Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Safari - 19 Nov 2019 at 10:31 PM

Caricato da

Chan YeolCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Safari - 19 Nov 2019 at 10:31 PM

Caricato da

Chan YeolCopyright:

Formati disponibili

2 0 RELATED TITLES

493 views

p2 - Guerrero Ch14

Uploaded by JerichoPedragosa on

Mar 01, 2017

vfgfgfgfgf Full description

Chapter 1 p2 - Guerrero p2 - Gue

Ch13 Ch17.Do

Saved Embed Share Print

Download 4 of 46 Search document

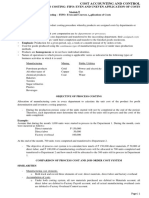

Chapter 14

Process Costing

Process costing is a method of cost accumulation that accumulated production costs by

department. This system is commonly used by companies that manufactures on a continuous

basis only one product or standard products.

Problems in process costing are often given in the CPA examination. To pass Practical

Accounting 2, candidates must be thoroughly familiar with situations encountered in these

problems, typical of which are the following:

1. Preparation of Cost of Production Report using:

a. First-in, First – out (FIFO) costing method

b. Average costing method

2. Accounting for spoilage (lost units)

a. Normal spoilage

b. Abnormal spoilage

COST OF PRODUCTION REPORT

At the end of each month the cost of production report is prepared for each department by the

cost accountant of the department. A production report has two sections:

1. Quantity schedule, which shows the follow of units.

2. cost analysis which shows the flow of cost.

Quantity Schedule

This section shows the number of units that were in process in the department at the start of

the month, the number of units begun during the month, the number of units transferred out

of the department during the month, the number of units still in work in process at the end of

the month.

The principal problem in the quantity schedule is the computation of the equivalents

production (measure of work done in terms of completed units) of units finished and units in

process for materials and conversion costs (labor and overhead). The computation of the

equivalent units of production (EUP) will depend on the inventory costing method used.

a. First in, First out (FIFO) Costing. Under this method, the stage of completion of the units of

Beginning Work in Process (BWIP) is determined separately from the units started and finished

this month. This means that the equivalent units of production are calculated only for work

actually performed during the month.

b. Average Costing. Under this method, the unit in process at the beginning is combined with

the units started and finished this month and presented in one batch of units. This means that

the work performed on the units in progress beginning (last month) is treated as if it were

performed this month.

Cost Analysis

This section summarized the costs incurred in the department, the cost per unit of the product,

the total costs of products completed and transferred out of department, and the costs related

to the ending inventory of work in process in each department. The principal problem in this

section is the computation of unit cost and the allocation of the total costs to units finished and

transferred out and to units in ending work in process.

Unit cost:

a. First in, first out (FIFO) Costing. Total costs incurred this month (current costs) divided by the

equivalent units of production.

b. Average Costing. Cost last month (cost incurred in BWIP) plus cost this month (current costs)

divided by the equivalent units production.

Allocation of total costs:

a. First in, first out (FIFO) Costing:

Finished and transferred out:

BWIP: Cost last month

Cost this month = EUP x UC

Started in process = Actual units UC

EWIP = EUP x UC

b. Average Costing:

Finished and transferred out = Actual units x total UC

EWIP = EUP x UC

ACCOUNTING FOR SPOILAGE (LOST UNITS)

Spoilage units are units of product that have been damaged or improperly manufactured and

cannot be completed as salable products. Spoilage may be classified as normal spoilage,

because it is a common occurrence that is inherent in the manufacturing process and abnormal

spoilage that results from unusual and nonrecurring factors, such as fire or water damage.

Candidates should be familiar with the following procedures in presenting spoilage in the cost

of production report.

Quantity Schedule. Normal and abnormal spoilage are presented separately and the equivalent

units of production computed bases on the work done.

Cost Analysis. The costs of units lost through normal spoilage are absorbed by the remaining

god units produced during the month. Costs of abnormal spoilage are presented separately and

charged to a Loss Abnormal Spoilage account so that the completed units do not absorb the

costs related abnormal lost units.

Computation of the cost of normal spoilage:

Spoiled units may be discovered at the start of the process, during the process or at the end of

the process. The computation of the cost of lost units depends on the point of discovery as

follows:

a. if lost units are discovered at the start or during the process –

• In the first department = no cost

• In the subsequent department = lost units x unit cost from preceding department

b. if lost units are discovered at the end of the process –

• In the first department = lost units x total unit costs in this department

• In the subsequent department = lost units x total unit cost from preceding and in this

department

c. if lost units are discovered at inspection point-

Search • In the first department = EUP of lost units x unitUpload

cost EN

• In the subsequent department = cost from preceding department plus cost in this

department (EUP x UC)

Learn more about Download

Allocation of cost of normal spoilage

4 of 46 Search document

Scribd Membership

Cost of normal spoilage is to be absorbed by the good units because good units cannot be made

without also making some units that are spoiled. Cost of normal spoilage should be alloxated

pro-rate among the good units on the bases of actual units or EUP. The allocations procedures

Home are:

a. If lost units are discovered at the start or during the process –

Saved • First In, First Out Costing – To all the goods units started finished this month and units in

process at the end.

• Average costing – To all the good units, finished and in process.

b. If lost units are discovered at the end of the process –

Bestsellers

• First in, First out costing – To all the units finished and transferred out.

• Average costing – to all the good units finished and in process.

Books c. if lost units are discovered at inspection point. To all the good units that passed the

inspection point.

Audiobooks

Snapshots

Magazines

Documents

Sheet Music

You're reading a preview

Unlock full access (pages 5-46) by

Related titles uploading documents or with a

This document is...

Scribd 30 Day Free Trial

Useful Not useful

Books, audiobooks, and more.

Get our free app Continue for Free

Chapter 1 p2 - Guerrero p2 - Guerrero AFAR - Income Test Bank -

PROBLEMS

Ch13 Ch17.Docx Recognition:… Chapter 3 Jo

Installment

1. Department of Hope Manufacturing Company presents the following Sales,

production data for the Order Costin

month of May, 2013: Franchise, Long-

term Construction

Opening inventory 3/8 completed 4,000 units

Started in process 13,000 units

Transferred 9,000 units

Closing inventory, 1/2 completed 4,000 units

3/4 completed 4,000 units

What are the equivalent units of production for the month of May, 2013.

FIFO AVERAGE

a.12,500 units 13,000 units

b.17,000 units You're Reading a Preview

12,500 units

C. 12,500 units 14,000 units PROBLEMS

1. Department of Hope Manufacturing Company presents the following production data for the

d. 15,000 units 14,000 units

month of May, 2013:

Upload your documents to download.

2. Rose Co, bad 3,000 units in work in process at April 1, 2013, which were 60% complete as to

Opening invcost,

conversion entorDu

y 3ring

/8 cApril,

omple10,000

ted 4,000 unitAt

units was completed. s April 30, 4,000 units remained in

St arte d in proce ss

work in process which were 40% complete as to ORconversion tcsost. Direct materials are added at

1 3 , 0 0 0 uni

Tranbegi

the sfernning

red of the process. 9,000 units

Closing inventory, 1/2 completed 4,000 units

Become a Scribd member for full access. Your

How many units were started 3/4 cduring

ompletApril?

ed 4,000 units

What

a. 0 the equivalent units offirst

9,00are 30 days

production for the are

monthfree.

of May, 2013.

b. 9,800

FIFO AVERAGE

c. 10,000

a.12,500 units 13,000 units

d. 11,000

b.17,000 units 12,500 units Continue for Free

C. 12,500 units 14,000 units

3. The Ilang-llang Corporation, engaged in a manufacturing business and using proce ss costing,

d. 15,000 units 14,000 units

gave the following production data for three different situations. Stages of completion of the

inventories apply to all cost elements.

2. Rose Co, bad 3,000 units in work in process at April 1, 2013, which were 60% complete as to

conversion cost,

(1) Started in During

process, April,units;

6,500 10,000 units was 5,500

transferred, completed.

units; At April 30, 400

in process, 4,000 units remained in

units

work in process and

50% completed which

600were 40%

units 25% complete as to conversion cost. Direct materials are added at

completed.

the beginning of the process.

(2 ) Beginning inventory, 6,250 units 40% completed; started in process, 25,000 units;

How many units

transferred, were

26,250 started

units; during at

in process April?

the end, 3,000 units 50% co mpleted and 2,000 units

25% completed.

a. 9,000

b. 9,800

(3) Beginning inventory, 6,000 units 30% completed; started in process. I3,000

c. 10,000

d. 11,000

3. The Ilang-llang Corporation, engaged in a manufacturing business and using proce ss costing,

gave the following production data for three different situations. Stages of completion of the

inventories apply to all cost elements.

(1) Started in process, 6,500 units; transferred, 5,500 units; in process, 400 units

50% completed and 600 units 25% completed.

(2 ) Beginning inventory, 6,250 units 40% completed; started in process, 25,000 units;

transferred, 26,250 units; in process at the end, 3,000 units 50% co mpleted and 2,000 units

25%

units;completed.

lost in processing, 500 units from production started this period (loss was normal and

occurred throughout the production process); transferred, 14,000 units; in process at the end,

(3) Beginning

3,000 inventory,

units 50% complet6,000

ed andunits

1,5030% completed;

0 units star

75% comp ted. in process. I3,000

leted

What are the equivalent production of the three different situations under FIFO and average

costing?

FIFO AVERAGE

1 2 3 1 2 3

a.5,850 25,750 14,825 5,850 28,250 16,625

b. 5,850 27,550 18,425 5,580 22,850 15,662

c.8,550 20,575 15,428 5,508 28,025 16,265

d. 5,058 20,775 12,524 5,850 28,250 16,625

units;

4. lost in

Orchids

occurred

Company

throughou t You're Reading a Preview

processing,

has 500

the

unitss from

a proces

production

production

cost system

process);

usingstarted

transferred,

this

the FIFO period

cost

14,000

flow(loss

metho

units; in

was

d. normal and

Al l materials

process

are introduced at the beginning of the process in Department One. The following information at the end,is

3,000 unitfor

available s 50%

the complet

month ofedJanuary

and 1,50 0 units 75% completed.

2012:

What are the Upload your documents to download.

equivalent production of the three different

Work in process, 1/1/08 (40% complete as to conversion 500

Units

situations under FIFO and average

costing?

costs)

Started in January

FIFO ORAVERAGE 2,000

Transferred to Department Two during January 2 ,1 0 0

1 2 3 1 2 3

Work in process, 1/31/08 (25% complete as to 400

Become a Scribd member for full access. Your

a.5,850 25,750 14,825 5,850 28,250 16,625

conversion costs)

b. 5,850 27,550 18,425 5,580 22,850 15,662

c.8,550 20,575

first 30 days are free.

15,428 5,508 28,025

What are the equivalent units of production for the month of January 2013?

d. 5,058 20,775 12,524 5,850 28,250

16,265

16,625

Materials Conversion

a.2,500 2,200

b.2,500 1,900 Continue for Free

4. Orchids Company has a process cost system using the FIFO cost flow method. Al l materials

are introduced

c.2,000 at the beginning

2,200 of the process in Department One. The following information is

available

d.2,000 for the month of

2,000January 2012:

Units

Work

5 in process,

. Anahaw 1/1/08

Company's (40%tion

produc complete as to conversion

cycle starts in the Mixing 500

Department. The following

costs)

information is available for the month of April 2013?

Started in January Units 2 ,0 0 0

T ra nsfe rre d to De part m en t T w

Work inprocess, April 1 (50% complete)o du ring J a nua ry 40,000 2 ,1 0 0

Work

Started ininpro

Apcess,

ril 1/31/08 (25% complete as to 240,000 400

conversion costs)

work-in-process, April 30 (60% complete) 2 5 ,0 0 0

What are the

Materials are equivalent units

added in the of production

beginning for the month

of the process of January

in the Mixing Depa2013?

rtment. Using the

weighted average method, what are the equivalent units of production for the month of April

Materials Conversion

2013?

a.2,500 2,200

b.2,500 1,900

c.2,000 2,200

d.2,000 2,000

5. Anahaw Company's production cycle starts in the Mixing Department. The following

information is available for the month of April 2013?

Units

Work inprocess, April 1 (50% complete) 40,000

Started in April 2 4 0 ,0 0 0

work-in-process, April 30 (60% complete) 2 5 ,0 0 0

Materials Conversion

Materials are added in the beginning of the process in the Mixing Department. Using the

a.240,000 250,000

weighted average method, what are the equivalent units of production for the month of April

b.255,000 255,000

2013?

c.270,000 280,000

d.280,000 270,000

6. Materials are added at the start of the process in Jasmin company's cutting department, the

first stage of the production cycle. The following information is available for the month of

March 2013.

units

Work in process, March 1 (60% complete as to 60,000

conversion costs)

Started in March 150,000

Transferred to the next department 110,000

Lost in production 30,000

You're Reading a Preview

Materials Conversion

Work in process, March 31 (50% complete as to 70,000

a.240,000 250,000

conversion costs

b.255,000 255,000

c.270,000 280,000

d.280,000 Upload your documents to download.

Under Jasmin's cost accounting system, the costs incurred on the lost units are absorbed by the

270,000

remaining good units. Using the First in, First out method, what are the equivalent units for the

materials unit cost calculation?

6. Materials are added at the start of the process in Jasmin company's cutting department, the

first stage

OR

a. 120 ,000of the production cycle. The following information is available for the month of

March

b.145,000 2013.

c. 180,000

Work

Become a Scribd member for full access. Your units

d. 210in ,00process,

0 March 1 (60% complete as to 60,000

conversion costs) first 30 days are free.

Started in March 150,000

T ra ns fe rr ed to t he next dep artm ent

7. Bayani Manufacturing Company, using the FIFO process cost 1 10,0system,

00 has the following data

Lfor

ostthe

in pmro du ct io n

onth of April: 3 0 , 0 00

Continue for Free

Work in process, March 31 (50% complete as to 70,000 Percent Complete

conversion costs Actual Units Materials Conversion cost

Beginning Inventory 15,000 * I 00% 40%

Under

TransfeJasmin's

rred in cost acco1unting

50,000system, the costs incurred on the lost units are absorbed by the

remaining

Transferredgood

out units. Using

120,t0he

00First in, First out method, what are the equivalent units for the

materials unit

Ending Inventorycost calculation?

45,000 100% 30%

a. 120,000

What are the equivalent units of production for the month of April?

b.145,000

c. 180,000

Materials Conversion Costs

d. 210,000

a.150,000 127,500

b.165,000 139,500

C. 135,000 124,500

7. Bayani Manufacturing Company, using the FIFO process cost system, has the following data

d. 150,000 133,500

for the month of April:

Percent Complete

Actual Units Materials Conversion cost

Beginning Inventory 15,000 * I 00% 40%

Transferred in 150,000

Transferred out 120,000

Ending Inventory 45,000 100% 30%

What are the equivalent units of production for the month of April?

Materials Conversion Costs

a.150,000 127,500

b.165,000 139,500

C. 135,000 124,500

d. 150,000 133,500

8. Eastern Products Inc., Input all materials at the start of operation

is process at the beginning of January consisted of 4,000 units with

P100,000 and labor and overhead of P20,000 . In January, 20,000 un

with material cost of P500,000. Labor and overhead in January cost

January., the inventory was 100% complete in materials but only 60

The ending inventory consisted of 10,000 units. The equivalent unit

the month of January amounted to:

You're Reading a Preview

a.20,000

Upload your documents to download.

b.10,000

C. 26,000

d. 30,000 OR

9. Become

Yakal Coma pany

Scribd member

com forflow

puted the full access.

of physYour

ical units completed fo

month, of March first

2030

13 days are free.

as follows:

8. Eastern Products Inc., Input all materials at the start of operation

Units completed:

is

Froprocess

m workat

-inthe

probceginning

ess on MofarcJa

hnuary

1, 200consiste

8 d of154,000

,000 units with

P100,000 Continue for Free

From Marcandh prla

obor

ductand

ion overhead of P20,000 . In 4January,

5,000 20,000 un

with material cost of P500,000. Labor and overhead in January cost

January.,

No. 9 – Cothe

ntininventory

ued was 100% complete in materials but only 60

The ending inventory consisted of 10,000 units. The equivalent unit

the monthare

Materials of January

added atamounted to: of the process. The 12,000 un

the beginning

March 31, 2013, were 80% complete as to conversion costs. The wo

a.20,000

2043 was 80% complete as to conversion costs. Using the FIFO met

b.10,000

March conversion costs were:

C. 26,000

d. 30,000

a. 55,200

b. 57,000

9. Yakal Company computed the flow of physical units completed fo

C. 60,600

month, of March 2013 as follows:

d. 63,600

Units completed:

Fro. m

10 work-iCompany

Mataba n process sells

on Mfood

arch processors

1, 2008 1 5 ,0 0 0

and manufactures them

From MaAt

process. rchthe

proend

ductof

ion 45value

August there were 200 units ,000 d at P30,09

P25,200 in materials cost and P4,895 in conversion cost. These were

No. 9 – Continued

materials and 25% complete as to conversion cost 1200 units were

September, and these had materials costs of P168,000. Processors w

Materials

.1,400 are

completed

a added

at the 50 atofthe

1,3end beginningtotal

September of the200process.and

units Thewere

12,000

100%un

March

and

b 0031,comp

.1,250% 2013,1,1were

lete 0as

0 to80% complete

conver sion cosast.toConv

convers

ersioion costs.

n cost Theg wo

durin Se

2043

c.1,20was

There 0were 80%

no1complete

units

,150 lost inas process.

to conversion costs. Using the FIFO met

March

d.1,200conversion 1,25costs

0 were:

What are the equivalent units of production for September?

a. 55,200

11. The Wiring Department is the second stage of Acacia Company'

b. 57,000

Mathe

1, terbeginning

ials Cowork-in

nversionprocCosess

t contained 25,000 units which wer

C. 60,600

conversion

d. 63,600

You're Reading

costs. During May,a100,000

Preview units were transferred-in fro

production cycle. On May 31, the ending work in Process contained

Upload your

80% complete as todocuments

conversion cost to download.

s. Material costs are added at th

10. Mataba Company sells food processors and manufactures them

the weighted-average method, the equivalent units were:

process. At the end of AuOR gust there were 200 units valued at P30,09

P25,200

Materialin s materia

Convlsercost

sionand

costP4,895

s in conversion cost. These were

a.1Become

materials

25,000and a Scribd

25% member

100,complete

00 0 fortofull

as access. Your

conversion cost 1200 units were

September,

b.105,000 and 0these

1first

5,03000had

daysma terials

are free.costs of P168,000. Processors w

a .1,400

completed 1,350 of September total 200 units and were 100%

c.105,000 at the 121end,000

b

and.1 ,2 0 0 1 ,1 0 0 to conversion cost. Conversion cost during Se

d.1250% 5,000complete121,as 000

cThere

.1,200were no1units ,1Continue

5 0 lost in for Free

process.

d.1,200 1,250

12. Dhalia Company adds materials at the beginning of the process

What are theconce

Information equivalent units

rning the of production

materials used infor September?

April 2013 production

11. The Wiring Department is the second stage of Acacia Company'

M

1, athe

terbeginning

ials Cowork-in

nversionprocCosess

t contained 25,000 units which wer

Units

conversion

Work-in-procosts.cess aDuring

t April May, 100,000 units were1transferred-in

0 ,0 0 0 fro

production

Started duricycle.

ng AprOn il May 31, the ending work in 5 Process

0,000 contained

80% complete

Completed andas to conversion

transferred costs. Material costs

to next are added at th

36,000

the weighted-averag

department during Aprile method, the equivalent units were:

Normal spoilage incurred 3 ,0 0 0

Materials Conversion costs

Abnormal spoilage incurred 5 ,0 0 0

a.125,000 100,000

Work in process at April 30 1 6 ,0 0 0

b.105,000 105,000

c.105,000 121,000

Under Dhalia's cost accounting system, costs of normal spoilage are

d.125,000 121,000

of good units produced. However, the costs of abnormal spoilage ar

overhead. Using the weighted-average method, what are the equiv

12. Dhalia Company adds materials at the beginning of the process

unit cost calculation for the month of April?

Information concerning the materials used in April 2013 production

a.47,000

b.52,000 Units

W

C. o55,000

rk-in-process at April 1 0 ,0 0 0

S

d.ta57,000

rted during April 5 0 ,0 0 0

Completed and transferred to next 36,000

department during

13. The following April

information pertains Lanao's First Department for

N ormal spoilage incurred

April: 3 ,0 0 0

Abnormal spoilage incurred 5 ,0 0 0

Work in process at April 30 1 6 ,0 0 0

Under Dhalia's cost accounting system, costs of normal spoilage are

of good units produced. However, the costs of abnormal spoilage ar

overhead. Using the weighted-average method, what are the equiv

unit cost calculation for the month of April?

a.47,000

b.52,000

C. 55,000

d. 57,000

13. The following information pertains Lanao's First Department for

April:

Potrebbero piacerti anche

- TREASURYDocumento41 pagineTREASURYjatin aroraNessuna valutazione finora

- HMCost3e SM Ch06Documento53 pagineHMCost3e SM Ch06Elisha Dagala100% (1)

- Quiz 12 - Subs Test - Audit of Investment (Q)Documento3 pagineQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburNessuna valutazione finora

- Mission StatementsDocumento14 pagineMission StatementsSatyam DixitNessuna valutazione finora

- Cost Acc Chapter 11Documento10 pagineCost Acc Chapter 11ElleNessuna valutazione finora

- Strategic Management MBA III 538483064Documento2 pagineStrategic Management MBA III 538483064Sidharth KapoorNessuna valutazione finora

- Pre-Quiz 3 - Process CostingDocumento10 paginePre-Quiz 3 - Process Costingnicah shayne madayag100% (1)

- Module No 2 - Average CostingDocumento8 pagineModule No 2 - Average CostingAnthony DyNessuna valutazione finora

- Redstone Commodity Update Q1 2020Documento13 pagineRedstone Commodity Update Q1 2020Frianata ZrNessuna valutazione finora

- Process Costing FIFO CRDocumento21 pagineProcess Costing FIFO CRMiyangNessuna valutazione finora

- Process Costing ModuleDocumento6 pagineProcess Costing ModuleClaire BarbaNessuna valutazione finora

- (Intermediate Accounting 3) : Lecture AidDocumento17 pagine(Intermediate Accounting 3) : Lecture AidClint Agustin M. RoblesNessuna valutazione finora

- Kinney 8e - IM - CH 06Documento19 pagineKinney 8e - IM - CH 06Nonito C. Arizaleta Jr.Nessuna valutazione finora

- Process CostingDocumento6 pagineProcess CostingHazel Jean Deterala0% (1)

- p2 - Guerrero Ch14Documento46 paginep2 - Guerrero Ch14JerichoPedragosa53% (19)

- Lecture Notes: BACOSTMX - Cost Accounting and Control Instructional Materials 4-Process CostingDocumento3 pagineLecture Notes: BACOSTMX - Cost Accounting and Control Instructional Materials 4-Process CostingAlexia VasquezNessuna valutazione finora

- Samsung Distribution Channel ProjectDocumento28 pagineSamsung Distribution Channel ProjectShivendra Singh0% (2)

- Cost Management: A Case for Business Process Re-engineeringDa EverandCost Management: A Case for Business Process Re-engineeringNessuna valutazione finora

- Freight Forwarding SoftwareDocumento10 pagineFreight Forwarding SoftwareShuklendu BajiNessuna valutazione finora

- 121process CostingDocumento21 pagine121process CostingAvox EverdeenNessuna valutazione finora

- Ch06 Process CostingDocumento9 pagineCh06 Process CostingNicole ValentinoNessuna valutazione finora

- WK 5 Lesson 5 Lecture NotesDocumento7 pagineWK 5 Lesson 5 Lecture NotesRosethel Grace GallardoNessuna valutazione finora

- Process CostinggDocumento22 pagineProcess CostinggKurt Del RosarioNessuna valutazione finora

- Module 6A Process Costing WeightedDocumento3 pagineModule 6A Process Costing WeightedSky SoronoiNessuna valutazione finora

- Process CostingDocumento15 pagineProcess CostingyebegashetNessuna valutazione finora

- Cost Accounting Systems: 1) Job-Order Costing 2) Process CostingDocumento5 pagineCost Accounting Systems: 1) Job-Order Costing 2) Process Costingeducation890Nessuna valutazione finora

- Lesson 8 Process CostingDocumento15 pagineLesson 8 Process CostingRohanne Garcia AbrigoNessuna valutazione finora

- Kinney 8e - CH 06Documento19 pagineKinney 8e - CH 06Ashik Uz ZamanNessuna valutazione finora

- Process CostingDocumento24 pagineProcess CostingBishnuNessuna valutazione finora

- 7 - Process Costing System (Handout 1)Documento5 pagine7 - Process Costing System (Handout 1)acadsbreakNessuna valutazione finora

- LH - 05 - CAC - Process CostingDocumento27 pagineLH - 05 - CAC - Process CostingRaven Claire ContrerasNessuna valutazione finora

- Pma2133 Chapter 2 Process Costing Jul2020Documento17 paginePma2133 Chapter 2 Process Costing Jul2020NUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Nessuna valutazione finora

- Lecture Notes: Afar Process CostingDocumento4 pagineLecture Notes: Afar Process CostingCha EsguerraNessuna valutazione finora

- Cost 1 Chapter 3 Part 2Documento41 pagineCost 1 Chapter 3 Part 2Genanew AbebeNessuna valutazione finora

- Reviewer Average Fifo FinalsDocumento9 pagineReviewer Average Fifo FinalsYeppeuddaNessuna valutazione finora

- Process Costing: Direct Costs Indirect CostsDocumento4 pagineProcess Costing: Direct Costs Indirect CostsMuhammad IrfanNessuna valutazione finora

- Kinney 8e - IM - CH 06Documento19 pagineKinney 8e - IM - CH 06JM TylerNessuna valutazione finora

- 7 Process Costing System Handout 2Documento4 pagine7 Process Costing System Handout 2acadsbreakNessuna valutazione finora

- Process Costing: Discussion QuestionsDocumento53 pagineProcess Costing: Discussion QuestionsDissa ElvarettaNessuna valutazione finora

- Process PPT 1Documento17 pagineProcess PPT 1Hemant bhanawatNessuna valutazione finora

- Chapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingDocumento12 pagineChapter 3: Process Costing: Cost & Management Accounting I/ Lecture Note On Process CostingFear Part 2Nessuna valutazione finora

- Process CostingDocumento2 pagineProcess CostingSarah Nicole S. LagrimasNessuna valutazione finora

- Chapter 8 - Process CostingDocumento12 pagineChapter 8 - Process CostingDaryl Joeh SagabaenNessuna valutazione finora

- O Equivalent Units (Number of Partially Completed Units in Ending WIP Inventory) The PercentageDocumento3 pagineO Equivalent Units (Number of Partially Completed Units in Ending WIP Inventory) The Percentagetjn8240Nessuna valutazione finora

- Process Costing Module 9 MergedDocumento50 pagineProcess Costing Module 9 MergedJoy DipasupilNessuna valutazione finora

- Lecture 4 S1 AY2022.23 Process Costing StudentDocumento44 pagineLecture 4 S1 AY2022.23 Process Costing StudentGautham PushpanathanNessuna valutazione finora

- Chapter 4 .Doc Process CostingDocumento13 pagineChapter 4 .Doc Process CostingMulumebet EshetuNessuna valutazione finora

- Topic 6 - Process Costing ADocumento5 pagineTopic 6 - Process Costing AFaizah MKNessuna valutazione finora

- Process Cost Accounting General ProceduresDocumento21 pagineProcess Cost Accounting General Proceduresbublooo123Nessuna valutazione finora

- تكاليف Ch17Documento14 pagineتكاليف Ch17alsaqarhamzaNessuna valutazione finora

- Process Costing Study GuideDocumento14 pagineProcess Costing Study GuideTekaling NegashNessuna valutazione finora

- Module 5 PROCESS COSTINGDocumento19 pagineModule 5 PROCESS COSTINGMark Laurence SanchezNessuna valutazione finora

- C.A-I Chapter-4Documento16 pagineC.A-I Chapter-4Tariku KolchaNessuna valutazione finora

- Process Costing NotesDocumento10 pagineProcess Costing NotesMegan CruzNessuna valutazione finora

- Chapter 4 - Process CostingDocumento12 pagineChapter 4 - Process CostinggsdhNessuna valutazione finora

- Additional Notes On Process CostingDocumento4 pagineAdditional Notes On Process CostingShiv AchariNessuna valutazione finora

- Example of Transferred-In CostsDocumento5 pagineExample of Transferred-In CostsZazan ZanuwarNessuna valutazione finora

- MAC Summary Chapter 18-Page 136Documento3 pagineMAC Summary Chapter 18-Page 136Mahamud AbdiNessuna valutazione finora

- Managerial Acc 3Documento52 pagineManagerial Acc 3emadhamdy2002Nessuna valutazione finora

- Process Costing Notes 1page PDFDocumento28 pagineProcess Costing Notes 1page PDFMahlet AbrahaNessuna valutazione finora

- ACCT 102 Lecture Notes Chapter 16Documento5 pagineACCT 102 Lecture Notes Chapter 16Trisha Bendaña ReyesNessuna valutazione finora

- Chapter 17Documento4 pagineChapter 17karam123Nessuna valutazione finora

- Process Costing: Discussion QuestionsDocumento53 pagineProcess Costing: Discussion QuestionsParth GandhiNessuna valutazione finora

- The Cost of Production ReportDocumento2 pagineThe Cost of Production ReportMeghan Kaye LiwenNessuna valutazione finora

- Process Costing Format of Process A/c Particulars Unit at Rs Particulars Unit at RsDocumento2 pagineProcess Costing Format of Process A/c Particulars Unit at Rs Particulars Unit at RsAliRazaSattarNessuna valutazione finora

- Key Points or Learnings..Documento3 pagineKey Points or Learnings..sakura harunoNessuna valutazione finora

- Chapter 6Documento8 pagineChapter 6Char LeneNessuna valutazione finora

- Risk Associated With Electronic CommerceDocumento38 pagineRisk Associated With Electronic CommerceChan YeolNessuna valutazione finora

- Grocery Store or Market. Just Name Five Vegetables That You Know Are Available in Your Place. To Put It Simply, No Need To Go Out of The House.)Documento2 pagineGrocery Store or Market. Just Name Five Vegetables That You Know Are Available in Your Place. To Put It Simply, No Need To Go Out of The House.)Chan YeolNessuna valutazione finora

- Features of Electronic Data InterchangeDocumento3 pagineFeatures of Electronic Data InterchangeChan YeolNessuna valutazione finora

- Reward Your Curiosity: p2 - Guerrero Ch15Documento1 paginaReward Your Curiosity: p2 - Guerrero Ch15Chan YeolNessuna valutazione finora

- RegulatorsDocumento16 pagineRegulatorsChan YeolNessuna valutazione finora

- LENGTEKDocumento2 pagineLENGTEKChan YeolNessuna valutazione finora

- Safari - 19 Nov 2019 at 9:59 PMDocumento1 paginaSafari - 19 Nov 2019 at 9:59 PMChan YeolNessuna valutazione finora

- Accountingtools: Standard CostingDocumento8 pagineAccountingtools: Standard CostingChan YeolNessuna valutazione finora

- MAS.m-1414. Cost Concepts, Classification and SegregatiDocumento1 paginaMAS.m-1414. Cost Concepts, Classification and SegregatiChan YeolNessuna valutazione finora

- Live Your: PassionsDocumento3 pagineLive Your: PassionsChan YeolNessuna valutazione finora

- Journal EntriesDocumento8 pagineJournal EntriesChan YeolNessuna valutazione finora

- Introducing: Are You Ready For Your Training?Documento1 paginaIntroducing: Are You Ready For Your Training?Chan YeolNessuna valutazione finora

- Post-Crisis Experienc EDocumento11 paginePost-Crisis Experienc EChan YeolNessuna valutazione finora

- Libro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Documento185 pagineLibro Modulo III Capítulo 3 - 9 (Koch y Macdonald)Remy Angel Terceros FernandezNessuna valutazione finora

- Dispute Form - Bilingual 2019Documento2 pagineDispute Form - Bilingual 2019Kxng MindCtrl OrevaNessuna valutazione finora

- CAKPO T. Paul Luc Uriel: Cakpouriel@Documento2 pagineCAKPO T. Paul Luc Uriel: Cakpouriel@chancia angeNessuna valutazione finora

- Financial Statement AnalysisDocumento23 pagineFinancial Statement AnalysisHinata UzumakiNessuna valutazione finora

- VMware VSphere Optimization Assessment QuickStart GuideDocumento2 pagineVMware VSphere Optimization Assessment QuickStart GuidewhhornNessuna valutazione finora

- The Audit Process: Principles, Practice and Cases Seventh EditionDocumento28 pagineThe Audit Process: Principles, Practice and Cases Seventh EditionSyifa FebrianiNessuna valutazione finora

- DM A1.1Documento33 pagineDM A1.1NaNóngNảyNessuna valutazione finora

- Summer InternshipDocumento18 pagineSummer InternshipMohit SinghalNessuna valutazione finora

- 3i Sustainabilityreport 2023Documento97 pagine3i Sustainabilityreport 2023Matthieu BlehouanNessuna valutazione finora

- KPIT - Campus Hiring - Management FreshersDocumento7 pagineKPIT - Campus Hiring - Management FreshersSwati MishraNessuna valutazione finora

- Pandapro DeckDocumento13 paginePandapro DeckJennivieve Venice EismaNessuna valutazione finora

- Pyq - Mat112 - Jun 2019Documento5 paginePyq - Mat112 - Jun 2019isya.ceknua05Nessuna valutazione finora

- Chap 6 and 8 Midterm Review SeatworkDocumento2 pagineChap 6 and 8 Midterm Review SeatworkLouina Yncierto0% (1)

- Making Automobile and Housing DecisionsDocumento12 pagineMaking Automobile and Housing DecisionsSteve SenoNessuna valutazione finora

- MBA630 Price-Barret Minor Project 1Documento21 pagineMBA630 Price-Barret Minor Project 1sylvia priceNessuna valutazione finora

- Creating A Model of Process Innovation For Reengineering of Business and ManufacturingDocumento7 pagineCreating A Model of Process Innovation For Reengineering of Business and Manufacturingapi-3851548Nessuna valutazione finora

- Online Selling Site Policies and GuidelinesDocumento3 pagineOnline Selling Site Policies and GuidelinesLeslie CatindigNessuna valutazione finora

- Project - PPT 4 PlanningDocumento43 pagineProject - PPT 4 PlanningBirhanu AbrhaNessuna valutazione finora

- IGCSE Business Chapter 02 NotesDocumento4 pagineIGCSE Business Chapter 02 NotesemonimtiazNessuna valutazione finora

- Case Digests - Corporation LawDocumento37 pagineCase Digests - Corporation LawFrancis Jan Ax ValerioNessuna valutazione finora

- 2.2.1.essential Job VocabularyDocumento16 pagine2.2.1.essential Job VocabularyСофия ЗвиревичNessuna valutazione finora

- Gotows Working Sheets (WS) : Click HereDocumento74 pagineGotows Working Sheets (WS) : Click HereHuiMinHorNessuna valutazione finora