Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sip Registration / Renewal Form: Debit Mandate Form Nach (One Time Mandate - Otm)

Caricato da

Sanjay PatilTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sip Registration / Renewal Form: Debit Mandate Form Nach (One Time Mandate - Otm)

Caricato da

Sanjay PatilCopyright:

Formati disponibili

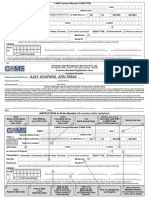

Debit Mandate Form NACH (One Time Mandate - OTM) Date D D M M Y Y Y Y

[Applicable for Lumpsum Additional Purchases as well as SIP Registrations]

umrn Office use only

Choose (P)

Sponsor Bank Code Office use only Utility Code Office use only

CREATE

ý MODIFY I/We hereby authorize Tata Mutual Fund to debit (P) ¨ SB ¨ CA ¨ CC ¨ SB-NRE ¨ SB-NRO ¨ Other

ý CANCEL

Bank A/c No.:

With Bank: Bank Name & Branch ifsc micr

an amount of Rupees Amount in Words `

Frequency 5 Monthly

5

Quarterly 5

Half Yearly As when presented (default) Debit Type 5

Fixed Amount Maximum Amount

(preselected)

Reference / Folio No. Email Id

Scheme / Plan reference No. All Schemes of Tata Mutual Fund Mobile

I agree for the debit of mandate processing charges by the bank whom I am authorising to debit my account as per latest schedule of charges of the bank.

Period

From D D M M Y Y Y Y Signature of First Account Holder Signature of Second Account Holder Signature of Third Account Holder

Sign Sign Sign

to D D M M Y Y Y Y

or Until Cancelled 1. 2. 3.

Name as in Bank Records Name as in Bank Records Name as in Bank Records

• This is to confirm that the declaration has been carefully read, understood & made by me/us. I am authorising the user Entity / Corporate to debit my account, based on the instructions as agreed and signed by me.

• I have understood that I am authorised to cancel / amend this mandate by appropriately communicating the cancellation / amendment request to the user entity / corporate or the bank where I have authorised the debit.

sip Registration / Renewal Form (For OTM Registered Investors only)

Please tick () as applicable:

OTM Debit Mandate is already registered in the folio. SIP Auto debit can start in TEN Days i.e. for debit date 15th, form can be submitted till 4th of the month.

OTM Debit Mandate is attached and to be registered in the folio. SIP Auto debit will start after mandate registration which takes 10 to 30 days depending on NACH or ECS modalities.

Advisor details (Only empanelled Distributors / Brokers will be permitted to distribute Units of Tata Mutual Fund) - Refer instruction overleaf

Broker / Agent Code Sub-Broker ARN Code Sub-Broker/Bank Branch Code EUIN Code

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this is an “execution-only” transaction without any interaction or advice by the employee/

relationship manager/sales person of the above distributor or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of

the distributor & the distributor has not charged any advisory fees on this transaction.

Sole / 1st Unitholder Signature / Thumb Impression 2nd Unitholder Signature / Thumb Impression 3rd Unitholder Signature / Thumb Impression

Transaction Charges: If the total commitment of investment through SIP (i.e. amount per SIP installment X no. of installments) amounts to Rs.10,000 or more and

your Distributor has opted to receive transaction Charges, the same are deductible as applicable from the installment amount and payable to the Distributor. In such

cases Transaction Charge will be recoverable in 3-4 installments. Units will be issued against the balance of the installment amounts invested. Upfront commission

shall be paid directly by the investor to the ARN Holder based on the investors’ assessment of various factors including the service rendered by the ARN Holder.

Investor(s) Details

Folio No. Application No. pan No. / pekrn.

Name of Sole / 1st holder

M a n d a t o r y

Name of 2nd holder

M a n d a t o r y

Name of 3rd holder

M a n d a t o r y

First SIP Cheque Details

Cheque No. Cheque Amount in Rs. Cheque Date

d d / m m / y y y y

Bank Name Branch City

Scheme and SIP Details

Scheme/Option/ Plan: Regular Direct sip Instalment sip Date Frequency Start Month / Year End Month / Year

Sub Option Amount (`) (Default 10th) (*Default) (Default : December 2099)

Monthly *

M M Y Y Y Y M M Y Y Y Y

Quarterly

SIP Top-up Top-up Amount (Rs.) SIP Top Up Frequency Upper SIP Amount (Rs.)

(Optional) (In multiples of Rs. 500/- only)

Half Yearly Yearly (default)

Auto Switch Option : Applicable for Tata Retirement Savings Fund (TRSF) only, for default values refer SID.

Plan Name Please tick the appropriate Autoswitch option (any one as per the plan)

Progressive Plan Auto Switch Option 1 (Progressive to Moderate @ age 45; Moderate to Conservative @age 60),

Auto Switch Option 2 (Progressive to Conservative @ age 60)

No Auto Switch

Moderate Plan Auto Switch Option 3 (Moderate to Conservative @ age 60) No Auto Switch

Systematic Withdrawal Plan : (Please P any one) Applicable after the age of 60 of the 1st unit holder, for TRSF only.

No Auto SWP Fixed SWP (Select Frequency) Fixed Amount (Frequency Monthly only) Rs.

Monthly or Quarterly (Default)

Declaration and Signatures : To - The Trustee, Tata Mutual Fund, Mumbai. Having read & understood the contents of SAI/SID/KIM of Tata Mutual Fund Scheme/s and terms and conditions overleaf, I/We hereby apply for

the respective Units of Tata Mutual Fund Scheme/s at NAV based resale price & agree to abide by terms, conditions, rules & regulations of scheme/s. I/We hereby declare that the particulars given are correct & complete

& express my willingness to make payments towards SIP installments referred above through participation in ECS/Direct Debit/Standing Instruction. The ARN Holder, where applicable, has disclosed to me/us all the

commissions (trail commission or any other mode), payable to him for the different cometing Schemes of various Mutual Funds from amoungs which the Scheme is being recommended to me /us.

Signature/s Sole / 1st Unitholder Signature / Thumb Impression 2nd Unitholder Signature / Thumb Impression 3rd Unitholder Signature / Thumb Impression

Received for Folio No. / Application No. _________________________________________________________________________________________ OTM Debit Mandate Form SIP Form

Potrebbero piacerti anche

- One Time Debit Mandate Form NACH / Auto Debit: Mutual FundsDocumento2 pagineOne Time Debit Mandate Form NACH / Auto Debit: Mutual FundsNothing NothingNessuna valutazione finora

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitDocumento2 pagineOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareNessuna valutazione finora

- Common Transaction SlipDocumento3 pagineCommon Transaction Slipabdriver2000Nessuna valutazione finora

- Sip - 1Documento1 paginaSip - 1Lamar Wealth solutionsNessuna valutazione finora

- SIP Registation Form-With One Time MandateDocumento4 pagineSIP Registation Form-With One Time MandatePrince ANessuna valutazione finora

- Sip Enrollment DetailsDocumento2 pagineSip Enrollment DetailsDBCGNessuna valutazione finora

- Application Form For Existing Investors: My DetailsDocumento8 pagineApplication Form For Existing Investors: My Detailsvikas9saraswatNessuna valutazione finora

- 3rd Party Payment Declaration Form - IdfcDocumento3 pagine3rd Party Payment Declaration Form - IdfcJason LiawNessuna valutazione finora

- Common Transaction Slip 12 06 2017 PDFDocumento3 pagineCommon Transaction Slip 12 06 2017 PDFvenkatnimmsNessuna valutazione finora

- Scan1 PDFDocumento2 pagineScan1 PDFshaumyaNessuna valutazione finora

- OTM Debit Mandate Form NACH/ECS/DIRECT DEBIT/SI: HDFC Mutual FundDocumento2 pagineOTM Debit Mandate Form NACH/ECS/DIRECT DEBIT/SI: HDFC Mutual FundNilesh MahajanNessuna valutazione finora

- Nach Mandate Format RevDocumento1 paginaNach Mandate Format RevMagathi Financial Services Private LimitedNessuna valutazione finora

- Ach FormDocumento2 pagineAch Formtrapasolhongsandra2Nessuna valutazione finora

- PAN BASED NACH MANDATE CUM SIP REGISTRATIONDocumento2 paginePAN BASED NACH MANDATE CUM SIP REGISTRATIONDevesh SinghNessuna valutazione finora

- Ach FormDocumento2 pagineAch Formtrapasolhongsandra2Nessuna valutazione finora

- Micro SIP Auto Debit 140110Documento2 pagineMicro SIP Auto Debit 140110Harneet SinghNessuna valutazione finora

- SLF017 ShortTermLoanRemittanceForm V02Documento2 pagineSLF017 ShortTermLoanRemittanceForm V02Marites Paragua75% (4)

- Tata - Transaction Slip-NO CODEDocumento1 paginaTata - Transaction Slip-NO CODEsudeshna palitNessuna valutazione finora

- Common Transaction Form Financial Transaction Kk3i5z51Documento8 pagineCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghNessuna valutazione finora

- Pradeep ReddyDocumento18 paginePradeep ReddyMasood RabbaniNessuna valutazione finora

- Ach - Form - 2023-07-11T213850.562Documento2 pagineAch - Form - 2023-07-11T213850.562Flex ClipNessuna valutazione finora

- ACH151Documento2 pagineACH151trapasolhongsandra2Nessuna valutazione finora

- SIP Application FormDocumento3 pagineSIP Application FormspeedenquiryNessuna valutazione finora

- Debit Mandate Form NACHDocumento2 pagineDebit Mandate Form NACHJAI BHAWANI TOUR & TRAVELSNessuna valutazione finora

- Mandate FormDocumento1 paginaMandate FormKartikey singhNessuna valutazione finora

- SB / Ca / CC / Sb-Nre / Sb-Nro / Other: DdmmyyyyDocumento2 pagineSB / Ca / CC / Sb-Nre / Sb-Nro / Other: DdmmyyyyDaleep RathoreNessuna valutazione finora

- Registration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachDocumento2 pagineRegistration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachG.R.AzhaguvelSaranya Professor MechanicalNessuna valutazione finora

- CAMS COTM Application Form-IndividualDocumento2 pagineCAMS COTM Application Form-IndividualGAJANAND MISHRA0% (1)

- Ach FormDocumento2 pagineAch FormFlex ClipNessuna valutazione finora

- Power Finance Corporation LTDDocumento4 paginePower Finance Corporation LTDAritra BhattacharjeeNessuna valutazione finora

- Ach FormDocumento2 pagineAch FormRishabh MakkarNessuna valutazione finora

- Ach FormDocumento2 pagineAch FormFlex ClipNessuna valutazione finora

- Auto Debit Mandate 9Documento2 pagineAuto Debit Mandate 9dipakkaushalNessuna valutazione finora

- Ach Form-13Documento2 pagineAch Form-13anjiNessuna valutazione finora

- Front Side:: PUNB00056000001651 Punjab National BankDocumento2 pagineFront Side:: PUNB00056000001651 Punjab National BankRishav RayNessuna valutazione finora

- Short-Term Loan Remittance Form (STLRF) : HQP-SLF-017Documento2 pagineShort-Term Loan Remittance Form (STLRF) : HQP-SLF-017Jo Sh100% (1)

- NACH Mandate Final EnglishDocumento2 pagineNACH Mandate Final EnglishShilpy SinhaNessuna valutazione finora

- APPLICATION FOR ACCEPTED BILLS-I FINANCINGDocumento2 pagineAPPLICATION FOR ACCEPTED BILLS-I FINANCINGAzim SengalNessuna valutazione finora

- Ach FormDocumento2 pagineAch Formashishsahu78Nessuna valutazione finora

- Ach FormDocumento2 pagineAch FormDhiraj PaikNessuna valutazione finora

- SIP Facility Appl Form V 1Documento4 pagineSIP Facility Appl Form V 1DBCGNessuna valutazione finora

- Av Birla Sip FormDocumento1 paginaAv Birla Sip FormVikas RaiNessuna valutazione finora

- HDFC Sip Nach FormDocumento6 pagineHDFC Sip Nach FormPraveen KumarNessuna valutazione finora

- Cams One Time MandateDocumento2 pagineCams One Time Mandatepiyush agarwalNessuna valutazione finora

- Cams One Time MandateDocumento2 pagineCams One Time Mandatepiyush agarwalNessuna valutazione finora

- Ach FormDocumento2 pagineAch Formtrapasolhongsandra2Nessuna valutazione finora

- SG NRE Open FormDocumento2 pagineSG NRE Open FormRanjith PNessuna valutazione finora

- Ach FormDocumento2 pagineAch Formvalli7370Nessuna valutazione finora

- UMRN authorization formDocumento1 paginaUMRN authorization formAnilkumar PasulapudiNessuna valutazione finora

- REC22-23 04jan20234079589Documento13 pagineREC22-23 04jan20234079589Prasoon AgarwalNessuna valutazione finora

- Transaction Form For Financial Transactions - CL04059Documento4 pagineTransaction Form For Financial Transactions - CL04059Professional positiveNessuna valutazione finora

- Sip Multiple FormDocumento2 pagineSip Multiple FormAmit SharmaNessuna valutazione finora

- Registration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachDocumento2 pagineRegistration Form Cum Mandate For Electronic Clearing Services (Ecs) /direct Debit/NachPatel DipenNessuna valutazione finora

- NSE NMF Debit MandateDocumento1 paginaNSE NMF Debit Mandatedibyaduti_20009197Nessuna valutazione finora

- Ach FormDocumento2 pagineAch FormFlex ClipNessuna valutazione finora

- Ach FormDocumento2 pagineAch FormSyed Tanveer Hasan HasanNessuna valutazione finora

- Auto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Documento2 pagineAuto Debit Instruction For Nach/Dd: Cc/Branchops/Mandate Form/002Dhruv SekhriNessuna valutazione finora

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsDa EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNessuna valutazione finora

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- Standards For Personal Grooming: A) Cleanliness of The BodyDocumento4 pagineStandards For Personal Grooming: A) Cleanliness of The BodySanjay PatilNessuna valutazione finora

- Cuba Poco New Logo CompressedDocumento1 paginaCuba Poco New Logo CompressedSanjay PatilNessuna valutazione finora

- Kempinski Presentation SchoolDocumento14 pagineKempinski Presentation SchoolSanjay PatilNessuna valutazione finora

- Presentation ONDocumento24 paginePresentation ONSanjay PatilNessuna valutazione finora

- Sanjay Bapurao Patil: Professional SummaryDocumento4 pagineSanjay Bapurao Patil: Professional SummarySanjay PatilNessuna valutazione finora

- GroomingDocumento36 pagineGroomingtriratnacomNessuna valutazione finora

- Biomedical Engineering Study Guide 2021 sm1Documento45 pagineBiomedical Engineering Study Guide 2021 sm1Lmd LmdNessuna valutazione finora

- Testing and Adjusting 12GDocumento5 pagineTesting and Adjusting 12GJuan GonzalezNessuna valutazione finora

- Case Study: Sanofi: Dispensing The Drug LordDocumento8 pagineCase Study: Sanofi: Dispensing The Drug Lordpersephone hadesNessuna valutazione finora

- Single and Double Volute Casing - RodeltaDocumento3 pagineSingle and Double Volute Casing - Rodeltamasood_me60Nessuna valutazione finora

- Concept Paper For Stuck Garbages in Our BarangayDocumento2 pagineConcept Paper For Stuck Garbages in Our BarangayJhonemar TejanoNessuna valutazione finora

- PE and Health 3 Week 2 FINALDocumento8 paginePE and Health 3 Week 2 FINALFritzie SulitanaNessuna valutazione finora

- Ez-Cfu™ One Step: For Growth Promotion TestingDocumento3 pagineEz-Cfu™ One Step: For Growth Promotion TestingLuis VignoloNessuna valutazione finora

- 10-600000-4200000031-SAM-MEC-CRS-000003 - 01 BEC-WTRAN-270769 WF-114807 Code CDocumento4 pagine10-600000-4200000031-SAM-MEC-CRS-000003 - 01 BEC-WTRAN-270769 WF-114807 Code Cmohammed rinshinNessuna valutazione finora

- Learning Strand I - EnglishDocumento19 pagineLearning Strand I - EnglishMaricel MaapoyNessuna valutazione finora

- Sahara ModularDocumento12 pagineSahara ModularDonnarose DiBenedettoNessuna valutazione finora

- HVDC Converter and System Control AnalysisDocumento20 pagineHVDC Converter and System Control Analysiskarthik78% (9)

- Nutritional Assessment Form of ChildrenDocumento6 pagineNutritional Assessment Form of ChildrenBisakha Dey100% (2)

- Commissioning Requirements Section 01810Documento28 pagineCommissioning Requirements Section 01810tivesterNessuna valutazione finora

- CHN 2 Module 6Documento11 pagineCHN 2 Module 6Carlos CerdeñaNessuna valutazione finora

- CHEMIST LICENSURE EXAM TABLEDocumento8 pagineCHEMIST LICENSURE EXAM TABLEJasmin NewNessuna valutazione finora

- Multi-Criteria Fire / CO Detector Data SheetDocumento6 pagineMulti-Criteria Fire / CO Detector Data SheetMazenabs AbsNessuna valutazione finora

- How To Make Waffles - Recipes - Waffle RecipeDocumento5 pagineHow To Make Waffles - Recipes - Waffle RecipeJug_HustlerNessuna valutazione finora

- Test - Ans SEAFOOD COOKERY 10Documento7 pagineTest - Ans SEAFOOD COOKERY 10EVANGELINE VILLASICANessuna valutazione finora

- Autorefractometro GRK 7000Documento82 pagineAutorefractometro GRK 7000Wilson CepedaNessuna valutazione finora

- Cell Membrane TransportDocumento37 pagineCell Membrane TransportMaya AwadNessuna valutazione finora

- Varicella Zoster VirusDocumento11 pagineVaricella Zoster VirusJayaram SNessuna valutazione finora

- Construction Safety Plan GuideDocumento13 pagineConstruction Safety Plan Guideemmanueloboh92% (24)

- Bladder StonesDocumento20 pagineBladder StonesRiean AuliaNessuna valutazione finora

- HVAC Control ModuleDocumento2 pagineHVAC Control ModuleData TécnicaNessuna valutazione finora

- Material Safety Data Sheet: Section 1 - Chemical Product and Company IdentificationDocumento6 pagineMaterial Safety Data Sheet: Section 1 - Chemical Product and Company IdentificationHazama HexNessuna valutazione finora

- Dum Aloo Recipe - How To Make Punjabi Dum Aloo, Restaurant StyleDocumento14 pagineDum Aloo Recipe - How To Make Punjabi Dum Aloo, Restaurant Styleabhishek.mishrajiNessuna valutazione finora

- Environmental Pollution Control (ET ZC362 - WILP Course) : BITS PilaniDocumento41 pagineEnvironmental Pollution Control (ET ZC362 - WILP Course) : BITS Pilanisa_arunkumarNessuna valutazione finora

- PST - Module 2 - Career Stage 2 Breakout Room Discussion Summary Table (g5)Documento3 paginePST - Module 2 - Career Stage 2 Breakout Room Discussion Summary Table (g5)Isidro PalomaresNessuna valutazione finora

- Effects of Air and Noise PollutionDocumento6 pagineEffects of Air and Noise Pollutionhaiqa malikNessuna valutazione finora