Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Auto Zone Questions

Caricato da

malimojTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Auto Zone Questions

Caricato da

malimojCopyright:

Formati disponibili

AutoZone, Inc.

Questions

1. How has AutoZone’s stock price performed over the previous five years?

Note: Other than calculated AutoZone share price an SP500 Index annual return, you can also insert

a chart of AutoZone share price and SP500 behavior since 29/12/2006 (data available in an Excel file)

2. Other financial measures, such as sales growth, net income growth, EPS, EPS growth and

ROIC [EBIAT/(Equity+Debt)], are consistent with the stock price performance?

3. How does a stock repurchase work? Why would a company use this tactic?

4. What impact does the stock repurchase have on the main financial measures?

Note: Estimate the impact on sales growth, net income growth, EPS, EPS growth and ROIC, if during

the period between 2007 and 2011 the company had reduced the debt instead of spending the cash

on the share repurchases

5. How much of AutoZone’s stock price performance should we attribute to the share

repurchase program?

6. Assume that AutoZone is planning to stop its share repurchase program. What would be the

best alternative use of those cash flows? How each alternative might influence the portfolio

manager’s decision about his position in AutoZone?

Notes:

1. Be aware there isn’t a “correct answer” to the case. You should make some assumptions

that should be clearly justified to improve your final mark.

2. Your case solution should be sent by e-mail (which should include a pdf or word file and an

excel file with the calculations used to solve the case) until the end of November 18.

(fmanagement.mim@gmail.com).

3. I am available to help you regarding any doubt you will have during your work.

Good work!

Potrebbero piacerti anche

- AutoZone S Stock PDFDocumento3 pagineAutoZone S Stock PDFGeorgina AlpertNessuna valutazione finora

- AZODocumento9 pagineAZOLegacy Mib100% (5)

- Case 32 - CPK AssignmentDocumento9 pagineCase 32 - CPK AssignmentEli JohnsonNessuna valutazione finora

- Integrative Case 10 1 Projected Financial Statements For StarbucDocumento2 pagineIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyNessuna valutazione finora

- Fonderia Case AssignmentDocumento1 paginaFonderia Case Assignmentpoo_granger5229Nessuna valutazione finora

- Nike Inc. Case StudyDocumento3 pagineNike Inc. Case Studyshikhagupta3288Nessuna valutazione finora

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Documento6 pagineDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNessuna valutazione finora

- Rosetta Stone: Pricing The 2009 Ipo: Principal and Selling StockholdersDocumento8 pagineRosetta Stone: Pricing The 2009 Ipo: Principal and Selling StockholdersgerardoNessuna valutazione finora

- Nike Case - Team 5 Windsor - FinalDocumento10 pagineNike Case - Team 5 Windsor - Finalalosada01Nessuna valutazione finora

- California Pizza Kitchen Rev2Documento7 pagineCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- DuPont QuestionsDocumento1 paginaDuPont QuestionssandykakaNessuna valutazione finora

- Roche S Acquisition of GenentechDocumento34 pagineRoche S Acquisition of GenentechPradipkumar UmdaleNessuna valutazione finora

- Case Nike - Cost of Capital Fix 1Documento9 pagineCase Nike - Cost of Capital Fix 1Yousania RatuNessuna valutazione finora

- AMERICAN HOME PRODUCTS CORPORATION Group1.4Documento11 pagineAMERICAN HOME PRODUCTS CORPORATION Group1.4imawoodpusherNessuna valutazione finora

- TN15 Teletech Corporation 2005Documento8 pagineTN15 Teletech Corporation 2005kirkland1234567890100% (2)

- Jetblue Airways Ipo ValuationDocumento6 pagineJetblue Airways Ipo ValuationXing Liang HuangNessuna valutazione finora

- Case Study - Nike IncDocumento6 pagineCase Study - Nike Inc80starboy80Nessuna valutazione finora

- Rosario FinalDocumento13 pagineRosario FinalDiksha_Singh_6639Nessuna valutazione finora

- Michael McClintock Case1Documento2 pagineMichael McClintock Case1Mike MCNessuna valutazione finora

- Debt Policy at Ust Inc Case AnalysisDocumento23 pagineDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Case 5 Midland Energy Case ProjectDocumento7 pagineCase 5 Midland Energy Case ProjectCourse HeroNessuna valutazione finora

- Rosetta Stone IPODocumento5 pagineRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNessuna valutazione finora

- Case Analysis of NikeDocumento6 pagineCase Analysis of NikeZackyNessuna valutazione finora

- Deluxe Corporation Case StudyDocumento3 pagineDeluxe Corporation Case StudyHEM BANSALNessuna valutazione finora

- What Can The Historical Income StatementsDocumento3 pagineWhat Can The Historical Income Statementsleo147258963100% (2)

- LinearDocumento6 pagineLinearjackedup211Nessuna valutazione finora

- Caso Dupont - Keren MendesDocumento17 pagineCaso Dupont - Keren MendesKeren NovaesNessuna valutazione finora

- DPC Case SolutionDocumento11 pagineDPC Case Solutionburiticas992Nessuna valutazione finora

- Gainesboro Machine ToolsDocumento2 pagineGainesboro Machine ToolsedselNessuna valutazione finora

- Appendix TN1 TN43 Flinder Valves and Controls IncDocumento1 paginaAppendix TN1 TN43 Flinder Valves and Controls IncStephanie WidjayaNessuna valutazione finora

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocumento11 pagineSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNessuna valutazione finora

- This Study Resource Was: Group 9 - M&M Pizza Case StudyDocumento2 pagineThis Study Resource Was: Group 9 - M&M Pizza Case StudyAsma AyedNessuna valutazione finora

- Debt Policy at Ust IncDocumento7 pagineDebt Policy at Ust IncIrfan Mohd0% (1)

- Group DDocumento16 pagineGroup DAbhishek VermaNessuna valutazione finora

- Nike, IncDocumento19 pagineNike, IncRavi PrakashNessuna valutazione finora

- Assignment 3 Week 3 Thecostofcapitalforgoffcomputerinc GM Drrahuldparikh 120620071214 Phpapp01Documento13 pagineAssignment 3 Week 3 Thecostofcapitalforgoffcomputerinc GM Drrahuldparikh 120620071214 Phpapp01Chris Galvez100% (1)

- Jun18l1-Ep04 QDocumento18 pagineJun18l1-Ep04 QjuanNessuna valutazione finora

- Business Analysis and Valuation IFRS Edition 3rd Ed - RemovedDocumento48 pagineBusiness Analysis and Valuation IFRS Edition 3rd Ed - RemovedAthira Khairunnisa100% (1)

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocumento2 pagineM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현100% (1)

- West Teleservice: Case QuestionsDocumento1 paginaWest Teleservice: Case QuestionsAlejandro García AcostaNessuna valutazione finora

- Chestnut FoodsDocumento2 pagineChestnut FoodsNiyanthesh Reddy25% (4)

- JetBlue Airways IPO ValuationDocumento9 pagineJetBlue Airways IPO ValuationMuyeedulIslamNessuna valutazione finora

- Wrigley CaseDocumento12 pagineWrigley Caseresat gürNessuna valutazione finora

- BCE: INC Case AnalysisDocumento6 pagineBCE: INC Case AnalysisShuja Ur RahmanNessuna valutazione finora

- Case Study - Linear Tech - Christopher Taylor - SampleDocumento9 pagineCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Nessuna valutazione finora

- Bond Problem - Fixed Income ValuationDocumento1 paginaBond Problem - Fixed Income ValuationAbhishek Garg0% (2)

- Tire City IncDocumento3 pagineTire City IncAlberto RcNessuna valutazione finora

- Accounting For The IphoneDocumento9 pagineAccounting For The IphoneFatihahZainalLim100% (1)

- Linear Technology Payout Policy Case 3Documento4 pagineLinear Technology Payout Policy Case 3Amrinder SinghNessuna valutazione finora

- Autozone: Case StudyDocumento17 pagineAutozone: Case StudyPatcharanan SattayapongNessuna valutazione finora

- Facebook IPO SlidesDocumento14 pagineFacebook IPO SlidesLof Kyra Nayyara100% (1)

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Da EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Nessuna valutazione finora

- Case 28 - Aanalysis Guidance - Autozone, Inc PDFDocumento1 paginaCase 28 - Aanalysis Guidance - Autozone, Inc PDFVoramon PolkertNessuna valutazione finora

- Fonderia Di Torino FinancialsDocumento4 pagineFonderia Di Torino Financialspeachrose12Nessuna valutazione finora

- Critical Financial Review: Understanding Corporate Financial InformationDa EverandCritical Financial Review: Understanding Corporate Financial InformationNessuna valutazione finora

- Quantitative Analytics in Debt Valuation & ManagementDa EverandQuantitative Analytics in Debt Valuation & ManagementNessuna valutazione finora

- Business Valuation A Complete Guide - 2020 EditionDa EverandBusiness Valuation A Complete Guide - 2020 EditionNessuna valutazione finora

- The Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEDocumento2 pagineThe Term Paper FIN 408, Course Title: Corporate Finance Answer The Following Questions From The Annual Reports of One of The Listed Companies in DSEAntora HoqueNessuna valutazione finora

- Corporate Finance:Project Help Manual: Submission Required. No PDF SubmissionDocumento4 pagineCorporate Finance:Project Help Manual: Submission Required. No PDF SubmissionHari AtharshNessuna valutazione finora

- Flagged by The System On. Resolved by On. Student Reason: Moderator ReasonDocumento3 pagineFlagged by The System On. Resolved by On. Student Reason: Moderator ReasonPetraNessuna valutazione finora

- HRM Individual Assignment PDFDocumento2 pagineHRM Individual Assignment PDFmalimojNessuna valutazione finora

- Hola-Kola - Capital Budgeting QuestionsDocumento1 paginaHola-Kola - Capital Budgeting QuestionsmalimojNessuna valutazione finora

- Hola-Kola - Capital Budgeting QuestionsDocumento1 paginaHola-Kola - Capital Budgeting QuestionsmalimojNessuna valutazione finora

- HRM Individual Assignment2Documento2 pagineHRM Individual Assignment2malimojNessuna valutazione finora

- Answer To 5th Question (Bebida Sol)Documento1 paginaAnswer To 5th Question (Bebida Sol)malimojNessuna valutazione finora

- Hola-Kola - Capital Budgeting QuestionsDocumento1 paginaHola-Kola - Capital Budgeting QuestionsmalimojNessuna valutazione finora

- Create Permission RoleDocumento13 pagineCreate Permission RolemalimojNessuna valutazione finora

- Create A Permission GroupDocumento7 pagineCreate A Permission GroupmalimojNessuna valutazione finora

- DarcDocumento9 pagineDarcJunior BermudezNessuna valutazione finora

- Broken BondsDocumento20 pagineBroken Bondsapi-316744816Nessuna valutazione finora

- Talking Art As The Spirit Moves UsDocumento7 pagineTalking Art As The Spirit Moves UsUCLA_SPARCNessuna valutazione finora

- Environmental Economics Pollution Control: Mrinal Kanti DuttaDocumento253 pagineEnvironmental Economics Pollution Control: Mrinal Kanti DuttashubhamNessuna valutazione finora

- Hole CapacityDocumento2 pagineHole CapacityAbdul Hameed OmarNessuna valutazione finora

- Ricoh IM C2000 IM C2500: Full Colour Multi Function PrinterDocumento4 pagineRicoh IM C2000 IM C2500: Full Colour Multi Function PrinterKothapalli ChiranjeeviNessuna valutazione finora

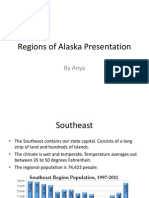

- Regions of Alaska PresentationDocumento15 pagineRegions of Alaska Presentationapi-260890532Nessuna valutazione finora

- g6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERDocumento23 pagineg6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERPrincess Nicole LugtuNessuna valutazione finora

- Hamstring - WikipediaDocumento21 pagineHamstring - WikipediaOmar MarwanNessuna valutazione finora

- Mcom Sem 4 Project FinalDocumento70 pagineMcom Sem 4 Project Finallaxmi iyer75% (4)

- FDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaDocumento3 pagineFDA Approves First Gene Therapy, Betibeglogene Autotemcel (Zynteglo), For Beta-ThalassemiaGiorgi PopiashviliNessuna valutazione finora

- Plaza 66 Tower 2 Structural Design ChallengesDocumento13 paginePlaza 66 Tower 2 Structural Design ChallengessrvshNessuna valutazione finora

- Acute Coronary SyndromeDocumento30 pagineAcute Coronary SyndromeEndar EszterNessuna valutazione finora

- Test Your Knowledge - Study Session 1Documento4 pagineTest Your Knowledge - Study Session 1My KhanhNessuna valutazione finora

- 2SB817 - 2SD1047 PDFDocumento4 pagine2SB817 - 2SD1047 PDFisaiasvaNessuna valutazione finora

- Digital MetersDocumento47 pagineDigital MetersherovhungNessuna valutazione finora

- Equivalent Fractions Activity PlanDocumento6 pagineEquivalent Fractions Activity Planapi-439333272Nessuna valutazione finora

- Gods Omnipresence in The World On Possible MeaninDocumento20 pagineGods Omnipresence in The World On Possible MeaninJoan Amanci Casas MuñozNessuna valutazione finora

- Analysis of Electric Machinery Krause Manual Solution PDFDocumento2 pagineAnalysis of Electric Machinery Krause Manual Solution PDFKuldeep25% (8)

- Waterstop TechnologyDocumento69 pagineWaterstop TechnologygertjaniNessuna valutazione finora

- of Thesis ProjectDocumento2 pagineof Thesis ProjectmoonNessuna valutazione finora

- DQ Vibro SifterDocumento13 pagineDQ Vibro SifterDhaval Chapla67% (3)

- DPSD ProjectDocumento30 pagineDPSD ProjectSri NidhiNessuna valutazione finora

- Chemistry Test 1Documento2 pagineChemistry Test 1shashankNessuna valutazione finora

- History of The Sikhs by Major Henry Cour PDFDocumento338 pagineHistory of The Sikhs by Major Henry Cour PDFDr. Kamalroop SinghNessuna valutazione finora

- IEC ShipsDocumento6 pagineIEC ShipsdimitaringNessuna valutazione finora

- Crown WF-3000 1.2Documento5 pagineCrown WF-3000 1.2Qirat KhanNessuna valutazione finora

- Deal Report Feb 14 - Apr 14Documento26 pagineDeal Report Feb 14 - Apr 14BonviNessuna valutazione finora

- Comparitive Study ICICI & HDFCDocumento22 pagineComparitive Study ICICI & HDFCshah faisal100% (1)

- The Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexDocumento9 pagineThe Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexRevanKumarBattuNessuna valutazione finora