Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Tax India

Caricato da

Amit GargTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Tax India

Caricato da

Amit GargCopyright:

Formati disponibili

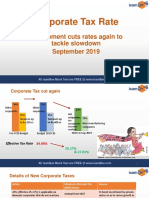

20 September 2019

EY Tax Alert

Government slashes

corporate tax rates for

domestic companies

Tax Alerts cover significant tax Executive summary

news, developments and changes

This Tax Alert summarizes the Taxation Laws (Amendment) Ordinance, 2019 (Ordinance)

in legislation that affect Indian promulgated by the President of India on 20 September 2019 to make certain

businesses. They act as technical amendments to the Income Tax Act, 1961 (ITA) and the Finance (No. 2) Act, 2019. The

summaries to keep you on top of Ordinance provides for a major reduction in corporate tax rates for existing and new

domestic companies. The Ordinance also implements the withdrawal of higher surcharge

the latest tax issues. For more for non-corporates on certain capital market transactions announced earlier on 24 August

information, please contact your 2019 as also provides relief from buy-back tax for listed companies in respect of buybacks

EY advisor. which were publicly announced prior to Budget announcement on 5 July 2019.

Background

Amidst the backdrop of a slowing economy and a clamour

Domestic companies claiming any tax exemptions

from the industry for fiscal stimulus, Finance Minister (FM)

or incentives shall also be eligible to exercise such

Nirmala Sitharaman had made a series of announcements

option after the expiry of the tax incentive period.

starting from 23 August 2019 on various fiscal and non-

fiscal measures being adopted to boost the economy. On

the direct tax front, some of the measures announced were

withdrawal of ‘angel tax’ for registered start-ups, c) Further, new domestic manufacturing companies,

withdrawal of higher surcharge for non-corporates on incorporated on or after 1 October 2019 and

certain capital market transactions, additional depreciation commencing manufacturing on or before 31

on motor vehicles and administrative measures to remove March 2023, making fresh investments in

harassment of taxpayers. manufacturing will have an option to avail an even

lower tax rate of 15% plus 10% surcharge and 4%

Continuing with such measures, on 20 September 2019, cess taking the ETR to 17.16% [2]. Companies

the Government promulgated the Ordinance containing exercising such option will not be required to pay

various fiscal measures to further promote growth and MAT. However, such new domestic manufacturing

investment through the following amendments. company should fulfil, inter alia, following

conditions:

Taxation Laws (Amendment) (i) It is not formed by splitting-up/ reconstruction

of a business already in existence[3];

Ordinance 2019 (ii) It should not use the following assets:

► Reduction of corporate tax rates for domestic

companies ► Any plant or machinery previously used in

India in value exceeding 20% of total value of

plant or machinery;

a) Prior to the Ordinance, existing domestic ► Any building previously used as a hotel/

companies were liable to tax at basic rate of either convention centre;

25% or 30%. The effective tax rate ranged from

26% to 34.94% after considering surcharge of (iii) t should not claim any specified tax incentive;

7%/12% and health & education cess of 4%.

(iv) It should exercise option to claim the benefit

The tax rate of 25% was applicable to two types of of lower tax rate in the first of the returns to be

domestic companies viz. (a) those having turnover filed by it and such option once exercised cannot

or gross receipts not exceeding INR4b in tax year be withdrawn.

2017-18; and (b) new domestic manufacturing

companies set up and registered on or after 1 The benefit of lower tax rate is also subject to

March 2016 fulfilling specified conditions. anti-avoidance provision in terms of which the Tax

Authority has power to apply the lower tax rate to

b) With effect from tax year 2019-20, domestic a reasonable level of profits, if it appears to the

companies[1] shall have an option to pay income Tax Authority that transactions with closely

tax at the rate of 22% plus 10% surcharge and 4% connected or other persons produces more than

cess taking the effective tax rate (ETR) to 25.17%, ordinary profits which might be expected to arise

subject to the condition that they will not avail and for this purpose, the company shall also be

specified tax exemptions or incentives under the liable to domestic transfer pricing provisions.

ITA. Such option once exercised cannot be

subsequently withdrawn. Companies exercising

such option will not be required to pay Minimum

Alternate Tax (MAT).

[1] i.e. defined in the current

Indian tax law to mean Indian company

or any other company which, in respect of its income liable to tax in [2] The Press Note issued by Government refers to ETR of 17.01%

India, has made prescribed arrangements for the declaration and [3] Except in case of rehabilitation of existing business disrupted by

payment, within India, of the dividends (including dividends on

natural or other specified calamity

preference shares) payable out of such income

d) The comparative effective tax rates before and after exercise of option are as follows: -

Current ETR ETR on Exercise of Reduction in tax

Sr Nature of domestic company

(%) Option (%) liability

1 Total turnover or gross receipts < INR4b during FY

2017-18 or new manufacturing companies

incorporated between 1 March 2016 and 30

September 2019

26% 25.17% 0.83%

o Income < INR 10m 27.82% 25.17% 2.65%

o Income > INR10m, but <INR100m 29.12% 25.17% 3.95%

o Income > INR100m

2 Optional tax rate for new manufacturing companies

incorporated on or after 1 October 2019

o Income < INR 10m 26% 17.16% 8.84%

o Income > INR10m, but <INR100m 27.82% 17.16% 10.66%

o Income > INR100m 29.12% 17.16% 11.96%

3 Other domestic companies

o Income < INR 10m 31.2% 25.17% 6.03%

o Income > INR10m, but <INR100m 33.38% 25.17% 8.21%

o Income > INR100m 34.94% 25.17% 9.77%

► Reduction of MAT rates

► Transitional relaxation on tax on buy-

backs by listed companies

The rate of MAT for other companies (including

domestic companies continuing to avail tax incentives) Prior to amendment by Finance (No.2) Act 2019, tax on

is reduced from base rate of 18.5% to 15% (before income distributed by a company to its shareholders by

application of surcharge and cess). way of buy-back of shares applied only to unlisted

companies. The Finance (No.2) Act 2019 extended it

even to listed companies with effect from 5 July 2019.

► Withdrawal of enhanced surcharge on capital This created hardships for listed companies who had

publicly announced buy-backs before 5 July 2019 but

gains

not completed it by that date. The Ordinance relaxes

the applicability in respect of buy-backs by listed

The Finance (No. 2) Act, 2019 had increased surcharge companies in respect of which public announcement of

for an individual, HUF[4], AOP[5] , BOI[6] and artificial buyback as per regulatory norms has been made before

juridical person to 25% (for total income between INR 2 5 July 2019. Thus, the buy-back tax will apply in case of

crore to INR 5 crore) and 37% (for total income listed companies where public announcement of buy-

exceeding INR 5 crore) from the earlier rate of 15%. back is made on or after 5 July 2019.

Subsequently, the FM in her press conference on 23

August 2019 announced a partial roll back of the

enhanced surcharge for: Other announcement made in

a) Individuals, HUFs, AOPs, BOIs and Artificial the Press Note[8]

Juridical Persons on capital gains income arising

on transfer of listed equity shares, units of equity-

oriented fund and business trust, which are liable ► Scope of Corporate Social Responsibility

to Securities Transaction Tax; and (CSR) spending expanded

b) Foreign Portfolio Investors (FPIs[7]) on capital In addition to the above, the Government has decided to

gains income arising on transfer of above referred widen the scope of mandatory CSR spending of 2%

capital assets as also on derivatives (which are under the Companies Act, 2013 to permit expenditure

deemed to be capital assets in their hands). on incubators funded by Government or public sector

companies or contributions to public funded

There was lack of clarity on withdrawal of enhanced universities, Indian Institutes of Technology, National

surcharge to FPIs in respect of capital gains arising on Laboratories and other autonomous bodies engaged in

securities other than those referred above (e.g. conducting research in science, technology,

debentures, government securities, etc). engineering and medicine aimed at promoting

sustainable development goals.

The Ordinance implements the withdrawal of enhanced

surcharge as announced earlier. Further, it also clarifies

that, in case of FPIs, the enhanced surcharge shall not

apply to capital gains on any ‘securities’.

[8] Issued by the Ministry of Finance dated 20 September 2019

[4] Hindu undivided family

[5] Association of Persons

[6] Body of individuals

[6] aka Foreign Institutional Investors (FIIs)

Comments

The reduction in corporate tax rates for domestic

companies is a bold and radical measure

implemented by the Government to tackle the

slow-down in the economy. All domestic companies

across all sectors will stand to benefit from the

reduction if they opt to sacrifice the tax incentives.

The special concessional effective tax rate of

17.16% for new domestic manufacturing

companies will make India more competitive when

compared to some of the other emerging markets

and give a boost to ‘Make in India’ policy of the

Government.

The non-applicability of MAT in above cases and

reduction in MAT rate in other cases ensure that

the reduction in corporate tax rates is truly

effective.

The withdrawal of buy-back distribution tax for

listed companies in respect of buy-backs which

were already publicly announced prior to 5 July

2019 will provide relief to those listed companies

who were caught unawares by the Union Budget

2019 and make the levy on listed company buy-

backs truly prospective in nature.

The expansion of the scope of CSR to payments

made to Government-funded/ recognized R&D

institutions provides opportunity to corporates to

avail dual benefit of CSR compliance under

corporate law as well as tax benefit under the ITA

provided such corporate does not opt for lower

rates as introduced by the Ordinance.

Our offices

Ahmedabad Ernst & Young LLP

Hyderabad

22nd Floor, B Wing, Privilon,

Oval Office, 18, iLabs Centre Hitech EY | Assurance | Tax | Transactions | Advisory

Ambli BRT Road, Behind Iskcon Temple, Off

City, Madhapur Hyderabad - 500 081

SG Highway,

Tel: + 91 40 6736 2000

Ahmedabad - 380 015

About EY

Tel: + 91 79 6608 3800

EY is a global leader in assurance, tax, transaction

Jamshedpur and advisory services. The insights and quality

Bengaluru

1st Floor, Shantiniketan Building services we deliver help build trust and confidence

6th, 12th & 13th floor Holding No. 1, SB Shop Area Bistupur, in the capital markets and in economies the world

“UB City”, Canberra Block Jamshedpur – 831 001 over. We develop outstanding leaders who team to

No.24 Vittal Mallya Road Tel: +91 657 663 1000 deliver on our promises to all of our stakeholders. In

Bengaluru - 560 001

so doing, we play a critical role in building a better

Tel: + 91 80 6727 5000

working world for our people, for our clients and for

Kochi

our communities.

Ground Floor, ‘A’ wing 9th Floor, ABAD Nucleus

Divyasree Chambers NH-49, Maradu PO EY refers to the global organization, and may refer

# 11, O’Shaughnessy Road Kochi - 682 304 to one or more, of the member firms of Ernst &

Langford Gardens Tel: + 91 484 304 4000 Young Global Limited, each of which is a separate

Bengaluru - 560 025 legal entity. Ernst & Young Global Limited, a UK

Tel: + 91 80 6727 5000 company limited by guarantee, does not provide

Kolkata services to clients. For more information about our

Chandigarh 22 Camac Street 3rd organization, please visit ey.com.

1st Floor, SCO: 166-167 Floor, Block ‘C’ Kolkata -

700 016 Ernst & Young LLP is one of the Indian client serving

Sector 9-C, Madhya Marg

Tel: + 91 33 6615 3400 member firms of EYGM Limited. For more information about

Chandigarh - 160 009 our organization, please visit www.ey.com/in.

Tel: + 91 172 671 7800

Ernst & Young LLP is a Limited Liability Partnership,

Mumbai registered under the Limited Liability Partnership Act,

Chennai

14th Floor, The Ruby 2008 in India, having its registered office at 22 Camac

Tidel Park, 6th & 7th Floor

29 Senapati Bapat Marg Dadar Street, 3rd Floor, Block C, Kolkata - 700016

A Block, No.4, Rajiv Gandhi Salai

(W), Mumbai - 400 028 © 2019 Ernst & Young LLP. Published in India.

Taramani, Chennai - 600 113

Tel: + 91 22 6192 0000 All Rights Reserved.

Tel: + 91 44 6654 8100

This publication contains information in summary form

Delhi NCR 5th Floor, Block B-2 Nirlon and is therefore intended for general guidance only. It is

Golf View Corporate Tower B not intended to be a substitute for detailed research or

Knowledge Park

Sector 42, Sector Road the exercise of professional judgment. Neither Ernst &

Off. Western Express Highway

Gurgaon - 122 002 Young LLP nor any other member of the global Ernst &

Goregaon (E) Young organization can accept any responsibility for loss

Tel: + 91 124 443 4000 Mumbai - 400 063 occasioned to any person acting or refraining from action

Tel: + 91 22 6192 0000 as a result of any material in this publication. On any

3rd & 6th Floor, Worldmark-1 specific matter, reference should be made to the

IGI Airport Hospitality District appropriate advisor.

Aerocity, New Delhi - 110 037 Pune

Tel: + 91 11 4731 8000 C-401, 4th floor Panchshil

Tech Park Yerwada

4th & 5th Floor, Plot No 2B (Near Don Bosco School)

Tower 2, Sector 126 Pune - 411 006

NOIDA - 201 304 Tel: + 91 20 4912 6000

Gautam Budh Nagar, U.P.

Tel: + 91 120 671 7000

Join India Tax Insights from EY on

Download the EY India Tax

Insights App Logo

Potrebbero piacerti anche

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDa EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNessuna valutazione finora

- MnA India TaxPerspectiveDocumento36 pagineMnA India TaxPerspectiveGamer LastNessuna valutazione finora

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreDocumento9 pagineRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreAlicia Jane NavarroNessuna valutazione finora

- My Tax Espresso Highlights of Budget 22mar2023Documento27 pagineMy Tax Espresso Highlights of Budget 22mar2023Claudine TanNessuna valutazione finora

- Misc Sections For Exams March 2022Documento11 pagineMisc Sections For Exams March 2022Daniyal AhmedNessuna valutazione finora

- On MAT and AMT WRO0533356 - FinalDocumento25 pagineOn MAT and AMT WRO0533356 - FinalOffensive SeriesNessuna valutazione finora

- (A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsDocumento15 pagine(A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsdencamsNessuna valutazione finora

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Documento11 pagineRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Rolly Balagon Caballero100% (1)

- (Updated July 2010) (2.2.1) Corporation Tax - General BackgroundDocumento13 pagine(Updated July 2010) (2.2.1) Corporation Tax - General BackgroundjfjkavanaghNessuna valutazione finora

- TaxationDocumento10 pagineTaxationIshika ChauhanNessuna valutazione finora

- Uganda Tax Amendment Bills For 2018Documento10 pagineUganda Tax Amendment Bills For 2018jadwongscribdNessuna valutazione finora

- Monthly Policy Review: September 2019Documento16 pagineMonthly Policy Review: September 2019Raktim DasNessuna valutazione finora

- Lecture 3 - Income Taxation (Corporate)Documento5 pagineLecture 3 - Income Taxation (Corporate)Paula MerrilesNessuna valutazione finora

- Deloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedDocumento4 pagineDeloitte Tax Alert - Corporate Tax Rates Slashed and Fiscal Relief AnnouncedSunil GidwaniNessuna valutazione finora

- EY Tax Booklet, 2022Documento65 pagineEY Tax Booklet, 2022Sabbir Ahmed PrimeNessuna valutazione finora

- The Regular Corporate Income TaxDocumento4 pagineThe Regular Corporate Income TaxReniel Renz AterradoNessuna valutazione finora

- Corporate Tax Rate Cut by GovernmentDocumento5 pagineCorporate Tax Rate Cut by GovernmentKumar MohitNessuna valutazione finora

- Finance Act 2021 Major HighlightsDocumento6 pagineFinance Act 2021 Major HighlightsAyodeji BabatundeNessuna valutazione finora

- Tax Reforms in India: Static DimensionsDocumento11 pagineTax Reforms in India: Static DimensionsLeela LazarNessuna valutazione finora

- It Goi Note On Mat and AmtDocumento17 pagineIt Goi Note On Mat and AmtKapil AroraNessuna valutazione finora

- Taxation Law 1 - Notes Co: Less: DeductionsDocumento24 pagineTaxation Law 1 - Notes Co: Less: DeductionsClint Lou Matthew EstapiaNessuna valutazione finora

- Direct Tax Code: Term ProjectDocumento22 pagineDirect Tax Code: Term Projectvikaschugh01Nessuna valutazione finora

- CREATE Salient ProvisionsDocumento3 pagineCREATE Salient ProvisionsAldrin Santos AntonioNessuna valutazione finora

- Trabaho BillDocumento14 pagineTrabaho BillAvia ColorNessuna valutazione finora

- DTTL Tax Unitedarabemirateshighlights 2021Documento6 pagineDTTL Tax Unitedarabemirateshighlights 2021nbNessuna valutazione finora

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocumento10 pagineCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaNessuna valutazione finora

- TRABAHO Bill, House's Version of TRAIN 2Documento6 pagineTRABAHO Bill, House's Version of TRAIN 2Andrew James Tan LeeNessuna valutazione finora

- Acct Chapter 15BDocumento20 pagineAcct Chapter 15BEibra Allicra100% (1)

- Budget Highlights 2018 19 Deloitte (PakistanDocumento10 pagineBudget Highlights 2018 19 Deloitte (PakistanAwais QureshiNessuna valutazione finora

- Advanatges of McitDocumento4 pagineAdvanatges of McitJudyann CadampogNessuna valutazione finora

- Suraj Sir 1Documento8 pagineSuraj Sir 1Avinash YadavNessuna valutazione finora

- TAXATIONDocumento83 pagineTAXATIONKofo IswatNessuna valutazione finora

- Samilcommentary Dec2023 enDocumento10 pagineSamilcommentary Dec2023 enhekele9111Nessuna valutazione finora

- 10.mat and AmtDocumento17 pagine10.mat and AmtShailendra SainwalNessuna valutazione finora

- Create BillDocumento31 pagineCreate BillJanet PaglingayenNessuna valutazione finora

- Summary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoDocumento6 pagineSummary of Changes Under The RA 11534 (CREATE ACT) Atty. Mark Anthony P. TamayoNievelita OdasanNessuna valutazione finora

- Corporate Recovery and Tax Incentives For EnterprisesDocumento5 pagineCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNessuna valutazione finora

- Mat and Amt: Objective of Levying MATDocumento17 pagineMat and Amt: Objective of Levying MATNitin ChoudharyNessuna valutazione finora

- Chapter 1: Introduction To Corporate Tax PlanningDocumento5 pagineChapter 1: Introduction To Corporate Tax PlanningMd Manajer RoshidNessuna valutazione finora

- Mat and Amt: Objective of Levying MATDocumento17 pagineMat and Amt: Objective of Levying MATSamuel AnthrayoseNessuna valutazione finora

- Computation of Tax Liability of CompanyDocumento8 pagineComputation of Tax Liability of CompanyVicky DNessuna valutazione finora

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Documento6 pagineInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainNessuna valutazione finora

- HAC - Tax Memorandum 2022-23-FinalDocumento18 pagineHAC - Tax Memorandum 2022-23-FinalAsad ZahidNessuna valutazione finora

- Taxation in Companies-Module IIIDocumento10 pagineTaxation in Companies-Module IIIlathaharihimaNessuna valutazione finora

- 8.special Tax Rates of Companies & MATDocumento22 pagine8.special Tax Rates of Companies & MATMuthu nayagamNessuna valutazione finora

- Aiias Economy Pt365 2022Documento63 pagineAiias Economy Pt365 2022Ismart ShankarNessuna valutazione finora

- Tax and Business Strategy - Impact of New Ghanaian Tax LawsDocumento6 pagineTax and Business Strategy - Impact of New Ghanaian Tax LawsM ArmahNessuna valutazione finora

- Ey Indonesia - Tax Alert - Omnibus - E-Blast PDFDocumento11 pagineEy Indonesia - Tax Alert - Omnibus - E-Blast PDFlarryNessuna valutazione finora

- Uganda Issues Tax Amendment Bills 2020Documento6 pagineUganda Issues Tax Amendment Bills 2020harryNessuna valutazione finora

- Tax Aspects of M&ADocumento18 pagineTax Aspects of M&AManeet TutejaNessuna valutazione finora

- Finance Act 2024 Tax MeasuresDocumento46 pagineFinance Act 2024 Tax Measuresetudiant etudiantsNessuna valutazione finora

- Iaet Section 29 NIRCDocumento1 paginaIaet Section 29 NIRCregine rose bantilanNessuna valutazione finora

- Lecture 3 - Income Taxation (Corporate)Documento8 pagineLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- Colombia Tax ReformDocumento6 pagineColombia Tax ReformshadiafeNessuna valutazione finora

- Public Finance & Taxation - Chapter 4, PT IIIDocumento32 paginePublic Finance & Taxation - Chapter 4, PT IIIbekelesolomon828Nessuna valutazione finora

- In Brief: Recent DevelopmentsDocumento7 pagineIn Brief: Recent DevelopmentsScar IceNessuna valutazione finora

- Tax Holiday in BangladeshDocumento7 pagineTax Holiday in BangladeshAulad Hossain100% (2)

- Salient Features CustomsDocumento5 pagineSalient Features Customssaqlain3210Nessuna valutazione finora

- Corporate Income Tax: Regular CorporationDocumento2 pagineCorporate Income Tax: Regular Corporationloonie tunesNessuna valutazione finora

- Prepared By: Leyla B. Malijan J19-65663Documento31 paginePrepared By: Leyla B. Malijan J19-65663leyla malijanNessuna valutazione finora

- Hdfcbank Credit Card Rewards CatalogueDocumento90 pagineHdfcbank Credit Card Rewards CatalogueMythili Bysani100% (1)

- Best Practices For Founders in The Wake of COVID-19Documento2 pagineBest Practices For Founders in The Wake of COVID-19Amit GargNessuna valutazione finora

- India Soars HighDocumento100 pagineIndia Soars HighHimanshu Jhamb100% (1)

- Automating Finance and Accunting - UiPath Point Fo View - 1557383913Documento19 pagineAutomating Finance and Accunting - UiPath Point Fo View - 1557383913Amit GargNessuna valutazione finora

- EY - GST News Alert: Executive SummaryDocumento6 pagineEY - GST News Alert: Executive SummaryAmit GargNessuna valutazione finora

- Applicant Unauthorized ColoniesDocumento58 pagineApplicant Unauthorized ColoniesAnand ChauhanNessuna valutazione finora

- IT SpendingDocumento34 pagineIT SpendingAmit GargNessuna valutazione finora

- IT SpendingDocumento34 pagineIT SpendingAmit GargNessuna valutazione finora

- Applicant Unauthorized ColoniesDocumento58 pagineApplicant Unauthorized ColoniesAnand ChauhanNessuna valutazione finora

- Internship Report by Vamsi KrishnaDocumento7 pagineInternship Report by Vamsi KrishnaManikanta MahimaNessuna valutazione finora

- Diocese of Bacolod V COMELECDocumento2 pagineDiocese of Bacolod V COMELECdragon stickNessuna valutazione finora

- PASTOR M. ENDENCIA v. SATURNINO DAVID GR Nos. L-6355-56 (Lawyerly)Documento10 paginePASTOR M. ENDENCIA v. SATURNINO DAVID GR Nos. L-6355-56 (Lawyerly)Juris AbiderNessuna valutazione finora

- Case of Koprivnikar v. SloveniaDocumento30 pagineCase of Koprivnikar v. SloveniavvvvNessuna valutazione finora

- WJD000836 Malaysian Judiciady PDFDocumento228 pagineWJD000836 Malaysian Judiciady PDFmaxx1116100% (1)

- ADMINISTRATIVE LAW NotesDocumento3 pagineADMINISTRATIVE LAW Notesasim khanNessuna valutazione finora

- Reschenthaler DOD EcoHealth LetterDocumento2 pagineReschenthaler DOD EcoHealth LetterBreitbart News100% (1)

- Mabuhay Miles Program Participation AgreementDocumento18 pagineMabuhay Miles Program Participation AgreementLuigi Marvic FelicianoNessuna valutazione finora

- 501.12 AttendanceDocumento3 pagine501.12 AttendanceMinidoka County Joint School DistrictNessuna valutazione finora

- Oman Income TaxDocumento84 pagineOman Income TaxsoumenNessuna valutazione finora

- R S CPC: Epresentative Uits UnderDocumento18 pagineR S CPC: Epresentative Uits UnderektaNessuna valutazione finora

- Untitled DocumentDocumento40 pagineUntitled DocumentVee Jay DeeNessuna valutazione finora

- BPI Vs C. Reyes, GR No. 182769, Feb. 1, 2012Documento6 pagineBPI Vs C. Reyes, GR No. 182769, Feb. 1, 2012Nei BacayNessuna valutazione finora

- Hartford Accident & Indemnity Co. v. W.S. DickeyDocumento2 pagineHartford Accident & Indemnity Co. v. W.S. DickeyKaren Selina AquinoNessuna valutazione finora

- Gma Network, Inc., vs. Commission On Elections 2. Beltran Vs Secretary of HealthDocumento86 pagineGma Network, Inc., vs. Commission On Elections 2. Beltran Vs Secretary of HealthJoannah GamboaNessuna valutazione finora

- Civil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesDocumento14 pagineCivil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesbubblingbrookNessuna valutazione finora

- Pesala Vs NLRCDocumento11 paginePesala Vs NLRCAda Hyasmin S. DalianNessuna valutazione finora

- Bank CertificateDocumento1 paginaBank CertificateUCO BANKNessuna valutazione finora

- CodicilDocumento4 pagineCodicilJosh NapizaNessuna valutazione finora

- General Two-Way Confidentiality and Non-Disclosure AgreementDocumento7 pagineGeneral Two-Way Confidentiality and Non-Disclosure AgreementMARCO SILVA CABREJONessuna valutazione finora

- E.Y. Industrial Sales, Inc. v. Shen Dar MachineryDocumento1 paginaE.Y. Industrial Sales, Inc. v. Shen Dar MachineryJoe HarveyNessuna valutazione finora

- Engagement Letter (Simple)Documento2 pagineEngagement Letter (Simple)Legal Forms100% (1)

- Labor Laws and LegislationDocumento3 pagineLabor Laws and LegislationErdanlove DielNessuna valutazione finora

- 10 11218 NMGDocumento13 pagine10 11218 NMGbarzilay123Nessuna valutazione finora

- Document Checklist For NRI Car Loan PDFDocumento1 paginaDocument Checklist For NRI Car Loan PDFarunkumarNessuna valutazione finora

- Labor 2 Reviewer-YapKDocumento12 pagineLabor 2 Reviewer-YapKKrystoffer YapNessuna valutazione finora

- Frenzel v. Catito, G.R. No. 143958, July 11, 2003Documento8 pagineFrenzel v. Catito, G.R. No. 143958, July 11, 2003Charmila SiplonNessuna valutazione finora

- LAWHIST - Week1 - Codamon Lim Tan PDFDocumento32 pagineLAWHIST - Week1 - Codamon Lim Tan PDFMargell TanNessuna valutazione finora

- If You Are Interested For The Complete Copies of This Reviewer Just Text Me 09155407032Documento34 pagineIf You Are Interested For The Complete Copies of This Reviewer Just Text Me 09155407032marygrace asuntoNessuna valutazione finora

- Rule of Strict Liability in Motor Accidents Adopted - Air 2001 SC 485Documento6 pagineRule of Strict Liability in Motor Accidents Adopted - Air 2001 SC 485Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್Nessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionValutazione: 5 su 5 stelle5/5 (27)

- Taxes Have Consequences: An Income Tax History of the United StatesDa EverandTaxes Have Consequences: An Income Tax History of the United StatesNessuna valutazione finora

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderValutazione: 5 su 5 stelle5/5 (4)

- The Great Multinational Tax Rort: how we’re all being robbedDa EverandThe Great Multinational Tax Rort: how we’re all being robbedNessuna valutazione finora

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionDa EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNessuna valutazione finora

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Da EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Nessuna valutazione finora

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationDa EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsValutazione: 3.5 su 5 stelle3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingDa EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingValutazione: 5 su 5 stelle5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDa EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCValutazione: 4 su 5 stelle4/5 (5)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreDa EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreValutazione: 4.5 su 5 stelle4.5/5 (13)

- Canadian International Taxation: Income Tax Rules for ResidentsDa EverandCanadian International Taxation: Income Tax Rules for ResidentsNessuna valutazione finora