Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Vanguard Case Study

Caricato da

vivek mehtaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Vanguard Case Study

Caricato da

vivek mehtaCopyright:

Formati disponibili

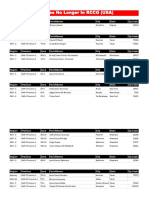

CHAPTER 7 BUSINESS STRATEGY AND MODELS

ILLUSTRATION 7.1 Vanguard’s low-cost strategy comes to Europe

The US company Vanguard pioneered a distinct low-cost strategy in the mutual fund industry

and is now exporting it worldwide.

Mutual funds are managed by investment companies Second, Vanguard distributed their funds directly to

that raise money from multiple customers and invest customers and did not need to pay commissions of

the money in a group of assets (stocks, bonds, money around eight per cent to brokers. Third, the company

market instruments, etc.). Each customer, often as part had internalised investment advisory functions of the

of a retirement plan, then owns shares that represent funds at cost instead of using external investment advi-

a portion of the holdings of the fund. They are charged sors that would charge a premium. Fourth, Vanguard

an annual fee or ‘expense ratio’ that covers investment relied on a no-nonsense thrifty organisational culture

advisory fees, administrative costs, distribution fees where managers were incentivised to control cost and

and other operating expenses. The traditional way of no one, not even senior executives, flew first class.

competing in the industry was by actively managed Fifth, the company had only a few retail centres and

and differentiated investments that tried to generate as spent less on advertising than anyone else in the indus-

high returns as possible and thus being able to charge try. Last, but not least, as one of the largest asset man-

higher fees. The emphasis was on the business perfor- agers globally they gained large economies of scale.

mance end of the business by offering differentiated By 2015, the next step for Vanguard was to do to

funds with higher returns. Vanguard instead focused the financial advisory services industry what they had

on the cost end of the business and offered custom- done to the mutual fund industry. Based on webcam

ers considerably lower annual fees and costs. Most chats and other cost reductions, the aim was to offer

comparisons showed that Vanguard’s fees or expense advisory services at a fraction of the cost of compet-

ratios were 65–80 per cent less than the industry itors. They would charge annually 0.3 per cent on

average depending on investment asset. The company assets compared to the industry average of one per

also launched the industry’s first index mutual fund cent, according to Vanguard CEO Bill McNabb:2

that passively followed a stock market index without

‘Can we provide really super-high quality advice at

ambitions to generate a better performance than the

a very low cost and do that in a very large way, and

market, but which outperformed many actively man-

change the market? I think we can. We continue to

aged funds.

think of our primary mission to reduce the complex-

Vanguard has started to export its low-cost focus to

ity and cost of investing across the board.’

Europe, and their non-US assets have more than dou-

bled in the last six years, reaching over $90bn (€68bn, Sources: (1) D. Oakley, Financial Times, 4 March 2015. (2) S. Foley,

£54bn) in Europe. ‘Lowering the cost of investing is in Financial Times, 8 December 2014.

our DNA,’ blogged Tom Rampulla, former head of Van-

guard Europe. Their low-cost strategy involved several

components. First, unlike competitors it did not need Questions

to make a profit. Tim Buckley, chief investment officer 1 What type of competitive strategy, low-cost,

explained: differentiation, focus or hybrid, would you

‘We are not a listed company. We’re a mutual com- suggest as a way of competing with Vanguard?

pany. We’re owned by our clients. So when we make 2 Using webcam chats is one approach to

a profit, we have two choices. We can roll that profit lower costs in financial advisory services

back into the business or we can pay it out to our as indicated above. What other ways could

owners, our clients, in the form of lower expenses. there be to lower costs to support a low-cost

Over the years we have lowered expenses and that strategy?

has attracted more clients.’1

214

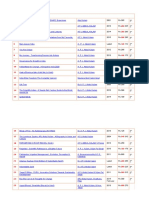

Potrebbero piacerti anche

- Maru Batting Center:: Customer Lifetime ValueDocumento7 pagineMaru Batting Center:: Customer Lifetime ValueDr EngineerNessuna valutazione finora

- CAP 382 The Mandatory Occurrence Reporting Scheme: Information and GuidanceDocumento52 pagineCAP 382 The Mandatory Occurrence Reporting Scheme: Information and GuidanceFaraz Ali KhanNessuna valutazione finora

- Information Dashboard DesignDocumento2 pagineInformation Dashboard DesignAriadna SetentaytresNessuna valutazione finora

- BG CaseDocumento23 pagineBG CaseTarun SinghNessuna valutazione finora

- Marubetting CaseDocumento7 pagineMarubetting CaseNiteshNessuna valutazione finora

- MERCEDES AMG PETRONAS Formula One Team Invites Fans To Develop New Virtual Reality Solutions To Speed Up Collaboration Between Trackside and Team HQ (Company Update)Documento3 pagineMERCEDES AMG PETRONAS Formula One Team Invites Fans To Develop New Virtual Reality Solutions To Speed Up Collaboration Between Trackside and Team HQ (Company Update)Shyam SunderNessuna valutazione finora

- Visual MerchandisingDocumento10 pagineVisual MerchandisingAvishkarzNessuna valutazione finora

- MDCM Deliverable 1Documento3 pagineMDCM Deliverable 1api-314801558Nessuna valutazione finora

- Dell Case Study On Growth StrategiesDocumento17 pagineDell Case Study On Growth StrategiesBharti VirmaniNessuna valutazione finora

- ThoughtWorks CaseDocumento12 pagineThoughtWorks CaseRocking Heartbroker DebNessuna valutazione finora

- Infosys Analysis by Naveen KumarDocumento12 pagineInfosys Analysis by Naveen KumarnaveenspacNessuna valutazione finora

- Data Mining Is A Business Process For Exploring Large Amounts of Data To Discover Meaningful Patterns and RulesDocumento4 pagineData Mining Is A Business Process For Exploring Large Amounts of Data To Discover Meaningful Patterns and Rulesfindurvoice2003100% (1)

- Case Study-Infosys IngeniousDocumento1 paginaCase Study-Infosys IngeniousDeepikaNessuna valutazione finora

- RBC LTVDocumento4 pagineRBC LTVShikha GuptaNessuna valutazione finora

- Change Management MID EXAMDocumento5 pagineChange Management MID EXAMMaleeha WaheedNessuna valutazione finora

- Group 3 - London Olympic Games 2012Documento27 pagineGroup 3 - London Olympic Games 2012Arieviana Ayu LaksmiNessuna valutazione finora

- Lenovo Global Customer Purchasing JourneyDocumento1 paginaLenovo Global Customer Purchasing JourneyKendra ShillingtonNessuna valutazione finora

- Economics Assignment 4Documento3 pagineEconomics Assignment 4Shivnath KarmakarNessuna valutazione finora

- Financial Problem - The ERP DecisionDocumento6 pagineFinancial Problem - The ERP DecisionLưu Thị Thu HườngNessuna valutazione finora

- Margin Builder Tool OverviewDocumento3 pagineMargin Builder Tool OverviewRedingtonValueNessuna valutazione finora

- GB962-A CXM Metrics v1.5.2Documento114 pagineGB962-A CXM Metrics v1.5.2Anonymous MtTXAZNessuna valutazione finora

- Tektronix ByWeNotIDocumento5 pagineTektronix ByWeNotIDevesha TrivediNessuna valutazione finora

- IIMK HubSpot and Motion AIDocumento4 pagineIIMK HubSpot and Motion AISrishti JoshiNessuna valutazione finora

- Airtel Marketing MyopiaDocumento36 pagineAirtel Marketing MyopiaBaskar NarayananNessuna valutazione finora

- Stillwater Consulting 16Documento11 pagineStillwater Consulting 16shankyforuNessuna valutazione finora

- What Was The Original Motivation Behind IntelDocumento1 paginaWhat Was The Original Motivation Behind IntelAntony LawrenceNessuna valutazione finora

- GSC20 Session5 IoT Bilel ITUDocumento21 pagineGSC20 Session5 IoT Bilel ITURishab ChowdhuryNessuna valutazione finora

- Adobe 2017 B2B Digital TrendsDocumento25 pagineAdobe 2017 B2B Digital TrendsJay MellmanNessuna valutazione finora

- Uality Customer Management: Loyalty Program T C " U Š Ć E "Documento8 pagineUality Customer Management: Loyalty Program T C " U Š Ć E "Rohit MishraNessuna valutazione finora

- Accenture Techombank CRMDocumento2 pagineAccenture Techombank CRMkrovidiprasannaNessuna valutazione finora

- Dagmar ApproachDocumento4 pagineDagmar ApproachPrasun GoalaNessuna valutazione finora

- Channel Strategy and Distribution NetworkDocumento1 paginaChannel Strategy and Distribution NetworkDebopriyo RoyNessuna valutazione finora

- Pha Documentation Software Selection Guide PDFDocumento6 paginePha Documentation Software Selection Guide PDFNour FathyNessuna valutazione finora

- Microsoft Latin AmericaDocumento18 pagineMicrosoft Latin AmericadjurdjevicNessuna valutazione finora

- Rohm and Haas: MKTG 611 Fall 2014Documento27 pagineRohm and Haas: MKTG 611 Fall 2014rberrospi_2Nessuna valutazione finora

- Mkg203 - Digital Marketing Communication: JNR Haro PosaDocumento5 pagineMkg203 - Digital Marketing Communication: JNR Haro PosaHaro PosaNessuna valutazione finora

- AirbusDocumento2 pagineAirbusapi-221421240Nessuna valutazione finora

- BMG Case StudyDocumento5 pagineBMG Case StudynwakahNessuna valutazione finora

- Business Model CanvasDocumento1 paginaBusiness Model CanvasRenoFizaldyNessuna valutazione finora

- Optimizing Spending On ServicesDocumento13 pagineOptimizing Spending On ServicesBerlin PacificNessuna valutazione finora

- At What Stage of Its Product Life Cycle Is Green Works OnDocumento3 pagineAt What Stage of Its Product Life Cycle Is Green Works OnVikram KumarNessuna valutazione finora

- Managing Presales - Div C - Group - 2 - RFP - Cisco Systems Implementing ERPDocumento11 pagineManaging Presales - Div C - Group - 2 - RFP - Cisco Systems Implementing ERPrammanohar22Nessuna valutazione finora

- Ques TestDocumento3 pagineQues Testaastha124892823Nessuna valutazione finora

- Team No. 11 Section 3 NAB - THE PLANNING TEMPLATEDocumento11 pagineTeam No. 11 Section 3 NAB - THE PLANNING TEMPLATEPRAVESH TRIPATHINessuna valutazione finora

- Mathsoft Group 1 BBMDocumento7 pagineMathsoft Group 1 BBMBrandon DeanNessuna valutazione finora

- NIKE Brand AuditDocumento31 pagineNIKE Brand Auditsaivijay2018Nessuna valutazione finora

- Scope of Ecommerce in MaharashtraDocumento13 pagineScope of Ecommerce in MaharashtraKavita Koli0% (1)

- Loyalty ApproachDocumento22 pagineLoyalty Approachlogan143Nessuna valutazione finora

- IFD Library Business Plan Version 1.0 FinalDocumento30 pagineIFD Library Business Plan Version 1.0 FinalCristiano Eduardo AntunesNessuna valutazione finora

- Guidelines For Preparation of TIVO in 2002Documento2 pagineGuidelines For Preparation of TIVO in 2002MOUSOM DATTANessuna valutazione finora

- 2015 Performance Partner Program Deal Registration GuideDocumento6 pagine2015 Performance Partner Program Deal Registration GuideWalid OsamaNessuna valutazione finora

- The "Retailification" of The Car Rental IndustryDocumento13 pagineThe "Retailification" of The Car Rental IndustryCognizant100% (1)

- Alternative 1: Reduce The Price of DMC's 10-hp Motor To That of The 7.5-hp MotorDocumento2 pagineAlternative 1: Reduce The Price of DMC's 10-hp Motor To That of The 7.5-hp MotorcbhawsarNessuna valutazione finora

- Lecture - 11 - E-Commerce Business Models and ConceptsDocumento37 pagineLecture - 11 - E-Commerce Business Models and ConceptsR.S.G.FNessuna valutazione finora

- Summary (Case Study)Documento2 pagineSummary (Case Study)Sangeetha GangaNessuna valutazione finora

- Working Capital ManualDocumento203 pagineWorking Capital ManualDeepika Pandey0% (1)

- MoveInSync AssignmentDocumento12 pagineMoveInSync AssignmentSaleem JavidNessuna valutazione finora

- Mahindra CaseDocumento4 pagineMahindra CaseNitin SinghNessuna valutazione finora

- Presentation2 - CBM - SecA - Group5Documento11 paginePresentation2 - CBM - SecA - Group5Abhishek ChopraNessuna valutazione finora

- CASE 5 Final ReportDocumento6 pagineCASE 5 Final Reportmaruf chowdhuryNessuna valutazione finora

- Meike SchalkDocumento212 pagineMeike SchalkPetra BoulescuNessuna valutazione finora

- ICONS+Character+Creator+2007+v0 73Documento214 pagineICONS+Character+Creator+2007+v0 73C.M. LewisNessuna valutazione finora

- Wetlands Denote Perennial Water Bodies That Originate From Underground Sources of Water or RainsDocumento3 pagineWetlands Denote Perennial Water Bodies That Originate From Underground Sources of Water or RainsManish thapaNessuna valutazione finora

- Sayyid DynastyDocumento19 pagineSayyid DynastyAdnanNessuna valutazione finora

- Q3 Grade 8 Week 4Documento15 pagineQ3 Grade 8 Week 4aniejeonNessuna valutazione finora

- ITC Green Centre: Gurgaon, IndiaDocumento19 pagineITC Green Centre: Gurgaon, IndiaAgastya Dasari100% (2)

- Statistics NotesDocumento7 pagineStatistics NotesAhmed hassanNessuna valutazione finora

- KalamDocumento8 pagineKalamRohitKumarSahuNessuna valutazione finora

- 37 Sample Resolutions Very Useful, Indian Companies Act, 1956Documento38 pagine37 Sample Resolutions Very Useful, Indian Companies Act, 1956CA Vaibhav Maheshwari70% (23)

- Vce Smart Task 1 (Project Finance)Documento7 pagineVce Smart Task 1 (Project Finance)Ronak Jain100% (5)

- DLP No. 10 - Literary and Academic WritingDocumento2 pagineDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- DMemo For Project RBBDocumento28 pagineDMemo For Project RBBRiza Guste50% (8)

- FPSCDocumento15 pagineFPSCBABER SULTANNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailsDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailstheffNessuna valutazione finora

- Roberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Documento564 pagineRoberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Patrologia Latina, Graeca et OrientalisNessuna valutazione finora

- Sample Financial PlanDocumento38 pagineSample Financial PlanPatrick IlaoNessuna valutazione finora

- Impact Grammar Book Foundation Unit 1Documento3 pagineImpact Grammar Book Foundation Unit 1Domingo Juan de LeónNessuna valutazione finora

- Laboratory Methodsin ImmnunologyDocumento58 pagineLaboratory Methodsin Immnunologyadi pNessuna valutazione finora

- Rebecca Young Vs CADocumento3 pagineRebecca Young Vs CAJay RibsNessuna valutazione finora

- Karnu: Gbaya People's Secondary Resistance InspirerDocumento5 pagineKarnu: Gbaya People's Secondary Resistance InspirerInayet HadiNessuna valutazione finora

- AnnulmentDocumento9 pagineAnnulmentHumility Mae FrioNessuna valutazione finora

- Government by Algorithm - Artificial Intelligence in Federal Administrative AgenciesDocumento122 pagineGovernment by Algorithm - Artificial Intelligence in Federal Administrative AgenciesRone Eleandro dos SantosNessuna valutazione finora

- Wonderland Audition PacketDocumento5 pagineWonderland Audition PacketBritt Boyd100% (1)

- Principles of Communication PlanDocumento2 paginePrinciples of Communication PlanRev Richmon De ChavezNessuna valutazione finora

- Harvard ReferencingDocumento7 pagineHarvard ReferencingSaw MichaelNessuna valutazione finora

- Chapter 3C Problem Solving StrategiesDocumento47 pagineChapter 3C Problem Solving StrategiesnhixoleNessuna valutazione finora

- Churches That Have Left RCCG 0722 PDFDocumento2 pagineChurches That Have Left RCCG 0722 PDFKadiri JohnNessuna valutazione finora

- Echeverria Motion For Proof of AuthorityDocumento13 pagineEcheverria Motion For Proof of AuthorityIsabel SantamariaNessuna valutazione finora

- Lesson 73 Creating Problems Involving The Volume of A Rectangular PrismDocumento17 pagineLesson 73 Creating Problems Involving The Volume of A Rectangular PrismJessy James CardinalNessuna valutazione finora

- DMSCO Log Book Vol.25 1947Documento49 pagineDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomNessuna valutazione finora