Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Q4 PCB

Caricato da

iskandar027Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Q4 PCB

Caricato da

iskandar027Copyright:

Formati disponibili

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

b) Provide option not to submit

Background

income tax returns if MTD is

correct and equivalent to

actual tax (subject to fulfilment

1) What is Schedular Tax Deduction of criteria under Section 77C (1)

System of Income Tax Act 1967 (“ITA

(PCB – Potongan Cukai Bulanan) 1967”)

a) Introduced on 1 January 1995.

b) A mechanism whereby The relevant Acts, Rules and

employers deduct monthly tax Regulations

payments from the employment

income of their employees.

1) Determination on residence status

c) PAYE – “Pay as you earn”

concept. Section 7 of ITA 1967

(For details, please refer to ITA 1967)

2) Mechanism

a) Employer deduct tax from the 2) Deduction of tax from emoluments

employee’s gross income every and pensions

month.

Section 107 of ITA 1967

b) The monthly tax is then remitted (For details, please refer to ITA 1967)

by employer to Lembaga Hasil

Dalam Negeri (“IRB”) no longer 3) Definition and components of

than the 15th of the following employment income

month.

Section 13(1) of ITA 1967

c) Deduction is according to (For details, please refer to ITA 1967)

formulas approved by the

Director General of Inland 4) Scheduled deduction

Revenue (“DGIR”) according to

provisions under Rule 3 of the Rule 3 of MTD Rules

Income Tax (Deduction from Employer to deduct for tax monthly

Remuneration) Rules 1994 (“MTD from employee’s remuneration.

Rules”).

(For details, please refer to MTD

Rules)

Objectives

5) Deduction by Direction of DGIR

Rule 4 of MTD Rules

1) To IRB DGIR may instruct employer to

a) Anti-avoidance measure - an deduct from employee’s

efficient manner of collecting remuneration the tax due

tax from employees.

(For details, please refer to MTD

2) To Employee (Tax Payer) Rules)

a) Reduce burden in paying tax in

one lump sum when the actual

tax is ascertained.

Norfisah binti Mohd Ali (2019197733) Page 1 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

6) Deadline for payment of amount b) Employees allowed to claim for

deducted and returns allowable deductions and

rebates under the ITA 1967 in

Rule 10 of MTD Rules each month or in any month in

Employer shall pay to the DGIR not the current year.

later than the 15th day of the month,

the total amount of tax deducted

from employee’s preceding month Duties and Responsibilities

remuneration.

(For details, please refer to MTD 1) Employer

Rules) a) Deduct the MTD from

employee’s monthly

7) Offence remuneration.

Rule 17 of MTD Rules b) Make additional deductions

from employee’s remuneration

(For details, MTD Rules) under Rule 4 of MTD Rules.

c) Remit the tax payment to the

DGIR not later than 15th of every

Implementation Methods calendar month, the tax

deducted from the employee’s

preceding month remuneration.

1) Determination of MTD amount

d) Furnish a complete and

a) Schedule of Monthly Tax accurate return, the following

Deduction; or employee information together

with payment submission:

b) Computerised Calculation • Employee income tax

Method number

• Name according to IC or

2) Schedule of Monthly Tax Deduction passport

• New and old IC numbers,

a) For employers not using police number, army number

computerised payroll software. or passport number (for

foreign employee); and

3) Computerised Calculation Method • MTD amount or additional

a) For employers who deduction amount.

• use computerised payroll

system provided by software e) Information on cessation of

provider, or developed / remuneration of employee

customised by employers under Rule 13 of MTD Rules.

according to specifications

determined and reviewed f) Keep and retain in safe custody

by IRB; or sufficient documents within

• Use system/application seven (7) years from the end of

developed by IRB and the relevant year of assessment

available in IRB’s website. (“YA”).

Norfisah binti Mohd Ali (2019197733) Page 2 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

g) Notify employee of his/her duties 2) Employee status

and responsibilities under the a) Categories

MTD Rules a) Category 1

1. Single

2) Employee (Tax Payer) b) Category 2

a) Submit to employer, information 1. Married. Husband/wife

on previous employment under not in employment.

the current year. c) Category 3

1. Married. Husband/wife in

b) Submit request for monthly employment

deductions in prescribed form. 2. Divorced

3. Widowed

c) Submit request to include 4. Single (with adopted

benefits in kind (BIK) and value child).

of living accommodation

(VOLA) as part of remuneration b) Example of MTD determination

in ascertaining MTD amount. • If wife claims for full child

relief

d) Keep and retain in safe custody 1. MTD for wife will be based

each receipt relating to claims on Category 3 with child

for deduction within seven (7) relief (KA1 – KA20); and

years from the end of the 2. MTD for husband will be

relevant YA. based on Category 3 no

child relief (K).

e) Furnish complete and accurate • MTD for single (with adopted

personal information and notify child) is ascertained under

changes in personal information Category 3 (KA1 – KA20).

to employer.

f) Submit accurate information on

taxable income. Resident

1) Criteria

Criteria for Implementation a) In Malaysia at least 182 days in

calendar year;

1) Residence status b) In Malaysia for less than 182 days

a) Residence status is determined (“shorter period”) but that

under Section 7 of ITA 1967. period is linked to a period of

physical presence of 182 days or

b) Resident employee more “consecutive” days in the

a) MTD after allowable tax following or preceding year

deductions under ITA 1967. (“longer period”).

c) Non-resident employee Temporary absence from

b) Computation based on Malaysia due to the following

Section 1A (Schedule 1) of reasons shall be taken as part of

ITA 1967. the consecutive days, provided

the employee is in Malaysia

Norfisah binti Mohd Ali (2019197733) Page 3 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

before and after each c) Exemption (short term

temporary absence; employee)

1. Business trips • Income of non-resident for

2. Treatment for ill-health of employment in Malaysia if:

himself or member of 1. Aggregate period or

immediate family periods of employment in

3. social visits not exceeding Malaysia does not

14 days in aggregate exceed 60 days in a

calendar year, or

c) In Malaysia for 90 days or more 2. Where the total period of

during the year and, in any 3 of employment which

the 4 immediately preceding overlaps 2 calendar years

years, he was in Malaysia for at does not exceed 60 days.

least 90 days or was resident in

Malaysia 2. Remuneration that is subject to MTD

a) Salary

d) Resident for the year b) Wages

immediately following that year c) Overtime

and for each of the 3 d) Commission

immediately preceding years. e) Tips

f) Allowance

g) Bonus or incentive

h) Director’s fee

Remuneration i) Perquisite

j) Employee’s share option

scheme (ESOS)

1. What is remuneration? k) Tax borne by employer

a) Income arising from gain or l) Gratuity

profit from employment as m) Compensation for loss of

specified under Section 13(1) of employment

ITA 1967. n) Any other remuneration related

to employment

b) Regarded as derived from

Malaysia and subject to 3. Remuneration that is not subject to

Malaysian tax if the employee: MTD

• Exercise an employment in a) Benefits-in-kind (BIK)

Malaysia • Benefits that cannot be

• Is on paid leave attributable converted into money.

to employment in Malaysia

• Performs duties outside b) Value of living accommodation

Malaysia which is incidental (VOLA)

to the exercise of • Living accommodation

employment in Malaysia provided for an employee by

• A director of a company his employer.

resident in Malaysia; or

• Employed to work on board c) Employee may make

of aircraft or ship operated irrevocable election to include

by a person who is a resident BIK and VOLA as part of his

in Malaysia. remuneration.

Norfisah binti Mohd Ali (2019197733) Page 4 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

4) Categories of remuneration 2) Optional deductions/relief

a) Normal remuneration a) Zakat rebates through salary

• Fixed monthly payments to deduction

employees whether the b) Selected approved deductions

amount is fixed or fluctuates c) Zakat rebates not through salary

according to the written deduction

contract of employment or

otherwise.

• Includes: MTD as Final Tax

1. Commission

2. Salary based on daily or

hourly rate 1) What is MTD as Final Tax

3. Salary of which value a) A condition whereby taxpayer is

depends on foreign qualified as not having to submit

exchange rate. tax returns to IRB.

b) Additional remuneration 2) Who is qualified?

• Additional payment to a) Employee who receives

employee either on a lump employment income under

sum, on regular basis, in Section 13 of ITA 1967;

arrears or non-fixed

payments. b) MTD of employee is based on

• Includes: MTD Rules;

1. Bonus or incentive

2. Salary in arrears or any c) Employee served under the

other arrears same employer for a period of

3. Employee share option twelve (12) months in a calendar

scheme (ESOS) year.

4. Tax borne by employer

5. Gratuity 3) Non-qualifying factors

6. Compensation for loss of a) If an employee work with more

employment than one employer at one time

7. Ex-gratia

8. Director’s fee b) Employment period less than

9. Commission (not paid twelve (12) months in a calendar

monthly) year

10. Other

c) Tax borne by employer

d) Joint assessment

Allowable Deductions (Reliefs)

e) Income such as BIK and VOLA

not taken into consideration in

1) Mandatory deductions computation of MTD; or

a) Individual

b) Spouse f) Taxpayer claiming for refund or

c) Child relief or rebate

d) Contribution to Employee

Provident Fund (EPF) or other

approved scheme.

Norfisah binti Mohd Ali (2019197733) Page 5 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

b) imprisonment for term not

Method of Payment exceeding 6 months; or

c) both

1) Electronic payment

a) Effective 1 September 2019, IRB

no longer accept:

• information submitted References

manually

• MTD payment paid using

cash or cheque at its 1) Lembaga Hasil Dalam Negeri

payment counter or send (LHDN) website www.hasil.gov.my

through post or courier. 2) Garis Panduan Potongan Cukai

Bulanan Di Bawah Kaedah-Kaedah

b) MTD payments must be made Cukai Pendapatan (Potongan

via Daripada Saraan) Pindaan 2019

• electronic medium (on-line) dated 1 January 2016 issued by

facility either through FPX, LHDN

IBG; or 3) Income Tax Act 1967

• through internet banking 4) Income Tax (Deductions from

portal of several commercial Income) Rules 1994

banks appointed as tax 5) Federal Government Gazette

collection agents by IRB P.U.(A) 311- Income Tax (Deduction

from Remuneration (Amendment)

Rules 2015 dated 29 December

2015

Offences

6) Federal Government Gazette

P.U.(A) 35 - Income Tax (Deduction

from Remuneration (Amendment)

Rule 17 of MTD Rules Rules 2014 dated 30 January 2014

7) 2019 Budget Commentary and Tax

1) Types of offences Information by Malaysian Institute of

a) Failure to remit MTD by the 15th Accountants (MIA)

of the following month 8) 2018/2019 Tax Booklet PWC

9) 2015 Tax Booklet PWC

b) Failure to deduct and / or

insufficient deduction of MTD

c) Failure to remit or insufficient

MTD or CP38 deduction remitted

d) Failure to give complete and

accurate information about

employee

2) Charges upon conviction

a) Fine of not less than RM200 and

not more than RM20,000; or

Norfisah binti Mohd Ali (2019197733) Page 6 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

TAX737

Q4 -Briefly explain Schedular Tax Deduction System (PCB System)

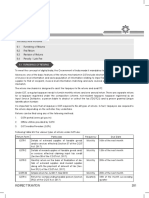

Types of deductions/reliefs/rebates for YA2019

1) Personal reliefs for resident individuals

Description Amount (RM)

1) Taxpayer 9,000

2) Disabled person (additional relief)

a) Taxpayer 6,000

b) Spouse 3,500

c) Supporting equipment 6,000

d) Wife – no source of income 4,000

e) Husband – no source of income 4,000

3) Child (per person)

a) Below 18 years 2,000

b) Disabled and unmarried 6.000

c) Over 18 years 8,000

d) Over 18 years and study overseas 8,000

e) Over 18 years and study local 8,000

f) Disabled and pursue tertiary education 8,000

4) Medical

a) Parents 5,000

b) Taxpayer, spouse, child on serious disease 6,000

5) Life insurance premiums/approved fund

contributors/private pension fund 7,000

6) Private retirement scheme/annuity premium 3,000

7) Insurance premiums for education or medical benefits 3,000

8) Pursue skills 7,000

9) Skim Simpanan Pendidikan Nasional 8,000

10) Parental care

a) Father 1,500

b) Mother 1,500

11) SOCSO 250

12) Lifestyle 2,500

13) Breastfeeding equipment 1,000

14) Childcare 1,000

15) Approved provident funds contribution 4,000

16) Takaful

a) Private sector 3,000

b) Public sector 7,000

Norfisah binti Mohd Ali (2019197733) Page 7 of 7

Adzlenna binti Isa (2019184029)

Norfadliana binti Abdul Hadi (2019964351)

Potrebbero piacerti anche

- Universiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General QuestionsDocumento1 paginaUniversiti Teknologi Mara Faculty of Accountancy Tax737: Tax Fraud and Investigation Tutorial Questions: Tax Administration A. General Questionsiskandar027100% (1)

- Project SchedulingDocumento38 pagineProject Schedulingmehra.harshal25Nessuna valutazione finora

- Arrow Diagram Method: Forward PassDocumento19 pagineArrow Diagram Method: Forward PassYAMINNessuna valutazione finora

- Project Management Phases: Class 6Documento22 pagineProject Management Phases: Class 6Nat TikusNessuna valutazione finora

- Scheme of Work Bi SVM Sem 2Documento34 pagineScheme of Work Bi SVM Sem 2amalcr07Nessuna valutazione finora

- Chapter 5 SCHEDULING & TRACKING WORK (Part 2)Documento90 pagineChapter 5 SCHEDULING & TRACKING WORK (Part 2)Zahirah SaffriNessuna valutazione finora

- February 2023 Maf661Documento6 pagineFebruary 2023 Maf661Shazwan ShahzanNessuna valutazione finora

- AC4391 Accounting and Business Ethics Assignment 5 Presentation Group 4Documento25 pagineAC4391 Accounting and Business Ethics Assignment 5 Presentation Group 4Ashtar Ali BangashNessuna valutazione finora

- ASSIGNMENT 1 HalalDocumento6 pagineASSIGNMENT 1 HalalNur AishaNessuna valutazione finora

- Lesson 5 Planning and SchedulingDocumento14 pagineLesson 5 Planning and SchedulingQuán Cóc Sài GònNessuna valutazione finora

- Chapter 10 Winding Up (Law485)Documento77 pagineChapter 10 Winding Up (Law485)TelsunTVNessuna valutazione finora

- TMC 451 Syllabus Content PDFDocumento1 paginaTMC 451 Syllabus Content PDFnorshaheeraNessuna valutazione finora

- Chandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressDocumento12 pagineChandler, Alfred 1981 “The United States: Seedbed of Managerial M4 Capitalism” in eds. Alfred Chandler and Herman Daems Managerial Hierarchies: Comparative Perspectives on the Rise of the Modern Industrial Enterprise Cambridge, Massachusetts: Harvard University PressCarmela Ledesma100% (1)

- Case StudyDocumento30 pagineCase StudyRed John100% (1)

- Universiti Kuala Lumpur: Final AssessmentDocumento5 pagineUniversiti Kuala Lumpur: Final AssessmentisqmaNessuna valutazione finora

- Module 2.0 - Pert-CpmDocumento9 pagineModule 2.0 - Pert-CpmTyron TayloNessuna valutazione finora

- Cat Fau S21Documento122 pagineCat Fau S21gene houNessuna valutazione finora

- Fau PDFDocumento122 pagineFau PDFGrace EtwaruNessuna valutazione finora

- Nota Fizik (Gerakan Harmonik Ringkas)Documento1 paginaNota Fizik (Gerakan Harmonik Ringkas)Chai Ming KuangNessuna valutazione finora

- Perimeter Are A VolumeDocumento37 paginePerimeter Are A VolumeAdrian CayabyabNessuna valutazione finora

- Sample 3 - 1 PDFDocumento12 pagineSample 3 - 1 PDFAimi SuhailaNessuna valutazione finora

- LABDocumento5 pagineLABMohd Hafiz AimanNessuna valutazione finora

- Critical Path AnalysisDocumento12 pagineCritical Path AnalysisfatimalakhaniNessuna valutazione finora

- Industrial Training Report (Nor Aisyah Asyira Binti Nazli-2019475676)Documento45 pagineIndustrial Training Report (Nor Aisyah Asyira Binti Nazli-2019475676)kun faridNessuna valutazione finora

- Lesson 4 Project Management 1Documento36 pagineLesson 4 Project Management 1Michelle Paunil DelovergesNessuna valutazione finora

- Project Scheduling by CPM & PertDocumento51 pagineProject Scheduling by CPM & PertMd. Mizanur RahamanNessuna valutazione finora

- Lesson 5 - Network DiagramDocumento47 pagineLesson 5 - Network DiagramLakshan UdayangaNessuna valutazione finora

- BASIC Ladder Uk 2.20Documento129 pagineBASIC Ladder Uk 2.20nitinsomanathanNessuna valutazione finora

- WBS Codes in Microsoft Project 2019Documento4 pagineWBS Codes in Microsoft Project 2019muhammad iqbalNessuna valutazione finora

- Phasmophobia Ghost Hidden Abilities Cheat SheetDocumento6 paginePhasmophobia Ghost Hidden Abilities Cheat SheetToxico PaidakiNessuna valutazione finora

- Application For Registration of Company 1Documento2 pagineApplication For Registration of Company 1api-536569860Nessuna valutazione finora

- Tutorial MS Project Lab 1,2,3,4,5Documento36 pagineTutorial MS Project Lab 1,2,3,4,5hamza razaNessuna valutazione finora

- List of Article AnalysisDocumento4 pagineList of Article Analysisremyzer09Nessuna valutazione finora

- Afiq ThesisDocumento116 pagineAfiq ThesisJagathisswary SateeNessuna valutazione finora

- Fundamentals of Multimedia. Ze-Nian Li and Mark S. DrewDocumento115 pagineFundamentals of Multimedia. Ze-Nian Li and Mark S. Drewraoul85Nessuna valutazione finora

- Planning Scheduling Pert CPMDocumento34 paginePlanning Scheduling Pert CPMlorraine atienzaNessuna valutazione finora

- Contoh Bajet KahwinDocumento22 pagineContoh Bajet KahwinNurul FarhanahNessuna valutazione finora

- Welcome: Pra U / STPM Physics 960Documento7 pagineWelcome: Pra U / STPM Physics 960ROSAIMI BIN ABD WAHAB MoeNessuna valutazione finora

- Storage SystemsDocumento31 pagineStorage SystemsPartha Pratim SenguptaNessuna valutazione finora

- SAT Math PracticeDocumento6 pagineSAT Math PracticeKyle Alexander HillegassNessuna valutazione finora

- Spenmo Malaysia - Draft IncorporationDocumento4 pagineSpenmo Malaysia - Draft IncorporationChan Wei FengNessuna valutazione finora

- Law485 c10 Winding UpDocumento35 pagineLaw485 c10 Winding UpndhtzxNessuna valutazione finora

- Act 564 Telemedicine Act 1997 PDFDocumento11 pagineAct 564 Telemedicine Act 1997 PDFAdam Haida & CoNessuna valutazione finora

- Chapter 3 ElectrochemistryDocumento8 pagineChapter 3 Electrochemistrymeshal retteryNessuna valutazione finora

- Excercise 4 Correlation Is AlyaDocumento6 pagineExcercise 4 Correlation Is AlyaXvia98Nessuna valutazione finora

- MGT 400 Individual AsignmentDocumento5 pagineMGT 400 Individual Asignment2023414494Nessuna valutazione finora

- Latest Updates in GSTDocumento6 pagineLatest Updates in GSTprathNessuna valutazione finora

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocumento3 pagineGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNessuna valutazione finora

- GST LatestAmendments Issues 01072023Documento85 pagineGST LatestAmendments Issues 01072023Selvakumar MuthurajNessuna valutazione finora

- Qrmp-Scheme NovDocumento2 pagineQrmp-Scheme NovVishwanath HollaNessuna valutazione finora

- Taxmann's Analysis - Rule 37A - Navigating Through The Intricacies and GSTN AdvisoryDocumento10 pagineTaxmann's Analysis - Rule 37A - Navigating Through The Intricacies and GSTN AdvisoryThouseefNessuna valutazione finora

- Aino Communique 111th Edition Jan 2023 PDFDocumento14 pagineAino Communique 111th Edition Jan 2023 PDFSwathi JainNessuna valutazione finora

- Day 6 & 7Documento23 pagineDay 6 & 7PrasanthNessuna valutazione finora

- Unit 5 GSTDocumento3 pagineUnit 5 GSTNishu KatiyarNessuna valutazione finora

- Instruction No 022022 GST Dated 22032022Documento13 pagineInstruction No 022022 GST Dated 22032022GroupA PreventiveNessuna valutazione finora

- 37th GST Council Meet Final Press Release GSTPW 20092019Documento2 pagine37th GST Council Meet Final Press Release GSTPW 20092019AVASTNessuna valutazione finora

- 37 Meeting of The GST Council, Goa 20 September, 2019 Press ReleaseDocumento2 pagine37 Meeting of The GST Council, Goa 20 September, 2019 Press ReleasePranay SaxenaNessuna valutazione finora

- TAXO Union Budget 2022Documento27 pagineTAXO Union Budget 2022sanjayNessuna valutazione finora

- Spesifikasi Kaedah Pengiraan Berkomputer PCB 2019Documento44 pagineSpesifikasi Kaedah Pengiraan Berkomputer PCB 2019fjNessuna valutazione finora

- 37th GSTC Meeting - 02Documento2 pagine37th GSTC Meeting - 02Sahil ShahNessuna valutazione finora

- Tutorial 1 - A1Documento4 pagineTutorial 1 - A1iskandar027Nessuna valutazione finora

- d14 p7sgp QPDocumento7 pagined14 p7sgp QPiskandar027Nessuna valutazione finora

- 9 The Aims of Punishment and Principles of SentencingDocumento14 pagine9 The Aims of Punishment and Principles of Sentencingiskandar027Nessuna valutazione finora

- Onq Tools Monthly Project Report TemplateDocumento3 pagineOnq Tools Monthly Project Report Templateiskandar027Nessuna valutazione finora

- Diagram IsuzuDocumento1 paginaDiagram Isuzuiskandar027Nessuna valutazione finora

- Application Checklist (7 Aug 2012)Documento6 pagineApplication Checklist (7 Aug 2012)iskandar027Nessuna valutazione finora

- Cooperate FinanceDocumento42 pagineCooperate Financeiskandar027100% (1)

- Class Notes - An Introduction To Forensic Accounting S1, 2014-2015Documento9 pagineClass Notes - An Introduction To Forensic Accounting S1, 2014-2015iskandar02750% (2)

- ConclusionDocumento3 pagineConclusioniskandar027Nessuna valutazione finora

- MfrsDocumento12 pagineMfrsiskandar027Nessuna valutazione finora

- Accounting Practices & Development in Public Sector: Prepared byDocumento77 pagineAccounting Practices & Development in Public Sector: Prepared byiskandar027Nessuna valutazione finora

- MemorandumDocumento23 pagineMemorandumiskandar027Nessuna valutazione finora

- W6-Module Concept of Income-Part 1Documento14 pagineW6-Module Concept of Income-Part 1Danica VetuzNessuna valutazione finora

- Guide To Ethical Sustainable Financial AdviceDocumento44 pagineGuide To Ethical Sustainable Financial AdviceCompliance CRGNessuna valutazione finora

- Mba Summer 2022Documento2 pagineMba Summer 2022Dhruvi PatelNessuna valutazione finora

- State Magazine, May 2001Documento38 pagineState Magazine, May 2001State MagazineNessuna valutazione finora

- Healthy Start Online Application FormDocumento2 pagineHealthy Start Online Application FormPhee WaterfieldNessuna valutazione finora

- Pay Roll SamDocumento2 paginePay Roll Samsamuel debebeNessuna valutazione finora

- Form U - Abstract of Payment of Gratuity Act, 1972 - Taxguru - inDocumento6 pagineForm U - Abstract of Payment of Gratuity Act, 1972 - Taxguru - iner_amit_hrNessuna valutazione finora

- Monthly Return For Unexempted Establishment Form 12ADocumento1 paginaMonthly Return For Unexempted Establishment Form 12AAnonymous wG3iH084Nessuna valutazione finora

- Critical Analysis of EVADocumento14 pagineCritical Analysis of EVAShivarajkumar JayaprakashNessuna valutazione finora

- PERS LawsuitDocumento120 paginePERS LawsuitStatesman JournalNessuna valutazione finora

- Information Sheet For Real Estate Client Template-68109Documento3 pagineInformation Sheet For Real Estate Client Template-68109Oscar Forradellas CasabonNessuna valutazione finora

- Analysis of Retirment SegmentDocumento16 pagineAnalysis of Retirment SegmentGAURAHARI PATRANessuna valutazione finora

- Paystub 202109Documento1 paginaPaystub 202109Ankush BarheNessuna valutazione finora

- Practice Financial ManagementDocumento12 paginePractice Financial ManagementWilliam OConnorNessuna valutazione finora

- Training Spend Rate CalculatorDocumento1 paginaTraining Spend Rate CalculatorRoosy RoosyNessuna valutazione finora

- White County Lilly Endowment Scholarship ApplicationDocumento11 pagineWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNessuna valutazione finora

- Income From Other SourcesDocumento12 pagineIncome From Other Sourcesyatin rajputNessuna valutazione finora

- Hoa (All)Documento2 pagineHoa (All)Balasubramaniam ElangovanNessuna valutazione finora

- INCOMEDocumento12 pagineINCOMEaviralmittuNessuna valutazione finora

- PLDT V Jeturian From Lawyerly - PHDocumento7 paginePLDT V Jeturian From Lawyerly - PHDaryl YuNessuna valutazione finora

- Engineers India LimitedDocumento20 pagineEngineers India LimitedSatyaranjan SahuNessuna valutazione finora

- Budget 2023 Tax GuideDocumento2 pagineBudget 2023 Tax GuideMichele RivarolaNessuna valutazione finora

- APM 3 - 91 Sick LeaveDocumento3 pagineAPM 3 - 91 Sick Leaveal_crespo_2Nessuna valutazione finora

- Lost Pension Accounts and Unclaimed BenefitsDocumento14 pagineLost Pension Accounts and Unclaimed BenefitsLisa Eka CahayatiNessuna valutazione finora

- Dharmadikari ReportDocumento43 pagineDharmadikari Reportricha_4ever20Nessuna valutazione finora

- IRTSA Charter of Demands For 7th CPC As Adopted by CGBDocumento8 pagineIRTSA Charter of Demands For 7th CPC As Adopted by CGBMrityunjay KrNessuna valutazione finora

- Primary Source DocumentsDocumento5 paginePrimary Source DocumentschelseaNessuna valutazione finora

- A10Documento14 pagineA10Siti Asyiah imaNessuna valutazione finora