Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BusOrgs CheatSheet Midterm

Caricato da

TDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BusOrgs CheatSheet Midterm

Caricato da

TCopyright:

Formati disponibili

Ch1:Agency:Analysis(1) Is there a P-A Rshp, (2) Did A have authority, (3)was agreement made by A w/in Pnr or EE?

Pnr or EE? Consider when determining b/w Pnr or EE: (1)investment in firm, Oshp of firm assets, & Liab for entities (corp) can b jointly liable 4 some action on basis of being part of shared enterprise. Claimed when (corp has a preexisting K’l rght), *expectancy (Corp doesn’t have legal rght yet, but given other dealings,

the Scope of A’s authority? firm debts & oblgns. (factors do exist=Pnr role); do not=status akin 2 EE) (2)whether (& what extent) indv’s theres common Oshp among 2+ corp (sister corp). CANT use enterprise Liab 2 pierce corp veil. reasonable expectancy that opp would b offered e.g., lease renewal); or *necessity (Corp needs in order 2

§1.01Elements of P-A Rshp: Arises when: (1)P indicates A should act on Ps b1/2, & (2)A is subject to P’s compensation based on firm’s profits & whether they receive fringe benefits (Ind subj 2 firms econ fortunes, Piercing Veil in LLC: Mentioned in Chpt 2; 2 Prong Test: (1)Is the unity of interest & Oshp such that stay in biz, e.g., certain raw materials necessary 2 manuf prdct) Ask yourself: (1)Is opp consistent w/ corps

ctrl, & (3)A manifests assent or otherwise consents so to act for P. -Agency Rshp arises only when the status resembles Pnr; paid salary=akin 2 EE) (3)Rght 2 engage in policy making; Participation in & votng pwr separate personalities of corp & the indv SH no longer exist? &,(2)Would equitable result occur if acts R current/anticipated future biz?; (2)Does corp even have resources 2 pursue the opp? Line of Biz Test:

elements in §1.01 are present. If parties characterize their Rshp as agency= not ctrlling. (§1.02) w/ regard 2 firm governance; Ability 2 assign work & 2 direct the activities of EEs w/in firm; & The ability 2 act treated as those of corp alone (injustice would result if percing werent allowed)? LLCs less formalities; harder *wheres corp now & where might it logically expand in the future taking into consideration financial

§2.04RS: Er subject 2 Liab 4 torts committed by EE acting w/in the SOE. §7.03P’s Liab-In Gen:(1)A P is 4 the firm & its Ps. 2 show unity of interest based on failure 2 follow formalities. *LAYA Factors: Consider when piercing corp constraints; Fairness Test: (NOT used in CA or DE) *Looks whether FiD taking a corporate Opp

subject to DirectLiab to a 3rd party harmed by an A’s conduct when either; (a)A acts w/ AA or the P Pshp Mgmt: Any Pnr has pwr 2 bind a Pshp in regards 2 day2day operations; bigger decisions/change 2 its veil; *Commingling F/A w/ ind SHs; *Diversion of corp's F/A 2 non-corporate uses; *Failure 2 maintain violated whats considered fair & equitable by corporate stds. Idea behind the test: If the opp falls w/in

ratifies the A’s conduct, & [(i)the A’s conduct is tortious, or (ii)the A’s conduct, if that of P, would subject P day2day operations; Maj vote typically appropriate. Std default rule-each Pnr has one vote. For Really BIG corporate formalities necessary 4 stock issuance; *SHs representing 2 persons outside the corp that they R corps biz or its prospective biz, should still b deemed 2 b corporate opp; Hybrid tests include the Line of Biz

to tort Liab; or (b) P is negl in selecting, supervising, or otherwise ctrlling the A; or (c)P delegates decisions; Outside ordinary course of biz, require unanimous approval. PersLiab; *Failure 2 maintain mins/adequate records; *Identical equitable Oshp in 2 entities; *Failure 2 concept & some aspect of interest, expectancy, & necessity tests. Some St employ fairness test; under

performance of a duty to use care 2 protect other persons or their prop to an A who fails 2 perform the duty. *Pshp Rule of Thumb: Absent PA contrary, diff arising b/w Pnrs as 2 ordinary matters connected w/ Pshp adequately capitalize Corp; *Absence of sep held Corporate assets; *Use of same office/biz location by corp fairness test, 1 would need 2 determine whether Off/Dir taking Opp would violate stds of whats fair &

(2)P is subject to VicLiab to 3rd party harmed by an A’s conduct when either: (a)A is an EE who commits biz must b decided by maj vote; Status quo remains in place unless by PA or a maj vote or Dissolve. & its indv SHs; equitable by corporate stds. Common Defenses: Even if Opp fall under 1 of above tests, might still b

a tort while acting w/in the SOE (§7.07); or (b)A commits a tort when acting w/ AppA in dealing w/ a 3rd Pshp Finan Struc (w/oPA), Each Pnr chargeable 4 losses of Pshp in same proportion that Pnrs share Rev Piercing: Direction of piercing diff, BUT test same. Occurs when claim against ind SH is found 2 b found NOT 2 qualify as Corporate Opp (1)Incapacity: Circumstances where Corp not able 2 take

party on or purportedly on b1/2 of the P (§7.08) profits. enforceable directly against corp in which ind is a SH. advantage of Opp; Corp couldnt take advantage of Opp b/c of Legal Restrictions (anti-trust laws, K

§7.07Agency Defined:(1)Er is subject to VicLiab 4 a tort committed by its EE acting w/in the SOE.(2)EE Interests Pnrs Hold:*Econ rghts:Includes the rght 2 receive $ [Econ rghts R transferable; When Piercing b/w Parent & Subsd Corps: Std 4 piercing same, but Cts R frequently less rigorous that fraud-like restrictions in a loan agreement, or Corp in bankruptcy, thus subj 2 restrictions on biz dealings); Practical

acts w/in the SOE when performing work assigned by the Er OR engaging in a course of conduct subj transferred, transferor Pnr will sometimes still hold mgmt rghts in the Pshp. May obtain an econ interest in conduct or injustice b shown. Cts look 4 interlocking BoD b/w parent & subsdy as indication that sub is Restrictions (Corp didnt have financial resources 2 purchase particular Opp, or holder of Opp refused 2 deal

to the Er’s ctrl. EE’s act is NOT w/in the SOE when it occurs w/in an independent course of conduct NOT several ways: (1)By voluntary transfer; (2)By invol transfer which may occur due 2 enforcement of judgment not“separate.” Just like Corp must b separate from SHs, sub corp must b separate & independent from its w/ corp, or Corp lacked skills 2 engage in Opp). (2)Source: Opp presented 2 sum1, NOT b/c corporate

intended by the EE 2 serve any purpose of the Er. SOE (*Clover): Acts w/in SOE are acts which R so against him/her; or (3)Following death of the transferor Pnr] *Mgmt rghts: Includes rght 2 vote & participate in parent or risks piercing. position BUT b/c of their personal skills/attributes/expertise. (Deemed not 2 b corporate opportunity b/c Opp

closely connected w/ what the servant is employed to do, &, so fairly & reasonably incidental to it, that they mgmt of Pshp. Mgmt rghts R not transferable w/out consent of ALL the Pnrs. Alter Ego Doctrine: Imposes Liab on Corp 4 acts of its sub when sub is organized/operated as mere tool/biz is determined 2 belong 2 the indv, not 2 Corp) If Corporate Opp exists, a person wishing 2 take advantage

may be regarded as methods, even if improper, of completing objectives of the Emnt. *Birkner Pshp Prop: Econ rghts dont entitle 2 any rght in any of the specific prop of the Pshp. (ALL prop acquired by conduit. Applies when theres such unity b/w parent & subsdy that the separateness of the 2 corps has of the Opp must fully disclose the Opp + their interest in Opp 2 BoD. (BoD has first rght of refusal on Opp) If

Criteria:(detailed what engaging in course of conduct is) *EE must be about Er’s biz & duties assigned by Er the Pshp is prop of the Pshp & not of Pnrs indvly) ceased & holding only the subsdy corp. liable would result in an injustice. Single biz Enterprise Theory: When BoD DOESN’T properly reject Opp, & indv takes Opp, breach may still b cleansed by disclosure 2, &

(vs. being wholly involved in personal endeavor); *EE’s conduct must occur substantially w/in hrs of ordinary *FiD & Other Duties in Pshp: (1)Pshp DoC: Std by which Pshp must evaluate & make Pshp decisions. Corps R operated as separate entities but integrate their resources 2 achieve common biz purpose, each approval by, the SHs or by showing that trans was fair. Violation of the Corporate Opp Doctrine subj 2

(spatial) boundaries of Ement; & *EE’s conduct must be motivated at least in part by purpose of serving Er’s RUPA §404c Pnr violates DoC if they engage in: *Gross negl, *Reckless conduct, *Intentional misconduct, constituent Corp may b held liable 4 debts incurred in pursuit of that biz purpose. Totality of Cir: must b various equitable remedies (such as constructive trust). No liability 4 possessing/knowing about corporate

interest. & *knowing violation of the law. (2)Pshp DoL: Pnrs have oblgns; 2 account 2 Pshp 4 profits, prop or benefits evaluated whether subsdy may b found 2 b alter ego/mere instrumentality of parent corp. Factors 2 b Opp. Corporate Opp Doctr Analy: *Line of Biz Test (most common)(Off/Dir may not take biz opp 4 his

§1.03Manifestation: A person manifests assent or intention through written or spoken words or other from the conduct (or winding up) of Pshp biz or use of Pshp prop; Cant act as/on b1/2 of party w/ adverse considered R whether: *Parent & Sub have common Dirs/Offs, *have common biz departments; *file own if: (1)Corp can financially exploit the opp; (2)Opp w/in Corp line of biz; (3)Corp has interest/expectancy in

conduct. interest 2 the Pshp; & 2 refrain from competing w/ Pshp in the subj matter of the Pshp biz (Pnr not 2 take consolidated financial statements & tax returns; *Parent finances the subsdy; *Sub receives no biz except Opp; (4)Off/Dir has not wrongfully employed Corp resources in pursuing/exploiting Opp; *Fairness Test;

-§2.01/3.01Actual Authority(AA)+Creation: (Express-comm 2 A OR Implied) A acts w/AA when it’s created opportunities belonging 2 Pshp; May take opportunity 4 personal benefit if they (1)Disclose the opportunity 2 that given to it by the parent; *Daily operations of the 2 corp are not kept separate. *Combined Biz/Fairness test; *ALI Approach (rarely used)(when Dir of corp presented w/ a biz opp closely

by (1)P’s manifestation 2 A that, (2)as reasonably understood by A, (3)expresses P’s assent that A take the other Pnrs & Pshp; & (2)Give the Pshp opportunity 2 act & if it declines, get Pshps consent 4 Pnr 2 take Other Claims that Might B Made Against Personal Assets of SHs: *Actual Fraud;*Fraudulent related 2 a biz in which corp is engaged, Dir must fully disclose the Opp 2 the corp; Only after corp formally

action on P’s b1/2. (AIA- P acted in manner that would lead A 2 reasonbly believe P intended 4 A 2 have opportunity. Pnr must perform duties 2 Pshp & Pnrs consis w/ Implied Covenant of GFFD (not consid Fid conveyances/transfers;*Improper dividends;*Negl (If SH commits neg act on b1/2 of corp &, as direct result, rejected Opp, Dir may take advantage of Opp; Approach “protects the DoL while providing long-needed

such pwrs 2 carry out duties; default rule is if P does not tell A how to carry out task, Ct lets A carry however Duty). Pnrs can waive specific duties (categ of act dont viol DoL) but not gen duties (DoL). Wvr occurs b4 sum1 is injured; injured party may sue corp but may also sue negl indvdl);&,*Personal guaranty of corp oblgn clarity+guidance 4 corporate decision makers)

they please) the fact, & ratification occurs after the fact. Ratification more informed action; 2 b effective Pnrs ratifying by SH (No need 2 pierce corp veil; SH already PersLiab under volun. k prom to pay on b1/2 of corp. Dominant SH & the DoL: Dom SH has more influence over the Corp & over BoD. Most Cts don’t allow

§2.02Scope of AA: (1)A has AA to take action designated or implied in the P’s manifestations to the A & action must b fully informed. *Ch 4: DoC/GOOD FAITH:Progression of Derivative Suit: SHs Derivative suits brought by SH on b1/2 of interested trans w/ Dom SH 2 b cleansed by vote of BoD, since BoD has been selected by that same SH.

acts necessary or incidental to achieving the P’s objectives, as the A reasonably underst&s the P’s Pshp Dissolution/Dissociation: 3phases when Pshp ends; (1)Dissolution, (Signals end of prior Corp claiming some harm suffered by 3rd party (including Dir(s)) claiming they caused/allowed harm 2 occur. *How can an interested trans w/ Dom SH b cleared? Intrinsically fair standard unless merger or more

manifestations & objectives when the A determines how to act.(P says or writes something to the A, or other constitution of the Pshp), (2)Winding up (Neutral period b4 termination when Pshp must conclude its biz/sell (1) SHs must b eligible 2 file claim; (2) SHs must file demand on BoD 2 bring suit; (3)BoD can accept (Corp significant trans is involved in which case an Entire fairness standard (requiring showing that procedures

acts implied to achieve P’s objec); (2)An A’s interpretation of the P’s manifestations is reasonable if it reflects its assets/pay creditors/make distributions 2 its Pnrs) & (3)Termination (Once the winding up phase has been will file suit), reject (SHs can file suit), not act (no action by Corp w/in 90day, SHs file) assoc’d w/ trans+price of trans was fair) is used.

any meaning known by the A to be ascribed by the P &, in the absence of any meaning known to the A, as a concluded, the Pshp is terminated). Note: even following dissolution, Pnrs may vote 2 continue Pshp, rathr Pwr/Scope/Purpose of Corporate Auth: Dir R charged w/ responsibility of maximizing value ofCorp 4 its Transfers of Ctrl: Dom SHs have ability directly/indirectly have ability 2 exercise ctrl over corp. Ctrlling SHs

reasonable person in the A’s position would interpret the manifestations in light of the context, including than proceeding 2 termination; vote of ALL the Pnrs is required. During winding up phase, the Pshp may not SHs. Actions not consistent w/ objective may not b deemed 2 b w/in scope of Corp authority. Scope & limits may determine All or Maj of indvs who will serve as corp BoD. BoD elect corp Off, thus, ctrl has substantial

circumstances of which the A has notice & the A’s fid duty to the P. (Requires us to look at the A’s embark upon new biz. R set in Corps ArtInc/bylaws. Historically, actions outside of Corp purpose were considered 2 b void(able) value. Easiest way 2 Purchase Ctrl is purchase ctrlling block of stock in corp from another SH. Usually

reasonable underst&ing); (3)An A’s underst&ing of the P’s objectives is reasonable if it accords w/ the P’s (B4 RUPA, when Pnr left, deemed dissolution; remaining Pnrs would vote either 2 continue Pshp or not) under Ultra Vires; Doctrine seldom used; Issues now challenged under category of “waste.” purchased in excess of market value, thus, aka “ctrl premium.” *Absent looting of corporate assets,

manifestations & the inferences that a reasonable person in the A’s position would draw from the *Dissociation: When Pnr leaves a firm voluntarily/involuntarily (expulsion/death). If Pnr doesnt have rght 2 “A trans constitutes ‘waste of corp assets’ if it involves expenditure of Corp funds/disposition Corp assets 4 conversion of Corp Opp, fraud, or other acts of bad faith, ctrlling SH free 2 sell, & purchaser free 2 buy that

circumstances creating the agency. leave the Pshp, dissociation is wrongful & dissociated Pnr might b liable 2 Pshp 4 damages. *Default Rules which no consid is received in exchange & 4 which theres no rational biz purpose, or, if consideration is interest at premium. (Cant buy board seat; SH may sell ctrl of, not officers in, a corp.) Note: Some Cts allow

-§2.03/3.03Apparent Authority(AppA)+Creation: (3rd Party Believes) A thru AppA has pwr 2 affect a P’s Provide: If a Pshp is 4 term/undertaking, dissociation b4 completion of term 4 undertaking (unless provided 4 received in exchange, considration is so inadequate in value that no person of ordinary sound biz judgment selling SH 2 facilitate resignation of existing BoD 2 b replaced w/ purchasers nominees, rather than waiting 4

relations w/ 3rd party which is created when (1) a 3rd party reasonably believes the A has authority 2 act on in PA) would b wrongful; Any dissociation violating the PA would b wrongful; However, Pnr may dissociate would deem it worth that which corp has paid.”*Dirs still can act outside Corp’s charter (i.e. through term 2 end. (fruits of ctrl)

P’s b1/2, & (2) belief is traceable 2 the P’s manifestations. (3rd party believes A to have authority 2 from at-will Pshp at any time, provided the PA doesnt provide otherwise. (Whether or not the dissociation was waste/excessive charitable acts.); Look whether theres direct/indirect benefit 2 Corp/SHs. Gift made 2 Pet

act/bind; NO need 4 3rd party 2 show detr rel) wrongful, the dissociated Pnr entitled 2 receive funds, representing their share of Pshp (minus any Charity? Large gift relative 2 corporate earnings/assets? Was gift anonymous? Duties in Agency:

§3.11Term. of AA: doesnt by itself end any AppA held by A; AppA ends when no longer reasonable 4 the damages)) -Under RUPA, assuming Pnrs dissociation doesnt result in dissolution & winding up of Pshp biz, Charitable Acts: can b made as long they R; *In reasonable amounts; *Not made indiscriminately/2 pet

3rd party w/ whom an A deals 2 believe that the A continues to act w/ AA. dissociated Pnrs usually entitled 2 greater of their share of *going concern value (value of Pshp as an charities; & w/ reasonable belief donation will advance Corps interests w/in community in which it operates. §8.01. Gen. Fid Principle: An A has Fid Duty 2 act loyally 4 P’s benefit in all matters connected w/ the

-§2.06Liab of Undisclosed P: A undisclosed P is subject to Liab to a 3rd party when: (1)3rd party made operating entity (w/out dissociated Pnr)) or *liquidation value (value 1 could get 4 selling all biz assets), Corp duty/purpose is 2 maximize wealth or value 4 its SHs, thus, excessive charitable acts may not be done agency Rshp.

a detr change in position in rel on the agreement; (2)P had notice of A’s conduct & that A’s conduct minus damages, if any, 4 the pnrs wrongful dissociation & minus other amounts that might be owed 2 the at their expense; Assets must be used toward the corporate purpose of maximizing SH value & to accomplish §8.02. Material Benefit Arising out of Position: An A has a duty not to acquire a material benefit from a 3rd

might induce 3rd parties 2 make a detr change in position; & (3)P did not take reasonable steps 2 notify Pshp. Pshp at-will: Dissociated Pnrs typically entitled 2 his/her share of biz w/in 120 days after dissociating. this goal, the co may not engage in “wasteful” acts. party in connection w/ transs conducted or other actions taken on b1/2 of the P or otherwise through the A’s

3rd party of the truth. Pshp 4 term/undertaking: Dissociated Pnr not entitled 2 b paid 4 his/her share of Pshp until end of term/ Scrutiny of Corporate Actions: Discretion of Dir won’t B interfered w/ by the Cts, unless there *bad faith, use of the A’s position.

*P authorizes an A to act on the P’s b1/2 w/ rspct to 3rd parties, but the P’s existence is not made known 2 completion of the undertaking. *willful neglect, or *abuse of discretion. §8.03. Acting as or on b1/2 of Adverse Party: An A has a duty not to deal w/ the P as or on b1/2 of an

the 3rd party.*May bind P to an A’s action, even if the A lacked AA & even if the 3rd party didnt know the A LimPshps (LP): (not subj 2 veil piercing) LPshps R governed by PA. *One Ltd Pnr; & (not PersLiab/involved DOC: §4.01(a): Dir/Off has duty 2 Corp 2 perform their functions in (1)good faith, & (2)in manner they adverse party in a trans connected w/ the agency Rshp.

was acting on b1/2 of P. in Daily Mgmt)(Liab lim 2 amount invested) *Cant bind LP; may not exercise AA/AppA; *No Fid duties; reasonably believe 2 b in best interests of Corp. DoC establishes std of conduct, any allegation that Dir §8.04. Competition: Throughout the duration of an agency Rshp, an A has a duty to refrain from competing

- §4.01Ratification Defined: (1)Ratification is the affirmance of a prior act done by another, whereby the act *Bound 2 exercise any rghts they have consistent w/ oblgn of GFFD. *Invlvmnt, like their Liab=ltd; If they breached DoC still subj 2 fundamental principles of tort law; Π must still show Dir failure led 2/was cause of w/ the P & from taking action on b1/2 of or otherwise assisting the P’s competitors. During that time, an A

is given effect as if done by an A acting w/ AA. (2)A person ratifies an act by; (a)Manifesting assent that the participate in ctrl, risk losing their ltd status & may incur PersLiab. (restriction on participation in biz known loss, which π alleged 2 have suffered. may take action, not otherwise wrongful, to prepare for competition following termination of the agency Rshp.

act shall affect the person’s legal relations, or (b)Conduct that justifies a reasonable assumption that the as“ctrl rule”) *LPs R protected from unLimLiab 2 creditors of firm (however, may still incur Liab for $ they BJR: Usually protects Dir from Liab against DoC claims; If biz decisions made by Dir R Informed, BJR will §8.05. Use of P’s Prop; Use of Conf Info: An A has a duty (1)not to use prop of the P for the A’s own

person so consents. (3)Ratification does not occur unless; (a)Act is ratifiable (§4.03); (b)Person ratifying has receive in form of improper distributions or fraudulent transfers) *One Gen. Pnr (responsible 4 mgmt) *Has protect Dir from Liab that challenge their biz judgment, UNLESS theres a showing of *Fraud, *Illegality, purposes or those of a 3rd party; & (2)not to use or communicate confidential info of the P for the A’s own

capacity (§4.04/cap. = (i) if the person existed at the time of the act & (ii) the person had capacity at the time personal Liab 4 the debts & oblgns; No requirement that it b indv (some form Corp 2 serve as GP).*FiD *Conflict of Interest, *Bad Faith, *Egregious decision, or, *Waste. Even if FICBEW present, no instant Liab; Π purposes or those of a 3rd party.

of ratifying the act (P may void ratification made earlier when P lacked capacity); (c)Ratification is timely as duties akin 2 duties of Pnrs in a Gen Pshp. States following ULPA approach: LPs dont incur PersLiab 4 still must prove: (1)Dir breached DoC (gross negl std), & (2)Damages. Key point: Not about protecting good §8.06. P’s Consent:

stated (§4.05/=not effective unless precedes occurrence of circumstances that would cause ratifications 2 participating in mgmt unless they take other action 2 incur Liab. Other States: Lps only incur Liab if: (1)LP decisions; about protecting bad decisions in GF. Prevents Cts from 2nd guessing the Biz Judgmnt of Dir. Conduct by an A that would otherwise constitute a breach of duty as stated in §§ 8.01-.05 does not constitute

have adverse & inequitable effects on right of 3rd party), & (d)Ratification encompasses the act in its entirety participates in ctrl, (2)3rd parties aware LP participates in ctrl, & (3)3rd party does biz w/ the LP w/ BJR Procedural & Substantive Requirements: Must satisfy both 2 b afforded protection; (1)Procedural: a breach of duty if the P consents to the conduct, provided that (a) In obtaining the P’s consent, the A

(§4.07) ALL OR NOTHING (may not partially ratify) reasonable belief that LP is a GP.*Safe Harbor Areas LP’s 2 participate: Being K'or 4 orAorEE of LP or of *Decisions must b informed; *keep sufficient records/documents that decisions R indeed informed; *Dir must (i) Acts in GF; (ii) Discloses all material facts that the A knows, has reason to know, or should know would

§4.02Effect of Ratification:(1)retroactively creates the effects of AA. (2)Ratification is not effective; (a)In Gen Pnr of the LP; Being an Off, Dir, or SH of a Corp Gen Pnr of the LP; Consulting w/ & advising Gen Pnr actually make decision. 2 Avoid Liab 4 breach of DoC on PRC grounds, Dir should: *Keep informed about & reasonably affect P’s judgment unless P has manifested that such facts are already known by the P or that

favor of person who causes it by misrep or other conduct makes K voidable; (b)In favor of an A against a w/ rspct 2 LP biz; Acting as surety or guarantor of LP; Requesting/attending a mtg of Pnrs; votng; & Winding properly oversee Corp activities & policies; *B adequately informed about Corp biz, its interests & relevant the P does not wish to know them, &; (iii) Otherwise deals fairly w/ the P; &, (b) The P’s consent concerns

P when the P ratifies 2 avoid a loss; or (c)2 diminish the rghts or other interests of persons, not parties up Pshp. issues, b4 making decisions; *Possess min lvl of skill & expertise w/ regard 2 role of Dir 4 specific biz; &, B either a specific act or trans, or acts or transs of a specified type that could reasonably be expected to occur

2 trans, that was acquired in the subj matter prior 2 the ratification. *Must know or have reason to know the Transfrblty of LimPnr Intst: May trans econ intrst w/out consent of other Pnrs, but requires consent of other aware of Fin status of Corp. (2)Substantive: Refrain from FICBEW* in the ordinary course of the agency Rshp. (2) An A who acts for more than one P in a trans b/w or among

material facts relating 2 trans. Pnrs 2 trnsfr Lim Pnr status; GP more restricted w/ rght 2 transfer GP interest in LPshp. Intrinsic & Entire Fairness as Def in DoC Actions: Affirm Def; looks 2 whether consid receivd by corp in them has a duty (a) To deal in GF w/ each P, (b) To disclose to each P (i) The fact that the A acts for the

§3.02Formal Req: If Law requires a writing/record signed by P 2 evid an A’s auth 2 bind P to a K, P not Dissociation from Pnrshp: At-will Pnrshp - LPnrs has rght 2 dissociate from Pnrshp; 4 term/undertaking - particular trans was fair. Dir not subj 2 Liab 4 trans beneficial, fair or causing NO injury 2 corp even if trans other P or Ps, & (ii) All other facts that the A knows, has reason to know, or should know would reasonably

bound in absence of such writing/record. LPnrs may not dissociate w/out incurring Liab 4 wrongful dissociation. constituted a breach of DoC. affect P’s judgment unless P has manifested that such facts are already known by the P or that the P does

§2.05. Estoppel to Deny Existence of Agency Rshp: Prevents 1 party from denying a purported A’s LLCs: (offer tax structure & flexibility of Pshp & LimLiab of Corp)* Formed by filing Art of Org w/ Sec of St in Informed Decisions: BJR ONLY protects informed decisions; Even if decision is not 2 act, decision itself not wish to know them, & (c) Otherwise to deal fairly w/ each P.

authority when the 3rd party wants 2 enforce the K. (3rd party must alter their position in rel of the alleged St wishng 2 form entity. *Operating Ag governs LLC & St statute (def rules) fill gaps. Significant Features: must b informed. *Francis v. United Jersey Bank: Dir has duty 2 know biz affairs of corp; *includes basic §8.07. Duty Created by K: An A has a duty to act in accordance w/ the express & implied terms of any K b/w

authority.) P who hasn’t authorized A still subject 2 liability to 3 rd party whos justifiably induced 2 make a (1)LimLiab (2)Pass thru taxation (3)Os ability 2 participate in mgmt w/out risking Liab (4)flexbl in ability 2 underst&ing of what Co does; *being informed on how Co is performing; *monitoring corporate affairs & the A & P.

detrimental change in position b/c trans is believed 2 be on P’s account if (1)P intentionally or carelessly allocate P+L 2 membrs (5)flex. & choices in entitys mgmt (centralized/decentralized) (6)Pshp like policies; *attending board mtgs regularly; & *making inquiries into questionable matters. §4.01(c)(2):biz §8.08. Duties of Care, Competence, & Diligence: Subject to any PA, an A has a duty to P to act w/ care,

caused such belief; or (2)having notice of such belief & that it might induce others 2 change their positions, P FiD(ManMan/MemMan). judgment is informedif Dir reasonably believes 2 b appropriate under the circumstances. “Reasonable competence, & diligence normally exercised by As in similar circumstances. Special skills or knowledge

didnt take reasonable steps 2 notify them of the facts. MemMan:(has Pshp feel) Os referred 2 as Mem; engaged in daily operation as A of LLC (has AppA in belief” test factors: (i)importance of biz judgment 2 b made; (ii)time available 4 obtaining info; (iii)costs related possessed by an A are circumstances to be taken into account in determining whether the A acted w/ due

*Ag Prb involving Torts:Under doctrine of RS; P is NOT responsible 4 the torts of their non-EE/A’s (or day2day biz); States split (vote 1 per or by % but typically set in Op Ag) 2 obtaining info; (iv)Dirs confidence in those who explored a matter & those making presentations; & (v)state care & diligence. If an A claims to possess special skills or knowledge, the A has a duty to the P to act w/ the

independent Kor) unless the tort arises out of area which the P exercised ctrl or tort arises under an ManMan: Ppl who operate R Managers; respons set4th Op Ag (has AppA in day2day biz) No req Man b of Corp biz at time & nature of competing demands 4 boards attention. -Model Biz Corps Act permits rel by care, competence, & diligence normally exercised by As w/ such skills or knowledge.

exceptions; (1)Inherently dangerous activity (activity likely to cause harm or damage unless some Mem (has AppA in day2day biz unless Man had no AA, and 3rd knw Man lacked AA) Dir on “outside advisers” extending beyond lawyers & accts. Duty of Care Breach Analysis: (1)π sues; §8.09. Duty to Act Only w/in Scope of AA & to Comply w/ P’s Lawful Instructions: (1) An A has a duty to

precautions are taken); (2)non-delegable duty (duties a person may not avoid by mere deleg of a task 2 Taxation: (dont pay taxes)(sim 2 pshp) P+L are passd thru 2 mem who r responsible 4 paying tax on the (2)Does BJR Apply? [applies?; we can stop, if not; Procedural(informed decision analysis), take action only w/in the scope of the A’s AA; (2) An A has a duty to comply w/ all lawful instructions received

another person. i.e LLord/Attorney duties); or (3)neg hiring. profits & will b able 2 report losses on their rspctive personal income tax returns Substantive(FICBEW exceptions apply?) Even if no BJR protection, Dir may still b off the hook! Dirs bad faith from the P & persons designated by the P concerning the A’s actions on b1/2 of the P.

EE vs Non-EE A Factors: (1) Does P exercise ctrl over means/manner by which A performs the work; (2) Liab 4 the Mem:Os have LimLiab; Not PersLiab 4 debts/oblgn of Biz; Can pierce LLC veil (std same as 4 may b cleansed by full disclosure+approval by: *Disinterested Dirs (not involved w/ bad faith actions) or, §8.10. Duty of Good Conduct: An A has a duty, w/in the scope of the agency Rshp, to act reasonably & to

Whether the A is engaged in a distinct occupation or biz; (3) Whether the type of work done by the A is corp.veil) (unity of interest/disregard 4 entitys sep existence+some fraud-like conduct/injustice); Violation of *SHs. (3)If BJR doesnt apply & there was breach of DoC, R there affirmative defenses? (Intrinsic fairness refrain from conduct that is likely to damage the P’s enterprise.

customarily done under a P’s direction or w/out supervision; (4) The skill required in the A’s occupation; (5) unity of interest is by *co-mingling funds, *no sep. fin records; *fail2rspct sep existence of LLC; or defense (action fair/beneficial/no injury), Entire Fairness [used in mergers & acquisitions(Intrinsic fairness & §8.11. Duty to Provide Info: An A has a duty to use reasonable effort to provide the P w/ facts that the A

Whether the A or the P supplies the tools or other instrumentalities required for the work & the place in which *undercapitalization. NOT 4 failin 2 have formal mtgs/maintain min. Procedural Fairness)] knows, has reason to know, or should know when (1) Subject to any manifestation by the P, the A knows or

to perform it; (6) The length of time during P is engaged by A; (7) Is the A paid by the job; (8) Do parties Transferability:(sim2pshp)(mbrshp interest not transferable w/out consent of other Mem) *attempted transfer Do Off & Dir Have Diff Duties?: Off have diff responsibilities in acting in accordance w/ their respective has reason to know that the P would wish to have the facts or the facts are material to the A’s duties to the P;

believe they are creating an Emnt Rshp; &, (9) Whether P is a biz? winds up in transfer of mem econ intrst (not mgmt interest) Trnsfree would only have rght 2 receive funds. DoC. Split of Auth: *Some dont allow Off of Corp 2 avail 2 BJR; 18 Jxs do. Even in JX where BJR not &, (2) The facts can be provided to the P w/out violating a superior duty owed by the A to another person.

Franchise Agreements: (see if F’or exercised ctrl) Involves a Co/Ind selling product or service or operating a Dissociation:(When mem leaves LLC) Dissociation may b Voluntary (“Im leavng) /Involuntary (“Uve been available 2 Corps Off, π still must show that those Off breached their DoC 2 prevail in any action. §307 of §8.12. Duties Regarding P’s Prop – Segregation, Record-Keeping, & Accounting: An A has duty,

biz pursuant 2 an agreement from another co./ind. If the F’or is more likely involved in the day2day functions expelld”) Usually entitled 2 receive value of her interest, less any damages caused by dissociation if Sarbanes Oxley Act (PR); Steps attorney must take if there’s evidence of material violation of securities law subject to any agreement w/ the P, (1) not to deal w/ the P’s prop so that it appears to be A’s prop; (2) not to

of the F, F’or will b more likely, but if F’or not involved in the day2day functions, likely 2 b off the hook. dissociation is “wrongful.” or breach of duty or similar violation by the Co or any A: (1)Report such evidence 2 chief legal counsel or mingle the P’s prop w/ anyone else’s; & (3)to keep & render accounts to the P of $ or other prop received or

Apparent Agency: P could incur Liab 4 wrongdoing committed by an A, acting w AppA of P if there is: LLC 4 term or an undertaking?; dissociating member may need 2 wait 2 receive payment for her interest until CEO (or equivalent). If that person doesnt respond appropriately, (2)Report such evidence 2 audit committee, paid out on the P’s account.

(1)Reasonable belief by 3rd party that the alleged A is an A of the P; (2)Some action or inaction by the P 2 the end of the term/undertaking. another committee of indpdnt Dir, or full BoD. If the co doesnt take appropriate action, then, (3)Attorney must §8.14. Duty to Indemnify: A P has a duty to indemnify an A (1) in accordance w/ the terms of any K b/w

create (or 2 fail 2 dispel) that reasonable belief on the part of the 3rd party; & (3)(in some JX’s) some showing Dissolution: Statutes provide LLCs existence continues until its dissolved. Will typically b dissolved & affairs w/draw from representation. them; & (2) unless otherwise agreed (a) When the A makes a payment (i) w/in the scope of the A’s AA, or (ii)

that the 3rd party’s injury could have been avoided had the alleged P exercised ctrl over the alleged wound up as per Op Ag or upon vote of its Mems. Failure 2 Act/Monitor the Firm: *Caremark claims; Where entire board accused of failing 2 act, BJR not that is beneficial to the P, unless the A acts officiously in making the payment; or, (b) When the A suffers a

A.*Butler v. McD’s: Doctrine of AppAg to a F’or/F’ee situation; (1)F’or acted in a manner that would lead a *Ch3: CORP Structure: centralized=core group manages firm. available (BJR only protects judgments); Involves instances of corporate wrongdoing, which BoD accused of loss that fairly should be borne by the P in light of their Rshp.

reasonable person 2 conclude that the operator &/or EEs of the F restaurant were EEs or As of the ∆; (2)π -Promoters (DoC/DoL) organize & make other arrngmnt b4 corp formed (lay grndwrk)(bound 2 K entered on failing 2 detect, prevent or stop. (1) Unless suspicion of wrongdoing, theres no duty upon board 2 install & §8.15. P’s Duty to Deal Fairly & in GF:

actually believed the operator &/or EE of the F restaurant were As or servants of the F’or; & (3)π thereby b1/2 of corp not yet been formed, UNLESS clear intent not 2 bound*Once formed, may b bound by K, but operate corporate system 2 find wrongdoing board doesnt suspect/believe exists. (2) Board must attempt in A P has a duty to deal w/ the A fairly & in GF, including a duty to provide the A w/ information about risks of

relied 2 his detrmnt upon care & skill of the allegedly neg operator &/or EEs of the F restaurant. only if Corp agrees by adopting K: *express/impliedly ratifying K (novation/paying rent 4 lease); good faith 2 ensure that adequate reporting system is in place so that board can obtain necessary info 2 physical harm or pecuniary loss that the P knows, has reason to know, or should know are present in the A’s

Int Torts: P not held liable 4 the int torts of their A’s bc they are (1)normally outside the SOE, & (2)committed accepting/acknowledging benefits of K. *Remains bound unless there’s agreement (novation=bye old k, Hi make informed decisions. 1way is 2 establish compliance programs; *policy manuals, *employee training, work but unknown to the A.

w/out any intent 2 serve the Er. *Exceptions: some part of the tort done w/ intent to serve Er (bouncer) or new K) 2 release from Liab (clear intent by both). -Incorprs actually work 4 Corp/execute ArtInc *audits, *sanctions 4 violations, & *provisions 4 self-reporting violations 2 regulators. *Provided that Dirs dont

4seeable (some Jxs); *Ira v. US - drunk sailor 4seeable: EE acts w/in the scope of Er-EE Rshp if harm (1)Is Characteristics:Corp considered sep person from its Os; SH: own corp/no participation direct w/ mgmt; Vote have info something improper is occurring & theres good system in place 4 corporate info, Dirs arent liable 4

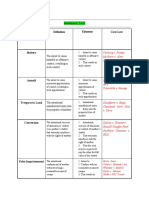

4seabl despite all reasonable efforts for the Er to 4stall; (2)Arises characteristically out of & in the course of on certain matters=*Elect Dir; *amend ArtInc+bylaw; *fund trans (merger/acquis); *Misc mattrs. Entitled 2 failing 2 monitor. *Recent cases, absent showing of bad faith, Dir wont b liable 4 failure 2 exercise DIFF Choices in Entities:

Emnt; &, (3)Is w/in the unique nexus/proximity of Emnt. Residual Intrst in assets of Corp (Upon liquidation, SH entitled 2 assets left after oblgation saitsfied) BOD: oversight; Stone Court “Only sustained/systematic failure of board 2 exercise oversight such as utter failed

LLCs CORPORATIONS

Frolic & Detour: Frolic takes an EE’s action outside the course of his Emnt, & an Er would probably NOT be elected by SH; resp 2 SH for managing; appoint Corp Off 2 manage day2day biz attempt 2 assure reasonable info & reporting system exists will establish the lack of GF thats nec condition 2

held liable for torts arising during an EE’s frolic bc its unrelated 2 Emplynt; Detours R generally considered 2 Formation:Created under St law; ArtInc filed w/ SoS in St; once properly filed, Corp established & known de liab.” Other cases, once a Dir is aware of wrongdoing, if Dir fails 2 take adequate action, that failure is Limited by requirmnt of having

fall w/in the course of Emnt b/c EE strays only slightly from direct assignment & an Er would b liable under jure Corp evaluated under gross negl std. Flexibility of Ctrl BoD w/ each Dir having 1

RS 4 torts arising during an EE’s detours. De Facto (equitable doc): Corp not properly formed, yet would-be SHs believe/act as corp properly formed. The Oblgn 4 Fiducs 2 Act in GF: Dir has duty 2 act in Good Faith; Provides basic std, w/out which vote.

LIAB: A’s Liab 4 Torts: A liable 4 tortious conduct, regardless whthr P is also liable thru vicarious liability. Os must establish:(1)they made GF, sub effort 2 comply w/ St Inc statute; (2)biz had legal rght 2 inc; & protections of BJR won’t apply. Unless breach of DoL or *acts/omissions not in *GF, *Intentional misconduct, Can b MemMan or Potential 2 go public or attract

A’s Liab 4 Ks: A not liable as a party 2 the K that A enters into on b1/2 of a disclosed principal, unless spcl (3)parties involved had GF belief & acted as if formed corp. Most St provide notice when ArtInc R/Rnt or *knowing violation of law, Dir not PersLiab. Bad Faith Claims (3types); (1)Subjective Bad Faith =motivated ManMan certain venture investments.

circumstance &/or parties agree A will b liable under K. Situations where A will b treated as party 2 K; properly filed. Incorprs will almost always have notice (or constructive notice) of whether the ArtInc were by intent 2 do harm, (2)Lack of Due Care/Fiduciary action taken solely by reason of gross negligence & Can be ctrlld by Ownr w/o Can reinvest earnings at a

(1)undisclosed P (A doesnt tell 3rd party they acting on b1/2 of P); or (2)UnID P (P is UnID or partially successfully filed.(*Hard 2 have GF belief corp been formed when it has not-St refuse 2 apply De Facto) w/out any malevolent intent, (3) intentional dereliction of duty, or conscious disregard 4 1s responsibilities Maj Financ'l Intrst lower tax rate

disclosed when A tells 3rd party that A is acting on b1/2 of P, but the ID of P is not disclosed; unID party may *When De Facto corp status unavailable, still possible P of Corp b protected by Corp by Estoppel. If 3rd party (more culpable than gross negl.)

Potential 2 take advantage of

not enter into K, A usually treated as a party & is bound). treats org like corp, 3rd party may b estopped from denying org’s Corp existence if denial would result in *Ch5: DoL Requires FiD (Off/Dir) 2 put interests of Corp b4 theirs. Arises when Dir involved in situation

certain tax benefits or avoid

*Ch 2: Pshps= (1)assoc of 2+ persons, (2)to carry on biz as co-Os, (3)4profit. *Characteristics: unjust harm 2 Ps. Conversely, if org holds itself out as Corp (even if not), that org will b estopped from where COI. COI: When Dir knows at time hes askd 2 take action w/ regard 2 potential trans, that he or May have Diff votng

phantom income issues that

decentralized = all pnrs participate in mgmt Ask: intent of the parties to carry on as co-Os of a definite biz? denying its own corp existence 2 avoid an oblgn or 2 obtain an unfair benefit. person related 2 him; (1)is a party 2 trans, or (2)has beneficial financial interest in trans, & then exercises his structures 4 Diff events.

may arise w/ pass thru

Relevant Factors Include:(1)Profit Sharing (unless profits R receved as debt service/wages/rent/annuity or Corp Operates as Sep Person:“making its own decisions” thru its BOD*May sue/b sued; *Must have PPB; influence 2 detriment of the Corp. COI include: *self-dealing (when Fid 4 Corp enters into trans w/ themselves

taxation.

PA allocates),(2)Contribution (Os make some contribution), (3)Participation in Mgmt/ctrl (not nec 2 have *Must have A 4 service of process in St formed so public record where Corp may b srvd; *Must file tax or w/ entity in which they (or fam mem) have substnl financial interest); *taking corporate opportunity (when

Non-managing members

equal votes/ctrl), (4)Risk of Loss (share in finan losses) & (5)Absence of Alt Classification (not Pshp if returns+pay taxes. -Since Corp sep from its Os, when corp wants 2 take money out of corp & give 2 SHs, FiD 4 corp misappropriates an Opp that belongs 2 Corp); *executive compensation (when execs whose comp

registered as another entity ex. LLC/Corp/etc.) SHs required 2 pay taxes = dbl taxation. Avoid x2 taxation; *selecting diff entity; *avoiding dividends & may participate in votng in

at issue R also on BoD that votes 2 determine their comp); *& other situations which a Fids Pers financial

Pshp Feat: In addition, Liabs (Pnrs are J&SLiab for debts; have pwr 2 create oblgns & liab 4 the Pshp), Tax intrst of the Corp. Alleged Violation DoL, Analy: *Is there a true conflict of interest? *If there is a CoI, has ways that would b difficult

increasing value of biz (recognized in form of capital gains, following sale of biz); *s-corp status. S-corp

2 achieve in a Corp Struct.

Treatment (not taxed on their income; P+L are “passed thru” 2 Pnrs 2 include on their rspctive “personal” tax (afforded pass thru tax status of a pshp) Strict Qualifying Requirements: strict internal revenue code the fiduciary (or fiduciaries) breached a duty 2 put Corp interests ahead of their own interest? *If so, can

returns), Fid duties (owe fid duties to each other & to the Pshp), Distinct entity (treated as a distinct legal conditions Including: b domestic corps wholly owned by persons, NOT entities, who are U.S. citizens + 100 conflict & breach b cleansed?(3types)(May be cleansed if; (1)after full discl, approved by maj vote of

entity, separate from its Pnrs). or less SHs disinterested Dir; (2)ratified by SHs; or (3)shown 2 b intrinsically fair 2 Corp) *If hasn’t been cleansed, trans

Default Rules: Intended 2 fill gaps in agreement/provide guidelines; May NOT b modified 2: *Unreasonably LimLiab: SH of Corp not PersLiab 4 acts/debts of Corp since corp sep person under law. SH ltd 2 amount can still be upheld IF its fair 2 Corp (use intrinsic fairness std; 4 merger/buyout use entire fairness std) *If

restrict Pnrs access 2 books & records of the Pshp; Eliminate the gen DoL; Unreasonably reduce the DoC; they investd; Corp creditors can look only 2 corp assets 4 payment, so long as basic rules followed: *SHs hasn’t been cleansed & doesnt hold up 2 intrinsic or entire fairness stds, trans voidable + FiD who violated

Eliminate the oblig of GFFD. must treat corp as separate person & not as extension of themselves. Key Corp Formalities: *Formal DoL may b liable.

JV: biz endeavor undertaken by 2+ parties; usually has a ltd scope & 4 ltd time. SHs/BoD mtgs+maintain mins; *Elect Dir; *Separate Bnk accounts/no commingling funds; *Corp funds/trans Problems w/ 50-50 Oshp: If irresolvable dispute,*Corp might not b able 2 function, *1side might need 2 take

Pshp by Estoppel: (Pshp may b held liable 4 actions of non-Pnr) (1)Manifestation by Non-Pnr such that he separate from ind funds/trans; *Adequate capitalization; *ID Biz as Corp. LimLiab Xception: If $$ supposed 2 action 2 run biz & risk future challenge,*co can b forced into liquidation, dissolution, etc.

holds himself out as a Pnr, (2)3rd partys detr rel on Non-Pnrs manifestation, & (3)such detr rel is reasonable. stay in Corp, but taken out as fraudulent conveyance/transfer or improper dividend. Biggest Exception: Corporate Opp Doctr: Not Sep Duty; Subset of DoL. Stands 4 principal that FiD (Off/Dir) of Corp may not

AppA of a Purported Pnr: Must be traceable back to something Pshp did 2 create that underst&ing; No need Piercing Corp Veil (only 4 prvt/closely held corp)-SH loses protection of corps liab shield & becomes take, 4 personal gain, an Opp (like biz venture/new Opp/Discovry) which firm has Prop rght & use it 4 their

4 party claiming AppA show detr rel. PersLiab. Creditor can disregard Corp prtction & pursue Pers Assets of SHs.Note on Enterprise Liab: Ind own advantage w/out 1st offering 2 Corp. Early Def of Corp Opp was sumthing which corp had; *interests

Potrebbero piacerti anche

- Lispector, The Egg and The ChickenDocumento11 pagineLispector, The Egg and The Chickentriswolff100% (1)

- Insurance Official OutlineDocumento60 pagineInsurance Official OutlineDylan WheelerNessuna valutazione finora

- Cheat Sheet MidtermDocumento2 pagineCheat Sheet MidtermNicholas DarusNessuna valutazione finora

- Determining WorthDocumento2 pagineDetermining WorthJosh LeBlancNessuna valutazione finora

- 3B Ottaway - Oil and Gas LawDocumento34 pagine3B Ottaway - Oil and Gas LawMathew LoveNessuna valutazione finora

- Civil Procedure - Personal JurisdictionDocumento3 pagineCivil Procedure - Personal JurisdictionKev MorNessuna valutazione finora

- Covert v. LVNV Funding, LLCDocumento7 pagineCovert v. LVNV Funding, LLCKenneth SandersNessuna valutazione finora

- Accounting Textbook Solutions - 49Documento19 pagineAccounting Textbook Solutions - 49acc-expertNessuna valutazione finora

- Business Associations Keyed To Ramseyer Bainbridge and Klein 7th EdDocumento7 pagineBusiness Associations Keyed To Ramseyer Bainbridge and Klein 7th EdMissy MeyerNessuna valutazione finora

- Heidegger's Schwarze Hefte PDFDocumento14 pagineHeidegger's Schwarze Hefte PDFAnonymous 6N5Ew3100% (1)

- Laes, DisabilityDocumento507 pagineLaes, DisabilityJuan Bautista Juan López100% (1)

- Christians, Beware! - Magna ParksDocumento391 pagineChristians, Beware! - Magna ParksRebekah RuizNessuna valutazione finora

- Crim Pro Two OUTLINEDocumento25 pagineCrim Pro Two OUTLINEannamelicharNessuna valutazione finora

- Criminal Law Outline in ColorDocumento20 pagineCriminal Law Outline in Colorsarahlaraa100% (1)

- PropI Estates GridDocumento1 paginaPropI Estates GridLAMark06100% (1)

- Fed Crim Law OutlineDocumento45 pagineFed Crim Law OutlineAndrew KatzNessuna valutazione finora

- 2012 Consumer Protection Section Annual ReportDocumento28 pagine2012 Consumer Protection Section Annual ReportMike DeWineNessuna valutazione finora

- Center For Economic Justice - Written Comments To TDIDocumento13 pagineCenter For Economic Justice - Written Comments To TDITexas WatchNessuna valutazione finora

- International Business Transactions: Revere Copper CaseDocumento51 pagineInternational Business Transactions: Revere Copper CaseRoy BhardwajNessuna valutazione finora

- Cheat Sheet TaxDocumento6 pagineCheat Sheet TaxShravan NiranjanNessuna valutazione finora

- Property 2 Cheat SheetDocumento9 pagineProperty 2 Cheat Sheetphillyphil20Nessuna valutazione finora

- Frankie McCoy v. D. Crest, Officer, Ms. Supple, Assistant Warden Major Thompson Sergeant Peguese, 829 F.2d 36, 4th Cir. (1987)Documento4 pagineFrankie McCoy v. D. Crest, Officer, Ms. Supple, Assistant Warden Major Thompson Sergeant Peguese, 829 F.2d 36, 4th Cir. (1987)Scribd Government DocsNessuna valutazione finora

- Claim Care Process 29 AprilDocumento2 pagineClaim Care Process 29 Aprilneethu09Nessuna valutazione finora

- Crim OutlineDocumento21 pagineCrim OutlineslavichorseNessuna valutazione finora

- Therefore ASAHI S.O.C.: Cts Use This Analysis When Dealing With Products. Product CanDocumento2 pagineTherefore ASAHI S.O.C.: Cts Use This Analysis When Dealing With Products. Product CanCory BakerNessuna valutazione finora

- City and County of Honolulu Reopening Framework and Matrix - 9/22/2020Documento9 pagineCity and County of Honolulu Reopening Framework and Matrix - 9/22/2020Honolulu Star-Advertiser50% (6)

- Ronda Everett v. Pitt County Board of Education, 4th Cir. (2015)Documento53 pagineRonda Everett v. Pitt County Board of Education, 4th Cir. (2015)Scribd Government DocsNessuna valutazione finora

- EO OutlineDocumento75 pagineEO OutlineNicolas RiegerNessuna valutazione finora

- Cheat Sheet: The Lawyer and SocietyDocumento5 pagineCheat Sheet: The Lawyer and SocietyAlarm GuardiansNessuna valutazione finora

- Torts BAR OutineDocumento90 pagineTorts BAR OutineKat-Jean FisherNessuna valutazione finora

- Bar Exam Subjects in Different JurisdictionsDocumento3 pagineBar Exam Subjects in Different JurisdictionsMarian ChavezNessuna valutazione finora

- Corporations - Spring 2008Documento117 pagineCorporations - Spring 2008herewegoNessuna valutazione finora

- Con Law OutlineDocumento48 pagineCon Law OutlineSeth WalkerNessuna valutazione finora

- Constitutional LawDocumento12 pagineConstitutional Lawpv balayanNessuna valutazione finora

- 2020 Bias Crimes ReportDocumento47 pagine2020 Bias Crimes ReportKGW NewsNessuna valutazione finora

- CPA Exam REG - Corporation TaxationDocumento3 pagineCPA Exam REG - Corporation TaxationManny MarroquinNessuna valutazione finora

- Criminal Law OutlineDocumento56 pagineCriminal Law OutlinesedditNessuna valutazione finora

- In Personam: First Question To Ask: Does The Statute (LONG ARM) Grant Jurisdiction?Documento12 pagineIn Personam: First Question To Ask: Does The Statute (LONG ARM) Grant Jurisdiction?Aaron WashingtonNessuna valutazione finora

- Tax HW 1Documento3 pagineTax HW 1lexyramdeoNessuna valutazione finora

- Personal. Jurisdiction Attack OutlineDocumento11 paginePersonal. Jurisdiction Attack OutlineKasem AhmedNessuna valutazione finora

- Corporations Allen Unknown PDFDocumento51 pagineCorporations Allen Unknown PDFJoe100% (1)

- Federal Income Tax 1 OutlineDocumento7 pagineFederal Income Tax 1 OutlineVanessa Joyce MongeNessuna valutazione finora

- Fourth Amendment: 1. Katz and Early CasesDocumento29 pagineFourth Amendment: 1. Katz and Early CasesGabbie ByrneNessuna valutazione finora

- Corps Final Outline WordDocumento30 pagineCorps Final Outline Wordrmexico316Nessuna valutazione finora

- Organize by Headings & Subheadings, Use Paragraphs: Statutory Construction ChecklistDocumento4 pagineOrganize by Headings & Subheadings, Use Paragraphs: Statutory Construction ChecklistHeidi Katherine RuckriegleNessuna valutazione finora

- The Federal Commerce PowerDocumento2 pagineThe Federal Commerce Powersuperxl2009Nessuna valutazione finora

- Civil Procedure DoctrinesDocumento51 pagineCivil Procedure DoctrinesEricha Joy GonadanNessuna valutazione finora

- BSD Apostille Request 20190107Documento1 paginaBSD Apostille Request 20190107CassieNessuna valutazione finora

- Fall Civ Pro I OutlineDocumento31 pagineFall Civ Pro I OutlineNicole AlexisNessuna valutazione finora

- Civil Procedure II OutlineDocumento20 pagineCivil Procedure II Outlinestarfish_carouselNessuna valutazione finora

- Cheat SheetDocumento1 paginaCheat Sheetsullivn1Nessuna valutazione finora

- Civ Pro DiagramsDocumento27 pagineCiv Pro DiagramsHanaiya GholsonNessuna valutazione finora

- Constitutional Law Outline: Andrew SharpDocumento28 pagineConstitutional Law Outline: Andrew SharpAndrew SharpNessuna valutazione finora

- Cheat SheetDocumento20 pagineCheat Sheetblondie639Nessuna valutazione finora

- Intentional Torts Intentional Torts D Case Law: Efinition ElementsDocumento12 pagineIntentional Torts Intentional Torts D Case Law: Efinition ElementsjaredNessuna valutazione finora

- Levoff Denied Motion To Dismiss PDFDocumento4 pagineLevoff Denied Motion To Dismiss PDFMikey CampbellNessuna valutazione finora

- Civil Procedure Outline 2011Documento36 pagineCivil Procedure Outline 2011Ian Ghrist100% (1)

- 19property Liebman S10 Merrill SmithDocumento29 pagine19property Liebman S10 Merrill Smithdamanja10Nessuna valutazione finora

- Civ Pro I (Fall 2001) NDocumento12 pagineCiv Pro I (Fall 2001) NJonathan EvansNessuna valutazione finora

- Congressional PowerDocumento1 paginaCongressional Powerashleyrmorgan0% (1)

- Corporate Law Practice ExamDocumento20 pagineCorporate Law Practice ExamnmiragliaNessuna valutazione finora

- Civ Pro II - Outline (Bahadur)Documento8 pagineCiv Pro II - Outline (Bahadur)KayceeNessuna valutazione finora

- Corporations MEE AttackDocumento8 pagineCorporations MEE AttackAnnie Weikel YiNessuna valutazione finora

- Agency Outline - Wyrsch - 3Documento11 pagineAgency Outline - Wyrsch - 3champion_egy325100% (1)

- Introduction and Judicial ReviewDocumento2 pagineIntroduction and Judicial ReviewTNessuna valutazione finora

- (The Labor Of) A Married Person During The Marriage While Domiciled in California"Documento10 pagine(The Labor Of) A Married Person During The Marriage While Domiciled in California"TNessuna valutazione finora

- Class #1 Notes-2Documento13 pagineClass #1 Notes-2TNessuna valutazione finora

- K Portion MBEDocumento13 pagineK Portion MBETNessuna valutazione finora

- A Political and Social History of Modern Europe V.1. by Hayes, Carlton J. H., 1882-1964Documento416 pagineA Political and Social History of Modern Europe V.1. by Hayes, Carlton J. H., 1882-1964Gutenberg.orgNessuna valutazione finora

- O2 Overview Booklet T2 (Judges To Malachi) .Docx-3Documento24 pagineO2 Overview Booklet T2 (Judges To Malachi) .Docx-3Poon CaniceNessuna valutazione finora

- 10 Domingo V ReedDocumento19 pagine10 Domingo V ReedIna VillaricaNessuna valutazione finora

- KM07 - Faerie MysteriesDocumento29 pagineKM07 - Faerie MysteriesYokius Crow100% (1)

- Signs of Victimhood GuideDocumento14 pagineSigns of Victimhood GuideTeodor-Florin Stoica100% (3)

- The Buddha's Ancient Path - Piyadassi TheraDocumento154 pagineThe Buddha's Ancient Path - Piyadassi Therakstan1122100% (1)

- A Half Century of EcclesiologyDocumento24 pagineA Half Century of Ecclesiologynis_octav7037Nessuna valutazione finora

- Module 2 Lesson 2 Developing Virtue As HabitDocumento42 pagineModule 2 Lesson 2 Developing Virtue As HabitReje CuaresmaNessuna valutazione finora

- Miles Mathis: From Theosophy To The Beat GenerationDocumento20 pagineMiles Mathis: From Theosophy To The Beat GenerationBlankafloraNessuna valutazione finora

- The Seven Capital Sins and Their Opposing VirtuesDocumento5 pagineThe Seven Capital Sins and Their Opposing VirtuesObyNessuna valutazione finora

- Print Daily One Year Bible Reading Bookmarks ColorDocumento3 paginePrint Daily One Year Bible Reading Bookmarks ColorIgnacio MirelesNessuna valutazione finora

- HH Bhakti Ananda Goswami: Inter-Religious and Interdisciplinary Study, Practice and MinistryDocumento7 pagineHH Bhakti Ananda Goswami: Inter-Religious and Interdisciplinary Study, Practice and MinistrydasaNessuna valutazione finora

- Spiritism4All - Manoel Miranda - Divaldo Franco - 02 - Broken Shackles - 1st EditionDocumento197 pagineSpiritism4All - Manoel Miranda - Divaldo Franco - 02 - Broken Shackles - 1st EditionSpiritism4AllNessuna valutazione finora

- Mrunal Emotional Intelligence:Meaning, Benefits, Models, Case StudiesDocumento8 pagineMrunal Emotional Intelligence:Meaning, Benefits, Models, Case StudiesPrateek BayalNessuna valutazione finora

- Sir Apollo Kaggwa Schools: Primary Five Mathematics Set SevenDocumento10 pagineSir Apollo Kaggwa Schools: Primary Five Mathematics Set Sevendavid galla okulluNessuna valutazione finora

- 15th World Sanskrit ConferenceDocumento13 pagine15th World Sanskrit ConferenceSam Chandran CNessuna valutazione finora

- Music 7 - Q1 - M3Documento15 pagineMusic 7 - Q1 - M3Joy Marize CagueteNessuna valutazione finora

- LearnEnglish Magazine RamadanDocumento4 pagineLearnEnglish Magazine RamadanEnglish for everyoneNessuna valutazione finora

- Juli Fix1Documento106 pagineJuli Fix1blackdiy studioNessuna valutazione finora

- 2014 Coulon Thebes in The First Millennium BCDocumento37 pagine2014 Coulon Thebes in The First Millennium BCoupouaout7Nessuna valutazione finora

- Living To Please GodDocumento12 pagineLiving To Please GodElishaNessuna valutazione finora

- Solved CMAT 2020 Paper With SolutionsDocumento38 pagineSolved CMAT 2020 Paper With SolutionsDivyanshu GuptaNessuna valutazione finora

- 2-2mys 2002 Dec ADocumento17 pagine2-2mys 2002 Dec Aqeylazatiey93_598514Nessuna valutazione finora

- Faith Over Fear - Sample LessonDocumento39 pagineFaith Over Fear - Sample LessonNanya effectNessuna valutazione finora

- 1-Contemplation and Practice in Sankara's Advaita Vedanta - CROPPEDDocumento396 pagine1-Contemplation and Practice in Sankara's Advaita Vedanta - CROPPEDAdi MaharajNessuna valutazione finora

- Dayao V Comelec-Philippine Guardian V Comelec CaseDocumento5 pagineDayao V Comelec-Philippine Guardian V Comelec CaseAaliyah AndreaNessuna valutazione finora