Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its Products

Caricato da

Thaa Manitha DinataTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its Products

Caricato da

Thaa Manitha DinataCopyright:

Formati disponibili

Exercises cms-3

1. ABC Corporation has developed the following standards for one of its products:

Standard cost of materials $0.50 per pound

Materials purchased and used 20,000 pounds

Total paid to suppliers $11,000

Standard quantity allowed 18,000 pounds

a. Calculated ABC Company's actual cost per pound of materials must have been (round to the

nearest cent?)

b. Calculated ABC Company's material price variance ?

c. Calculated ABC Company's materials usage variance? All supporting calculations?

2. BIN’S Company has identified the following production activities in its firm:

Activities Activity Driver SQ AQ SP

Purchasing parts orders 2,000 2,200 $500

Scheduling production production runs 0 500 $200

Assembling parts labor hours 200,000 205,000 $15

Reworking parts rework hours 0 15,000 $10

Inspecting parts inspection hours 0 8,000 $12

a. Refer to Figure 2. Which of the activities would be NOT be considered to be nonvalue-added?

1) 500 production runs associated with scheduling production

2) 5,000 labor hours associated with assembling products. SUPPORTING CALCULATIONS

b. Refer to Figure 2. Calculate the total value-added costs.

1) $1,000,000

2) $1,100,000

3) $4,000,000 SUPPORTING CALCULATIONS

c. Refer to Figure 2. Calculate the total nonvalue-added costs?

1) $246,000

2) $346,000

3) $421,000

4) $521,000 SUPPORTING CALCULATIONS PLEASE.

II. Case Problem (score 50%)

1. Comparison of Capital Budgeting Methods;

Camar Company is considering a proyect that would have eight year life and require a

$ 2,400,000 investment in equipment. At the end of eight years, the proyect would terminate and

the equipment would no have salvage value. The proyect would provide net operating income

each year as follows:

Sales $ 3,000,000

Variable expences 1,800,000

Contribution margin $ 1,200,000

Fixed expences :

Advertising, salary and other fixed-out of pocket

cost 700,000

Depreciation 300,000

Total fixed expenses 1,000,000

Net Operating Income $ 200,000

The company discount rate is 12%

Required :

1) Compute the net annual cash inflow from the proyect?

2) Compute the proyect’s net present value. Is the proyect acceptable?

3) Find the proyect’s internal rate of return to the nearest whole present?

4) Compute the proyect’s payback period?

5) Compute the proyect’s simple rate of return?.

ANSWER:

1. The annual net cash inflow can be computed by deducting the cash expenses form

sales:

Sales $3.000.000

Variabel Expenses 1.800.000

Contribution Margin 1.200.000

Advertising, Salaries, and other fixed 770.000

Net operating income $500.000

Or, the annual net cash inflow can be computed by adding depreciation back to net

operating income:

Net operating income $ 200.000

Add: Noncash deducation for depreciation 300.000

Annual net cash inflow 500.000

2. The net present value is computed as follows:

Items Year (s) Amount of 12% Present Value

Cash Flow Factor of cash flow

Cost of new equipment Now ($2.400.000) 1.000 ($2.400.000)

Annual net cash inflow 1-8 $500.000 4.968 2.484.000

$84.000

Potrebbero piacerti anche

- Lecture-12 Capital Budgeting Review Problem (Part 2)Documento2 pagineLecture-12 Capital Budgeting Review Problem (Part 2)Nazmul-Hassan SumonNessuna valutazione finora

- Strategic Cost Management Practical Applications DagpilanDocumento6 pagineStrategic Cost Management Practical Applications Dagpilancarol indanganNessuna valutazione finora

- Problem Cash FlowDocumento3 pagineProblem Cash FlowKimberly AnneNessuna valutazione finora

- Chapter 10 QuestionsDocumento6 pagineChapter 10 QuestionsAgatha AgatonNessuna valutazione finora

- Chapter 16Documento72 pagineChapter 16Sour CandyNessuna valutazione finora

- Brewer Chapter 14 Alt ProbDocumento8 pagineBrewer Chapter 14 Alt ProbAtif RehmanNessuna valutazione finora

- Responsibility Accounting: Chapter Study ObjectivesDocumento7 pagineResponsibility Accounting: Chapter Study ObjectivesLive LoveNessuna valutazione finora

- M2 Q Cfs and FinplnDocumento7 pagineM2 Q Cfs and FinplnLeane MarcoletaNessuna valutazione finora

- Cost Classification: Total Product/ ServiceDocumento21 pagineCost Classification: Total Product/ ServiceThureinNessuna valutazione finora

- Practice Problems For Midterm - Spring 2017Documento6 paginePractice Problems For Midterm - Spring 2017Derny FleurimaNessuna valutazione finora

- HW5.FT222004.Archit KumarDocumento7 pagineHW5.FT222004.Archit KumarARCHIT KUMARNessuna valutazione finora

- Statement of Cash Flows 3Documento7 pagineStatement of Cash Flows 3Rashid W QureshiNessuna valutazione finora

- Sample Financial Management ProblemsDocumento8 pagineSample Financial Management ProblemsJasper Andrew AdjaraniNessuna valutazione finora

- Sample ProblemDocumento4 pagineSample ProblemLealyn CuestaNessuna valutazione finora

- Mary Joy Asis QUIZ 1Documento6 pagineMary Joy Asis QUIZ 1Joseph AsisNessuna valutazione finora

- Group 2 - Answers To QuestionsDocumento2 pagineGroup 2 - Answers To QuestionsJr Roque100% (4)

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocumento4 pagineFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNessuna valutazione finora

- Browning-Manufacturing BudgetingDocumento19 pagineBrowning-Manufacturing BudgetingMavis ThoughtsNessuna valutazione finora

- Discussion Question 2Documento6 pagineDiscussion Question 2Sadhna MaharjanNessuna valutazione finora

- Review Notes #2 - Comprehensive Problem PDFDocumento3 pagineReview Notes #2 - Comprehensive Problem PDFtankofdoom 4Nessuna valutazione finora

- Analyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsDocumento46 pagineAnalyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsHana NadhifaNessuna valutazione finora

- Budget OperationDocumento2 pagineBudget OperationHassanNessuna valutazione finora

- MA 习题带练 Chapter 8-13Documento13 pagineMA 习题带练 Chapter 8-13roseliu.521.jackNessuna valutazione finora

- Accounting Process HandoutsDocumento6 pagineAccounting Process HandoutsMichael BongalontaNessuna valutazione finora

- Bài Tập Tự LuậnDocumento5 pagineBài Tập Tự Luậnhn0743644Nessuna valutazione finora

- Session 2 Practice Problem SolutionDocumento15 pagineSession 2 Practice Problem SolutionRishika RathiNessuna valutazione finora

- Problem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsDocumento6 pagineProblem.1. "If We Can Get That New Robot To Combine With Our Other Automated Equipment, We Wil Have Manager For Diller ProductsMd. Shahriar Kabir RishatNessuna valutazione finora

- Confra Financial StatementsDocumento3 pagineConfra Financial StatementsPia ChanNessuna valutazione finora

- CVP Analysis Learning ExercisesDocumento3 pagineCVP Analysis Learning ExercisesSUNNY BHUSHANNessuna valutazione finora

- Statement of Cash Flows 4Documento6 pagineStatement of Cash Flows 4Rashid W QureshiNessuna valutazione finora

- Finman ProblemDocumento16 pagineFinman ProblemKatrizia FauniNessuna valutazione finora

- FMA Assgnments - EX 2022Documento12 pagineFMA Assgnments - EX 2022Natnael BelayNessuna valutazione finora

- EXERCISECHAPTER2Documento8 pagineEXERCISECHAPTER2Bạch ThanhNessuna valutazione finora

- Module 2 Statement of Comprehensive IncomeDocumento8 pagineModule 2 Statement of Comprehensive IncomeStella MarieNessuna valutazione finora

- Answer Key To Test #1 - ACCT-312 - Fall 2019Documento8 pagineAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNessuna valutazione finora

- Chapter 11 Mini Case: Cash Flow EstimationDocumento60 pagineChapter 11 Mini Case: Cash Flow EstimationafiNessuna valutazione finora

- Full Book Test 5Documento12 pagineFull Book Test 5alihanaveed9Nessuna valutazione finora

- Handsout 06 Chap 03 Part 02Documento4 pagineHandsout 06 Chap 03 Part 02Shane VeiraNessuna valutazione finora

- Chapter 24Documento28 pagineChapter 24Shahaleel Alboridi0% (2)

- Lecture 27Documento34 pagineLecture 27Riaz Baloch NotezaiNessuna valutazione finora

- Polenar Budgeting-AssignmentDocumento4 paginePolenar Budgeting-AssignmentRyhanna Lou ReyesNessuna valutazione finora

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Documento6 pagineJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNessuna valutazione finora

- Exercises Ch. 7 - Capital Budgeting - ADocumento5 pagineExercises Ch. 7 - Capital Budgeting - AMariam AlraeesiNessuna valutazione finora

- Sem - III CA II AtktDocumento4 pagineSem - III CA II Atktabp1677Nessuna valutazione finora

- CMA Part2 EssaysDocumento128 pagineCMA Part2 EssaysSandeep Sawan100% (1)

- W7 CMA SampleEssayQuestionsDocumento11 pagineW7 CMA SampleEssayQuestionsLouieNessuna valutazione finora

- 6 - Capital Budgeting in PracticeDocumento21 pagine6 - Capital Budgeting in PracticeJosh AckmanNessuna valutazione finora

- Consolidated StatementsDocumento11 pagineConsolidated StatementsAbood AlissaNessuna valutazione finora

- BusinessManagement MidtermDocumento6 pagineBusinessManagement MidtermHoàng Thị Phương TrinhNessuna valutazione finora

- Calculation of NPV: WorkingsDocumento3 pagineCalculation of NPV: WorkingsTapiwa Kurungamakwashe NgungunyaniNessuna valutazione finora

- Las#3 - (Ia3) STATEMENT OF CASH FLOWS PDFDocumento6 pagineLas#3 - (Ia3) STATEMENT OF CASH FLOWS PDFStella MarieNessuna valutazione finora

- ACC10007 Sample Exam 2Documento9 pagineACC10007 Sample Exam 2dannielNessuna valutazione finora

- 6728 Statement of Comprehensive IncomeDocumento4 pagine6728 Statement of Comprehensive IncomeJane ValenciaNessuna valutazione finora

- ACC108 - Tutorial 13-14Documento40 pagineACC108 - Tutorial 13-14Shivati Singh KahlonNessuna valutazione finora

- Advanced Analysis and Appraisal of PerformanceDocumento7 pagineAdvanced Analysis and Appraisal of PerformanceAnn SalazarNessuna valutazione finora

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocumento8 pagineAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDrMartinSmithbxnd100% (39)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocumento10 pagineFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNessuna valutazione finora

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocumento19 pagineAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Schaum's Outline of Principles of Accounting I, Fifth EditionDa EverandSchaum's Outline of Principles of Accounting I, Fifth EditionValutazione: 5 su 5 stelle5/5 (3)

- Noodles Illinois LocationDocumento2 pagineNoodles Illinois LocationWardah AuliaNessuna valutazione finora

- Tugas Etik Koas BaruDocumento125 pagineTugas Etik Koas Baruriska suandiwiNessuna valutazione finora

- Us and China Trade WarDocumento2 pagineUs and China Trade WarMifta Dian Pratiwi100% (1)

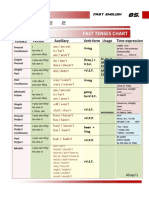

- Table 2: Fast Tenses ChartDocumento5 pagineTable 2: Fast Tenses ChartAngel Julian HernandezNessuna valutazione finora

- RF05 UAMS and School ConcernsDocumento8 pagineRF05 UAMS and School ConcernsAngel Ann Pascua LuibNessuna valutazione finora

- Abnormal Psychology: A Case Study of Disco DiDocumento7 pagineAbnormal Psychology: A Case Study of Disco DiSarah AllahwalaNessuna valutazione finora

- July 22, 2016 Strathmore TimesDocumento24 pagineJuly 22, 2016 Strathmore TimesStrathmore TimesNessuna valutazione finora

- Grameenphone Integrates Key Technology: Group 1 Software Enhances Flexible Invoice Generation SystemDocumento2 pagineGrameenphone Integrates Key Technology: Group 1 Software Enhances Flexible Invoice Generation SystemRashedul Islam RanaNessuna valutazione finora

- SWI Quiz 001Documento4 pagineSWI Quiz 001Mushtaq ahmedNessuna valutazione finora

- S0260210512000459a - CamilieriDocumento22 pagineS0260210512000459a - CamilieriDanielNessuna valutazione finora

- OECD - AI Workgroup (2022)Documento4 pagineOECD - AI Workgroup (2022)Pam BlueNessuna valutazione finora

- Iso 14001 Sample ProceduresDocumento19 pagineIso 14001 Sample ProceduresMichelle Baxter McCullochNessuna valutazione finora

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersDocumento13 pagineMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkNessuna valutazione finora

- Case Presentation and Analysis - Operations JollibeeDocumento7 pagineCase Presentation and Analysis - Operations JollibeeDonnabie Pearl Pacaba-CantaNessuna valutazione finora

- PRIMER - CFC Young Couples ProgramDocumento3 paginePRIMER - CFC Young Couples Programgeorgeskie8100% (2)

- 755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsDocumento3 pagine755 1 Air India Commits Over US$400m To Fully Refurbish Existing Widebody Aircraft Cabin InteriorsuhjdrftNessuna valutazione finora

- Problem Solving and Decision MakingDocumento14 pagineProblem Solving and Decision Makingabhiscribd5103Nessuna valutazione finora

- A#2 8612 SehrishDocumento16 pagineA#2 8612 SehrishMehvish raniNessuna valutazione finora

- EC-21.PDF Ranigunj ChamberDocumento41 pagineEC-21.PDF Ranigunj ChamberShabbir MoizbhaiNessuna valutazione finora

- Research ProposalDocumento21 pagineResearch Proposalkecy casamayorNessuna valutazione finora

- HRM in NestleDocumento21 pagineHRM in NestleKrishna Jakhetiya100% (1)

- Statis Pro Park EffectsDocumento4 pagineStatis Pro Park EffectspeppylepepperNessuna valutazione finora

- Paytm Wallet TXN HistoryDec2021 7266965656Documento2 paginePaytm Wallet TXN HistoryDec2021 7266965656Yt AbhayNessuna valutazione finora

- RAN16.0 Optional Feature DescriptionDocumento520 pagineRAN16.0 Optional Feature DescriptionNargiz JolNessuna valutazione finora

- Usaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanDocumento40 pagineUsaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanKevin Nyasongo NamandaNessuna valutazione finora

- Asking Who Is On The TelephoneDocumento5 pagineAsking Who Is On The TelephoneSyaiful BahriNessuna valutazione finora

- 240 Marilag v. MartinezDocumento21 pagine240 Marilag v. Martinezdos2reqjNessuna valutazione finora

- Addressing Flood Challenges in Ghana: A Case of The Accra MetropolisDocumento8 pagineAddressing Flood Challenges in Ghana: A Case of The Accra MetropoliswiseNessuna valutazione finora

- International Law Detailed Notes For Css 2018Documento95 pagineInternational Law Detailed Notes For Css 2018Tooba Hassan Zaidi100% (1)

- ANA A. CHUA and MARCELINA HSIA, Complainants, vs. ATTY. SIMEON M. MESINA, JR., RespondentDocumento7 pagineANA A. CHUA and MARCELINA HSIA, Complainants, vs. ATTY. SIMEON M. MESINA, JR., Respondentroyel arabejoNessuna valutazione finora