Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Weekly Wrap For The Week Ended 270919

Caricato da

Dilkaran Singh0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni1 paginaWeekly stock rates

Titolo originale

Weekly Wrap for the Week Ended 270919

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoWeekly stock rates

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

10 visualizzazioni1 paginaWeekly Wrap For The Week Ended 270919

Caricato da

Dilkaran SinghWeekly stock rates

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

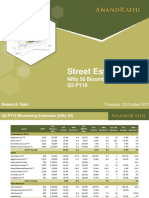

WEEKLY UPDATE - For the week ended 27-09-2019

Key Rates Current Previous

Index Name - Domestic Price Last Week 1 Week 1 Month 1 Year CYTD19

Repo Rate 5.40% 5.75%

Nifty 11,512 11,274 2.1% 3.7% 4.9% 6.0% Reverse Repo Rate 5.15% 5.50%

Sensex 38,823 38,015 2.1% 3.1% 6.9% 7.6% Cash Reserve Ratio 4.00% 4.00%

BSE Midcap 14,266 14,120 1.0% 5.8% -4.9% -7.6% Statutory Liquidity Ratio 18.75% 18.75%

NSE Midcap 100 16,272 16,333 -0.4% 3.6% -7.1% -9.0%

BSE Smallcap 13,332 13,204 1.0% 5.9% -10.8% -9.3% Macro Data Points Latest Previous

Bankex 33,782 32,625 3.5% 6.4% 20.7% 11.2% Real GDP Gr% 5 5.8

BSE Auto 16,900 17,081 -1.1% 5.0% -23.1% -18.9% CPI % 3.21 3.2

BSE Capital Goods 18,702 18,071 3.5% 8.7% 6.4% -0.6% WPI % 1.1 1.1

Bse FMCG 11,734 11,290 3.9% 6.9% 2.0% -0.8% IIP Gr % 4.3 1.2

BSE Healthcare 12,693 13,017 -2.5% 1.0% -16.7% -8.8% C D Ratio % 75.75 76.36

BSE Information Tech 15,312 15,579 -1.7% -3.2% -2.5% 8.7% *Bloomberg Consensus Projections

BSE Metal 9,134 9,318 -2.0% 6.7% -34.7% -22.9%

Bse Oil 14,562 13,893 4.8% 10.0% -1.9% 5.9% Nifty 50 Index

BSE Power 1,939 1,922 0.9% 0.9% -1.9% -3.0% Weekly Gainers Price % Gain

BSE Realty 2,009 2,041 -1.6% 1.6% 12.2% 11.7% BHARAT PETROLEUM CORP LTD 470 16.3%

Index Name - Global BAJAJ FINSERV LTD 8,550 11.1%

S&P 500 (US) 2,978 2,992 -0.5% 3.8% 2.2% 18.8% HINDUSTAN PETROLEUM CORP 306 10.3%

Dow Jones (US) 26,891 26,935 -0.2% 4.3% 1.7% 15.3% INDIAN OIL CORP LTD 146 9.8%

FTSE (UK) 7,419 7,345 1.0% 4.7% -1.7% 10.3% BAJAJ FINANCE LTD 4,057 9.6%

DAX (Germany) 12,388 12,468 -0.6% 5.6% -0.4% 17.3% Weekly Losers Price %Loss

Nikkei (Japan) 21,879 22,079 -0.9% 7.0% -8.1% 9.3% YES BANK LTD 49 -12.2%

CAC (France) 5,632 5,691 -1.0% 4.5% 1.6% 19.0% TATA MOTORS LTD 120 -10.0%

Shanghai (China) 2,932 3,006 -2.5% 1.0% 5.0% 17.6% ZEE ENTERTAINMENT ENTERPRISE 274 -9.2%

MSCI India 1,304 1,283 1.7% 2.9% 1.0% 3.3% INDIABULLS HOUSING FINANCE L 390 -8.9%

MSCI World 2,183 2,198 -0.6% 3.7% -0.2% 15.9% STATE BANK OF INDIA 281 -6.8%

MSCI Emerging Markets 1,009 1,021 -1.2% 4.6% -4.0% 4.5%

Commodities Price Last Week 1 Week 1 Month 1 Year CYTD19 Institutional Activity

Gold ($/Ounce) 1,494.5 1,516.9 -1.5% -3.2% 26.3% 16.5% Category Equity Debt

MCX Gold (Rs/10Gm) 37,481 37390 0.2% -2.4% 22.6% 18.7% MTD CYTD19 MTD CYTD19

Silver ($/Ounce) 17.52 17.99 -2.6% -3.8% 22.9% 13.0% Foreign Institutions (USD Mn) -530.26 6,675.82 99.07 4,346.25

MCX Silver (Rs/1 KG) 44,604 45686 -2.4% -1.4% 19.6% 16.6% *As per latest data available

Crude ($/Bbl) 62.03 64.28 -3.5% 4.3% -24.1% 15.3%

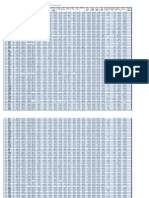

Currencies EPS Estimates (Bloomberg) FY19A FY20P* FY21P* FY20P/E FY21P/E

Dollar Index 99.17 98.51 -0.7% 1.2% 4.5% 3.1% Nifty 466 576 689 20.0 16.7

INR/USD 70.56 70.95 0.5% 1.3% 2.9% -1.1% Sensex 1,445 1,861 2,251 20.9 17.2

INR/GBP 86.80 88.76 2.3% 1.0% 9.8% 2.6% NSE Midcap 100 480 1,033 1,269 15.7 12.8

INR/EUR 77.16 78.31 1.5% 2.9% 10.2% 3.7% BSE Midcap 475 740 920 19.3 15.5

INR/JPY 0.65 0.66 1.2% 3.7% -1.4% -2.4% *Bloomberg Consensus Projections

Fixed Income (Yield in %) Latest 1Wk ago 1Mth ago 1Yr ago 1st Jan19

Call Rate 5.15 5.15 5.35 6.30 6.45 Trailing PE* Current

MCLR 1 Yr 8.15 8.40 8.40 8.45 8.55 Nifty 24.69

LAF (INR Bn) 1,448 365 1,097 -716 -617 Sensex 26.87

GOI 1 Year 5.65 5.60 5.67 7.65 6.89 BSE Midcap 30.00

GOI 2 Year 5.79 5.80 5.77 7.89 6.83 NSE Midcap 100 33.91

GOI 3 Year 6.15 6.13 6.05 8.02 7.04 *Bloomberg

GOI 5 Year 6.42 6.46 6.24 8.13 7.24

GOI 10 Year 6.74 6.79 6.53 8.07 7.42

1 year AAA over G-Sec 133 135 114 117 133

2 year AAA over G-Sec 127 120 118 104 139

3 year AAA over G-Sec 110 112 103 97 128

5 year AAA over G-Sec 96 84 101 87 118

10 year AAA over G-Sec 98 81 96 81 100

Potrebbero piacerti anche

- Case 4 - Jaipur-GroupDocumento7 pagineCase 4 - Jaipur-GroupharrellwongNessuna valutazione finora

- Amex Platinum Charge Card BenefitsDocumento3 pagineAmex Platinum Charge Card BenefitsSiddhant agrawal0% (1)

- Nifty50 Q2 FY18 Quarterly EstimatesDocumento8 pagineNifty50 Q2 FY18 Quarterly Estimatessrinivas NNessuna valutazione finora

- Daily Digest - 15 June, 2023Documento2 pagineDaily Digest - 15 June, 2023Anant VishnoiNessuna valutazione finora

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocumento3 pagineCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNessuna valutazione finora

- Morning Cuppa 12-DecDocumento2 pagineMorning Cuppa 12-DecSaroNessuna valutazione finora

- Monthly Report - Growth Fund - P - Apr'21Documento5 pagineMonthly Report - Growth Fund - P - Apr'21dapen kujangNessuna valutazione finora

- Morning Cuppa 24-JanDocumento2 pagineMorning Cuppa 24-JanSaroNessuna valutazione finora

- Daily Digest - 01 April, 2024Documento2 pagineDaily Digest - 01 April, 2024saraonahembram3Nessuna valutazione finora

- TS - MSCI Indonesia Nov-21 Rebalancing PreviewDocumento6 pagineTS - MSCI Indonesia Nov-21 Rebalancing PreviewAdri KhosasihNessuna valutazione finora

- Morning Cuppa 14-JulyDocumento2 pagineMorning Cuppa 14-JulyAjish CJ 2015Nessuna valutazione finora

- Morning Cuppa 11-MayDocumento2 pagineMorning Cuppa 11-MayShashank MisraNessuna valutazione finora

- Views On Markets and SectorsDocumento19 pagineViews On Markets and SectorskundansudNessuna valutazione finora

- Morning Cuppa 15-AprDocumento2 pagineMorning Cuppa 15-AprAkshay ChaudhryNessuna valutazione finora

- Nifty 50 Quarterly Estimates Q4FY23Documento9 pagineNifty 50 Quarterly Estimates Q4FY23gann wolfNessuna valutazione finora

- Morning Cuppa 31-OctDocumento2 pagineMorning Cuppa 31-OctKeshavNessuna valutazione finora

- EBLSL Daily Market Update 5th August 2020Documento1 paginaEBLSL Daily Market Update 5th August 2020Moheuddin SehabNessuna valutazione finora

- Morning Cuppa 21-NovDocumento2 pagineMorning Cuppa 21-NovSarvjeet KaushalNessuna valutazione finora

- EBLSL Daily Market Update 6th August 2020Documento1 paginaEBLSL Daily Market Update 6th August 2020Moheuddin SehabNessuna valutazione finora

- Doddy Bicara InvestasiDocumento38 pagineDoddy Bicara InvestasiNur Cholik Widyan SaNessuna valutazione finora

- Morning Cuppa 14-DecDocumento2 pagineMorning Cuppa 14-DecKeshav KhetanNessuna valutazione finora

- Morning Cuppa 23-JanDocumento2 pagineMorning Cuppa 23-JanSaroNessuna valutazione finora

- Morning Cuppa 08-Oct-202110080838430715214Documento2 pagineMorning Cuppa 08-Oct-202110080838430715214flying400Nessuna valutazione finora

- Morning Cuppa 09-JanDocumento2 pagineMorning Cuppa 09-JanWhaosidqNessuna valutazione finora

- Morning Cuppa 20-DecDocumento3 pagineMorning Cuppa 20-DecSaroNessuna valutazione finora

- Morning Cuppa 12-JanDocumento2 pagineMorning Cuppa 12-JanSaroNessuna valutazione finora

- Update Harga: Real-Time: QualityDocumento44 pagineUpdate Harga: Real-Time: QualityNul AsashiNessuna valutazione finora

- Morning Cuppa 17-AugDocumento2 pagineMorning Cuppa 17-AugSourav PalNessuna valutazione finora

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςDocumento43 pagineΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtNessuna valutazione finora

- Morning Cuppa 22-FebDocumento2 pagineMorning Cuppa 22-FebNitin ChauhanNessuna valutazione finora

- Morning Cuppa 30-OctDocumento2 pagineMorning Cuppa 30-OctKeshavNessuna valutazione finora

- Morning Cuppa 30-MayDocumento2 pagineMorning Cuppa 30-MayAkshay ChaudhryNessuna valutazione finora

- ICICI Prudential MF Head Start - 07062022Documento2 pagineICICI Prudential MF Head Start - 07062022Chucha LullNessuna valutazione finora

- EBLSL Daily Market Update 4th August 2020Documento1 paginaEBLSL Daily Market Update 4th August 2020Moheuddin SehabNessuna valutazione finora

- ICICI Prudential MFDocumento2 pagineICICI Prudential MFDOLLY KHAPRENessuna valutazione finora

- 2009 Forbes 200 Small CompaniesDocumento3 pagine2009 Forbes 200 Small CompaniesOld School ValueNessuna valutazione finora

- Doddy Bicara InvestasiDocumento34 pagineDoddy Bicara InvestasiAmri RijalNessuna valutazione finora

- Harga Wajar DBIDocumento40 pagineHarga Wajar DBISeptiawanNessuna valutazione finora

- Relative ValuationDocumento1 paginaRelative Valuationjuan.farrelNessuna valutazione finora

- Kenanga Today - 230322 (Kenanga)Documento5 pagineKenanga Today - 230322 (Kenanga)hl lowNessuna valutazione finora

- EBLSL Daily Market Update - 22nd July 2020Documento1 paginaEBLSL Daily Market Update - 22nd July 2020Moheuddin SehabNessuna valutazione finora

- Update Harga: Real-Time: QualityDocumento40 pagineUpdate Harga: Real-Time: Qualitymatumbaman 212Nessuna valutazione finora

- ICICI Prudential MF Head Start - 03082022Documento2 pagineICICI Prudential MF Head Start - 03082022shailendra kumarNessuna valutazione finora

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Documento2 pagineEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiNessuna valutazione finora

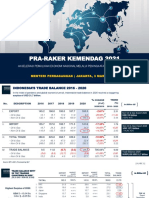

- Pra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDocumento38 paginePra-Raker Kemendag 2021: Akselerasi Pemulihan Ekonomi Nasional Melalui Peningkatan Peran PerwadagDedy Lampe PRayaNessuna valutazione finora

- Nomura - Jun 8 - India Insurance May-22 VolumesDocumento10 pagineNomura - Jun 8 - India Insurance May-22 VolumesSpam NestNessuna valutazione finora

- Corporate Accounting ExcelDocumento6 pagineCorporate Accounting ExcelshrishtiNessuna valutazione finora

- Investments Problem SetDocumento5 pagineInvestments Problem Setzer0fxz8209Nessuna valutazione finora

- Stock Screener Database - CROICDocumento6 pagineStock Screener Database - CROICJay GalvanNessuna valutazione finora

- Matriks Valuasi Saham Syariah 23112020Documento2 pagineMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aNessuna valutazione finora

- Morning Cuppa 20-JanDocumento2 pagineMorning Cuppa 20-JanSaroNessuna valutazione finora

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocumento10 pagineThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNessuna valutazione finora

- ICICI Prudential MF Head Start - 08062022Documento2 pagineICICI Prudential MF Head Start - 08062022Chucha LullNessuna valutazione finora

- Daily Technicals (08-Dec-2023)Documento18 pagineDaily Technicals (08-Dec-2023)drtohogNessuna valutazione finora

- Trabajo Aula (Grupo-02) - 18-11-2022Documento6 pagineTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNessuna valutazione finora

- Proximus Consensus Ahead of q1 2023Documento4 pagineProximus Consensus Ahead of q1 2023Laurent MillerNessuna valutazione finora

- RESEARCHREP Othr Traders Takedown 011322Documento8 pagineRESEARCHREP Othr Traders Takedown 011322JebmoisesbNessuna valutazione finora

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocumento12 pagineQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANINessuna valutazione finora

- Morning Cuppa 27-OctDocumento2 pagineMorning Cuppa 27-OctKeshavNessuna valutazione finora

- Update Harga: Real-Time: QualityDocumento38 pagineUpdate Harga: Real-Time: QualityAqila NaufalNessuna valutazione finora

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsDa EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNessuna valutazione finora

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementDa EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNessuna valutazione finora

- Assignment On Indian RupeeDocumento42 pagineAssignment On Indian Rupeepranjaraval100% (5)

- 10 Socialscience sp11Documento14 pagine10 Socialscience sp11Priya GuptaNessuna valutazione finora

- Sutlej Cotton Mills Ltd. v. CITDocumento18 pagineSutlej Cotton Mills Ltd. v. CITSaksham ShrivastavNessuna valutazione finora

- MTP 2 AccountsDocumento8 pagineMTP 2 AccountssuzalaggarwalllNessuna valutazione finora

- GK Tornado Lic Assistant Main Exams 2019 Eng 18Documento203 pagineGK Tornado Lic Assistant Main Exams 2019 Eng 18Sakshi GuptaNessuna valutazione finora

- Rure Maths RahmanDocumento1 paginaRure Maths Rahmanmrinal.rakhaNessuna valutazione finora

- RBI Intervention in Foreign Exchange MarketDocumento26 pagineRBI Intervention in Foreign Exchange Marketshamchandak03100% (1)

- First Trial Exam-IB2Documento16 pagineFirst Trial Exam-IB2Rita ChandranNessuna valutazione finora

- SAP STD Invoice FormatDocumento2 pagineSAP STD Invoice FormatVASEEMNessuna valutazione finora

- @mint EpaperDocumento16 pagine@mint EpaperJazz SinNessuna valutazione finora

- EProcurement System Government of MaharashtraDocumento2 pagineEProcurement System Government of MaharashtraShweta JoshiNessuna valutazione finora

- Rbi FuntionsDocumento14 pagineRbi Funtionsvrush12Nessuna valutazione finora

- ECB Trade CreditDocumento27 pagineECB Trade CreditSachin DakahaNessuna valutazione finora

- Chapter - 8 Foreign Exchange Forwards and Futures: Example 8.1Documento40 pagineChapter - 8 Foreign Exchange Forwards and Futures: Example 8.1debojyotiNessuna valutazione finora

- Security Features Analysis of Indian Currency For Recognition and AuthenticationDocumento8 pagineSecurity Features Analysis of Indian Currency For Recognition and AuthenticationDeepak Paul TirkeyNessuna valutazione finora

- Problem Assignment - 01Documento5 pagineProblem Assignment - 01Anand BabarNessuna valutazione finora

- Demonetization ProjectDocumento8 pagineDemonetization ProjectFloydCorreaNessuna valutazione finora

- Tender Document PDFDocumento111 pagineTender Document PDFalekyaNessuna valutazione finora

- Masala BondDocumento14 pagineMasala Bondmaddy100% (1)

- Invoice CROCS-35698Documento1 paginaInvoice CROCS-35698hurdithadidevNessuna valutazione finora

- Reserve Bank of India Rbi Payment NotificationDocumento3 pagineReserve Bank of India Rbi Payment NotificationAditya KulkarniNessuna valutazione finora

- MCQ of Maths CompleteDocumento104 pagineMCQ of Maths Completeblack jackNessuna valutazione finora

- DevaluationDocumento3 pagineDevaluationBibhuti Bhusan SenapatyNessuna valutazione finora

- Market Monitor: Public Sector Banks To Submit Plan To Deal With Key Business RisksDocumento15 pagineMarket Monitor: Public Sector Banks To Submit Plan To Deal With Key Business RisksKaran PatniNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sumit PatelNessuna valutazione finora

- Mint Bengaluru 23-06-2023Documento18 pagineMint Bengaluru 23-06-2023Justine Nelson BurhNessuna valutazione finora

- The Curious Case of Black Money and White Money Exposing The DirtyDocumento248 pagineThe Curious Case of Black Money and White Money Exposing The DirtyAngel100% (1)

- SL Paper1Documento65 pagineSL Paper1Mariana BritoNessuna valutazione finora