Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reviewer Income

Caricato da

Trisha Gonzaga0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

13 visualizzazioni5 pagineTitolo originale

REVIEWER-INCOME.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

13 visualizzazioni5 pagineReviewer Income

Caricato da

Trisha GonzagaCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 5

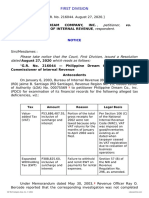

REVIEWER: INCOME TAXATION 26.

In the exercise of taxation, the state can tax

anything at any time and any amount

TRUE OR FALSE 27. Taxation and power of eminent domain

may be exercised simultaneously

1. A person may refuse to pay a tax on the

28. Taxation and police power may be

ground that he receives no personal benefit

exercised simultaneously

from it

29. All of our tax laws are statutory law on

2. A taxpayer has a right to question illegal

taxation

expenditures of public funds

30. The non-impairment clause is statutory law

3. One of the essential characteristics of a tax

on taxation

is it unlimited in amount

31. Non-payment of tax makes the business

4. A tax is generally unlimited because it is

illegal

based on the needs of the state

32. The non-payment of license fee makes the

5. A license fee is charged imposed under the

business illegal

police power of the state

33. Margin fee is a tax

6. Penalty is imposed by the state only

34. Custom’s duty is a tax

7. Imposition of taxes is a legislative act

35. Territoriality is one of the Constitutional

8. Collection of taxes is an administrative act

limitations on the power of taxation

9. A state has the power to tax even if not

36. International comity is an inherent

granted by the Constitution

limitation in taxation

10. A state cannot exercise police power if not

37. Taxes may be used for sectarian purposes is

granted by the Constitution

allowed by an ordinance

11. There can only be tax if there is a law

38. The President can refuse to implement tax

imposing the tax

law if it appears to be unconstitutional

12. The power to tax is inherent

39. There can be double taxation in Philippines

13. A tax is based on law while debt is based on

40. Double taxation is illegal if it violates the

contract

uniformity of taxation

14. A tax is also a custom duty

41. Revenue Regional Director is allowed or

15. A person cannot be imprisoned for non-

authorized to issue Letter of Authority

payment of property tax

42. Revenue Officers have no authority to

16. A law may be passed violating uniformity

administer oaths and take testimony in any

to taxation

official matter or investigation conducted

17. The RDO is known as the alter ego of the

by them regarding any matters within the

BIR Commissioner

jurisdiction of the Bureau.

18. The BIR Commissioner is directly under the

43. Revenue Officers have no authority to make

President’ office

arrest or seizures for the violation of the

19. Provision in the Philippines Constitution

penal law, rule or regulation administered

on taxation are grants of power

by the BIR

20. Due process of law in taxation in the

44. Internal Revenue officers assigned to

Constitution is a grant power

perform assessment or collection functions

21. An excise tax is also called a privilege tax

shall not remain in the same assignment for

22. A tax which is neither personal tax nor

more than (2) years.

property is an excise tax

23. Estate tax is proportional tax

24. A Progressive tax is a tax, the rate of which

is directly proportional to tax base

25. Taxation without representation is not

tyranny

MULTIPLE CHOICE 8. Levied only on hands:

1. All of the following is territoriality principle Tax

doctrine except one: Special Assessment

Residence of the taxpayer Toll

Source of the income License Fee

Situs of the thing or property taxed 9. One of the following is not a source of tax

International Organizations Administrative rulings and

2. Taxation is equitable in all of the following, opinions

except: Judicial decisions

Its burden falls on those better to 1987 Constitution

pay

Exert opinion on taxation

It is based on ability 10. The government may not do all except one:

It is based on benefits received Tax itself

It is based on uniformity rule. Delegate its power to tax to private

3. The only tax where non-payment of which entities

will not result to imprisonment

Imposed tax arbitrarily

Excise tax

Disregard uniformity in taxation

Donor’s tax 11. A form of tax escape through which one is

Personal tax given tax immunity wherein others are

Property tax subjected to tax.

4. One of the following is not a major tax Shifting

under the Tax Code: Tax immunity

Income tax Tax exemption

Donor’s tax Tax avoidance

Excise tax 12. A form of tax escape by a manufacture or

Estate tax producer who improves his proceeds of

5. One of the following can be both be as production thereby minimizing his unit

progressive tax and a proportional tax: production cost.

Donor’s tax Tax avoidance

Income tax on individuals Capitulation

Both a and b Transformation

Estate tax Shifting

6. A tax which is both under taxation and 13. A waiver by the government right to collect

police power: tax:

Compensatory tax Tax exemption

Regulatory tax Tax amnesty

National tax Tax avoidance

General tax Tax evasion

7. A Demand on proprietorship 14. A tax imposed based on the number

Tax Income tax

Special Assessment Specific tax

Toll Ad valorem tax

License fee Custom duties

15. The theory which most justifies the 1. Which of the following powers and duties

necessity of taxation: of Bureau of international revenue(BIR) is

Protection and benefits theory false?

Revenue purposes theory Assessment and collection of all

Lifeblood theory national internal revenue taxes,

fees, and charges

Ability to pay theory

16. One of the characteristics of internal Enforcement of all forfeitures,

revenue laws is that they are: penalties, and fines connected

with assessment and collection of

Criminal in nature

taxes.

Penal in nature

Execute judgments in all cases

Political nature

decided by court of tax appeals

Generally prospective in and ordinary courts.

application

Give effect to and administer the

17. Which of the following is not an example

supervisory and eminent domain

of excise tax?

power conferred by the Tax code

Transfer tax or other laws

Sales tax 2. The organization of BIR comprise of:

Real property tax One commissioner and 4 deputy

Income tax Commissioner

18. Taxation is an inherent power because: One commissioner and 6 deputy

It is the life blood of the commissioner

government One commissioner and 5 deputy

Protection and benefit theory commissioner

It co-exist with the existence of the One commissioner and 3 deputy

state commissioner

It is exercised for the general 3. Which of the following statement is true?

welfare of the people The commissioner has the power

19. A tax is invalid, except: to interpret tax laws subject to

Theory of taxation and its purpose review of the President of the

are disregard Philippines

Basis of taxation is not recognized The commissioner has the power

Inherent and constitutional to decide disputed assessment,

limitations are not observed refunds of internal revenue, taxes,

fees or charge, penalties imposed

It results to double taxation

in relation thereto, or other tax

20. The following are similarities of the

matters, subject to exclusive

inherent powers of the state, except one:

appellate jurisdiction of Regional

Are necessary attributes of

Trial courts.

sovereignty

The commissioner has the power

Interfere with private rights and

to decide disputed assessment,

property refunds of internal revenue taxes,

Superior to the non-impairment fees or charge, penalties imposed

claims in relation thereto, or other tax

Are legislative in character matters, subject to exclusive

appellate jurisdiction of Court of

Tax Appeals.

The commissioner has the power Fair market value under letter a or

to interpret tax laws about not to letter be which is higher

decide on tax cases. Fair market value under letter a or

4. Any return, statement or declaration filed letter b which is lower

in any office authorize to receive the same 8. The commissioners have the authority to

shall not be withdrawn: Provided that ___ prescribe real property value subject to

from the date of such filling, the same limitations set by the law. Which of the

shall be modified, changed, or amended, following limitations is invalid?

provided further that no notice of audit or There must be consultation with

investigation of such return, statement or competent appraisers both from

declaration has, in the meantime, been private and public sectors, with

actually served upon the tax payers prior notice affected taxpayers

Within 2 years The adjustment in the FVM of the

Within 5 years property must be done once in

Within 3 years every three years through the

Within 4 years rules and regulations issued by the

5. What evidence is needed for the Secretary of Finance based on the

commissioner to assess the tax liability of current Philippine standards.

the tax payers in case the latter failed to The adjustment shall be published

submit the required returns, statements, in newspapers of general

reports and other documents or when circulation in the province, city or

there is a reason to believe that such municipality concerned.

report is false, incomplete or erroneous? In the absence of provision stated

Best evidence obtainable under letter C, the adjustments

Probable evidence obtainable must be posted in the provincial

Reliable evidence obtainable capitol, city or municipal hall in

three (3) constitution public

Virtual evidence obtainable

places therein.

6. Jeopardy assessment (termination of

9. The commissioner can inquire into

taxable period) is necessary under the

taxpayers’ bank accounts without

following circumstances:

violating the Bank Secrecy Law and

The taxpayers is retiring from

Foreign Currency Deposits Act under

business subject to tax

which of the following reason/s:

The tax payers is intending to

To determine the gross estate of

leave the Philippines, or removing

the decedent

his property therefrom

To determine the financial

The taxpayers is hiding or

incapability to the taxpayer, but a

concealing his property

prior approval to the taxpayer is

All of the above needed.

7. For purposes of computing internal

Foreign tax authority requested for

revenue tax, the real property must be

such information

valued.

All of the Above

Fair market value as determined

10. Which of the following statement is False?

by the Commissioner

One who has applied accreditation

Fair market value as determined

and denied by the Commissioners,

by the Provincial or City Assessors

he may appeal such denial to the

Office

Secretary of finance, who shall

rule on the appeal within What are the Sources of National Internal

sixty(60) days from the receipt of Revenue tax?

such appeal. Failure of the

secretary to rule on the appeal Income taxation

within the prescribe period shall Excise taxation

be deemed as approval of the Transfer Taxation

application for accreditation of the VAT

appellant.

Doc Stamp

The commissioner may prescribe

Other percentage taxation

the manner of compliance with

any documentary or procedural Others

requirement in connection with

the submission or preparation of

financial statement accompanying

tax returns.

The commissioners shall delegate

his powers to his subordinate with

the rank equivalent to division

chief or higher, subject to

limitations and restrictions

None of the Above

11. The following powers of the

Commissioners shall not be delegated

except:

The power to recommend the

promulgations of rules and

regulations by the Secretary of

Finance

The power to issue rulings of first

impression or to reverse, revoke,

or modify any existing ruling of

the Bureau.

The power to assign or reassign

internal revenue officers to

establishment where articles

subject to excise tax produced or

kept.

The power to compromise or abate

deficiency tax amounting to P

500,000 or less, and minor

criminal violations

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Attachments To IRS Letter Re Request For Review of 501 (C) (3) StatusDocumento36 pagineAttachments To IRS Letter Re Request For Review of 501 (C) (3) StatusCBS News PoliticsNessuna valutazione finora

- 2001 Bar ExaminationDocumento30 pagine2001 Bar ExaminationHaRry PeregrinoNessuna valutazione finora

- CIR v. Michel Lhuillier Pawnshop, Inc.Documento14 pagineCIR v. Michel Lhuillier Pawnshop, Inc.Anonymous 8liWSgmINessuna valutazione finora

- RDO 83 Talisay CT MinglanillaDocumento2 pagineRDO 83 Talisay CT MinglanilladumdumjudithNessuna valutazione finora

- RDO No. 30 - BinondoDocumento201 pagineRDO No. 30 - BinondoBe YoungNessuna valutazione finora

- Levy United States Post OfficeDocumento3 pagineLevy United States Post OfficeSia Meri Rah ElNessuna valutazione finora

- US Internal Revenue Service: I8829 - 1996Documento2 pagineUS Internal Revenue Service: I8829 - 1996IRSNessuna valutazione finora

- Cir Vs Reyes and A.reyes Vs CirDocumento8 pagineCir Vs Reyes and A.reyes Vs CirJonathan UyNessuna valutazione finora

- 2016 Form1095CDocumento1 pagina2016 Form1095CpatNessuna valutazione finora

- Effectiveness of Income Tax Collection in Sri Lanka EditedDocumento38 pagineEffectiveness of Income Tax Collection in Sri Lanka EditedIshu GunasekaraNessuna valutazione finora

- RDO No. 88 - Tacloban City 2Documento371 pagineRDO No. 88 - Tacloban City 2Rex Lagunzad Flores75% (4)

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocumento11 pagine35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNessuna valutazione finora

- 122 - Maj 2 - Politics & Govern. - 01A Lesson Proper For Week 9Documento5 pagine122 - Maj 2 - Politics & Govern. - 01A Lesson Proper For Week 9kylezandrei calapizNessuna valutazione finora

- Critical Writing PAF3113Documento7 pagineCritical Writing PAF3113Adlin SofiyaNessuna valutazione finora

- Taxation Reviewerdocx PDF FreeDocumento17 pagineTaxation Reviewerdocx PDF FreeAlexis Kaye DayagNessuna valutazione finora

- Mesh w9 PDFDocumento4 pagineMesh w9 PDFKevin ColemanNessuna valutazione finora

- Robert Clarkson v. Internal Revenue Service and John Henderson, District Director, Defendants, 811 F.2d 1396, 11th Cir. (1987)Documento3 pagineRobert Clarkson v. Internal Revenue Service and John Henderson, District Director, Defendants, 811 F.2d 1396, 11th Cir. (1987)Scribd Government DocsNessuna valutazione finora

- Steps To SuccessDocumento188 pagineSteps To SuccessOmar Branch100% (2)

- CIR Vs Lingayen ElectricDocumento2 pagineCIR Vs Lingayen ElectricRobert Quiambao100% (2)

- Digest RR 5-2015Documento1 paginaDigest RR 5-2015Cristine100% (1)

- EXAMPLE - 83 (B) Letter To IRS Individual)Documento1 paginaEXAMPLE - 83 (B) Letter To IRS Individual)Joe WallinNessuna valutazione finora

- 23 Churchill v. RaffertyDocumento3 pagine23 Churchill v. RaffertyViene CanlasNessuna valutazione finora

- Update On Taxpayers Rights Remedies VicMamalateoDocumento53 pagineUpdate On Taxpayers Rights Remedies VicMamalateoNimpa PichayNessuna valutazione finora

- Solidarność - Polska 1980-1982Documento68 pagineSolidarność - Polska 1980-1982Jerry VashchookNessuna valutazione finora

- Job Aid For Form 1701-OfflineDocumento20 pagineJob Aid For Form 1701-OfflineRozen Jake Domingo ValenaNessuna valutazione finora

- CIR. v. YumexDocumento115 pagineCIR. v. YumexPio Vincent BuencaminoNessuna valutazione finora

- Taxation MCQ Part 2Documento17 pagineTaxation MCQ Part 2Deb Bie100% (1)

- Understanding The UCCDocumento8 pagineUnderstanding The UCCBobby Souza95% (22)

- Instructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesDocumento3 pagineInstructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesIRSNessuna valutazione finora

- Taxation LawDocumento40 pagineTaxation Lawnelzahumiwat0Nessuna valutazione finora