Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

How To Create A Linear Regression Model in Excel

Caricato da

HanyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

How To Create A Linear Regression Model in Excel

Caricato da

HanyCopyright:

Formati disponibili

EDUCATION MARKETS SIMULATOR YOUR MONEY ADVISORS ACADEMY

Advertisement

CORPORATE FINANCE & ACCOUNTING FINANCIAL ANALYSIS

Creating a Linear Regression

Advertisement

Corporate

Finance &

Accounting Model in Excel

FINANCIAL ANALYSIS

CORPORATE FINANCE

BY TROY SEGAL | Updated Jul 14, 2019

FINANCIAL STATEMENTS

What is Linear Regression?

FINANCIAL RATIOS Linear regression is a data plot that graphs the linear relationship between an Advertisement

independent and a dependent variable. It is typically used to visually show the

ACCOUNTING strength of the relationship and the dispersion of results – all for the purpose of

explaining the behavior of the dependent variable.

DEBT

Feedback

MERGERS & ACQUISITIONS Say we wanted to test the strength of the relationship between the amount of ice

cream eaten and obesity. We would take the independent variable, the amount of

CORPORATE INSURANCE ice cream, and relate it to the dependent variable, obesity, to see if there was a

relationship. Given a regression is a graphical display of this relationship, the lower

the variability in the data, the stronger the relationship and the tighter the fit to

the regression line.

KEY TAKEAWAYS

Linear regression models the relationship between a dependent and

independent variable(s).

Regression analysis can be achieved if the variables are independent,

there is no heteroscedasticity, and the error terms of variables are not be

correlated.

Modeling linear regression in Excel is easier with the Data Analysis

ToolPak.

Important Considerations

There are a few critical assumptions about your data set that must be true to

proceed with a regression analysis:

1. The variables must be truly independent (using a Chi-square test).

2. The data must not have different error variances (this is called

heteroskedasticity (also spelled heteroscedasticity)).

3. The error terms of each variable must be uncorrelated. If not, it means the

variables are serially correlated.

Advertisement

If those three things sound complicated, they are. But the effect of one of those

considerations not being true is a biased estimate. Essentially, you would misstate

the relationship you are measuring.

-33% -9%

Outputting a Regression in Excel

The first step in running regression analysis in Excel is to double-check that the 7299 EGP 3999 EGP 5699 EGP

free Excel plugin Data Analysis ToolPak is installed. This plugin makes calculating a -22%

range of statistics very easy. It is not required to chart a linear regression line, but it

makes creating statistics tables simpler. To verify if installed, select "Data" from

6399 EGP 6499 EGP 2799 EGP

the toolbar. If "Data Analysis" is an option, the feature is installed and ready to use. Advertisement

If not installed, you can request this option by clicking on the Office button and

selecting "Excel options".

Using the Data Analysis ToolPak, creating a regression output is just a few clicks.

Important: The independent variable goes in the X range.

Given the S&P 500 returns, say we want to know if we can estimate the strength

and relationship of Visa (V) stock returns. The Visa (V) stock returns data populates

column 1 as the dependent variable. S&P 500 returns data populates column 2 as

the independent variable.

1. Select "Data" from the toolbar. The "Data" menu displays.

2. Select "Data Analysis". The Data Analysis - Analysis Tools dialog box displays.

3. From the menu, select "Regression" and click "OK".

4. In the Regression dialog box, click the "Input Y Range" box and select the

dependent variable data (Visa (V) stock returns).

5. Click the "Input X Range" box and select the independent variable data (S&P

500 returns).

6. Click "OK" to run the results.

[Note: If the table seems small, right-click the image and open in new tab for

higher resolution.]

Interpret the Results

Using that data (the same from our R-squared article), we get the following table:

The R2 value, also known as the coefficient of determination, measures the

proportion of variation in the dependent variable explained by the independent

variable or how well the regression model fits the data. The R2 value ranges from 0

to 1, and a higher value indicates a better fit. The p-value, or probability value, also

ranges from 0 to 1 and indicates if the test is significant. In contrast to the R2 value,

a smaller p-value is favorable as it indicates a correlation between the dependent

and independent variables.

Charting a Regression in Excel

We can chart a regression in Excel by highlighting the data and charting it as a

scatter plot. To add a regression line, choose "Layout" from the "Chart Tools"

menu. In the dialog box, select "Trendline" and then "Linear Trendline". To add the

R2 value, select "More Trendline Options" from the "Trendline menu. Lastly, select

"Display R-squared value on chart". The visual result sums up the strength of the

relationship, albeit at the expense of not providing as much detail as the table

above.

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with

thousands of Investopedia traders and trade your way to the top! Submit trades in

a virtual environment before you start risking your own money. Practice trading

strategies so that when you're ready to enter the real market, you've had the

practice you need. Try our Stock Simulator today >>

Related Articles

FINANCIAL RATIOS

Regression Basics For Business Analysis

FINANCIAL ANALYSIS

What Is the Difference Between Linear

and Multiple Regression?

Partner Links

Sign up for our daily newsletters

ADVANCED TECHNICAL ANALYSIS CONCEPTS

Learn to trade stocks by investing $100,000

What is the Difference Between R- virtual dollars...

Squared and Adjusted R-Squared?

Trade like a top hedge fund manager using

technical analysis and double your wealth...

PORTFOLIO MANAGEMENT

How Can You Calculate Correlation

Using Excel?

FINANCIAL RATIOS

How to Calculate Beta in Excel

RISK MANAGEMENT

Optimize Your Portfolio Using Normal

Distribution

Related Terms

How the Least Squares Method Works

The least squares method is a statistical technique to determine the line of best fit for a

model, specified by an equation with certain parameters to observed data. more

What Regression Measures

Regression is a statistical measurement that attempts to determine the strength of the

relationship between one dependent variable (usually denoted by Y) and a series of other

changing variables (known as independent variables). more

How the Least Squares Criterion Method Works

The least-squares criterion is a method of measuring the accuracy of a line in depicting the

data that was used to generate it. That is, the formula determines the line of best fit. more

What Is an Error Term?

An error term is defined as a variable in a statistical model, which is created when the

model does not fully represent the actual relationship between the independent and

dependent variables. more

Line Of Best Fit

The line of best fit is an output of regression analysis that represents the relationship

between two or more variables in a data set. more

R-Squared

R-squared is a statistical measure that represents the proportion of the variance for a

dependent variable that's explained by an independent variable. more

About Us Terms of Use Dictionary

Editorial Policy Advertise News

Privacy Policy Contact Us Careers

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

Investopedia is part of the Dotdash publishing family. The Balance | Lifewire | TripSavvy | The Spruce and more

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Margin of Overpull Drilling Calculations & Excel Sheet - Drilling ManualDocumento9 pagineMargin of Overpull Drilling Calculations & Excel Sheet - Drilling ManualHanyNessuna valutazione finora

- Field Service Manual For Proprietary Connections: VoestDocumento46 pagineField Service Manual For Proprietary Connections: VoestHanyNessuna valutazione finora

- Api Buttress Connection Data SheetDocumento7 pagineApi Buttress Connection Data SheetHanyNessuna valutazione finora

- Running Procedure VAGTDocumento16 pagineRunning Procedure VAGTHanyNessuna valutazione finora

- Pipe Care Units (PCUs) - Ramco Tubular ServicesDocumento4 paginePipe Care Units (PCUs) - Ramco Tubular ServicesHanyNessuna valutazione finora

- Slip Type Elevator - YT - HYT - YC - HYC Slip Type Elevator For Drilling or Work-Over OperationDocumento1 paginaSlip Type Elevator - YT - HYT - YC - HYC Slip Type Elevator For Drilling or Work-Over OperationHanyNessuna valutazione finora

- Pipe Recovery Operations - WikipediaDocumento6 paginePipe Recovery Operations - WikipediaHanyNessuna valutazione finora

- 2.875 N80 6.51ppf EUEDocumento1 pagina2.875 N80 6.51ppf EUEHanyNessuna valutazione finora

- Tenarishydril Blue: Pipe Body DataDocumento1 paginaTenarishydril Blue: Pipe Body DataOscar Salinas JimenezNessuna valutazione finora

- Slip Type Elevator - Shanghai Oilwell Solutions Co., LTDDocumento2 pagineSlip Type Elevator - Shanghai Oilwell Solutions Co., LTDHanyNessuna valutazione finora

- HSE Alert 88-20 Dropped Object - Property DamageDocumento1 paginaHSE Alert 88-20 Dropped Object - Property DamageHanyNessuna valutazione finora

- Casing Make-Up TorqueDocumento4 pagineCasing Make-Up TorqueHany0% (1)

- Slip Type Elevators - Tubing Elevator - USA Made Keystone Energy ToolsDocumento6 pagineSlip Type Elevators - Tubing Elevator - USA Made Keystone Energy ToolsHanyNessuna valutazione finora

- Tubing Performance Data Sheet: Pipe Size & Weight: 2-7/8 - 6.50lb/ft Pipe Grade: L-80 Range: 2 Tool Joint: EUEDocumento1 paginaTubing Performance Data Sheet: Pipe Size & Weight: 2-7/8 - 6.50lb/ft Pipe Grade: L-80 Range: 2 Tool Joint: EUEHanyNessuna valutazione finora

- Technical Manual: Specifications - Operation - Maintenance - PartsDocumento3 pagineTechnical Manual: Specifications - Operation - Maintenance - PartsHanyNessuna valutazione finora

- Dana Gas Cancels Egyptian Asset DivestmentDocumento5 pagineDana Gas Cancels Egyptian Asset DivestmentHanyNessuna valutazione finora

- Performance Sheet Tubing: Pipe Body: Tubular AssemblyDocumento1 paginaPerformance Sheet Tubing: Pipe Body: Tubular Assemblykm1790Nessuna valutazione finora

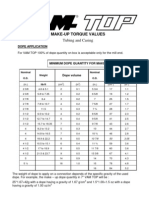

- VAM TOP Torque TableDocumento25 pagineVAM TOP Torque TableRafael Silva75% (4)

- Provided by IHS Under License With API No Reproduction or Networking Permitted Without License From IHS Not For Resale, 09/23/2009 06:30:37 MDTDocumento1 paginaProvided by IHS Under License With API No Reproduction or Networking Permitted Without License From IHS Not For Resale, 09/23/2009 06:30:37 MDTHanyNessuna valutazione finora

- Derrick Drawwork Raising Bridle Line Inspection ReplacementDocumento6 pagineDerrick Drawwork Raising Bridle Line Inspection ReplacementHany100% (2)

- CDS 4.500 17.00lb VM+125+CY VAM®+21 API+Drift+3.615 87.5Documento1 paginaCDS 4.500 17.00lb VM+125+CY VAM®+21 API+Drift+3.615 87.5HanyNessuna valutazione finora

- SWOT and TOWS MatrixDocumento4 pagineSWOT and TOWS MatrixHanyNessuna valutazione finora

- CDS 4.500 17.00lb Q125 VAM®+21 API+Drift+3.615 87.5Documento1 paginaCDS 4.500 17.00lb Q125 VAM®+21 API+Drift+3.615 87.5HanyNessuna valutazione finora

- Log ResponsesDocumento0 pagineLog ResponsesTran Dang SangNessuna valutazione finora

- Recommended Field Running Procedure For EUE-PA ConnectionsDocumento3 pagineRecommended Field Running Procedure For EUE-PA ConnectionsHanyNessuna valutazione finora

- 1 Functions of The DF PDFDocumento39 pagine1 Functions of The DF PDFالاسمر الجنوبيNessuna valutazione finora

- Pre-Spud InspectionDocumento6 paginePre-Spud InspectionHany100% (2)

- Drilling Fluid CompositionDocumento18 pagineDrilling Fluid CompositionHanyNessuna valutazione finora

- Water Based Drilling FluidsDocumento4 pagineWater Based Drilling FluidsHanyNessuna valutazione finora

- Pages From 14-Spec 2Documento1 paginaPages From 14-Spec 2HanyNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- C5 Schematy 1 PDFDocumento294 pagineC5 Schematy 1 PDFArtur Arturowski100% (4)

- Rabindranath TagoreDocumento13 pagineRabindranath TagoreVinay EkNessuna valutazione finora

- Essentials or Legal Rules As To ProposalDocumento7 pagineEssentials or Legal Rules As To ProposalmasoodNessuna valutazione finora

- Marathi Book ListDocumento4 pagineMarathi Book ListGajanan PatilNessuna valutazione finora

- 1 Partnership FormationDocumento7 pagine1 Partnership FormationJ MahinayNessuna valutazione finora

- Erinnerungsmotive in Wagner's Der Ring Des NibelungenDocumento14 pagineErinnerungsmotive in Wagner's Der Ring Des NibelungenLaur MatysNessuna valutazione finora

- Using APpropriate LanguageDocumento25 pagineUsing APpropriate LanguageVerna Dell CorpuzNessuna valutazione finora

- Safety Competency TrainingDocumento21 pagineSafety Competency TrainingsemajamesNessuna valutazione finora

- Senarai Nama Guru & Akp 2022Documento2 pagineSenarai Nama Guru & Akp 2022AHMED HAFIZ BIN CHE ABDULLAH MoeNessuna valutazione finora

- Isomers: Constitutional Isomers Stereoisomers Conformational IsomersDocumento6 pagineIsomers: Constitutional Isomers Stereoisomers Conformational IsomersJules BrunoNessuna valutazione finora

- Narrations - Direct and Indirect SpeehesDocumento6 pagineNarrations - Direct and Indirect Speehesskitteringkite100% (1)

- 1 - Pre-Bid Clarifications 16dec - 2016Documento13 pagine1 - Pre-Bid Clarifications 16dec - 2016Anirban DubeyNessuna valutazione finora

- PMO Crossword 1Documento4 paginePMO Crossword 1Waseem NosimohomedNessuna valutazione finora

- Baywatch - Tower of PowerDocumento20 pagineBaywatch - Tower of Powerkazimkoroglu@hotmail.comNessuna valutazione finora

- FSR 3.0 Frame Generation Mod Test Status (By LukeFZ)Documento10 pagineFSR 3.0 Frame Generation Mod Test Status (By LukeFZ)Gabriel GonçalvesNessuna valutazione finora

- Krok 1 Stomatology: Test Items For Licensing ExaminationDocumento28 pagineKrok 1 Stomatology: Test Items For Licensing ExaminationhelloNessuna valutazione finora

- Block RosaryDocumento9 pagineBlock RosaryRendine Rex Vizcayno100% (1)

- Principles of DTP Design NotesDocumento11 paginePrinciples of DTP Design NotesSHADRACK KIRIMINessuna valutazione finora

- Project Report On e BikesDocumento57 pagineProject Report On e Bikesrh21940% (5)

- Tesla Roadster (A) 2014Documento25 pagineTesla Roadster (A) 2014yamacNessuna valutazione finora

- Moses MendelssohnDocumento2 pagineMoses Mendelssohncoolio_94Nessuna valutazione finora

- Impact of Government Policy and Regulations in BankingDocumento65 pagineImpact of Government Policy and Regulations in BankingNiraj ThapaNessuna valutazione finora

- Deep Learning The Indus Script (Satish Palaniappan & Ronojoy Adhikari, 2017)Documento19 pagineDeep Learning The Indus Script (Satish Palaniappan & Ronojoy Adhikari, 2017)Srini KalyanaramanNessuna valutazione finora

- Note 1-Estate Under AdministrationDocumento8 pagineNote 1-Estate Under AdministrationNur Dina AbsbNessuna valutazione finora

- Marketing Mix 4P's and SWOT Analysis of OLPERSDocumento3 pagineMarketing Mix 4P's and SWOT Analysis of OLPERSSaad AliNessuna valutazione finora

- Nosocomial InfectionDocumento31 pagineNosocomial InfectionDr. Ashish Jawarkar0% (1)

- State Bank of India: Re Cruitme NT of Clerical StaffDocumento3 pagineState Bank of India: Re Cruitme NT of Clerical StaffthulasiramaswamyNessuna valutazione finora

- The Ambiguity of Micro-UtopiasDocumento8 pagineThe Ambiguity of Micro-UtopiaspolkleNessuna valutazione finora

- The 5 Best 5G Use Cases: Brian SantoDocumento4 pagineThe 5 Best 5G Use Cases: Brian SantoabdulqaderNessuna valutazione finora

- California Law of Perscriptive EasementsDocumento3 pagineCalifornia Law of Perscriptive EasementsSylvester MooreNessuna valutazione finora