Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ajanta Pharma LTD.: Liquidity

Caricato da

Deepak DashTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ajanta Pharma LTD.: Liquidity

Caricato da

Deepak DashCopyright:

Formati disponibili

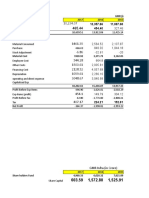

Ajanta Pharma Ltd.

Liquidity, Working Cycle & Turnover Ratios : Mar 2010 -

Mar 2019 : Non-Annualised : Rs. Crore

Mar-10 Mar-11 Mar-12 Mar-13

12 mths 12 mths 12 mths 12 mths

IGAAP IGAAP IGAAP IGAAP

-

Liquidity

Cash to current liabilities (times) 0.016 0.008 0.007 0.096

Cash to avg cost of sales (times) 5.347 3.16 2.658 8.321

Quick ratio (times) 0.762 0.435 0.535 0.734

Current ratio (times) 1.676 0.994 1.222 1.42

Total outside liabilities / tangible net worth 1.648 1.231 1.342 0.922

Total term liabilities / tangible net worth 1.156 0.377 0.4 0.208

Debt to equity ratio (times) 1.156 0.734 0.7 0.347

Long term Borrowings to PBDITA (net of P&E&OI&FI) 0 0.653 0.566 0.344

Borrowings to PBDITA (net of P&E&OI&FI) 2.775 1.749 1.429 0.587

Interest cover (times) 2.761 4.209 6.687 9.846

Interest incidence (%) 8.6 8.77 6.87 8.53

Structure of current assets (% of total)

Short term investments 0 0 0 0

Inventories 0 49.1 52.51 44.05

Trade receivables & Bills receivables 0 38.7 40.56 41.49

Other short term receivables 0 1.13 1 1.13

Cash & bank balance 4.76 1.64 7.71

Loans & advances by finance cos (short term) 0 0 0 0

Short term loans & advances 0 6.31 4.29 5.63

Asset held for sale or transfer 0 0 0 0

Unamortised expenses (short term) 0 0 0 0

Working capital & turnover ratios

Net working capital 77.77 -1.04 54.48 91.51

Net working capital (cost of sales method) 169.64 125.09 168.28 118.04

Working cycle (days)

Raw material cycle 130.43 126.54 96.77 77.02

WIP cycle 9.97 9.61 13.3 11.88

Finished goods cycle 83.63 55.21 47.78 51.83

Debtors cycle 86.48 63.65 59.96 56.27

Gross working capital cycle 310.51 255.01 217.81 197

Creditors cycle 123.67 139.64 105.53 135.86

Net working capital cycle 186.84 115.38 112.27 61.14

Turnover ratios (times)

Raw material turnover 2.798 2.884 3.772 4.739

WIP turnover 36.609 37.966 27.435 30.722

Finished goods turnover 4.364 6.611 7.64 7.042

Debtors turnover 4.221 5.735 6.088 6.487

Creditors turnover 2.951 2.614 3.459 2.687

Asset utilisation ratios (times)

Total income / total assets 0.836 0.98 1.116 1.317

Total income / compensation to employees 8.67 7.835 7.038 7.388

Sales / GFA excl reval 1.957 1.806 1.909 2.22

Sales / NFA excl reval 2.646 2.52 2.766 3.386

Sales net of repairs / NFA excl reval 2.646 2.52 2.766 3.386

Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19

12 mths 12 mths 12 mths 12 mths 12 mths 12 mths

IGAAP IGAAP INDAS INDAS INDAS INDAS

0.319 0.509 0.429 0.948 0.73 0.313

14.412 27.635 23.565 7.649 7.64 9.097

1.02 1.541 1.886 2.56 2.297 1.83

1.613 2.214 2.652 3.425 3.382 3.214

0.642 0.385 0.265 0.175 0.201 0.195

0.128 0.068 0.03 0 0 0

0.24 0.09 0.07 0.004 0.001 0.009

0.197 0.112 0.063 0 0 0

0.372 0.149 0.15 0.008 0.004 0.037

39.629 91.196 136.59 520.79 2,344.54 1,252.90

5.16 3.69 3.32 2.91 6.11 3.98

12.12 3.4 10.81 23.28 16.57 6.14

32.79 26.71 26.73 22.99 28.83 39.27

39.04 42.03 49.36 43.71 39.79 40.61

0.59 2.06 0.1 0.16 2.94 3.5

6.41 18.44 4.65 2.93 3.51 3.4

0 0 0 0 0 0

9.04 7.36 8.34 6.94 8.36 7.08

0 0 0 0 0 0

0 0 0 0 0 0

161.77 297.3 418.12 514.66 715.02 679.31

121.89 210.88 275.56 274.81 475.4 757.07

59.3 69.26 68.04 69.55 101.95 155.01

9.15 7.43 5.53 5.66 4.85 8.84

46.77 34.96 40.24 41 45.17 61.75

51 55.76 68.58 69.22 77.66 89.2

166.21 167.41 182.4 185.43 229.63 314.79

114.31 91.83 94.18 107.75 106.36 122.5

51.91 75.57 88.22 77.69 123.27 192.29

6.155 5.27 5.364 5.248 3.58 2.355

39.88 49.126 65.969 64.477 75.196 41.305

7.805 10.442 9.07 8.902 8.08 5.911

7.157 6.546 5.322 5.273 4.7 4.092

3.193 3.975 3.875 3.387 3.432 2.98

1.46 1.428 1.321 1.182 0.934 0.769

7.79 7.521 8.131 8.465 6.599 5.619

2.6 2.848 2.644 2.369 1.635 1.201

4.265 5.135 4.47 3.625 2.274 1.612

4.265 5.135 4.47 3.625 2.274 1.612

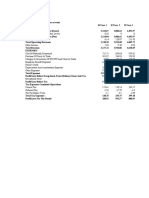

Liquidity, Working Cycle & Turnover Ratios : Mar 2017 - Mar 2019 : Non-

Annualised : Rs. Crore

Mar-17 Mar-18 Mar-19

12 mths 12 mths 12 mths

INDAS INDAS INDAS

-

Liquidity

Cash to current liabilities (times) 0.948 0.73 0.313

Cash to avg cost of sales (times) 7.649 7.64 9.097

Quick ratio (times) 2.56 2.297 1.83

Current ratio (times) 3.425 3.382 3.214

Total outside liabilities / tangible net worth 0.175 0.201 0.195

Total term liabilities / tangible net worth 0 0 0

Debt to equity ratio (times) 0.004 0.001 0.009

Long term Borrowings to PBDITA (net of P&E&OI&FI) 0 0 0

Borrowings to PBDITA (net of P&E&OI&FI) 0.008 0.004 0.037

Interest cover (times) 520.79 2,344.54 1,252.90

Interest incidence (%) 2.91 6.11 3.98

Structure of current assets (% of total)

Short term investments 23.28 16.57 6.14

Inventories 22.99 28.83 39.27

Trade receivables & Bills receivables 43.71 39.79 40.61

Other short term receivables 0.16 2.94 3.5

Cash & bank balance 2.93 3.51 3.4

Loans & advances by finance cos (short term) 0 0 0

Short term loans & advances 6.94 8.36 7.08

Asset held for sale or transfer 0 0 0

Unamortised expenses (short term) 0 0 0

Working capital & turnover ratios

Net working capital 514.66 715.02 679.31

Net working capital (cost of sales method) 274.81 475.4 757.07

Working cycle (days)

Raw material cycle 69.55 101.95 155.01

WIP cycle 5.66 4.85 8.84

Finished goods cycle 41 45.17 61.75

Debtors cycle 69.22 77.66 89.2

Gross working capital cycle 185.43 229.63 314.79

Creditors cycle 107.75 106.36 122.5

Net working capital cycle 77.69 123.27 192.29

Turnover ratios (times)

Raw material turnover 5.248 3.58 2.355

WIP turnover 64.477 75.196 41.305

Finished goods turnover 8.902 8.08 5.911

Debtors turnover 5.273 4.7 4.092

Creditors turnover 3.387 3.432 2.98

Asset utilisation ratios (times)

Total income / total assets 1.182 0.934 0.769

Total income / compensation to employees 8.465 6.599 5.619

Sales / GFA excl reval 2.369 1.635 1.201

Sales / NFA excl reval 3.625 2.274 1.612

Sales net of repairs / NFA excl reval 3.625 2.274 1.612

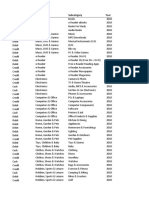

Potrebbero piacerti anche

- Schaum's Outline of Basic Business Mathematics, 2edDa EverandSchaum's Outline of Basic Business Mathematics, 2edValutazione: 5 su 5 stelle5/5 (1)

- Balance Sheet: Particulars 2014 2015 AssetsDocumento11 pagineBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNessuna valutazione finora

- Balance Sheet - in Rs. Cr.Documento72 pagineBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- AMULDocumento22 pagineAMULsurprise MFNessuna valutazione finora

- (All Non-Ratios in Millions)Documento13 pagine(All Non-Ratios in Millions)Aninda DuttaNessuna valutazione finora

- Vitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Documento6 pagineVitrox'S Income Statement For Years Ended 2016,2017,2018 2018 2017 2016 (RM) '000 (RM) '000 (RM) '000Hong JunNessuna valutazione finora

- FM WK 5 PmuDocumento30 pagineFM WK 5 Pmupranjal92pandeyNessuna valutazione finora

- Ceat Balance SheetDocumento2 pagineCeat Balance Sheetkcr kc100% (2)

- Company Info - Print FinancialsDocumento2 pagineCompany Info - Print FinancialsDhruv NarangNessuna valutazione finora

- Financial Management II ProjectDocumento11 pagineFinancial Management II ProjectsimlimisraNessuna valutazione finora

- Financial Modelling CIA 2Documento45 pagineFinancial Modelling CIA 2Saloni Jain 1820343Nessuna valutazione finora

- Arch PharmalabsDocumento6 pagineArch PharmalabsChandan VirmaniNessuna valutazione finora

- Term Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional UniversityDocumento9 pagineTerm Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional Universitymanpreet1415Nessuna valutazione finora

- Aditya nuVODocumento12 pagineAditya nuVOPriyanshi yadavNessuna valutazione finora

- Juhayna Food Industries: in Millions of EGP (Except For Per Share Items)Documento11 pagineJuhayna Food Industries: in Millions of EGP (Except For Per Share Items)Shokry AminNessuna valutazione finora

- GMR (In Crore) 2017 2016 2015Documento20 pagineGMR (In Crore) 2017 2016 2015Shashank PatelNessuna valutazione finora

- 15 - Manish - DLFDocumento8 pagine15 - Manish - DLFrajat_singlaNessuna valutazione finora

- 17 - Manoj Batra - Hero Honda MotorsDocumento13 pagine17 - Manoj Batra - Hero Honda Motorsrajat_singlaNessuna valutazione finora

- Asian PaintsDocumento40 pagineAsian PaintsHemendra GuptaNessuna valutazione finora

- Total Shareholders Funds 12,797 13,195 10,206 10,505 10,485Documento6 pagineTotal Shareholders Funds 12,797 13,195 10,206 10,505 10,485sayan duttaNessuna valutazione finora

- Minda Industries - Forecasted SpreadsheetDocumento47 pagineMinda Industries - Forecasted SpreadsheetAmit Kumar SinghNessuna valutazione finora

- Cipla Balance SheetDocumento2 pagineCipla Balance SheetNEHA LAL100% (1)

- AFSA - Group 7 - Havells Vs BajajDocumento103 pagineAFSA - Group 7 - Havells Vs BajajArnnava SharmaNessuna valutazione finora

- CHAPTER - 4 Data Analysis and InterpretationDocumento12 pagineCHAPTER - 4 Data Analysis and InterpretationSarva ShivaNessuna valutazione finora

- CV Assignment - Agneesh DuttaDocumento9 pagineCV Assignment - Agneesh DuttaAgneesh DuttaNessuna valutazione finora

- Hero Motocorp FinancialsDocumento41 pagineHero Motocorp FinancialssahilkuNessuna valutazione finora

- LDG - Financial TemplateDocumento20 pagineLDG - Financial TemplateQuan LeNessuna valutazione finora

- VERTICAL LIABILITIES 1Documento4 pagineVERTICAL LIABILITIES 1NL CastañaresNessuna valutazione finora

- Balance Sheet of Dabur India - in Rs. Cr.Documento45 pagineBalance Sheet of Dabur India - in Rs. Cr.Sourabh ChiprikarNessuna valutazione finora

- Bemd RatiosDocumento12 pagineBemd RatiosPRADEEP CHAVANNessuna valutazione finora

- Financial Analysis (HAL) FinalDocumento22 pagineFinancial Analysis (HAL) FinalAbhishek SoniNessuna valutazione finora

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocumento9 pagineRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNessuna valutazione finora

- Apollo Tyres: PrintDocumento2 pagineApollo Tyres: PrintTiaNessuna valutazione finora

- Ashok Leyland Limited: RatiosDocumento6 pagineAshok Leyland Limited: RatiosAbhishek BhattacharjeeNessuna valutazione finora

- ABB India: PrintDocumento2 pagineABB India: PrintAbhay Kumar SinghNessuna valutazione finora

- Jubilant CompleteDocumento16 pagineJubilant CompleteShivamKhareNessuna valutazione finora

- Jet AirwaysDocumento5 pagineJet AirwaysKarthik SrmNessuna valutazione finora

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Documento128 pagineGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNessuna valutazione finora

- Financial Statements - TATA - MotorsDocumento5 pagineFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNessuna valutazione finora

- Balance Sheet of TCSDocumento8 pagineBalance Sheet of TCSAmit LalchandaniNessuna valutazione finora

- Balance Sheet of TCSDocumento8 pagineBalance Sheet of TCSSurbhi LodhaNessuna valutazione finora

- Relaxo Footwear - Updated BSDocumento54 pagineRelaxo Footwear - Updated BSRonakk MoondraNessuna valutazione finora

- Eveready Industries India Balance Sheet - in Rs. Cr.Documento5 pagineEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNessuna valutazione finora

- Hero MotoCorp LTDDocumento10 pagineHero MotoCorp LTDpranav sarawagiNessuna valutazione finora

- Balance Sheet: Hindalco IndustriesDocumento20 pagineBalance Sheet: Hindalco Industriesparinay202Nessuna valutazione finora

- Swot Analysis I. Strenghts: WeaknessesDocumento5 pagineSwot Analysis I. Strenghts: WeaknessesNiveditha MNessuna valutazione finora

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocumento9 pagineMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNessuna valutazione finora

- Ratio Analysis: Balance Sheet of HPCLDocumento8 pagineRatio Analysis: Balance Sheet of HPCLrajat_singlaNessuna valutazione finora

- Moneycontrol United SpiritsDocumento2 pagineMoneycontrol United SpiritsBitan GhoshNessuna valutazione finora

- MaricoDocumento13 pagineMaricoRitesh KhobragadeNessuna valutazione finora

- Balance Sheet ACC Sources of FundsDocumento13 pagineBalance Sheet ACC Sources of FundsAshish SinghNessuna valutazione finora

- Asian Paints BsDocumento2 pagineAsian Paints BsPriyalNessuna valutazione finora

- Housing Development Finance Corporation: PrintDocumento2 pagineHousing Development Finance Corporation: PrintAbdul Khaliq ChoudharyNessuna valutazione finora

- MKT Ca1Documento96 pagineMKT Ca1Nainpreet KaurNessuna valutazione finora

- Balance Sheet of Essar Oil: - in Rs. Cr.Documento7 pagineBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNessuna valutazione finora

- Three Statement ModelDocumento9 pagineThree Statement ModelAnkit SharmaNessuna valutazione finora

- MBA06070 VinayJaju AsianPaintsDocumento15 pagineMBA06070 VinayJaju AsianPaintsVinay JajuNessuna valutazione finora

- Finance Satyam AnalysisDocumento12 pagineFinance Satyam AnalysisNeha AgarwalNessuna valutazione finora

- BHEL Valuation of CompanyDocumento23 pagineBHEL Valuation of CompanyVishalNessuna valutazione finora

- Balancesheet - MRF LTDDocumento4 pagineBalancesheet - MRF LTDAnuNessuna valutazione finora

- ChatLog Courses Mojo Session Sunday 21 June 10 AM 2020 - 06 - 21 10 - 38Documento1 paginaChatLog Courses Mojo Session Sunday 21 June 10 AM 2020 - 06 - 21 10 - 38Deepak DashNessuna valutazione finora

- ChatLog Couses Mojo Class 2020 - 05 - 09 12 - 12Documento3 pagineChatLog Couses Mojo Class 2020 - 05 - 09 12 - 12Deepak DashNessuna valutazione finora

- ChatLog CoursesMojo Finance Class 2020 - 05 - 02 12 - 55Documento5 pagineChatLog CoursesMojo Finance Class 2020 - 05 - 02 12 - 55Deepak DashNessuna valutazione finora

- ChatLog Courses Mojo Internship Class 1 2020 - 04 - 26 12 - 35Documento4 pagineChatLog Courses Mojo Internship Class 1 2020 - 04 - 26 12 - 35Deepak DashNessuna valutazione finora

- The POSH InfringementDocumento9 pagineThe POSH InfringementDeepak DashNessuna valutazione finora

- SumitDocumento1 paginaSumitDeepak DashNessuna valutazione finora

- Countries and Currencies: What Is Currency?Documento6 pagineCountries and Currencies: What Is Currency?Salman SiddiquiNessuna valutazione finora

- BE-5 - Dr. TrilokDocumento43 pagineBE-5 - Dr. TrilokDeepak DashNessuna valutazione finora

- ChatLog Courses Mojo Class Sat 6th June 10 AM 2020 - 06 - 06 11 - 43Documento3 pagineChatLog Courses Mojo Class Sat 6th June 10 AM 2020 - 06 - 06 11 - 43Deepak DashNessuna valutazione finora

- BE-3 - Dr. TrilokDocumento29 pagineBE-3 - Dr. TrilokDeepak DashNessuna valutazione finora

- BE-11 - Dr. Trilok - Corporate GovernanceDocumento18 pagineBE-11 - Dr. Trilok - Corporate GovernanceDeepak DashNessuna valutazione finora

- AI in The Field of Medical ScienceDocumento6 pagineAI in The Field of Medical ScienceDeepak DashNessuna valutazione finora

- The Evolution of The Internet of Things: White PaperDocumento7 pagineThe Evolution of The Internet of Things: White PaperJuan BendeckNessuna valutazione finora

- Ethical Dilemma-MahabharatDocumento25 pagineEthical Dilemma-MahabharatDeepak DashNessuna valutazione finora

- SumitDocumento1 paginaSumitDeepak DashNessuna valutazione finora

- Mode of Payment Category Subcategory YearDocumento87 pagineMode of Payment Category Subcategory YearDeepak DashNessuna valutazione finora

- EXL - Session 2 FunctionsDocumento327 pagineEXL - Session 2 FunctionsDeepak DashNessuna valutazione finora

- BiddingDocumento3 pagineBiddingDeepak DashNessuna valutazione finora

- Registration Number:: Post:::::::::::::: Suman DashDocumento3 pagineRegistration Number:: Post:::::::::::::: Suman DashDeepak DashNessuna valutazione finora

- MACRODocumento7 pagineMACRODeepak DashNessuna valutazione finora

- SumitDocumento1 paginaSumitDeepak DashNessuna valutazione finora

- AI in The Field of Medical ScienceDocumento6 pagineAI in The Field of Medical ScienceDeepak DashNessuna valutazione finora

- Registration Number:: Post:::::::::::::: Suman DashDocumento3 pagineRegistration Number:: Post:::::::::::::: Suman DashDeepak DashNessuna valutazione finora

- Total Result 3,405 9,280 6,116 1,083 259 2,391 7,547 1,677 Total Result 3,216 3,114 5,770 3,950Documento21 pagineTotal Result 3,405 9,280 6,116 1,083 259 2,391 7,547 1,677 Total Result 3,216 3,114 5,770 3,950Deepak DashNessuna valutazione finora

- Brand Study Advertising Plan For Titan Watches PDFDocumento43 pagineBrand Study Advertising Plan For Titan Watches PDFfftddfdsdNessuna valutazione finora

- Table 1 - 5Documento12 pagineTable 1 - 5AndresAguirreCastanoNessuna valutazione finora

- Ajanta Pharma LTD.: Margins On Income On Total IncomeDocumento2 pagineAjanta Pharma LTD.: Margins On Income On Total IncomeDeepak DashNessuna valutazione finora

- Ajanta Pharma LTD.: Net Fixed AssetsDocumento4 pagineAjanta Pharma LTD.: Net Fixed AssetsDeepak DashNessuna valutazione finora

- Mexicana Wire WorksDocumento1 paginaMexicana Wire WorksDeepak DashNessuna valutazione finora

- Accounting Principles: Rapid ReviewDocumento3 pagineAccounting Principles: Rapid ReviewAhmedNiazNessuna valutazione finora

- ABM Module 4Documento6 pagineABM Module 4Xyxy LofrancoNessuna valutazione finora

- Ho and Branch HandoutDocumento4 pagineHo and Branch HandoutDelsey SerephinaNessuna valutazione finora

- MS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingDocumento7 pagineMS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingMonica GarciaNessuna valutazione finora

- Chapter 2: Asset-Based Valuation Asset-Based ValuationDocumento6 pagineChapter 2: Asset-Based Valuation Asset-Based ValuationJoyce Dela CruzNessuna valutazione finora

- CH.7 Plant Assets, Natural Resources, & IntangiblesDocumento98 pagineCH.7 Plant Assets, Natural Resources, & IntangiblesJuan Andres MarquezNessuna valutazione finora

- Ratio TestDocumento1 paginaRatio TestRavi UdeshiNessuna valutazione finora

- Part II: Discussion QuestionsDocumento8 paginePart II: Discussion Questionssamuel39Nessuna valutazione finora

- Quizzes Answers 15 29Documento7 pagineQuizzes Answers 15 29Minie KimNessuna valutazione finora

- Hoba Icare Answer KeysDocumento15 pagineHoba Icare Answer KeysMark Gelo WinchesterNessuna valutazione finora

- Maynard Company (A)Documento2 pagineMaynard Company (A)flamebuster007Nessuna valutazione finora

- Financial Accounting & Reporting 2: PX - Set SolutionDocumento15 pagineFinancial Accounting & Reporting 2: PX - Set SolutionGabrielle Marie Rivera33% (3)

- Write Your Answer For Part A HereDocumento9 pagineWrite Your Answer For Part A HereMATHEW JACOBNessuna valutazione finora

- BusscomDocumento3 pagineBusscomneo14Nessuna valutazione finora

- 03 AddDocumento13 pagine03 AddHà My NguyễnNessuna valutazione finora

- FAM2e Chap2 PresentationDocumento51 pagineFAM2e Chap2 Presentationakhilyerawar7013100% (1)

- S7 Capital Structure Online VersionDocumento34 pagineS7 Capital Structure Online Versionconstruction omanNessuna valutazione finora

- Notes ReceiDocumento2 pagineNotes ReceiDIANE EDRANessuna valutazione finora

- Managerial Accounting Fourth Canadian Edition 4Th Edition Full ChapterDocumento23 pagineManagerial Accounting Fourth Canadian Edition 4Th Edition Full Chaptergeorge.terrell473100% (20)

- Update Harga: Real-Time: QualityDocumento44 pagineUpdate Harga: Real-Time: QualityNul AsashiNessuna valutazione finora

- Quiz TM 5 AKMDocumento2 pagineQuiz TM 5 AKMRani AdhirasariNessuna valutazione finora

- Raymond LTD Balance SheetDocumento15 pagineRaymond LTD Balance Sheetvaibhav guptaNessuna valutazione finora

- Chapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocumento28 pagineChapter 17: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsZee GuillebeauxNessuna valutazione finora

- Test Bank For Advanced Financial Accounting 7 e 7th Edition Thomas H Beechy V Umashanker Trivedi Kenneth e MacaulayDocumento16 pagineTest Bank For Advanced Financial Accounting 7 e 7th Edition Thomas H Beechy V Umashanker Trivedi Kenneth e MacaulayPearline Teel100% (35)

- شلبتر 6Documento8 pagineشلبتر 6Ahmad RahhalNessuna valutazione finora

- CBA - Fundamentals of Accounting - UpdatedDocumento4 pagineCBA - Fundamentals of Accounting - UpdatedVher DucayNessuna valutazione finora

- Managerial and Cost Accounting Exercises IDocumento20 pagineManagerial and Cost Accounting Exercises IRithik VisuNessuna valutazione finora

- AAHamlen3e Student Quiz Ch03 021015 PDFDocumento7 pagineAAHamlen3e Student Quiz Ch03 021015 PDFRita LuncefordNessuna valutazione finora

- MC6 Matcha Creations: InstructionsDocumento2 pagineMC6 Matcha Creations: InstructionsReza eka PutraNessuna valutazione finora

- Nonprofit Accounting LJDocumento26 pagineNonprofit Accounting LJFreddhy AndresNessuna valutazione finora