Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Metropolitan Bank Vs Wilfred Chiok

Caricato da

Mosarah AltTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Metropolitan Bank Vs Wilfred Chiok

Caricato da

Mosarah AltCopyright:

Formati disponibili

TOPICS: Article 1131 (Principle of relativity of contracts) & Article 1191 (Right of Rescission)

FACTS:

Wilfred N. Chiok had been engaged in dollar trading for several years. He usually buys dollars

from Gonzalo B. Nuguid at the exchange rate prevailing on the date of the sale. Chiok pays

Nuguid either in cash or manager’s check, to be picked up by the latter or deposited in the

latter’s bank account. Nuguid delivers the dollars either on the same day or on a later date as

may be agreed upon between them, up to a week later. For this purpose, Chiok maintained

accounts with Metropolitan Bank and Trust Company and Global Business Bank, Inc. Chiok

likewise entered into a Bills Purchase Line Agreement (BPLA) with Global Bank. Under the

BPLA, checks drawn in favor of, or negotiated to, Chiok may be purchased by Global Bank.

Upon such purchase, Chiok receives a discounted cash equivalent of the amount of the check

earlier than the normal clearing period.

Pursuant to the BPLA, Global Bank “bills purchased” Security Bank & Trust Company (SBTC)

Manager’s Check (MC) No. 037364 issued in the name of Chiok and credited the same amount

of the MC to the latter’s Savings Account. Global Bank issued MC No. 025935 and MC No.

025939 to Gonzalo Bernardo , who is the same person as Nuguid, pursuant to Chiok’s

instruction. Likewise upon Chiok’s application, Metrobank issued Cashier’s Check (CC) No.

003380 in the name of Bernardo.

Chiok filed a Complaint for damages with application for ex parte restraining order and/or

preliminary injunction with the RTC of Quezon City against the spouses Nuguid, Global Bank

and Metrobank. On the same day, RTC issued a TRO directing the spouses Nuguid to refrain

from presenting the said checks for payment and the depositary banks from honoring the same

until further orders from the court.

RTC rendered its Decision in favor Chiok and ordering the depository banks to pay him. CA

affirmed the lower courts’s decision with modifications that states that the contract to buy foreign

currency between Chiok and Naguid is rescinded.

ISSUE:

WON purchaser of manager’s and cashier’s checks has a right to have the checks cancelled by

filing an action for rescission of its contrcat with the payee.

RULINGS:

No. Under Art. 1191 of the Civil Code, the power to rescind obligations is implied in reciprocal

ones, in case one of the obligors should not comply with what is incumbent upon him. The

injured party may choose between the fulfillment and the rescission of the obligation, with the

payment of damages in either case. When Nuguid failed to deliver the agreed amount to Chiok,

the latter had a cause of action against Nuguid to ask for the rescission of their contract. On the

other hand, Chiok did not have a cause of action against Metrobank and Global Bank that would

allow him to rescind the contracts of sale of the manager’s or cashier’s checks, which would

have resulted in the crediting of the amounts thereof back to his accounts.

Moreover, the right of rescission under Article 1191 of the Civil Code can only be exercised in

accordance with the principle of relativity of contracts under Article 1131. Under Article 1131,

contracts can only bind the parties who entered into it, and it cannot favor or prejudice a third

person, even if he is aware of such contract and has acted with knowledge thereof. Metrobank

and Global Bank are not parties to the contract to buy foreign currency between Chiok and

Nuguid. Therefore, they are not bound by such contract and cannot be prejudiced by the failure

of Nuguid to comply with the terms thereof.

Potrebbero piacerti anche

- Swire Realty v. Yu, GR 207133, March 9, 2015 (Reviewed)Documento2 pagineSwire Realty v. Yu, GR 207133, March 9, 2015 (Reviewed)Steve UyNessuna valutazione finora

- Montemayor v. MilloraDocumento2 pagineMontemayor v. MilloraPaolo Bañadera0% (1)

- Metropolitan Bank and Trust Company vs. Wilfred N. ChiokDocumento1 paginaMetropolitan Bank and Trust Company vs. Wilfred N. ChiokBruce WayneNessuna valutazione finora

- De Guzman VDocumento7 pagineDe Guzman VMary Joy GorospeNessuna valutazione finora

- Case No. 3 Omengan vs. PNB Et - Al, January 23, 2007Documento1 paginaCase No. 3 Omengan vs. PNB Et - Al, January 23, 2007Eunice EsteraNessuna valutazione finora

- Balila Vs IACDocumento3 pagineBalila Vs IACNath AntonioNessuna valutazione finora

- 5 - US vs. PAnaligan, 14 Phil 46Documento1 pagina5 - US vs. PAnaligan, 14 Phil 46gerlie22Nessuna valutazione finora

- Land Bank of The Philippines Vs Heirs of Spouses Jorja Rigor-Soriano and Magin SorianoDocumento2 pagineLand Bank of The Philippines Vs Heirs of Spouses Jorja Rigor-Soriano and Magin Sorianocarla_cariaga_2Nessuna valutazione finora

- Filinvest vs. Philippine AcetyleneDocumento2 pagineFilinvest vs. Philippine AcetyleneRonwell LimNessuna valutazione finora

- Swire Realty Development Corporation VSDocumento2 pagineSwire Realty Development Corporation VSMichael Vincent BautistaNessuna valutazione finora

- Genuino Civil Law Digest. Republic Vs David To Vda de BuncioDocumento16 pagineGenuino Civil Law Digest. Republic Vs David To Vda de BuncioJoyce GenuinoNessuna valutazione finora

- Doctrine: Pacto de Recto Sale Right of Redemption Equitable MortgageDocumento2 pagineDoctrine: Pacto de Recto Sale Right of Redemption Equitable MortgageVaneza LopezNessuna valutazione finora

- Philippine National Bank vs. Aic Construction CorporationDocumento2 paginePhilippine National Bank vs. Aic Construction CorporationJay jogs100% (1)

- Ayson-Simon Vs AdamosDocumento2 pagineAyson-Simon Vs AdamosNaiza Mae R. Binayao100% (1)

- Spouses Teves v. Integrated CreditDocumento10 pagineSpouses Teves v. Integrated CreditNerry Neil TeologoNessuna valutazione finora

- Bugatti V Court of AppealsDocumento2 pagineBugatti V Court of AppealsNaiza Mae R. BinayaoNessuna valutazione finora

- Heirs of Franco V GonzalesDocumento2 pagineHeirs of Franco V GonzalesEcnerolAicnelav75% (4)

- Universal Food Corporation Vs CADocumento4 pagineUniversal Food Corporation Vs CAHazel Dawn100% (1)

- People Vs RegulacionDocumento2 paginePeople Vs Regulacionmimisabayton100% (2)

- Stronghold Vs Stroem Case DigestDocumento3 pagineStronghold Vs Stroem Case DigestJustineNessuna valutazione finora

- Commonwealth Insurance Vs CADocumento2 pagineCommonwealth Insurance Vs CAJackie Bana100% (1)

- Jaime v. SalvadorDocumento2 pagineJaime v. SalvadorKaren Ryl Lozada BritoNessuna valutazione finora

- 21 Spouses Victor and Edna Binua Vs OngDocumento2 pagine21 Spouses Victor and Edna Binua Vs OngRhenz ToldingNessuna valutazione finora

- Fucc VS Bayanihan Automotive CorpDocumento2 pagineFucc VS Bayanihan Automotive CorpPriscilla DawnNessuna valutazione finora

- SPOUSES POON v. PRIME SAVINGSDocumento3 pagineSPOUSES POON v. PRIME SAVINGSJohn Ray PerezNessuna valutazione finora

- Doctrine: Moot and Academic Principle: Creditors Peso Debts Dollar DebtsDocumento4 pagineDoctrine: Moot and Academic Principle: Creditors Peso Debts Dollar DebtsArrianne ObiasNessuna valutazione finora

- Towne & City Devt v. Voluntad - People's Industrial v. CADocumento5 pagineTowne & City Devt v. Voluntad - People's Industrial v. CAIyahNessuna valutazione finora

- Dizon vs. Gaborro, 83 SCRA 688, 22 June 1978Documento2 pagineDizon vs. Gaborro, 83 SCRA 688, 22 June 1978Bibi JumpolNessuna valutazione finora

- Poon V Prime Savings BankDocumento3 paginePoon V Prime Savings BankAllen Windel Bernabe100% (1)

- Robes-Francisco vs. CfiDocumento2 pagineRobes-Francisco vs. CfiRichard AmorNessuna valutazione finora

- 118 Tong Bros. v. IACDocumento2 pagine118 Tong Bros. v. IACCarlos PobladorNessuna valutazione finora

- Comglasco Vs SantosDocumento2 pagineComglasco Vs SantosDyrene Rosario Ungsod100% (2)

- Buenaventura V Metropolitan Bank and Trust CompanyDocumento1 paginaBuenaventura V Metropolitan Bank and Trust CompanyMac SorianoNessuna valutazione finora

- Buenaventura VS MetrobankDocumento2 pagineBuenaventura VS MetrobankAngelyn Suson100% (2)

- Cesar Areza Vs Express Savings BankDocumento2 pagineCesar Areza Vs Express Savings BankIyahNessuna valutazione finora

- Dalton vs. FGR Realty and Development CorpDocumento2 pagineDalton vs. FGR Realty and Development CorpCharry Castillon100% (1)

- California Bus Lines Vs State Investment HouseDocumento2 pagineCalifornia Bus Lines Vs State Investment HouseNaiza Mae R. Binayao100% (3)

- Averia v. AveriaDocumento2 pagineAveria v. AveriaJonathan Brava100% (2)

- Topic: NATURE OF THE CASE: Petition For Review On Certiorari Under Rule 45 of The 1997 Revised RulesDocumento2 pagineTopic: NATURE OF THE CASE: Petition For Review On Certiorari Under Rule 45 of The 1997 Revised Rulesrgtan3100% (6)

- Case DigestDocumento4 pagineCase DigestReanne Claudine LagunaNessuna valutazione finora

- Culaba Vs CADocumento3 pagineCulaba Vs CARubyFranzCabangbang-QuilbanNessuna valutazione finora

- Spouses Batalla v. Prudential Bank G.R. No. 200676, March 25, 2019Documento3 pagineSpouses Batalla v. Prudential Bank G.R. No. 200676, March 25, 2019Jeremiah De Leon100% (1)

- Case Digest - Filipino Pipe and Foundry Corp Vs NAWASADocumento2 pagineCase Digest - Filipino Pipe and Foundry Corp Vs NAWASAMaxene Pigtain100% (1)

- Rural Bank of Paranaque v. CADocumento1 paginaRural Bank of Paranaque v. CAIvan LuzuriagaNessuna valutazione finora

- Insular Bank of Asia and America v. Spouses Salazar (Escalation Clause - Rules)Documento3 pagineInsular Bank of Asia and America v. Spouses Salazar (Escalation Clause - Rules)kjhenyo218502Nessuna valutazione finora

- 246 First United Constructors Corporation v. Bayanihan - TiglaoDocumento2 pagine246 First United Constructors Corporation v. Bayanihan - TiglaoAngelo TiglaoNessuna valutazione finora

- Ignacio Barzaga v. CADocumento2 pagineIgnacio Barzaga v. CASor ElleNessuna valutazione finora

- Norma M. Diampoc vs. Jessie Buenaventura and The Registry of Deeds, 859 SCRA 422, G.R. No. 200383 (March 19, 2018)Documento5 pagineNorma M. Diampoc vs. Jessie Buenaventura and The Registry of Deeds, 859 SCRA 422, G.R. No. 200383 (March 19, 2018)Lu Cas100% (2)

- BPI v. CoscolluelaDocumento5 pagineBPI v. CoscolluelaKharina Mar SalvadorNessuna valutazione finora

- Philippine National Bank vs. Spouses RocamoraDocumento2 paginePhilippine National Bank vs. Spouses RocamoraAmado EspejoNessuna valutazione finora

- Tomimbang V 2Documento10 pagineTomimbang V 2denelizaNessuna valutazione finora

- Filinvest Credit Corporation vs. Philippine Acetylene, Co., IncDocumento2 pagineFilinvest Credit Corporation vs. Philippine Acetylene, Co., Incamareia yapNessuna valutazione finora

- Unlad Resources Development Vs DragonDocumento3 pagineUnlad Resources Development Vs DragonBaby-Lyn MillanoNessuna valutazione finora

- JN Dev't Corp vs. PhilGuaranteeDocumento2 pagineJN Dev't Corp vs. PhilGuaranteeJane SudarioNessuna valutazione finora

- Principle: There Is A Solidart Liability Only When The Obligation Expressly So States or When TheDocumento2 paginePrinciple: There Is A Solidart Liability Only When The Obligation Expressly So States or When TheEmmylou Bagares0% (1)

- Security Bank v. MercadoDocumento3 pagineSecurity Bank v. Mercadodelayinggratification100% (1)

- Slc-Law: Persons and Family RelationsDocumento1 paginaSlc-Law: Persons and Family RelationsJomar TenezaNessuna valutazione finora

- 7 - Delfin Tan vs. Erlinda C. Benolirao Et AlDocumento2 pagine7 - Delfin Tan vs. Erlinda C. Benolirao Et Almark anthony mansuetoNessuna valutazione finora

- 28 Bachrach Motor V EspirituDocumento1 pagina28 Bachrach Motor V Espirituluigimanzanares100% (1)

- MBTC Vs ChiokDocumento3 pagineMBTC Vs ChiokNath AntonioNessuna valutazione finora

- Rights of The AccusedDocumento13 pagineRights of The AccusedLorebeth EspañaNessuna valutazione finora

- Pretrial Process FlowDocumento1 paginaPretrial Process FlowMosarah AltNessuna valutazione finora

- Tax Case Digests CompilationDocumento207 pagineTax Case Digests CompilationFrancis Ray Arbon Filipinas83% (24)

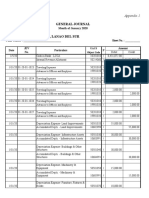

- General Journal: Appendix 1Documento5 pagineGeneral Journal: Appendix 1Mosarah AltNessuna valutazione finora

- Tax Case Digests CompilationDocumento207 pagineTax Case Digests CompilationFrancis Ray Arbon Filipinas83% (24)

- 2021 Schedule of Preweek LecturesDocumento1 pagina2021 Schedule of Preweek LecturesMarcky MarionNessuna valutazione finora

- Equitable PCI Vs TanDocumento2 pagineEquitable PCI Vs TanMosarah AltNessuna valutazione finora

- Abad Vs PhilcomsatDocumento2 pagineAbad Vs PhilcomsatFiels GamboaNessuna valutazione finora

- Banking and AMLADocumento26 pagineBanking and AMLAMosarah AltNessuna valutazione finora

- Tax DigestsDocumento13 pagineTax DigestsMosarah AltNessuna valutazione finora

- Civil Law Compilation Bar Q&a 1990-2017 PDFDocumento380 pagineCivil Law Compilation Bar Q&a 1990-2017 PDFReynaldo Yu100% (10)

- Tax ReviewerDocumento45 pagineTax ReviewerMosarah AltNessuna valutazione finora

- LectureDocumento25 pagineLectureMarieNessuna valutazione finora

- Politicsl LawDocumento91 paginePoliticsl LawMosarah AltNessuna valutazione finora

- Equitable PCI Vs TanDocumento2 pagineEquitable PCI Vs TanMosarah AltNessuna valutazione finora

- PNB Vs BalmacedaDocumento2 paginePNB Vs BalmacedaMosarah AltNessuna valutazione finora

- People V WagasDocumento1 paginaPeople V WagasMosarah AltNessuna valutazione finora

- San Miguel Corp Vs PuzonDocumento2 pagineSan Miguel Corp Vs PuzonMosarah AltNessuna valutazione finora

- Salazar Vs JY BrothersDocumento4 pagineSalazar Vs JY BrothersMosarah AltNessuna valutazione finora

- Equitable Banking Vs Special SteelDocumento1 paginaEquitable Banking Vs Special SteelMosarah AltNessuna valutazione finora

- Spec Com BQsDocumento15 pagineSpec Com BQsMosarah AltNessuna valutazione finora

- Politicsl LawDocumento91 paginePoliticsl LawMosarah AltNessuna valutazione finora

- Ting Ting Pua V Sps TiongDocumento2 pagineTing Ting Pua V Sps TiongeieipayadNessuna valutazione finora

- Cayanan Vs North StarDocumento2 pagineCayanan Vs North StarMosarah AltNessuna valutazione finora

- Mock Trial ScriptDocumento25 pagineMock Trial ScriptRonilo Subaan94% (18)

- Siochi Vs CA 2010 PDFDocumento9 pagineSiochi Vs CA 2010 PDFMosarah AltNessuna valutazione finora

- Sps Ros Vs PNB 2011 PDFDocumento8 pagineSps Ros Vs PNB 2011 PDFMosarah AltNessuna valutazione finora

- Ching Vs CA 1990Documento6 pagineChing Vs CA 1990Mosarah AltNessuna valutazione finora

- Sps Uy Vs CA 2000Documento7 pagineSps Uy Vs CA 2000Mosarah AltNessuna valutazione finora

- Diagnostic ExamsDocumento13 pagineDiagnostic ExamsGerard Nelson ManaloNessuna valutazione finora

- Umali vs. CA (Corpo)Documento2 pagineUmali vs. CA (Corpo)ggg10Nessuna valutazione finora

- Ba LLB Ipr Protect TopicsDocumento2 pagineBa LLB Ipr Protect TopicsSKOB MUSICNessuna valutazione finora

- Module 8Documento37 pagineModule 8Elijah Eartheah BanesNessuna valutazione finora

- Florencio Ordain v. BF HomesDocumento2 pagineFlorencio Ordain v. BF HomesRafaelNessuna valutazione finora

- Review On POJK No. 14.POJK.04.2019 - Baker MckenzieDocumento2 pagineReview On POJK No. 14.POJK.04.2019 - Baker MckenzietheresaNessuna valutazione finora

- Corporate Law V-B - Project TopicDocumento3 pagineCorporate Law V-B - Project TopicfishNessuna valutazione finora

- IV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawDocumento2 pagineIV Semester 3 Yrs. LL.B. / VIII Semester 5 Yrs. B.A. LL.B./B.B.A.LL.B. Examination, June/July 2015 Opt. - Ii: Banking LawNnNessuna valutazione finora

- Limited Liability Partnership Agreement (LLP) : Party of The SECOND PART" AND (3) GHI of - , AnDocumento24 pagineLimited Liability Partnership Agreement (LLP) : Party of The SECOND PART" AND (3) GHI of - , AnishikaNessuna valutazione finora

- Chapter 16 - Contractual AgreementsDocumento7 pagineChapter 16 - Contractual AgreementsChaeyoung StrawberueNessuna valutazione finora

- LOC Unit 3&4Documento10 pagineLOC Unit 3&4Prateek duhanNessuna valutazione finora

- RFBT03-11 - Law On PartnershipDocumento77 pagineRFBT03-11 - Law On PartnershipjovelioNessuna valutazione finora

- Award CIRPDocumento3 pagineAward CIRPAreeka MirNessuna valutazione finora

- LOH Lease Option MemoDocumento2 pagineLOH Lease Option Memo5nrx9wNessuna valutazione finora

- People v. NitafanDocumento1 paginaPeople v. Nitafandwight yuNessuna valutazione finora

- Too Darn Hot!: From: "Kiss Me Kate"Documento8 pagineToo Darn Hot!: From: "Kiss Me Kate"Samuel SmallsNessuna valutazione finora

- This Study Resource WasDocumento2 pagineThis Study Resource WasNah HamzaNessuna valutazione finora

- Resolution For Car LoanDocumento2 pagineResolution For Car LoanDeepak AgarwalNessuna valutazione finora

- Special Power of AttorneyDocumento2 pagineSpecial Power of AttorneyNievelita OdasanNessuna valutazione finora

- Sheridan Top 5 Mistakes When Creating Monthly Income Feb10Documento32 pagineSheridan Top 5 Mistakes When Creating Monthly Income Feb10ericotavaresNessuna valutazione finora

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocumento14 pagineIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNessuna valutazione finora

- PDF DocumentDocumento47 paginePDF DocumentAoo MiiNessuna valutazione finora

- Companies Act 2013 - Ppt-1Documento21 pagineCompanies Act 2013 - Ppt-1raj kumar100% (2)

- My Bus TicketDocumento4 pagineMy Bus Ticketfskc8wjpm5Nessuna valutazione finora

- Fria 2018Documento19 pagineFria 2018mjpjoreNessuna valutazione finora

- Nota Terkini Company LawDocumento154 pagineNota Terkini Company LawPeter LuaNessuna valutazione finora

- Reviewer in NegoDocumento7 pagineReviewer in NegoJoan BartolomeNessuna valutazione finora

- WODHAC22SP00003Documento16 pagineWODHAC22SP00003lapatillaNessuna valutazione finora

- Application - For - Business - Credit - WESCO - Distribution IncDocumento3 pagineApplication - For - Business - Credit - WESCO - Distribution Incdannyc2008Nessuna valutazione finora

- Right of Two or More DepositorsDocumento15 pagineRight of Two or More DepositorsDANICA FLORESNessuna valutazione finora