Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Step by Step Process For New Business Application

Caricato da

Jed de LeonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Step by Step Process For New Business Application

Caricato da

Jed de LeonCopyright:

Formati disponibili

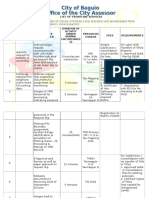

Business Permit and Licensing Office

CITIZEN’S CHARTER Monday to Frdiay excluding Holidays

8:00 a.m. to 5:00 p.m. (No Noon Break)

STEP BY STEP PROCESS FOR NEW BUSINESS APPLICATION

PRE-REGISTRATION STEP 1 STEP 2 STEP 3 POST REGISTRATION

Requirements: Application filing and verification Assessment of fees and charges Payment and Claiming of Mayor’s Permit Inspection and checking of compliance

1. Occupancy Permit Requirements: Requirements: Requirements: Requirements:

2. DTI/SEC/CDA 1. Filled up unified form 5. Business Capitalization All documents from step 2 Regulatory requirements by concerned government

3. Barangay Clearance / Permit 2. DTI/SEC/CDA registration 6. Barangay Clearance / All documents from step 1 agencies and LGU related offices

3. Occupancy Permit permit

Office in Charge:

Office in Charge: CTO, BFP, BPLO (frontline) Office in Charge:

4. Contract of lease BPLO (frontline) CTO and BPLO (backroom) CTO, BPLO and other offices (if necessary) (backroom) Jointly by LGU JIT and concerned government agencies

Office in Charge: BPLO Duties: Inspection team including BFP

Duties (frontline):

Duties: 1. Issue Tax Order of Payment (ToP) and

1. Accept payment Duties (frontline):

NOTE: Please see revenue code for the amount 1. Release and validate submissions 2. Issue OR, Mayor’s Permit, and other clearances 1. Inspection and checking of compliance

advise to pay at the pay counter 2. JIT should submit reports to BPLO for those businesses complying

2. Assess eligibility for renewal based on record businesses

2. Preparation of ToP Duties (frontline): and not complying with the required documents

with occupancy permits transmitted previously by CEO

3. Endorse to next step 1. Print OR, print and sign (if applicable) 3. Non-compliance businesses/establishments will be included in the negative list

Processing Time: 1 to 2 hours Mayor’s Permit, and other clearances and subject for revocation or not renewing the business permit

Processing Time: 1 hour at most Processing Time: 1 to 2 hours Processing Time: Within each year

STEP BY STEP PROCESS FOR RENEWAL BUSINESS APPLICATION

PRE-REGISTRATION STEP 1 STEP 2 STEP 3 POST REGISTRATION

Requirements: Application filing and verification Assessment of fees and charges Payment and Claiming of Mayor’s Permit Inspection and checking of compliance

1. Income tax

2. Barangay Clearance / permit Requirements: Requirements: Requirements: Requirements:

All documents from step 2 Regulatory requirements by concerned government

1. Filled up unified form All documents from step 1 agencies and LGU related offices

2. Barangay Clearance / permit Office in Charge:

3. Income tax return from previous year

Office in Charge: CTO, BFP, BPLO (frontline) Office in Charge:

BPLO (frontline) CTO and BPLO (backroom) CTO, BPLO and other offices (if necessary) (backroom) Jointly by LGU JIT and concerned government agencies

Office in Charge: BPLO

Inspection team including BFP

Duties: Duties (frontline):

Duties:

1. Review and validate submissions 1. Issue Tax Order of Payment (ToP) and

1. Accept payment Duties (frontline):

NOTE: Please see revenue code for the amount 2. Issue OR, Mayor’s Permit, and other clearances 1. Inspection and checking of compliance

2. Assess eligibility for renewal based on consolidated list advise to pay at the pay counter 2. JIT should submit reports to BPLO for those businesses complying

consisting of positive findings 2. Preparation of ToP Duties (frontline): and not complying with the required documents

3. Endorse to next step 1. Print OR, print and sign (if applicable) 3. Non-compliance businesses/establishments will be included in the negative

Processing Time: 1 to 2 hours Mayor’s Permit, and other clearances list and subject for revocation or not renewing the business permit

Processing Time: 5 to 30 minutes

Processing Time: 1 to 2 hours Processing Time: Within each year

Business Permit and Licensing Office

CITIZEN’S CHARTER Monday to Frdiay excluding Holidays

8:00 a.m. to 5:00 p.m. (No Noon Break)

STEP BY STEP PROCESS FOR STEP BY STEP PROCESS FOR HANDLING COMPLAINTS ISSUANCE OF SPECIAL MAYOR’S PERMIT

NEW BUSINESS APPLICATION RENEWAL BUSINESS APPLICATION STEP 1

STEP 1

Request for Special Permit

Determine Violators

Pre-Registration Pre-Registration Office in Charge: BPLO Personnel and Mayor’s Office

Office in Charge: BPLO/CTO/JIT Procedure:

Requirements: Requirements: Procedure: FORMS FOR SPECIAL PERMITS: (Tarpaulin, Motorcade, Bazaar, Seasonal Candle store, Fireworks)

1. Occupancy Permit 3.

Barangay Clearance / Permit 1. Income tax 2. Barangay Clearance / permit Shall determine violators thru any of the following: 1. Shall write a request letter to the City Mayor for approval

2. Shall approve the letter of request and endorse the same to the BPLO.

2. DTI/SEC/CDA 1. Complaints 3. Delinquency Reports (CTO) 3. Shall receive the endorsed letter and assist the applicant with application form.

STEP 1 2. JIT Inspection Reports 4. Shall fill-out the Application for Special Permit form and submit the same to the BPLO personnel.

STEP 1 Application filing and verification Forms: Complaint Form, JIT Inspection Report

Application filing and verification Processing Time: 5 to 10 minutes Forms: Application for Special Permit Form, Approved Request Letter

Requirements: Processing Time: 5 to 10 minutes

Requirements: 1. Filled up unified form 3. Income tax return from previous year STEP 2 STEP 2

1. Filled up unified form 4. Contract of lease 2. Barangay Clearance / permit Issue Notice of Delinquency Assessment

2. DTI/SEC/CDA registration 5. Business Capitalization Office in Charge: BPLO

3. Occupancy Permit 6. Barangay Clearance / permit Duties: Office in Charge: Office in Charge: BPLO personnel

Office in Charge: BPLO 1. Release and validate submissions BPLO/JIT/CTO Procedure:

Procedure: 1. Shall check the completeness of information in the application form, then assess

Duties: 2. Assess eligibility for renewal based on record businesses and evaluate taxes, fees and other charges for payment.

1. Release and validate submissions with occupancy permits transmitted previously by CEO 1.Shall inform the owner of the business establishment about the violation by issuing

a Notice of Violation. Forms: Application for Special Permit Form, and Tax Order of Payment

2. Assess eligibility for renewal based on record businesses 3. Endorse to next step Processing Time: 5 to 10 minutes

2. The owner of the business shall be given seven (7) working days as per E.O No. 004-2015-6

with occupancy permits transmitted previously by CEO or as prescribed by the concerned office, upon receipt of notice, to take necessary actions

3. Endorse to next step Processing Time: 5 to 30 minutes STEP 3

to address the violation. Receiving of Payment

3. For complaints from other parties, the owner or designated representative and the complainant

Processing Time: 1 hour at most STEP 2 shall be invited for a Technical Conference together with BPLO, Legal Officer, Admin. Officer and the JIT. Office in Charge: CTO

Assessment of fees and charges Forms: Notice of Delinquency Procedure:

STEP 2 Processing Time: 5 to 10 minutes 1. Shall receive payment of taxes, fees and charges from applicants and shall

issue corresponding receipts in accordance with Billing and Collection Control Procedure.

Assessment of fees and charges Requirements: Forms: Official Receipt

All documents from step 1 STEP 3 Processing Time: 5 to 10 minutes

Requirements: Office in Charge: Checking and Inspection

All documents from step 1 BPLO (frontline) CTO and BPLO (backroom) STEP 4

Office in Charge: Duties: Office in Charge: Preparation, Approval & Releasing of Special Permit

BPLO (frontline) CTO and BPLO (backroom) 1. Issue Tax Order of Payment (ToP) and advise to pay at the pay counter BPLO/JIT/CTO Office in Charge: BPLO Personnel, BPLO Chief

Duties: 2. Preparation of ToP Procedure: Procedure:

1. Issue Tax Order of Payment (ToP) and advise to pay at the pay counter Processing Time: 1 to 2 hours 1. Shall perform follow-up inspection to determine if actions were already taken. 1. Shall check completeness of all requirements and prepare the Special Permit.

2. Preparation of ToP Note: If no actions were still taken by the concerned establishment after five (5) days from 2. Shall approve the Special Permit.

Processing Time: 1 to 2 hours STEP 3 the date of receiving the notice as per E.O No. 004-2015-6, the concerned office 3. Shall release the Special Permit to the applicant.

shall recommend closure of establishment to the City Mayor. Forms: Special Permit, TOP, O.R. & Approved Special Permit

Payment and Claiming of Mayor’s Permit Processing Time: 5 to 10 minutes Processing Time: 5 to 10 minutes

STEP 3 NOTE: Please see revenue code for the amount

Payment and Claiming of Mayor’s Permit Requirements:

All documents from step 2

STEP 4

Implementation of Actions

FOR RETIREMENT

Requirements: Office in Charge: STEP 1

All documents from step 2 CTO, BFP, BPLO (frontline) CTO, BPLO and other offices (if necessary) (backroom) Office in Charge: Requirement/s: Declare the gross income

Office in Charge: Duties (frontline): BPLO & City Mayor Procedure:

CTO, BFP, BPLO (frontline) CTO, BPLO and other offices (if necessary) (backroom) 1. Accept payment Procedure: 1. Fill-out the Retirement form

Duties (frontline): 2. Issue OR, Mayor’s Permit, and other clearances Processing Time: 5 to 10 minutes

1. Shall approve the recommended action by the concerned office.

1. Accept payment Duties (frontline): 2. Shall implement the action. If the action is to issue a Cease and Desist Order STEP 2

2. Issue OR, Mayor’s Permit, and other clearances 1. Print OR, print and sign (if applicable) Mayor’s Permit, and other clearances (System Generated), the BPLO shall serve the order together with the help of PNP Requirement/s: State the reason for closure, Brgy. Certificate for closure or stopped operation

Duties (frontline): Processing Time: 1 to 2 hours and other concerned department. Income statement & attach the retirement form and all documents from steps 1 & 2

1. Print OR, print and sign (if applicable) Mayor’s Permit, and other clearances 3. If the action is to issue a Closure Order as per City Ordinance No. 4-(215), the BPLO shall Procedure:

Processing Time: 1 to 2 hours Post-Registration serve the order together with the help of PNP and other concerned department. 1. Request letter for closure: (addressee BPLO, Head MR. RENE C. MANABAT)

Forms: Cease and Desist Order (System Generated) and Closure Order Processing Time: 5 to 10 minutes

Inspection and checking of compliance

Post-Registration Requirements: Processing Time: 5 to 10 minutes STEP 3

Inspection and checking of compliance Regulatory requirements by concerned government agencies and LGU related offices Requirement/s: All documents from steps 1 & 2

Requirements: Office in Charge: STEP 4 Procedure:

Regulatory requirements by concerned government agencies and LGU related offices Jointly by LGU JIT and concerned government agencies Implementation of Actions 1. Proceed to the City Treasurer Office for verification and approval of gross sales

Processing Time: 5 to 10 minutes

Office in Charge: Inspection team including BFP

Jointly by LGU JIT and concerned government agencies Duties (frontline): Office in Charge: STEP 4

BPLO & City Mayor Requirement/s: Application Gross income with approval of City Treasurer

Inspection team including BFP 1. Inspection and checking of compliance Procedure:

Duties (frontline): 2. JIT should submit reports to BPLO for those businesses complying Procedure:

1. If owner has already complied with the pending permits & licenses, the owner shall 1. Assessment/billing

1. Inspection and checking of compliance and not complying with the required documents request to the City Mayor for lifting of Closure Order. Processing Time: 5 to 10 minutes

2. JIT should submit reports to BPLO for those businesses complying 3. Non-compliance businesses/establishments will be included in the negative list 2. Shall approve the lifting of Closure Order.

and not complying with the required documents and subject for revocation or not renewing the business permit 3. A copy of the approved Lifting Order shall be issued by the BPLO to the owner. STEP 4

3. Non-compliance businesses/establishments will be included in the negative list Processing Time: Within each year Forms: Lifting Order Requirement/s: Surrender the business permit & plate and Xerox of official receipt

and subject for revocation or not renewing the business permit Procedure:

Processing Time: 5 to 10 minutes 1. Certificate of Retirement and Release the Certificate of Retirement

Processing Time: Within each year Processing Time: 5 to 10 minutes

NOTE: Please see revenue code for the amount NOTE: Please see revenue code for the amount NOTE: Please see revenue code for the amount NOTE: Please see revenue code for the amount

Potrebbero piacerti anche

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDa EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNessuna valutazione finora

- BPLO Citizen's CharterDocumento18 pagineBPLO Citizen's CharterAntonio V. RanqueNessuna valutazione finora

- 16 Citizen's Charter Maria Aurora Aurora 2019 1st EditionDocumento27 pagine16 Citizen's Charter Maria Aurora Aurora 2019 1st EditionAntonio V. RanqueNessuna valutazione finora

- Citizen's Charter Sample 113934Documento27 pagineCitizen's Charter Sample 113934Bennur Rajib Arajam BarraquiasNessuna valutazione finora

- Supplemental To The Citizen - S Charter 2021 EditionDocumento4 pagineSupplemental To The Citizen - S Charter 2021 EditionChristian Romar H. DacanayNessuna valutazione finora

- Rev - Bpls Monitoring ReportDocumento4 pagineRev - Bpls Monitoring ReportCA T He100% (1)

- Mdad Services 2020Documento16 pagineMdad Services 2020Hambeca PHNessuna valutazione finora

- New Business Registration Proposal - 100719Documento3 pagineNew Business Registration Proposal - 100719Lawrence SantellaNessuna valutazione finora

- LBP Citizen's Charter - 2020 - 2nd Edition-405-487Documento83 pagineLBP Citizen's Charter - 2020 - 2nd Edition-405-487Jame BeduyaNessuna valutazione finora

- Citizens Charter: 2020 (1 EditionDocumento27 pagineCitizens Charter: 2020 (1 EditionCo Tam BehNessuna valutazione finora

- Citizen's Charter2023Documento22 pagineCitizen's Charter2023Carlo CaguimbalNessuna valutazione finora

- MPDO Citizen's Charter SampleDocumento11 pagineMPDO Citizen's Charter Sampleryanpacabis23Nessuna valutazione finora

- Initial Cosmetics TraderDocumento4 pagineInitial Cosmetics TradersalemcarolineNessuna valutazione finora

- Citizen-charter-15-Lfo-08-Issuance of Standards Compliance Certificate (SCC) For LPG Marketer (M)Documento5 pagineCitizen-charter-15-Lfo-08-Issuance of Standards Compliance Certificate (SCC) For LPG Marketer (M)Genesis AdarloNessuna valutazione finora

- CPDO Services 2020Documento26 pagineCPDO Services 2020MarvinPatricioNarcaNessuna valutazione finora

- CPRS StepDocumento10 pagineCPRS StepJojie TayabanNessuna valutazione finora

- Citizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsDocumento4 pagineCitizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsGenesis AdarloNessuna valutazione finora

- For Printing BPLO MISC Cit CharterDocumento11 pagineFor Printing BPLO MISC Cit CharterMC Ivana PerezNessuna valutazione finora

- Application For Registration of New Ecozone EnterprisesDocumento4 pagineApplication For Registration of New Ecozone EnterprisesMark Kevin SamsonNessuna valutazione finora

- Contact Info For Business QC-MAKATI-MANILADocumento9 pagineContact Info For Business QC-MAKATI-MANILAHiraeth WeltschmerzNessuna valutazione finora

- HFSRB Citizens-Charter-2020Documento54 pagineHFSRB Citizens-Charter-2020Jane Therese RoveloNessuna valutazione finora

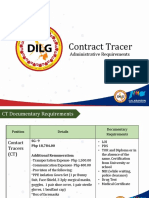

- Contract Tracer: Administrative RequirementsDocumento46 pagineContract Tracer: Administrative RequirementsMae Rabadon BermudezNessuna valutazione finora

- Business Permit and Licensing OfficeDocumento15 pagineBusiness Permit and Licensing Officeshau ildeNessuna valutazione finora

- Schedule of Tax Payment-Iloilo City TreasurerDocumento4 pagineSchedule of Tax Payment-Iloilo City TreasurerJorge ParkerNessuna valutazione finora

- 17citizens Charter CEODocumento9 pagine17citizens Charter CEOevelyn PiedadNessuna valutazione finora

- Certificate of Adjoining OwnershipDocumento3 pagineCertificate of Adjoining OwnershipKurt Anthony BaclayonNessuna valutazione finora

- 2.4 All Other Types of Loas Related To Registration As May Be Determined by The AuthorityDocumento3 pagine2.4 All Other Types of Loas Related To Registration As May Be Determined by The AuthorityMark Kevin SamsonNessuna valutazione finora

- Citizen-Charter-04-Oimb-22-Issuance of COC For Liquid Fuels Retail Outlet (LFROs)Documento5 pagineCitizen-Charter-04-Oimb-22-Issuance of COC For Liquid Fuels Retail Outlet (LFROs)Kurt Morin Cantor0% (1)

- Citizen Charter April 2023Documento25 pagineCitizen Charter April 2023Parody CentralNessuna valutazione finora

- Toa Form: Procedure On Transfer of Assignment (Toa)Documento4 pagineToa Form: Procedure On Transfer of Assignment (Toa)Yoan Baclig BuenoNessuna valutazione finora

- New BPLS Compliance Montitoring FormDocumento1 paginaNew BPLS Compliance Montitoring FormDann Dansoy100% (1)

- BOC - Import License ApplicationDocumento6 pagineBOC - Import License ApplicationRaeanne Sabado BangitNessuna valutazione finora

- BPLS Compliance Monitoring ReportDocumento2 pagineBPLS Compliance Monitoring ReportSalome SuriaNessuna valutazione finora

- Delisting of ProjectDocumento5 pagineDelisting of ProjectMark Kevin Samson100% (1)

- II. Implementation of LGU Complementary Reforms (Check If Applicable)Documento1 paginaII. Implementation of LGU Complementary Reforms (Check If Applicable)Victor DawisNessuna valutazione finora

- Schedule of Tax Payment-Iloilo City TreasurerDocumento4 pagineSchedule of Tax Payment-Iloilo City TreasurerJorge ParkerNessuna valutazione finora

- Hlurb Buyers GuideDocumento10 pagineHlurb Buyers GuideAxl PagdangananNessuna valutazione finora

- Citizen-Charter-15-Lfo-04-Issuance of Standards Compliance Certificate (SCC) For LPG Refilling Plant (RP)Documento5 pagineCitizen-Charter-15-Lfo-04-Issuance of Standards Compliance Certificate (SCC) For LPG Refilling Plant (RP)Genesis AdarloNessuna valutazione finora

- Admin and FinDocumento148 pagineAdmin and Fincenro staritaNessuna valutazione finora

- Instruction Kit For Eform Adt - 2: Page 1 of 8Documento8 pagineInstruction Kit For Eform Adt - 2: Page 1 of 8maddy14350Nessuna valutazione finora

- RMC No. 27-2024 AnnexesDocumento14 pagineRMC No. 27-2024 AnnexesChristineNessuna valutazione finora

- Citizen Charter Finance UnitDocumento88 pagineCitizen Charter Finance Unitlindsay boncodinNessuna valutazione finora

- Bpco Compliance Monitoring ReportDocumento1 paginaBpco Compliance Monitoring ReportErwinBasconNessuna valutazione finora

- TFGGGGGGGGGGVVVBBJJDocumento3 pagineTFGGGGGGGGGGVVVBBJJAshley RiotNessuna valutazione finora

- Online Accreditation Process 2017Documento3 pagineOnline Accreditation Process 2017Lucena City Tourism Office0% (1)

- PDO-Locational ClearanceDocumento1 paginaPDO-Locational ClearanceTimothy John DicheNessuna valutazione finora

- Office or Division: Classification: Type of Transaction: Who May Avail: Checklist of Requirements Where To SecureDocumento5 pagineOffice or Division: Classification: Type of Transaction: Who May Avail: Checklist of Requirements Where To SecureMark Kevin SamsonNessuna valutazione finora

- Citizen Charter 04 Oimb 17 Securing SCC For DealerDocumento4 pagineCitizen Charter 04 Oimb 17 Securing SCC For Dealerrendee reyesNessuna valutazione finora

- Sale of Bidding DocumentsDocumento9 pagineSale of Bidding DocumentsRobeckson GarciaNessuna valutazione finora

- Administrative Order No. 23 Compliance Report TemplateDocumento3 pagineAdministrative Order No. 23 Compliance Report TemplateRichard Adrian0% (1)

- Department of Trade & Industry (DTI) Registration: 3 DaysDocumento2 pagineDepartment of Trade & Industry (DTI) Registration: 3 DaysBplo CaloocanNessuna valutazione finora

- Issuance of Motorized Tricycle Operator'S PERMIT (MTOP) (Annual Regulatory Fees)Documento3 pagineIssuance of Motorized Tricycle Operator'S PERMIT (MTOP) (Annual Regulatory Fees)c lazaroNessuna valutazione finora

- SRF-Serviced Plots-Manual Submission ONLYDocumento1 paginaSRF-Serviced Plots-Manual Submission ONLYARUL SANKARANNessuna valutazione finora

- LGU:IMELDA Province: Zamboanga Sibugay: I. Compliance To Revised BPLS StandardsDocumento2 pagineLGU:IMELDA Province: Zamboanga Sibugay: I. Compliance To Revised BPLS StandardsLemuel MejaresNessuna valutazione finora

- Final Bill Checklist SynergyDocumento3 pagineFinal Bill Checklist Synergymudassir mNessuna valutazione finora

- Business Permit and Licensing Office: Mondays To Fridays 8:00 AM To 5:00 PMDocumento17 pagineBusiness Permit and Licensing Office: Mondays To Fridays 8:00 AM To 5:00 PMProject UltimaNessuna valutazione finora

- Steps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Documento17 pagineSteps in Application For Development Permit, Certificate of Registration and License To Sell For Condotel As of August 5, 2020Crest PedrosaNessuna valutazione finora

- List of Frontline ServicesDocumento21 pagineList of Frontline ServicesRms CrsNessuna valutazione finora

- Check List: FurnishedDocumento2 pagineCheck List: FurnishedAkshay Kumar SahooNessuna valutazione finora

- IC Citizen Charter - Rev 2022 215 220Documento6 pagineIC Citizen Charter - Rev 2022 215 220Michaela Christel J TorresNessuna valutazione finora

- QA Guide For Project Definition DocumentsDocumento4 pagineQA Guide For Project Definition DocumentsJed de LeonNessuna valutazione finora

- Change Impact Statement TemplateDocumento1 paginaChange Impact Statement TemplateJed de LeonNessuna valutazione finora

- Guidelines Talk 4 Ascend FEAST Dec 20, 2020 CusDocumento2 pagineGuidelines Talk 4 Ascend FEAST Dec 20, 2020 CusJed de LeonNessuna valutazione finora

- Guidelines Talk 2 Ascend FEAST Dec 6, 2020 CusDocumento3 pagineGuidelines Talk 2 Ascend FEAST Dec 6, 2020 CusJed de LeonNessuna valutazione finora

- Talk 2: Rain and Rescue: Powerful God-Encounters Happened On MountaintopsDocumento3 pagineTalk 2: Rain and Rescue: Powerful God-Encounters Happened On MountaintopsJed de LeonNessuna valutazione finora

- Christmas Song Picture GameDocumento1 paginaChristmas Song Picture GameJed de LeonNessuna valutazione finora

- Lesson 1 Study Guide What Is MarriageDocumento4 pagineLesson 1 Study Guide What Is MarriageJed de LeonNessuna valutazione finora

- Management of Developing DentitionDocumento51 pagineManagement of Developing Dentitionahmed alshaariNessuna valutazione finora

- 4th Summative Science 6Documento2 pagine4th Summative Science 6brian blase dumosdosNessuna valutazione finora

- Mbs KatalogDocumento68 pagineMbs KatalogDobroslav SoskicNessuna valutazione finora

- Basic Electrical Engineering Mcqs Unit 1Documento13 pagineBasic Electrical Engineering Mcqs Unit 1shubha christopherNessuna valutazione finora

- Senographe Crystal: The Choice Is Crystal ClearDocumento7 pagineSenographe Crystal: The Choice Is Crystal ClearmuhammadyassirNessuna valutazione finora

- RB Boiler Product SpecsDocumento4 pagineRB Boiler Product Specsachmad_silmiNessuna valutazione finora

- DELIGHT Official e BookDocumento418 pagineDELIGHT Official e BookIsis Jade100% (3)

- 感應馬達安裝、保養使用說明書31057H402E (英)Documento17 pagine感應馬達安裝、保養使用說明書31057H402E (英)Rosyad Broe CaporegimeNessuna valutazione finora

- Vicat Apparatus PrimoDocumento10 pagineVicat Apparatus PrimoMoreno, Leanne B.Nessuna valutazione finora

- Aliant Ommunications: VCL-2709, IEEE C37.94 To E1 ConverterDocumento2 pagineAliant Ommunications: VCL-2709, IEEE C37.94 To E1 ConverterConstantin UdreaNessuna valutazione finora

- D05 Directional Control Valves EngineeringDocumento11 pagineD05 Directional Control Valves EngineeringVentas Control HidráulicoNessuna valutazione finora

- Environmental Product Declaration: Plasterboard Knauf Diamant GKFIDocumento11 pagineEnvironmental Product Declaration: Plasterboard Knauf Diamant GKFIIoana CNessuna valutazione finora

- Hasil Pemeriksaan Laboratorium: Laboratory Test ResultDocumento1 paginaHasil Pemeriksaan Laboratorium: Laboratory Test ResultsandraNessuna valutazione finora

- Mental Status ExaminationDocumento34 pagineMental Status Examinationkimbomd100% (2)

- WT Chapter 5Documento34 pagineWT Chapter 5Wariyo GalgaloNessuna valutazione finora

- Science 9-Quarter 2-Module-3Documento28 pagineScience 9-Quarter 2-Module-3Mon DyNessuna valutazione finora

- 45096Documento12 pagine45096Halusan MaybeNessuna valutazione finora

- Crime Free Lease AddendumDocumento1 paginaCrime Free Lease AddendumjmtmanagementNessuna valutazione finora

- Liquid Enema ProcedureDocumento3 pagineLiquid Enema Procedureapi-209728657Nessuna valutazione finora

- Poster For Optimisation of The Conversion of Waste Cooking Oil Into BiodieselDocumento1 paginaPoster For Optimisation of The Conversion of Waste Cooking Oil Into BiodieselcxmzswNessuna valutazione finora

- Editorship, Dr. S.A. OstroumovDocumento4 pagineEditorship, Dr. S.A. OstroumovSergei OstroumovNessuna valutazione finora

- Traditional vs. Enterprise Risk Management - How Do They DifferDocumento4 pagineTraditional vs. Enterprise Risk Management - How Do They DifferJaveed A. KhanNessuna valutazione finora

- US Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistDocumento114 pagineUS Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistGeorges100% (2)

- S:/admin/mpi/MP1169 - Amaia Skies Samat/000 - ACTIVE DOCUMENTS/09 - SPECS/2013-07-23 - Design Development/04-Plumbing/15050Documento19 pagineS:/admin/mpi/MP1169 - Amaia Skies Samat/000 - ACTIVE DOCUMENTS/09 - SPECS/2013-07-23 - Design Development/04-Plumbing/15050Lui TCC BariaNessuna valutazione finora

- Birla Institute of Management and Technology (Bimtech) : M.A.C CosmeticsDocumento9 pagineBirla Institute of Management and Technology (Bimtech) : M.A.C CosmeticsShubhda SharmaNessuna valutazione finora

- Durock Cement Board System Guide en SA932Documento12 pagineDurock Cement Board System Guide en SA932Ko PhyoNessuna valutazione finora

- TS802 - Support StandardDocumento68 pagineTS802 - Support StandardCassy AbulenciaNessuna valutazione finora

- Private Standard: Shahram GhanbarichelaresiDocumento2 paginePrivate Standard: Shahram Ghanbarichelaresiarian tejaratNessuna valutazione finora

- Marine Advisory 03-22 LRITDocumento2 pagineMarine Advisory 03-22 LRITNikos StratisNessuna valutazione finora

- Lesson 2 Basic Osah, General Provisions, Safety Rules..Documento30 pagineLesson 2 Basic Osah, General Provisions, Safety Rules..GM VispoNessuna valutazione finora