Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Impairment of Asset

Caricato da

QuỳnhDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Impairment of Asset

Caricato da

QuỳnhCopyright:

Formati disponibili

Case study 1

Magenta Ltd has two divisions, Turquoise and Pink, each of which is a separate cash-

generating unit. Magenta Ltd adopts a decentralised management approach whereby unit

managers are expected to operate their units. However, there is one corporate asset, the

information technology network to the company as a whole. The information technology

network is not a depreciable asset.

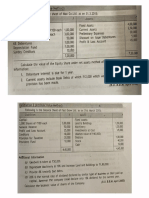

At 30 June 2010, the net assets of each division, including its allocated share of the information

technology network, were as follows

Turquoise Pink

Information technology network $ 284 000 $ 116 000

Land 450 000 290 000

Plant (20% p.a. straight-line depreciation) 1 310 000 960 000

Accumulated depreciation (917 000) (384 000)

Goodwill 46 000 32 000

Patent (10% straight-line amortisation) 210 000 255 000

Accumulated amortisation – patent (21 000) (102 000)

Cash 20 000 12 000

Inventory 120 000 80 000

Receivables 34 000 40 000

Liabilities (276 000) (189 000)

Net assets 1 260 000 1 110 000

Additional information as at 30 June 2010:

Turquoise land had a fair value less costs to sell of $437 000

Pink patent had acarrying amount below fair value less costs to sell

Pink plant had a fair value less costs to sell of $540 000

Receivables were considered to be collectable

The IT network is not depreciated, as it is assumed to have an indefinite life.

Magenta Ltd’s management undertook impairment testing at 30 June 2010 and

determined the recoverable amount of each cash-generating unit to be: $1 430 000 for

Turquoise and $1 215 000 for Pink

Required

Prepare any journal entries necessary to record the results of the impairment testing for each of

the CGUs.

Case study 2

One of the cash-generating units of Lemon Ltd is associated with the manufacture of wine

barrels. At 30 June 2009, Lemon Ltd believed, based on an analysis of economic indicators,

that the assets of the unit were impaired. The carrying amounts of the assets and liabilities of

the unit at 30 June 2009 were

Buildings 420 000

Accumulated depreciation* – buildings (180 000)

Factory machinery 220 000

Accumulated depreciation** - machinery (40 000)

Goodwill 15 000

Inventory 80 000

Receivables 40 000

Allowance for doubtful debts (5 000)

Cash 20 000

Account payable 30 000

Loans 20 000

* Depreciated at $60 000 p.a.

** Depreciated at $45 000 p.a.

Lemon Ltd determined the value in use of the unit to be $535 000. The receivables were

considered to be collectable, except those considered doubtful. The company allocated the

impairment loss in accordance with IAS 36.

During the 2009 -2010 period, Lemon Ltd increased the depreciation charge on buildings to

$65 000 p.a. and to $50 000 p.a. for factory machinery. The inventory on hand at 1 July 2009

was sold by the end of the year. At 30 June 2010, Lemon Ltd, because of a return in the market

to the use of traditional barrels for wines and an increase in wine production, assessed the

recoverable amount of the cash-generating unit to be $30 000 greater than the carrying amount

of the unit. As a result, Lemon Ltd recognised a reversal of the impairment loss.

Required

a. Prepare the journal entries for Lemon Ltd at 30 June 2009 and 2010

b. What differences would arise in relation to the answer in requirement a if the

recoverable amount at 30 June 2010 was $20 000 greater than the carrying amount of

the unit?

c. If the recoverable amount of the buildings at 30 June 2010 was $175 000, how would

this change the answer to requirement B?

Potrebbero piacerti anche

- IAS 36 - Impairment of Asset - Case Study 1Documento2 pagineIAS 36 - Impairment of Asset - Case Study 1CavipsotNessuna valutazione finora

- Accounting GovernmentDocumento21 pagineAccounting GovernmentJolianne SalvadoOfcNessuna valutazione finora

- Solution Practice 9 Business Combinations and ImpairmentDocumento8 pagineSolution Practice 9 Business Combinations and ImpairmentGuinevereNessuna valutazione finora

- Week 11 Tutorial QuestionsDocumento2 pagineWeek 11 Tutorial QuestionsMi ThaiNessuna valutazione finora

- Financial Statement Analysis - AssignmentDocumento6 pagineFinancial Statement Analysis - AssignmentJennifer JosephNessuna valutazione finora

- Project in Government Accounting and Accounting FoDocumento11 pagineProject in Government Accounting and Accounting FoRosy MoradosNessuna valutazione finora

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocumento7 paginePractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNessuna valutazione finora

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocumento5 pagineBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNessuna valutazione finora

- Bài tập buổi 12Documento7 pagineBài tập buổi 12Huế ThùyNessuna valutazione finora

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Documento2 pagineLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNessuna valutazione finora

- Finals Quiz 2 Buscom Version 2Documento3 pagineFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNessuna valutazione finora

- Cash FlowDocumento8 pagineCash Flowswapnil choubeyNessuna valutazione finora

- CAA CH 2 Questions Pt.1Documento4 pagineCAA CH 2 Questions Pt.1JohnNessuna valutazione finora

- SeatworkDocumento10 pagineSeatworkRochelle Mae DiestroNessuna valutazione finora

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Documento5 pagineAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNessuna valutazione finora

- 1 - Accounting Information Systems Problems With SolutionsDocumento22 pagine1 - Accounting Information Systems Problems With Solutionsbusiness docNessuna valutazione finora

- Corporate LiquidationDocumento4 pagineCorporate LiquidationMae100% (1)

- CH 3 In-Class Exercises SOLUTIONS CorrectedDocumento2 pagineCH 3 In-Class Exercises SOLUTIONS CorrectedAbdullah alhamaadNessuna valutazione finora

- CH 3 In-Class ExercisesDocumento2 pagineCH 3 In-Class ExercisesAbdullah alhamaadNessuna valutazione finora

- Financial Reporting - Assignment 3Documento4 pagineFinancial Reporting - Assignment 3SitiFarhanaNessuna valutazione finora

- Homework - WaterkloofDocumento3 pagineHomework - WaterkloofIrfaan CassimNessuna valutazione finora

- Company Accounting-IgcseDocumento2 pagineCompany Accounting-IgcseGodfreyFrankMwakalingaNessuna valutazione finora

- CRANBERRY PLC Scenario Chapter 12Documento3 pagineCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNessuna valutazione finora

- Vertical Financial StatementDocumento4 pagineVertical Financial StatementForam VasaniNessuna valutazione finora

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocumento4 pagineAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Q5 Vikings LimitedDocumento2 pagineQ5 Vikings Limitedamosmalusi5Nessuna valutazione finora

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocumento5 pagineAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNessuna valutazione finora

- Accounting Exercises On Cash FlowsDocumento2 pagineAccounting Exercises On Cash FlowsMicaella GoNessuna valutazione finora

- Output No. 3Documento1 paginaOutput No. 3chingNessuna valutazione finora

- Corporate Liquidation (Integration) PDFDocumento5 pagineCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Profe03 Activity Chapter 7Documento5 pagineProfe03 Activity Chapter 7eloisa celisNessuna valutazione finora

- Bus Com 12Documento3 pagineBus Com 12Chabelita MijaresNessuna valutazione finora

- Acaccountancy and Advanced AccounatcnyDocumento323 pagineAcaccountancy and Advanced AccounatcnyAayush GhdoliyaNessuna valutazione finora

- Tutorial QuestionsDocumento2 pagineTutorial QuestionsNishika KaranNessuna valutazione finora

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Documento12 pagineWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNessuna valutazione finora

- Financial Reporting and Analysis Final OSADocumento9 pagineFinancial Reporting and Analysis Final OSATracy-lee JacobsNessuna valutazione finora

- WORKSHEET - 5 On CFSDocumento6 pagineWORKSHEET - 5 On CFSNavya KhemkaNessuna valutazione finora

- Name: Section: Date:: Angel SantaDocumento5 pagineName: Section: Date:: Angel SantaJoebet DebuyanNessuna valutazione finora

- Q2 Lister LimitedDocumento1 paginaQ2 Lister Limitedamosmalusi5Nessuna valutazione finora

- Cash Flow (Exercise)Documento5 pagineCash Flow (Exercise)abhishekvora7598752100% (1)

- 4 Tangible Fixed Assets: DR CR 000 000Documento7 pagine4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNessuna valutazione finora

- QuestionDocumento2 pagineQuestionKamoheloNessuna valutazione finora

- Trial Balance As On 31Documento3 pagineTrial Balance As On 31Lipson ThomasNessuna valutazione finora

- Chap 14 3-6Documento4 pagineChap 14 3-6Buenaventura, Lara Jane T.Nessuna valutazione finora

- Problem SolutionsDocumento5 pagineProblem Solutionsmd nayonNessuna valutazione finora

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocumento4 paginePROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNessuna valutazione finora

- Chapter 37-Presentation of FsDocumento8 pagineChapter 37-Presentation of FsEmma Mariz GarciaNessuna valutazione finora

- Of Financial PositionDocumento3 pagineOf Financial PositionIrah LouiseNessuna valutazione finora

- Chapter 37 Financial StatementsDocumento68 pagineChapter 37 Financial StatementsheyheyNessuna valutazione finora

- Sem I Acc - NEP-UGCF 2022Documento8 pagineSem I Acc - NEP-UGCF 2022Raj AbhishekNessuna valutazione finora

- MA - Vertical Statement Question BankDocumento18 pagineMA - Vertical Statement Question Bankmanav.vakhariaNessuna valutazione finora

- Afar Assign#01. H - JikDocumento5 pagineAfar Assign#01. H - JikjasonnumahnalkelNessuna valutazione finora

- Sheet-2 Cash Flow Statement 19.11.2020 - 24398004Documento4 pagineSheet-2 Cash Flow Statement 19.11.2020 - 24398004anushkasaxena717Nessuna valutazione finora

- Co Accg 1 - Tut QN - Oct 2022Documento10 pagineCo Accg 1 - Tut QN - Oct 2022Xuan Hui LohNessuna valutazione finora

- Pricilla AFAR Question PaperDocumento2 paginePricilla AFAR Question PaperjasonnumahnalkelNessuna valutazione finora

- 150.curren and Non Current Assets and Liabilities 2Documento3 pagine150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNessuna valutazione finora

- PAS 1 Presentation of FSDocumento11 paginePAS 1 Presentation of FSPatrickMendozaNessuna valutazione finora

- Quiz 1 - Limited CompaniesDocumento2 pagineQuiz 1 - Limited CompaniesELIZABETH MARGARETHANessuna valutazione finora

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocumento6 pagineCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONessuna valutazione finora

- Accounting For ManagerDocumento7 pagineAccounting For ManagerMasara OwenNessuna valutazione finora

- Budgeting 2018Documento13 pagineBudgeting 2018Joemar Santos TorresNessuna valutazione finora

- SolutionDocumento8 pagineSolutionIts meh SushiNessuna valutazione finora

- Hardhat Case - Rajesh Kumar NayakDocumento12 pagineHardhat Case - Rajesh Kumar NayakSandeep RawatNessuna valutazione finora

- This Study Resource Was: Xcostacm - Chapter 2 - Costs - Concepts and ClassificationsDocumento2 pagineThis Study Resource Was: Xcostacm - Chapter 2 - Costs - Concepts and ClassificationsTeodorico PelenioNessuna valutazione finora

- Audit Report ELPI TBK Konsolidasian 2022Documento118 pagineAudit Report ELPI TBK Konsolidasian 2022argo indNessuna valutazione finora

- Chapter 20 Ia2Documento24 pagineChapter 20 Ia2JM Valonda Villena, CPA, MBANessuna valutazione finora

- Responsibility Acctg Transfer Pricing GP AnalysisDocumento21 pagineResponsibility Acctg Transfer Pricing GP AnalysisstudentoneNessuna valutazione finora

- IAS 27 Ifrs 10: Statements (2011) andDocumento5 pagineIAS 27 Ifrs 10: Statements (2011) andJuan TañamorNessuna valutazione finora

- Advanced Accounting Chapter 5Documento19 pagineAdvanced Accounting Chapter 5Ya Lun100% (1)

- CorporationDocumento7 pagineCorporationDo RaemondNessuna valutazione finora

- Vertical Analysis of URC Financial StatementDocumento2 pagineVertical Analysis of URC Financial StatementMalou De MesaNessuna valutazione finora

- Caso Ceres en ClaseDocumento4 pagineCaso Ceres en ClaseAdrian PeranNessuna valutazione finora

- MAS-Midterm Exam Name: - ScoreDocumento15 pagineMAS-Midterm Exam Name: - ScoreRengeline LucasNessuna valutazione finora

- Q1-Review On Fa3Documento4 pagineQ1-Review On Fa3Santos Gigantoca Jr.Nessuna valutazione finora

- Unit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingDocumento18 pagineUnit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingRobin G'koolNessuna valutazione finora

- Basic Accounting For CorporationDocumento12 pagineBasic Accounting For CorporationBrian Christian VillaluzNessuna valutazione finora

- ACC101-Group Assignment-Spring19Documento2 pagineACC101-Group Assignment-Spring19Xuân HinhNessuna valutazione finora

- Chapter 3: Financial Statement Analysis and Financial ModelsDocumento33 pagineChapter 3: Financial Statement Analysis and Financial ModelsKamrul HasanNessuna valutazione finora

- Auditing Problems Test Banks - IntangiblesDocumento5 pagineAuditing Problems Test Banks - IntangiblesAlliah Mae ArbastoNessuna valutazione finora

- Im Acco 20213 Accounting Principles 3Documento107 pagineIm Acco 20213 Accounting Principles 3magua deceiNessuna valutazione finora

- Financial Accounting - Multilingual GlossaryDocumento53 pagineFinancial Accounting - Multilingual GlossaryoratorioNessuna valutazione finora

- Break Even PointDocumento11 pagineBreak Even Pointrahi4ever86% (7)

- Comprehensive Case 2 A202 - StudentsDocumento22 pagineComprehensive Case 2 A202 - Studentslim qsNessuna valutazione finora

- Introduction To Corporations: Dr. Ronnie G. Salazar, CpaDocumento102 pagineIntroduction To Corporations: Dr. Ronnie G. Salazar, CpaJoshua CabinasNessuna valutazione finora

- Ch10 DepreciationDocumento18 pagineCh10 DepreciationRama KrishnaNessuna valutazione finora

- Leong Hup International Buy: MalaysiaDocumento30 pagineLeong Hup International Buy: MalaysiaKeyaNessuna valutazione finora

- Exercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionDocumento5 pagineExercise 1-10: Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Fifth Canadian EditionjorwitzNessuna valutazione finora

- Ding of Accounting Standards 1-15Documento25 pagineDing of Accounting Standards 1-15Moeen MakNessuna valutazione finora

- Assignment Marriot Case SolutiionDocumento6 pagineAssignment Marriot Case SolutiionRaheel AhmedNessuna valutazione finora