Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Effective Interest Method

Caricato da

Kurt Del RosarioDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Effective Interest Method

Caricato da

Kurt Del RosarioCopyright:

Formati disponibili

CHAPTER 27

EFFECTIVE INTEREST METHOD

Suggested Answer:

Introduction

PFRS 9, requires bond discounts and

bond premium shall be amortized using

effective Interest Method.

Two kinds of Interest Rate

Nominal Rate- also known as

coupon rate or stated rate

appearing on the face of the

bond.

Effective Rate- also known as

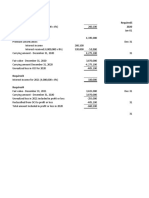

CA= 1,900,500- this is the acquisition price and

yield rate or market rate. This is

frequently in accounrting for bonds, this

the actual rate which the

becomes the coriginal carrying amount

bondholder earns during the

bond investment. This is also

Interest Received+ Face Amount x Nominal

the rate that discounts future

Rate

cash payment through the

=2,000,000 x 8%=160,000

expected life of bond.

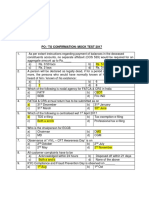

Effective Rate Vs. Nominal Rate

Interest Income= CA x Effective Rate

Effective Nominal =1,900,500 x 10%= 190,050

Rate Rate

Bond is at Lower Higher Discount on Amortization= Int. Inc- Int Rec.

Premium. =190,050-160,0000=30,050

The rate is

Bond is at Higher Lower Current Carrying Amount= Preceeding CA+

discount, Discount Amortization

the rate is = 1,900,500+30,050= 1,930,550

Illustrative Problem #1 Journal Entry

EIM- Discount

On January 1, 2017 Charisma company

purchased bonds with face value of 2,000,000

for 1,900,500 including transaction cost of

100,500 to be held as financial assets at

amortized cost.

The bonds matures on Dec 31, 2019 and pay

interest of 8% annually every Dec 31 with a

10% effective yield

CHAPTER 27

EFFECTIVE INTEREST METHOD

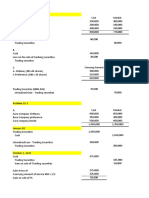

Accounting for Bond Premium

- The process is similar with accounting

for bond discounts. However it differs

on the computational part, The

difference is the carrying amount; in

discount; CA is increasing, in premium

CA is decreasing,

- Therefore, to get CA in Discount, you

have to add Preceeding CA and

Discount Amortization, In Premium,

you have to deduct Preceeding CA to

Premium Amortization,

Accounting for Serial Bonds

- The process is similar to the previous

one, but the key difference is, this time

it is a serial bonds, which means that the

payment is held on installments, The

effective interest method or table should

be added a column for Principal

Payment, this is the amount to be paid

annually,

- To get Carrying Amount= Preceeding

CA- Principal Payment- Premium

Amort/ + Discount Amortization.

- The other are still the same manner of

computation.

Potrebbero piacerti anche

- Financial Asset at Amortized CostDocumento20 pagineFinancial Asset at Amortized CostJudith Gabutero0% (1)

- Requirement A.: Acquisation of The BondsDocumento3 pagineRequirement A.: Acquisation of The BondsMaria LicuananNessuna valutazione finora

- CHapter 25 Financial Accounting Vol1Documento8 pagineCHapter 25 Financial Accounting Vol1Judith GabuteroNessuna valutazione finora

- AmortizationDocumento20 pagineAmortizationJudith Gabutero100% (2)

- Ia Activity 4Documento23 pagineIa Activity 4WeStan LegendsNessuna valutazione finora

- Chapter16 Equity Investments PDFDocumento69 pagineChapter16 Equity Investments PDFRomuell BanaresNessuna valutazione finora

- Zeta Company Required1 Required5 2020 Required2Documento2 pagineZeta Company Required1 Required5 2020 Required2AnonnNessuna valutazione finora

- FINAL-Investment in AssociateDocumento16 pagineFINAL-Investment in AssociateJessa75% (4)

- BSA 3202 Topic 1 - Investment in AssociatesDocumento15 pagineBSA 3202 Topic 1 - Investment in AssociatesFrancis Abuyuan100% (1)

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocumento3 pagineMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNessuna valutazione finora

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDocumento3 pagineAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancer50% (4)

- MODULE 3 - DiscussionDocumento11 pagineMODULE 3 - DiscussionAlbert Sean Locsin50% (2)

- Module 3Documento79 pagineModule 3kakimog738Nessuna valutazione finora

- Problems Chapter 22 Investment PropertyDocumento8 pagineProblems Chapter 22 Investment PropertyXNessuna valutazione finora

- Worksheet No.1 (02/03/22)Documento3 pagineWorksheet No.1 (02/03/22)Sharmin ReulaNessuna valutazione finora

- Chapter 19 20Documento11 pagineChapter 19 20Kyle Francine BoloNessuna valutazione finora

- Chapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Documento5 pagineChapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Reinalyn Mendoza75% (4)

- Chapter 18 CompilationDocumento21 pagineChapter 18 CompilationMaria Licuanan0% (1)

- Seatwork - Module 1Documento5 pagineSeatwork - Module 1Alyanna Alcantara100% (1)

- Impairment of AssetDocumento54 pagineImpairment of AssetX50% (2)

- INVESTMENTS With AnswersDocumento3 pagineINVESTMENTS With AnswersShaira BugayongNessuna valutazione finora

- Receivable FinancingDocumento5 pagineReceivable FinancingAphol Joyce MortelNessuna valutazione finora

- CHAPTER 23 Problems Answer KeyDocumento2 pagineCHAPTER 23 Problems Answer KeyShane TabunggaoNessuna valutazione finora

- Remarkable Company - Audit On ReceivablesDocumento2 pagineRemarkable Company - Audit On ReceivablesShr BnNessuna valutazione finora

- Theories ExerciseDocumento1 paginaTheories ExerciseZeneah MangaliagNessuna valutazione finora

- Impairment of AssetsDocumento21 pagineImpairment of AssetsDeryl GalveNessuna valutazione finora

- This Study Resource Was: FINANCIAL ASSET AT AMORTIZED COST (Investor or Bondholder)Documento9 pagineThis Study Resource Was: FINANCIAL ASSET AT AMORTIZED COST (Investor or Bondholder)Erica CadagoNessuna valutazione finora

- Problem 23-1, Page 650 Erica Company: Required: # Debit CreditDocumento14 pagineProblem 23-1, Page 650 Erica Company: Required: # Debit CreditDeanne LumakangNessuna valutazione finora

- Receivable FinancingDocumento80 pagineReceivable Financingjay1ar1guyena100% (2)

- GROUP2 AE105 Chp.11 14Documento26 pagineGROUP2 AE105 Chp.11 14Isabelle CandelariaNessuna valutazione finora

- AC 1201 - Financial Assets at Fair ValueDocumento14 pagineAC 1201 - Financial Assets at Fair ValueCarmelou Gavril Garcia Climaco100% (5)

- Peach Company Purchased A Machine For P7 Q1Documento1 paginaPeach Company Purchased A Machine For P7 Q1Zes ONessuna valutazione finora

- Integ 1 Inventories To Investment PropertyDocumento17 pagineInteg 1 Inventories To Investment PropertyJohn Lexter Macalber100% (1)

- 13 Equity Investment Talusan UsmanDocumento18 pagine13 Equity Investment Talusan UsmanTakuriNessuna valutazione finora

- Chapter 20 CompilationDocumento41 pagineChapter 20 CompilationMaria Licuanan0% (1)

- INVESTMENTS ReviewerDocumento35 pagineINVESTMENTS ReviewerRyze100% (1)

- IA Chapter 15Documento12 pagineIA Chapter 15Blue Sky100% (1)

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocumento11 pagineTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNessuna valutazione finora

- BAIACC2X-Course Materials (Week2)Documento80 pagineBAIACC2X-Course Materials (Week2)Mitchie FaustinoNessuna valutazione finora

- Answer Key Assignment in Equity Investments - VALIX 2017Documento3 pagineAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNessuna valutazione finora

- Chapter 20Documento74 pagineChapter 20astherille caxxNessuna valutazione finora

- Ac 1201 Effective Interest Method Market Price of BondsDocumento24 pagineAc 1201 Effective Interest Method Market Price of BondsAnne Marieline BuenaventuraNessuna valutazione finora

- Intermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesDocumento6 pagineIntermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesJennilyn BercasioNessuna valutazione finora

- DepletionDocumento25 pagineDepletionRachelle Deleña100% (1)

- Chapter 15 ProblemsDocumento7 pagineChapter 15 Problemsmercyvienho100% (2)

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocumento2 pagineCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNessuna valutazione finora

- Chapter 14 AnswersevenDocumento4 pagineChapter 14 AnswersevenJulianne Mejia100% (1)

- Borrowing Cost CH 25 Ia Ppe GGDocumento4 pagineBorrowing Cost CH 25 Ia Ppe GGZes ONessuna valutazione finora

- Activity in E3 - LiabilitiesDocumento9 pagineActivity in E3 - LiabilitiesPaupau100% (1)

- Notes Receivable SampleDocumento6 pagineNotes Receivable SamplekrizzmaaaayNessuna valutazione finora

- Impairment of Loans and Receivable FinancingDocumento17 pagineImpairment of Loans and Receivable FinancingGelyn CruzNessuna valutazione finora

- Financial Markets, Institutions & Money - Summary BookDocumento32 pagineFinancial Markets, Institutions & Money - Summary BookDung Hoàng Khưu VõNessuna valutazione finora

- Short-Term Sources For FinancingDocumento15 pagineShort-Term Sources For FinancingClaire Agnes MitraNessuna valutazione finora

- Session 9 LiabilitiesDocumento28 pagineSession 9 LiabilitiesVivek JainNessuna valutazione finora

- Short-Term Sources For Fin Ancing Current AssetsDocumento13 pagineShort-Term Sources For Fin Ancing Current AssetsJannah NavaretteNessuna valutazione finora

- Short Term FinancingDocumento4 pagineShort Term FinancingJay Lord GallardoNessuna valutazione finora

- Solution Manual For Essentials of Investments 9th Edition by BodieDocumento18 pagineSolution Manual For Essentials of Investments 9th Edition by BodieCameronHerreracapt100% (38)

- 1 Premiums: 1.1 Basic Journal EntriesDocumento3 pagine1 Premiums: 1.1 Basic Journal EntriesAudreySyUyanNessuna valutazione finora

- Lec 04Documento14 pagineLec 04Ryan GroffNessuna valutazione finora

- Time Value of MoneyDocumento15 pagineTime Value of MoneyMarlon LabayNessuna valutazione finora

- Answer: D. This Is A Function of Banks or Banking InstitutionsDocumento6 pagineAnswer: D. This Is A Function of Banks or Banking InstitutionsKurt Del RosarioNessuna valutazione finora

- CH12Documento4 pagineCH12Kurt Del RosarioNessuna valutazione finora

- Integrity Initiative CampaignDocumento3 pagineIntegrity Initiative CampaignKurt Del Rosario100% (2)

- CH 13Documento3 pagineCH 13Kurt Del RosarioNessuna valutazione finora

- Open Market Operations vs. Quantitative Easing: What's The Difference?Documento4 pagineOpen Market Operations vs. Quantitative Easing: What's The Difference?Kurt Del RosarioNessuna valutazione finora

- CH 14Documento5 pagineCH 14Kurt Del RosarioNessuna valutazione finora

- How To Prepare For Rising Interest Rates: Cut Bond DurationDocumento4 pagineHow To Prepare For Rising Interest Rates: Cut Bond DurationKurt Del RosarioNessuna valutazione finora

- How Interest Rates Work On Car LoansDocumento3 pagineHow Interest Rates Work On Car LoansKurt Del RosarioNessuna valutazione finora

- Answer: D. This Is A Function of Banks or Banking InstitutionsDocumento6 pagineAnswer: D. This Is A Function of Banks or Banking InstitutionsKurt Del RosarioNessuna valutazione finora

- Lines of Credit: Key TakeawaysDocumento2 pagineLines of Credit: Key TakeawaysKurt Del RosarioNessuna valutazione finora

- Understanding Credit Card InterestDocumento4 pagineUnderstanding Credit Card InterestKurt Del RosarioNessuna valutazione finora

- Cost Report 1 2Documento2 pagineCost Report 1 2Kurt Del RosarioNessuna valutazione finora

- Interest Rates Affect The Ability of Consumers and Businesses To Access CreditDocumento4 pagineInterest Rates Affect The Ability of Consumers and Businesses To Access CreditKurt Del RosarioNessuna valutazione finora

- Open Market Operations vs. Quantitative Easing: What's The Difference?Documento4 pagineOpen Market Operations vs. Quantitative Easing: What's The Difference?Kurt Del RosarioNessuna valutazione finora

- Kurt B. Del Rosario Nstp101 N24Documento3 pagineKurt B. Del Rosario Nstp101 N24Kurt Del RosarioNessuna valutazione finora

- The Toy Company Office of The CeoDocumento2 pagineThe Toy Company Office of The CeoKurt Del RosarioNessuna valutazione finora

- Interest Rates Affect The Ability of Consumers and Businesses To Access CreditDocumento4 pagineInterest Rates Affect The Ability of Consumers and Businesses To Access CreditKurt Del RosarioNessuna valutazione finora

- The Law On Trademarks, Service Marks and Trade Names Definition of Terms (Sec. 121)Documento13 pagineThe Law On Trademarks, Service Marks and Trade Names Definition of Terms (Sec. 121)Kurt Del RosarioNessuna valutazione finora

- Practical Exam Paper For Computer VI: Naga City Montessori SchoolDocumento15 paginePractical Exam Paper For Computer VI: Naga City Montessori SchoolKurt Del RosarioNessuna valutazione finora

- Have A Dream.: Prologue The Virtual Unreality MachineDocumento172 pagineHave A Dream.: Prologue The Virtual Unreality MachineKurt Del RosarioNessuna valutazione finora

- HishDocumento24 pagineHishKurt Del RosarioNessuna valutazione finora

- BadmintonDocumento9 pagineBadmintonKurt Del RosarioNessuna valutazione finora

- Cost Report 1 2Documento2 pagineCost Report 1 2Kurt Del RosarioNessuna valutazione finora

- Agao COVIDDocumento4 pagineAgao COVIDKurt Del RosarioNessuna valutazione finora

- Activities On Biodiversity - Del Rosario, BT11Documento2 pagineActivities On Biodiversity - Del Rosario, BT11Kurt Del Rosario100% (1)

- TYYYDocumento1 paginaTYYYKurt Del RosarioNessuna valutazione finora

- Research Title PageDocumento2 pagineResearch Title PageKurt Del RosarioNessuna valutazione finora

- Market Price of BondsDocumento1 paginaMarket Price of BondsKurt Del RosarioNessuna valutazione finora

- Compliance of Students On TheDocumento23 pagineCompliance of Students On TheKurt Del RosarioNessuna valutazione finora

- Term PaperDocumento2 pagineTerm PaperKurt Del RosarioNessuna valutazione finora

- MS 1979 2015Documento44 pagineMS 1979 2015SHARIFFAH KHAIRUNNISA BINTI SYED MUHAMMAD NASIR A19EE0151Nessuna valutazione finora

- Sialoree BotoxDocumento5 pagineSialoree BotoxJocul DivinNessuna valutazione finora

- Bleeding in A NeonateDocumento36 pagineBleeding in A NeonateDrBibek AgarwalNessuna valutazione finora

- ARS122 Engine Spare Part Catalogue PDFDocumento134 pagineARS122 Engine Spare Part Catalogue PDFIrul Umam100% (1)

- Module 5 The Teacher and The Community School Culture and Organizational LeadershipDocumento6 pagineModule 5 The Teacher and The Community School Culture and Organizational LeadershipHazeldiazasenas100% (6)

- June 2019Documento64 pagineJune 2019Eric SantiagoNessuna valutazione finora

- Toolbox Talks - Near Miss ReportingDocumento1 paginaToolbox Talks - Near Miss ReportinganaNessuna valutazione finora

- How To Defend The Faith Without Raising Your VoiceDocumento139 pagineHow To Defend The Faith Without Raising Your VoiceCleber De Souza Cunha100% (2)

- Continuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingDocumento44 pagineContinuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingTorres Xia100% (1)

- HandbookDocumento6 pagineHandbookAryan SinghNessuna valutazione finora

- Mrunal Handout 12 CSP20Documento84 pagineMrunal Handout 12 CSP20SREEKANTHNessuna valutazione finora

- Ott OTT Ecolog 1000 Water Level LoggerDocumento3 pagineOtt OTT Ecolog 1000 Water Level LoggerNedimZ1Nessuna valutazione finora

- Bonding and Adhesives in DentistryDocumento39 pagineBonding and Adhesives in DentistryZahn ÄrztinNessuna valutazione finora

- Your Marathon Training PlanDocumento16 pagineYour Marathon Training PlanAndrew Richard ThompsonNessuna valutazione finora

- Harvard Referencing GuideDocumento6 pagineHarvard Referencing GuideKhánh Nguyên VõNessuna valutazione finora

- Fora Active Plus P 30 ManualDocumento32 pagineFora Active Plus P 30 ManualBvcNessuna valutazione finora

- Physio Essay #4Documento2 paginePhysio Essay #4Maria Margarita Chon100% (1)

- Dysfunctional Uterine Bleeding (DUB)Documento1 paginaDysfunctional Uterine Bleeding (DUB)Bheru LalNessuna valutazione finora

- Tropical Fruit CHAPTER-3Documento32 pagineTropical Fruit CHAPTER-3Jeylan FekiNessuna valutazione finora

- Cor Tzar 2018Documento12 pagineCor Tzar 2018alejandraNessuna valutazione finora

- Iso 2281 1990Documento8 pagineIso 2281 1990jesus torresNessuna valutazione finora

- Secrets of Sexual ExstasyDocumento63 pagineSecrets of Sexual Exstasy19LucianNessuna valutazione finora

- Mil-Std-1949a NoticeDocumento3 pagineMil-Std-1949a NoticeGökhan ÇiçekNessuna valutazione finora

- Mock Test MCQ 2017Documento18 pagineMock Test MCQ 2017Alisha ChopraNessuna valutazione finora

- Diarrhoea in PediatricsDocumento89 pagineDiarrhoea in PediatricsKimbek BuangkeNessuna valutazione finora

- TextDocumento3 pagineTextKristineNessuna valutazione finora

- Kmart PDFDocumento105 pagineKmart PDFkaranbhayaNessuna valutazione finora

- Essential Intrapartum and Newborn CareDocumento6 pagineEssential Intrapartum and Newborn CareDianne LabisNessuna valutazione finora

- Group Interative Art TherapyDocumento225 pagineGroup Interative Art TherapyRibeiro CatarinaNessuna valutazione finora

- Diagnostic Evaluation and Management of The Solitary Pulmonary NoduleDocumento21 pagineDiagnostic Evaluation and Management of The Solitary Pulmonary NoduleGonzalo Leal100% (1)