Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Baltic Energy Report

Caricato da

Swedbank AB (publ)Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Baltic Energy Report

Caricato da

Swedbank AB (publ)Copyright:

Formati disponibili

Swedbank Analysis

18 December 2009

Baltic Energy Report

We expect energy prices to grow in Baltic countries due not only to global

developments but also to supply- and demand- mismatch (e.g.,

,electricity), and that this will affect consumption of energy, companies,

and households.

Changes are needed in energy policies to avoid negative side effects, but

support to renewables use should continue. A good mix of different energy

sources is needed, and countries should cooperate more.

The current crisis makes changes difficult, but might encourage these

changes, which are good from a long-term perspective.

Foreword

Energy-related issues have become increasingly important for the economy and

society. Many discussions about the sufficiency of energy resources and the en-

vironment are taking place all over the world--about the impact these issues are

having on energy prices, and about the accessibility and efficient use of energy.

Questions of energy security and import dependence have been hot themes, es-

pecially as Russian gas supplies to Europe were cut in the last two winters. The

global energy price rally in recent years affected both consumers and producers,

as it was also a part of the financial bubble. Important factors that increasingly

had an impact on consumers and producers are international agreements (e.g.,

the Kyoto agreement and the expected agreement in Copenhagen), and rules

and regulations inside the EU (e.g., affecting the use of renewable energy, and

pollution).

Those global processes affect the Estonian, Latvian, and Lithuanian energy sec-

tors as well. Cross-border influences are increasing, and changes that some

years ago were just on the waiting list are now becoming a reality of life. As the

region until now has effectively been separated from the EU electricity grid (and

connected only to the old Soviet Union system) and relying only on Russian natu-

ral gas supplies, the changes have started to affect the region’s energy sector

strongly. The quotas of carbon dioxide emissions, closure of the Ignalina nuclear

power station (NPS), and opening of the electricity market are about to change

significantly the Baltic energy market.

The energy sector and related issues are also affected by the economic crisis,

especially its deepness, which has changed substantially the outlook of that sec-

tor. The existing development plans are still based on the old economic growth

Please read important information on the last page

rates and, hence, are too heavily weighted by the risks emerging from the above-

mentioned changes. Still, the coincidence of the changes in the energy sector

with the time of economic crisis make the adjustment process in the economy

more painful as generating the spike in prices. However, if structural changes are

taking place anyway due to the crisis and the loss in competitiveness, they might

be deeper because they being pressured also by the changes in the energy sec-

tor and this together could be highly beneficial from a long-term perspective.

The changes taking place now and in the near future in the energy sectors of the

Baltic countries are big and are affected by many processes, which quite often

are working toward opposite outcomes. Hence, there are lot of uncertainties re-

garding possible outcomes, particularly regarding prices, as many of these out-

comes are dependent on political decision-making. The latter factor is hard to

predict due to the wide range of views and the unknown outcome of international

agreements (e.g., the Copenhagen climate summit).

Issues related to energy are very important for all of society; however, people’s

general knowledge about these issues is fragmented. Hence, it is difficult to fol-

low the energy-related discussions. Households and companies should take en-

ergy-related aspects more into account when making long-term plans, especially

concerning the efficiency of the processes and the targets. Although energy-

related themes have been one of the media’s favoured themes, attention has

been focused on rather narrow issues, and many important themes have been

forgotten. Very often, a one-sided view of the problems has been presented. We

hope that this report will help readers – managers and households - to follow the

discussions better and make deliberate decisions.

This report1 primarily concentrates on the medium-term outlook, i.e., on the years

2010-15. We start by describing the situation in energy supply, industry, and con-

sumption in 2008-09 so that the reader will be able to understand the situation of

the three countries in those years. The second part of the report discusses the

changes taking place in 2010 and onward and their possible consequences. We

point to the shortcomings of the current processes and to the need to revise cur-

rent energy sector development plans because of the changed economic envi-

ronment. We look at future energy-, particularly electricity-, producing capacities

and energy demand developments and assess the impact the emerging supply

gap would have on economic developments. The analysis is based mostly on the

data of 2005-08; if possible, 2009 data are used.2 The long-term analysis also

uses data starting in 1996 to find the relation between energy consumption and

the factors influencing it.

1

In December 2006 Baltic Energy Report was published by Hansabank Markets Research in which we covered

the processes and developments in the Estonian, Latvian, and Lithuania energy sectors up to 2005.

2

Latest annual data in Eurostat are from 2007 and thus to some extent outdated. We have used also data from

the national statistics of Estonia, Latvia, and Lithuania for 2008-09.

2 Swedbank Analysis, 18 December 2009

Overview of energy resources, industry and

consumption

Energy resources

Primary energy resources comprise resources extracted, imported energy, and

recovered products in a country.3

Estonia’s main energy recourses are oil shale, peat, and timber, which are

mostly used for producing heat and electrical energy (approximately 70% of oil

shale goes for the production of electricity, and peat and timber are used to gen-

erate heating energy; the remaining shale oil is produced for exports and energy

production). Natural gas and different oil products dominate among imported en-

ergy. Estonia produces all its needed electricity; however, some municipalities

use only imported natural gas for generating heating energy, and all motor fuels

are imported. The share of renewables in energy consumption, which is approxi-

mately 16-17%, is dominated by timber and products of timber. The share of hy-

dro and wind energy, although very small (0.32% in 2008), has grown rapidly in

recent years.

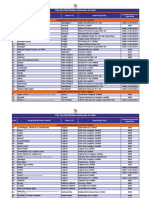

Table 1. Structure of primary energy in 2008

Estonia Latvia Lithuania Total

oil shale 81.5% 34.9%

peat 1.2%

0.1% 0.5% 0.8%

timber etc 16.9%

82.0% 20.1% 30.0%

hydro and wind energy* 0.3%

15.2% 2.9%

nuclear energy** 74.1% 28.9%

other 0.1% 2.7% 5.3% 2.8%

*In Estonia mostly wind energy, in Latvia mostly hydro energy

**Includes hydro and wind energy

Source: national statistics

Estonia’s dependence on imported4 energy has declined, and, although there

have been wide swings, it is one of the lowest in Europe (according to 2006 data,

Estonia was the sixth-least dependent).5 Latvia’s and Lithuania’s import depend-

ence is higher than EU average: in 2006 these countries’ dependence was 60%

and 58.6%, respectively, compared with the EU average of 53.8%. Despite low

import dependence, Estonia still imports all its natural gas and oil products. The

same applies to Latvia and Lithuania.

Latvia’s high import dependence is the result of scarce domestic energy re-

sources – only timber, peat, and hydro energy could be listed as important.

Lithuania’s import dependence is related to its oil refinery Mazekiu Nafta, which

imports all crude oil to produce oil products for export. However, Lithuania also

imports natural gas and several oil products. The most important domestic en-

3

Recovered recourses have minor importance in Estonia, Latvia and Lithuania as of now.

4

Import dependence shows how much a country imports the energy it uses. It is calculated as the ratio of net

imports of energy to general energy consumption (see definitions in appendix 1).

5

“EU Energy and Transport in Figures. Statistical pocketbook 2009.“

(http://ec.europa.eu/energy/publications/statistics/statistics_en.htm)

Swedbank Analysis, 18 December 2009 3

ergy recourse in Lithuania is nuclear energy, but the raw material (uranium) is

imported. Timber has also some importance.

Chart 1. Im port dependance

70%

60%

50%

40%

30%

20%

10%

0%

Estonia Latv ia Lithuania

Source: Swedbank calculations on local statistics

Chart 2. Im ported energy, TJ

900

other

750

crude oil

600

electricity

450

oil products

300 natural gas

150

0

Estonia Latv ia Lithuania Total

Source: Swedbank calculations on local statistics

Declining import dependence in the Baltic countries in recent years is a result not

only of declining imports of natural gas and motor fuels, but also of growing ex-

ports of electricity (imports of electricity have also grown). Such developments

are possible mostly due to smaller consumption of heating energy (warmer win-

ters, better isolation); however, the economic crisis has cut also the need to use

energy. The increasing energy prices have definitely been a factor, forcing en-

ergy consumers to change their habits.

Natural gas is imported only from Russia, as there are no other connections in

the region. This type of dependency implies a very high supply risk, especially

taking into account the problems experienced with Russian gas supplies to the

EU in recent years. The supply risk has several sources, which have been dis-

cussed extensively in recent years:6 the possible decline of production in Russia

due to the low level of investments in the energy sector and the exhaustion of ex-

isting gas fields; the too-high promises of exports, compared with current and fu-

ture production capacities; political and economic interests; domestic consump-

tion (including seasonal factors); and increased tensions between Russia and

6

These themes have been discussed in many reports and papers in which Russian energy policy, exports, and

the economy in general are the main themes. See, for example, Steven Woehrel, Russian Energy Policy To-

ward Neighboring Countries. Sept. 2., 2009.

4 Swedbank Analysis, 18 December 2009

possible other suppliers (e.g., Turkmenistan7). Lithuania’s increasing import de-

pendence from natural gas after the closure of the Ignalina NPS at the end of

2009 is clearly raising import-related risks. However, taking into account the de-

cline of the demand for natural gas in Europe during the crisis, which has caused

Russian gas production and exports to fall and the holding by Russian Gazprom

of shares in local gas monopolies, we see that the realisation of these gas-related

risks is currently very low. Still, the realization of these risks is unpredictable, as

political interest may overrun the economic interest (and Gazprom is a state-

owned company).

The three Baltic countries are also totally dependent on imported oil products,

although there are small deposits of oil in the sea on the border of Latvia and

Lithuania, and the latter has used them (and Latvia has considered doing the

same). Mazeikiu Nafta has to import all its crude oil for production and this is an

actual risk not only for the company but also for the Lithuanian economy.8 Esto-

nia and Latvia are importing much of their oil products from Lithuania, but in re-

cent years, imports from Norway and other countries have increased substan-

tially. There is no obstacle to importing oil products from other countries, and this

has been done in the past and will be done in the future. Hence, the import-

related risks with oil products are not as high as with natural gas.

The big risks are related to prices – and this includes natural gas and all other

energy products. Prices of different energy products - including domestic ones-

are directly or indirectly dependent on the global price of crude oil. The rapid in-

crease of oil prices in the last few years affected directly and seriously economic

developments in all three countries. Although the global price growth was felt in

all countries, the Baltics were affected more seriously than most of the other EU

countries due to high energy dependence and the large share of energy in do-

mestic consumption. The rapid price growth of heating and electrical energy was

definitely one factor that made the crisis deeper in the three countries: due to

regulatory factors,9 it continued in the second half of 2008 and partly at the be-

ginning of 2009 when in other countries energy prices were already declining.

The current price growth in global markets poses a risk for domestic consump-

tion, and households, particularly, are vulnerable to a possible increase of (heat-

ing) prices during the 2009-10 winter, i.e., when the decline of income will be the

deepest during the crisis (see also Charts 13 and 14).10

7

Countries of Central Asia can export natural gas only through Russia. Turkmenistan just finished the building

its gas pipeline to China. This will diminish the possibility of Russia’s buying gas from other countries if its own

production is not enough to fulfil agreements. This would make also gas exports less profitable for Gazprom.

8

Lithuania has felt the negative impact of import-related risks since the supply of crude oil to the oil refinery

ended after the government’s decision to sell shares of the company to a Polish company instead of to the Rus-

sian Lukoil. The formal reason for stopping supplies was an emergency break of the pipeline, but the pipeline

has not yet been repaired and Mazeikiu Nafta still imports all needed oil through ports. Estonia and Latvia have

also seen different type of supply cuts from Russia.

9

For example, up to mid-2009 price regulations in Estonia had a minimum six-month lag. Prices for households

(heating energy) thus grew at that time, when globally prices were already quickly declining.. See also Chart 14.

10

Of course, companies are not immune, and other countries are affected as well. The latter means increased

pressure on the region’s economies, which are very open and export most of their production.

Swedbank Analysis, 18 December 2009 5

Chart 3. Global energy prices (Reuters/CRB indexes), dollar

30 120

25 100

heating oil (ls)

20 80

natural gas (ls)

15 60 crude oil (rs)

10 40

5 20

0 0

2005 2006 2007 2008 2009

Source: ReutersEcowin

Energy exports are most of all dependent on external demand or economic

growth and prices. It is natural that domestic primary energy resources dominate

in the energy exports of Estonia and Latvia; Lithuania, however, mostly exports

oil products, produced from imported crude oil. Estonian energy exports are

dominated by shale oil, but important also are timber and peat (the latter has lost

its dominant position in recent years). Latvian energy exports are dominated by

timber and timber products (over 50%), but oil products (19%) and bio fuels

(3.5%) are also exported.

Chart 4. Structure of energy exports, 2008

100%

other

80% oil shale and products

bio f uels

60% crude oil etc

electricity

40%

timber etc

20% oil products

0%

Estonia Latv ia Lithuania

Source: Swedbank calculations on local statistics

Energy industry

Estonian energy industry is based on oil shale, although renewables have been

growing very rapidly in recent years. The Lithuanian energy sector is using mostly

nuclear energy and crude oil as input, but natural gas plays an important and

growing role as input as well. The Latvian energy sector is concentrated around

hydro energy, natural gas, and timber. The use of renewables has increased in

all three countries. Outputs of the energy industry are electrical and heating en-

ergy, and different energy products, of which a large share is used as inputs for

energy generation (e.g., heating or electrical energy).

Not all energy resources are used for energy generation purposes: some are

used as raw materials in industry or in other sectors and areas. Both in Estonia

and in Latvia this type of energy resource makes slightly more than 2% of total

energy resources, and its share has been increasing in recent years. Natural gas

6 Swedbank Analysis, 18 December 2009

is almost the sole energy resource that also has a nonenergy use, mostly as in-

put for the chemical industry. The nonenergy use of energy resources in Lithua-

nia was 12.8% in 2008 (of which almost 80% was natural gas, the remaining be-

ing oil products).

Chart 5. Energy transform ation, PJ

600

500

Estonia

400

Latv ia

300

Lithuania

200

100

0

Gross inland Energy Energy Final consumption

consumption transf ormation transf ormation

input output

Source: Swedbank calculations on local statistics

Table 2. Energy industry, PJ

Estonia Latvia Lithuania Total

Gross inland consumption 224.1 203.0 390.0 817.1

Energy transformation input 176.6 79.8 591.0 847.5

Energy transformation output 96.1 68.0 504.4 668.5

ratio to input 54.4% 85.1% 85.3% 78.9%

Is not going for transformation 47.5 123.1 -201.0 -30.4

ratio to incland consumption 21.2% 60.7% -51.5% -3.7%

Own use of energy sector 8.7 3.1 38.4 50.2

ratio to transformation output 9.1% 4.6% 7.6% 7.5%

Use as raw material 5.0 na 49.8 54.8

Losses 7.6 7.0 9.9 24.4

ratio to transformation output 7.9% 10.3% 2.0% 3.7%

Final consumption 122.3 181.0 205.3 508.5

ratio to incland consumption 54.6% 89.2% 52.6% 62.2%

Source: Swedbank on national statistics

Oil shale (the only Estonian resource) is mostly used as input for generating

other types of energy. The use of oil shale for nonenergy purposes has declined

constantly. As of now, approximately 70% of oil shale is used for generating elec-

tricity; the rest goes for generating heating energy (a declining share, now less

than 4%) and other fuels (mostly shale oil). The share of shale oil is now already

27%. Shale oil is used for generating energy, including heating energy. It is pos-

sible to produce motor fuels from shale oil; however, due to some technological

limitations, this is not done currently (but plans for the future exist). The majority

of the product is exported – the rise in global prices and new technologies has

made the production of shale oil profitable. Exports of shale oil have grown con-

stantly, but the economic crisis brought down the demand in 2008, with export

volumes declining by approximately 25%.

The biggest producer of oil products in the region is Lithuania’s Mazeikiu Nafta,

and the company generates substantial imports and exports as well. This com-

pany is the reason why the Lithuanian economy is so heavily dominated by the

energy industry, and why Lithuania’s energy exports and imports are much bigger

Swedbank Analysis, 18 December 2009 7

than Estonia’s or Latvia’s. The company was built before Lithuania regained in-

dependence, when the supply risks were very small (if nonexistent). The factory

would not have been built if current supply problems (crude oil imported over sea)

existed at the time.

Heating energy in Estonia is mostly produced from local resources (oil shale,

shale oil, peat and peat products, and different types of renewables), but natural

gas also plays an important role. Latvia and Lithuania are mostly producing heat-

ing energy from natural gas, although local resources are also important.11 The

very rapid growth of energy prices in recent years and the lack of substitutes

forced many municipalities and energy producers to look for alternatives, particu-

larly for replacing natural gas, as the price growth was very sharp. As a result, the

use of local resources has grown, but alternative ways have also been introduced

(e.g., cogeneration plants, the use of waste, etc.). This development path will

continue in the future, as this is also considered more environmentally friendly

because it uses more renewable sources. The production of heating energy is in-

creasingly accompanied by the production of electricity as well – most of the new

plants are coproducing plants (CPPs) now.

The production of heating energy has fluctuated strongly, as demand has fluctu-

ated. The two main factors for declining consumption are warmer winters and ris-

ing prices, which have forced households to use energy more efficiently. The lat-

ter effect is, however, expected to be more pronounced in coming winters as the

economic crisis, declining incomes, and state-supported programmes (special EU

funding is available) will work toward a more efficient and lower use of energy.

Chart 6. Actual heating-degree days, degrees

4500

4250

Lithuania

Latv ia

4000

Estonia

3750

3500

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Source: Eurostat

Electricity in Estonia is produced mostly from oil shale; in Latvia, from hydro en-

ergy; and, in Lithuania, from nuclear energy. Electricity is also produced in CPPs

and renewables (wind, bio energy, waste, etc.) (see also Chart 19, and above).

As the production capacities are distributed unequally in the Baltic region – there

is a shortage in Latvia, while overcapacity in Estonia and Lithuania – electricity

has always been traded between the countries. Latvia exports electricity at times

of high water levels (usually in spring), when Estonia and Lithuania import it, but

otherwise Latvia has to import electricity.

11

In statistics, the production and use of heating energy by many households (especially in the countryside,

where density is very low) are not reported under production of heating energy; the latter covers only the pro-

duction heating energy distributed centrally. Single households use mostly timber, peat, and products thereof,

but also fuel oils, electricity (partly), and other sources

8 Swedbank Analysis, 18 December 2009

Chart 7. Exports and im ports of electricity in Estonia, MJ

12000

10000

8000 Balance

Imports

6000

Exports

4000

2000

0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Source: ESA

The three Baltics are not connected to the pan-EU electricity grid. The connec-

tions with Russia and Byelorussia still exist; however as of now has been rather

small (Latvia being the most active user)12. The first and only connection with the

EU electricity grid is now through the Estlink between Estonia and Finland13.

The use of renewables has different aspects to it – as in overall energy con-

sumption and electricity generation. The EU has set an target to produce 21% of

electricity used from renewables by 2010. The target for Estonia is 5.1%, for

Lithuania, 7%, and for Latvia, 49.3%. As of 2008, Estonia had produced 1.5%,

Latvia 36.4%, and Lithuania 4.6% electricity from renewables; the average for the

EU was 15.5%. The high level for Latvia is a result of its using hydro energy,

which is not much used in Estonia or Lithuania. The EU targets its use of renew-

able energy sources in 2020 at 20% of total energy consumption, while Estonia’s

target is 25%.

The attainment of the 2010 target for Estonia is very likely despite the low level in

200814because new, big capacities will be employed in 2009-10. Besides CPPs,

wind energy is widely used. In addition, other renewable energy sources will be

used (e.g. waste, timber).

In 2008, wind-based electricity-generating capacities in Estonia, Latvia, and

Lithuania were 77 MW, 30 MW, and 54 MW, respectively.15 The growth of these

capacities in 2009 has been very rapid, and there are plans for further develop-

ment. The rapid growth of wind parks is related to state support.16 The building of

12

The connection is also needed for technical reasons the total Baltic network is too small to maintain its stabil-

ity for a long period).

13

Estonian Energy has a 39.9% share, Latvenergo, 25%, Lietuvos Energija, 25%, and Finnish Pohjolan Voima

and Helsingin Energia, 5.05% each. See also http://www.nordicenergylink.com/. Poland has not been interested

in building a connection with Lithuania. Finland has agreed to build a second connection (Estlink2) if Estonia

opens its electricity market; hence, this will take place in April 2010 instead of 2013, as planned before.

14

”Elektrienergia tootmine taastuvatest energiaallikatest 2007-2009. 29.10.09. Majandus- ja

Kommunikatsiooniministeerium. Energeetika aruanded ja uuringud.”: The development plan of Estonian energy

industry up to 2018 foresees that CPPs using bio fuels and wind generators could produce electricity of more

than 800 GWh, or more than 10% of consumption.

15

See www.thewindpower.net

16

The support scheme, introduced in May 2007, includes both purchase obligation and support for selling elec-

tricity. As of now, the limits on those who can get the support have been removed, and there are plans to in-

crease the annual maximum limit to 600 MWh. As of 2008, Estonia subsidized production electricity by

100GWh, Latvia by 180 GWh, and Lithuania by 287 GWh; this includes subsidies for windmills in Estonia of

100GWh, in Latvia of 58 GWh, and in Lithuania of 130 GWh.

Swedbank Analysis, 18 December 2009 9

wind parks requires that compensation plants be built to stabilize the uneven pro-

duction of electricity by wind energy. It is considered that plants based on natural

gas are the most efficient for this purpose because they are the most flexible.

However, there is a possibility of using other energy resources as well for this

purpose (e.g., timber and peat based). However, the building of compensation

(and reserve) capacities makes wind energy much more expensive, and, in the

case of natural gas, it also increases the import dependence on one supplier (see

above about the related risks).

Energy consumption

Energy intensity has been constantly declining in all three countries, but Estonia

is still one of the most energy intensive countries in the EU, tied for 3rdplace with

the Czech Republic.17 Latvia and Lithuania are not far behind Estonia (see Chart

8 and 9). There are several reasons behind the high energy intensity in all three

countries:

1. The heating period is relatively long – in Europe, the only longer heating

periods than Estonia are in Finland, Sweden, Norway, and Iceland (see

also Chart 6).

2. The large share of energy-intensive production in the economic structure.

Although the share of such production has fallen, low prices (see Appen-

dix 2) have not encouraged this change. As energy prices are rising rap-

idly, we expect that the energy intensity of the economy will decline as

energy-intensive production shrinks and disappears as becoming less

competitive, but also the use of energy becomes more efficient.

3. Energy use is inefficient, partly because of the nonrational location of pro-

duction (the very high level of transport cost and poor logistics). This is

mostly an inheritance from the previous economic system (i.e., from the

years before 1990), which can be seen also in other Central and Eastern

European countries. The most striking fact is that important and big indus-

tries are dependent on imported energy resources, including from one

supplier. In the Baltic countries, those companies and industries that are

importing and using extensively natural gas are most open to the related

risks (e.g., the chemical industry in Estonia and Lithuania, and metalwork-

ing in Latvia. This means that, if companies will not change their produc-

tion or technology, they will become more and more uncompetitive due to

rising energy prices (and the high use of energy).

4. Although companies have constantly modernized the production process,

the use of old technology of wealthier countries, or cheaper, but more en-

ergy consuming, technology has been rather widespread. There are many

reasons behind such choices, but prices are among the most important:

cheaper equipment, low environmental and energy taxes, and cheap en-

ergy in the Baltic countries. As the price and cost factors will gradually

cease to exist (actually, this change might be very rapid for some busi-

nesses) the use of old energy-consuming technologies has to end, or

companies will lose their competitiveness.

5. Although losses have declined, they are still relatively big in both con-

sumption and production. The level of losses in Latvia was 3.9% of total

17 th rd

In 2006 Estonia was in 4 place; in 2007, 3 ; there are no data yet for 2008, but data from Estonian Statistics

show a decline in energy intensity.

10 Swedbank Analysis, 18 December 2009

energy resources in 2007 (and 3.4% in 2008, second only to Romania’s

4.2%). Estonia’s respective figure in 2007 was 3.5% (for 4th place, and

.3% in 2008), while Lithuania’s was 2.8% (for 6th place, and 2.5% in

2008).

6. The extensive use of low-effective energy resources.

7. The share of energy industry in the economy (the oil shale industry in Es-

tonia, and Mazeikiu Nafta in Lithuania) is very large. Latvia’s relatively low

energy intensity is a result of its high dependence on imports. If measured

by the final consumption of energy, then Latvia is the most energy-

consuming country (energy consumption vs. household consumption

spending) among the three.

Chart 8. Gross inland consum ption of Chart 9. Final consum ption of energy to GDP

energy in EU per GDP (2007, 2008) in EU (2007, 2008)

Bulgaria Bulgaria

Estonia Latv ia

Czech Rep Czech Rep

Estonia 08 Poland

Slov akia

Romania

Romania

Estonia

Lithuania

Slov akia

Poland

Latv ia 08

Lithuania 08

Estonia 08

Hungary

Lithuania

Latv ia

Hungary

Slov enia

Lith. 08

Finland

Finland

Latv ia 08

Slov enia

Malta

Cy prus

Belgia

Luxembour

Cy prus

Portugal

Portugal

Belgia

Sweden

Sweden

Netherlands

Austria

Greece

Greece

EU

Spain

France

EU

Germany

Netherland

Spain

Germany

Austria

Italy

Luxembourg

France

Italy

Malta

UK

UK

Denmark

Ireland

Ireland

Denmark

0 5 10 15 20 25 30

0 5 10 15

Source: Eurostat, national statistics, Swedbank calculations

Source: Eurostat, national statistics, Swedbank calculations

Energy intensity has been constantly falling in all three countries, as mentioned

above and taking into account current and future developments (price growth, the

decline in energy supply, restructuring of the economy, etc.), we foresee that this

process will continue. However, one cannot expect that changes to the industrial

structure will be rapid. However, the more efficient use of energy could be a very

rapid process, which would mostly be triggered by rising prices.

Households

Households’ energy consumption depends on the wealth and geographical loca-

tion of the country: wealthier countries are using more energy, while those coun-

tries located in the south use less energy. The positions of Estonia, Latvia and

Lithuania in the EU are therefore logical, as they are relatively poor (which damp-

ens use), but their required energy use is high (which increases use). The posi-

Swedbank Analysis, 18 December 2009 11

tions of the three countries are also logical in light of their geographical location

and differences in wealth level.

Chart 10. Household energy consum ption in 2007

6

5

4

3

2

1

0

Malta

Sweden

Czech R

Greece

Poland

France

Ireland

Estonia

Austria

Finland

Luxemb

Netherl

Bulg

Spain

Lith

UK

Port

Rom

EU

Belgium

Denmark

Cypr

Slovakia

Slovenia

Latvia

Italy

Hungary

Germany

to consumer consumption per capita

Source: Eurostat, Swedbank calculations

Chart 11. Share of energy products in HICP in 2008

180

150

120

90

60

30

0

Malta

Sweden

Czech R

Finland

Greece

Austria

UK

France

Ireland

Spain

Luxemb

Lithuania

Estonia

Poland

Bulgaria

Romania

Netherl

Portugal

EU

Belgium

Denmark

Slovenia

Latvia

Slovakia

Italy

Germany

Cyprus

Hungary

electricity nat.gas liq.f uels

non-liq.f uels heating motor f uels etc Source: Eurostat

The differences in energy consumption among the three countries are relatively

small; however, the Latvian people use less electricity and central heating, while

Estonians use natural gas rather modestly. The use of motor fuels and solid fuels

(mostly timber) is approximately the same in all three countries--4.1% and 9.6%

of total energy consumption, respectively.

The changes in energy use can be seen in the example of Estonia. The share of

energy products in the Estonian consumer basket were falling until 2008,18 but

rapid price growth and the deterioration of the economic situation caused the

share to rise to 14.6% in 2008. The strongest growth of shares was witnessed in

heating energy (from 3.4% in 2007 to 4.4%) but consumption of motor fuels and

oils also rose (from 5.6% in 2007 to 5.7%). In 2009, two opposite factors have af-

fected the energy consumption of households. On the one hand, the deepening

of the general economic problems has forced households to diminish their spend-

ing, and to limit it more and more to necessary goods and services. Hence, the

share of spending on energy should grow because it is for the most part neces-

18

We use the consumer price index (CPI) consumer basket, as there is no other source available. The CPI bas-

ket reflects consumption structure in the previous year.

12 Swedbank Analysis, 18 December 2009

sary spending (heating and partly transport). On the other hand, prices fell in the

first half of 2009.

Chart 12. Retail trade volum es of m otor fuels in Baltic

countries, 2005=100

160

140

Estonia

Latv ia

120

Lithuania

100

80

2004 2005 2006 2007 2008 2009

Source: Eurostat

Chart 13. Chare of energy products in Estonian CPI basket

18%

15% motor f uels and oils

heating energy

12%

stov e heating

9% heating oil

6% nat.gas

electricity

3%

0%

2004 2005 2006 2007 2008 2009 Source: ESA

Chart 13b. Share of energy products in Latvian CPI basket

15%

solid f uel

12%

motor f uel

9% heating

gas ov erall

6%

nat.gas

3% electricity

0%

2004 2005 2006 2007 2008 2009

Source: Latv ian Statistics

Swedbank Analysis, 18 December 2009 13

Chart 14. Price level of m ain energy products in Estonian CPI

(Jan 2004=1)

3.0

CPI

2.5

electricity

nat.gas

2.0

stov e heating

heating energy

1.5

motor f uels and oils

1.0

2004 2005 2006 2007 2008 2009

Industry

The energy intensity of industry (manufacturing) is partly dependent on used

technology, but economic structure plays the most important role. Most of the so-

called new EU members have problems related to inefficient economic structure

with regard to energy use. This is because energy-intensive production was

placed in the past (i.e., prior to the 1990s) in areas where there was a need to

import energy (i.e., transport and risk factors were not considered). As long as

prices remained low, it was possible to continue such production. But when en-

ergy prices rise, such production becomes less and less competitive and will

gradually cease to exist.19 The adjustment process is taking place in the three

Baltic countries as well, and it has not yet ended; moreover, it is possible that the

biggest part of it has yet to take place.20 Of course, there are other aspects that

determine the location of production besides energy accessibility and price, e.g.,

access to raw materials, transport, and consumers.

Some industries are more energy intensive than others (e.g., chemical industry,

the production of several building materials, metalworking, timber and paper in-

dustry vs. services). Hence, it is natural that, even with the best technology, some

countries will have more energy-intensive industry (economy) than others will.

In 2008, the share of manufacturing in the final consumption of energy in Estonia

was 21.9%; in Latvia, 15.5%; and, in Lithuania, 18.8% The average consumption

of energy in manufacturing was relatively low in the EU (7.15 TJ per millions of

euros of produced value added in 2007), and the lowest levels were reported not

only in the biggest economies (Germany, Italy, and France), but also in Malta and

Ireland.21 High value-added production in machinery and the equipment industry

is the reason, which lowers the overall intensity of energy consumption in the in-

dustry.

19

It is possible to support such a production, and this has been done due to social reasons. Until other produc-

tion costs are sufficiently low, the more expensive energy (transport) will not affect production negatively. But as

in the common economic zone one can expect convergence to take place, such an irrationally located produc-

tion will finally become bankrupt as it is more costly and, hence, less competitive.

20

However, one should not forget that the current economic crisis has forced companies to concentrate heavily

on cost efficiency; hence, it is quite possible that on the company level the adjustment has now neared its end.

Hence, there remain only issues that are not related to particular energy consumption ways (e.g., technology

issues and logistics).

21

As there are no data in Eurostat on value added produced in 2007 in Bulgaria, Spain, Portugal, the UK, and

Denmark, we were not able to make the respective calculations.

14 Swedbank Analysis, 18 December 2009

Chart 15. Energy use in industry, shares of total

other

wood processing

paper-& pulp industry

Lithuania

f ood industry

Estonia

machinery , transport v ehicles

Latv ia

building materials

chemical industry

metal industry

0% 5% 10% 15% 20% 25% 30%

Source: Swedbank calculations on local statistics

Chart 16. Final consum ption of energy, PJ

250

other

200 electricity

heating

150

timber etc

100 nat.gas

coal, oil shale

50 oil products

0

Estonia Latv ia Lithuania

Source: national statistics

Chart 17. Energy consum ption in industry per value added

produced, 2007

18

15

12

9

6

3

0

Malta

Sweden

Czech R

Ireland

France

Austria

Greece

Estonia

Luxemb

Poland

Finland

Romania

Netherl

Lithuania

EU

Belgium

Slovenia

Latvia

Slovakia

Germany

Italy

Hungary

Cypros

Source: Eurostat, Swedbank calculations

The energy intensity of industry in Lithuania was relatively low in 2007 and com-

parable with the Swedish level; Estonia’s was comparable with levels in Luxem-

bourg and the Czech Republic, while Latvia’s was comparable with Poland’s (see

Chart 17). Taking into account that Latvia has rather few own energy recourses, it

is surprising that Latvian industry is so energy intensive. It is quite possible that

this is the consequence of the old economic structure, which used imported en-

ergy. For example, the metalworking industry in Latvia is somewhat energy con-

suming, while the Estonian and Lithuanian metalworking industries are substan-

tially less energy intensive. The chemical industry is a big energy user in Estonia

Swedbank Analysis, 18 December 2009 15

and Lithuania, while the Latvian chemical industry plays a smaller, albeit still im-

portant role among energy consumers (chemical industries are using mostly

natural gas). Estonia is using a lot of energy in the paper and pulp industry, while

in Lithuania the timber-processing industry is small and, hence, also a small en-

ergy consumer.

Transport sector

The transport sector is not a big energy consumer: according to 2008 data, it ac-

counts for 0.9% in Lithuania, 1.2% in Estonia, and 2.1% in Latvia of total final en-

ergy consumption. However, the transport sector itself depends heavily on en-

ergy (fuels), and its importance in the economy is far bigger than the figures sug-

gest. Most of the energy in the transport sector is used by road transport. It is

natural that the transport sector uses mostly oil-based motor fuels, although in

Latvia and Lithuania natural gas and bio fuels are used as well (but not in Esto-

nia).

The transport sectors in the three countries are relatively energy intensive, albeit

far less energy intensive than EU’s top users, Cyprus, Luxembourg, Poland, and

Slovenia.. Of the three, Latvia has the most energy-intensive transport sector,

and Lithuania the least intensive.

The rise in prices forces the transport sector to work on making more efficient use

of energy. It does not mean only that more effective engines will be used but,

more important, that the logistics and work organisation should be improved (e.g.,

trips without load, and the location of warehouses and production). The global

economic decline means that, at least in 2009, we can forecast a decline in en-

ergy consumption in the transport sector. Growth will most likely not be seen until

2011 or in the 2nd half of 2010 at best.

Chart 18. Energy consum ption in Estonian transport sector

(TJ/transport sales th EEK)

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

Total railway road marine air

Source: Swedbank calculations, ESA data

The energy intensity of the transport sector is also affected by the structure of the

transport sector and the use of public transport. In the three Baltic countries, road

transport is more widespread than other means of transport, but it is the most en-

ergy-intensive transport sector. The reason behind such a widespread use of

road transport lies mainly in the shortage of other means (railways, waterways).

The low use of public transport is a result of several factors ranging from low

density, which makes public transport costly and hard to organize, to poor coop-

eration between municipalities and legal shortcomings.

16 Swedbank Analysis, 18 December 2009

Future developments in energy production and

consumption

Energy consumption in the three Baltic countries declined in 2008-2009, and it is

highly probable that the decline will continue in 2010 as well, due to the deep

economic crisis. The causes of this crisis are not the theme of our current report,

but we are of the opinion that the developments in the (global) energy sector

made things worse and that they will continue to negatively affect economic de-

velopments in the region. For example, the rapid price growth in 2007 and espe-

cially in the 1st half of 2008 caused several big companies to lose some of their

competitiveness and diminished households’ consumption possibilities. With re-

spect to the latter, it should also be noted that the increase of heating costs dur-

ing winter is one major reason why households are now holding back on their

spending and building up precautionary savings.22 Big changes like the closure of

the Ignalina nuclear power station (NPS) and the development of renewable en-

ergy, which will raise energy prices, will take place when the three economies are

in the very situation that will compel them to make big and painful adjustments.

The fact that several changes are taking place at the same time clearly are mak-

ing things worse, compared with a situation in which those changes would take

place separately.

As local energy supply will diminish and prices rise, the recovery of economic

growth will be more difficult, and for some industries and enterprises this could be

the final bell. However, this difficult time may also encourage companies and

households to make changes (especially regarding energy efficiency) that proba-

bly would not be so attractive if the general economic situation were to remain as

it had been in 2007 or even in 2008. It might be that a very heavy cost burden

may force the countries to make changes that will build up strong long-term ad-

vantages for local economies (structural changes in production and consump-

tion).

Closure of Ignalina NPS and its impact

The biggest change is the closure of the Ignalina NPS.23 This closure means

that Lithuania’s electricity consumption will be not covered by its own production

(there will be shortages at peak times), Latvia will have fewer possibilities to im-

port, and only Estonia could benefit, from increased export possibilities. However,

as Estonia is about to close a substantial share of its production capacities24 and

due to a shortage of CO2 emission quotas, there is a great need to build up new

capacities, including renewables, in the Baltic countries and to import electricity.

22

Improved consumer confidence has not yet translated into consumption, and retail sales continue to fall.

23

The reasons for the closure are, first of all, political (Lithuania agreed to it as part of its EU accession agree-

ment). The environmental and safety considerations have been criticized on several occasions as being too ex-

cessive and ungrounded. The closure of the Ignalina NPS was pushed through at a time when nuclear energy

was very unpopular, while now opinions have changed (but not the agreement on the Ignalina NPS). It is as-

sumed that after the closure Lithuania will cover one-third of its electricity consumption from the production of

Lietuvos electrine (a gas-based plant), about 4% from hydro and wind energy, some 12.5% from CPPs, and

about 35% from imports..

24

According to Elering (the Estonian grid company), during 2008-10 393 MW of old capacities will be closed

(and new capacities added of 80 MW); during 2010-16, capacities of 972 MW will be closed (with new capaci-

ties 104-144 MW added). Capacities may increase in wind energy generation up to 444-3586 MW until 2013;

however, this increase will be limited because of the shortage of compensative capacities. According to the

same source, the shortage of electrical energy will appear at the latest by 2016, but maybe as early as 2011.

Swedbank Analysis, 18 December 2009 17

Chart 19. Installed capacities of electricity in Baltic countries

31.12.2009, MW

5000

Windmills

4000 Hy dro

Hy dro Pump Storage

3000

Nuclear

2000 CHP

Thermal

1000

0

Estonia Latv ia Lithuania Source: Eesti Energia

The shortage of capacity has to be covered with electricity imports, at least in

the short and medium term. There will be no problems in the summer, but in win-

ter and in the event of an improvement in the economic situation (approximately

in 2015-16) there will not be enough capacity in the Baltic countries to cover their

electricity needs. It is possible to import electricity from Russia, and Belorussia,

and Finland (i.e., from the Nordic countries). Estlink has a capacity of 350 MW,

and Russian connections can provide up to 2700 MW.25 However, none of the

three countries is wants to be so heavily dependent on imported electricity. In a

worst-case scenario in which weather conditions worsen and capacity shortages

occur at the same time, these connections might not be enough to cover de-

mand. In the next three-six years, Estonia is the only country that can produce

the electricity it needs and export it also to Latvia and Lithuania.

There is an urgent need to build more connections, with other countries of EU,

which would diminish the risks and affect both the consumption and price of elec-

tricity. As of now, there are plans to build following connections: Estlink2 (650

MW), Lithuania-Poland and Lithuania-Sweden (both 1000 MW). The earliest time

for new connection seems to be 2013 (Estlink2).

The increase in electricity imports will be accompanied by the opening of an

electricity market in 2010 (Lithuania at the beginning of the year,26 and Estonia

in April27). The Latvian electricity market is already open.28 The opening of the

market means that companies with more consumption than certain amount of

electricity will start to buy electricity from the free market (will lose access to the

electricity sold by regulated prices). The opening of the market includes some

limits. For example, exports and imports in Lithuania will remain the monopoly of

Lietuvos Energija, and there will be import limits to keep local producers working

besides their higher price. The limits are mostly motivated by the intention to limit

the inflow of cheap Russian electricity, and to prevent Russian producers from

25

At peak demand (in winter) in Baltic countries there is peak time also in Russia and hence the import possibili-

ties will decline for Baltic countries. (OÜ Põhivõrk. Eesti elektrisüsteemi tootmisseadmete piisavuse aruanne.

Tallinn 2008).

26

This means that about 35% of the market will be opened; imports will be limited.

27

According to the draft law, companies that use more than 2GWh of electricity (approximately 35% of con-

sumption) will start to buy electricity from the free market, where the electricity change will be created (as a rule

electricity buyers and sellers will participate, and the market price will affect the electricity price sold to custom-

ers). Two-party contracts are allowed between producers and consumers.

28

Only two-party contracts are allowed.

18 Swedbank Analysis, 18 December 2009

overtaking the market with dumping-like prices.29 Due to differences among the

three countries in the opening of the markets, there will be no common electricity

market in the region in 2010: Lithuania will clearly differ from Estonia and Latvia

through its higher price, but differences between Estonia and Latvia will also re-

main. It is unlikely that a common electricity market will emerge in the event that

situation one of the countries runs a different policy than the others, whether this

applies to price regulation, access to the market, or how trading between produc-

ers and users is conducted. It is hard to predict when the harmonization will take

place, but it will definitely require time (although not a connection with other EU

countries).

The opening of markets and the closure of the Ignalina NPS will result in electric-

ity price growth, as the local electricity supply will diminish and generally more

expensive Nordic electricity will be sold in the Baltics. It is difficult to forecast what

the price will be as of now. While households and smaller companies will still buy

electricity, the price of which is regulated according to existing rules, the free

market prices are very difficult to predict. The price decline that could be ex-

pected from the imports of Russian electricity will be avoided due to the limited

openness of the market and the limits set on Russian sellers. Taking into account

the price dynamics in the Nord Pool, it is likely that the free market price will be

somewhat higher in the Baltics than currently; however, there will be periods

when the price of electricity will be lower than now.

Chart 20. NordPool prices (1-year futures), euro

50

45

40

35

30

25

Nov .08 Jan.09 Mar.09 May .09 Jul.09 Sep.09

The potential price increase is limited by the current economic situation, in which

demand for electricity (and overall for energy) has strongly fallen. According to

Eurostat data, in the first seven months of 2009, electricity consumption in the

three countries was 7.9% lower than a year before, including 8.1% less in Latvia,

8.9% in Lithuania, and 6.4% in Estonia. Taking account of the economic outlook

for 2010, we expect electricity consumption to fall in 2010 as well (although in Es-

tonia slight growth may appear, particularly in the second half of the year). On the

assumption that economic growth in 2011-12 will be rather modest compared

with 2005-08, we see that the long-term projections on which the energy devel-

opment programmes are built are too high and, hence, that the capacity problem

the three countries face will be smaller than commonly assumed both previously

and often now.

29

The Russian electricity prices are dumping-like as Russia does not apply carbon dioxide quotas, which makes

the electricity production there much cheaper.

Swedbank Analysis, 18 December 2009 19

Chart 21. Carbon Dioxide Em ission Rights (IPE), euro/ton

35

30

25

20

15

10

5

Apr.05 Jan.06 Oct.06 Jul.07 Apr.08 Jan.09 Oct.09

Source: EcoWin

The electricity price is also affected by the changes that will take place in carbon

dioxide trading in the EU in 2013, when the quotas will become freely tradable. It

is highly probable that this will result in higher electricity prices in almost all coun-

tries. It is extremely difficult to project now what the price of the quotas will be, but

some forecast that the electricity price in the Baltic countries will increase very

substantially (e.g., twice as high in Estonia). It might happen that the production

of electricity from fossil fuels and particularly from oil shale will be economically

unsound,30 if the price of the quotas is too high. The price growth of electricity will

have a direct effect on many industries and companies and, hence, on the econ-

omy. Of course, high energy-consuming sectors will be affected the most, and we

can expect that these companies will have to change their production and tech-

nology and increase efficiency, or else close production. Higher energy prices will

also affect consumer prices and households. A very rapid rise in prices may slow

economic growth rather dramatically: taking into account that the three econo-

mies will be on the verge of economic recovery at that time, such an increase

could cause another setback to the economy in the worst case. The price growth

could be smoothed in two ways: by producing electricity with little need (or with

no need) of carbon dioxide quotas and by importing electricity from Russia. Both

options are now carefully being studied in all three countries.

Building additional capacities

All three countries are interested in building up additional capacities for electricity

generation. However, many agreements and regulations concerning environ-

mental issues should first be considered, including issues related to carbon diox-

ide trading. This means that the countries should focus on finding a way to pro-

duce electricity from renewables or in a way that requires fewer carbon dioxide

quotas (e.g., from waste, using nuclear energy).

Despite risks related to import resources, both Latvia and Lithuania are develop-

ing the generation of electricity from natural gas. For example, a plant is under

construction in Latvia with a capacity of 400 MW, and a similar one is being

planned. Lithuania is reconstructing an existing plant, and Estonia is planning to

build a CPP based on natural gas instead of an outdated plant using oil shale, for

peak time and rebalancing purposes.

30

Einari Kisel. Makromajandusliku mõjuga protsessid Eesti energeetikas. Ettekanne Eesti Panga avatud

seminaril. Oktoober 2009.

20 Swedbank Analysis, 18 December 2009

Lithuania is planning to build a new nuclear power station after Ignalina is

closed. Unfortunately, the process has been very slow, with several setbacks,

and, hence, there is no certainty that the plant will be built. At first there were

hopes that the new NPS would be built before the closure of the Ignalina NPS or

soon thereafter. Now this target date has shifted into the more distant future. As

of now, Latvia, Estonia, and Poland have also agreed to participate in the project,

and [ok?] a strategic investor with a majority stake will be involved in the project

as well. The possibility of having too small a stake in the project may diminish the

interest of the above-mentioned countries in participating in the project; Estonia in

particular has expressed a concern that too many participants may diminish the

expected benefits to others. The building of a new NPS requires that a connec-

tion between Lithuania and Poland be built. The more participants are involved in

the building of a new NPS, the bigger its capacity should be (3400 MW is now be-

ing considered) and, hence, the more costly and time-consuming the building it-

self would be.

In Estonia, other options for the use of nuclear energy have been discussed, in-

cluding possible participation in a NPS in Finland or the building of an NPS in Es-

tonia. The building of a third nuclear reactor in Olkiluoto (the fifth in Finland) has

taken more time than planned; hence, it is unknown when the next one will be

built (suggested locations include Olkiluoto and Loviisa). It is also uncertain

whether Finnish producers would be interested in this new partnership. The build-

ing of Estonia’s own NPS is one potential option, and there have been some

preparations made for this (e.g., a study about possible locations, and the starting

of geological research on the Pakri peninsula). It is not clear, therefore, whether

an NPS will be built in Estonia. However, if it is decided to do so, the NPS most

likely will be small and it will be built over the long-term (the so-called 4th genera-

tion reactors are targeted).31

Adding renewable resources

There are many possibilities for using renewable energy. In Estonia, wind energy

is the most discussed, but timber (and products) and other local resources are

used the most in all three countries, particularly in local heating plants, which

generally are small. However, bigger plants are now being built or planned, in-

cluding CPPs. The use of renewable energy is supported by different initiatives.

However, the negative aspect is that the development of the use of renewable

energy has brought up many negative side effects, which, in the case of the pro-

duction of electricity, is making energy far more expensive or creating problems

in other areas (e.g., the environment).

The use of additional hydro energy resources is rather limited in the three coun-

tries: only small capacities could be added. The major objection against the use

of hydro energy is its negative impact on the natural environment (e.g., on the

spawning of salmon and other fish, flooding of forests).

The use of wind energy for generating electricity is the fastest expanding area. It

is relatively expensive requiring compensation plants to stabilize the instability of

wind energy. Estonian wind energy companies have built no such plants yet.

Hence, there is no good understanding among wind park developers (and others)

of how expensive the production is and what kind of obstacles the high level of

31

Nuclear energy issues, including the possibility of an Estonian NPS, are discussed, for example, here:

www.tuumaenergia.ee

Swedbank Analysis, 18 December 2009 21

wind energy generation creates.32 It is considered that the most effective com-

pensation plants should use natural gas, as the work of the plant must be easily

started and stopped. However, this would increase the dependence on imports

and related risks.33 Additional wind energy capacities are impossible to use if

there are not enough compensation plants; as of now, there is not even a clear

understanding of what the limit is for current systems.

The use of wind energy has brought up several negative side effects. Many of

them are the result of the irresponsible behaviour of investors and insufficient

regulation, as seen in the example of Estonia. There have been many intentions

expressed to build the windmills too close to houses (which increases vibration-

caused health problems),34 in areas of relatively dense population35 or areas of

natural beauty (thereby polluting the landscape). There are also problems directly

related to natural protection – the migration paths of birds are also the windiest

areas – and defence. The intentions of some (foreign) investors to build big wind

parks for electricity exports while allowing all negative the side effects and con-

sequences to be borne by local people have not worked well for the development

of renewable energy.36

The development of other energy resources has also brought up hot disputes,

particularly in the case of CPPs. When bigger CPPs using waste or timber have

been opened, accusations about rising prices and shortage of resources have

always followed, including that the other big investments using the same re-

source will now be unsuccessful. However, quite often (but not always) these ac-

cusations are just the reflection of growing or emerging competition. Sometimes,

a decline in very large profits is also behind such accusations.

The use of timber and other related products is one area where there is lot of

room for growth in the Baltic countries, particularly Estonia and Latvia. The use of

residues from the wood and timber industries, which are important industries in

the region, would benefit in different way: by diminishing waste, making the in-

dustry more profitable, and increasing its competitiveness. However, as men-

tioned above, the expansion of such a type of energy generation has also kindled

disputes. This is in addition to the accusations that the forest cutting will destroy

nature and diminish forests (in fact, the forested areas are growing because the

wood industry can use only forests of a certain age, while energy generation is

using waste and brushwood).

Bio fuels (here we mean from agricultural sources), which have been used in

Latvia and Lithuania, have been far less successful in Estonia, although several

plants are being built. There are many reasons behind this, mostly related to the

price of raw materials and problems in companies’ management. Globally, there

have been pointed to the fact that the increased use of bio fuels was one reason

32

The most striking outcome of this ignorance is that the amount of planned capacities exceeds by several

times the maximum of capacities that could be added to existing system (see above).

33

Anto Raukas. Eesti energeetilised valikud. Ettekanne Eesti Panga avatud seminaril. Oktoober 2009.

34

Estonia has a low population density (houses are located sparsely), and, hence, the nonpopulated areas are

mostly forest and swamp areas, which are either not suited for the development of wind energy or are natural

reserves.

35

For example, one municipality (Lüganuse) would have been covered totally with windmills if all projects had

been finalized (http://www.epl.ee/artikkel/402048)

36

For example, the Hiiumaa wind sea park was meant to generate electricity for Sweden, but the related cost to

be borne by Estonia and the local population (http://www.epl.ee/artikkel/462117,

http://www.kalev.ee/est/hiiu/?news=974773&category=9&Hiiumaa-tuulepargi-elekter-hakkaks-Rootsi-minema)

22 Swedbank Analysis, 18 December 2009

behind the rapid growth of grain prices in 2007-08, and this could be one factor to

be blamed for the increased nutrition problems in the world.

Consequently, there is a need to talk about negative side effects: what the use

of renewables might bring, especially if the policy measures are not adequate. Al-

though the use of renewable energy is very important for the future, we must still

recognize that the economic measures taken to encourage the use of renewable

energy have brought many negative side effects. We are of the opinion that the

support schemes meant to encourage the use of renewable energy should be

considered carefully, and that those methods that have smaller negative side ef-

fects should be used. The direct subsidies37 are clearly supporting the use of re-

newable energy. However, the excessively high level of them (at least in the case

of Estonia) has created a situation of possible overinvestment and, hence, big

negative side effects. 38

Taking into account the rise in energy prices, the generation of electricity from

wind parks (and other sources) should soon become profitable without subsidies.

At the same time the energy produced from fossil fuels will become more expen-

sive (carbon dioxide quota trading), which means that the profitability differentials

between “old” and “new” energy production will diminish in the future. If the gov-

ernment finds that there is still a need to continue the financial support of renew-

able energy, then we are of the opinion that other measures should be used

(e.g., financial support to guarantee the justified profitability of producers39). It is

important that both enterprises and governments work harder more to avoid and

reduce the negative side effects, i.e., clear rules should be set to develop energy

production in the future.

It is quite probable that a Copenhagen climate agreement could further support

the use of renewable energy. Hence, all three countries have to work to increase

the generation of renewable energy and reduce pollution.

The biggest problem with the use of renewable energy is, however, that the Baltic

countries are not able to cover their energy needs only or mainly from that source

(the use of fossil fuels will diminish in distant future also because fossil fuels will

become more expensive and be exhausted). One option is to generate nuclear

energy. This energy source, the direct effect of which on the environment is mod-

est, has low production costs, and high working reliability, albeit the investment

costs are very high. The nuclear waste is generally small in amount,40 but its

handling in the distant future needs special attention. Of course, there are strong

opponents of the use of nuclear energy, and the issues related to nuclear energy

should be discussed widely and openly in society. While Lithuania with its exist-

ing (but closing) NPS has generally experienced public support for its use of nu-

clear energy, Estonians differ in their opinions on the topic.

37

From January 2010 onward, the price that every electricity consumer pays for the support of renewable en-

ergy will double in Estonia (from 6 cents to 12 cents per kWh).

38

When the support scheme was created in 2007, the government suggested it should be 84 cents per kWh,

but Riigikogu set it at 115 cents. (BNS). It is possible that the lower level would not have guaranteed the fulfil-

ment of the target of renewable energy consumption, but it definitely would have caused fewer problems and

reduced the opposition to wind energy generated by the very aggressive and irresponsible developers. There

are now applications to build wind energy capacities over 4000 MW, but Estonia’s peak time consumption in last

rd

winter was only 1888 MW. (Eesti Päevaleht, 3 Dec., 2009. Erik Müürsepp interview with the manager of Eler-

ingi Mr Taavi Veskimägi).

39

I.e., analogous to how the prices of natural monopolies are regulated.

40

A. Raukas.

Swedbank Analysis, 18 December 2009 23

Factors affecting consumption

How much capacity is needed (and how big imports should be) depends most of

all on how much energy will be consumed in the future. The expectations in cur-

rent energy development plans regarding future energy consumption have clearly

been overestimated, taking into account the deep crisis the three countries are in

now. The actual need for not only imports and additional capacity, but also calcu-

lated profitability of the investment projects, is outdated as of now.

Although there are signs of stabilisation and growth in the global economy, as

well in the Baltic countries, the overall long-term outlook remains subdued. The

projection of slow economic growth, which will be much lower than in past (at

least in the next couple of years), is dominating, but we cannot rule out alterna-

tive outcomes.

The estimations of future energy consumption are usually based on the relation

between economic growth and energy consumption. However, strong energysav-

ing considerations (driven by prices and supply) are weakening this relation.

There are other aspects to take into account (the following takes into account the

specifics of the Baltic countries).

Oil shale-based electricity generation will decline future as carbon dioxide trad-

ing will make this type of production substantially more expensive than now, and

cheaper imported electricity will mean that oil shale-based electricity will be gen-

erated only at the time of peak consumption and in case of emergency (e.g.,

supply cuts with Finland). The gradual shutting down and renovating of produc-

tion is already taking place, and, in a 10-year perspective, the generation of oil

shale-based electricity will be substantially smaller.

The production of shale oil seems to have good prospects as of now, especially

taking into account that prices of oil products will continue to grow in the future.

Assuming increasing investments in the sector, we forecast that production and

exports will grow, and it might be that in the long term the Baltic countries will use

motor fuels produced from oil shale.

Although energy generation from natural gas is relatively environmentally

friendly, we expect that after strengthening its position in the next few years in the

Baltic countries, it will lose its position in the long term. There are several reasons

for this (supply security, supply amounts, price, import risks, and wish to diminish

import dependence). The connection for using natural gas provided by other pro-

ducers (i.e. other than Russian) would increase the use of natural gas.

The production technologies are a very important factor, to which all Baltic en-

ergy producers are paying attention as they try to produce more cheaply and

more effectively while also reducing waste. For example, the new Estonian En-

ergy generators in Narva will use a new technology, and Lithuania will use new

generators to reduce the use of natural gas and the price of electricity.

Industries, which are highly dependent on imported energy, will try to lessen that

dependency. This means that more effort will be made to use more effective and

less energy-consuming technology, but it will also cause the energy-intensive

sectors to lose ground in the Baltic countries.

Energy intensity will also diminish because of faster price growth. If the most

pessimistic projections about electricity (but also all energy) prices prove correct,

we could already see in 2013 substantial changes in the economies of the three

24 Swedbank Analysis, 18 December 2009

countries, as many products will cease production, and companies will close due

to much higher energy prices.

Households will continue to make big efforts to diminish the use of heating en-

ergy (and electricity). The rising prices and state support schemes (e.g., loans,

guarantees, and direct support for increasing the energy efficiency of housing)

should hasten the process significantly.41 It is quite likely that dependence on one

(imported) energy resource would be reduced and cheaper ways used more.

However, one should take care that negative side effects do not emerge (e.g.,

cheap energy resources may pollute the air more; many smaller heating plants

might increase pollution).

Energy consumption will decline in 2009-10, and maybe even into the beginning

of 2011, due to the economic crisis – production is substantially lower and low

incomes are forcing households, municipalities, and companies to use energy

more efficiently. Although the resumption of economic growth might also bring

higher energy consumption, we cannot rule out the possibility that the substantial

changes in energy consumption habits will take place, especially taking into ac-

count the rise in energy prices.

Energy price

The price is the most important factor affecting the production and consumption

of energy. The global price decline in the second half of 2008 was a short term

albeit very deep response to the break-up the crisis, which ended immediately af-

ter consumer and business confidence stabilized and recovered. However, a fur-

ther price rise has been limited by weak demand and generally weak economic

developments. Still, the pressure for further growth is strong. There is a strong

long-term underlying process of diminishing resources and growing population

and wealth, such that demand will be generated while supply is about to diminish.

At the same time, the conditions exist for building up a new price bubble of natu-

ral resources as investors are looking for good investment opportunities, which

are scarce in the current economic situation.42 One should, however, not forget

that the rapid price growth in recent years and problems with supply have made

consumers cautious; they are looking almost everywhere for alternative sources