Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Welcome To Central Record Keeping Agency PDF

Caricato da

parthi janaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Welcome To Central Record Keeping Agency PDF

Caricato da

parthi janaCopyright:

Formati disponibili

Back

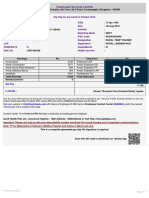

Transaction Statement-ATAL PENSION YOJANA (APY) for the period of Apr 01, 2019 to Oct 28, 2019

Subscriber Details

PRAN : 500132461111

Name Statement Date : Oct 28, 2019 08:40 AM

: SHRI PARTHIBAN R

PRAN Generation

: ARG TRADERS,NO 82A SIDCO INDUSTRIAL : Mar 03, 2017

Date

Address ESTATE,CHETTIPALAYAM ROAD

MALUMICHAMPATTI,COIMBATORE 6 Saving Bank A/C

: 500101010723931

No.

COIMBATORE

APY-SP Bank Reg.

TAMIL NADU - 641050 : 7002343

no.

INDIA

APY-SP Bank

: NPS215520B

IRA Status : IRA compliant Branch Reg. No.

Mobile APY-SP Bank : CITY UNION BANK LTD

: 7667344308 Name

Number

CITY UNION BANK-

Email ID : JANAPARTHI19@GMAIL.COM APY-SP Bank

: MALUMICHAMPATTI-

Branch Name

Date Of Birth : Nov 14, 1988 452

Pension Amount

: 1000

Marital Status : Unmarried Selected

Periodicity of

Spouse Name : : Monthly

Contribution

Nominee

: POONKODI

Name

Percentage : 100%

The total contribution to your pension account till Oct 28, 2019 was Rs. 3105.00.

Value of your Holding (investments) as on Oct 28, 2019 is Rs. 3419.34.

The details of your transactions are as under

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2019 Opening balance 2426.00

08-Apr-2019 By APY Contribution for APRIL 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

03-Jun-2019 By APY Contribution for MAY 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

21-Jun-2019 By APY Contribution for JUNE 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

22-Jul-2019 By APY Contribution for JULY 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

20-Aug-2019 By APY Contribution for AUGUST 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

By APY Contribution for SEPTEMBER

23-Sep-2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

2019

17-Oct-2019 By APY Contribution for OCTOBER 2019 CITY UNION BANK LTD (7002343), 97.00 0.00 97.00

28-Oct-2019 Closing Balance 3,105.00

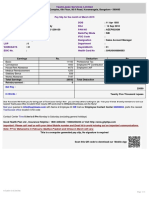

Billing Summary

Perticulars Amount

Summary of Billing during the statement period (22.08)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement:

1. The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for a period of 5 years,

i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory social security scheme & who are not

2.

income tax payers. This Government co-contribution is payable into subscriber's savings bank account half yearly basis in a Financial Year once subscriber has made

the entire contribution for six months.

3. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank branch. In case there

4. is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any discrepancy, you must contact your

APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government securities and upto 15%

5.

will be invested in equity).

6. This is a computer generated statement and does not require any signature.

The amount shown in the field 'Pension Amount Selected' is the guaranteed pension that will be received (irrespective of present value of your holding), if you continue

7.

to contribute till 60 years of age.

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required

to collect additional amount for delayed payments. The overdue interest for delayed contributions would be as shown below: Overdue interest

Overdue interest for delayed contribution: Rs. 1 per month for contribution for every Rs. 100, or part thereof, for each delayed monthly payment. Overdue interest

for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest amount collected

will remain as part of the pension corpus of the subscriber.

CRA Home | Downloads | FAQs | Contact Us | System Configuration | Entrust Secured | Privacy Policy | Grievance Redressal Policy

Copyright © 2010 CRA. All Rights Reserved. Best viewed in Internet Explorer 6 & above or Firefox Ver 1.5 with a resolution of 1024* 768.

Potrebbero piacerti anche

- Your Business Advantage Checking Bus Platinum Privileges: Account SummaryDocumento6 pagineYour Business Advantage Checking Bus Platinum Privileges: Account SummaryN N100% (1)

- Statement of AccountDocumento2 pagineStatement of AccountSoumya Ranjan Mohanty Pupun100% (1)

- Account StatementDocumento2 pagineAccount Statementsia kamathNessuna valutazione finora

- SalarySlipwithTaxDetails JUNEDocumento2 pagineSalarySlipwithTaxDetails JUNEParveen SainiNessuna valutazione finora

- April 2019 PaySlipDocumento1 paginaApril 2019 PaySliparchit chopraNessuna valutazione finora

- AxisDocumento2 pagineAxisMukeshChoudharyNessuna valutazione finora

- Sbi PDFDocumento5 pagineSbi PDFshweta pundirNessuna valutazione finora

- Invoice Cum Bill of Supply: Ferns N Petals Pvt. LTDDocumento1 paginaInvoice Cum Bill of Supply: Ferns N Petals Pvt. LTDSunita MoryaNessuna valutazione finora

- May 2019 - PaySlip PDFDocumento1 paginaMay 2019 - PaySlip PDFHemamber ReddyNessuna valutazione finora

- Payslip ModelDocumento1 paginaPayslip ModelKarthikeyan KarthikeyanNessuna valutazione finora

- Kieso Ifrs Test Bank Ch17Documento45 pagineKieso Ifrs Test Bank Ch17FaradibaNessuna valutazione finora

- RECEIVABLES Answer KeyDocumento24 pagineRECEIVABLES Answer KeyInsatiable Life100% (1)

- Investments:: True or FalseDocumento9 pagineInvestments:: True or FalseXienaNessuna valutazione finora

- PCE Trial Exam 1Documento55 paginePCE Trial Exam 1Kenny Chen68% (22)

- Transaction Statement1563132579Documento1 paginaTransaction Statement1563132579Vincent VNessuna valutazione finora

- Transaction Statement1626153268Documento2 pagineTransaction Statement1626153268Rohit PalNessuna valutazione finora

- Welcome To Central Record Keeping Agency 22-23Documento2 pagineWelcome To Central Record Keeping Agency 22-23tsvvpkumarNessuna valutazione finora

- Transaction Statement1676126669Documento1 paginaTransaction Statement1676126669Vasanth EllendulaNessuna valutazione finora

- Account Statement 2019-2020Documento2 pagineAccount Statement 2019-2020suhasNessuna valutazione finora

- Transaction Statement1673011931Documento1 paginaTransaction Statement1673011931SAMIR KUMARNessuna valutazione finora

- Transaction Statement1627022355Documento1 paginaTransaction Statement1627022355RamakantaSahooNessuna valutazione finora

- Transaction Statement1624372022Documento1 paginaTransaction Statement1624372022RamakantaSahooNessuna valutazione finora

- Welcome To Central Record Keeping Agency - PRDocumento2 pagineWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNessuna valutazione finora

- Wa0007Documento2 pagineWa0007sandhya.iyyanar1992Nessuna valutazione finora

- Transaction Statement1676376886Documento2 pagineTransaction Statement1676376886mukeshpradhan675Nessuna valutazione finora

- Transaction Statement1656568636Documento2 pagineTransaction Statement1656568636Gulzar Ali QadriNessuna valutazione finora

- Transaction Statement1705415418Documento1 paginaTransaction Statement1705415418bhavanakatakam0Nessuna valutazione finora

- Welcome To Central Record Keeping AgencyDocumento2 pagineWelcome To Central Record Keeping AgencyAbhishek SenguptaNessuna valutazione finora

- Transaction Statement1704420433Documento2 pagineTransaction Statement1704420433palakaamresh46Nessuna valutazione finora

- Transaction Statement1700677173Documento2 pagineTransaction Statement1700677173Madhav LungareNessuna valutazione finora

- Welcome To Central Record Keeping Agency 2019Documento2 pagineWelcome To Central Record Keeping Agency 2019pratik patilNessuna valutazione finora

- Welcome To Central Record Keeping Agency 2023Documento2 pagineWelcome To Central Record Keeping Agency 2023pratik patilNessuna valutazione finora

- Transaction Statement1705397004Documento2 pagineTransaction Statement1705397004sureshpatil25Nessuna valutazione finora

- Transaction Statement1698469666Documento2 pagineTransaction Statement1698469666rk370666Nessuna valutazione finora

- June 2019 - PaySlipDocumento1 paginaJune 2019 - PaySlipVishal GauravNessuna valutazione finora

- 120 Led Anuj JiDocumento1 pagina120 Led Anuj Jiamit testNessuna valutazione finora

- Annexure KDocumento1 paginaAnnexure KHeet ShahNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceUdit jainNessuna valutazione finora

- SalarySlipwithTaxDetails JulyDocumento2 pagineSalarySlipwithTaxDetails JulyParveen SainiNessuna valutazione finora

- WHRBG 1224421 Payslip 02 2019 PDFDocumento1 paginaWHRBG 1224421 Payslip 02 2019 PDFAmit RamaniNessuna valutazione finora

- Invoice 221214 144420Documento2 pagineInvoice 221214 144420neelima khandelwalNessuna valutazione finora

- March 2019 - PaySlip PDFDocumento1 paginaMarch 2019 - PaySlip PDFHemamber ReddyNessuna valutazione finora

- DocumentDocumento2 pagineDocumentkapil jainNessuna valutazione finora

- Client Master List: National Securities Depository LimitedDocumento2 pagineClient Master List: National Securities Depository Limitedmrcopy xeroxNessuna valutazione finora

- January 2019 PaySlipDocumento1 paginaJanuary 2019 PaySlipAjay KumarNessuna valutazione finora

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocumento1 pagina(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountVivek RajputNessuna valutazione finora

- GST Invoice: Amount Particular S:No Hsn/Sac Rs. 508.47 1 ROSPL10M1Documento1 paginaGST Invoice: Amount Particular S:No Hsn/Sac Rs. 508.47 1 ROSPL10M1shri balajiNessuna valutazione finora

- Theog InvoiceDocumento1 paginaTheog InvoiceSiddhant JainNessuna valutazione finora

- Cash Disbursements Record: Entity Name: Fund Cluster: Sheet No.Documento1 paginaCash Disbursements Record: Entity Name: Fund Cluster: Sheet No.Joshua Ponce ToñacaoNessuna valutazione finora

- CPK1935816 PDFDocumento1 paginaCPK1935816 PDFAmit KumarNessuna valutazione finora

- CPK1935816 PDFDocumento1 paginaCPK1935816 PDFAmit KumarNessuna valutazione finora

- Taxff PDFDocumento8 pagineTaxff PDFashokkumar sNessuna valutazione finora

- 67258548945019553Documento6 pagine67258548945019553Shiv GargNessuna valutazione finora

- Eastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)Documento1 paginaEastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)pradeepkalali kNessuna valutazione finora

- VIKRANT Slip SepDocumento2 pagineVIKRANT Slip SepVivek Kumar RajNessuna valutazione finora

- Invoice 2nd Hard DriveDocumento2 pagineInvoice 2nd Hard DriveARNAV UTHRANessuna valutazione finora

- HDBMB 2583652 PaySlip 10 2022Documento1 paginaHDBMB 2583652 PaySlip 10 2022PriyanshuNessuna valutazione finora

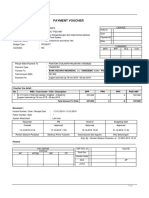

- Payment Voucher 7039515Documento1 paginaPayment Voucher 7039515pikapikaNessuna valutazione finora

- Ts EamcetDocumento1 paginaTs EamcetGaneshNessuna valutazione finora

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Documento6 pagineEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan ChatterjeeNessuna valutazione finora

- Scan 185Documento2 pagineScan 185Pawan Kumar RaiNessuna valutazione finora

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Documento3 pagineEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Naveen GaneshNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jayant PrasadNessuna valutazione finora

- Mediclaim Policy Parents - H1096407Documento3 pagineMediclaim Policy Parents - H1096407Lokesh AnandNessuna valutazione finora

- Exam 4 Fin 2020 - 2Documento2 pagineExam 4 Fin 2020 - 2samaresh chhotrayNessuna valutazione finora

- Home Office and Branch AccountingDocumento2 pagineHome Office and Branch AccountingJack Herer100% (1)

- Lesson 2 Quiz MaterialDocumento4 pagineLesson 2 Quiz Materiallinkin soyNessuna valutazione finora

- Solution For Individual Assignment MCQ And14!29!14-31Documento5 pagineSolution For Individual Assignment MCQ And14!29!14-31Sagita RajagukgukNessuna valutazione finora

- Audit of Insurance CompaniesDocumento15 pagineAudit of Insurance CompaniesYoung MetroNessuna valutazione finora

- IRCTC 09022023142232 OutcomeofboardmeetingDocumento7 pagineIRCTC 09022023142232 OutcomeofboardmeetingsaiNessuna valutazione finora

- USGAAP v8.pdf - DownloadassetDocumento31 pagineUSGAAP v8.pdf - Downloadassetjay raiNessuna valutazione finora

- What Does REHABILITATION MeanDocumento23 pagineWhat Does REHABILITATION MeanMaLizaCainapNessuna valutazione finora

- Practice of Human Resource Accounting in Banking Sector of BangladeshDocumento11 paginePractice of Human Resource Accounting in Banking Sector of BangladeshSucheta SahaNessuna valutazione finora

- Assignment / Tugasan - Financial AccountingDocumento10 pagineAssignment / Tugasan - Financial Accountinghemavathy0% (1)

- Analisis Laporan KeuanganDocumento15 pagineAnalisis Laporan KeuanganMhmmd HirziiNessuna valutazione finora

- Thesis On Indian BanksDocumento4 pagineThesis On Indian Bankslizbrowncapecoral100% (2)

- Compound Interest 2Documento2 pagineCompound Interest 2bdbndNessuna valutazione finora

- Appendix 80 - BRS-MDSDocumento1 paginaAppendix 80 - BRS-MDSPayie PerezNessuna valutazione finora

- Imad A. Moosa: Department of Accounting and Finance Mortash UniversityDocumento6 pagineImad A. Moosa: Department of Accounting and Finance Mortash UniversitySamina MahmoodNessuna valutazione finora

- Retirement of Partner PPT 13.01.21 A.hannan AccountacyDocumento15 pagineRetirement of Partner PPT 13.01.21 A.hannan AccountacyVishal GoelNessuna valutazione finora

- Note Receivable Part 2Documento7 pagineNote Receivable Part 2Carlo VillanNessuna valutazione finora

- Compiled by Daisy B. Medina-Cruz, CPA, MBA: Week 8 Assignment/Quiz The Financial Statement Audit ProcessDocumento8 pagineCompiled by Daisy B. Medina-Cruz, CPA, MBA: Week 8 Assignment/Quiz The Financial Statement Audit ProcessAngelica Mae MarquezNessuna valutazione finora

- CH 14Documento42 pagineCH 14maxhaakeNessuna valutazione finora

- DLP L06 - Four Types of Financial RatiosDocumento5 pagineDLP L06 - Four Types of Financial RatiosMarquez, Lynn Andrea L.Nessuna valutazione finora

- Rizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)Documento2 pagineRizwan & Co. Chartered Accountants: Completed by Schedule Reviewed by (SPS/AM) Reviewed by (Partner)faheemNessuna valutazione finora

- Answers To TestsDocumento19 pagineAnswers To TestsАнтон ВасильевNessuna valutazione finora

- Banking Regulation Act 1949Documento13 pagineBanking Regulation Act 1949jhumli0% (1)

- Amir Salman RizwanDocumento72 pagineAmir Salman RizwanSaad ArshadNessuna valutazione finora

- The Scope of Marine InsuranceDocumento4 pagineThe Scope of Marine InsuranceseaguyinNessuna valutazione finora