Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Allowances and Deductions Under Section 10 in India 2019-2020 - Income Tax Act 1961

Caricato da

Suyash PrakashTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Allowances and Deductions Under Section 10 in India 2019-2020 - Income Tax Act 1961

Caricato da

Suyash PrakashCopyright:

Formati disponibili

Allowances and deductions under section 10 in India 2019-2020 – Income Tax Act 1961

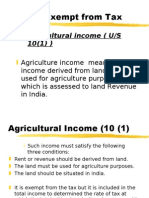

Section 10 of Income Tax Act

Sections Particulars Exemption limit

Sec 10(1) Agricultural Income (from agricultural land, farm house, or sapling Fully exempt from tax

seedling grown in nursery) for self employed

Sec 10(2) Income received from HUF (Hindu-undivided family) by a tax Fully exempt from tax

payer in his capacity as a member of HUF

Sec 10(10C) Compensation received at the time of voluntary retirement for Exempt from tax up to a certain limit of

salaried employees compensation amount Rs. 5,00,000

Sec 10(10D) Amount received under life insurance policy including policy Fully exempt from tax

bonus

Sec Amount withdrawn from Provident fund by salaried employees Fully exempt from tax

10(11)(12)

Sec Compensation received in case of any disaster from central Fully exempt from tax

10(10BC) government

Sec 10(13A) House rent allowance (HRA) to salaried employees (rent paid by Fully exempt from tax and 50% of salary

the employees to stay in a rented house) amount if residential house is in metro

cities otherwise 40% in non-metro

Sec 10(14) Children education allowance (salaried employees can claim a pre Exemption up to Rs. 100 per month per

defined allowance for two children) child

Sec 10(14) Special compensatory allowance for hilly areas or climate Exemption up to Rs. 7,000 per month

allowance or high altitude allowance to salaried employees

Sec 10(14) Border area allowance or remote area or any disturbed area Exemption up to Rs. 1,300 per month

Prof. Rupashree Page 1

rule 2BB allowance to salaried employees

Sec 10(14) Tribal area allowance in: Madhya Pradesh, Tamilnadu, Assam, UP, Exemption up to Rs. 200 per month

Karnataka, West Bengal, Bihar, Orissa and Tripura to salaried

employees

Sec 10(14) Compensatory field area allowance available in various areas of Exemption up to Rs. 2,600 per month

AP, Manipur, Sikkim, Nagaland, HP, UP and J&K to salaried

employees

Sec 10(14) Transport allowance granted to employee for the purpose of Exemption up to Rs. 1,600 (Rs. 3,200

commuting from home to office salaried employees for blind, deaf and dumb) per month

Sec 10(15) Income from tax free securities to all assesses (Income received as Fully exempt from tax

interest from securities, bonds, deposits notified by government)

Sec 10(23D) Income from mutual fund (Any income earned from mutual funds Fully exempt from tax

registered under SEBI or set-up by any PSU or authorized by RBI)

Sec 10(34) Income from dividends (Tax paid by the company over the profits Fully exempt from tax

is considered as the final payment of tax no further credit to be

claimed as dividends)

Sec 10(38) Long term capital gains on transfer of shares and securities Fully exempt from tax

Sec 10(43) Reverse Mortgage (Any amount received by the individual as loan Fully exempt from tax

in lump-sum or in installments in transaction of reverse mortgage)

Sec 10(44) New Pension System exemption (Any income received by any Fully exempt from tax

person on the behalf of New pension system)

Sec 10(49) Income of National financial holdings company Fully exempt from tax

Prof. Rupashree Page 2

Source: IT Department

Prof. Rupashree Page 3

Potrebbero piacerti anche

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3Da EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3Nessuna valutazione finora

- Income Tax Department - Salary BenefitsDocumento19 pagineIncome Tax Department - Salary BenefitsHarty RobertNessuna valutazione finora

- Income-Tax-List of Benefits Available To Salaried Persons-AY-22018-19Documento19 pagineIncome-Tax-List of Benefits Available To Salaried Persons-AY-22018-19pankaj hitlarNessuna valutazione finora

- Employees - Benefits AllowableDocumento15 pagineEmployees - Benefits Allowablesubashjayaraj25Nessuna valutazione finora

- Incomes Which Do Not Form Part of Total Income: Prepared By: Mandeep KaurDocumento22 pagineIncomes Which Do Not Form Part of Total Income: Prepared By: Mandeep KaurYashika JainNessuna valutazione finora

- Income Tax Department - BENEFITS AND SECDocumento18 pagineIncome Tax Department - BENEFITS AND SECpratyush1200Nessuna valutazione finora

- List of Benefits Available To Salaried PersonsDocumento11 pagineList of Benefits Available To Salaried PersonsHemant Kumar VermaNessuna valutazione finora

- List of Benefits Available To Salaried Persons (AY 2021-22) S. N. Sec Tio N Particulars BenefitsDocumento17 pagineList of Benefits Available To Salaried Persons (AY 2021-22) S. N. Sec Tio N Particulars BenefitsAnkit SinghalNessuna valutazione finora

- Unit 4 FPTMDocumento38 pagineUnit 4 FPTMAmit GuptaNessuna valutazione finora

- 1.b Allowances Available To Different Categories of Tax Payers (AY 2016-17)Documento28 pagine1.b Allowances Available To Different Categories of Tax Payers (AY 2016-17)PaviBangaloreNessuna valutazione finora

- Imp Points of IncomeTaxDocumento4 pagineImp Points of IncomeTaxKushal D KaleNessuna valutazione finora

- Exemptions Under Income Tax ActDocumento8 pagineExemptions Under Income Tax ActsanatnaharNessuna valutazione finora

- Chapter 2.2 TaxDocumento13 pagineChapter 2.2 TaxSiddharth VaswaniNessuna valutazione finora

- Salaried Employees Tax Benefits GuideDocumento20 pagineSalaried Employees Tax Benefits Guidebond0071993Nessuna valutazione finora

- Benefits - Section 10Documento4 pagineBenefits - Section 10Naga LingamNessuna valutazione finora

- List of Beneftis For Salaries Income Tax AY 2023 24Documento20 pagineList of Beneftis For Salaries Income Tax AY 2023 24Shaik ChandNessuna valutazione finora

- Section-10: Income Exempt From TaxDocumento21 pagineSection-10: Income Exempt From TaxJitendra VernekarNessuna valutazione finora

- Income Tax DepartmentDocumento22 pagineIncome Tax DepartmentAkash GuptaNessuna valutazione finora

- Salary and Its Tax Treatment in IndiaDocumento20 pagineSalary and Its Tax Treatment in IndiaParth PandeyNessuna valutazione finora

- Notes On Income From SalaryDocumento5 pagineNotes On Income From SalaryNarendra KelkarNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento29 pagine11.tax Free Incomes FinalRaun JainNessuna valutazione finora

- Unit 2 Income From SalariesDocumento21 pagineUnit 2 Income From SalariesShreya SilNessuna valutazione finora

- 11 TaxDocumento37 pagine11 TaxArpita KapoorNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento35 pagine11.tax Free Incomes Finalpraveenr5883Nessuna valutazione finora

- Income Exempt From TaxDocumento20 pagineIncome Exempt From TaxSaad AliNessuna valutazione finora

- NTPC Tax CircularDocumento20 pagineNTPC Tax CircularKundan RathodNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento37 pagine11.tax Free Incomes FinalsaandoNessuna valutazione finora

- Agricultural Income Under Section 10Documento7 pagineAgricultural Income Under Section 10Apurva KuvalekarNessuna valutazione finora

- Adobe Scan 09-Nov-2023Documento5 pagineAdobe Scan 09-Nov-2023james17stevensNessuna valutazione finora

- Perquisites and Allowances Under The Head SalariesDocumento15 paginePerquisites and Allowances Under The Head SalariesAYUSHI TYAGINessuna valutazione finora

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocumento32 pagineSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanilpeddamalliNessuna valutazione finora

- Salaries NotesDocumento48 pagineSalaries Notesbhatiasanjay89Nessuna valutazione finora

- Section-10: Income Exempt From TaxDocumento21 pagineSection-10: Income Exempt From TaxRakesh SharmaNessuna valutazione finora

- Chapter 10 - Incomes Which Do Not Form Part of Total Income - NotesDocumento10 pagineChapter 10 - Incomes Which Do Not Form Part of Total Income - NotesRahul TiwariNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento40 pagine11.tax Free Incomes FinalKARTHIK ANessuna valutazione finora

- Exempted Income: To: Dr. Pooja Sikka By: Parneet Kaur LLB-2 Year Roll No. 22Documento22 pagineExempted Income: To: Dr. Pooja Sikka By: Parneet Kaur LLB-2 Year Roll No. 22Parneet kaurNessuna valutazione finora

- Exempted Incomes For Different CategoriesDocumento10 pagineExempted Incomes For Different Categorieskmr_arnNessuna valutazione finora

- Section 10 ExemptDocumento2 pagineSection 10 ExemptUttam Kumar GhoshNessuna valutazione finora

- 80.deductions or Allowances Allowed To Salaried EmployeeDocumento11 pagine80.deductions or Allowances Allowed To Salaried Employeehustlerstupid737Nessuna valutazione finora

- Salary1 2022 DisDocumento45 pagineSalary1 2022 Disparinita raviNessuna valutazione finora

- EXEMPTED INCOME Sec10Documento2 pagineEXEMPTED INCOME Sec10jishnu surendranNessuna valutazione finora

- Income ExemptDocumento21 pagineIncome Exemptapi-3832224100% (1)

- 11.tax Free Incomes FinalDocumento38 pagine11.tax Free Incomes FinalshineNessuna valutazione finora

- Treatment of Income From Different Sources Whole Income Tax CoverageDocumento58 pagineTreatment of Income From Different Sources Whole Income Tax CoverageAkash BhardwajNessuna valutazione finora

- 11.tax Free Incomes FinalDocumento40 pagine11.tax Free Incomes FinalGhs ShahpurkandiNessuna valutazione finora

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocumento40 pagineQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNessuna valutazione finora

- Taxation SalaryDocumento13 pagineTaxation SalarySumant ParakhNessuna valutazione finora

- Non Taxable IncomeDocumento35 pagineNon Taxable IncomeGayatri RaneNessuna valutazione finora

- Non Taxable Income, Income From Salary and Income From HPDocumento35 pagineNon Taxable Income, Income From Salary and Income From HPAnonymous ckTjn7RCq8Nessuna valutazione finora

- Income Exempt From Tax SalariesDocumento15 pagineIncome Exempt From Tax SalariesmallronakNessuna valutazione finora

- Fully Taxable Allowances Dearness Allowance or Dearness PayDocumento7 pagineFully Taxable Allowances Dearness Allowance or Dearness PayDeeksha KapoorNessuna valutazione finora

- As Amended by Finance Act, 2017Documento3 pagineAs Amended by Finance Act, 2017JonnyNessuna valutazione finora

- University Institute of Legal Studies (UILS) Chandigarh UniversityDocumento26 pagineUniversity Institute of Legal Studies (UILS) Chandigarh UniversityRishabh GoyalNessuna valutazione finora

- Exempted IncomeDocumento6 pagineExempted Incomeshyam visanaNessuna valutazione finora

- Section 10 of The Income Tax ActDocumento10 pagineSection 10 of The Income Tax ActVANSHIKA SINGHNessuna valutazione finora

- Unit 4Documento14 pagineUnit 4Rupesh PatilNessuna valutazione finora

- Income Not Forming Part OF Total IncomeDocumento35 pagineIncome Not Forming Part OF Total IncomeBeing HumaneNessuna valutazione finora

- Income Tax 2Documento6 pagineIncome Tax 2KABILESWARAN SNessuna valutazione finora

- Business Taxation 1Documento22 pagineBusiness Taxation 1AnshuNessuna valutazione finora

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Documento6 pagineIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyNessuna valutazione finora

- Business Quiz Round 2Documento22 pagineBusiness Quiz Round 2Suyash PrakashNessuna valutazione finora

- List of Guides - Finance SpecialisationDocumento4 pagineList of Guides - Finance SpecialisationSuyash PrakashNessuna valutazione finora

- Insurance & Risk MGT - BbaDocumento84 pagineInsurance & Risk MGT - BbaSuyash PrakashNessuna valutazione finora

- Management AssignmentDocumento1 paginaManagement AssignmentSuyash PrakashNessuna valutazione finora

- Business Quiz: Presented byDocumento55 pagineBusiness Quiz: Presented bySuyash PrakashNessuna valutazione finora

- Communication AddressDocumento3 pagineCommunication AddressSuyash PrakashNessuna valutazione finora

- New Doc 2019-08-18 19.26.52Documento2 pagineNew Doc 2019-08-18 19.26.52Suyash PrakashNessuna valutazione finora

- Business Quiz: Conducted by GROUP 2Documento34 pagineBusiness Quiz: Conducted by GROUP 2Suyash PrakashNessuna valutazione finora

- SL No First Name Last Name Gender (M/F) PG Date of Birth (Dd/Mm/Yyyy)Documento12 pagineSL No First Name Last Name Gender (M/F) PG Date of Birth (Dd/Mm/Yyyy)Suyash PrakashNessuna valutazione finora

- Oyo - Final ReportDocumento17 pagineOyo - Final ReportSuyash PrakashNessuna valutazione finora

- Management Department (Bba) Inter Collegiate Fest Training Registrations Event: Business QuizDocumento1 paginaManagement Department (Bba) Inter Collegiate Fest Training Registrations Event: Business QuizSuyash PrakashNessuna valutazione finora

- Tata Group'S Growth StrategiesDocumento11 pagineTata Group'S Growth StrategiesSuyash PrakashNessuna valutazione finora

- ON Your OWN: ## Aur Kya Chahiye ##Documento12 pagineON Your OWN: ## Aur Kya Chahiye ##Suyash PrakashNessuna valutazione finora

- ON Your OWN: ## Aur Kya Chahiye ##Documento12 pagineON Your OWN: ## Aur Kya Chahiye ##Suyash PrakashNessuna valutazione finora

- PDF CropDocumento6 paginePDF Crop04vijilNessuna valutazione finora

- CBDT e Payment Request FormDocumento2 pagineCBDT e Payment Request Formsaurabh100% (1)

- Aguinaldo Industries V CirDocumento1 paginaAguinaldo Industries V CirChristine JacintoNessuna valutazione finora

- Pay Slip July 2020...Documento2 paginePay Slip July 2020...laxman lucky100% (2)

- Internasional TaxDocumento24 pagineInternasional TaxnanaNessuna valutazione finora

- GO (RT) No56 2023 FinDated05 01 2023 - 15Documento1 paginaGO (RT) No56 2023 FinDated05 01 2023 - 15Sarath SNessuna valutazione finora

- Experis Key InformationDocumento11 pagineExperis Key InformationTahir SamadNessuna valutazione finora

- NHS Pension Schemes-An Overview-20210706 - (V6)Documento5 pagineNHS Pension Schemes-An Overview-20210706 - (V6)pboletaNessuna valutazione finora

- Classicals Views On Public DebtDocumento12 pagineClassicals Views On Public DebtPradyumna Prusty50% (2)

- SLT eBill-00372777690152ImageDocumento1 paginaSLT eBill-00372777690152ImageDushshantha Gayashan0% (1)

- Income and Business Taxation Fabm 2Documento32 pagineIncome and Business Taxation Fabm 2Daniela Mariz CepresNessuna valutazione finora

- Work Sheet Computation of Income Under The Head "Capital Gains"Documento4 pagineWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNessuna valutazione finora

- Child and Family Benefits Calculator - Yukon (30k)Documento3 pagineChild and Family Benefits Calculator - Yukon (30k)MahmozNessuna valutazione finora

- F6 Self Assessment NotesDocumento7 pagineF6 Self Assessment NotesVivy Mwix SeinNessuna valutazione finora

- 1702 Nov 2011Documento18 pagine1702 Nov 2011BeatriceChuNessuna valutazione finora

- Report MoDocumento3 pagineReport MoPaul VillacortaNessuna valutazione finora

- IRS Form 673 - Foreign Earned Income ExclusionDocumento2 pagineIRS Form 673 - Foreign Earned Income Exclusionawang90Nessuna valutazione finora

- Comparison SEZ Law and Investment Law (Short Note)Documento7 pagineComparison SEZ Law and Investment Law (Short Note)Khin HtetNessuna valutazione finora

- Tax AssignmentDocumento7 pagineTax AssignmentNaiha AbidNessuna valutazione finora

- BUS13401n14099 10 09Documento2 pagineBUS13401n14099 10 09jc199707Nessuna valutazione finora

- I FHMHFMDocumento1 paginaI FHMHFMRaghuraman NarasimmaluNessuna valutazione finora

- CHAPTER 42 - Accounting For Income TaxDocumento18 pagineCHAPTER 42 - Accounting For Income TaxJoshua Wacangan100% (1)

- Fiscal Policy Objectives-7Documento5 pagineFiscal Policy Objectives-7Rahul ItankarNessuna valutazione finora

- Taxation Comex1 CoverageDocumento3 pagineTaxation Comex1 CoverageOwncoebdiefNessuna valutazione finora

- Form16 (2021-2022)Documento2 pagineForm16 (2021-2022)COMMON SERVICE CENTERNessuna valutazione finora

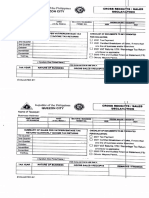

- 2022 GrossReceipts - SalesDeclarationFormDocumento1 pagina2022 GrossReceipts - SalesDeclarationFormMark Anthony AlvarioNessuna valutazione finora

- GENERAL FORMULA: Selling Price - Cost of Property Gain or LossDocumento4 pagineGENERAL FORMULA: Selling Price - Cost of Property Gain or LossTrisha Sargento EncinaresNessuna valutazione finora

- GST On Reverse ChargeDocumento5 pagineGST On Reverse ChargeHEERA BABU MERTIANessuna valutazione finora

- Jeeves InsuranceDocumento1 paginaJeeves InsuranceJEEVAN BONDARNessuna valutazione finora

- Tax Practice Math Solution PDFDocumento1 paginaTax Practice Math Solution PDFnurulaminNessuna valutazione finora