100% (2)

- Chapter 13 Cash FlowsDocumento20 pagineChapter 13 Cash Flowsalesha nindyaNessuna valutazione finora

- AKMDocumento2 pagineAKMalesha nindyaNessuna valutazione finora

- AKMDocumento2 pagineAKMalesha nindyaNessuna valutazione finora

- Bab 7 Dan 8 AkmDocumento2 pagineBab 7 Dan 8 Akmalesha nindyaNessuna valutazione finora

- AKM 1 Bab 3Documento5 pagineAKM 1 Bab 3alesha nindyaNessuna valutazione finora

- P 10-6Documento2 pagineP 10-6alesha nindyaNessuna valutazione finora

- P 10-6Documento2 pagineP 10-6alesha nindyaNessuna valutazione finora

- Kasus 6-1 - Jihan NabilahDocumento21 pagineKasus 6-1 - Jihan Nabilahalesha nindyaNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Wohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Documento30 pagineWohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Simon Graf von BrühlNessuna valutazione finora

- Arthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Documento357 pagineArthur N. J. M. Cools, Thomas K. M. Crombez, Johan M. J. Taels - The Locus of Tragedy (Studies in Contemporary Phenomenology) (2008)Awan_123Nessuna valutazione finora

- Q3 2023 Investor Conference Call DetailsDocumento2 pagineQ3 2023 Investor Conference Call DetailsDionnelle VillalobosNessuna valutazione finora

- Cost-Effective Sustainable Design & ConstructionDocumento6 pagineCost-Effective Sustainable Design & ConstructionKeith Parker100% (2)

- Sitras RSC: FeaturesDocumento4 pagineSitras RSC: FeaturesAnonymous m1cSnEavoNessuna valutazione finora

- SP BVL Peru General Index ConstituentsDocumento2 pagineSP BVL Peru General Index ConstituentsMiguelQuispeHuaringaNessuna valutazione finora

- Big Data Report 2012Documento103 pagineBig Data Report 2012bileshNessuna valutazione finora

- Mahabharata of KrishnaDocumento4 pagineMahabharata of KrishnanoonskieNessuna valutazione finora

- Safe Work Method Statement TemplateDocumento5 pagineSafe Work Method Statement Templatebmb00Nessuna valutazione finora

- Harvard Case Whole Foods Market The Deutsche Bank ReportDocumento13 pagineHarvard Case Whole Foods Market The Deutsche Bank ReportRoger Sebastian Rosas AlzamoraNessuna valutazione finora

- Prodman Part IIDocumento14 pagineProdman Part IIVladimir Sabarez LinawanNessuna valutazione finora

- CEIL Engineers Annexure ADocumento2 pagineCEIL Engineers Annexure AZeeshan PathanNessuna valutazione finora

- GeM Bidding 2062861Documento6 pagineGeM Bidding 2062861ManishNessuna valutazione finora

- EssayDocumento6 pagineEssaylinhJNessuna valutazione finora

- Flinn (ISA 315 + ISA 240 + ISA 570)Documento2 pagineFlinn (ISA 315 + ISA 240 + ISA 570)Zareen AbbasNessuna valutazione finora

- Judicial Process - AssignmentDocumento16 pagineJudicial Process - AssignmentApoorva Kulkarni SharmaNessuna valutazione finora

- 4 Socioeconomic Impact AnalysisDocumento13 pagine4 Socioeconomic Impact AnalysisAnabel Marinda TulihNessuna valutazione finora

- Case Report UnpriDocumento17 pagineCase Report UnpriChandra SusantoNessuna valutazione finora

- SAA Committee GlossaryDocumento29 pagineSAA Committee GlossarysanjicamackicaNessuna valutazione finora

- LIBOR Transition Bootcamp 2021Documento11 pagineLIBOR Transition Bootcamp 2021Eliza MartinNessuna valutazione finora

- Glory To GodDocumento2 pagineGlory To GodMonica BautistaNessuna valutazione finora

- Internet Marketing Ch.3Documento20 pagineInternet Marketing Ch.3Hafiz RashidNessuna valutazione finora

- Week 4 & 5 DDG (Designing Channel Networks)Documento32 pagineWeek 4 & 5 DDG (Designing Channel Networks)Aqib LatifNessuna valutazione finora

- ALBAO - BSChE2A - MODULE 1 (RIZAL)Documento11 pagineALBAO - BSChE2A - MODULE 1 (RIZAL)Shaun Patrick AlbaoNessuna valutazione finora

- James Tager Retirement AnnouncementDocumento2 pagineJames Tager Retirement AnnouncementNEWS CENTER MaineNessuna valutazione finora

- Identity Mapping ExerciseDocumento2 pagineIdentity Mapping ExerciseAnastasia WeningtiasNessuna valutazione finora

- Jas PDFDocumento34 pagineJas PDFJasenriNessuna valutazione finora

- DR Sebit Mustafa, PHDDocumento9 pagineDR Sebit Mustafa, PHDSebit MustafaNessuna valutazione finora

- Project Proposal - Tanya BhatnagarDocumento9 pagineProject Proposal - Tanya BhatnagarTanya BhatnagarNessuna valutazione finora

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento2 pagineCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNessuna valutazione finora