Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pas 8

Caricato da

Angelica DanucoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pas 8

Caricato da

Angelica DanucoCopyright:

Formati disponibili

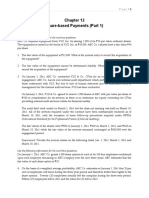

Change of cost formulas

1. During 20x1, ALBEIT ALTHOUGH Company decided to change from the Average

cost formula for inventory valuation to the FIFO cost formula. Inventory balances

under each method were as follows:

Average FIFO

January 1 4,000,000 4,800,000

December 31 8,000,000 8,400,000

Income tax rate is 30%. What is the net cumulative effect of the accounting change in

ALBEIT’s opening retained earnings balance?

a. 400,000 increase c. 280,000 increase

b. 560,000 decrease d. 560,000 increase

Change in depreciation method, EUL, and salvage value

2. On January 1, 20x1, PRISTINE UNCORRUPTED Co. acquired an equipment for

₱4,000,000. The equipment will be depreciated using the straight-line method

over 20 years. The estimated residual value is ₱400,000.

In 20x6, following a reassessment of the realization of the expected economic

benefits from the equipment, PRISTINE Co. changed its depreciation method to sum-

of-the-years digits (SYD). The remaining useful life of the asset is estimated to be 4

years and the residual value is changed to ₱200,000. How much is the depreciation

expense in 20x6?

a. 1,160,000b. 1,140,000 c. 1,233,560 d. 1,110,669

Change in provisions

3. On December 31, 20x1, LIBERATED FREE Company recognized the following

provisions:

Dec. 31, Warranty expense 200,000

20x1 Estimated warranty obligation 200,000

Dec. 31, Probable loss on litigation 400,000

20x1 Estimated liability on pending litigation 400,000

In 20x2, LIBERATED incurred ₱260,000 in discharging its warranty obligation and

settled the pending lawsuit for ₱360,000. How much is the net effect of the

settlements of the provisions on profit or loss in 20x2?

a. 20,000 increase c. 60,000 decrease

b. 20,000 decrease d. 0

Current period error

Use the following information for the next two questions:

On January 10, 20x2, prior to the authorization of LIBERTINE IMMORAL Co.’s

December 31, 20x1 financial statements for issue, the accountant of LIBERTINE Co.

received a bill for an advertisement made in the month of December 20x1

amounting to ₱1,600,000. This expense was not accrued as of December 31, 20x1.

4. The correcting entry, if the books are still open, includes

a. a debit to advertising expense for ₱1,600,000

b. a credit to advertising income for ₱1,600,000

c. a debit to retained earnings for ₱1,600,000

d. a credit to retained earnings for ₱1,600,000

5. The correcting entry, if the books are already closed, includes

a. a debit to advertising expense for ₱1,600,000

b. a credit to advertising income for ₱1,600,000

c. a debit to retained earnings for ₱1,600,000

d. a credit to retained earnings for ₱1,600,000

Prior period error

6. On January 15, 20x3 while finalizing its 20x2 financial statements, DIAPHANOUS

TRANSPARENT Co. discovered that depreciation expense recognized in 20x1 is

overstated by ₱1,600,000. Ignoring income tax, the entry to correct the prior

period error includes

a. a debit to depreciation expense for ₱1,600,000

b. a debit to retained earnings for ₱1,600,000

c. a credit to depreciation expense for ₱1,600,000

d. a debit to accumulated depreciation for ₱1,600,000

Counterbalancing and non-counterbalancing errors

Use the following information for the next four questions:

GULOSITY GREEDINESS Co. reported profits of ₱4,000,000 and ₱8,000,000 in 20x1

and 20x2, respectively. In 20x3, the following prior period errors were discovered:

The inventory on December 31, 20x1 was understated by ₱200,000.

An equipment with an acquisition cost of ₱1,200,000 was erroneously charged as

expense in 20x1. The equipment has an estimated useful life of 5 years with no

residual value. GULOSITY Co. provides full year depreciation in the year of

acquisition.

The unadjusted balances of retained earnings are ₱8,800,000 and ₱16,800,000 as of

December 31, 20x1 and 20x2, respectively.

7. How much is the correct profit in 20x1?

a. 7,560,000 b. 5,610,000 c. 4,760,000 d. 5,160,000

8. How much is the correct profit in 20x2?

a. 7,560,000 b. 5,160,000 c. 5,720,000 d. 5,610,000

9. How much is the correct retained earnings in 20x1?

a. 9,960,000 b. 17,520,000 c. 9,860,000 d. 18,420,000

10. How much is the correct retained earnings in 20x2?

a. 9,960,000 b. 17,520,000 c. 9,860,000 d. 18,420,000

Counterbalancing and non-counterbalancing errors

Use the following information for the next four questions:

HELICAL SPIRAL Co. reported profits of ₱1,600,000 and ₱2,400,000 in 20x1 and

20x2, respectively. In 20x3, the following prior period errors were discovered:

Prepaid supplies in 20x1 were overstated by ₱80,000.

Accrued salaries payable in 20x1 were understated by ₱160,000.

Repairs and maintenance expenses in 20x1 amounting to ₱400,000 were

erroneously capitalized and being depreciated over a period of 4 years.

The unadjusted balances of retained earnings are ₱6,400,000 and ₱8,800,000 as of

December 31, 20x1 and 20x2, respectively.

11. How much is the correct profit in 20x1?

a. 1,006,000 b. 1,610,000 c. 1,720,000 d. 1,060,000

12. How much is the correct profit in 20x2?

a. 2,704,000 b. 2,160,000 c. 2,740,000 d. 2,610,000

13. How much is the correct retained earnings in 20x1?

a. 5,806,000 b. 5,520,000 c. 5,860,000 d. 5,420,000

14. How much is the correct retained earnings in 20x2?

a. 8,960,000 b. 8,600,000 c. 8,860,000 d. 8,420,000

Counterbalancing and non-counterbalancing errors

Use the following information for the next sixteen questions:

THRALL SLAVE Company made the following errors:

a. December 31, 20x1 inventory was understated by ₱100,000.

b. December 31, 20x2 inventory was overstated by ₱160,000.

c. Purchases on account in 20x1 were understated by ₱400,000 (not included in

physical count).

d. Advances to suppliers in 20x2 totaling ₱520,000 were inappropriately charged

as purchases.

e. December 31, 20x1 prepaid insurance was overstated by ₱20,000.

f. December 31, 20x1 unearned rent income was overstated by ₱104,000.

g. December 31, 20x2 interest receivable was understated by ₱68,000.

h. December 31, 20x2 accrued salaries payable was understated by ₱120,000.

i. Advances from customers in 20x2 totaling ₱240,000 were inappropriately

recognized as sales but the goods were delivered in 20x3.

j. Depreciation expense in 20x1 was overstated by ₱28,800

k. In 20x2, the acquisition cost of a delivery truck amounting to ₱360,000 was

inappropriately charged as expense. The delivery truck has a useful life of five

years. THRALL’s policy is to provide a full year’s straight line depreciation in the

year of acquisition and none in the year of disposal.

l. A fully depreciated equipment with no residual value was sold in 20x3 for

₱200,000 but the sale was recorded in the following year.

Profits before correction of errors were ₱492,000, ₱624,000, and ₱840,000 in 20x1,

20x2, and 20x3, respectively.

Retained earnings before correction of errors were ₱4,492,000, ₱5,116,000 and

₱5,956,000 in 20x1, 20x2, and 20x3, respectively.

15. What is the net effect of the errors on the 20x1 profit? (over) understatement

a. (187,200) b. 187,200 c. (164,200) d. 164,200

16. What is the net effect of the errors on the 20x2 profit? (over) understatement

a. (572,000) b. 572,000 c. 563,400 d. (563,400)

17. What is the net effect of the errors on the 20x3 profit? (over) understatement

a. (78,000) b. 78,000 c. (60,000) d. 60,000

18. How much is the correct profit (loss) in 20x1?

a. (348,000) b. 348,000 c. 324,800 d. 304,800

19. How much is the correct profit (loss) in 20x2?

a. 1,196,000 b. 1,296,000 c. 1,684,800 d. 1,286,000

20. How much is the correct profit (loss) in 20x3?

a. 900,000 b. 926,000 c. 968,400 d. 986,000

21. What is the net effect of the errors on the 20x1 retained earnings? (over)

understatement

a. (182,700) b. 182,700 c. (165,200) d. (187,200)

22. What is the net effect of the errors on the 20x2 retained earnings? (over)

understatement

a. 348,800 b. (348,800) c. (384,800) d. 384,800

23. What is the net effect of the errors on the 20x3 retained earnings? (over)

understatement

a. 444,800 b. (444,800) c. 524,800 d. (524,800)

24. How much is the correct retained earnings in 20x1?

a. 4,304,800 b. 4,404,800 c. 4,524,400 d. 4,340,800

25. How much is the correct retained earnings in 20x2?

a. 5,500,800 b. 5,756,800 c. 5,246,400 d. 5,340,400

26. How much is the correct retained earnings in 20x3?

a. 6,340,800 b. 6,400,800 c. 6,479,800 d. 7,004,400

27. Assuming that the errors were discovered late in 20x3 when the books are still

open, the compound correcting entry will include

a. 384,400 net debit to retained earnings

b. 384,400 net credit to retained earnings

c. 444,800 net debit to retained earnings

d. 444,800 net credit to retained earnings

28. Assuming that the errors were discovered late in 20x3 when the books are still

open, the compound correcting entry will include

a. 444,800 net debit to retained earnings

b. 444,800 net credit to retained earnings

c. 60,000 net debit to retained earnings

d. 60,000 net credit to retained earnings

29. What is the net effect of the errors on the 20x1 working capital? (over)

understatement

a. (216,000) b. 216,000 c. 80,000 d. (80,000)

30. What is the net effect of the errors on the 20x2 working capital? (over)

understatement

a. 228,000 b. (228,000) c. (68,000) d. 68,000

31. What is the net effect of the errors on the 20x3 working capital? (over)

understatement

a. No effect b. 132,000 c. 200,000 d. (200,000)

Potrebbero piacerti anche

- Assign. 2 Module 2Documento9 pagineAssign. 2 Module 2Kristine VertucioNessuna valutazione finora

- Answer Key Week 4Documento10 pagineAnswer Key Week 4Chin FiguraNessuna valutazione finora

- Auditing ProblemsDocumento5 pagineAuditing ProblemsJayr BVNessuna valutazione finora

- Exam 3Documento22 pagineExam 3Darynn F. Linggon100% (2)

- Cash Basis & AccrualDocumento5 pagineCash Basis & AccrualFerb CruzadaNessuna valutazione finora

- Ncpar Cup 2012Documento18 pagineNcpar Cup 2012Allen Carambas Astro100% (2)

- Activity - Chapter 6 - Statement of Cash FlowsDocumento4 pagineActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNessuna valutazione finora

- Chapter 38 - Teacher's ManualDocumento27 pagineChapter 38 - Teacher's ManualHohoho67% (6)

- Income Taxes: Name: Date: Professor: Section: ScoreDocumento3 pagineIncome Taxes: Name: Date: Professor: Section: ScoreJamie Rose AragonesNessuna valutazione finora

- Use The Following Information For The Next Two QuestionsDocumento7 pagineUse The Following Information For The Next Two QuestionsJohn Carlo Aquino0% (1)

- Accounting Errors 8-7 (Answers)Documento2 pagineAccounting Errors 8-7 (Answers)angela pajel0% (1)

- Chapter 12 - Sh. Based Payments (Part 1)Documento6 pagineChapter 12 - Sh. Based Payments (Part 1)Xiena100% (1)

- Cash BasisDocumento4 pagineCash BasisMark DiezNessuna valutazione finora

- ReviewerDocumento9 pagineReviewerMarielle JoyceNessuna valutazione finora

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Documento5 pagineAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNessuna valutazione finora

- Problem 3 LessorDocumento7 pagineProblem 3 LessorGelo Owss33% (9)

- Chapter 6Documento5 pagineChapter 6Angelita Dela cruzNessuna valutazione finora

- P1-PB. Sample Preboard Exam PDFDocumento12 pagineP1-PB. Sample Preboard Exam PDFAj VesquiraNessuna valutazione finora

- Use The Following Information For The Next Four QuestionsDocumento1 paginaUse The Following Information For The Next Four QuestionsTine Vasiana DuermeNessuna valutazione finora

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocumento5 pagineBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- BFJPIA Cup 4 Business Law and TaxationDocumento8 pagineBFJPIA Cup 4 Business Law and TaxationJerecko Ace ManlangatanNessuna valutazione finora

- 5rd Batch - P1 - Final Pre-Boards - EditedDocumento11 pagine5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- Balucan InAcc Week 3Documento14 pagineBalucan InAcc Week 3Luigi Enderez BalucanNessuna valutazione finora

- PDF ReceivablesDocumento6 paginePDF ReceivablesJanine SarzaNessuna valutazione finora

- A6 Share 221 eDocumento2 pagineA6 Share 221 eNika Ella SabinoNessuna valutazione finora

- Takehome Assessment No. 4Documento9 pagineTakehome Assessment No. 4Raezel Carla Santos Fontanilla0% (4)

- Intermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementDocumento19 pagineIntermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementAG VenturesNessuna valutazione finora

- QUIZ REVIEW Homework Tutorial Chapter 5Documento5 pagineQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNessuna valutazione finora

- ECO 444 Investments Test Bank-No AnswersDocumento17 pagineECO 444 Investments Test Bank-No AnswersAllan Genesis Romblon100% (1)

- ACG3141 Chap 14 PDFDocumento35 pagineACG3141 Chap 14 PDFLexter Dave C EstoqueNessuna valutazione finora

- Page 1 of 4 Chapter 4 - Intermediate Accounting 3Documento4 paginePage 1 of 4 Chapter 4 - Intermediate Accounting 3happy2408230% (1)

- Week 2Documento29 pagineWeek 2Rialyn Joy KismaliNessuna valutazione finora

- Intermediate Accounting Exam SolutionsDocumento11 pagineIntermediate Accounting Exam SolutionsDean Craig80% (5)

- Case Study MANACODocumento39 pagineCase Study MANACOAmorNessuna valutazione finora

- Statement of Financial PositionDocumento3 pagineStatement of Financial Positionlyka0% (1)

- Quiz - Chapter 32 - She Part 1 PrintingDocumento3 pagineQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- Notes QuizDocumento2 pagineNotes QuizErika Gayle0% (1)

- AnnounceDocumento14 pagineAnnounceskydawn0% (1)

- MB2 2013 Ap Set BDocumento6 pagineMB2 2013 Ap Set BMary Queen Ramos-UmoquitNessuna valutazione finora

- Income Taxes Problem SolvingDocumento3 pagineIncome Taxes Problem SolvingLara FloresNessuna valutazione finora

- Chapter 49-Pfrs For SmesDocumento6 pagineChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Statement of Changes in Equity: Kabuuang Puntos Itinala Ang Email (Romarch - Sajorga@lsu - Edu.p Isinumite Ang Form Na ItoDocumento6 pagineStatement of Changes in Equity: Kabuuang Puntos Itinala Ang Email (Romarch - Sajorga@lsu - Edu.p Isinumite Ang Form Na ItoAlvin BaternaNessuna valutazione finora

- IA 3 Final Assessment PDFDocumento5 pagineIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Far-1 4Documento3 pagineFar-1 4Raymundo Eirah100% (1)

- Interim Financial Reporting: Indoyon - JaniolaDocumento11 pagineInterim Financial Reporting: Indoyon - JaniolaCaryl JANIOLANessuna valutazione finora

- Audit of InvestmentsDocumento9 pagineAudit of InvestmentsGirlie SisonNessuna valutazione finora

- Practical Accounting - Part 1Documento17 paginePractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- AdsadsdDocumento28 pagineAdsadsdTong Wilson60% (5)

- Auditing ProblemsDocumento8 pagineAuditing ProblemsKheianne DaveighNessuna valutazione finora

- Cost Accounting 2014Documento94 pagineCost Accounting 2014Juliet Leron MediloNessuna valutazione finora

- ACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFDocumento19 pagineACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFJenever Leo SerranoNessuna valutazione finora

- OPT QuizDocumento5 pagineOPT QuizAngeline VergaraNessuna valutazione finora

- Accounting ProbDocumento2 pagineAccounting ProbLino GumpalNessuna valutazione finora

- Review Notes #2 PDFDocumento9 pagineReview Notes #2 PDFJha Ya100% (3)

- CH7 - DiscussionDocumento8 pagineCH7 - DiscussionRichell ArtuzNessuna valutazione finora

- Use The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternDocumento6 pagineUse The Following Information For The Next Four Cases:: Depreciation Methods Fact PatternPRESCIOUS JOY CERALDENessuna valutazione finora

- Midterm Exam - LUNADocumento22 pagineMidterm Exam - LUNAJoyce LunaNessuna valutazione finora

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocumento19 pagineIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- Exam 2Documento19 pagineExam 2SHE50% (2)

- Inventory & Bad DebtsDocumento5 pagineInventory & Bad DebtsshahabNessuna valutazione finora

- Management Accounting - Budgeting DecisionsDocumento76 pagineManagement Accounting - Budgeting DecisionsAngelica DanucoNessuna valutazione finora

- Everything On Archetypes PDFDocumento18 pagineEverything On Archetypes PDFanaaremereNessuna valutazione finora

- Intermediate Accounting Borrowing Costs Exercises - Doc 1Documento4 pagineIntermediate Accounting Borrowing Costs Exercises - Doc 1Angelica Danuco0% (1)

- Valix Financial Accounting Vol 3 AnswersDocumento1 paginaValix Financial Accounting Vol 3 AnswersJobby JaranillaNessuna valutazione finora

- Dress Code Policy Download 20170928Documento1 paginaDress Code Policy Download 20170928Angelica DanucoNessuna valutazione finora

- Laporan Keuangan TRIN Per Juni 2023-FinalDocumento123 pagineLaporan Keuangan TRIN Per Juni 2023-FinalAdit RamdhaniNessuna valutazione finora

- Engineering Mathematics John BirdDocumento89 pagineEngineering Mathematics John BirdcoutnawNessuna valutazione finora

- The Function and Importance of TransitionsDocumento4 pagineThe Function and Importance of TransitionsMarc Jalen ReladorNessuna valutazione finora

- Line Integrals in The Plane: 4. 4A. Plane Vector FieldsDocumento7 pagineLine Integrals in The Plane: 4. 4A. Plane Vector FieldsShaip DautiNessuna valutazione finora

- Army Watercraft SafetyDocumento251 pagineArmy Watercraft SafetyPlainNormalGuy2Nessuna valutazione finora

- Research Paper On Marketing PlanDocumento4 pagineResearch Paper On Marketing Planfvhacvjd100% (1)

- Amine Processing Unit DEADocumento9 pagineAmine Processing Unit DEAFlorin Daniel AnghelNessuna valutazione finora

- Bankers ChoiceDocumento18 pagineBankers ChoiceArchana ThirunagariNessuna valutazione finora

- Estill Voice Training and Voice Quality Control in Contemporary Commercial Singing: An Exploratory StudyDocumento8 pagineEstill Voice Training and Voice Quality Control in Contemporary Commercial Singing: An Exploratory StudyVisal SasidharanNessuna valutazione finora

- HUAWEI PowerCube 500Documento41 pagineHUAWEI PowerCube 500soumen95Nessuna valutazione finora

- Internal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XDocumento36 pagineInternal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XbiabamanbemanNessuna valutazione finora

- Caldon Lefm 240ci Ultrasonic Flow Meters: Integral Manifold DesignDocumento6 pagineCaldon Lefm 240ci Ultrasonic Flow Meters: Integral Manifold DesignJim LimNessuna valutazione finora

- Present Perfect Tense ExerciseDocumento13 paginePresent Perfect Tense Exercise39. Nguyễn Đăng QuangNessuna valutazione finora

- Little: PrinceDocumento18 pagineLittle: PrinceNara Serrano94% (18)

- Operation of A CRT MonitorDocumento8 pagineOperation of A CRT MonitorHarry W. HadelichNessuna valutazione finora

- Travelstart Ticket (ZA10477979) PDFDocumento2 pagineTravelstart Ticket (ZA10477979) PDFMatthew PretoriusNessuna valutazione finora

- New - BMP3005 - ABF - Assessment Brief - FDocumento5 pagineNew - BMP3005 - ABF - Assessment Brief - Fmilka traykovNessuna valutazione finora

- 2 Year Spares List For InstrumentationDocumento2 pagine2 Year Spares List For Instrumentationgudapati9Nessuna valutazione finora

- D15 Hybrid P1 QPDocumento6 pagineD15 Hybrid P1 QPShaameswary AnnadoraiNessuna valutazione finora

- Tso C197Documento6 pagineTso C197rdpereirNessuna valutazione finora

- Capital Structure and Leverage: Multiple Choice: ConceptualDocumento53 pagineCapital Structure and Leverage: Multiple Choice: ConceptualArya StarkNessuna valutazione finora

- Bakteri Anaerob: Morfologi, Fisiologi, Epidemiologi, Diagnosis, Pemeriksaan Sy. Miftahul El J.TDocumento46 pagineBakteri Anaerob: Morfologi, Fisiologi, Epidemiologi, Diagnosis, Pemeriksaan Sy. Miftahul El J.TAlif NakyukoNessuna valutazione finora

- British Birds 10 LondDocumento376 pagineBritish Birds 10 Londcassy98Nessuna valutazione finora

- Basler Electric TCCDocumento7 pagineBasler Electric TCCGalih Trisna NugrahaNessuna valutazione finora

- Chapter 15: Religion in The Modern World: World Religions: A Voyage of DiscoveryDocumento11 pagineChapter 15: Religion in The Modern World: World Religions: A Voyage of DiscoverysaintmaryspressNessuna valutazione finora

- Things You Can Do at Burnham ParkDocumento2 pagineThings You Can Do at Burnham ParkBcpo TeuNessuna valutazione finora

- Ch04Exp PDFDocumento17 pagineCh04Exp PDFConstantin PopescuNessuna valutazione finora

- Planning Effective Advertising and Promotion Strategies For A Target AudienceDocumento16 paginePlanning Effective Advertising and Promotion Strategies For A Target Audiencebakhoo12Nessuna valutazione finora

- Comparison of Sic Mosfet and Si IgbtDocumento10 pagineComparison of Sic Mosfet and Si IgbtYassir ButtNessuna valutazione finora

- Eu Clinical TrialDocumento4 pagineEu Clinical TrialAquaNessuna valutazione finora