Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Impact of Capital Structure On Banking Performance (A Case Study of Pakistan)

Caricato da

Urooj FatimaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Impact of Capital Structure On Banking Performance (A Case Study of Pakistan)

Caricato da

Urooj FatimaCopyright:

Formati disponibili

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/275620217

Impact of Capital Structure on Banking Performance (A Case Study of Pakistan)

Article · February 2013

CITATIONS READS

26 9,945

3 authors, including:

Ammar Ali Gull

Ghulam Ishaq Khan Institute of Engineering Sciences and Technology

9 PUBLICATIONS 74 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Corporate Board Gender Quotas View project

All content following this page was uploaded by Ammar Ali Gull on 29 April 2015.

The user has requested enhancement of the downloaded file.

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

Impact of Capital Structure on Banking Performance

(A Case Study of Pakistan)

Muhammad Muzaffar Saeed1

MS/MBA (Banking & Finance)

GC University Faisalabad, Pakistan

Ammar Ali Gull2

MS/MBA (Banking & Finance)

GC University Faisalabad, Pakistan

Muhammad Yasran Rasheed3

MS/MBA (Banking & Finance)

GC University Faisalabad, Pakistan

Corresponding Author

Muhammad Muzaffar Saeed

MBA/ MS (Banking & Finance)

GC University Faisalabad, Pakistan

Abstract

This paper examines the impact of capital structure on performance of Pakistani banks. The study extends empirical

work on capital structure determinants of banks within country over the period of five years from 2007 to 2011 by

utilizing data of banks listed at Karachi stock exchange. Multiple regression models are applied to estimate the

relationship between capital structure and banking performance. Performance is measured by return on assets, return

on equity and earnings per share. Determinants of capital structure includes long term debt to capital ratio, short

term debt to capital ratio and total debt to capital ratio. Findings of the study validated a positive relationship

between determinants of capital structure and performance of banking industry.

Keywords: Capital, Long term Debt, short term Debt, Return on Assets, Return on Equity and Earnings per share.

1. Introduction

Capital structure consists of debt and equity used to finance the firm. Capital structure is one of the major topics

among scholars in finance. The ability of the organization to carry out their stakeholders need is closely related to

the capital structure. Capital structure in finance term means the way a firm finances his assets across the blend of

debt, equity or hybrid securities (Saad, 2010). Capital structure of the organization is very hard to determine.

Financial managers are facing difficulties in precisely determining the optimal capital structure. Optimal capital

structure means with a minimum weighted average cost of capital and thus maximize the value of organization. A

business utilizes various kinds of financing to operate a company efficiently. Funds Framework (CS) is really

associated with various kinds of funding utilized by a company to get assets essential for its procedures as well as

development. Funds framework mainly includes long-term financial debt, preferred share and interest really worth.

It may be quantified if you take just how much of every kind of funding a business retains as a portion of its

funding. Funds Framework differs from monetary framework because it includes short-term financial debt, company

accounts payable, and other debts. The majority of the businesses boost account through collateral or even financial

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 393

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

debt. Financial debt arrives as relationship or even long-term information payable, while collateral is actually

categorized because typical share, favored share, or even maintained income. Both funding offers pros and cons

more than one another. The actual creators contain the possession privileges as well as manage from the

organization when they increase funds through financial debt. The organization needs to spend the main as well as

curiosity towards the worried financial debt cases. This particular opportunity is going to be dropped within

collateral, since the investors turn out to be a fundamental element of the organization. Financial debt funding is

simpler as well as more affordable with regard to little companies. Repayment associated with curiosity upon normal

gets load for any organization as well as decreases their own income. There isn't any responsibility within collateral

funding to settle the cash. Investors have an opportunity upon plans with regard to much better development

possibilities from the organization.

Pakistani financial field observed extreme modifications since independence in 1947. At first it was suffered by

political and socioeconomic problems. Insufficient educated human sources and professionals resulted in to low

quality associated with services and products. Financial dimension is a tool which point out the financial strengths,

weaknesses, opportunities and threats. Modigliani and Miller (1958) recommended that in the world without

abrasion, there is no modification between debt and equity financing as glance the value of the firms. Thus ruling

decisions adds no value and are of no concern to the managers. Indication would suggest that this does not exist in

reality. On the other hand today capital structure is one of the most important financial decisions for any business

and firm. This decision is imperative because the organization need to enhance return to different organizations and

also have an effect on the value of the organization. Modigliani and Miller (1958) have tentatively proved that

capital structure is irrelevant in the perfect market condition, characterized by the capital market with no taxes, no

transactional costs and homogeneous anticipations other works that assume several market imperfections on the

conflicting suggest that capital structure decisions are relevant meanwhile it can influence shareholders wealth.

Modigliani and Miller (1963) by studying corporate taxes suggested that firms should use as much as debt capital as

possible in order to use to the full their value by increasing the interest tax shield. In the economic growth of the

country commercial banks play a vital role in the process. Pakistani banking industry was on top during 55 years of

the banking history especially in late 1970s after the nationalizing of the banking industry and insurance

corporations in 1974. The financial sectors of the Pakistan became one of the most important industries in the

country. The time from 1974 to 1991 axiom increase public sector involvement in decision making of the financial

institutions. Due to that very reason it has a negative impact on investment environment in banking industry.

1.1, Aim of Research

The purpose of conducting the study is to measure the impact of capital structure on banking performance to provide

empirical evidence regarding Pakistani banking sector over a period of 2007 to 2011.

2. Literature Review

Ebaid (2009) examined the capital structure and performance of firms, basically the aim was to check the

relationship between debt level and financial performance of companies (listed at Egyptian stock exchange during

the period of 1997 to 2005). By using the three accounting based measure of performance (ROA) return on assets

(ROE) return on equity and gross profit margin. He found that there is negative significant influence of short term

debt (STD) and the Total debt (TD) on the financial performance measured by the return on asset (ROA) but no

significant relationship fond between long term debt (LTD) and this measure of financial performance. He also

proposed that there is not significant influence of the debt (TD, STD and LTD) on financial performance measured

by both of gross profit margin and Return on equity .The results also indicated that control variable firm size has no

significant effect on the firm’s performance. In this research paper least squares regression model was used to check

the performance of the firms.

San and Heng (2011) they examined that the relationship of capital structure and corporate performance of firms

before and during 2007 crisis, all 49 construction companies are taken from Malaysia which were listed in Main

board of Bursa Malaysia from 2005 to 2008 these forty nine companies are divided in three units like small, medium

and large or big size. Always financial crisis are occurred by the poor corporate performance, in the Malaysia

construction industries and construction activates are the major source of growth and development in Malaysia, in

this research (capital structure) independent variables are used Long term debt to capital (LDC), debt to capital

(DC), debt to asset (DA), debt to equity market value (DEMV), debt to common equity (DCE), long term debt to

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 394

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

common equity (LDCE) and (Corporate performance) dependent variables are return on capital (ROC), return on

equity (ROE), return on asset (ROA), earnings per share (EPS), operating margin (OM) and net margin (NM). The

pooling regression model is employed to test the influence of capital structure on the company’s performance

method of ordinary least square (OLS) is used to estimate the regression line (OLS) is used to minimize the error in

estimated and actual points. The result shows that, there is relationship between capital structure and corporate

performance, in the interim the results also indicate that there are no relationship between the various variables that

are examined in this study. For the big construction companies only return on capital (ROC) and Earnings per share

(EPS) for large construction companies have significant relationship with capital structure, mean while Return on

capital (ROC) and Debt equity to market value (DEMV) are the most correlated and showing the strongest

relationship among all the variables examined. Basically, debt equity to market value (DEMV), long term debt to

capital (LDC) and debt to capital (DC) have direct influence on corporate performance of the large companies and

other independent variables don’t affect the dependant variables. Debt to capital (DC) has direct impact on corporate

performance of small companies and yet other in-dependant variables don’t affect the dependent variables.

Ahmad and Abdullah and Roslan (2012) investigated the impact of capital structure on firm performance by

analyzing the relationship between operating performance of Malaysian firms. Modigliani and Miller (1958) have

theoretically argued and proved that capital structure is irrelevant in a perfect market condition, characterized by the

capital market with no taxes, no transaction costs and homogenous expectations; other works that assume several

market imperfections on the contrary suggested that capital structure decisions are relevant since it can affect

shareholders wealth. Modigliani and Miller (1963) in existence of corporate taxes suggested that firms should use as

much debt capital as possible in order to maximize their value by maximizing the interest tax shield. The dependent

variables used in this research are ROA( Return on asset), ROE (return on equity) and control variable are firm size

(SIZE), sales growth (SG), growth (AG), firm efficiency and independent variables are long-term debt (LTD), short-

term debt (STD) and total debt (TD). All the companies are public listed organizations in the Malaysia, specifically

the Modigliani-Miller theorem; trade-off theory and pecking order theory were reviewed to provide sufficient

understanding of how much capital structure could affect firm’s performance. This study covers tow major sectors

consumers and industrials sectors 58 firm’s sample starting from 2005 to 2010 with total of 358 observations and

two general pooled regression models are used . Findings of the study validated that STD and TD have significant

relationship with return on asset (ROA) while Return on equity (ROE) and all capital structure indicators have

significant relationship. The significant relationship between short-term debt, long-term debt and total debt with

ROE is consistent with the findings of (Abor 2005; Mesquita and Lara 2003). The positive significant relationship

between long-term debts with ROA is coherent with the findings of (Philips and Sipahioglu 2004; Grossman and

Hart 1986). Which indicates that higher levels of debt in the firm’s capital structure is directly, associated with

higher performance levels and other finding is that Return on Equity (ROE) is not significant associated with all the

capital structure variables.

Amidu (2007) conducted a study to investigate the dynamics involved in the determination of the capital structure of

the Ghana banks. The dependent variables used in this paper are the leverage (LEV) is total debts divided by total

capital; short-term debt ratio (SHORT) is total short-term debt to capital while long-term debt ratio (LONG) is the

total long-term debt divided by total capital. The explanatory variables include (PRE) profitability, (RSK) risk, and

asset structure (AST), tax (TAX), size (SZE) and sales growth (GROW). The regression line model is use in this

research and the result was a negative relationship between profitability and leverage. The results of prior studies

show that higher profits increase the level of internal financing(Titman and Wessels 1988; and Barton

1989).Profitable banks accumulate internal reserves and this enables them to depend less on external funds. The

results of this study show that profitability, corporate tax, growth, asset structure and bank size influence bank’s

financing or capital structure decision. The significant finding of this study is that more than 87 percent of the banks,

assets are financed by debts and out of this short-term debt appear to constitute more than three quarters of the

capital of the banks. This highlights the importance of short-term debts over long-term debts in Ghanaian banks

financing.

Pal and Soriya (2012) suggested that intellectual capital (IC) performance of Indian pharmaceutical and textile

industry. The data was gathered from the 105 pharmaceutical companies and 102 textile companies. Dependent

variables used in this study includes MB (market to book value), ROA (return on Asset), ATO (asset turnover ratio)

and ROE (return on equity), independent variables are PC, DER, VAIC and sales. Correlation and regression

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 395

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

analysis were conducted to find the results. The use of MB as the market valuation is also debatable because the

market sentiments of the stakeholders may not always consider financial statements of the company. Yongvanich

and Guthrie (2005) and Abeysekera and Guthrie (2005) classified intellectual capital into three components: external

capital, internal capital and Human capital. Profitability measured by ROA clearly indicates that; profitability of the

companies is reflected through intellectual capital performance. Findings of the study may be exercised by the

managers to organize and utilize ‘intellectual capital’ to have additional profitable output. Return on equity is found

to be positively influenced by ‘intellectual capital’ in case of pharmaceutical industry indicating that these firms are

generating profits from every unit of shareholders’ equity.

Abor (2007) examined that Industry classification and capital structure of Ghanaian SMEs. The analytical technique

employed was regression. The dependent variables were LDR, SDR and TDR, independent variables in the model

are defined as: industry dummy (IND) = constructed as a categorical variable; (= 0 if manufacturing, 1 if agriculture,

2 if construction and mining, 3 if hospitality, 4 if information and communication, 5 if pharmaceuticals and medical

services, 6 if wholesale and retail trading, 7 if general business services). The control variables (C) include firm age

= number of years, since commencement of business, firm size = log of total assets, asset structure = fixed tangible

assets divided by total assets (i.e. the proportion of total assets that has collateral value. It is a measure of the firm’s

collateral value), profitability (PRE) = profit before interest and taxes/total assets, growth (GROW) = average

growth in sales. The outcomes of the research show which little as well as moderate businesses within the farming

field show the very best funds framework as well as resource framework or even security worth, since the at

wholesale prices as well as list industry business possess the lowermost financial debt percentage as well as resource

framework. The actual regression outcomes shows that farming, pharmaceutical drug as well as healthcare sectors

rely much more upon long-term (LTD) as well as short-term financial debt (short term debt) compared to the actual

production field. The outcomes additionally display how the building as well as exploration business is actually not

as likely in order to rely on short-term financial debt (STD), whilst resort as well as food rely much more upon long-

term financial debt (LTD) and less upon short-term financial.

Chen (2009) Impact associated with funds framework as well as functional danger upon success associated with life

insurance coverage business within Taiwan. Staking and Babbel (1995) supported the hypothesis found by

Modigliani and Miller. Jou (1999) found that value of a firm initially increasing with financial leverage and then

falling with financial leverage.

Cummins and Harrington (1988) used the CAPM model to examine the property-liability insurance industry, and

subsequently found a significant relationship between the expected return and systematic risk and unsystematic risk.

Dependent variables are used reserve to liability ratio and equity ratio and independent variables are profit margin

and returns on assets (ROA) as well as Structural formula modeling that involve factor-analysis as well as path-

analysis. The research proposed 4 crucial results. Very first, based on the empirical outcome, the study design offers

superb goodness-of-fit. In other words, utilizing several monetary indices superbly steps the particular monetary

elements. 2nd, the administrative centre framework exerts an adverse as well as substantial impact on functional

danger. 3rd, there isn't any reciprocal relationship however the one-way impact in between funds framework as well

as functional danger. 4th, the actual functional danger exerts an adverse as well as substantial impact on success.

Komnenic and Pakrajcic (2012) purpose of their paper was to empirically investigate the impact of intellectual

capital (IC) on organizational performance as well as to identify the IC components that may be the drivers of the

traditional indicators of business success. Dependent variables are used in this research (HEC) Human capital

efficiency and (SCE) structural capital efficiency and independent variables are (ROA) return on asset, (ROE) return

on equity and control variable were (CEE) capital employed efficiency. Regression results of this study reveal that

human capital is positively associated with all three corporate performance measures. The hypothesis regarding a

positive association between structural capital and MNCs’ profitability and productivity has been confirmed only

partially since the results indicate that the structural capital variable shows a statistically significant and positive

relationship only with the performance measure return on equity.

Pratheepkanth (2011) conducted a study his finding regarding the capital structure (CS) and its impact on financial

performance during 2005 to 2009 of business organizations in Sri Lanka. The result of research validated a negative

relationship between capital structure (CS) and financial performances of the Sri Lankan companies.

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 396

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

The arguments of prior researchers have well-balanced views on the determination of capital structure and firm

performance. This study attempts to seek the extant up to which capital structure has affected the corporate

performance particularly banking sector of Pakistan.

3. Research Methodology

A methodology is not a formula but a series of choices from which, we choose specific methods to solve specific

problems. To investigate the impact of corporate governance characteristics on firm performance in Pakistan, this

study is conducted by using the methodologies adopted in earlier research work on this issue. As other studies have

discussed these relationships, conceptual frame work of our study is based on deduction method and for analysis of

data collected from secondary sources quantitative techniques were employed. Descriptive statistics, correlation

matrix and regression models are generally used for analysis of data. Methodology had been adopted to get the

objectives, which is analyzing the changes in debt level towards affecting the firm performance. The data for the

study is collected from financial statement of listed banks, website of Karachi stock exchange (KSE) and State bank

of Pakistan (SBP).

3.1, Data and Sample

All banks operating in Pakistan are the population of the study. Sample of study include 25 banks, which are listed

at (KSE) or schedule banks in (SBP) state bank of Pakistan over a period of 2007, 2008, 2009, 2010 and 2011.

3.2, Variables

The independent variables consist of long-term debt, short-term debt, total debt and control variables consist of firm

size, asset Growth and dependent variables are Return on Equity (ROE), Return on Asset (ROA) and earnings per

share (EPS).

3.2.1,Long term Debt to Capital

Mesquita and Lara (2003) and Abor (2005) have used long term debt to capital (LTDTC) as a measure of capital

structure and it is calculated by following formula.

3.2.2,Short term Debt to Capital Ratio

Abor (2005; 2007) said that short-term Debt to capital ratio (STDTC) is measured by dividing short-term debt with

total capital.

3.2.3,Total Debt to Capital Ratio

For the purpose of study, this ratio is calculated by dividing total debt on capital.

3.2.4,Return on Assets

Return on Assets (ROA) measures the profitability of the firms and calculated as

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 397

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

3.2.5,Return on Equity

Return on Equity (ROE) is used to calculate a firm’s profitability by revealing how much profit a firm generates

with money invested by shareholders and its formula is given below.

3.2.6,Earnings per Share

Earnings per share (EPR) measure shareholders profitability by revealing how much profit a share generate with

money shareholders have invested and calculated by this formula.

3.2.7,Firm Size

To measure firm size (SIZE) different methods are used by scholars. According to Titman and Twite (2003) firm

size is calculated as natural log of total book value of assets. In this study we will use the book value of the total

assets to calculate the firm size (SIZE).

3.2.8,Assets Growth

Assets growth is used by many scholars in their studies and for the purpose of this research; it is calculated by the

following formula.

3.3 Research Hypothesis

Following hypothesis are developed to investigate the impact of capital structure on banking performance.

H01 = Capital structure has not significant impact on banking performance.

H02 = Capital structure has significant impact on banking performance.

3.4 Model Specification

Multiple regression models are used to find out the association between capital structure characteristics and firm

performance in the context of Pakistan. Three regression models are formulated to check the relationship between

capital structure and banking performance. Our base models take the following form:

Y it = α + βXit + µit

Where:

Yit is the dependent variable.

β0 is the intercept.

Xit is the independent variable.

µit are the error terms.

i is the number of firms and

t is the number of time periods.

Return on asset

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 398

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

ROAit =β0it+β1STDTCit +β2LTDTCit + β3TDTCit + β4SIZEit +β5AGit +µit

Return on equity

ROEit =β0it+β1STDTCit +β2LTDTCit + β3TDTCit + β4SIZEit +β5AGit +µit

Earnings per Share

EPSit =β0it+β1STDTCit +β2LTDTCit + β3TDTCit + β4SIZEit +β5AGit +µit

4. Results and Discussion

Tables 1, 2 and 3 explain the results that are found by applying descriptive statistics, correlation and regression

technique. Descriptive statics of study are given in table 1. The values of Mean, Median and Standard Deviation of

independent (LTDTC, STDTC and TDTC) dependent (ROA, ROE and EPS) and control variables (AG and SIZE)

of sample of 25 banks are calculated from 2007 to 2011.

Table 2 shows the correlation matrix which tells us relationship among variables in this study. Correlation is also

defined as dependence of one variable upon other. The diagonal elements which are the correlations of the variables

with themselves are always equal to one. Short term debt to capital (STDTC) has positive association with all

variables except firm size (SIZE). Long term debt to capital (LTDTC) has positive correlation with all measures.

TDTC has favorable association with firm size (SIZE) and negative association with assets growth (AG). According

to findings of correlation analysis firm size (SIZE) and asset growth (AG) are positively correlated.

Table 3 is used to explain the results of regression analysis. To examine the impact of capital structure on

profitability of banks researchers used regression model, already used by many scholars. R Square for ROE is

0.511611 which means 51% of sample describes ROE, While 51% variation in dependent variable is explained by

the independent variables and 49% variation in ROE remains unexplained by the independent variables of the study.

F-Statistics of return on assets is 8.246738 and it shows the overall significance of model. T-statistics tells us the

significance of regression results. Outcomes of regression analysis showed a positive significant relationship among

return on equity and STDTC, TDTC, SIZE and negative association with LTDTC and AG. Regression model of

return on assets produces highest value of R- square 73% as compare to other models and value of F- statistic is

12.531268. STDTC, TDTC and SIZE are found to have a strong favorable impact on profitability as measured by

ROE. LTDTC and AG have a negative but insignificant impact on ROE. Value of R square is 67% for earnings per

share which means sample defines the dependent variables up to 67% and F statistic for earnings per share is

14.623751. As per regression results earnings per share have a strong optimistic connection with all independent and

control variables, except long term debt to capital (LTDTC) and assets growth (AG).

5. Conclusion and Recommendations

The intended aim of conducting this study was to provide an empirical evidence regarding influence of capital

structure on profitability of banking sector in Pakistan. The findings of study validated a strong positive dependence

of short term debt to capital (STDTC) on all profitability measures (ROA, ROE and EPS). Long term debt to capital

(LTDTC) having a negative relationship with return on assets (ROA), return on equity (ROE) and earnings per share

(EPS). Total debt to capital and firm size (SIZE) experienced a strong optimistic connection with all dependent

variables (ROA, ROE and EPS). Assets growth (AG) proposed a negative insignificant impact upon return on asset

and return on equity, while a negative significant impact on profitability as measured by earnings per share. Now by

analyzing the results of each variable we can conclude that there exist a positive relation relationship among capital

structure and profitability of Pakistani banks.

5.1, Recommendations

It is suggested that further research addressing a longer period of time with having a broader selection of capital

structure and profitability measures can expose some new issues. This study can be extended by adding more banks

or by conducting a study on global level with inclusion of all banks around the world. Future research could include

more variables such as taxation. A comparative analysis of Islamic banking and conventional banks may be included

in further research. There is also an opportunity to conduct a comparative study to check the relationship among

capital structure and profitability of Foreign and Domestic Banks in Pakistan.

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 399

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

References

Abor, J. (2005). The effect of capital structure on profitability: An empirical analysis of listed firms in Ghana. The

Journal of Risk Finance, 6(5), 438-445.

Abor, J. (2007). Corporate governance and financing decisions of Ghanaian listed firms. Corporate Governance, 7,

83-92.

Abor, J. (2007). Debt policy and performance of SMEs: Evidence form Ghanaian and South African firms.The

Journal of Risk Finance, 8(4), 364-379.

Abeysekera, I., & Guthrie, J. (2005). An empirical investigation of annual reporting trends of intellectual capital in

Sirilanka.Critical Perspectives on Accounting, 16(3), 151-63.

Ahmad, Z., Hasan, N. M. A., & Roslan, S. (2012). International Review of Business Research Papers,8(5), 137-155.

Amidu, M. (2007). Determinants of capital structure of banks in Ghana: an empirical approach. Baltic Journal of

Management, 2(1), 67-79.

Barton, S.L., Hill, N.C. &Srinivasan, S. (1989). An empirical test of stakeholder theory Predictions of

capital.Financial Management, 18(1), 36-44.

Cummins, J.D., &Harrington, S. E. (1988). The relationship between risk and return: evidencefor property-liability

insurance stocks.Journal of Risk and Insurance,55(1), 15-32.

Ebaid, E. I.(2009). The impact of capital-structure choice on firm performance: empirical evidence from Egypt.The

Journal of Risk Finance, 10(5), 477-487.

Grossman, S., & Hart, O. (1986), The costs and benefit of ownership: A theory of vertical and lateral integration.

Journal of Political Economy, 94, 691-719.

Jou, D. G. (1999). Interest rate risk, surplus, leverage and market reward an empirical study of Taiwan life

insurance industry. Journal of Management & Systems,6(3), 281-300.

Komnenic, B., & Pokrajcic, D. (2012). Intellectual capital and corporate performance of MNCs in Serbia. Journal of

Intellectual Capital, 13(1), 106-119.

Mesquita, J.M.C., & Lara, J. E. (2003). Capital structure and profitability: the Brazilian case working paper.

Academy of Business and Administration Sciences Conference, Vancouver, July 11-13.

Min-Tsung, C.(2009). Relative effects of debt and equity on corporate operating performance Aquantile regression

study. .International Journal of Management, 26(1),

Modigliani, F., & Miller, M.(1958). ‘The cost of capital, corporation finance and the theory of investment.The

American Economic Review, 48(3), 261-97.

Modigliani, F., & Miller, M. (1963). Corporate income taxes and the cost of capital: A correction. American

Economic Review, 53, 443-53.

Pal, K., &Soriya, S. (2012). IC performance of Indian pharmaceutical and textile industry. Journal of Intellectual

Capital, 13(1), 120-137.

Phillips,&Sipahioglu (2004). Performance implications of capital structure evidence from quoted UK organizations

with hotel interests.The Service Industries Journal, 24(5), 31-51.

Pratheepkanth, P. (2011). Capital Structure and Financial Performance: Evidencefrom Selected Business Companies

in Colombo Stock Exchange Sri Lanka. Journal of Arts,Science& Commerce,23.

Saad, N. M. (2010). Corporate Governance Cpmpliance and the Effects to capital Structure.International Journal of

Economics and Financial, 2(1),105-114.

Saeedi, A., &Mahmoodi, I. (2011). Capital Structure and Firm Performance:Evidence from Iranian Companies.

International Research Journal of Finance and Economics, 70,

Staking, K.B.,&Babbel, D. F. (1995). The relation between capital structure, interest rate sensitivity and market

value in the property-liability insurance industry. Journal of Risk and Insurance, 62(4), 690-718.

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 400

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

Titman, S., & Wessels, R. (1988). The determinants of capital structure choice.Journal of Finance, 43(1), 1-19.

Tze, O. S., & Heng, B. T. (2011). Capital Structure and Corporate Performance ofMalaysian Construction Sector.

International Journal of Humanities and Social Science, 1(2), 28-36.

Yongvanich, M., & Guthrie, J. (2005). Extended performance reporting an examination of theAustralian mining

industry. Accounting Forum, 29(1), 103-19.

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 401

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

Annexure

List of Tables

Table 1; Descriptive Statistic

Variables AG EPS LTDTC ROA ROE SIZE STDTC TDTC

Mean 28.256 35.385 1.892 0.958 1.246 12.426 7.249 9.148

Median 15.358 10.842 1.346 1.119 0.624 7.891 5.272 5.273

Std. Dev. 40.823 57.248 1.215 2.451 3.152 2.426 4.129 2.782

Observations 125 125 125 125 125 125 125 125

Table 2; Correlation Matrix

Variables STDTC LTDTC TDTC SIZE AG

STDTC 1

LTDTC 0.253015672 1

TDTC 0.353214678 0.582673159 1

SIZE -0.472346812 0.332567823 0.623472497 1

AG 0.172567138 0.273549234 -0.261347422 0.473872481 1

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 402

ijcrb.webs.com FEBRUARY 2013

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 10

Table 3; Regression Analysis

ROE ROA EPS

Variable Coefficient t-Statistic Coefficient t-Statistic Coefficient t-Statistic

C -0.285905 -7.634672 -0.196349 -3.964367 -0.851349 -8.187234

STDTC 0.152417 4.375138* 0.082563 5.071441* 0.553672 4.263489*

LTDTC -0.211473 -3.750427* -0.113672 -0.614524 0.356782 -2.861347*

TDTC 0.183601 2.882652* 0.062594 2.292217* 0.304231 5.423752*

SIZE 0.180872 3.292314* 0.086134 4.192154* 0.623457 9.723821*

AG -0.192045 -1.588859 -0.152469 -0.210233 0.756234 -3.757257*

R-squared 0.511611 0.731672 0.672345

F-statistic 8.246738 12.531268 14.623751

Observations 125 125 125

*Represents the level of significance at 5 percent.

COPY RIGHT © 2013 Institute of Interdisciplinary Business Research 403

View publication stats

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Vector SpaceDocumento3 pagineVector SpaceUrooj FatimaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Eng-301 (Group 3) Assignment Punctuation & Their UsesDocumento9 pagineEng-301 (Group 3) Assignment Punctuation & Their UsesUrooj FatimaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- SE-401 (Minahel Noor Fatima)Documento14 pagineSE-401 (Minahel Noor Fatima)Urooj FatimaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Financial Statement AnalysisDocumento3 pagineFinancial Statement AnalysisUrooj FatimaNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Assignment ENG-301 Roll No 248Documento4 pagineAssignment ENG-301 Roll No 248Urooj FatimaNessuna valutazione finora

- Assignment: Slavery in The Chocolate Industry Q.1Documento4 pagineAssignment: Slavery in The Chocolate Industry Q.1Urooj FatimaNessuna valutazione finora

- T BillsDocumento4 pagineT BillsUrooj FatimaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Assignment: Q: Discuss The Progress and Growth of Islamic Banking Sector in Pakistan?Documento4 pagineAssignment: Q: Discuss The Progress and Growth of Islamic Banking Sector in Pakistan?Urooj FatimaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Topic:-Submitted To: - Submitted From:-: National Bank of PakistanDocumento4 pagineTopic:-Submitted To: - Submitted From:-: National Bank of PakistanUrooj FatimaNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Topic:-Submitted To: - Submitted From:-: National Bank of PakistanDocumento4 pagineTopic:-Submitted To: - Submitted From:-: National Bank of PakistanUrooj FatimaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Urooj Fatima (2016-Ag-3712) Performance Measure RatiosDocumento8 pagineUrooj Fatima (2016-Ag-3712) Performance Measure RatiosUrooj FatimaNessuna valutazione finora

- Kse 100Documento20 pagineKse 100Urooj FatimaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Modal LogicDocumento14 pagineModal LogicL'Homme RévoltéNessuna valutazione finora

- Chapter 6: Fatigue Failure: Introduction, Basic ConceptsDocumento21 pagineChapter 6: Fatigue Failure: Introduction, Basic ConceptsNick MezaNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- CS405PC JP Unit-3Documento44 pagineCS405PC JP Unit-3MEGHANA 3Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Upflow Anaerobic Sludge Blanket-Hollow Centered Packed Bed (UASB-HCPB) Reactor For Thermophilic Palm Oil Mill Effluent (POME) TreatmentDocumento12 pagineUpflow Anaerobic Sludge Blanket-Hollow Centered Packed Bed (UASB-HCPB) Reactor For Thermophilic Palm Oil Mill Effluent (POME) TreatmentAgung Ariefat LubisNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Math 11-CORE Gen Math-Q2-Week 1Documento26 pagineMath 11-CORE Gen Math-Q2-Week 1Christian GebañaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Speech Enhancement Using Minimum Mean-Square Error Short-Time Spectral Amplitude EstimatorDocumento13 pagineSpeech Enhancement Using Minimum Mean-Square Error Short-Time Spectral Amplitude EstimatorwittyofficerNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- BXE Experiment No.3Documento8 pagineBXE Experiment No.3DsgawaliNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- UntitledDocumento33 pagineUntitledapi-235198167Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Simultaneous Equations - Word ProblemsDocumento27 pagineSimultaneous Equations - Word ProblemsSandy Wong0% (1)

- Nadella Cam Follower PF810EDocumento22 pagineNadella Cam Follower PF810EAldair MezaNessuna valutazione finora

- CHAPTER 69 Steering FundDocumento16 pagineCHAPTER 69 Steering FundÆxis QuevedoNessuna valutazione finora

- Princom The Fundamentals of Electronics Module 2Documento9 paginePrincom The Fundamentals of Electronics Module 2melwin victoriaNessuna valutazione finora

- All The Questions of Section - A Are in Google Form and The Link To Attempt Them Is " Https://Forms - Gle/Jfvq8Wszicewchrj7 " 12 M Section - BDocumento4 pagineAll The Questions of Section - A Are in Google Form and The Link To Attempt Them Is " Https://Forms - Gle/Jfvq8Wszicewchrj7 " 12 M Section - BKamal AnandNessuna valutazione finora

- EMDCSS DatasheetDocumento5 pagineEMDCSS DatasheetHoracio UlloaNessuna valutazione finora

- 39 - Profil Uang Elektronik - Spesifikasi TeknisDocumento9 pagine39 - Profil Uang Elektronik - Spesifikasi TeknisM DedeNessuna valutazione finora

- Programming in C - CPU Scheduling - Round RobinDocumento3 pagineProgramming in C - CPU Scheduling - Round RobinGenus SumNessuna valutazione finora

- Fixed Frequency, 99% Duty Cycle Peak Current Mode Notebook System Power ControllerDocumento44 pagineFixed Frequency, 99% Duty Cycle Peak Current Mode Notebook System Power ControllerAualasNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- PDF 4.6 MDocumento2 paginePDF 4.6 MmdisicNessuna valutazione finora

- Parola A Do ZDocumento8 pagineParola A Do ZjovicaradNessuna valutazione finora

- Flower-Visiting Insect Pollinators of Mustard (Brassica: Napus) in Jammu RegionDocumento7 pagineFlower-Visiting Insect Pollinators of Mustard (Brassica: Napus) in Jammu RegionMamata SubediNessuna valutazione finora

- Catalogue Solid Core PDFDocumento16 pagineCatalogue Solid Core PDFdangodNessuna valutazione finora

- Module 1 SIMPLE INTERESTDocumento15 pagineModule 1 SIMPLE INTERESTElle Villanueva VlogNessuna valutazione finora

- Converting CLOBs 2 VARCHARDocumento15 pagineConverting CLOBs 2 VARCHARMa GicNessuna valutazione finora

- J R Rice - Path Independentt Integral - JAM68Documento8 pagineJ R Rice - Path Independentt Integral - JAM68CJCONSTANTENessuna valutazione finora

- ANSYS Tutorial Design OptimizationDocumento9 pagineANSYS Tutorial Design OptimizationSimulation CAE100% (4)

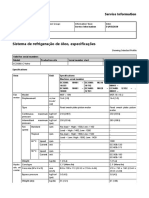

- Sistema de Refrigeração de Óleo, EspecificaçõesDocumento2 pagineSistema de Refrigeração de Óleo, EspecificaçõesAlexandreNessuna valutazione finora

- PM BCE DCS Crash WebDocumento4 paginePM BCE DCS Crash WebAna Paola VazquezNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Astrophysics QuestionsDocumento19 pagineAstrophysics QuestionsMauzoom AliNessuna valutazione finora

- Sample Questions Paper 2 - TNQT Digital-4July19Documento6 pagineSample Questions Paper 2 - TNQT Digital-4July19Gudimetla KowshikNessuna valutazione finora

- TF100-9D - Refrigerant Hose With Att FittingsDocumento28 pagineTF100-9D - Refrigerant Hose With Att FittingsJai BhandariNessuna valutazione finora