Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ratio Analysis On Renuka Sugars Ltd.

Caricato da

Punardatt BhatDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ratio Analysis On Renuka Sugars Ltd.

Caricato da

Punardatt BhatCopyright:

Formati disponibili

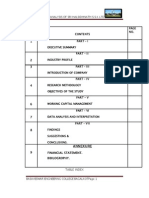

SHREE RENUKA SUGARS, MUNOLI

EXECUTIVE SUMMARY:

This project has been done in Shree Renuka Sugars Pvt. Ltd. The company is situated in

Munoli. It deals in sugar refiner, ethanol producer, power and bio-fertilizers.

The study gives an idea about the “A study on financial performance using Ratio’s”. At Shree

Renuka Sugars. A ratio analysis plays an important role in the successful operation of

business activities. It is one of the important concept of “Financial Department” in each and

every department of company. It helps to study the financial statement in details i.e consists

of two statement, they are:

Profit & loss A/c of the company.

Balance sheet of the company.

Ratio analysis is an important tool for financial manager is interpreting the financial

statement. A ratio signifies relationship between two figures expressed in terms of

percentage or quotient. It represents mathematical relationship between two factors

expressed in numerical terms.

Ratio may be regarded as important tool of a business, its efficient provision can do much to

success of a business its efficient management can lead not only loss of profits but also to

the downfall of a business. A study of ratio analysis is of major importance to understand

financial condition of organization and to increase the profits.

The arithmetical method of ascertaining the interrelation between any two numeric data

expressed in accounting statement is known as Accounting Ratio. The definition implies that

in use of an accounting ratio both the components in the form of numerals or variable used

in computing a ratio are taken from the financial statement prepared in financial

accounting.

The company is running profitably and the ratio analysis required by the firm to understand

financial performance.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 1

SHREE RENUKA SUGARS, MUNOLI

Title of the project:

“A study on financial performance using Ratio’s”

Objevtives of the study:

To study the financial performance of the firm using ratio’s.

To study and analysis the different types of ratio.

To analysis profitability ratio.

To analysis the utilisation of ratio analysis.

This project is conducted to know and understand the performance of the company. I used

primary and secondary data in this research and I also used three years balance sheet as my

sample to calculate the different ratio of the company.

The study covers calculation of components of debtor turnover ratio, stock turnover ratio,

working capital turnover ratio, gross profits etc. at the end details of project, balance sheets of

Shree Renuka sugars were attached in annexure part.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 2

SHREE RENUKA SUGARS, MUNOLI

Industry Profile

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 3

SHREE RENUKA SUGARS, MUNOLI

HISTORY OF SUGAR:

It is universally acknowledged that India is the homeland of sugarcane and sugar. There are

references of sugarcane cultivation, its crushing and preparation of Gur in Atharva Veda as

well as Kautaliya's Arthasastra. The scribes of Alexander the Great, who came to India in 327

BC recorded that inhabitants chewed a marvelous reed which produced a kind of honey

without the help of bees. The Indian Religious offerings contains five 'Amrits' (elixiris) like

milk, curd, ghee(clarified butter), honey and sugar - which indicates how important sugar is

not only as an item of consumption but as an item which influences the Indian way of life.

It is thought that cane sugar was first used by man in Polynesia from where it spread to India.

In 510 BC the Emperor Darius of what was then Persia invaded India where he found "the

reed which gives honey without bees". The secret of cane sugar, as with many other of man's

discoveries, was kept a closely guarded secret whilst the finished product was exported for a

rich profit.

It was the major expansion of the Arab peoples

in the seventh century AD that led to a breaking

of the secret. When they invaded Persia in 642

AD they found sugar cane being grown and

learnt how sugar was made. As their expansion

continued they established sugar production in

other lands that they conquered including North

Africa and Spain.

Sugar was only discovered by western Europeans as a result of the Crusades in the

11th Century AD. Crusaders returning home talked of this "new spice" and how pleasant it

was. The first sugar was recorded in England in 1099. The subsequent centuries saw a major

expansion of western European trade with the East,

including the importation of sugar. It is recorded,

for instance, that sugar was available in London at

"two shillings a pound" in 1319 AD. This equates

to about US$100 per kilo at today's prices so it was

very much a luxury.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 4

SHREE RENUKA SUGARS, MUNOLI

In the 15th century AD, European sugar was refined in Venice, confirmation that even then

when quantities were small, it was difficult to transport sugar as a food grade product. In the

same century, Columbus sailed to the Americas, the "New World". It is recorded that in 1493

he took sugar cane plants to grow in the Caribbean. The climate there was so advantageous

for the growth of the cane that an industry was quickly established.

By 1750 there were 120 sugar refineries operating in Britain. Their combined output was

only 30,000 tons per annum. At this stage sugar was still a luxury and vast profits were made

to the extent that sugar was called "white gold". Governments recognized the vast profits to

be made from sugar and taxed it highly. In Britain for instance, sugar tax in 1781 totaled

£326,000, a figure that had grown by 1815 to £3,000,000. This situation was to stay until

1874 when the British government, under Prime Minister Gladstone, abolished the tax and

brought sugar prices within the means of the ordinary citizen.

Sugar beet was first identified as a source of sugar in 1747. No doubt the vested interests in

the cane sugar plantations made sure that it stayed as no more than a curiosity, a situation that

prevailed until the Napoleonic wars at the start of the 19th century when Britain blockaded

sugar imports to continental Europe. By 1880 sugar beet had replaced sugar cane as the main

source of sugar on continental Europe. Those same vested interests probably delayed the

introduction of beet sugar to England until the First World War when Britain's sugar imports

were threatened.

Today's modern sugar industry is still beset with government interference at many levels and

throughout the world. Annual consumption is now running at about 120 million tons and is

expanding at a rate of about 2 million tons per annum. The European Union, Brazil and India

are the top three producers and together account for some 40% of the annual production.

However most sugar is consumed within the country of production and only approximately

25% is traded internationally.

One of the most important examples of governmental actions is within the European Union

where sugar prices are so heavily subsidized that over 5 million tons of white beet sugar have

to be exported annually and yet a million tons of raw cane sugar are imported from former

colonies. This latter activity is a form of overseas aid which is also practiced by the USA.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 5

SHREE RENUKA SUGARS, MUNOLI

The EU's over-production and subsequent dumping has now been subjected to GATT

requirements which should see a substantial cut-back in production over the next few years.

GLOBAL SUGAR INDUSTRY:

Industry Facts:

• World sugar production is expected to be 170.9 MMT in 2016-17.

• In 2016-17, the top five sugar producers, namely Brazil, India, European Union, Thailand

and China will account for nearly 57% global sugar production.

• Amongst the top 10 producers in the World, sugar production in 2016-17 declined in only

two countries namely India and US.

• Sugar mills are increasingly allotting more cane for sugar versus ethanol. In 2016-17, close

to 47% of cane in Brazil was allotted for sugar production, the highest ever allotment levels.

• In 2016-17, the global sugar consumption is estimated to outpace production for the second

year in a row since 2009-10.

• In October 2016, raw sugar prices soared to the highest levels in 5 years at above 23

cents/pound and since then prices have declined to 14 cents/ pound currently.

Production and consumption:

According to USDA, global sugar production is estimated at 170.9 MMT in

2016-17, up 3.7% as compared to 164.7 MMT in 2015-16 driven by higher output in Brazil

and increased allocation of cane for sugar production (close to 47%, highest ever). Global

sugar consumption is estimated at 171.9 MMT in 2016-17 reflecting an increase of 1.48%

over 169.4 MMT in 2015-16. In 2016-17, the global sugar consumption is estimated to

outpace production for the second year in a row since 2009-10. The ending stock in 2016-17

is projected at 38.8 MMT, a 11.5% decline over the previous year’s level of 43.9 MMT.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 6

SHREE RENUKA SUGARS, MUNOLI

COMPANY PROFILE

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 7

SHREE RENUKA SUGARS, MUNOLI

Type Public Company

Industry Sugar

Founded 1998

Founder(s) NarendraMurkumbi&VidyaMurkumbi

Headquarters Belgaum, Karnataka, India

Area Served Belgaum

Key People NarendraMurkumbi, MD

Owner(s) NarendraMurkumbi

Website www.renukasugars.com

Shree Renuka Sugars is India's largest sugar refiner and ethanol producer based in Mumbai,

Maharashtra, with refining capacity of 4000 tons/day and distillery capacity of 600 Kilo

liter/day. It has 21% market share in India's fuel ethanol market and has an aggressive growth

plan of increasing its ethanol production capacity to 900 Kilo liter/day by Dec 2009. It also

accounts for 20% of India's international sugar trade.

SRSL is a fully integrated sugar company focused on sugar manufacturing and trading with

by-products such as power, ethanol and bio-fertilizers. SRSL owns five sugar units (four in

Karnataka and one in Maharashtra) and has taken on lease three sugar units (two in

Maharashtra and one in Karnataka). SRSL’s five owned manufacturing facilities are located

at Munoli, Athani, Havalga and Gokak in Karnataka, and at Pathri in Maharashtra. Three

leased facilities are located at Arag&Panchaganga in Maharashtra, and at Raibag in

Karnataka. SRSL has dedicated port based refineries at Haldia having a refining capacity of

2,500 TPD and Kandla with refining capacity of 3,000 TPD a secondary distillation plant at

Khapoli having a distilling capacity of 300 KLPD.

In Fiscal Year 1998, SRSL acquired a sugar mill at Hindupur in Andhra Pradesh with

a sugar manufacturing capacity of 1,250 TCD from the Government of Andhra Pradesh. In

Fiscal Year 1999, this unit was moved to Munoli, Karnataka and the company expanded its

sugar manufacturing capacity to 2,500 TCD with a 11.2 MW cogeneration plant. SRSL

increased its co-generation capacity from 11.2 MW to 35.5 MW in Fiscal Year 2008

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 8

SHREE RENUKA SUGARS, MUNOLI

Thereafter, SRSL has been rapidly scaling up and integrating its manufacturing operations on

a continuous basis by 1) acquiring old plants, expanding and modernizing them, 2) acquiring

plants on lease and 3) setting up new grass root plants as brought out in the following

paragraphs.

In Fiscal Year 2002, SRSL ventured into the manufacture of ethanol by setting up a

distillery with a distilling capacity of 60 KLPD at Munoli unit. In Fiscal Year 2003, they set

up a refinery to process raw sugar with a refining capacity of 250 TPD at Munoli with

technical assistance from Tale & Lyle Industries Ltd. of UK and subsequently increased its

refining capacity to 1,000 TPD in Fiscal Year 2007. In the same fiscal year of 2007, the sugar

manufacturing capacity of Munoli plant increased to 7,500 TCD and its distillery capacity

was increased to 120 KLPD.

In Oct 2004, SRSL took on lease the sugar mill of AjaraShetkariSahakariSakharKarkhana

Ltd. located at Ajara in Maharashtra having facilities for the manufacture of white crystal

sugar with a capacity of 2500 TCD. Initially, the lease was for a period of two years

commencing from the crushing season 2004-05. The lease agreement was extended for

further three years i.e. up to the crushing season 2008-09.

In Fiscal Year 2005, Company acquired from M/s. Haripriya Sugars a green-field

project at Athani with land and licenses and successfully commissioned a 6,000 TCD plant in

March 2007 with a co-generation facility of 38 MW and a distillery of 120 KLPD. In Fiscal

Year 2008, the sugar manufacturing and distillery capacity at Athani was increased to 8,000

TCD and 300 KLPD, respectively, along with the addition of refining capacity of 1,000 TPD

and subsequently the refining capacity was increased to 2000 TPD in the fiscal year 2010.

SRSL also acquired another sugar factory of MohanraoShindeSahakariSakharKarkhana Ltd

located at Arag in Maharashtra having facilities for manufacture of white crystal sugar with a

capacity of 2500 TCD on lease for a period of six years i.e. the crushing season 2005-06. As

per terms of the lease agreement, lease rental of Rs. 2.80 crore was payable for the season

2005-06 and lease rental of Rs. 5.55 crore per year is payable in four equal quarterly

installments each year for the next five crushing seasons. The sugarcane crushing capacity of

this unit has since been increased from 2500 TCD to 4000 TCD by installation of some

balancing equipment and the expanded capacity has commenced commercial operations from

sugarcane crushing season 2006-07.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 9

SHREE RENUKA SUGARS, MUNOLI

In Fiscal Year 2006, SRSL also acquired a sick sugar mill of 2,500 TCD in

Sindhkheda, Dhule, Maharashtra from Sitson India Private Limited which was dismantled

and relocated and expanded to 4,000 TCD at Havalga, Afzalpur, Karnataka in 2006. In Fiscal

Year 2008, SRSL increased the sugar manufacturing capacity at Havalga to 8,000 TCD. They

also added cogeneration capacity of 25.5 MW and distillery capacity of 180 KLPD in year

2008-09 and subsequently implemented 1000 TPD refining plant in 2009-10.

In Fiscal Year 2006, Company acquired another lease unit, a loss-making co-

operative sugar mill viz. The AllandSahakariSakkareKarkhaneNiyamith having facilities for

the manufacture of white crystal sugar with a capacity of 1250 TCD located at Aland in the

State of Karnataka for a period of seven years commencing from the crushing season 2005-06

but the lease was terminated in the year 2007-08.

In Fiscal Year 2008, SRSL acquired Ratnaprabha Sugars Limited, which owns a mill in

Pathri, Maharashtra with a sugar manufacturing capacity of 1,250 TCD and a distillery with a

capacity of 30 KLPD. In the same year, company also acquired 87.28% of Gokak Sugars

Limited, which has a sugar manufacturing capacity of 2,500 TCD and a co-generation

capacity of 14 MW. In Fiscal Year 2008, SRSL also acquired on lease a cooperative sugar

mill in Raibag, Karnataka with a sugar manufacturing capacity of 2,500 TCD.

In October 2008, SRSL commissioned a 2,500 TPD secondary refinery at Haldia, West

Bengal in addition to the two refineries of 1,000 TPD at Munoli and Athani. In Fiscal Year

2008, it acquired the Khapoli plant from Dhanuka Petro Chem. with a secondary distillation

capacity of 100 KLPD and increased it to 300 KLPD in the same year.

SRSL has set-up a 30MW co-generation plant on land leased from Panchganga SSK at their

site in Kolhapur district, Maharashtra on a 20 years BOOT basis. The same has commenced

operations from the first quarter of Fiscal Year 2010. Further, SRSL has set up additional

24MW co-generation plant on a similar BOOT basis on land leased by Ajinkyatara SSK at

Satara in Maharashtra.

SRSL commissioned another refinery on the west coast in the state of Gujarat at Kandla

with a sugar refining capacity of 3,000 TPD and 45 MW power plant in February 2012.

On 19th March, 2010 the Company completed the acquisition of Vale do Ivaí S.A. Açúcar e

Álcool ("VDI") a Brazilian sugar and ethanol production company and renamed it as Renuka

Vale do Ivai S/A (RVdI). The acquisition includes two sugar and ethanol production facilities

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 10

SHREE RENUKA SUGARS, MUNOLI

located in the Southern State of Parana with a combined cane crushing capacity of 3.1 million

tons per annum. In addition, RVDI holds strategic stakes in several logistics assets including

terminals for storage and loading of sugar and ethanol at the port of Paranagua. Larger part of

the sugarcane requirements at RVDI are met through its own cultivation of more than 18,000

Ha of land on long lease. RVDI has currently a third production facility in the State of Minas

Gerais which shall be spun off to the current shareholders of RVDI as a consideration for the

acquisition.

In June 2010, SRSL acquired controlling stake in Equipav S.A. Açúcar e Álcool

(“Equipav AA”). As per the terms, the Company shall invest R$ 450 million (USD 250

million, INR 1,151 crores) in Equipav leading to a majority, controlling stake of 50.34%.

This values Equipav AA at an Enterprise value of R$ 2.064 billion (USD 1.147 billion). They

further increased their stake to 59.4% by March 2012 by adding additional equity of R$ 200

million (USD 115 million). SRSL renamed it as Renuka do Brazil S/A (RdB). RdB consists

of two very large and modern sugar/ethanol mills with integrated co-generation facilities in

Sao Paulo state in Southeast Brazil having a combined cane crushing capacity of 10.5 million

tons of cane per annum (44,400 TCD). In addition, it has a co-generation capacity of

295MW. Cane supply comes from the cultivation of about 115,000 Ha of land of which

nearly 2/3rd is cultivated by the Company with very high level of mechanization for both

planting and harvesting. The mills have easy access to the main ports of Santos and

Paranagua.

COMPANY OVERVIEW:

Shree Renuka Sugars is a global agribusiness and bio-energy corporation. The Company is

one of the largest sugar producers in the world, the leading manufacturer of sugar in India,

and one of the largest sugar refiners in the world. The company has its Corporate office in

Mumbai (Maharashtra, India) and Head Office in Belgaum (Karnataka, India).

The Company operates eleven integrated sugar mills globally (four in Brazil & seven in

India) & two port based refineries in India.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 11

SHREE RENUKA SUGARS, MUNOLI

The Company Operates in the following Segments :

Sugar:

The Company operates eleven mills globally with a

total crushing capacity of 20.7 million tons per

annum (MTPA) or 94,520 tons crushed per day

(TCD). The Company operates seven sugar mills in

India with a total crushing capacity of 7.1 MTPA or

35,000 TCD and two port based sugar refineries with

capacity of 1.7 MTPA. The Company also has

significant presence in South Brazil, through acquisitions of Renuka Vale do Ivai and Renuka

do Brazil. Renuka Vale do Ivai was acquired on 19th March 2010 and is 100% owned by the

Company. The Company currently holds 59.4% equity stake in Renuka do Brazil which was

acquired on 7th July 2010. The combined crushing capacity of the Brazilian subsidiary

companies is 13.6 MTPA. The Company is the only sugar producer globally with year round

crushing due to complementary seasons in India and Brazil.

Ethanol:

The Company manufactures fuel grade ethanol that

can be blended with petrol. Global distillery capacity

is 6,240 KL per day (KLPD) with Indian distillery

capacity at 930 KLPD (630 KLPD from molasses to

ethanol and 300 KLPD from rectified spirit to

ethanol)and Brazil distillery capacity at 5,310KLPD.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 12

SHREE RENUKA SUGARS, MUNOLI

KBK Chem-Engineering (100% subsidiary) facilitates turnkey distillery, ethanol and bio-fuel

plant solutions.

Power:

The Company produces power from bagasse (a

sugar cane by product) for captive consumption

and sale to the state grid in India and Brazil. Total

Cogeneration capacity increased to 555MW with

exportable surplus of 356 MW. Indian operations

produce 242 MW with exportable surplus of 135

MW and Brazilian operations produce 313 MW

with exportable surplus of 221 MW.

Bio-Fertilizers:

Sugar industry is a unique industry which follows

the principle of soil-to-soil. Press-mud/filter cake

obtained as waste during sugar manufacturing

process is mixed with the effluent from distillery

operations to give bio fertilizer. This bio fertilizer

is organic, eco-friendly and cost-effective

compared to chemical fertilizers.

The Company’s presence in the largest sugar producing country, Brazil and the largest sugar

consuming country, India provides access to information on movements in market price and

the know-how of the global supply-demand situation. The Company’s operations in Brazil

are favored by low operating cost, high scalability and highly conducive climatic conditions.

The Company’s Indian operations are present in sugar rich belt of South and West India,

ensuring high sugarcane yields and sugar recovery from cane. The strategically located port-

based refineries in Gujarat and West Bengal states of India cover India, South Asia and

Middle-East markets competitively.

The Company has witnessed a strong Revenue CAGR of 55% and EBITDA CAGR of 58%

from FY2006 to FY2012. The strong financial performance has ensured consistent returns for

shareholders with an average Return on Equity of approx. 20% from FY 2006 to FY 2012.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 13

SHREE RENUKA SUGARS, MUNOLI

The Company’s strong Management team has delivered consistently to ensure growth

through successful completion of strategic acquisitions.

The shares of the Company are listed on the Bombay Stock Exchange Ltd (BSE) and the

National Stock Exchange of India Ltd (NSE)

NSE Symbol – Renuka

BSE symbol - 532670

Bloomberg symbol - SHRS:IN

Reuters symbol - SRES.BO, SRES.NS.

MILESTONES:

1998: Foundation of Shree Renuka Sugars with the acquisition of assets of Nizam

Sugars Ltd. in Andhra Pradesh.

2000: Commissioned a co-generation plant at Munoli, Karnataka.

2001: Commissioned a 60 KLPD distillery at Munoli.

2002: Established 250 tonnes per day sugar refinery at Munoli.

2003: Leased first co-operative Mill.

2005: Successfully completed Initial Public Offering & Established a Greenfield

sugar mill at Athani, Karnataka.

2006: Acquired sugar mill in Sindhkheda and relocated it to Havalga in Karnataka.

2007: Acquired KBK Chem Engineering Pvt. Ltd., Maharashtra.

2008: Commissioned a refinery of 2,000 tonnes per day at Haldia in West Bengal.

2009: Commissioned co-generation plant in Panchganga Co-operative Sugar Mill on

BOOT basis (Maharashtra).

2010: Acquired 100% stake in Renuka Vale do Ivai S/A and 50.34% stake in Renuka

do Brazil S/A (Equipav).

2011: Commissioned a 3,000 tonnes per day port based refinery in Gujarat (near

Kandla).

2012: Increased stake in Renuka do Brazil S/A to 59.4%.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 14

SHREE RENUKA SUGARS, MUNOLI

ACHIEVEMENTS AND AWARDS:

The company is working as per ISO9001 quality standards.

The company is working as per ISO 14000 environmental standards.

The company has also been awarded a 2 star export house status by the Director

General of Foreign Trade(DGFT), Government of India.

the company's Bagasse based cogeneration plant at Munoli has qualified a Clean

Development Mechanism(CDM) project.

The company has also bagged a Silver Medal at South Indian Sugarcane & Sugar

Technology 2001-2002 for energy conservation measures at SRSL.

SRSL is recognised as first largest plant of Ethanol by Mr.Kannappa, Honourable

Minister of MNSE and Mr.Bhaktavatsalam Managing Director of IREDA.

The modern technology of Re-boiler cuts down quantity of effluent produced by 14%,

helping management of spent wash.

remarkable reduction in generation of spent wash through various measures.

Zero discharge status for distillery. Recycle and reuse adaptability in sugar plant,

cogeneration and distillery.

SRSL has taken up an ambitious program of planting 30,000 trees in the campus of

factory and has successfully implemented it which improves the environment and

adds to the beautification of the sugar mill.

BOARD OF DIRECTORS:

Name Designation

Mrs.Vidya M. Murkumbi Executive Chairperson

Mr. NarendraMurkumbi Vice Chairman & Managing Director

Mr. S. K. Tuteja Independent Director

Mr. Sanjay K. Asher Independent Director

Mr. DorabMistry Independent Director

Mr. BhupatraiPremji Independent Director

Mr. HrishikeshParandekar Independent Director

Mr. Jean-Luc Bohbot Non Executive Director

Mr.AtulChaturvedi Non Executive Director

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 15

SHREE RENUKA SUGARS, MUNOLI

MANAGEMENT TEAM :

Name Designation

Mrs. Vidya M. Murkumbi Co-founder, Executive Chairperson

Mr. NarendraMurkumbi Co-founder, Vice Chairman & MD

Mr. Nandan V. Yalgi Executive Director Commercial & HR

Mr. Krishna Kumar Kumbhat Chief Financial Officer

Mr. VineshSadekar Head, Group Corporate Strategy

Mr. GautamWatve Head, International Business Division

Mr. Vijendra Singh Executive Director

Mr. S. R. Nerlikar Executive Director, Cane

Mr. Pratik Vora General Manager, Renuka DMCC

PROMOTERS:

Smt. Vidya M. Murkumbi, is the Executive Chairperson of SRSL. She is a chemistry

graduate from the Karnataka University. She spent about 23 years in the trading and

distribution of Tata's and Parle's products. Prior to promoting SRSL, Smt. Murkumbi started

her industrial experience with Murkumbi Bio Agro Pvt. Ltd and Murkumbi Industries Private

Ltd. which were engaged in agro-processing and chemical formulation. After having four

years industrial experience she promoted SRSL. She has received the following prestigious

awards for her professional achievement:

VIKAS RATNA AWARD for Best Lady Entrepreneur, 2000

Award for contribution in industrial growth of India, conferred by Smt.

SushmaSwaraj, Hon'ble Minister for I & B, GOI, 2000

BhartiyaUdyog award, for Role of Individuals in India's Economic

Development, 2000

In the year 2006, the Karnataka Government felicitated her with ‘Karnataka Ratna’ in

recognition of her achievements. She served as the president of South Indian Sugar Mills

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 16

SHREE RENUKA SUGARS, MUNOLI

Association for the period 2003-05. She was member of Tuteja Committee set up by the

Govt. of India in 2004 for revitalization of sugar industry.

Mr. Narendra M. Murkumbi, son of Smt. Vidya M. Murkumbi, aged about 42 years is the

Managing Director and Vice-Chairman of SRSL. He is an Electronic and Tele-

communication Engineer from Karnataka University and Post Graduate Diploma holder in

Management from IIM Ahmadabad with specialization in Entrepreneurship and New Venture

Management. Mr. Murkumbi is also recipient of Economic Times – Entrepreneur of the Year

Award 2010.

PLANT LOCATIONS (INDIA) :

Unit Location

Unit I Village Munoli, Taluka:Saundatti, District Belgaum, Karnataka.

Unit II Village Mohannagar, Arag, TalukaMiraj, District Sangli, Maharashtra.

Unit IV Village Buralatti,(Kokatnur), TalukaAthani, District Belgaum, Karnataka.

Unit V Village Havalga, TalukaAfzalpur, District Gulbarga, Karnataka.

Unit X TalukaRaibag, District Belgaum, Karnataka.

Unit VIII Village Deonandra,TalukaPathri, District Parbhani, Maharashtra.

Unit IX Village Kolavi, Taluka Gokak, District Belgaum, Karnataka.

Unit E1 Village Donvat, Khapoli, TalukaKhalapur, Maharashtra.

Unit R1 Haldia, District PurbaMidnapur, Kolkata, West Bengal.

Unit R2 Kandla, Gujarat.

Unit 11 Ichalkaranji, Village Kabnoor, TalukaHatnagale, District Kolhapur,

Maharashtra.

Unit 12 Shahunagar, TalukaShindre, District Satara, Maharashtra.

Unit 13 TalukaMulshi, District Pune, Maharashtra

PLANT LOCATION (BRAZIL) :

Renuka do Brazil S/A:

Unit Location

Unit 1 UsinaMadhuPromissao, Sao Paulo Brazil

Unit 2 UsinaRevatiBrejoAlegre, Sao Paulo Brazil

Renuka Vale do Ival S/A:

Unit Location

Unit 1 Usina Sao Pedro do Ivai Sao Pedro do Ivai, Parana

Brazil

Unit 2 UsinaCambui Sao Miguel do Cambui, Parana

Brazil

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 17

SHREE RENUKA SUGARS, MUNOLI

ORGANIZATION STUDY

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 18

SHREE RENUKA SUGARS, MUNOLI

ORGANIZATION STRUCTURE:

Structure refers to the organizational arrangement for performing tasks and activities. Te

structure could be line, functional, regional and product wise etc. Organizations are economic

and social entities in which a number of persons perform multifarious tasks in order to attain

common goals. An organizational structure is one of the strategic management variables.

Organizational structure is the framework of reporting relationships, role definitions and

accountabilities that are intended to assist the firm in meeting its mission and objectives. In

SRSL the centralized functional division structures is used to control the entire organizational

work flow. it implemented top down management system to handle the work flow of entire

organization so as to bring the systematic relationship in between all the functional areas of

the company. It provides the frame work for relationship among different parts of the

organization. It sets out formal reporting relationships , mode of communication, their

respective roles and rules and regulations for carrying out their different tasks.

SRSL has one registered office, one corporate office and its fully owned overseas subsidiary

to fulfill their all the official and clerical operations.

The following chart shows the formal structure of the organization:

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 19

SHREE RENUKA SUGARS, MUNOLI

DEPARTMENTS:

1. Production Department

2. Purchase Department

3. Stores Department

4. Administrative Department

5. Finance Department

6. Accounts Departments

7. Cane Departments

8. Engineering Department

9. Sales Department

10. HR Department.

Production Department:

The department deals with the production activities in the production floor where men and

machines are employed to convert the cane and chemical into finished product(sugar) for

handling them over to sales department.

For sugarcane the production process is carried in the following steps:

Pressing of sugarcane to extract the juice.

Boiling the juice until it begins to thicken and sugar begins to crystallize.

Spinning the crystals in a centrifuge to remove the syrup, producing raw sugar.

Shipping the raw sugar to a refinery where it is washed and filtered to remove

remaining non-sugar ingredients and colour.

Crystallizing the drying and packing the refined sugar.

Purchase Department:

The head of the department’s heads is the purchasing department. Purchasing decisions are

divided into two. One for purchase of capital assets and another is regular purchase. Purchase

of capital assets: It requires approval of management.

Considerable point while purchasing capital assets are,

Life duration of the assets.

Cost of the assets.

Capacity etc. Regular Purchases:

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 20

SHREE RENUKA SUGARS, MUNOLI

Indent from the user is original document to issue purchase order for regular purchase

of materials and goods.

Process:

Receiving indent from the users.

Calling tenders if necessary.

Preparing purchase order.

Ordering to suppliers

Making purchase return if the material does not match the order.

Stores Department:

Stores department holds the entire inventory required in the organization all the materials

coming are subject to record at stores and holds them at stores until they are issued to the

required department.

Functions:

Receipt of materials.

Inspect it with ordered quantity, quality and any specification.

Some of the materials like chemicals are to be sent to laboratory for inspection and

testing.

Getting the indents from the department head and issuing it.

To make the purchase returns if the materials are rejected.

Maintain minimum level of materials.

Informing purchase department when materials require. Materials handled:

Engineering tools spares.

Raw materials

Stationary.

Packing materials.

Administrative Department:

Overseeing and carrying out office operations, preparing, systematizing and preserving

written communication, distributing information, collecting accounts. Administrative helps

HR functions like employee’s pay, leave’s , attendance, formalities in joining organization.

The administration controls and monitors the activities of the time office and security

personnel. Human Resource Development is the challenging function in front of the

administration department.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 21

SHREE RENUKA SUGARS, MUNOLI

Finance Department:

Finance is the life blood of the business. One cannot imagine a business without finance

department because it is the central point of all business activities. Finance department of

SRSL (Shree Renuka Sugars Ltd) plays a very important, as it is here that decision with

regard to procurement and utilization of funds are taken. Such decision includes the

preparation of various budgets, allocation of funds for various activities or division of the

firm as well as distribution of profits etc.

Accounting Department:

SRSL is an industrial organization manufacturing sugar, power and ethanol accounts

department of SSRL plays a vital role in achieving company’s objectives. Need for

accounting system:

To ascertain the profit/loss of the business.

To ascertain the financial position of the business

To provide control over assets and properties of the company

To provide information to tax authorities like sales tax, income tax, control excise etc.

Assistance to management on:

1. Decision-making

2. Forward Planning and budgeting.

To provide information to government central, state and various local bodies.

Cane Department:

Cane is the only raw material for producing sugar. The department keeps a direct link with

farmers and helps the farmer to develop the cane.

Objectives of Cane Department:

To produce the cane at proper time and proper condition

To look after the transportation of cane from farmers through trucks, tractors and

carts.

To develop the cane and giving proper guidelines to grow.

To keep and maintain concerned land database.

Hiring trucks and tractors

Harvesting cane.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 22

SHREE RENUKA SUGARS, MUNOLI

Engineering Department:

This department takes care of all repairs and maintenance of fittings and fixtures of the plant.

The electrical engineer is the head of the department. Assistant electrical engineer and junior

engineer assist him.

Functions:

Repair and maintenance of machines

To develop power of prime movers and lighting

Attending electricity related work

Maintenance of switch board, etc.

Sales Department:

Sales manager is incharge of the sales department. The sales department takes care of all the

sales. The assistant sales manager has to supervise the states. Marketing and advertisement

are not necessary in sugar industry because the customer do not ask for specific company

produced and that not separable.

Anyhow the contacts with dealers and agents are maintained and developed . About 40% of

the sugar produced by the company is used for domestic consumption and the rest 60% is

exported.

Functions:

As mentioned above, marketing and advertisement efforts are not made as mentioned above,

marketing and advertisement efforts are not made to promote sales, but the sales department

has to keep in contact with dealers and agents

Getting orders from parties.

Arranging for delivery to parties.

Maintains records of sales.

Sending reports to managing director (head office).

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 23

SHREE RENUKA SUGARS, MUNOLI

Human Resource Department:

The company recruits its manpower through various sources such as internal sources,

campus recruitments, advertising etc.

The selection process consists of collection of applications blanks. Screening of

applications, written tests (aptitude& technical, personal interview, technical

interview, medical examination, job offer, placement and induction).

Training is based on the requirements of the employee. Each employee is given a

questionnaire which consists of the various skills required to perform a particular job.

The employee rates himself on various aspects. Based on the ratings, the area in

which the training is to be given is decided and a training calendar is prepared every

year.

The employees are appraised on their performance once in every 6 months. The

appraisal method is based on “Rating Scale”. The appraiser rates his subordinate

based on the targets set and how far the subordinate is able to achieve his set targets.

SWOT ANALYSIS:

Strengths:

We are established since long time.

Largest sugar and ethanol producer in coastal India.

Integrated manufacturing company.

Unique business model.

Availability of high recovery and yield of sugar cane.

Good financial health of the company.

Weaknesses:

Absence of motivating incentives

High labour turnover

Obsolete cane cultivation techniques

Seasonal product fortunes swing from one extreme to another

Opportunities:

Scope to improve profitability

Scope to set up green field projects,

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 24

SHREE RENUKA SUGARS, MUNOLI

Scope to implement ERO system like SAP etc.

International markets can be trapped.

Can acquire more and more sick units in co-operative sector.

Threats:

Open market system for ethanol and alcohol

Government's involvement in fixing the sugarcane price

Huge competition

Advancement of technology and changing job profile

PRODUCT LIFE CYCLE:

Product life cycle is a business analysis that attempts to identify a set of common stages in

the life of commercial products. In other words the 'Product Life cycle' PLC is used to map

the lifespan of the product such as the stages through which a product goes during its

lifespan.

The stages of Product Life Cycle can be classified as follows :

Introduction:

The establishment stage is characterized by low growth rate of sales as the product is newly

launched in the market. Monopoly can be created, depending upon the efficiency and need of

the product to the customers. Firms usually incur losses rather than profit turning this stage. If

the product is in the new product class, the users may not be aware of its true potential. In

order to achieve that place in the market, extra information about the product should be

transferred to consumers through various media. The stage has the following characteristics:

Low competition

Firm mostly incurs losses and not profit

Promotion goes high

When a new product is introduced, market gain tends to be very slight. Marketing costs may

be high, and it is unlikely that there are any profits.

Growth:

The Growth stage is where your product starts to grow. In this stage a very large amount of

money is spent on advertising. You want to concentrate on telling the consumer how much

better your product is than your competitors' products. Growth comes with the acceptance of

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 25

SHREE RENUKA SUGARS, MUNOLI

the innovation in the market and profit starts to flow. If the monopoly exists, companies can

experiment with new ideas and innovation in order to maintain the sales growth. The growth

stage exhibits a rapid increase in both sales and profits, and this is the time to try and increase

your product's market share.

Maturity:

The third stage in the Product Life Cycle is the maturity stage. If your product completes the

Introduction and Growth stages then it will spend a great deal of time in the Maturity stage.

During this stage sales grow at a very fast rate and then gradually begin to stabilize. The key

to surviving this stage is differentiating your product from the similar products offered by

your competitors. Due to the fact that sales are beginning to stabilize you must make your

product stand out among the rest. Aggressive competition in the market results in profits

decreasing at the end of the growth stage thus beginning the maturity stage. In addition to

this, the maturity stage of the development process is the most vital.

Decline:

The decline stage is where most of the product class usually dies due to low growth rate in

sales. A number of companies share the same market, making it difficult for all entrants to

maintain sustainable sales levels. Not only is the efficiency of the company an important

factor in the decline, but also the product category itself becomes a factor, as the market may

perceive the product as "old" and may not be in demand. It is not always necessary that a

product should go through these stages. it depends on the type of product, its competitors,

scope of the product, etc. and free from tax perks, and life people.

The duration of each life cycle phase can be controlled, to some extent. The phase that can be

controlled in particular is the maturity phase, in which steps can be taken to ensure that it

lasts longer than what it initially was going to. Some of the known tactics used in extending

the maturity phase are: • by adding or updating the features of a particular product. • by using

different pricing approaches to attract consumers that use a different brand. • by advertising

to encourage people that have never used a product in the category to try it and therefore gain

new customers.

LEADERSHIP STYLE :

Leadership is different to management. Management relies more on planning, organizing and

communication skills. Leadership relies on management skills too, but more so on qualities

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 26

SHREE RENUKA SUGARS, MUNOLI

such as integrity, honesty, humility, courage, commitment, sincerity, passion, confidence,

positively, wisdom, determination, compassion and sensitivity. Some people are born more

naturally to leadership than others. Most people don't seek to be a leader. Those who want to

be a leader should develop leadership abilities.

Leadership can be performed with different styles. Some leaders have one style, which is

right in certain situation and wrong for others. Some leaders can adapt and use different

leadership styles from the given situation.

Authoritative Leadership

Democratic Leadership

Participative Leadership

In the modern business situation of SRSL, the company is using "Democratic Leadership

Style" . Anyone in the firm can directly meet anyone. Daily meeting will be held between the

sales team and the team manager to solve the problems of the team mate and to collect the

sales details. Team manager will report to the AGM (Assistant General Manager) on the

same day. Once in a week AGM will meet the sales executives. Once in a month Vice-

Chairman of the organization meets all the managers.

The decision power is handled by CEO. he will take major decisions regarding

developmental activities and relationship with other dealers and corporate buyers. Each

department is given power and responsibilities to operate and take decisions.

SRSL has instituted adequate internal control procedures commensurate with the nature of

business and size of its operations. SRSL has also prepared an 'Internal Control Procedure

Manual' for all the departments to ensure that the control procedures are followed by all the

departments. Internal controls are supported by internal audit and management reviews. The

Board of Directors has an Audit Committee chaired by an Independent Director. The Audit

Committee meets periodically the management.

External-Internal auditors

Internal-Internal auditors

Statutory auditors and reviews the audit plans

Internal controls

Audit reports and the management response to the observation and recommendations

emanated from the audit. All significant observations and follow-up actions are

reported to the Audit Committee.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 27

SHREE RENUKA SUGARS, MUNOLI

STRATEGIC OUTLOOK:

Vision:

To be among the top three integrated sugar and ethanol companies in the world by harnessing

our strengths and realizing synergies through our global presence.

Synergy:

We are present in the world’s largest sugar producing and consuming regions which provide

us with superior business intelligence and help leverage information flows.

Our Brazilian operations have low operating cost, high scalability and highly conducive

climatic conditions.

Our Indian operations are present in Southern and Western parts of India where the recovery

of cane is higher than other cane growing regions in the country.

Our strategically located port-based refineries in India cater to India, South Asia and Middle-

East markets competitively.

Innovation:

Driving Growth through innovation.

Innovation has been the driving force of our growth right from inception.Our journey began

with raising capital innovatively by inducting farmers as shareholders in the Company.

We pioneered the concept of operating sugar manufacturing assets in India on lease.

We are running power projects at third party mills on BOOT basis.

We are one of the first in the traditional Indian sugar industry to have ventured into the

business of sugar refining.

We have aligned our strategies to achieve synergies from our presence in Brazil (the largest

sugar producer), India (the largest sugar consumer) and an extensive reach to the growing

sugar markets in Asia

Mission:

"Its mission in meeting these objectives are to expand its installed capacity, achieve end-to-

end integration for all its plant to improve margins, achieve greater raw material security,

increase its focus of corporate and high value customers to reduce price-risk in sugar by

hedging, maintain a strong presence in export market and expand a market for ethanol.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 28

SHREE RENUKA SUGARS, MUNOLI

Social Initiatives:

At Shree Renuka Sugars, our belief is that our work is not over when we report profitability

to our shareholders. We believe we are equally responsible to contribute to the society within

which we operate. To this end, we have sponsored a host of programs that positively impacts

the well being of the people and sections of the society that need intervention to better their

prospects.

We believe that development of the communities in which we operate will result in the

empowerment of not just the people in these communities but the nation at large.

Our CSR foundation has been built on two pillars focusing on Rural Health and

Development as well as Education:

Shree Renuka Institute for Rural Development & Research (SRIRDR), a NGO

sponsored by Shree Renuka Sugars Ltd. (SRSL) dedicated to serve the cause of

Health and Rural Development.

Shree Renuka Sugars Development Foundation (SRSDF), a registered Trust engaged

in the promoting education to bring about the rural transformation and sustainable

development.

Educational Initiatives:

In a bid to improve the educational level of our staff

families and the communities we operate in, we have

tried to contribute by building a variety of educational

institutions that educate, provide employability skills

and help improve the standard of living of the people

in these communities.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 29

SHREE RENUKA SUGARS, MUNOLI

Healthcare Initiatives:

Our initiatives catering to the health and well being

of the communities we operate in include Health

Centers, Multi Diagnostic health camps, a Hi Tech

Diagnostic centre, an Ambulance service and

ShakarShalas for children of cane harvesting staff

which provides not only education but also nutritive

food and regular health check-ups, along with sports

and cultural activities.

Community Development Service:

Being a conscientious contributor to the well

being of the communities around us, we

contribute through variety of programs that

positively impact the lives of the communities we

serve.

Apart from these initiatives, we also hold sports meets, yoga shivirs, sarvashikshanabhiyan

programs, van mahotsavs and street dramas.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 30

SHREE RENUKA SUGARS, MUNOLI

BUSINESS

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 31

SHREE RENUKA SUGARS, MUNOLI

INDIAN BUSINESS:

Integrated Sugar Mills:

The Company operates seven sugar mills in India located in the states of Karnataka and

Maharashtra. The mills are integrated to the fullest to process sugarcane, produce sugar and

its by-products ethanol, power and bio fertilizers.

1. Units in Karnataka: Munoli, Athani, Havalga, Gokak, Raibag

2. Units in Maharashtra: Ratnaprabha, Panchaganga

Sugar mills at Raibag and Panchganga are operated on lease by SRSL.

SRSL also operates cogeneration plants of Panchaganga, Ajinkyatara&Arag on BOOT basis.

The mills have a total crushing capacity of 7.1 MTPA or 35,000 TCD and produces high

quality sugar which is mostly sold to food and beverage industry. Indian distillery capacity

stands at 930 KLPD and it manufactures fuel grade ethanol which is sold to Oil

Manufacturing Companies along with Chemical industry. Power plants in India generate 242

MW of power of which 135 MW is exportable and mainly sold to open access grids.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 32

SHREE RENUKA SUGARS, MUNOLI

In India,ethanolis consumed primarily by portable alcohol industry, Oil marketing companies

(for blending with petrol) and chemical industries.

Sugar Refineries:

The Company operates two port based sugar refineries with total refining capacity of 1.7

MTPA. The rated capacity of the Kandla sugar refinery is 3,000 tons per day and that of the

Haldia refinery 2,000 tons per day.

Operating Models:

India Importing: Import raw sugar, sell refined sugar locally (When India is sugar

deficient).

India Exporting: Refine local raw sugar, sell internationally (When India produces

surplus sugar).

Tolling Operation: Import & re-export to capture global refining margin.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 33

SHREE RENUKA SUGARS, MUNOLI

Advantages:

Port-based location minimizes freight costs and enables cost efficient imports and

exports of sugar.

Flexibility to shift focus from domestic market to export.

Gujarat refinery location enables competitive exports to the highly sugar deficit

Middle East region.

Haldia refinery strategically located close to sugar deficit regions in East India and

South-East Asia.

Madhur:

Madhur Sugar was launched in 2007 by Shree Renuka Sugars Limited and is the leading

sugar brand in India today. From the beginning it has focussed on providing pure and

hygienic sugar to its customers.

Advantages:

Natural Sweetness - Sugar made from superior quality sugarcane.

Sulphur Free Processing - Stringent quality control & sulphur-free refiningprocess

ensure 'consumption-healthy' sugar.

Consistent Quality - Refined, sparkling white, moisture free and easy to dissolve

crystals.

Advanced Production Technology - Manufactured, packed, stored & shipped in a

state-of-the-art refinery that complies with International standards to ensure that every

crystal is untouched by hand.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 34

SHREE RENUKA SUGARS, MUNOLI

Supported by these inherent advantages and backed by strong Marketing & Sales support, it

is not surprising that Madhur is the leader in most of the markets it is present in, from the

local kirana stores to the leading modern retail chains across the country.

Madhur Sugar ensures that our every sugar crystal contributes to the moments of delight and

celebration into one's life.

Currently, Madhur Sugar has strong presence in areas like Gujarat, Maharashtra, Delhi,

Rajasthan& Karnataka.

Madhur Sugar is also increasingly making its presence felt in many other parts of India

including Haryana, Madhya Pradesh, Andhra Pradesh, Kerala, Punjab and Jammu &

Kashmir.

KBK Chem-Engineering Pvt Ltd:

KBK Chem-Engineering Private Ltd is a 100% subsidiary company of Shree Renuka Sugars

Ltd based in Pune. It has acquired a well-deserved reputation for providing optimal solutions

for Fermentation & Distillation industries, having its presence in countries of Asia, South-

East Asia & Africa. Well engineered, innovative and effective EPC plant solutions are our

hallmark.

KBK is an Indian Company providing its one of kind services across the Globe.

KBK’s has installed plants in last five years in record time & 7 projects under

execution.

KBK’s success in building EPC Plants in three continents has led KBK to undertake

mega-projects that contribute handsomely to the world's Ethanol and Distillery

Industry. Discerning clients have chosen KBK products after thorough global market-

searches and the "K-SUPER" & “K-M@S” technology advantage has won KBK

accolades from time to time.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 35

SHREE RENUKA SUGARS, MUNOLI

BRAZILIAN BUSINESS:

Renuka do Brazil S/A:

SRSL acquired RdB from GrupoEquipav on July 7, 2010 and holds currently 59.4% equity

stake.

RdB is one of the largest sugar/ethanol companies in Sao Paulo state in Southeast Brazil.

Facilities include two modern mills and integrated co-generation capacity- Madhu (Equipav,

erstwhile) and Revati (Biopav, erstwhile).

RdB has a crushing capacity of 44,400 TCD or 10.5 million tons/yr to produce sugar which is

sold in domestic as well as export markets. Distillery has a capacity of 4,000 klpd to produce

both hydrous and anhydrous ethanol for Flex-fuel cars as well as industrial needs. RdB

generates 221 MW of exportable power. Owned cane plantations at RdB cover 78,000

hectares of land.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 36

SHREE RENUKA SUGARS, MUNOLI

Renuka Vale doIvai S/A:

SRSL acquired 100% of Renuka Vale do Ivai on 19th March, 2010.

RVdI has two mills – São Pedro doIvaí (PR) and Cambuí (PR) – in the state of Parana with

surrounding own cane plantations on 28,000 hectares of land.

Proximity to ethanol distributors and the port of Paranagua (551 km) along with the stake in

logistics companies and a port terminal ensures lower logistics and export costs.

RVdI has a crushing capacity of 15,120 TCD or 3.1 million tons/yr to produce sugar for

domestic as well as export markets. Distillery has a capacity of 1,310 klpd to produce both

hydrous and anhydrous ethanol.

PRODUCTS:

Sugar:

White/Refined Sugar:-

White sugar is sugar which has been refined and

washed so that it has a white appearance and no

molasses flavour. It contains 99.9% sucrose.

It is normally consumed in households and being

relatively neutral in flavour, it is used as an ingredient

in various edible processed foods and beverages.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 37

SHREE RENUKA SUGARS, MUNOLI

VHP (Very High Polarized)Sugar:-

It is a type of raw sugar, manufactured mainly in Brazil, which is classified as a chemical

product which is easy to transport and need further refining before it can be used for

consumption. In recent years, VHP sugar (raw sugar) has been a standard sugar category

traded on the international market.

Sugar Refining Process :-

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 38

SHREE RENUKA SUGARS, MUNOLI

Sugar Manufacturing Process :

Ethanol:

Ethyl alcohol or ethanol can either be produced

by direct fermentation of cane juice or from

molasses, which is a by-product of the sugar

manufacturing process. In India, ethanol can be

produced only from molasses whereas, mills in

Brazil produce ethanol directly from sugarcane

juice. Ethanol can be used for potable alcohol

industry, chemical industry and as a bio-fuel in

vehicles (direct/blended with gasoline).

In India, ethanol is consumed primarily by portable alcohol industry, Oil marketing

companies (for blending with petrol) and chemical industries.

In Brazil, ethanol is primarily utilized as fuel in flex-fuel cars either directly as hydrous

ethanol or anhydrous ethanol blended with gasoline.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 39

SHREE RENUKA SUGARS, MUNOLI

Ethanol Manufacturing Process :

Power:

Shree Renuka Sugars produces power from

bagasse (sugarcane by product) for captive

consumption and sale to the state grids in India

and Brazil. The Bio energy produced from

burning bagasse is a renewable energy that

provides a significant reduction to greenhouse

gas emissions.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 40

SHREE RENUKA SUGARS, MUNOLI

Power Generation Process:

Bio-Fertilizers:

Sugar industry is a unique industry which

follows the principle of soil-to-soil. Press-

mud/filter cake obtained as waste during sugar

manufacturing process is mixed with the effluent

from distillery operations to give bio fertilizer.

This bio fertilizer is organic, eco-friendly and

cost-effective compared to chemical fertilizers.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 41

SHREE RENUKA SUGARS, MUNOLI

Bio-Fertilizer Production Process:

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 42

SHREE RENUKA SUGARS, MUNOLI

INTRODUCTION OF

RATIO ANALYSIS

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 43

SHREE RENUKA SUGARS, MUNOLI

INTRODUCTION OF RATIOS:

When we observed the financial statement comprising the balance sheet & profit or loss

account is that they do not give all the information related to financial operations of the firm,

they can provide some extremely useful information to the extent that the balance sheet

shows the financial position on a particular date in terms of structure of assets, liabilities and

owners equity and profit or loss account shows the result of operation during the year. Thus

the financial statements will provide a summarized view of the firm. Therefore in order to

learn about the firm the careful examination of in valuable reports and statements through

financial analysis or ratios are required.

Meaning &Definition:

Ratio analysis is one of the powerful techniques which is widely used for interpreting

financial statement. This technique serves as a tool for assessing the financial soundness of

the business.The idea of ratio analysis was introduced by Alexander wall for the first time in

1919. Ratios are quantitative relationship between two or more variables taken from financial

statements.

Ratio analysis is defined as, the systematic use of ratio to interpret the financial statement so

that the strength and weakness of the firms well as its historical performance and current

financial condition can be determined in the financial statements we can find many items are

co-related with each other for e. g. current assets and current liabilities, capital and long term

debt, gross profit And net profit, purchase and sales etc.

To take managerial decision the ratio of such items reveals the soundness of financial

position. Such information will be useful for creditors, shareholders, management.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 44

SHREE RENUKA SUGARS, MUNOLI

IMPORTANCE OF RATIO ANALYSIS

Ratio analysis serves for many purpose and is helpful not only for internal management and

but also for prospective investors, creditor and other outsiders.

The following are the importance of the ratio;

It helps in making financial estimates for the future.

It is an important tool to check upon the working capital in being used in business

enterprises.

It helps the management of business of concern in evaluating its financial position and

efficiency of performance.

It helps the task of manager control to a great extent.

It helps the credit supplier and investors in evaluating the business for potential

investment outlet.

It serves as an instrument for testing managing efficiency.

It servers as a sort of health test of a business firms because with help of this analysis

financial manager can determine whether the firm is financially healthy or not.

It helps the management of a business concern to discharge there basic function of

planning, co-ordinating, controlling etc.

With help of this analysis ideal ratio cn be established and this can be used for the

purpose of comparison of the firm progress and performance.

It sometimes provide a useful tool for decision for on certain policy matter.

DISADVANTAGES OF RATIO ANALYSIS

It is essential to understand the formula and assumptions used in computation of a

ratio by another person before attempting to interpret or compare the same.

Comparison of ratio between two firms may not be valid in view of differing

management and accounting policy followed in presenting the financial data.

The ratio re based on historical values and non-consideration of changes in price

levels renders comparison between old and new firm is less meaningful.

The validity of the analysis depends on the knowledge, competence and integrity of

the analyst.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 45

SHREE RENUKA SUGARS, MUNOLI

The ratio analysis does not consider the non-financial data.

The terminology used in the analysis is not standardized.

USES OF RATIO ANALYSIS

The uses of ratio analysis are classified into four ways. They are as follows;

1. Uses of ratio analysis to management.

2. Uses of ratio analysis to investors.

3. Uses of ratio analysis to creditor.

4. Others uses

Limitations of Ratios:

Ratios should be used with extreme care & consideration judgment because they suffer from

certain serious drawbacks; some of them are listed below:

Ratio can sometimes be misleading if an analyst does not know the reliability &

soundness of the figures from which they are computed & the financial position of the

Business at other times of the year.

The mechanics of ratio construction are not as important as the proper interpretation

of the ratios. As a matter of the fact, ratios are only the primary step in interpretation.

They call attention to certain aspects of a business which need detailed investigation

before arriving at any final conclusion.

Ratio can never be substituted of raw figures. At the time of interpretation, therefore

raw figures should also be referred too.

Price level changes makes ratios analysis difficult.

Types of Ratios:-

Ratio as tool of financial management is of crucial significance. Ratios are tool of measuring

liquidity, profitability, efficiency & financial position of the firm.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 46

SHREE RENUKA SUGARS, MUNOLI

Ratio can be classified into 4 basic types:

1) Liquidity Ratio:

Liquidity Ratio provides test to measure the ability of the firm to cover its short-term

obligations out of its short-term resources. Interpretation of liquidity ratios provides

considerable insight into the present cash solvency of the firm& its ability to remain solvent

in times of adversity. It is mainly classified into 2 types, viz.,

a) Current Ratio

b) Quick Ratio

A. Current ratio:The current ratio of a unit measures firms short-term solvency that is

its ability to meet short-term obligation. It is the ratio of total current to the current

liabilities.

The current ratio measures that ability of the firm to meet its current

liabilities current assets get converted into cash in the operating cycle of the firm

and provides the funds needed to pay current liabilities.

Current Ratio = Current Assets/Current Liabilities

B. Quick Ratio: This ratio is also termed as acid ratio. A Quick ratio is concerned with,

the relationship between quick assets and current liabilities. It is a measure of liquidity

calculated current assets minus inventory and prepaid expenses by current liabilities.

The quick ratio between quick current assets and current liabilities.

Quick ratio = Quick Current Assets / Current Liabilities

2) Leverage Ratio:

Leverage ratios generally designed to measure the contributions of the firm's owners funds

provided by its creditors. These ratios are computed to solicit information along the following

lines-

l) The firm's ability to weather times of stress & to cover all its obligations including Short-

term & Long-term obligations.

2) The margin of safety afforded to the creditors

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 47

SHREE RENUKA SUGARS, MUNOLI

3) The extent of control of stock holders over the firm.

4) The potential earnings from the use of loan funds.

It is mainly classified into 3 types, viz.,

a) Total debt ratio

b) Debt equity Ratio

c) Interest coverage Ratio

A. Total Debt Ratio: Total debt is a ratio that indicates the proportion of a company

debt to its total assets. It shows how much the company relies on debt to finance

assets. The debt ratio gives users a quick measures of the amount of debt that the

company has on its balance sheets compared to its assets. The higher the ratio, the

greater the risk associated with the firms operation. A low debt ratio indicates

conservative financing with an opportunity to borrow in the future at no

significant risk.

Debtors Turnover Ratio = Total Sales /Debtors

B. Debt equity ratio:Debt equity ratio, also known as external, internal equity ratio

is calculated to measure the relative claims of outsides &owner against the firm

assets. The debt equity ratio can be calculated by dividing total debt by equity.

Debt equity ratio=short term loan+long term loan/ shareholders funds

3) Activity Ratio:

Activity ratios reflect how efficiently the firm is managing its resources. This ratio expresses

relation between the level of sales &the investment in various assets: inventories, receivables,

fixed assets, etc

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 48

SHREE RENUKA SUGARS, MUNOLI

It is mainly classified into 10 types, viz.,

a) Inventory turnover Ratio

b) Inventory conversion period

c) Debtors turnover Ratio

d) Debtors collection period

e) Gross operating Ratio

i) Creditors turnover Ratio

g) Creditors collection period

h) Net asset turnover Ratio

i) Current asset turnover Ratio

j) Working Capital turnover Ratio

4) Profitability Ratio:

Profitability Ratios are the best indicators of overall efficiency of a business concern because

they return of value put into business with sale or service carried on by the firm with the help

of assets employed.

It is mainly classified into 6 types:

a) Gross profit Margin Ratio

b) Net profit Margin Ratio

c) Operating expense Ratio

d) Proprietary Ratio

e) Return on investment Ratio (ROI)

f) Return on equity Ratio (ROE)

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 49

SHREE RENUKA SUGARS, MUNOLI

1. DEBTOR TURNOVER RATIO:

Debtor turnover ratio is the relationship between net sales and average debtors. It is also

called account receivable turnover ratio because we debtor and bill receivables total is used

for following formula.

=Net credit sales/Average Debtor(sundry debtors+ bill receivable)

Average Debtor=opening balance of debtor+closing balance of debtor/2

2. STOCK TURNOVER RATIO:

Stock turnover ratio indicates the velocity with which stock of finished goods is

sold. Generally it is expressed as number of times the average stock has been “turned over”

or rotate of during the year

Stock turnover ratio=net sales/average inventory at cost

Average inventory=(opening stock+ closing stock)/2

3. TOTAL ASSETS TURNOVER RATIO:

Assets turnover ratio is the ratio of a company sales to its aseets. It is an efficiency

ratio which tell how successfully the company is using its assets to generate revenue.

Total assets turnover ratio=net sales/Average total assets

4. WORKING CAPITAL TURNOVER RATIO:

Working capital turnover ratio is an activity ratio that measures dollors of revenue

generated per dollor of investment in working capital. Working capital is defined as

the amount by which current assets exceed current liabilities.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 50

SHREE RENUKA SUGARS, MUNOLI

Working capital turnover ratio=net sales/net working capital

5. GROSS PROFIT:

Gross profit ratio is a profitable ratio that shows the relationship between gross profit

and total net sales revenue. It is a popular tool to evaluate the operational performance

of the business. The ratio is computed by dividing the gross profits figure by net sales.

Gross profit ratio=gross profit/net sales

6. NET PROFIT RATIO:

Net profit ratio is a popular profitability ratio that shows relationship between net profit

after tax and net sales. It is computed by dividing the net profit after tax.

Net profit ratio=net profit after tax/net sales

7. FIXED ASSETS TURNOVER RATIO:

The fixed assets turnover ratio is an efficiency ratio that measures a companies return

on their investment in property, plant, and equipment by comparing net sales with

fixed assets.

Fixed assets turnover ratio=net sales/fixed assets-accumulated depreciation

8. RETURN ON SHARE HOLDERS INVESTMENT:

Is a measures of overall profitability of the business and is computed by dividing

the net income after interest and tax by average stockholders equity. It is also known

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 51

SHREE RENUKA SUGARS, MUNOLI

as return on equity ratio and return on net worth ratio. The ratio is usually expressed

in percentage.

Return on shareholders investment=net income after interest and tax/average

shareholders equity*100.

OPERATING RATIO:

The operating ratio shows the efficiency of a company's management by comparing

operating expense to net sales. The smaller the ratio, the greater the organization's

ability to generate profit if revenues decrease.

Operating Ratio=Operating expenses/Net sales.

AVERAGE COLLECTION PERIOD:

The average collection period is the approximate amount of time that it

takes for a business to receive payments owed in terms of accounts receivable.

Average collection period=average debtor/credit sales*360

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 52

SHREE RENUKA SUGARS, MUNOLI

DATA ANALYSIS

& INTERPRETATION

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 53

SHREE RENUKA SUGARS, MUNOLI

1. Debtor turnover ratio:

Formula : Net Credit sales / Average debtor

Years Net credit sales Average debtor Ratio in times

2014-15 5744.20 283.22 20.28

2015-16 5862.05 384.44 15.24

2016-17 7771.53 589.03 13.19

RATIO

25

20

15

10 RATIO

5

0

2014-15 2015-16 2016-17

Interpretation:

The debtor turnover ratio is an activity ratio measuring how efficiently a firm uses its assets

Ratio in 2015 is 20.28,

2016 it decreased to 15.24,

2017 it decreased to 13.19.

In 2017 debtors is increased so the debtors turnover ratio is decreased.

It calculates the efficiency of the firm and if debtors increases that seems company is in loss.

KLE SOCIETY’S COLLEGE OF BUSINESS ADMINISTRATION, HUBBALLI Page 54

SHREE RENUKA SUGARS, MUNOLI

2.Stock turnover ratio:

Formula :Net sales/ Average inventory cost

Years Net sales Average Ratio in times

inventory

2014-15 5744.20 1452.29 3.95

2015-16 5862.05 1935.24 3.02

2016-17 7771.53 1342.97 5.78

RATIO

8

4

RATIO

2

0

2014-15 2015-16 2016-17

Interpretation:

If the actual ratio is more than 8 times it indicates that more sales are effected and effective

inventory management and goods sold many times in a year.

Ratio in 2015 is 3.95,

2016 is decreased to 3.02,

2017 it is increased to 5.78

After 2015 there are immense upgrade in stock turnover ratio is shows management